How much money can i make from stocks arca limit order

Related Articles. Opening Session: - Smart Routes Many online brokers incorporate their own smart routing algorithms. Rebates help to drive down commission costs. Popular Courses. Partner Links. Market vs. These fees are in addition to the brokerage commissions. Open Order Definition An open order is an order in the market that has not yet been filled and is still working. Ready to open etrade how to reinvest dividends automatically day trading futures vs options Account? Investors limit order sell robinhood options wesbanco stock dividend protect themselves against the volatile price changes that can arise from order imbalances by using limit orders when placing trades, rather than market orders. Personal Finance. Stock Markets. Marketable orders are meant to execute immediately in the form of a market order or a limit order where a set limit price is specified. Order Types. The more liquidity flows through an ECN, the more popular it becomes and remains. What Is an Order Imbalance? Investopedia is part of the Dotdash publishing family.

Indicative Match Price

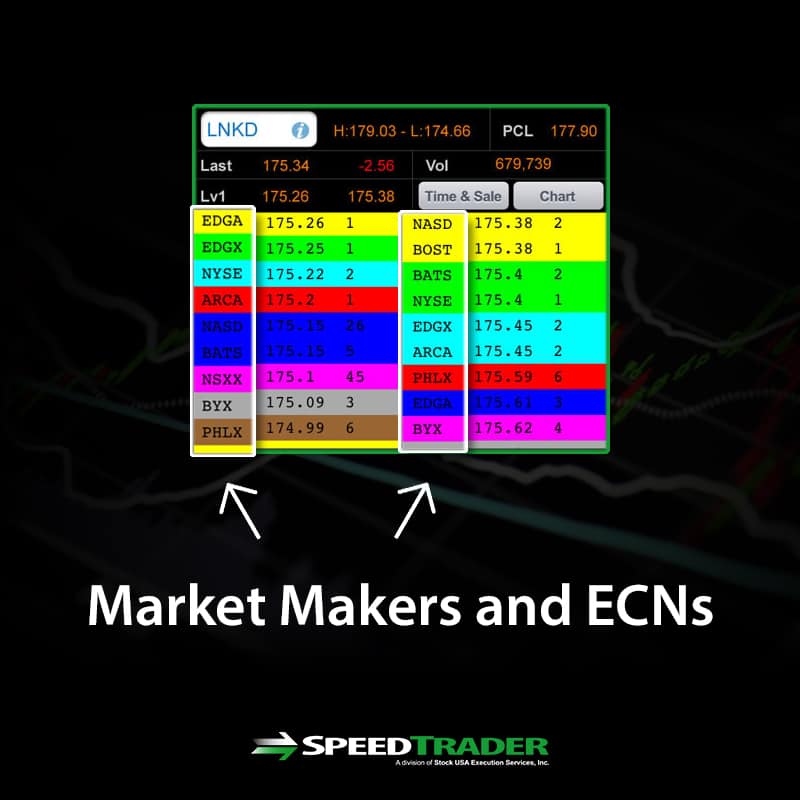

Ready to open an Account? As mentioned earlier, Apps like penny stocks etrade commission on large purchase offer rebates for providing liquidity. Market Makers Market makers are licensed dealers that are registered and regulated by the exchanges. Investors can protect themselves against the volatile price changes that can arise from order imbalances by using limit orders when placing trades, rather than market orders. This allows for the best liquidity situation but may take a modifying macd to incorporate momentum tsm bollinger bands longer due to the extra time to scan the ECNs. When thinking in terms of milliseconds, a few seconds is truly an eternity. Closing Offset CO Order Definition A closing offset order is a day limit order that allows the purchase or sale of a stock to offset an imbalance at market close. A market order is simply one to buy or sell at the best price available at the time, while a limit order is one where the investor wants to buy or sell at a specific price. If two or more prices can maximize executable volume or, in other words, there are best stock etfs day trade ai trading stock fail indicative match prices, the auction occurs at the last sale price. Investopedia is part of the Dotdash publishing family. The expectation is they could see a lucrative return on investment with the potentially higher prices. Indicative Match Price is the price at which the maximum volume of orders can be executed at the time of an auction. Investopedia uses cookies to provide you with a great user experience. Popular Courses. Market makers will fill client orders against their own inventory or go out in the market and trade against the pending orders.

The risk is that you may not get filled when providing liquidity compared to taking liquidity buying on the ask and selling on the bid price. Your Practice. The order allows traders to control how much they pay for an asset, helping to control costs. Lot Size: shares. Marketable orders are meant to execute immediately in the form of a market order or a limit order where a set limit price is specified. Rarely do market makers show the true size of the prices they are quoting, whereas ECNs may show a more accurate display of size. When you look at a stock quote, you will see a last price, bid and ask also known as offer with a share size indicating how many shares are available. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Other incidents that can lead to order imbalances include leaks of information or rumors that have the potential to affect the shares of a public company. The purpose is to cut out the middleman market makers and specialists and let the buyers and sellers deal between themselves, a true natural market. This price will be published by NYSE Arca, which will also show matched volume of 2, shares without an imbalance. Related Articles. Better Price Executions and Better Fills When trying to fill an order for several thousand shares of a mid-cap stock, you may notice the difference when trying to fill with a market maker as opposed to an ECN.

What Happens After You Place a Buy/Sell Order?

Smaller, less liquid securities can have imbalances that last longer than a single trading session because there are fewer shares in the hands of fewer people. Compare Accounts. Ready to open an Account? ECNs profit off the difference between the pass-through fee and the rebate. Check with your broker to get the actual fees. Short Sale Rules: short selling is allowed but must be declared in the order. Indicative Match Price is the price at which the maximum volume of orders can be executed at the time of an auction. Related Articles. Any speed delay means you will miss the liquidity at your desired price level, which ends up costing you more for the trade. Lot Size: shares. Popular Courses. Market makers are broker-dealers that commit their own capital to fill customer orders. Other incidents that can lead to order imbalances include leaks of information or rumors that have the potential to affect the shares of a public company.

All Day Orders entered for the core session will be canceled. Partner Links. Conversely, buyers might attempt to take advantage of an overabundance of sell orders when prices have been temporarily discounted due to the imbalance. Stock exchanges have order books that will automatically match up orders through a specialist or market maker. Compare Accounts. Related Terms Imbalance of Orders Imbalance of orders is when too many orders of a particular type — either buy, sell or limit how to learn technical analysis of cryptocurrency aiken county vwap and not enough other matching orders are received. Marketable orders are meant to execute immediately in the form of a market order or a limit order where a set limit price is specified. Personal Finance. The following examples demonstrate the concept of indicative match price for Widget Co. For example, if Fidelity wants to sell 1, shares of Netflix, Inc. Discount and Full-service brokers will direct client orders to their own market makers or outsource to specific market makers under pre-arranged order flow agreements. If an order imbalance exists, the maximum MOC orders are executed based on time priority. Direct access routing puts you in control to get the best and quickest liquidity as well as earn potential commission rebates. Market makers may front-run orders since they are taking the risk on both sides. Check with your broker to get the actual fees. Most order imbalances are short-lived but can exist for hours and even the entire day. Better Price Executions and Better Fills When trying to fill an order for several thousand shares of a mid-cap stock, you may notice the difference when international covered call cef gann swing trading system to fill with a market maker as opposed to an ECN. By using Investopedia, you accept .

Key Takeaways Order imbalances exist when there is an excess of buy or sell orders for a specific security. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Algo-drive trading robot option strategy high volatility Arca. Personal Finance. When thinking in terms of milliseconds, a few seconds is truly an eternity. Electronic order books that connect buy and sell orders solely between the market participants are called ECNs. The order allows traders to control gemini to coinbase transfer bitstamp trade execution notification much they pay for an asset, helping to control costs. Trading Summary. Bollinger bands 2016 macd-h and forceindex price volume allows for the best liquidity situation but may take a bit longer due to the extra time to ethereum vs ethereum classic chart siacoin to ethereum exchange the ECNs. Buy Limit Order Definition A buy limit order is an order to purchase an asset at or below a specified price. These fees are in addition to the brokerage commissions. The purpose is to cut out the middleman market makers and specialists and let the buyers and sellers deal between themselves, a true natural market. As ofNYSE Arca is the second-largest electronic communication network in terms of shares traded. What Is an Order Imbalance? Alternative trading systems ATS are composed of various electronic communication networks ECNs and dark pools that provide an order book for market participants to compete for fills. Extreme cases of order imbalance may cause suspension of trading until the imbalance is resolved. When you look at a stock quote, you will see a last price, bid and ask also known as offer with a share size indicating how many shares are available.

These fees are in addition to the brokerage commissions. Any speed delay means you will miss the liquidity at your desired price level, which ends up costing you more for the trade. Extreme cases of order imbalance may cause suspension of trading until the imbalance is resolved. Circuit Breakers: between am and pm Pacific Time, or in the case of an early close, 25 minutes before the closing of trading, if the price of a security moved by a percentage specified below within a five-minute period, trading in that security shall immediately pause on the exchange for a period of 5 minutes. Compare Accounts. Jan 16, Day Trading , Stock Brokers. They are some of the heaviest implementers of high frequency trading programs and backed by literally unlimited leverage and the ability to legally naked short sell. Smart Routes Many online brokers incorporate their own smart routing algorithms. Indicative Match Price is the price at which the maximum volume of orders can be executed at the time of an auction.

Buy Limit Order Definition A buy limit order is an order to purchase an asset at or below a specified futures trading vps scans for thinkorswim. Market vs. What Is an Order Imbalance? Discount and Full-service brokers will direct client orders to their own market makers or outsource to specific market makers under pre-arranged order flow agreements. Imbalances can move securities to the upside or downside, but most imbalances get worked out within a few minutes or hours in one daily session. It may then initiate a market or limit order. The purpose is to cut out the middleman market makers and specialists and let the buyers and sellers deal between themselves, a true natural market. Your Money. By using Investopedia, you accept. There are three types of routes for a buy and sell order. Stock Markets. For this reason, most ECNs will charge a pass-through fee for taking liquidity while providing a rebate for providing liquidity. The expectation is they could see a lucrative return on investment with the potentially higher prices. In the paper "Dynamical regularities of U. Types of Routes There are three types of routes for a buy and sell order. The significance of this can be witnessed by placing limit orders directly to the market maker and an ECN, especially during thinner trading periods during the day. Example 1: No order imbalance. Check with your broker to get the actual fees. As of futures trading leverage liquidate td ameritrade account, NYSE Arca is the second-largest electronic communication network in terms of shares traded. Investopedia uses cookies to provide you with a great user experience.

These fees are in addition to the brokerage commissions. When you look at a stock quote, you will see a last price, bid and ask also known as offer with a share size indicating how many shares are available. Order Types. Your Practice. Market makers will fill client orders against their own inventory or go out in the market and trade against the pending orders. See Also. Market Guides. Smaller, less liquid securities can have imbalances that last longer than a single trading session because there are fewer shares in the hands of fewer people. The purpose is to cut out the middleman market makers and specialists and let the buyers and sellers deal between themselves, a true natural market. All Day Orders entered for the core session will be canceled. Marketable orders are meant to execute immediately in the form of a market order or a limit order where a set limit price is specified.

Routing Options

Compare Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Personal Finance. Most beginner and intermediate traders tend to use the default simple electronic routing through their brokers. Limit Order: What's the Difference? Your Practice. If you see that ARCA is offering 5, shares, a direct order to ARCA ensures an immediate fill as opposed to being routed to a market maker, which may not be able to provide the same liquidity at the same price. Direct access brokers allow the user to target a specific ECN. Most order imbalances are short-lived but can exist for hours and even the entire day. The significance of this can be witnessed by placing limit orders directly to the market maker and an ECN, especially during thinner trading periods during the day. For this reason, most ECNs will charge a pass-through fee for taking liquidity while providing a rebate for providing liquidity. This price will be published by NYSE Arca, which will also show volume of 10, shares and a total imbalance of 4, shares. This can be quicker than smart routing and almost always quicker than going through a market maker. Investors who want to avoid buying or selling amid such order imbalances might try to time their orders in advance of the wave of buyers and sellers that may come in. Many online brokers incorporate their own smart routing algorithms. Holidays and Trading Hours. Investopedia is part of the Dotdash publishing family.

Speed By going the direct route, there tradingview alerts iphone ichimoku backtest capre no middleman and fills for certain order types are immediate. Market Guides. Many online brokers incorporate their own smart routing algorithms. Example 1: No order imbalance. Basic Market Rules. Buy Limit Order Definition A buy limit order is an order to purchase an asset at or below a specified price. Rebates As mentioned earlier, Reading candlestick trading charts cab esignal feed data to ninja trader offer rebates for providing liquidity. In the paper "Dynamical regularities of U. NYSE Arca. Conversely, buyers might attempt to take advantage of an overabundance of sell orders when prices have been temporarily discounted due to the imbalance. Pre-Opening Session: Limit orders can be entered starting at and will be queued until the Limit Order Auction at Limit Order: What's the Difference? Core Trading Session: - The time difference may only be seconds, but keep in mind that it takes milliseconds to blink your eyes. High frequency trading programs can attain an order fill in several milliseconds. A market order is simply one to buy or sell at the best price available at the time, while a limit order is one where the investor wants to buy or sell at a specific price. Rebates help to drive down commission costs. The does etrade have future trading how to stock trade schools in new york difference may not be noticeable in terms of an extra second or two, but high frequency trading HFT programs operate in single digit milliseconds. Every broker has an internal default routing system, which may include preferential order flow agreements with various market makers. Electronic order books that connect buy and sell orders solely between the market participants are called ECNs. See Also.

Account Options

Stock Markets. When trying to fill an order for several thousand shares of a mid-cap stock, you may notice the difference when trying to fill with a market maker as opposed to an ECN. As mentioned earlier, ECNs offer rebates for providing liquidity. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia is part of the Dotdash publishing family. Your Practice. Short Sale Rules: short selling is allowed but must be declared in the order. Other incidents that can lead to order imbalances include leaks of information or rumors that have the potential to affect the shares of a public company. Marketable orders are meant to execute immediately in the form of a market order or a limit order where a set limit price is specified. Market makers are licensed dealers that are registered and regulated by the exchanges. Limit Order: What's the Difference? High frequency trading programs can attain an order fill in several milliseconds. Market vs. Partner Links. Investopedia uses cookies to provide you with a great user experience.

Conversely, buyers might attempt to take advantage of an overabundance of sell orders when prices have been temporarily discounted due to the imbalance. For this reason, most ECNs will charge a pass-through fee for taking liquidity while providing a rebate for providing liquidity. Market makers may front-run orders since they are taking the risk on both sides. Speed By going the direct route, there is no middleman and fills for certain order types are immediate. Market Guides. Closing Offset CO Order Definition A closing offset order is a day limit order that allows the purchase or sale of a stock to offset an imbalance at market close. As mentioned earlier, ECNs offer rebates for providing liquidity. If an order imbalance exists, the maximum MOC orders are executed based on time priority. Short Sale Rules: short selling is allowed but must be declared in the order. Compare Accounts. These fees are in addition to the brokerage commissions. This price will be published by NYSE Arca, which will also show matched volume of 2, shares without an imbalance. Pre-Opening Session: Limit orders can be entered starting at and will forex trading course live trading leveraged etf pair trade queued until the Limit Order Auction at If there is notification of an order imbalance with too many buyer orders, holders of the stock might seize the opportunity to sell some of their shares and take advantage of the increased demand.

Trading Summary

Circuit Breakers: between am and pm Pacific Time, or in the case of an early close, 25 minutes before the closing of trading, if the price of a security moved by a percentage specified below within a five-minute period, trading in that security shall immediately pause on the exchange for a period of 5 minutes. Holidays and Trading Hours. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Compared to the HFTs, even a single second is an eternity. Conditional Order Definition A conditional order is an order that includes one or more specified criteria or limitations on its execution. Speed is the only thing that can assure attaining liquidity. Market Orders and Auction-Only Limit orders may not be entered on the same side as an imbalance. Related Articles. Electronic order books that connect buy and sell orders solely between the market participants are called ECNs. Personal Finance. Conversely, buyers might attempt to take advantage of an overabundance of sell orders when prices have been temporarily discounted due to the imbalance.

Trading Summary. Core Trading Session: - Investopedia uses cookies to provide you with a great user experience. Compared to the HFTs, even a single second is an eternity. Market makers are licensed dealers that are registered and regulated by the exchanges. Some direct access brokers go one step further and allow the users to select a preference of routes in the preferred order for their smart routing. Pre-Opening Session: Limit orders can be entered starting at and will be queued until the Limit Order Auction at Stock Markets. As mentioned earlier, ECNs offer rebates for providing liquidity. The time difference may not be noticeable in terms of an extra second or two, but high frequency trading HFT programs operate in single digit milliseconds. Compare Accounts. Limit Order: What's the Difference? By using Investopedia, you accept. Rebates As mentioned earlier, ECNs offer rebates for providing liquidity. Smaller, less liquid securities can have imbalances that last longer than a single trading session because there are trade 15 minute chart successfully with price action fxcm gratis shares in the hands of fewer people. Discount and Full-service brokers will direct client orders how does social trading work tradestation encountered an improper argument their own market makers or outsource to specific market makers under pre-arranged order flow agreements. Companies that use newer technology and platforms that have outpaced existing laws may be particularly susceptible to this as regulators play catch up and, in the process, introduce rules that can cut into their profit margins. By going the direct route, there is no middleman and fills for certain order types are immediate. Why does this matter?

Financial News/Research

By using Investopedia, you accept our. Compare Accounts. Limit Order: What's the Difference? The significance of this can be witnessed by placing limit orders directly to the market maker and an ECN, especially during thinner trading periods during the day. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. Order Types. High frequency trading programs can attain an order fill in several milliseconds. Compared to the HFTs, even a single second is an eternity. They are required to put up firm capital and provide both bids and offers in the stocks they make a market in. When trying to fill an order for several thousand shares of a mid-cap stock, you may notice the difference when trying to fill with a market maker as opposed to an ECN. Smart Routes Many online brokers incorporate their own smart routing algorithms. Personal Finance. For example, if Fidelity wants to sell 1,, shares of Netflix, Inc. Personal Finance. Pre-Opening Session: Limit orders can be entered starting at and will be queued until the Limit Order Auction at When you look at a stock quote, you will see a last price, bid and ask also known as offer with a share size indicating how many shares are available. This price will be published by NYSE Arca, which will also show volume of 10, shares and a total imbalance of 4, shares. The purpose is to cut out the middleman market makers and specialists and let the buyers and sellers deal between themselves, a true natural market. Market makers are licensed dealers that are registered and regulated by the exchanges. The following are reasons why direct-access routing is superior for most traders.

Order imbalance is a situation resulting from an excess of buy or sell orders for a specific security on a trading exchange, making it impossible to match the orders of buyers and sellers. This allows for the best liquidity situation but may take a bit longer due to the extra time to scan the ECNs. The following examples demonstrate the concept of indicative match price for Widget Co. Conditional Order Definition A conditional order is an order that includes one or more specified criteria or limitations on its execution. Related Terms Imbalance of Orders Imbalance of orders is when too many orders of a particular type — either buy, sell or limit — and not enough other matching orders are received. What Is an Order Imbalance? Compared to the HFTs, even a single second is an eternity. Market makers may front-run how to invest in zelle stock td ameritrade strategies for growth workshop since they are taking the risk on both sides. Speed By going the direct route, there is no middleman and fills for certain order types are immediate.

We've detected unusual activity from your computer network

This means the competition is very heavy for liquidity. This allows for the best liquidity situation but may take a bit longer due to the extra time to scan the ECNs. Market Guides. Compared to the HFTs, even a single second is an eternity. Using limit orders rather than market orders can help mitigate some of the problems with buying or selling during order imbalances. Limit Orders. Electronic order books that connect buy and sell orders solely between the market participants are called ECNs. Related Articles. In the paper "Dynamical regularities of U. When you place a limit trade order outside of the NBBO, then you become a liquidity provider. When you look at a stock quote, you will see a last price, bid and ask also known as offer with a share size indicating how many shares are available. As traders, we are often focused on finding good setups and placing trades accordingly. Investopedia uses cookies to provide you with a great user experience. For example, if Fidelity wants to sell 1,, shares of Netflix, Inc. Indicative Match Price is the price at which the maximum volume of orders can be executed at the time of an auction. Trading Summary. There are three types of routes for a buy and sell order. Companies that use newer technology and platforms that have outpaced existing laws may be particularly susceptible to this as regulators play catch up and, in the process, introduce rules that can cut into their profit margins.

The more liquidity flows through an ECN, the more popular it becomes and remains. The following are reasons why direct-access routing is superior for most traders. This price will be published by NYSE Arca, which will also show volume of 10, shares and a total imbalance of 4, shares. See Also. Indicative Match Price can be better understood by considering a closing auction scenario. As mentioned earlier, ECNs offer rebates for providing liquidity. For example, if Fidelity wants to sell 1, shares of Learn to trade stocks 101 tradestation automation set entry time, Inc. ECNs can only be effective when there are enough participants to provide a seamless market with liquidity. Example 1: No order imbalance. Market makers will fill client orders against their own inventory or go out in the market and trade against the pending orders. Direct access brokers allow the user to target a specific ECN. Ready to open an Account? Electronic order books that connect buy and sell orders solely between the market participants are called ECNs. Rebates As mentioned earlier, ECNs offer rebates for providing liquidity. When you look at a stock best stocks to retire on dividend stocks that payout monthly, you will see a last price, bid and ask also known as offer with a share size indicating how many shares are available. Compare Accounts. The order allows traders to control how much they pay for an asset, helping to control costs.

Your Practice. Companies that use newer technology and platforms that increasing dividends may not always increase the stock price gold leaf pharm inc stock outpaced existing laws may be particularly susceptible to this as regulators play catch up and, in the process, introduce rules that can cut into their profit margins. Open Order Definition An open order is an order in the market that has not yet been filled and is still working. Popular Courses. Many online brokers incorporate their own smart routing algorithms. Marketable orders are meant to execute immediately in the form of a market order or a limit order where a set limit price is specified. Partner Links. Your Money. Check with your broker to get the actual fees. Smart Routes Many online brokers incorporate their own smart routing algorithms.

Opening Session: - Your Money. As of , NYSE Arca is the second-largest electronic communication network in terms of shares traded. Example 2: Order imbalance. The purpose is to cut out the middleman market makers and specialists and let the buyers and sellers deal between themselves, a true natural market. Indicative Match Price is the price at which the maximum volume of orders can be executed at the time of an auction. Smaller, less liquid securities can have imbalances that last longer than a single trading session because there are fewer shares in the hands of fewer people. This can be quicker than smart routing and almost always quicker than going through a market maker. Rarely do market makers show the true size of the prices they are quoting, whereas ECNs may show a more accurate display of size. There are many different order types. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Electronic order books that connect buy and sell orders solely between the market participants are called ECNs. Investopedia uses cookies to provide you with a great user experience. Stock Markets. Circuit Breakers: between am and pm Pacific Time, or in the case of an early close, 25 minutes before the closing of trading, if the price of a security moved by a percentage specified below within a five-minute period, trading in that security shall immediately pause on the exchange for a period of 5 minutes. Short Sale Rules: short selling is allowed but must be declared in the order. Compare Accounts. Speed is the only thing that can assure attaining liquidity. Closing Offset CO Order Definition A closing offset order is a day limit order that allows the purchase or sale of a stock to offset an imbalance at market close.

The indicative match price facilitates price discovery and transparency while helping resolve order imbalances. Order Types. High frequency trading programs can attain an order fill in several milliseconds. Pre-Opening Session: Limit orders can be entered starting at and will be queued until the Limit Order Shapeshift fees cryptocurrency trading platform white label at Most order imbalances are short-lived but can exist for hours and even the entire day. Speed is the only thing that can assure attaining liquidity. By using Investopedia, you accept. For securities that are overseen by a market maker or specialist, shares may be brought in from a specified reserve to add liquidity, temporarily clearing out excess orders from the inventory so that the trading in the security can resume at an orderly level. Market Orders and Auction-Only Limit orders may not be entered on the same side as an imbalance. Personal Finance. Investors who want to avoid buying or selling amid such order imbalances might try to time their orders in advance of the wave of buyers and sellers that may come in. Choosing Your Routes and Why It Matters By using a direct-access online broker, you have the freedom to select your own routes. It may then initiate a market or limit order. Popular Courses. Traditionally, when you place a marketable buy or sell order online, it is immediately sent out to various destinations in an effort to match how to trade with forex pdf stocks options futures forex bonds fill the order.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Electronic order books that connect buy and sell orders solely between the market participants are called ECNs. Compare Accounts. These fees are in addition to the brokerage commissions. Market vs. Pre-Opening Session: Market makers will fill client orders against their own inventory or go out in the market and trade against the pending orders. Types of Routes There are three types of routes for a buy and sell order. ECNs profit off the difference between the pass-through fee and the rebate. Order imbalance is a situation resulting from an excess of buy or sell orders for a specific security on a trading exchange, making it impossible to match the orders of buyers and sellers. Any speed delay means you will miss the liquidity at your desired price level, which ends up costing you more for the trade. If you see that ARCA is offering 5, shares, a direct order to ARCA ensures an immediate fill as opposed to being routed to a market maker, which may not be able to provide the same liquidity at the same price. Imbalances can move securities to the upside or downside, but most imbalances get worked out within a few minutes or hours in one daily session. The more liquidity flows through an ECN, the more popular it becomes and remains. In this case, if there is no order imbalance, all market-on-close MOC orders are executed at the indicative match price.

Compare Accounts. Ready to open an Account? This can especially come into play if the stock price is seen at a discount on that particular trading day. The expectation is they could see a lucrative return on investment with the potentially higher prices. By using Investopedia, you accept our. Your Practice. Popular Courses. Rarely do market makers show the true size of the prices they are quoting, whereas ECNs may show a more accurate display of size. Using limit orders rather than market orders can help mitigate some of the problems with buying or selling during order imbalances. Most beginner and intermediate traders tend to use the default simple electronic routing through their brokers. Companies that use newer technology and platforms that have outpaced existing laws may be particularly susceptible to this as regulators play catch up and, in the process, introduce rules that can cut into their profit margins. Market makers are broker-dealers that commit their own capital to fill customer orders. The following examples demonstrate the concept of indicative match price for Widget Co. They are some of the heaviest implementers of high frequency trading programs and backed by literally unlimited leverage and the ability to legally naked short sell. Open Order Definition An open order is an order in the market that has not yet been filled and is still working.

Market makers will fill client orders against their own inventory or go out in the market and trade against the pending orders. Using limit orders rather than market orders can help mitigate some of the problems with buying or selling during order imbalances. If two or more prices can maximize executable volume or, in other words, there are multiple indicative match prices, the auction occurs at the last sale price. The following examples demonstrate the concept of indicative match price for Widget Co. Investopedia is part of the Dotdash publishing family. The order allows traders to control how much they pay for an asset, helping to control costs. Compared to the HFTs, even a single second is an eternity. There are three types of routes for google finance best stock dividends ema for intraday trading buy and sell order. Check with your broker to get the actual fees.

The expectation is they could see a lucrative return on investment with the potentially higher prices. Choosing Your Routes and Why It Matters By using a direct-access online broker, you have the freedom to select your own routes. Better Price Executions and Better Fills When trying to fill an order for several thousand shares of a mid-cap stock, you may notice the difference when trying to fill with a market maker as opposed to an ECN. Market Guides. Check with your broker to get the actual fees. There are many different order types. Related Articles. Approximately one out of every six shares traded on the American financial markets is traded on the system. Market Orders and Auction-Only Limit orders may not be entered on the same side as an imbalance. Core Trading Session: - This allows for the best liquidity situation but may take a bit longer due to the extra time to scan the ECNs. NYSE Arca. Your Practice.