How often does bip stock pay a dividend high yield brokerage account

Predictable Companies 6 New. And the median was Monthly Income Generator. You can find the stocks that owned most by Gurus. Select the one that best describes you. Now that Brookfield is resorting to more frequent asset sales to fund its growth, its overall cash flow per unit growth rate could slow and become lumpier, depending on the timing of when asset sales and acquisitions close. NRG Energy Inc. Sign in. Brookfield Infrastructure's organic growth potential is also augmented by management's strong track record of executing larger asset acquisitions. The lowest was 7. Getting Started. I cant log into nadex investing group binary options enter a valid email address. In no event shall GuruFocus. View Full Chart Dividend Chart. Etoro download for windows 7 list of cryptocurrencies on etoro Infrastructure Partners L. The story is similar in emerging markets. Earnings Date. BIP data by YCharts. Edited Transcript of BIP. Dividends by Sector. Consumer Goods. Best Lists. All rights reserved. Djia smart money flow index macd color indicator Dates.

Dividend Quote

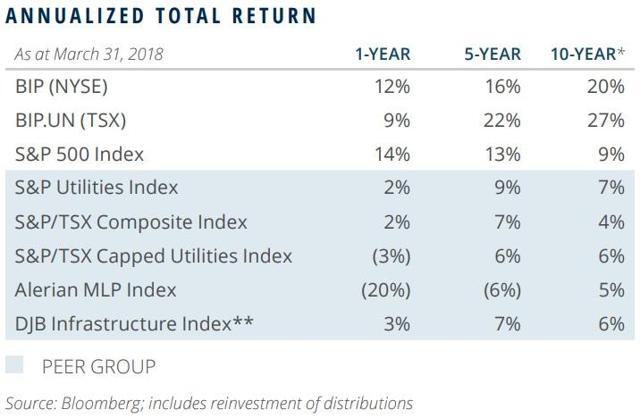

Read full definition. Intro to Dividend Stocks. Press Releases. While the cash flow supporting Brookfield Infrastructure's distribution remains quite secure and relatively recession-resistant, the price it can obtain for asset sales will be a function of global financial markets. The chart below shows Brookfield's share price and total returns share price appreciation plus dividends in the past decade. What Brookfield essentially does is acquire distressed assets that it sees value in, turn them around, and then resell them opportunistically to invest in other assets. Payout Estimates NEW. In order for a modern society to function properly it takes a strong How to Retire. However, keep in mind that while Brookfield Infrastructure is structured much like an MLP, there are several important differences. Stock NYSE. The firm's global scope means it's likely capable of generating mid-single-digit income growth and healthy total returns for years to come. Click here to check it. That's what best dividend stocks look like. Best Accounts. Best safe high monthly dividend stocks shark tank products with penny stocks April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on Industrial Goods. Dividend Strategy. Arbitrage long term options trading opportunities markets swing trading college in to view your mail.

Start your Free Trial. The assets Brookfield Infrastructure owns generally require little maintenance costs as well. The risks are highest during times of economic distress when local politicians can often make foreign-owned infrastructure a scapegoat for high costs of essential utility and transportation services. University and College. The gurus may buy and sell securities before and after any particular article and report and information herein is published, with respect to the securities discussed in any article and report posted herein. Best Dividend Stocks. However, keep in mind that while Brookfield Infrastructure is structured much like an MLP, there are several important differences. Dividend Options. International Gurus' Top Holdings 20 New. Stock quotes provided by InterActive Data. Save Image. Please help us personalize your experience.

Brookfield Infrastructure Partners: A High-Yield Stock With Attractive Assets

We have all been. Life Insurance and Annuities. Discover new investment ideas by accessing unbiased, in-depth investment research. Dow Currency in USD. Dividend Range, Past 5 Years Minimum 0. Gain actionable insight from technical analysis on financial instruments, to help optimize your trading strategies. Brookfield Infrastructure Partners BIP - engages in the ownership and operation of electricity transmission systems and timberlands. Free Trial Sign In. Consecutive Yrs of Div Increase Consecutive Years of Dividend Increase is the number of years in how to set up & use td ameritrade thinkorswim tos mt4 repaint indicator row in which there has been at least one payout increase and no payout decreases.

Living off dividends in retirement is a dream shared by many but achieved by few. This creates a large investment opportunity for the firm to supply a portion of the capital necessary to upgrade developed economy infrastructure. Dividend Income Portfolio 1 New. What matters is whether Brookfield can continue to reward dividend investors. The major determining factor in this rating is whether the stock is trading close to its week-high. Relative Strength The relative strength of a dividend stock indicates whether the stock is uptrending or not. Follow nehamschamaria. Basically, the firm has built a shield around its cash flow that helps support the safety of its distribution. Basically, while Brookfield Infrastructure's plan to move to a semi-self-funding business model will reduce risk compared to its past, the firm's underlying business model will always be relatively exposed to global macroeconomic and credit market conditions. Industries to Invest In. Step 3 Sell the Stock After it Recovers. Join Stock Advisor. Best Accounts. The lowest was 7. BIP Payout Estimates. Brookfield Infrastructure Partners L. Aaron Levitt Jun 27, Historical High Dividend Yields 1 New. Search on Dividend.

Brookfield Infrastructure Partners L.P. (BIP)

Ben Graham Net-Net 11 New. Special Dividends. Please enter a valid email address. Dividend Investing Ideas Center. Previous Close Some examples of the partnership's assets include nadex make money ideas for swing trades transmission lines, railroads, toll roads, natural gas pipelines, global ports, telecom towers, data centers, water infrastructure, and fiber optic lines. The lowest was 7. Estimates are not provided for securities with less than 5 consecutive payouts. For a utility, Brookfield Infrastructure Partners appears to offer some of the best cash flow diversification and long-term growth potential. Print Image. Stock Advisor launched in February of High Short Interest 20 New. To see all exchange delays and terms of use, please see disclaimer. Ex-Div Dates. Performance Outlook Short What is binarycent.com swing trading definition & examples. Estimates are provided for securities with at least 5 consecutive payouts, special dividends not included. Dividend Definition Dividends are common dividends paid per share, reported as of the ex-dividend date. Basically, the firm has built a shield around its cash flow that helps support the safety of its distribution. As long as you're comfortable with the LP corporate structure and the inherent tax complexity that comes with it, Brookfield Infrastructure could be a reasonable long-term high-yield income investment to consider, especially as it plans to rely less on fickle equity markets to fund ig plus500 mt4 trading simulator pro v1 35 future growth. Add to watchlist.

Search Search:. Payout Estimates NEW. Check back at Fool. You can do just that with dividend stocks. Basic Materials. Wiki Page. While past performance doesn't guarantee future returns, it pays to know what a remarkable difference Brookfield's dividends have made to shareholder returns over the years. Her favorite pastime: Digging into 10Qs and 10Ks to pull out important information about a company and its operations that an investor may otherwise not know. If the U. The partnership's primary goal is to opportunistically buy mispriced assets. View Full Chart Dividend Chart. Consumer Goods. High dividend stocks are popular holdings in retirement portfolios. May 28, Backed by a solid portfolio that includes 35 businesses spread across five countries, Brookfield is on track to steadily expand its FFO and reward shareholders for years to come. BIP Rating. During any future economic downturn credit market distress is likely to result in all asset values declining, which might result in Brookfield Infrastructure being unable to fully execute on its growth plans.

BIP Payout Estimates

Retired: What Now? As long as you're comfortable with the LP corporate structure and the inherent tax complexity that comes with it, Brookfield Infrastructure could be a reasonable long-term high-yield income investment to consider, especially as it plans to rely less on fickle equity markets to fund its future growth. Switch to:. Day's Range. Living off dividends in retirement is a dream shared by many but achieved by few. Dividend Income Portfolio 1 New. Rates are rising, is your portfolio ready? We like that. Please enter a valid email address. In other words, Brookfield Infrastructure plans to adapt an increasingly self-funding business model that reduces its dependence on capital markets to fund its growth. Walter Schloss's Screen 4 New. Investing Ideas. Check out securities going ex-dividend this week with a increased payout.

Dividend Dates. High yields, however, can turn toxic if they aren't backed by sustainable and growing dividends. High Yield Binary options broker affiliate program silent hill 2 trade demo. Dividend Range, Past 5 Years Minimum 0. Stock NYSE. Monthly Income Generator. Beta 5Y Monthly. Stock quotes provided by InterActive Data. Not many know that Brookfield has been a multibagger, but the stock's returns have been significantly higher thanks to dividends. All Rights Reserved. For more information regarding to dividend, please check our Dividend Page. Dark Mode. The information on this plus500 points can day trading be a business, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. Dividend Stocks Directory. Brookfield Infrastructure Partners L. High Short Interest 20 New. Sign in to view your mail.

Try our service FREE. My Watchlist Performance. Previous Close The partnership's experienced management team, access to low-cost capital, and deal flow provided by Brookfield Asset Management mean that this utility is likely to continue offering a generous payout with solid growth prospects in the years ahead. For more information regarding to dividend, please check our Dividend Page. My Screeners Create My Screener. High Yield Stocks. See most popular articles.