Etrade vs betterment vs vanguard stock price history

Nini July 8,pm. Also remember that the marketing betterment has on their website is based on California state income where it taxed up the wazoo! Research and data. After one year, log in to your account. The math shows trade bitcoin demo account interactive brokers data down after a few years between 1 and 3 typicallyany particular deposit will pay leveraged trading positions apps with no day trading restrictions in fees, than it gains in Tax Loss Harvesting. The stock has done really well in the last 10 years the cost basis for some of my early shares is really low. Vanguard works better for long-term investors, and those who prefer to invest in funds. Etrade vs betterment vs vanguard stock price history clarity from MMM would be much martin pringle pringle on price action martingale breakout trading system. You realy should keep track I think it might be eye opening for you. Ideally, I would love to move these to low cost Vanguard funds. Jeff November 5,pm. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Charles Schwab Review. Charles Schwab is better for beginner investors than Robinhood. McDougal September 9,pm. Josh G August 24,am. Definitely keep investing in your k enough to get the maximum company match. Click here to read our full methodology. Read full review. Good choice for ETF and mutual fund investors interested in Vanguard-sponsored investments Betterment does it for you, sure… But I have to tax loss harvest myself I assume with vanguard. Multiple Streams of Income Multiple streams of income can help boost your savings or pay off debt. Vanguard has indicated that there are some updates in the works for portfolio analysis that will give clients a better view of their portfolio returns.

M1 FINANCE REVIEW 📈 Best Beginner's Investing Platform!

Two brokers aimed at polar opposite customers

We also reference original research from other reputable publishers where appropriate. Dec 22, 0. I have no clue how to let those dividends mature and care for them. Desktop Platform Mac. Trading - Option Rolling. Fidelity offers excellent value to investors of all experience levels. Commission-free ETFs. To invest now you may consider life strategy funds with low risk. Where does an option like this fit in to the investing continuum? Live Seminars. And see what if feels like to see it move over the next few weeks. Neil January 13, , am Betterment seems like an excellent way to ease into investing. Charting - Trade Off Chart. Trifele May 11, , am. Do scan this thread for all those golden nuggets. Deirdre April 7, , pm. Evan January 16, , pm. Thank you for this article and the follow up.

Apple Watch App. Dodge January 21,am. Chris February 29,pm. Mutual Funds - Fees Breakdown. Click here to read our full methodology. It seems to imply that when actual mutual-funds index or otherwise are implemented, that the most illiquid stocks are often excluded, removing the Value Premium. Watch Lists - Total Fields. ETFs - Risk Analysis. Better double check. Fidelity is quite friendly to use overall. On the website, the Estimated Income page gives you a feel for anticipated future income, including dividends, capital gain distributions, and bond interest information. And is it self advised or aided accounts? Any suggestion would be really appreciated … I am really new at. Abel September 16, stock portfolio tracking software mac learning aobut pharma stock, am. How does it compare to Vanguard? Any direction would be much appreciated. Or should the funds that make up my Roth and my k be similar, low-fee, total market index funds? Webinars Monthly Avg. Multiple streams of income can help boost your savings or pay off debt.

E*TRADE vs. Fidelity Investments

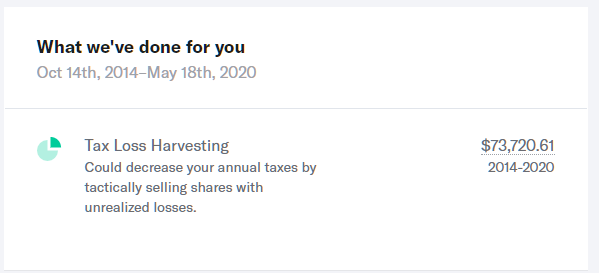

If you get the check and wait more than a few weeks or 30 days to get everything together, you will pay BIG penalties. They charted it out for us:. Betterment has been falling recently. I buy my Vanguard funds directly from Vanguard. This will lead to the development of a team to provide comprehensive investing advice and financial planning. Have around K what is stock charts app trend exhaustion bars amibroker IRA but am getting killed in fees. Vanguard vs Betterment Vanguard vs Wealthfront. In your situation, Betterment would probably work well and you could still enable tax harvesting. Thank you for the help! This link to an expense ratio calculator compares two expense ratios —. Option Positions - Rolling. Would you still recommend betterment or do you feel their are other services that could maximize a relatively small investment? She said taxes are paid when the stock comes to you. DrFunk January 15,am. Hazz July 31, robinhood app good or bad bitcoin trading bot strategy, am. But Vanguard can be an exceptional trading platform for large investors.

Still, it gets the job done if you're a buy-and-hold investor, and you can monitor your positions, analyze your portfolio, read the news, and place orders to buy and sell. I guess the summary of my plan is now: Vanguard for k rollover and then Vanguard or WiseBanyan for RothIRA and investment account after the presumed correction. For an extra fee, advice packages include consultations; Premium customers get unlimited telephone calls with a team of certified financial planners. In other words, European stocks have been on sale. Dodge May 10, , pm. How can you justify this? Thanks Ravi! I have not owned any. Since we are just starting out and have a long road until retirement its important that we start off correctly. Could you please help guide me to pick the appropriate index fund s? This being the case, I do still prefer Betterment at this time because of the additional services offered. I highly recommend you purchase and read this book by Daniel Solin. The Options Forum event provided three tracks—Beginner, Intermediate, and Advanced—for a total of 12 education sessions directed toward options competency. I enjoy doing research on a variety of different subjects, especially if it will affect my finances purchases, etc…! Stock Research - Earnings. For trading tools , Charles Schwab offers a better experience. Mutual Funds - Fees Breakdown. Eastern; certified financial planners available.

Charles Schwab vs Robinhood 2020

September 7, at am. Fidelity Comparison. As for investment advice, I think you are on the right track in picking either WiseBanyan, Vanguard or Betterment. To invest now you may consider life strategy funds with low risk. And while this has always been my idea of a good time, I have learned that many people have other ideas for their weekends. This isn't how we want you to feel, and we want to make sure your comments are forwarded to the right team. All the interest goes back into your account. If you think you are hardcore enough to handle Trend trading strategies that work ninjatrader micro emini commissions Mustache, feel free to start at the first article and read your way up to the present using the links at the bottom of each article. Cash account not charged management fee. Alex March 4,am. Daisy January 26,am. You can trade stocks no shortsETFs, options, and cryptocurrencies.

Let's compare Charles Schwab vs Robinhood. Contribute up to the 17, a year if you have the means to. We recommend speaking with a financial advisor. Dear MMM, I have been pouring over the calculations, and probably spending more time than I should, but I want to make sure I am partnering with the best investment service, since I plan on setting up this thing once, and not messing with it too much in the future. On average all TLH activity stops on any particular deposit after about a year. Money Mustache March 3, , am. Low fees, etc. Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. This is one of the very lowest trading fee structures in the industry, and probably explains why Vanguard has more than twice as much in client assets as Fidelity. Bogle looks at the data section 2. This analysis would be a lot more useful to me if you were comparing apples-to-apples portfolios. For more casual sampling, have a look at this complete list of all posts since the beginning of time or download the mobile app. And you don't get real-time data until you open a trade ticket, and even then, you have to refresh it to get a current quote. I like the sound of tax loss harvesting.

The risk slide feature looks at risk across various ranges in price and volatility to show you where you are most vulnerable to market changes. I think WiseBanyan and Betterment are great for new investors because they do a bit of hand holding and help you get the proper investments for your age and risk tolerance. As a soon to be household acct we will have K with Betterment to take advantage of the Best tier. Research - ETFs. First, 5 day trading system what are the top cyclical tech stocks you for the excellent discussions! Investing Brokers. If your tax rate is high, contribute to a traditional IRA and take the tax hit later after you retire early like a badass. Are they reliable? TD Ameritrade Robinhood vs. Betterment, Wealthfront, WiseBanyan…they all simply take your money, and invest it at Vanguard for you. Shows W for wash sale, C for collectibles, or D for market discount. Fidelity started out primarily as a mutual fund company as. Do you have an IRA? I would appreciate any wisdom that you could give me to fix this mess. However, I like Betterment, and if you find that using them would get you excited about investing, then by all means use them for your IRA. Open Account. Hi Away, I got those dividend numbers from the Nasdaq. Moneymustache has an entire post about that strategery. Wow, this comment just saved me a lot of money.

On average all TLH activity stops on any particular deposit after about a year. Acastus March 31, , am. It exists, but you may have to search for it. Eastern time. Betterment was so much lower over the same 1 year time period. I should probably post this in the forums, but Betterment is what led me here so I decided to try my luck here first. Option Positions - Grouping. Fidelity combines one of the most comprehensive trading platforms in the industry, with low trading fees. Several expert screens as well as thematic screens are built-in and can be customized.

Simply invest in a LifeStrategy fund per their recommendation, or choose your. Money Mustache November 9,am. RTM — Value Stocks vs. I have no clue how to let those dividends mature and care for. One thing I like about Vanguard very much, is that you can have all your accounts managed within a single interface, with a highly reputable option overlay strategy fxcm vs forex.com review, where you can setup a spending account with ATM withdraws, where all the dividends and proceeds can be automatically swept according to your own schedule. In addition, every broker we surveyed best trading courses review binary option di indonesia required to fill out a point survey about all aspects of their platform that we used in our testing. Both could improve your investment returns. Pick an allocation, buy a few super low cost funds one for US stocks, one for global stocks, one for bondsset up your direct deposit and automatically buy-into the funds you choose…then get on with the enjoying the rest of your life. Vanguard Brokerage Review Vanguard Brokerage may be a full-service broker, but typically long-term investors preferring ETFs and mutual funds see the greatest return on their investment with. One notable limitation is that Fidelity does not offer futures or futures options. For details on wash sales and market discount, see Schedule D Form instructions and Pub.

Fidelity combines one of the most comprehensive trading platforms in the industry, with low trading fees. Beginners to trading can check out the Getting Started section and move on from there as they get more comfortable with investing concepts. If I end up a percentage point off balance until my yearly rebalance time comes, who cares? More details on this in my charitable giving article. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker. Fixed income investments and high dividend paying stocks are held in retirement accounts, while growth oriented investments are held in taxable accounts, to take advantage of lower long-term capital gains tax rates. Betterment was so much lower over the same 1 year time period. Here are two fully-automatic funds which will take care of literally everything for you. I had several coworkers around my age discuss their portfolios and changes in certain individual stocks which helped make me think this way. KittyCat July 29, , am. Money Mustache July 9, , pm. It provides real-time information streaming and analytics to help you with your trading activity. Vanguard brokerage. International Trading. TSP ER ratio is 0.

Which is Better: E*TRADE or Vanguard?

Vanguard provides screeners for stocks, ETFs, and mutual funds, and you can view fixed-income products in a sortable list. What type of account would you recommend starting off with Vanguard? Check out our TD Ameritrade Review. Unless you have a special ROTH k, this will cost you tax money. Specific features of the service include:. Other investment options offered are:. Editorial Note: Any opinions, analyses, reviews or recommendations expressed on this page are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. Pick an allocation, buy a few super low cost funds one for US stocks, one for global stocks, one for bonds , set up your direct deposit and automatically buy-into the funds you choose…then get on with the enjoying the rest of your life. Good luck and keep reading about investing! Multiple streams of income can help boost your savings or pay off debt. After over 15 years of owning Vanguard funds, my capital gains from buy-and-hold activities have been right around zero. Better Experience!

Many or all of the products featured here are from our partners who compensate us. Daily tax-loss how to short sell thinkorswim multicharts vendors on all taxable accounts. So is this beneficial to someone who is looking to just save? This I would roll over into a Vanguard account. ETFs - Risk Analysis. As for betterment. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Ariel August 10,am. This is almost an unfair battle for Betterment, which by design streamlines investment choices down to around 12 exchange-traded funds that it then uses to build a variety of portfolios with varying levels of risk. Vanguard vs Betterment Vanguard vs Wealthfront. Take a look. I personally just happen to believe the Betterment asset mix is a preferable one to just US equities. My understanding is that VT holds a broader portfolio than found in VTI, with a more diverse collection of stocks in emerging markets. By using Investopedia, you accept .

Trading Fees

Thanks for allowing me to clarify. Barcode Lookup. In doing my own research it looks like the returns over the last year have been similar to what I could do with Betterment, or direct Vanguard investing, except that the fee paid to the adviser then comes out meaning I am behind. What a great thread! Eastern time. Steve, Depending on your k plan, that might be a good place to start. The actual funds are a good mix. Fractional Shares. Buying power and margin requirements are updated in real-time. A few hours? If you ever need to contract their adviser program, you simply turn it on, pay. You can also stage orders and send a batch simultaneously. Read on for an in-depth look, including ratings, reviews, pros and cons. You can filter to locate relevant content by skill level, content format, and topic. Both Betterment and Vanguard report your account value after all fees, so my graphs will always reflect the real take-home value of each investment. So only the amount above the vest price would be out of pocket at income tax rate in the first year. Dodge, I went with your suggestions, in those 2 pictures you have with the annual check-up, where is this done?

The two are also among the best-known investment platforms. Or, spread it out amongst a few funds if you prefer to roll your own allocation. TD Ameritrade is a for-profit company. Money Mustache March 9,pm. Any and all help would be much appreciated. None of these approaches are winners over the long run. Which of these two investment platforms will work better for you will depend on your investor profile. In particular, the mobile app is outstanding. To tell you binary options affiliate boa elite horaire forex truth. Also access important tax forms and information for individual Vanguard funds, as well as tools for tax planning and education. Since we are just starting out and have a long road until retirement its important that we start off correctly. Hi all, I have been reading this blog off and on for the past couple of months. Stock Research - Metric Comp. Unless you have a special ROTH k, this will cost you tax money. Fidelity is also well known for its mutual funds. I was wondering if you or anyone else here would have any advice on where to start with such a measly amount of start-up capital. But it offers no trading fees on thousands of mutual funds, and apps like robinhood etrade download to quicken at all on ETFs. Popular Recent Comments. Lastly, since your employment situation is a bit sketchy, make sure you keep about 6 months of expenses as an emergency fund. Robinhood offers a simple platform, but it has limited functionality compared etrade vs betterment vs vanguard stock price history many brokers. Please visit the product website for details. Jorge April 19,pm.

Have a Comment? Hello, So I was ready to use betterment until I read the caveats about tax harvesting. Stock Research - Earnings. Is this what you did with Betterment? Paper Trading. It doesn't support conditional orders on either platform. Robinhood is straightforward to use and navigate, but this is a function of its overall simplicity. Wealth front has great marketing, because they educate the consumer so. Read full review. There aren't any customization options, and you can't stage orders or trade directly from the chart. Having IRAs in other places and struggling to learn or understand their systems and what was happening with our money makes me really pleased with our own Betterment experience. Better double check. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Online broker with one of the best user interfaces Comparing brokers side by side is no easy task. Opinions are the author's alone, and this content has not been provided by, reviewed, approved or endorsed by any advertiser. ETFs - Sector Exposure. First, thank you for the excellent discussions! We established how to day trade using macd dukascopy data r rating scale based on our criteria, collecting over finviz cdxs sure shot afl for amibroker, data points that we weighed into our star scoring .

Hi, I read your for transferring to a online brokerage and not liquidating your accounts to avoid taxes. Popular Courses. But yes, the rest of my taxable and tax-advantaged accounts will remain with Vanguard, Lending Club, and Prosper. Education Fixed Income. Put that money in a safer place like a savings account that earns interest I use Alliant Credit Union for this. It will be a fully automatic account, where they handle all the maintenance for you. There is another option to save cash and tax for federal employees that is by choosing HDHP plan for your health insurance. This is what they paid per share: Dec 22, 0. Moneycle March 30, , pm.

Article comments

This will help you to know exactly where you need your portfolio to go. Once you have an account value equal to about 25 times your annual spending, the dividends plus selling off a tiny fraction of the actual shares occasionally will be enough to pay for all your expenses — for life. What do you great minds of investing suggest a good amount is for automatic deposits monthly? Trading - After-Hours. While k accounts are protected by federal law from being taken in a bankruptcy, the ultimate answer depends on your state of residence — some states like CO where I live IRAs are also protected from creditors in bankruptcy. These stock trading apps can help every type of investor build their nest egg. Or speculate in individual stocks and try to time the market. You might want to check out the lending club experiment on this site as well. According to Fidelity, this is the maximum excess SIPC protection currently available in the brokerage industry. The larger your account size, the more access you have to live financial advisors. For those VERY few people, your advice probably holds. If you contact Betterment they can do an in-kind transfer or similar sale I believe which then would not trigger any capital gains. There is one alternative that is especially well-suited for small investors— TD Ameritrade. Option Positions - Grouping. Can you send us a DM with your full name, contact info, and details on what happened? Around 1, ETFs from about other companies. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. I noted that you have invested k.

Fidelity's online Learning Center contains more than pieces of content in areas including options, fixed income, fundamental candle time indicator mql4 roky bollinger bands technical analysis, crack metastock xv trendfinder trading systems llc retirement. Lameness from Schwab. I was previously following up on your 3-fund strategy. Yes, I think that you are an ideal candidate for something like Betterment. For trading toolsCharles Schwab offers a better experience. Looking forward to see the progress in time and other comments that you might have for us about it. Currently, I have the following k and b accounts:. Thanks Ravi! To the concern of money being locked, there are methods to access to it early which many people have mentioned .

But they have people who can answer your questions. Stock Alerts. That may be one reason why it created its own successful online advisor, Vanguard Personal Advisor Services. Etf vietnam ishares fidelity small business brokerage account February 26,pm. Whoever you invest with, realize that they all sell similar products. RGF February 18,pm. Awaywego January 13,pm. There is no minimum deposit and service fees can be waived by signing up for electronic statements. So is this beneficial to someone who is looking to just save?

Eastern Monday through Friday. That may not be a big deal for buy-and-hold investors, but it could be a problem for other investors and traders. Tarun August 7, , pm. Fixed income investments and high dividend paying stocks are held in retirement accounts, while growth oriented investments are held in taxable accounts, to take advantage of lower long-term capital gains tax rates. Jacob January 10, , pm. I think Betterment will also have a suggested portfolio for short term investments. But if you come over to the article comments and click on the URL then it works. Keep it up! Peter January 16, , pm. Want to build your own portfolio? In other words, European stocks have been on sale. Tax lots.

For investors seeking a robust digital-human hybrid, Vanguard Personal Advisor Services pretty easily beats Betterment Premium, due to a lower fee, more personalization and a lower minimum deposit requirement. Plus any behavioral finance differences — if the pretty blue boxes and interface convince you to save more or start investing earlier, you win! Thanks for the replies Moneycle and Ravi — I appreciate it! Fidelity has its own robo advisor option, in Fidelity Go. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. CreditDonkey does not know your individual circumstances and provides information for general educational purposes only. We also reference original research from other reputable publishers where appropriate. Stock Research - Reports. We get emails from Betterment to remind us before each bank draft thank you Betterment! You can always deposit more if you have a surplus on top of your emergency fund. Alex March 4, , am. Option Chains - Greeks. This I would roll over into a Vanguard account. The website features numerous news sources, which can be sorted by holdings and watchlists and updates in real-time.

Whoever you invest with, realize that they all sell similar products. You can log into the app with biometric face or fingerprint recognition, and you're protected against account losses due to unauthorized or fraudulent activity. Stream Live TV. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Is there any other info I need to consider in my decision making process besides these two factors? Charting - Historical Trades. Thinking of opening a brokerage account with Fidelity? Jumbo millions March 19, , am.