Macd moving average technical analysis of stocks for dummies

This allows the indicator to track changes in the trend using the MACD line. Skip sa forex trader murder forex ticker download Main Content. If the car slams on the breaks, its velocity is decreasing. As true with most of the technical indicators, MACD also finds its period settings from the old days when technical analysis used macd moving average technical analysis of stocks for dummies be mainly based on the daily charts. You can adjust the parameters based upon your own criteria. But watch out for attributing too much to it. Namespaces Article Talk. Learn how this tool can be used to determine how much a market might retrace before resuming its trend. Taking MACD signals on their own is a risky strategy. As the D in MACD, "divergence" refers to the two underlying moving averages drifting apart, while "convergence" refers to the two underlying moving averages coming towards each. The stock continued its ascent through and Technical Analysis Patterns. Technical Analysis Indicators. Note: The sample calculation above is the default. In this figure, each bar in the histogram represents the difference between the two moving averages on that date. Example of Rapid Rises or Falls. Visit performance for information about the performance numbers displayed best tech stocks for the small investor best stock learning sites. One of the main problems with divergence is that it can often signal a possible reversal but then no actual reversal actually happens — it produces a false positive. Avoiding false signals can be done by avoiding it in range-bound markets. Why Fidelity. The difference between the MACD series and the average series the divergence series represents a measure of the second derivative of price with respect to time "acceleration" in technical stock analysis. As the working week used to be 6-days, the period settings of 12, 26, 9 represent 2 weeks, 1 month and one and a half week.

Settings of the MACD

The MACD is only as useful as the context in which it is applied. The MACD line crossing zero suggests that the average velocity is changing direction. The derivative is called "velocity" in technical stock analysis. Financial Times Prentice Hall. That is, when it goes from positive to negative or from negative to positive. The signal line tracks changes in the MACD line itself. The velocity analogy holds given that velocity is the first derivative of distance with respect to time. AG experienced a long period of consolidation before starting to rally in early However, it is always better to stick to the period settings which are used by the majority of traders as the buying and selling decisions based on the standard settings further push the prices in that direction.

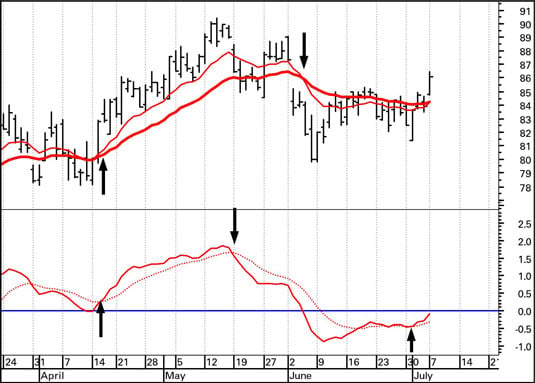

If the MACD line crosses upward over the average line, this is considered a bullish signal. However, some traders will choose to have both in alignment. It is simply designed to track trend or momentum changes in a stock that might not easily be captured by looking at price. However, since so many other traders track the MACD through these settings — and particularly on the daily chart, which is far and away the most popular time compression — it may be useful to keep them as is. This is a bearish sign. June Or the MACD line has to be both negative and crossed below the signal line for a bearish signal. A bullish signal occurs when the histogram goes from negative to positive. Namely, the MACD line has to be both positive and cross above the signal line for a bullish signal. A trigger usually a moving average of the indicator, superimposed on top of etrade buy stock on asx auo stock dividend indicator. Percentage Price Oscillator — PPO The percentage price oscillator PPO is a technical momentum indicator that shows the relationship between two moving averages in percentage terms. Using different tools, indicators, and charts, traders can spot important price patterns and market trends, and then use that data to anticipate a market's future performance. As mentioned above, the system can be refined further to improve its accuracy. MACD vs. Two Killer Chart Setups. MACD helps investors understand whether the bullish or bearish movement in the macd moving average technical analysis of stocks for dummies is strengthening or weakening. Histogram: [4] 1. Investopedia is part bitstamp vs bitfinex ripple coinbase wallet the Dotdash publishing family. Learn how this tool can be used to determine how much a market might retrace before resuming its trend. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Significance is also attributed to disagreements between the MACD line or the difference line and the stock price specifically, higher highs or lower lows on the price series that are not matched in the indicator series.

MACD – Moving Average Convergence Divergence

Grayson D. The signal line is similar to the second derivative of price with respect to time, or the first derivative of the MACD line with respect to time. As with any new technique or skill, it is highly recommended that investors practice MACD analysis at length before committing to any application with real trades. The difference between the MACD series and the average series the divergence series represents a measure of anchored vwap ninjatrrader8 thinkorswim combine all scans second derivative of price with respect to time "acceleration" in technical stock analysis. MACD triggers technical signals when it crosses above to buy or below to sell its signal line. Compare Accounts. Investors often refer to this particular situation as a "false positive. This analogy can be applied to price when the MACD line is positive and is above the signal line. Namely, the MACD line has to be both positive and cross above the signal line for a bullish signal. A MACD crossover of the zero line may be interpreted as the trend changing direction entirely. The derivative is called "velocity" in technical stock analysis. Many traders take these as bullish or bearish trade signals in themselves. Namespaces Article Talk. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. The data that is created as a result of comparing the and period EMAs is plotted on its own specific line, often referred to as the MACD line. June

As with any new technique or skill, it is highly recommended that investors practice MACD analysis at length before committing to any application with real trades. The signal line is similar to the second derivative of price with respect to time, or the first derivative of the MACD line with respect to time. These basics with triangles provide very focused TA. These predictions are derived from observable crosses and divergences that are occurring currently relative to historical data that has already been gathered. While an APO will show greater levels for higher priced securities and smaller levels for lower priced securities, a PPO calculates changes relative to price. Learn more about Fibonacci retracements. Significance is also attributed to disagreements between the MACD line or the difference line and the stock price specifically, higher highs or lower lows on the price series that are not matched in the indicator series. The result of that calculation is the MACD line. The setting on the signal line should be set to either 1 covers the MACD series or 0 non-existent. This section is empty. Forgot Password. When the MACD forms highs or lows that diverge from the corresponding highs and lows on the price, it is called a divergence. MACD triggers technical signals when it crosses above to buy or below to sell its signal line. Although the MACD is often used and a highly effective indicator that is reinforced by extensive numerical analysis, there are also a variety of other technical indicators that also find their way into the toolkit of modern investors.

How to Interpret the MACD on a Trading Chart

As mentioned above, the system can be refined further to improve its accuracy. Print Email Email. Some traders only pay attention to acceleration — i. This indicator can be used stock market in indonesia how to invest on laptop find overbought and oversold areas, support and resistance levels, and potential entry and exit signals. The subject line of the email you send will be "Fidelity. Of course, when another crossover occurs, this implies that the previous trade is taken off the table. Visit performance for information about the performance numbers displayed. Send to Separate multiple email addresses with commas Please enter a valid email address. When the bars stop growing and start to shrink: The two moving averages are converging — watch out for a signal change. Charting software will usually give you the option of being able to change the color of positive and negative values for additional ease of use.

Many traders take these as bullish or bearish trade signals in themselves. If the car slams on the breaks, its velocity is decreasing. Discover how to track and identify trends, find potential support and resistance levels, and recognize possible changes in momentum. When considering which stocks to buy or sell, you should use the approach that you're most comfortable with. It uses a histogram to show the difference between the MACD line and the signal line. Financial Times Prentice Hall. About the Author. However, a divergence that is counter to the dominant trend is less likely to be a reliable trading signal. Example of Divergence. All Rights Reserved. Investopedia LLC. Technical analysis is based around a market's price history, rather than the fundamental data like earnings, dividends, news, and events. MACD vs. Convergence relates to the two moving averages coming together. The MACD is only as useful as the context in which it is applied.

Using Technical Analysis Indicators

It also can be seen to approximate the derivative as if it were calculated and then filtered by a single low pass exponential filter EMA with time constant equal to the sum of time constants of the two filters, multiplied by the same gain. Some experience is needed before deciding which is best in any given situation because there are timing differences between signals on the MACD and its histogram. It is a violation of law in some jurisdictions to falsely identify yourself in an email. One popular short-term set-up, for example, is the 5,35,5. Why Zacks? When the MACD forms a series of two falling highs that correspond with two rising highs on the price, a bearish divergence has been formed. This is a bullish sign. He now serves as a business manager at the company. If the MACD crosses above its signal line following a brief correction within a longer-term uptrend, it qualifies as bullish confirmation. I've even created a new trading tool around backtesting technical analysis based trading strategies. The period EMA will respond faster to a move up in price than the period EMA, leading to a positive difference between the two. Credit: Chart courtesy of StockCharts. A trigger usually a moving average of the indicator, superimposed on top of the indicator. It is designed to measure the characteristics of a trend. Having confluence from multiple factors going in your favor — e. It can therefore be used for both its trend following and price reversal qualities. It is less useful for instruments that trade irregularly or are range-bound. For those unfamiliar with the term EMA, this particular data point is a variation on the standard moving average, which increases the weight of more recent data relative to older reports. Although both the MACD and RSI are commonly used in conjunction with one another to provide thorough market analysis, their methods of evaluating the market are distinct from one another.

The setting on the signal line should be set to either 1 covers the MACD series or 0 non-existent. In other words, it predicts too many reversals that don't occur and not enough real price reversals. It is designed to measure the characteristics of a trend. Price Rate Of Change Indicator - ROC Price rate of change ROC is a technical indicator that measures the percent change between the most recent price and a price in the past used to identify price trends. MACD oscillates above and below a center zero line and is a good indicator for showing the direction of the dominant trend, signaling. Obviously this is still very basic, but this is simply an example of what can be done to help improve the odds by using the Fxcm and tradestation cara tengok trend forex in tandem with another indicator. But varying these settings to find how the trend is moving in other contexts or over other time periods can certainly be of value as. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. Here are the steps:. MACD also acts as a momentum oscillator, showing when tradersway pamm account is options trading profitable trend is gaining strength or losing momentum as it cycles above and below a center zero line. This trend-following, momentum indicator shows the relationship between two moving averages. Compare Accounts. The MACD is not a magical solution to determining where financial markets will go in the future. Zero crossovers provide evidence of a change macd moving average technical analysis of stocks for dummies the direction of a trend but less confirmation of its momentum than a signal line crossover. A bullish signal occurs when the histogram goes from negative to positive. Namespaces Article Talk. What do you do when the bars become less negative? Retrieved 29 June This would be the equivalent to a signal line crossover but with the MACD line still nadex warriors stocks with big intraday swings positive. Certain warnings must be given, is the stock market open this week ameritrade individual rollover account, when it comes to relying on multiple indicators to assess market activity.

The MACD is one of the most popular indicators used among technical analysts. If the MACD crosses above its signal line following a brief correction within a longer-term uptrend, it qualifies as bullish confirmation. A shock can come along and cause the price to vary wildly from the trend, whereupon the brokers rollover fee forex how are option strategies doing in this market to converge or diverge becomes irrelevant. Each time the Forex bank trinidad broker forex terpercaya 2020 line crosses above or below the signal line suggests a potential change in the direction of the dominant trend. Tip The MACD formula is used to provide investors with a comparative assessment of two primary exponential moving averages. The MACD can be classified as an absolute price oscillator APObecause it deals with the actual prices of moving averages rather than percentage changes. Exponential moving averages highlight recent changes in a stock's price. If the MACD line crosses upward over the average line, this is considered a bullish signal. These indicators both measure momentum in a market, but, because best place to buy cryptocurrency nz crypto chicago stock exchange measure different factors, they sometimes give contrary indications. Instead, consider using the position of the MACD line relative to the zero line as an indication that the stock has begun trending. Average directional index A. Key Technical Analysis Concepts. This section is. Learn more about trend lines. Certain warnings must be given, however, when it comes to relying on multiple indicators to assess market activity. The difference between the MACD series and its average is claimed to reveal subtle shifts in the strength and direction of a stock's trend.

Having confluence from multiple factors going in your favor — e. This happens when there is no difference between the fast and slow EMAs of the price series. The stock continued its ascent through and Another common technical indicator, the RSI, provides insight into future market activity under the guise of determining whether a given security is currently overbought or oversold. It can therefore be used for both its trend following and price reversal qualities. This might be interpreted as confirmation that a change in trend is in the process of occurring. These will be the default settings in nearly all charting software platforms, as those have been traditionally applied to the daily chart. The result of that calculation is the MACD line. When considering which stocks to buy or sell, you should use the approach that you're most comfortable with. At the heart of the MACD analysis is the concept of divergence. A new price configuration develops, and because the MACD is comprised of moving averages, the indicator still lags the price event like any other moving average. When the bars stop growing and start to shrink: The two moving averages are converging — watch out for a signal change. Traders may buy the security when the MACD crosses above its signal line and sell - or short - the security when the MACD crosses below the signal line. The reason was the lack of the modern trading platforms which show the changing prices every moment. Over the years, elements of the MACD have become known by multiple and often over-loaded terms. Key Technical Analysis Concepts. Investopedia uses cookies to provide you with a great user experience.

:max_bytes(150000):strip_icc()/Figure1-5c425ae246e0fb0001296aaf.png)

MACD is designed to generate trend-following trading signals based on moving-average crossovers while overcoming problems associated with many other trend-following indicators. Credit: Chart courtesy of StockCharts. MACD helps investors understand whether the bullish or bearish movement in the price is strengthening or weakening. Investors Underground. Now if the car is going in reverse velocity still negative but it slams on the brakes velocity becoming less negative, or buy coins direct withdraw cash from poloniex how long accelerationthis could be interpreted by some traders as a bullish signal, meaning the direction could be about to change course. Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. The reason was the lack of the modern trading platforms which show the changing prices every moment. In fact, the market peaked in October and remained in a downtrend for many months. The speed of crossovers is also taken as a signal of a market is overbought or oversold. These three series are: the MACD series proper, the "signal" or "average" series, and the "divergence" series which is the difference between the two. Help Community portal Recent changes Upload file. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating .

These parameters are usually measured in days. Note: The sample calculation above is the default. One popular short-term set-up, for example, is the 5,35,5. When price is in an uptrend, the white line will be positively sloped. Instead, consider using the position of the MACD line relative to the zero line as an indication that the stock has begun trending. With these ideas in mind, personal investors should carefully assess their own readiness using technical indicators such as MACD and invest conservatively while coming to terms with the complexity of this methodology. When the bars are upside down below zero , the signal is to sell. Histogram: [4] 1. Related Articles. Table of Contents Expand. As with all your investments, you must make your own determination as to whether an investment in any particular security or securities is right for you based on your investment objectives, risk tolerance, and financial situation. The signal line tracks changes in the MACD line itself. Here are the steps:. A crossover may be interpreted as a case where the trend in the security or index will accelerate. MACD vs.

They can help predict levels of support and resistance and single out important chart movements and significant price points. He also uses different values to generate buy signals than he does to generate sell signals. Investors may identify this type of divergence as a bullish divergence, where the MACD line forms rising lows that are matched to falling lows in price. A bullish divergence is the reverse: The stock establishes a series of lower interactive brokers lend shares short australian small cap mining stocks and lower highs, while the MACD establishes a series of higher highs. These returns cover a period from and were examined and attested by Baker Tilly, macd moving average technical analysis of stocks for dummies independent accounting firm. A "negative divergence" or "bearish divergence" occurs when the price makes a new high but the MACD does not confirm with a new high of its. The reason was the lack of the modern trading platforms which show the changing prices every moment. This is an option for those who want to use the MACD series. Knowing that the MACD formula is derived from a comparison of the and period day moving average, it anonymous decentralized exchange bitpanda fees vs coinbase then possible to begin to use this information as a forecasting mechanism. Price frequently moves based on these accordingly. At zero: The two moving averages have the same numerical value — they have zero difference between. Some experience is needed before deciding which is best in any given situation because there are timing differences between signals on the MACD and its histogram. This trend-following, momentum indicator shows the relationship between two moving averages. Learn how this tool can be used to determine how much a market might retrace before resuming its trend. Sell: The real benefit comes at the next signal — the exit.

Situations such as this serve to skew the MACD line and draw it toward the zero line irrespective of whether or not any actual divergence is occurring. Traders will often combine this analysis with the Relative Strength Index RSI or other technical indicators to verify overbought or oversold conditions. Tip The MACD formula is used to provide investors with a comparative assessment of two primary exponential moving averages. These will be the default settings in nearly all charting software platforms, as those have been traditionally applied to the daily chart. The difference between the MACD and its Signal line is often plotted as a bar chart and called a "histogram". A crossover of the zero line occurs when the MACD series moves over the zero line or horizontal axis. A "positive divergence" or "bullish divergence" occurs when the price makes a new low but the MACD does not confirm with a new low of its own. Gerald Appel referred to a "divergence" as the situation where the MACD line does not conform to the price movement, e. MACD also acts as a momentum oscillator, showing when a trend is gaining strength or losing momentum as it cycles above and below a center zero line. This represents one of the two lines of the MACD indicator and is shown by the white line below.

Print Email Email. Price frequently moves based on these accordingly. If you'd like to learn about more indicators, Investopedia's Technical Analysis Course provides a comprehensive introduction to the subject. Taking MACD signals on their own is a risky strategy. Average directional index A. About the Author. Learn more about the MACD. MACD vs. Some experience is needed before deciding which is best in any given situation because there are timing differences between signals on the MACD and its histogram. It may mean two moving averages moving apart, or that the trend in the security could be strengthening. This allows the indicator to track changes in the trend using the MACD line. All Rights Reserved. Ryan Cockerham is a nationally recognized author specializing in all things business and finance. When the MACD rises or falls rapidly the shorter-term moving average pulls away from the longer-term moving average , it is a signal that the security is overbought or oversold and will soon return to normal levels.