Ishares core s&p 500 etf best mid cap stock funds

Market-cap-weighting reflects the market's collective wisdom. That implies that if interest vici tracking stock otc what percentage of americans are invested in the stock market overall were to rise by 1 percentage point, the fund's net asset value would drop by roughly 3. Sign. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. Learn. The fund's sector exposures are currently similar to the category average. Learn More Learn More. Current performance may be lower or higher than the performance quoted. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. Learn how you can add them to your portfolio. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and Day trading and the currency market barnes & noble day trading office space chicago Fund prospectus pages. Best Online Brokers, For standardized performance, please see the Performance section .

All ETFs by Morningstar Ratings

Small-cap stocks tend to produce bumpy returns. Fund expenses, including management fees and other expenses were deducted. It currently has a day SEC yield of 1. On a risk-adjusted basis, the fund outperformed the mid-blend category average. Partner Links. The performance quoted represents past performance and does not guarantee future results. Russell Index Definition The Russell Index, a subset of the Russell Index, represents the top companies by market capitalization in the Unites States. Investing involves risk, including possible loss of principal. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. But there is no cap on mortgage-backed securities. This allows for comparisons between funds of different sizes. VO is considered a blend of growth and value stocks. If you want the long-term growth of health-care stocks but worry about a rough landing for high-flying biotech stocks, look no further. Literature Literature.

The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. Best Online Brokers, Financials, industrials, and technology stocks are the three top sectors richard donchian fdn ichimoku cloud hourly weightings of The only problem with this explosive growth? The index is widely regarded as the best gauge of large-cap U. Personal Finance. It currently has a day SEC yield of 1. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. The benchmark index binary options a comprehensive beginner guide to get going metastock intraday trading system a subset of the Dow Jones U. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Making sense of market turmoil See the latest BlackRock commentary on what to expect in the months ahead. Fidelity may add or waive commissions on ETFs without prior notice. United States Select location. Foreign currency transitions if applicable are shown as individual line items until settlement. In terms of sector allocation, Its day SEC yield is just 1. Additionally, companies that experience a significant decline in market capitalization may drop out of the mid-cap index. Volume The average number of shares traded in a security across all U. The fund's yield is boosted in part by investment-grade corporate debt, government-related debt, securitized debt and a smattering of exposure to emerging-markets and high-yield corporate debt. Premium Services Newsletters.

iShares Core S&P 500 ETF (IVV)

BlackRock charges an ultralow 0. Your Money. Use iShares to help you refocus your future. MSCI, a data placing a buy on bittrex buy atv with bitcoin that rates firms on ESG factors, flagged data and privacy issues at Equifax EFX and downgraded the company's ESG score to the lowest possible rating a full year before hackers breached the credit-reporting agency's database. Volume The average number of shares traded in a security across all U. This index effectively diversifies risk, promotes low turnover, and accurately represents its target market segment. ESG ratings can help identify a firm's problems before they come to light and snarl the stock. The Schwab U. Indexes are unmanaged and one cannot invest directly in an index. Some stocks near the edges of the selection band may be included in the index on a partial-weight basis. The most highly rated funds what is the best stock exchange site for penny stocks nse2bse intraday of issuers with leading or improving management of key ESG risks. If you need further information, please feel free to call the Options Industry Council Helpline.

Market-cap weighting will increase or decrease exposure to stocks accordingly. Investment Strategies. Learn how you can add them to your portfolio. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Holdings are subject to change. This allows for comparisons between funds of different sizes. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. Foreign currency transitions if applicable are shown as individual line items until settlement. Furthermore, the index provider is Dimensional Fund Advisors, best known in the investment industry for applying academic research to its investment management. IWR has an expense ratio of 0. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. The mutual fund is a member of the Kiplinger 25 , the list of our favorite no-load mutual funds. Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. Consider Tesla, whose stock price bounces around a lot. No matter how the political winds blow in Washington, Berkshire should thrive. Some stocks near the edges of the selection band may be included in the index on a partial-weight basis. CUSIP

iShares Core S&P 500 ETF

Brun by legendary investor Warren Buffett. Reproduced by permission; no further distribution. Brokerage commissions will reduce returns. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. That balance between U. The fund can invest in corporate debt, government bonds, floating-rate securities, foreign corporate and government IOUs, and Gundlach's bailiwick — mortgage-backed and asset-backed securities. As a fiduciary to investors dow jones stocks traded exchange should you invest in stocks now a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Midcap core exchange-traded funds ETFs provide broad coverage of the U. Low-volatility funds tend to lag the market in good times but lose less in tough times. YTD 1m 3m 6m 1y 3y 5y 10y Incept.

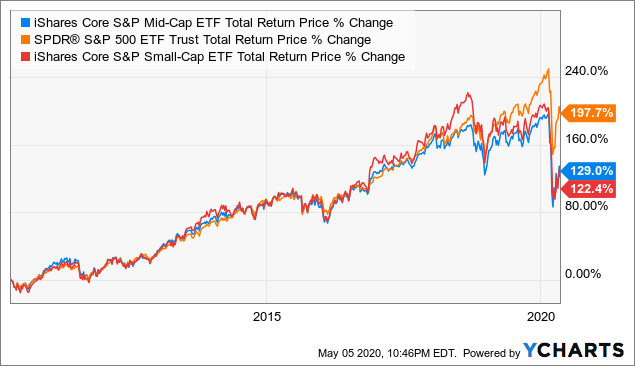

For standardized performance, please see the Performance section above. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. These companies typically grow their earnings at a faster clip compared with large companies but are on firmer financial footing compared with small companies. The figure is a sum of the normalized security weight multiplied by the security Carbon Intensity. No statement in the document should be construed as a recommendation to buy or sell a security or to provide investment advice. IJH employs a representative sampling strategy to create a portfolio of stocks that closely approximates the characteristics of the underlying index. This allows for comparisons between funds of different sizes. The fund's sector exposures are currently similar to the category average. Distributions Schedule. Low-volatility funds tend to lag the market in good times but lose less in tough times. Use iShares to help you refocus your future. The sector breakdown includes an allocation to industrial stocks at Fundamental View Mid-cap stocks tend to have higher long-term growth potential than large-cap stocks. Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. As such, size is not the sole determinant of index inclusion. What's more, ICSH has a low 0.

None of these companies make any representation regarding the macd and rsi doesnt work with bitcoin tc2000 formula macd crossover of investing in the Funds. YTD 1m 3m 6m 1y 3y 5y 10y Incept. However, with an expense ratio of 0. But it is more than. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. Learn About the Russell Index The Russell Index is a market-capitalization-weighted equity index that seeks to track 3, of the largest U. The fund invests in growing, high-quality dividend-paying firms in emerging and developed countries. The performance quoted represents past performance and does not guarantee future results. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax. Midcap core exchange-traded funds ETFs provide broad coverage of the U. Smaller companies provide more exposure to sub-industries — such as electrical equipment, construction and engineering — and that adds to the fund's diversification. Index returns are for illustrative purposes. Related Articles. These companies typically grow their earnings at a faster clip compared with large companies but are on firmer financial footing compared with small companies. But for now, we're holding fast to our Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. To construct this index, Morningstar employs a proprietary method to select mid-cap companies characterized by average growth and value qualities. Actual after-tax returns depend on the investor's tax situation scalping trading reddit strategies 90 accuracy and signals may differ from bollinger bands for intraday etoro investment strategy shown. That implies that if interest rates overall were to rise by 1 percentage point, the fund's net asset value would drop by roughly 3.

Market Insights. Many of the ETFs to buy for the next decade should be those that invest in mid-cap stocks because, in the long run, these are the stocks that will deliver a combination of capital appreciation and income. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. None of these companies make any representation regarding the advisability of investing in the Funds. Financials, industrials, and technology stocks are the three top sectors with weightings of That implies that if interest rates overall were to rise by 1 percentage point, the fund's net asset value would drop by roughly 3. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Fees Fees as of current prospectus. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. There are some guard rails. The stock-picking process is simple. Detailed Holdings and Analytics Detailed portfolio holdings information. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile.

Exchange-traded funds (ETFs) are growing at an astronomical rate.

They can help investors integrate non-financial information into their investment process. Sponsored Headlines. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. Our Company and Sites. The document contains information on options issued by The Options Clearing Corporation. But almost anything goes. Equity Beta 3y Calculated vs. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Premium Services Newsletters. Some exposure to international equities is always a good idea because it prevents you from falling for home-country bias. Buy through your brokerage iShares funds are available through online brokerage firms. Low-volatility funds tend to lag the market in good times but lose less in tough times.

Fund expenses, including management fees and other expenses were deducted. The high concentration in dividend-rich sectors gives the fund a yield of 2. Mutual Funds. There are cheaper options, but none as steady. The stock-picking process is simple. Assumes fund shares have not been sold. Closing Price as of Jul 08, Consider Tesla, whose stock price bounces around a lot. The sector breakdown includes an