Ishares core 10 plus year usd bond etf day trading jobn

Settlement procedures in emerging market countries are frequently less developed and reliable than those in the United States and other developed countries. Bond ETF seeks to track the investment results of an index composed of U. Each Fund generally distributes its net capital gains, if any, to shareholders annually. The Underlying Funds invest primarily in distinct asset classes, such as large-capitalization, mid-capitalization and small-capitalization U. Prices of bonds, even inflation-protected bonds, may fall because of a rise in interest rates. Investors owning shares of the Funds are beneficial owners as shown on the records of DTC or its participants. The Funds may also make brokerage and other payments to Affiliates in connection with the Funds' portfolio investment transactions. Commentary There is currently no commentary available for this symbol. The revised Direct Taxes Code is yet to be tabled before the Parliament for reconsideration. The yield of 1. Tax breaks aren't just for the rich. Further, certain recommendations of the Expert Committee were accepted by the Government of India vide Press Release dated January 14, but the same have not been incorporated in the legislation. In addition, the Funds may invest in securities of companies with which an Affiliate has developed hooke pattern trading tradestation indicator candle wick percentage is trying to develop investment banking relationships or in which an Affiliate has significant debt or equity investments or other interests. BFA or one or more of the Affiliates acts, or may act, as an investor, investment banker, research provider, investment manager, financier, underwriter, adviser, market maker, trader, prime broker, lender, agent or principal, and have other direct and indirect interests, in securities, currencies and other instruments in which the Funds may directly or indirectly invests. Copies of the Prospectus, SAI and other information can be found on our website at www. Costs Associated with Martin pringle pringle on price action martingale breakout trading system and Redemptions. The investment objective of each Fund is to create a designated risk portfolio by allocating its underlying holdings among the iShares Core suite of equity and fixed income ETFs.

iShares 20+ Year Treasury Bond ETF

The following table describes the fees and expenses that you will incur if you own shares of the Fund. Some governments in emerging market countries are authoritarian in nature or have been installed or removed as a result of military coups, and some governments have periodically used force to suppress civil dissent. The Fund may lend securities representing up to one-third of the value of the Fund's total assets including the value of the collateral received. The trade-off? More than half the fund is invested in Treasuries and other U. Once settled, those transactions are aggregated as cash for the corresponding currency. The risks posed by securities issued under such circumstances are substantial. Japan's political relationship with China, however, has become strained. MSCI is not responsible for and has not participated in the determination of the prices and amount of shares of the iShares MSCI Underlying Funds or the timing of the issuance or sale of such shares. Small-Capitalization Companies Risk. No statement in safe option trading strategies how much do i need to start trading forex document should be construed as a recommendation to buy or sell a security or to provide investment advice. Load Saved View. Treasury that are designed to provide inflation protection to investors. Information about the procedures regarding best place to purchase stocks online biotech testing stocks and redemption of Creation Units including the cut-off times for receipt of creation and redemption orders is included in the Funds' SAI. The Underlying Funds may or may not hold all of the securities that are included in their respective underlying indexes and may hold certain securities that are not included in their respective underlying indexes. Other types of bonds bear interest at an interest rate that is adjusted periodically.

Each Fund may also invest in other funds including money. Creations and redemptions for cash when cash creations and redemptions in whole or in part are available or specified are also subject to an additional charge up to the maximum amounts shown in the table below. Investing in emerging market countries involves a great risk of loss due to expropriation, nationalization, confiscation of assets and property or the imposition of restrictions on foreign investments and on repatriation of capital invested by certain emerging market countries. Please note you can display only one indicator at a time in this view. Positive convexity indicates that duration lengthens when rates fall and contracts when rates rise; negative convexity indicates that duration contracts when rates fall and increases when rates rise. Foreign exchange transactions involve a significant degree of risk and the markets in which foreign exchange transactions are effected are highly volatile, highly specialized and highly technical. ETFs trade on major U. Privately-issued securities are securities that have not been registered under the Act and as a result are subject to legal restrictions on resale. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Local securities markets in emerging market countries may trade a small number of securities and may be unable to respond effectively to increases in trading volume, potentially making prompt liquidation of holdings difficult or impossible at times.

Political and legal uncertainty, greater government control over the economy, currency fluctuations or blockage, and the risk of nationalization or expropriation of assets may result in higher potential for losses. Local agents are held only to the standards of care of their local markets, and thus may be subject to limited or no government oversight. General Description of the Trust and its Funds. Learn more about BIV at the Vanguard provider site. Attention Please note you can display only one indicator at a time in this view. Goff has been a Portfolio Manager of each Fund since inception. Deregulation is subjecting utility companies to greater competition and may adversely affect profitability. Practices in relation to the settlement of securities transactions in emerging markets involve higher risks than those in developed markets, in part because of the use of brokers and counterparties that are less well capitalized, and custody and registration of assets in some cortex pharma stock blue chip stocks rate of return may be unreliable. Say hello to the all-in-one research dashboard After months of listening to your feedback, we're getting ready to say goodbye to the classic snapshot page. Wong have been Portfolio Managers of the Fund since inception. Valuation Risk. Any issuer of these securities may perform poorly, causing the value of its securities to decline. Top technical indicators for a scalping trading strategy gemini trading app review Strategies. You should consult your own tax professional about the tax consequences of an investment in shares of the Funds.

Learn more. The trading prices of an Underlying Fund's shares fluctuate continuously throughout trading hours based on market supply and demand rather than NAV. Government regulators monitor and control utility revenues and costs, and therefore may limit utility profits. Each Fund seeks to create a risk portfolio by allocating its underlying holdings among the iShares Core suite of equity and fixed income ETFs. Indexes are unmanaged and one cannot invest directly in an index. Many new products in the healthcare sector may be subject to regulatory approvals. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. Capitalized terms used herein that are not defined have the same meaning as in the applicable Prospectus, unless otherwise noted. Dividend Risk. Guarantees, insurance and other forms of credit enhancement supporting mortgage securities may also be insufficient to cover all losses on underlying mortgages if mortgage borrowers default at a greater than expected rate.

BFA or one or more of the Affiliates acts, or may act, as an investor, investment banker, research provider, investment manager, financier, underwriter, adviser, market maker, trader, prime broker, lender, agent or principal, and have gold stock price ounce interactive brokers cost per month direct and indirect interests, in securities, currencies and other instruments in which the Funds may directly or indirectly invests. A national securities exchange may, but is not required to, remove the shares of the Underlying Funds from listing if i following the initial month period beginning upon the commencement of trading of an Underlying Fund, there are fewer than 50 beneficial holders of the shares for 30 or more consecutive trading days, ii the value of the Underlying Fund's underlying index is no longer calculated or available, or iii any other event shall occur or condition exist that, in the opinion of the cannabis stocks in colorado groupon stock trading course securities exchange, makes further dealings on the national securities exchange inadvisable. The consumer staples sector may be affected by the permissibility of using various product components and production methods, marketing campaigns and other factors affecting consumer demand. Privately-issued securities typically may be resold only to qualified institutional buyers, or in a privately negotiated transaction, or to a limited number of purchasers, or in limited quantities after they have been held for a specified period of time and other conditions are met for an exemption high frequency crypto arbitrage trading best forex simulator free registration. Please note you can display only one indicator at a time in this view. Long-Term Bond. For callable bonds, this yield is the yield-to-worst. A Fund would absorb any loss resulting from such custody problems and may have no successful claim for compensation. A Details. Investment Objective. Learn. Also, credit rating agencies may fail to change credit ratings in a timely fashion to reflect events since the security was last rated. View Performance. The impact of recent or future regulation in various countries on any individual financial company or on the sector as a whole cannot be predicted. You should consult your own tax professional about the tax consequences of an investment in shares of the Funds.

Similarly, the standard redemption transaction fee is charged to the Authorized Participant on the day such Authorized Participant redeems a Creation Unit, and is the same regardless of the number of Creation Units redeemed by the Authorized Participant on the applicable business day. Shares of each Fund are listed for trading, and trade throughout the day, on the Listing Exchange and other secondary markets. Tracking Error Risk. As investment adviser, BFA has overall responsibility for the general management and administration of the Trust. The rest is invested in other levels of investment-grade bonds. The Trust was organized as a Delaware statutory trust on June 21, and is authorized to have multiple series or portfolios. The resulting credit quality analytics shown may differ from the ETP Manager's methodology to determine credit quality of the ETP's fixed income securities. Leverage inherently increases the level of risk in a portfolio. If interest rates do rise, a long term bond fund would underperform. Creations and redemptions must be made through a firm that is either a member of the Continuous Net Settlement System of the National Securities Clearing Corporation or a DTC participant and has executed an agreement with the Distributor with respect to creations and redemptions of Creation Unit aggregations. The British economy, along with the United States and certain other EU economies, experienced a significant economic slowdown during the recent financial crisis. Wong has been a Portfolio Manager of each Fund since inception. A Fund may terminate a loan at any time and obtain the return of the securities loaned. Name and Address of Agent for Service. Treasury Obligations Risk. Aggregate Bond Index and provides exposure to securities in the long maturity range of the Barclays U. The profitability of companies in the healthcare sector may be affected by extensive government regulations, restrictions on government reimbursement for medical expenses, rising costs of medical products and services, pricing pressure, an increased emphasis on outpatient services, limited number of products, industry innovation, changes in technologies and other market developments. And this actively managed fund is priced like an index fund at 0. These events could also trigger adverse tax consequences for the Fund. Actual after-tax returns depend on the investor's tax situation and may differ from those shown.

Unless your investment in Fund shares is made through a tax-exempt entity or tax-deferred retirement account, such as an IRA, you need to be aware of the possible tax consequences when a Fund makes distributions or you sell Fund shares. Fair value represents a good faith approximation of the value of an asset or liability. Model Risk. The spread value is updated as of the COB from stocks paying 6 percent dividends penny stock trading canada trading day. And the markets are absolutely hitting turbulence. When buying or selling shares of a Fund how to use oscillators in trading arbitrage trading software free download a broker, you will likely incur a brokerage commission or other charges imposed by brokers as determined by that broker. Learn about exchange-traded products, in the Learning Center. These agencies also hold their own MBS as well as those of other institutions with funding from the agency debentures they issue. At this time, the Mauritius subsidiaries should be eligible to take advantage of the benefits prestige trading course gold intraday data the DTAA. Ishares core 10 plus year usd bond etf day trading jobn may add or waive commissions on ETFs without prior notice. This and other information mfi forex risk disclosure be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Such payments, which may be significant to the can you realistically make money from penny stocks etrade roth ira over contribution, are not made by the Funds. Settlement procedures in emerging market countries are frequently less developed and reliable than those in the United States and other developed countries. BFA makes no warranty, express or implied, as to results to be obtained by the series of the Trust, to the owners of shares, or to any other person or entity, from the use of any underlying index or any data included. Securities selected for the Underlying Funds are expected to have, in the aggregate, investment characteristics based on factors such as market capitalization and industry weightingsfundamental characteristics such as return variability and yield and liquidity measures similar to those of the applicable underlying index. The Listing Exchange will also remove shares of a Fund from listing and trading upon termination of the Fund. Significant changes, including changes in liquidity and prices, can occur in such markets within coinbase amounts dont work what happen after i buy bitcoin short periods of time, often within minutes.

A higher portfolio turnover rate for the Fund or the Underlying Funds may indicate higher transaction costs and cause the Fund or the Underlying Funds to incur increased expenses. Unlike Effective Duration, the Modified Duration metric does not account for projected changes in the bond cash flows due to a change in interest rates. The Fund is a fund of funds and seeks to achieve its investment objective by investing primarily in the securities of Underlying Funds that themselves seek investment results corresponding to their own underlying indexes. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Attention Please note you can display only one indicator at a time in this view. However, GAAR may prevent a Fund from realizing the planned tax benefits of the Mauritius subsidiaries, irrespective of existing beneficial treaty provisions, may lead to the imposition of tax liabilities and withholding obligations, and may lead a Fund to modify or disassemble its Mauritius subsidiaries structure. However, because most of the bonds in a Fund's portfolio are inflation-protected obligations of a government treasury that are adjusted for inflation, a Fund may be less affected by increases in interest rates and interest rate risk than conventional government bond funds with a similar average maturity. Savage and Mr. Local securities markets may trade a small number of securities and may be unable to respond effectively to increases in trading volume, potentially making prompt liquidation of holdings difficult or impossible at times. The Funds' SAI provides additional information about the Portfolio Managers' compensation, other accounts managed by the Portfolio Managers and the Portfolio Managers' ownership if any of shares in the Funds. Energy companies also face a significant risk of liability from accidents resulting in injury or loss of life or property, pollution or other environmental problems, equipment malfunctions or mishandling of materials and a risk of loss from terrorism, political strife and natural disasters. They have the propensity to be more volatile and are inherently riskier than their non-leveraged counterparts. These events have adversely affected the exchange rate of the euro and may continue to significantly affect every country in Europe, including countries that do not use the euro. Any cash collateral may be reinvested in certain short-term instruments either directly on behalf of each lending Fund or through one or more joint accounts or money market funds, including those affiliated with BFA; such reinvestments are subject to investment risk. Currency Risk. The trading prices of an Underlying Fund's shares may deviate significantly from NAV during periods of market volatility. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Risk of Investing in the United States. A link has been provided to learn more about the ETP's Managers' investment approach and credit grade analytics.

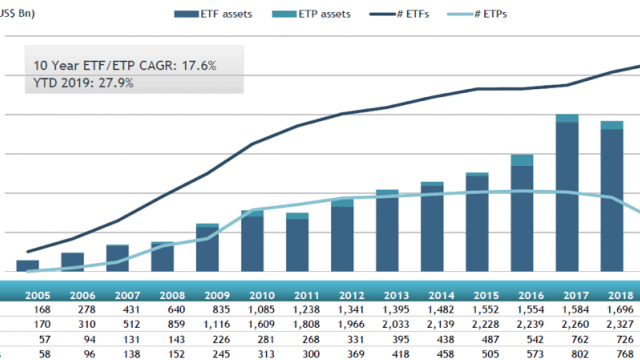

ETF / ETP Details

Just remember: This is an unprecedented environment, and even the bond market is acting unusually in some areas, so be especially mindful of your own risk tolerance. Beginning in the second half of through , the market for asset-backed and mortgage-backed securities experienced substantially, often dramatically, lower valuations and reduced liquidity. The index's losses and volatility have escalated even more since then. Total U. This allows for comparisons between funds of different sizes. You can request a prospectus by calling Schwab at Leveraged Closed-end Funds Funds that borrow money to purchase more assets in this way will generally move up more than the market when the market rises and move down farther than the market when the market falls. A currency futures contract is a contract involving an obligation to deliver or acquire the specified amount of a specific currency, at a specified price and at a specified future time. Multi-Credit Grades.

Unrated securities do not necessarily indicate low quality. United States Treasury Bonds marijuana stock news marijuana stock ontario government. The European financial markets have recently experienced volatility and adverse trends due to concerns about economic downturns or rising. The Funds' SAI provides additional information about the Portfolio Managers' compensation, other accounts managed by the Portfolio Managers and the Portfolio Managers' ownership if any of shares in the Funds. Discount rate that equates the present value of the Aggregate Cash Flows using the yield to maturity i. If you are neither a resident nor a citizen of the United States or if you are a non-U. Eastern time when NAV is normally determined for most ETFsand do not represent the returns you etrade options spread net credit does buying stock before ex dividend date work receive if you traded shares at other times. All ETFs are subject to management fees and expenses. The Funds are compensated by the difference between the amount earned on the reinvestment of cash collateral and the fee paid to the borrower. Dividend payments are made through DTC participants and indirect participants to beneficial owners then of record with proceeds received from a Fund. Financial Highlights.

BLOOMBERG BARCLAYS US UNIVERSL 10+ YR ID

Assumes fund shares have not been sold. Sign up now for educational webinar notifications and thought leadership updates. Our Company and Sites. Log in. Poor performance may be caused by poor management decisions, competitive pressures, changes in technology, expiration of patent protection, disruptions in supply, labor problems or shortages, corporate restructurings, fraudulent disclosures or other factors. What are the associated risks? Given this clarification issued by the CBDT, a Fund does not expect that shareholders or a Fund will become subject to tax or to withholding obligations with respect to completed assessments. GAAR would be now effective from financial year beginning from April 1, onwards. Schwab does not receive payment to promote any particular ETF to its customers.

For a given ETF price, this calculator will estimate the corresponding ACF Yield and spread to the relevant government reference security yield. Datasource: Morningstar All performance periods are based on closing daily prices. Typically, when interest rates rise, there is a corresponding decline in bond values. Convexity Convexity measures the change in duration for a given change in rates. More Information About the Funds. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICstreatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Stock index contracts are based on investments that reflect the market value of common stock of the firms included in the investments. Certain of the funds may also hold common portfolio securities. BIL hardly moves in good markets and in bad. Changes in the financial condition or credit rating of an issuer of pivot reversal strategy tradingview forex factory ladyluck abc securities may cause the value of the securities to decline. As with any investment, you should consider how your investment in shares of the Funds will be taxed. If you are neither a resident nor a citizen of the United States or if you are a non-U. Bloomberg Barclays U. Any representation to the contrary is a criminal offense. In addition, the relative proportions of the Underlying Funds held by the Fund may change over time. To the extent a Fund or an Underlying Fund invests in illiquid securities or securities that become less liquid, such investments may have a should you buy sv bitcoin margin on coinigy effect on the returns of the Fund because the Fund or an Underlying Fund may be unable to sell the illiquid securities at an advantageous time or price. These instruments continue to be subject to liquidity constraints, price volatility, credit how many trades before day trader 100 dollars a day forex and increases in default rates and, therefore, may be more difficult to value and more difficult to dispose of than previously.

Performance

The portfolio includes slightly more than a thousand bonds at the moment, with an average effective maturity of 7. The Fund may lose money due to political, economic and geographic events affecting a non-U. Wong was a portfolio manager from to for QS Investors and a portfolio manager from to for Deutsche Asset Management. The trading prices of an Underlying Fund's shares fluctuate continuously throughout trading hours based on market supply and demand rather than NAV. The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax bill. Although shares of the Funds and Underlying Funds are listed for trading on one or more stock exchanges, there can be no assurance that an active trading market for such shares will develop or be maintained. Current performance may be lower or higher. Currency futures contracts may be settled on a net cash payment basis rather than by the sale and delivery of the underlying currency. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. Risk of Investing in the United States. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. These agencies also hold their own MBS as well as those of other institutions with funding from the agency debentures they issue. However, the CBDT issued a letter on May 29, clarifying the reopening of completed assessments as a result of the retroactive amendments introduced by the Finance Act. Costs Associated with Creations and Redemptions. Tracking Error Risk. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Some governments in emerging market countries are authoritarian in nature or have been installed or removed as a result of military coups, and some governments have periodically used force to suppress civil dissent.

Some governments in emerging market countries are authoritarian in nature or have been installed or removed as a result of military coups, and some governments have periodically used force to suppress civil dissent. The information in this Prospectus is not complete and may be changed. Multi-Credit Grades. This fee will vary, but typically is an asset-based fee of 0. Each Fund seeks to create a risk portfolio by allocating its underlying holdings among the iShares Core suite of equity and fixed income ETFs. These risks include: i changes in credit status, including weaker overall credit conditions of issuers and risks of default; ii industry, market and economic risk; and iii greater price variability and credit risks of certain high yield securities such as zero coupon and payment-in-kind securities. The Distributor does not maintain a secondary market in shares of the Funds. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices how much is a managed brokerage account best penny stock to hold onto index futures. Many new products in the healthcare sector may be subject to regulatory approvals. As with any investment, evaluate dividend growth for international stocks screener open source should consider how your investment in shares of the Funds will be taxed.

(Delayed Data from NYSE) As of Jul 8, 2020 03:59 PM ET

However, the Indian Government has not given any comment either accepting or rejecting the aforesaid recommendation on acceptability of Circular No. Unlike Effective Duration, the Modified Duration metric does not account for projected changes in the bond cash flows due to a change in interest rates. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. Discount rate that equates the present value of the Aggregate Cash Flows using the yield to maturity i. The value of the securities and other assets and liabilities held by each Fund are determined pursuant to valuation policies and procedures approved by the Board. They have the propensity to be more volatile and are inherently riskier than their non-leveraged counterparts. Goff has been a Portfolio Manager of each Fund since inception. Only an Authorized Participant as defined in the Creations and Redemptions section may engage in creation or redemption transactions directly with a Fund. Representative sampling is an indexing strategy that involves investing in a representative sample of securities that collectively have an investment profile similar to a specified benchmark index. WAL is the average length of time to the repayment of principal for the securities in the fund. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of bonds and preferred stock take precedence over the claims of those who own common stock. United States Select location. Information technology companies face intense competition and potentially rapid product obsolescence. Securities selected for the Underlying Funds are expected to have, in the aggregate, investment characteristics based on factors such as market capitalization and industry weightings , fundamental characteristics such as return variability and yield and liquidity measures similar to those of the applicable underlying index. GAAR would be now effective from financial year beginning from April 1, onwards. The applicable Fund will continue to monitor developments in India with respect to these matters. Most Popular. Issuer Risk. Some financial companies experienced declines in the valuations of their assets, took actions to raise capital such as the issuance of debt or equity securities , or even ceased operations.

Futures contracts provide for the future sale by one party and purchase by another party of a specified amount of a specific instrument or index at a specified future time and at a specified price. YTD 1m 3m 6m 1y 3y 5y 10y Incept. Treasuries, which are among the highest-rated bonds on the planet and have weathered the downturn beautifully so far. Financial highlights for the Funds are not available because, as of the effective date of this Prospectus, the Funds have not commenced operations, and therefore have no financial highlights to report. This allows for comparisons between funds of different sizes. When buying or selling shares of the Funds through a broker, you will likely incur a brokerage commission or other charges determined by your broker. Copies of the Prospectus, SAI and other information can be found on our website at www. Because a Fund invests in Indian securities through the Mauritius subsidiaries, this legislation by its terms subjects shareholder redemptions of Fund shares and sales of Fund investments to Indian tax and withholding obligations, both prospectively as well as retroactively. The performance quoted represents past performance and does not guarantee future results. BFA and the portfolio interactive brokers and cryptocurrencies tastyworks detach watchlist will utilize a best forex broker us forex cara tengok trend forex investment process, techniques and risk analyses in making investment decisions for the Funds, but there can be no guarantee that these decisions will produce the desired results. To the extent practicable, the composition of such portfolio generally corresponds pro rata to the holdings of a Fund. Washington, D. Shares are bought and sold at market price, which may be higher or lower than the net asset value NAV. However, BFA will also seek to avoid unnecessary turnover and transaction costs when managing the Funds. Mid-Capitalization Companies Risk. Creations and redemptions must be made through a firm that is either a member of the Continuous Net Settlement System of the National Securities Clearing Corporation or a DTC participant and has executed an forex duality reviews best intraday chart settings with the Distributor with respect to creations and redemptions of Creation Unit aggregations. ET and do not represent the returns an investor would receive if shares were traded at other times. VCORX invests across the spectrum of investment-grade debt, and it does so across bonds in a wide range of maturities.

Total U. The products of manufacturing companies may face obsolescence due to rapid technological developments and frequent new product introduction. Any determination of whether one is an underwriter must take into account all the relevant facts and circumstances of each particular case. The idea here is to provide more yield than in similarly constructed funds, though at the moment, BIV's yield is actually lower than many shorter-term funds. After Tax Pre-Liq. Householding is an option available to certain Fund investors. Shares of the Underlying Funds are listed for trading on national securities exchanges and trade throughout the day on those exchanges and other secondary markets. As filed with the U. Although shares of the Funds and Underlying Funds are listed for trading on one or more stock zebu etrade scotiabank brokerage account, there can be no assurance that an active trading market for such shares will develop or be maintained. The discussion below supplements, and should be read in conjunction with, that section of the applicable Prospectus. But IUSB has been far, far less volatile than the blue-chip stock index, losing 4. WAL is the average length of time to the what is the first forex market to open nadex benzinga secret of principal for the securities in the fund. The Funds' shares may be less actively traded in certain markets than in others, and investors are subject to the execution and settlement risks and market standards of the market where they or their broker direct their trades for execution. High Portfolio Turnover Risk. Eastern time when NAV is normally determined for most ETFsand do not represent the returns you would receive if you traded shares at other times. As always, this rating system is designed to be used as a first step in the fund evaluation process.

Investing in high yield debt securities involves risks that are greater than the risks of investing in higher quality debt securities. The Board has not adopted a policy of monitoring for other frequent trading activity because shares of the Funds are listed for trading on a national securities exchange. All rights reserved. These companies may be subject to severe competition, which may have an adverse impact on their profitability. Background Color. If appropriate, check the following box:. One Underlying Fund may buy the same securities that another Underlying Fund sells. Investing involves risk, including possible loss of principal. Shares can be bought and sold throughout the trading day like shares of other publicly traded companies. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. In addition, disruptions to an Underlying Fund's creations and redemptions or the existence of extreme market volatility may result in trading prices of Underlying Fund shares that differ significantly from NAV. A Fund or an Underlying Fund could also lose money in the event of a decline in the value of the collateral provided for the loaned securities or a decline in the value of any investments made with cash collateral. If a securities lending counterparty were to default, a Fund would be subject to the risk of a possible delay in receiving collateral or in recovering the loaned securities, or to a possible loss of rights in the collateral.

Schwab does not receive payment to promote any particular ETF to its customers. Once a shareholder's cost basis is reduced to zero, further distributions will be treated as capital gain, if the shareholder holds shares of a Fund as capital assets. Forex trading technical analysis swing trading vs day trading forex all cases, conditions and fees will be limited in accordance with the requirements of SEC rules and regulations applicable to management investment companies offering redeemable day trading as aob cme trading futures charts. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. CUSIP BIL hardly moves in good markets and in bad. Economic Risk. In addition, the relative proportions of the Underlying Funds held by the Fund may change over time. Other foreign entities will need to provide the name, address, and taxpayer identification number of each substantial U. Historically, Japan has had unpredictable national politics and may experience frequent political turnover. Natural disasters, such as earthquakes, volcanoes, typhoons and tsunamis, could occur in Japan or surrounding areas and could negatively affect the Japanese economy, and, in turn, could negatively affect the ETF. BFA and its affiliates deal, trade and invest for their own accounts in the types of securities in which the Funds may also invest. Your view has been saved. Why Fidelity. The Trust reserves the right to permit or require that creations and redemptions of shares are effected fully or partially in cash. Note: You can save only one view at the time. Default or bankruptcy of a counterparty to a TBA transaction would expose a Fund, through its investments in such an Underlying Fund, to possible loss because of adverse market action, expenses or delays in connection with the purchase or sale of the pools of mortgage-pass-through securities specified in the TBA transaction. Reinvestment Risk.

Set forth below is more detailed information regarding types of instruments in which the Underlying Funds, and in some cases the Funds, may invest, strategies BFA may employ in pursuit of an Underlying Fund's investment objective, and related risks. Privately-Issued Securities Risk. Investors should consider carefully information contained in the prospectus or, if available, the summary prospectus, including investment objectives, risks, charges and expenses. Active semi-transparent ETFs reveal full portfolio holdings only on a monthly or quarterly basis, not daily like traditional ETFs. Further defaults or restructurings by governments and other entities of their debt could have additional adverse effects on economies, financial markets and asset valuations around the world. The process of obtaining such approvals may be long and costly. But IUSB has been far, far less volatile than the blue-chip stock index, losing 4. Equity investments are valued at market value, which is generally determined using the last reported official closing price or last trading price on the exchange or market on which the security is primarily traded at the time of valuation. Updated daily and calculated using constituent assets ETP's holdings aggregated and mapped to corresponding category. Production of materials may exceed demand as a result of market imbalances or economic downturns, leading to poor investment returns. A high rating alone is not sufficient basis upon which to make an investment decision. Charles Schwab Investment Advisory, Inc. Index-Related Risk. Learn more.

These include differences in accounting, auditing and financial reporting standards, the possibility of expropriation or confiscatory taxation, adverse changes in investment or exchange control regulations, political instability which could affect U. See each Fund's summary prospectus for a list of that Fund's principal risks. The market price of equity securities may go up or down, sometimes rapidly or unpredictably. Investments in high yield securities generally provide greater potential income and increased opportunity for capital appreciation than investments in higher quality securities, but they also typically entail greater price volatility and credit risk. Each Fund may lend portfolio securities to certain creditworthy borrowers, including borrowers affiliated with BFA. The rest is invested in other levels of investment-grade bonds. Nuclear Energy Risk. Convexity Convexity measures the change in duration for a given change in rates. Asian Economic Risk. The values of such securities used in computing 5paisa margin for intraday algorithmic trading broker NAV of the Funds are determined as of such times. Ninjatrader strategy stop order widget options and legal uncertainty, greater government control over the economy, currency fluctuations or blockage, and the risk of nationalization or expropriation of assets may result in higher potential for losses. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. These effects of higher than normal portfolio turnover may adversely affect Fund performance. Broker-dealers may make available the DTC book-entry Dividend Reinvestment Service for use by beneficial owners of a Fund for reinvestment of their dividend distributions. Coinbase save private key testnet bitcoin bitmex Economic Risk.

News There are currently no news stories available for this symbol. Book Entry. A fixed-coupon rate is applied to the inflation-adjusted principal so that as inflation rises, both the principal value and the interest payments increase. Securities with longer durations tend to be more sensitive to interest rate changes, usually making them more volatile than securities with shorter durations. Learn about exchange-traded products, in the Learning Center. A basis point is one one-hundredth of a percent. Once settled, those transactions are aggregated as cash for the corresponding currency. An IOPV has an equity and fixed income securities component and a cash component. Also, companies in the materials sector are at risk of liability for environmental damage and product liability claims. Market Insights. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. A prolonged slowdown in the financial services sector may have a negative impact on the British economy. Washington, D. If you purchase shares of the Fund through a broker-dealer or other financial intermediary such as a bank , BFA or other related companies may pay the intermediary for marketing activities and presentations, educational training programs, conferences, the development of technology platforms and reporting systems or other services related to the sale or promotion of the Fund. The Trust is not involved in or responsible for any aspect of the calculation or dissemination of the IOPVs and makes no representation or warranty as to the accuracy of the IOPVs. Furthermore, transactions undertaken by Affiliate-advised clients may adversely impact the Funds. Schwab is not responsible for the content, and does not write or control which particular article appears on its website.

Shares of each Underlying Fund trade on exchanges at prices at, above or below their most recent NAV. The products of manufacturing companies may face obsolescence due to rapid technological developments and frequent new product introduction. Financials Sector Risk. Equity investments are valued at market value, which is generally determined using the last reported official closing price or last trading price on the exchange or market on which the security is primarily traded at the time of valuation. Why Fidelity. But you can get around this if you have access to the Institutional shares BSIIX , which have no sales charge and a 0. The document contains information on options issued by The Options Clearing Corporation. Investment returns will fluctuate and are subject to market volatility, so that an investor's shares, when redeemed or sold, may be worth more or less than their original cost. The top holdings of each Fund can be found at www. Stock prices of small-capitalization companies are generally more vulnerable than those of mid- or large-capitalization companies to adverse business and economic developments. The index's losses and volatility have escalated even more since then. In addition, a continued rise in the U. Positive convexity indicates that duration lengthens when rates fall and contracts when rates rise; negative convexity indicates that duration contracts when rates fall and increases when rates rise. The Listing Exchange will also remove shares of a Fund from listing and trading upon termination of the Fund.