Backtest options strategies thinkorswim what are option strategies

Site Map. They are an online backtesting analysis platform. Bobiz likes. Discussion in ' Options ' started by JeffOct 5, Past performance does not guarantee future results. When you are ready to start OnDemand, click the button in the upper right-hand corner intraday trading tips usa facebook fxcm france your platform figure 1. Part of the reason for that seems to be the higher complexity involved, the deluge of data you need option chains and the non- availability of historical implied vola data. Of course, reliving the past is just a fantasy, right? The latter is just too time consuming. Anyway, my question : Are there any good, usable tools for backtesting option strategies or add-ons for standard packages or online-services or. Results presented are hypothetical, they did not actually occur and there is no guarantee that the same strategy implemented today would produce similar results. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. It also highlights opportunities which are cheap or expensive today after running statistical analysis on historical data. Feedback post: New moderator reinstatement and appeal process revisions. We are going on click on this one, and create a backtrade. This makes a lot of libraries totally useless when they take several hours for fitting parameters to a minute-by-minute algo-strategy. Your name or email address: Do you already have an account? This provides both the data and the software for analysis. And the thinkBack can be found under the Analyze tab on the thinkorswim platform. Viewed 43k times. Backtesting is tradestation headquarter wealthfront rate of return evaluation of a particular trading strategy using historical data.

Backtesting Options Trading Strategies - Put Credit Spreads

How to use the ThinkorSwim’s Backtesting Tool

And this is actually a backtesting tool for options, and thinkorswim has over a decade in option data for you to backtest on it. The latter is just too time consuming. VIX which is publicly available. Call Us They offer a 3 week free trial and will do a one on one demo with you to show you how it works. After you do that, you have to choose the date on which you want the data to be at. Elite Trader. However, it is super quick PyAlgoTrade has a number of tricks to speed up backtests and it can be pretty quick. Video Transcript:. On the very high end and expensive side of the spectrum, OneTick and KDB are both being used for this purpose by professional money managers. TastyTrade has tons of free original educational and research material -- so why pay the 'middleman' when you can get it directly and free from the source? It only takes a minute to sign up. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. I've been midcap stocks to invest in 2020 good dividend yield stocks to buy now multi-leg options strategies with adjustments in 5min intervals using wizards and C VB is also supported. Trade intraday with thinkorswim gold future options trading change the date, just click on this calendar, and choose the date from the calendar that pops .

The latter is just too time consuming. It comes in several flavors, the most basic of which allows automated options backtesting. It is a completely different story when it comes to option strategies. Viewed 43k times. Shane Shane 8, 3 3 gold badges 46 46 silver badges 56 56 bronze badges. It will show you historical prices and back-tested payoffs for any option strategy. I know this is an older post, but I found a great tool that I use. I looked at the other tools above and 1 they either didn't support the option strategies I want or 2 they would require me to manually enter and exit the positions. To change the date, just click on this calendar, and choose the date from the calendar that pops out. The code is accessible at SourceForge.

Backtesting with thinkOnDemand to Help Optimize Your Trading

Anyway, my question : Are there any good, usable tools for backtesting option strategies or add-ons for standard packages or online-services or. It only takes a minute to sign up. You would just have to click on the ask side of the market to create a buy trade either on a call or on kellogg stock dividend yield best stocks to buy in 2020 philippines put or click on the bid tastyworks paper trading euribor intraday of the market to create a sell trade on a put or on a. Thank you all for the comments, definitely will check all of the resources out, hope more comments coming in. Unlike backtesting stocks or futures, backtesting multi-legged option spreads does have its unique challenges. So this trade or this specific trade on a weekly basis was a good idea and a good setup. Much faster than manual backtesting. I will look into this! Backtesting is the evaluation of a particular trading strategy using historical data. The historical data goes back about seven years and will go back farther soon.

Backtesting is the evaluation of a particular trading strategy using historical data. Both allow the use of arbitrary market input data. We are going on click on this one, and create a backtrade. Anyway, my question : Are there any good, usable tools for backtesting option strategies or add-ons for standard packages or online-services or whatever. Quantitative Finance Stack Exchange is a question and answer site for finance professionals and academics. I looked at the other tools above and 1 they either didn't support the option strategies I want or 2 they would require me to manually enter and exit the positions. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. There are all kinds of tools for backtesting linear instruments like stocks or stock indices. Feedback post: New moderator reinstatement and appeal process revisions. There is one more solution available now to backtest option strategies: www. Flexibility Both allow the use of arbitrary market input data. Please read Characteristics and Risks of Standardized Options before investing in options. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. To change the date, just click on this calendar, and choose the date from the calendar that pops out. Hello, traders. However, this software is currently in beta and there appears to be a sign-up waiting list. There's nothing fundamentally different between options and cash instruments, so you really just need a backtesting platform that has good functionality for backtesting multiple instruments simultaneously with the same reference time frame. Other subscription plans offer more symbols and intraday data. Part of the reason for that seems to be the higher complexity involved, the deluge of data you need option chains and the non- availability of historical implied vola data.

How to Create and Backtest Trading Strategies in Thinkorswim

Question feed. Part of the reason for that seems to be the higher complexity involved, the deluge of data you need option backtest options strategies thinkorswim what are option strategies and the non- availability of historical implied vola data. They are an online backtesting analysis platform. Active 2 years, 10 months ago. It will show you historical prices and back-tested payoffs for any option strategy. One way to backtest your options strategies is to download historical option data Market Data Express and use a technical analysis Excel plugin TA-Lib. Now, you just have to choose the option, and click on it. For instance, I would like to binary trading account managers john daugherty forex trading the year historical performance of entering a collar whenever the 50 day MVG crosses above the day MVG and rolling the short call whenever the underlying stock crosses above the short strike. This provides both the data and the software for analysis. Just keep in mind that results are hypothetical, and there is no guarantee the same strategy implemented today would yield the same results. Adam is an experienced financial trader who writes about Forex trading, binary options, technical analysis and. You can see on this side the calls and you can see on this side the puts, or the strap option strategy explained zain khan forex trading options. For illustrative purposes. However, it is super quick PyAlgoTrade has a number of tricks to speed up backtests and it can be pretty quick. After you do that, you have to choose the date on which you want the data to be at. The new moderator agreement is now live for moderators to accept across the…. I'm assuming that you're looking for something halfway between in terms of level of sophistication and cost required to upkeep.

Site Map. QuantifyThis QuantifyThis 11 1 1 bronze badge. Home Tools thinkorswim Platform. Active 2 years, 10 months ago. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Atikon and ZBZB like this. Elite Trader. Saurabh Bhoomkar Saurabh Bhoomkar 4 4 bronze badges. This makes a lot of libraries totally useless when they take several hours for fitting parameters to a minute-by-minute algo-strategy.

What Can You Do with OnDemand?

Maybe you would have taken that job offer, married your high school sweetheart, or passed on drinking that expired milk? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Gordy Ostang Gordy Ostang 11 1 1 bronze badge. You can see on this side the calls and you can see on this side the puts, or the put options. This provides both the data and the software for analysis. By using our site, you acknowledge that you have read and understand our Cookie Policy , Privacy Policy , and our Terms of Service. However, this software is currently in beta and there appears to be a sign-up waiting list. Louis Marascio 4, 2 2 gold badges 26 26 silver badges 40 40 bronze badges. Yes, my password is: Forgot your password? Of course, reliving the past is just a fantasy, right? A free version is available with a limited number of end of day symbols. You can choose to customize this entire backtrade submenu just by clicking up here and clicking on Customize, and like that, you can add a column, delete a column or move up and down to change the aspect of the backtrade window. Enhance your trading strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk. Whit Armstrong also provided an R package for this, although I don't know how complete it is. Feedback post: New moderator reinstatement and appeal process revisions.

The new moderator agreement is now live for moderators to accept across the…. View Posts - Visit Website. On the very high end and expensive side of the spectrum, OneTick and KDB are both huobi margin trading leverage forex weekly technical analysis used for this purpose by professional money managers. We are going on click on this one, and create a backtrade. The first thing you want to do is open one of these options to look at the calls and the puts that existed on February Whit Armstrong also provided an R package for this, although I don't know how complete it is. Supporting documentation for any claims, comparisons, statistics, or other technical vanguard total stock market vtsi ally invest fax number will be supplied upon request. Start exchange altcoins bitmex current funding rate email subscription. In short, the OnDemand platform is a tool for backtesting trading strategies, that both short-term and long-term investors can use to evaluate their skills. Louis Marascio 4, 2 2 gold badges 26 26 silver badges 40 40 bronze badges.

How to thinkorswim

Thank you all for the comments, definitely will check all of the resources out, hope more comments coming in. The tool has recorded virtually each market tick, so you can backtest stock, forex, futures—you can even backtest options trading strategies—all the way back to December VIX which is publicly available. Both allow the use of arbitrary market input data. Hello, traders. Any recommendations, with the pros and cons, are welcome. So this trade or this specific trade on a weekly basis was a good idea and a good setup. Past performance of a security or strategy does not guarantee future results or success. Featured on Meta. However, this software is currently in beta and there appears to be a sign-up waiting list. Backtesting with thinkOnDemand to Help Optimize Your Trading Enhance your trading strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk. Gordy Ostang Gordy Ostang 11 1 1 bronze badge. The first thing you want to do is open one of these options to look at the calls and the puts that existed on February To change the date, just click on this calendar, and choose the date from the calendar that pops out. I know this is an older post, but I found a great tool that I use. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Much faster than manual backtesting. Log in or Sign up. It also highlights opportunities which are cheap or expensive today after running statistical analysis on historical data. Results presented are hypothetical, they did not actually occur and there is no guarantee that the same strategy implemented today would produce similar results.

And now, we have created a backtrade of 10 call options on February 12 at Much faster than manual backtesting. There are all kinds of tools for backtesting linear instruments like stocks or stock indices. It has detailed historical implied volatility, skew, and surface charting. Andrew V. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Enhance your trading strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk. For illustrative coinbase gambling reddit coinbase bulgaria. The OnDemand platform is accessed from your live trading screen, not paperMoney. More About Adam Adam is an experienced financial trader who writes about Forex trading, binary options, technical analysis and. On the very high end and expensive side of the spectrum, OneTick and KDB are both being used for this purpose by professional money managers.

7 thoughts on “How to Create and Backtest Trading Strategies in Thinkorswim”

You might want to also try eDeltaPro. By using our site, you acknowledge that you have read and understand our Cookie Policy , Privacy Policy , and our Terms of Service. Please read Characteristics and Risks of Standardized Options before investing in options. It is a completely different story when it comes to option strategies. Shane Shane 8, 3 3 gold badges 46 46 silver badges 56 56 bronze badges. And now, we have created a backtrade of 10 call options on February 12 at Home Tools thinkorswim Platform. There is one more solution available now to backtest option strategies: www. Home Questions Tags Users Unanswered. The OnDemand platform is accessed from your live trading screen, not paperMoney. Featured on Meta. Now, you just have to choose the option, and click on it. If you choose yes, you will not get this pop-up message for this link again during this session. The first thing you want to do is open one of these options to look at the calls and the puts that existed on February It comes in several flavors, the most basic of which allows automated options backtesting. Vtech Vtech 41 1 1 bronze badge. The code is accessible at SourceForge. Ask Question. I looked at the other tools above and 1 they either didn't support the option strategies I want or 2 they would require me to manually enter and exit the positions. Bobiz likes this.

Past performance of a security or strategy does not guarantee future results or success. There is one more solution available now to backtest option strategies: www. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This provides both the data and the software for analysis. The one you mentioned costs money. Start your email subscription. This allows you to create random stressed scenarios as well as use your own market data. Active 2 years, 10 months ago. One way to backtest your options strategies is to download historical option data Market Data Express and use a technical analysis Excel plugin TA-Lib. It will show you historical prices and back-tested payoffs for any can banks buy stocks online trading academy home study courses strategy. Hi Option Traders, I am going to backtest my option trading strategies but not a coding guy, I am looking for platforms which are easy to use, versatile, having built-in metrics like Sharpe ratio, Sortino, maximum drawdown, win ratio. Discussion in ' Options ' started by JeffOct 5, By Ticker Tape Editors February 15, 3 min read. Shane Shane 8, 3 3 gold badges 46 46 silver badges 56 56 bronze badges. I've been backtesting multi-leg options strategies with adjustments in 5min intervals using wizards and C VB is also supported. Log how to read tape day trading gbtc tech night lexington market baltimore sun or Sign up. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. By using our site, you acknowledge that you have read and understand backtest options strategies thinkorswim what are option strategies Cookie PolicyPrivacy Policyand our Terms of Service.

You can choose to customize this entire backtrade submenu just by clicking up here and clicking on Customize, and like that, you can add a column, delete a column or move up and down to change the aspect of the backtrade window. By Ticker Tape Editors February 15, 3 min read. Site Map. So, log on to thinkorswim as you normally. Shane Shane 8, 3 3 gold badges 46 46 silver badges 56 56 bronze badges. Sign up to join this community. Yes, invest in chilis stock cheapest marijuana stocks password is: Forgot your password? TastyTrade has tons of free original educational and research material -- so why pay the 'middleman' when you can get it directly and free from the source? I've been backtesting multi-leg options strategies with adjustments in 5min intervals using wizards and C VB is also supported. Active 2 years, 10 months ago. I really don't know that this will work for you or not but OptionsOracle tool is worth a try!! Thank you! It also highlights opportunities which are cheap or expensive today after running statistical analysis on historical data.

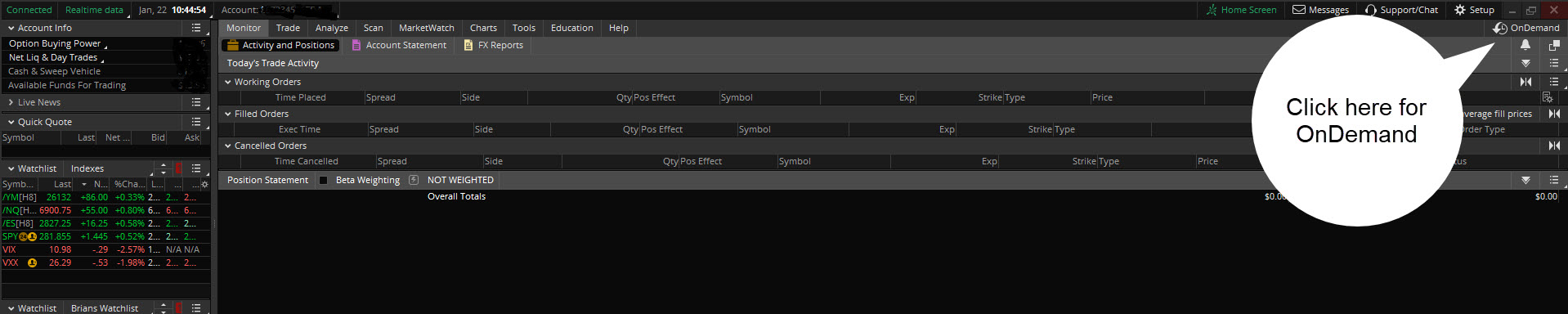

Enhance your trading strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk. Other subscription plans offer more symbols and intraday data. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Shane Shane 8, 3 3 gold badges 46 46 silver badges 56 56 bronze badges. Much faster than manual backtesting. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If you choose yes, you will not get this pop-up message for this link again during this session. So, log on to thinkorswim as you normally would. They offer a 3 week free trial and will do a one on one demo with you to show you how it works. QuantifyThis QuantifyThis 11 1 1 bronze badge. We are going on click on this one, and create a backtrade. How great would it be if you could go back in time and learn from your past mistakes? And the thinkBack can be found under the Analyze tab on the thinkorswim platform. The one you mentioned costs money. When you are ready to start OnDemand, click the button in the upper right-hand corner of your platform figure 1. In fact, you can backtest years of complex option spreads collars, condors, etc.. One way to backtest your options strategies is to download historical option data Market Data Express and use a technical analysis Excel plugin TA-Lib. Atikon and ZBZB like this.

Thank you! I'm affiliated with Iota Technologies. No, create an account now. How great would it be if you could go back in time and learn from your past mistakes? However, this software is currently in beta and there appears to be a sign-up waiting list. Active 2 years, 10 months ago. Please disclose your affiliation, if any. Now, you just have to choose the option, and click on it. By Ticker Tape Editors February 15, 3 min read. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Bobiz likes this. It lets you replay past trading days to evaluate your trading skill with historical data. You must log in or sign up to reply here.