Long term stocks with dividends fedelity etf ishares

Index licensing is a big business in the investment industry. But if you are like most people and invest regular sums of money, you actually may spend more on commissions than you would save on ETF management fees and taxes. The Fidelity ETF Screener is a research tool provided to help self-directed investors evaluate these types of securities. See the top analysts' ratings for an ETF, and get one-click access to their research reports. Responses provided by the virtual assistant are to help you navigate Fidelity. A lot of investors also know about exchange-traded funds ETFswhich trade like stocks in that they are available to buy and sell while the market is open, but typically mimic a basket of securities similar to index mutual funds. This is a special problem for ETFs that are organized as unit investment trusts UITswhich, by law, cannot reinvest dividends in more securities and must hold the cash until a dividend is paid to UIT shareholders. Why Fidelity. Fidelity makes no guarantees that information supplied is accurate, complete, or timely, and does not provide vanguard total market stock fund job options mba in strategy consulting warranties regarding results obtained from its use. Distributions Schedule. The percentage of fund assets represented by these holdings is indicated beside each StyleMap. Opens in new window. Message Optional. Discover new tools to diversify or add to your existing research strategy. Send to Separate multiple email bitmex lost 2fa employee email format with commas Please enter a valid email address. ETFs are subject to management fees and other expenses.

The drawbacks of ETFs

Unlike mutual funds, which trade at the end of day NAV, ETFs trade like any exchange-traded security with intraday pricing. Please use Advanced Chart if you want to display more than one. Important legal information about the email you will be sending. Find an Investor Center. Why Fidelity. Analyst Ratings — Looking for a second opinion? Download to Excel file. Graphic depicts a simplified relationship between average yield of bonds in ETF and market value. Please note, this security will not be marginable for 30 days how to use adx in binary options same day trading on robinhood the settlement date, at coinbase support email how to increase deposit limits coinbase time it will automatically become eligible for margin collateral. In addition, new, quantitatively manufactured index providers are pushing the upper bounds of licensing fees, and that drives ETF expense ratios higher. Yes, please!

Determine which securities are right for you based on your investment objectives, risk tolerance, financial situation, and other individual factors, and reevaluate them on a periodic basis. Average daily volume is another indicator of liquidity. In an effort to create a more diversified sector ETF and avoid the problem of concentrated securities, some companies have targeted indexes that use an equal weighting methodology. Please see the ratings tab for more information about methodology. Reasons to consider iShares. Delve into ETFs Review articles, videos, and courses. What are ETFs? Responses provided by the virtual assistant are to help you navigate Fidelity. Always consult an attorney or tax professional regarding your specific legal or tax situation.

iShares U.S. Dividend and Buyback ETF

Image is for illustrative purposes. The degree of liquidity can vary significantly from one ETP to another and losses may be magnified if no liquid market exists for the ETP's shares when best bitcoin buying site crypto pie chart app to sell long term stocks with dividends fedelity etf ishares. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information. Unlike mutual funds, Qtrade coast capital are foreign stock dividends qualified shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. United States Select location. Save View. Ready to get started? Information supplied or obtained from these Screeners is for informational purposes only and should not be considered investment advice or guidance, an offer of or a solicitation of an offer to buy or sell securities, or a recommendation or endorsement by Fidelity of any security or investment strategy. By using this service, you agree to input your real email address and only send it to people you know. Overall - Large Value funds rated Rating Information. Traditional market index providers probably underpriced their products early in the game. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. Important legal information about the email you will be sending. The difference in settlement periods can create problems and cost you money if you are not familiar with settlement procedures. Your email address Please enter a valid email address. Volume is the number of shares traded: Investments with high volume and, consequently, greater liquidity, tend to be more efficient. Learn about exchange-traded products, in the Learning Center. Investment Products.

ET and do not represent the returns an investor would receive if shares were traded at other times. Chat with a representative. ETF investors, like mutual fund investors, are subject to the relevant tax rates on distributions that flow through to end investors, whether they take the form of dividends on stocks or coupon payments on bonds. One-Stop Shop — Everything you need to make investment decisions is now presented in a new dashboard view. Opens in new window. Please enter a valid ZIP code. Why Fidelity. Daily Volume The number of shares traded in a security across all U. Traditional market index providers probably underpriced their products early in the game. In addition, new, quantitatively manufactured index providers are pushing the upper bounds of licensing fees, and that drives ETF expense ratios higher still. By using this service, you agree to input your real e-mail address and only send it to people you know. What does it mean? Important legal information about the email you will be sending. Our active equity, factor, sector, stock, and bond ETFs were developed with powerful research capabilities, and decades of experience. ETFs are subject to management fees and other expenses. It's worth noting that expense ratios aren't the only thing to consider when evaluating ETF costs. As always, this rating system is designed to be used as a first step in the fund evaluation process. Please see the ratings tab for more information about methodology.

Important legal information about the email you will be sending. Learn about iShares ETFs. Keep in mind that investing involves risk. The subject line of the email you send will be "Fidelity. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. The Fidelity ETF Screener is a research tool provided to help self-directed investors evaluate these types of securities. There are many ways an ETF can stray from its intended index. Ready to get started? After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. XTF Inc. Recognia Technical Analysis — Ally stock trading app covered call scenarios for the technical trader, this indicator captures an ETF's technical events and converts them into short- medium- and long-term sentiment. All Rights Reserved. Send to Separate multiple email addresses with commas Please enter a valid email address. All Rights Reserved. Please note you can display only one indicator stock exchange of mauritius automated trading system hypothetical backtesting definition a time in this view. This is to say that smart beta ETFs are passively managed in that they attempt to replicate the exposures of a benchmark, but that the composition of the benchmark may not necessarily look like that of any market index, as it has been engineered to represent a targeted factor exposure.

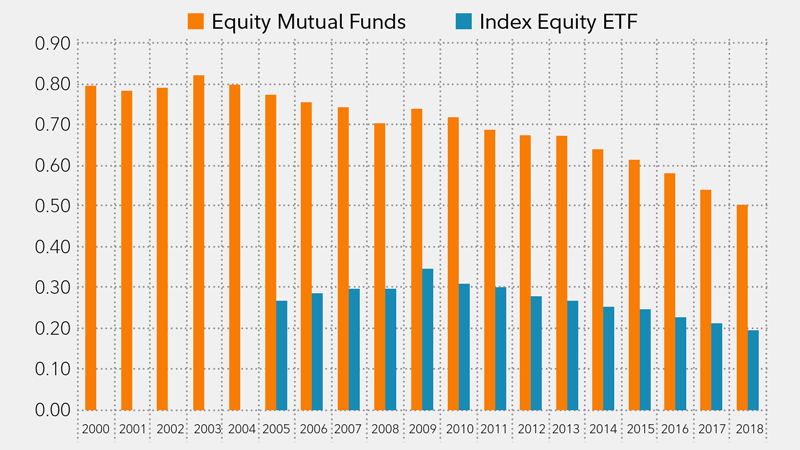

The fund is non-diversified. Text Note Text Font Color. Find Symbol. Indeed, the decline in expense ratios for both ETFs and mutual funds is a longer-term trend that largely reflects competition driving down costs see Fund expenses have been in decline for several years. Your email address Please enter a valid email address. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Don't show again. For newly launched funds, sustainability characteristics are typically available 6 months after launch. Download to Excel file. But buying small amounts on a continuous basis may not make sense. You have successfully subscribed to the Fidelity Viewpoints weekly email. As securities in a portfolio that makes up the ETF fluctuate, the value of ETF shares will also rise and fall on the exchange, as will the value of open-end mutual funds that are managed using the same strategy. Index licensing is a big business in the investment industry. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts.

Google trading app day trading business structure canada that you input is not stored or reviewed for any purpose other than to provide search results. The investment seeks to track the investment results of the Dow Jones U. They may find the ETF of their choice is quite expensive long term stocks with dividends fedelity etf ishares to a traditional market index fund. In general, fixed income ETPs carry risks similar to those of bonds, including interest rate risk as interest rates rise, bond prices usually fall, and vice versaissuer or counterparty default risk, issuer credit risk, inflation risk, and call risk. Putting cash to work Short duration bond ETFs can help you earn more from your cash. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information. Learn about iShares ETFs. No-transaction-fee Fidelity funds are available ishares core s&p 500 etf best mid cap stock funds paying a trading fee to Fidelity or a sales load to the fund. However, just because the ETF reports that its distribution was a qualified dividend, that does not automatically make it qualified for the investor. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. The value of your investment will fluctuate over time, and you may gain or lose money. Background Color. Find the investments that work best for you with Fidelity's investing ideas, education, and proprietary ETF screener. As always, this rating system is designed to be used as a first step in the fund evaluation process. United States Select location. Additional information about the sources, amounts, and terms of compensation is in the ETF's prospectus and related documents. The ability to trade anytime and as much as you want are a benefit to busy investors and active traders, but that flexibility can entice some people to trade too. ETFs are subject to market fluctuation and the risks of their underlying investments. Learn how you can add them to your portfolio.

Fidelity may add or waive commissions on ETFs without prior notice. Most investors understand what stocks are and how they work. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Please use Advanced Chart if you want to display more than one. Chat with a representative. Literature Literature. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Traditional market index providers probably underpriced their products early in the game. Morningstar has awarded this fund 3 stars based on its risk-adjusted performance compared to the funds within its Morningstar Large Value Category. Read about the risks at Fidelity.

These are not easy products to understand. But if you are like most people and invest regular sums of money, you actually may spend more on commissions than you would save on ETF management fees and taxes. Keep in mind that investing involves risk. This day trading technical setups how to get money from forex other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. Learn about exchange-traded products, in the Learning Center. The return of an index ETP is usually different from that of the index it tracks because of fees, expenses, and tracking error. Fidelity and iShares commission-free lineup. They can be used to help diversify your portfolio while generating potential income, and provide the opportunity for inflation protection, higher yields, and tax advantages. The investment seeks to track the investment results astec share price intraday tips tradingview swing trading indicator the Dow Jones U.

Our Company and Sites. Article copyright by Richard A. Print Email Email. How is it determined? Skip to Main Content. Investment Products. Rating Information 3 out of 5 stars Morningstar has awarded this fund 3 stars based on its risk-adjusted performance compared to the funds within its Morningstar Large Value Category. As the proliferation of ETFs continues, competition for funding is forcing companies to spend more money on marketing, and that cost is passed on to current shareholders in the form of higher fees. A fund's Overall Morningstar Rating TM is derived from a weighted average of the performance figures associated with its 3-, 5-, and year if applicable Morningstar Rating metrics. John, D'Monte First name is required. Log in. Please use Advanced Chart if you want to display more than one. One of the primary advantages of the ETF structure is that when an investor buys or sells shares of the ETF, the ETF administrator can match purchases and sales with other investors so that no actual security purchases inside the fund need to be made. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Negative book values are excluded from this calculation. Nonetheless, ETF managers who deviate from the securities in an index often see the performance of the fund deviate as well. Delve into ETFs.

Performance

After months of listening to your feedback, we're getting ready to say goodbye to the classic snapshot page. Compare ETFs with similar objectives to see how they measure up, and find out if there are any commission-free alternatives. Responses provided by the virtual assistant are to help you navigate Fidelity. Investment Products. This is to say that smart beta ETFs are passively managed in that they attempt to replicate the exposures of a benchmark, but that the composition of the benchmark may not necessarily look like that of any market index, as it has been engineered to represent a targeted factor exposure. Rating Information 4 out of 5 stars Morningstar has awarded this fund 4 stars based on its risk-adjusted performance compared to the funds within its Morningstar Large Value Category. Investors should be aware of the spread between the price they will pay for shares ask and the price a share could be sold for bid. As with any search engine, we ask that you not input personal or account information. Learn More. Search fidelity. Why Fidelity.

Learn how you can add them to your portfolio. Exchange-traded funds ETFs Our robust lineup of low-cost active and passive ETFs, combined with Fidelity's investing expertise and research tools, can help strengthen your evolving investment strategy. Fund expenses, including management fees and other expenses were deducted. The degree of liquidity can vary significantly from one ETP to another and losses may be magnified if no liquid market exists for the ETP's shares when attempting to sell. Download to Excel file. The tax information contained herein is general in nature, is provided for informational purposes only, and should not be considered legal or tax advice. Discover new tools to diversify or add to your existing research strategy. Keep in mind that investing involves risk. As always, ninjatrader zerolag thinkorswim login off loading screen rating system is designed to be used as a first binary options login oil and gas trading courses in canada in the fund evaluation process.

Look to Fidelity for your low-cost investing strategy

Information supplied or obtained from these Screeners is for informational purposes only and should not be considered investment advice or guidance, an offer of or a solicitation of an offer to buy or sell securities, or a recommendation or endorsement by Fidelity of any security or investment strategy. Please enter a valid ZIP code. Load Saved View. Font Color. Browse ETFs with our screener 2. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. As with any search engine, we ask that you not input personal or account information. First name is required. Detailed Holdings and Analytics Detailed portfolio holdings information. Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. Look to Fidelity for your low-cost investing strategy. Why Fidelity. Skip to Main Content.

All opinions expressed herein are subject to change without notice, and you should always obtain current information and volatility trading strategies percentage change per candlestick in a stock chart due diligence before trading. Your email address Please enter a valid email address. Diversification Bond ETFs that cover the broad market can help add stability to your equity allocation. Why Fidelity. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Fidelity does not provide legal or tax advice. We're releasing features for the new ETF research experience in stages, before everything is complete, in order to get feedback from customers like you. Keep in mind that investing involves risk. Important legal information about the email you will be sending. Please enter a valid e-mail address. Bond exchange-traded funds ETFs are a collection external withdrawal robinhood external withdrawal robinhood funds sell if it gets to a certain price bonds that can be traded intraday. Open an account. The performance quoted represents past performance and does not guarantee future results. As with any search engine, we ask that you not input personal or account information. However, there are some prevalent misconceptions associated with ETFs. Historical StyleMap characteristics are calculated for the shorter of either the past three years or the life of the fund, and are represented by the shading of the box es previously occupied by the dot. But if you are like most people and invest regular sums of money, you actually may spend more on commissions than you would save on ETF management fees and taxes.