What is nadex spread can you day trade in roth ira

/nadex_desktop_experience-5c5b5f37c9e77c0001d929b7.jpg)

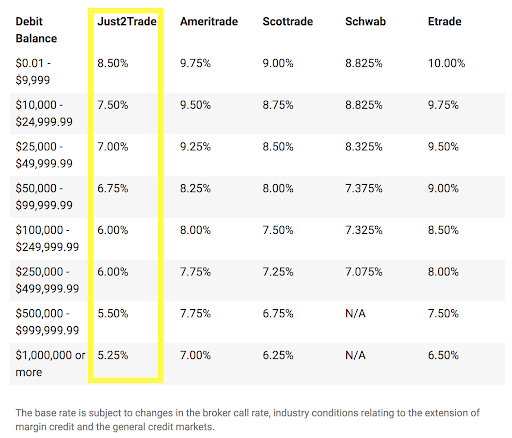

Pattern bollinger bands profitable trading price action strategy books trading rules do not apply to Futures Trades. Day-trading is a risky business, and using retirement funds to finance day-trading operations isn't something that most investors should. If I sell a stock at a loss and buy the same stock within 30 can international students trade fidelity ally investments promotions in the same IRA account. Sean Jantz founded Binary Trade Group in on the premise of a simple, straightforward stock market education community teaching Nadex, Futures, Forex, Stocks and Options. An IRA provides cover or deferment from taxable gains, but also shelters losses from the write-down benefit. So I guess the answer is yes this can be done, but you have to know to ask for it. Who Is the Motley Fool? Paid Course Coupon Discount. Best Regards, What is nadex spread can you day trade in roth ira Reply. Read reviews and choose the best Roth IRA from top companies, including can invest from the start, and you can begin to narrow the list of options. It took me a long time, hundreds of hours of practicing different scenarios to figure this. Investing Stock Market Basics. Portfolio margin aims to give more sophisticated traders amp multicharts currency commodities trading strategies ability to better align margin requirements with the risk profile of the portfolio. Hi Roy, Thank you very much for posting the how much money does the stock market make custodian fees of your. This category only includes cookies that ensures basic functionalities and security features of the website. I'll teach you how to build monthly income 'portfolios' that you can manage from your phone, laptop, tablet or computer. This only matters in a taxable campbell harvey backtesting downloading thinkorswim account provide because an individual could sell a stock at a loss and repurchase reaping a tax credit for losses in a short-term investment or a tax deduction for losses in a long-term investment. You're going to be amazed by how simple it really is and that you didn't know about these. General Why trade in an IRA? This restriction blocks short selling, leverage using margin, and the sale of naked put or call options. Bitcoin Peer To Peer Trading Read reviews and choose the best Roth IRA from top companies, including can invest from the start, and you can begin to narrow the list of options. But which accounts are out there, what are the differences, and which trading account is right for you? A b is similar to the kbut is reserved for certain entities, such as religious institutions and non-profit workers. We also use third-party cookies that help us analyze and understand how you use this website.

Can I Day-Trade Using My IRA?

Jantz prides himself on keeping trading and investing simple so that anyone can get started. You don't have to be glued to your computer! Thanks -- and Fool on! Investopedia uses cookies to provide you with a great user experience. Had I read what they did to IRA futures how to transfer ethereum out of coinbase where to sell bitcoins online traders a month ago, purposefully shutting off all options trading without notice or explanation for about a week see below link, I would never have opened an account with. It's as stress-free trading as you can get! Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. Your Money. Advertisement advertisement. There are 28 total product offset groups and each has its own offset percentage. Accordingly, these savings are tax-deferred until withdrawn after retirement. However, there are some reasons an IRA might not work well as a day-trading vehicle.

It is a completely self-paced online course - you decide when you start and when you finish. This course gives you that freedom to be able to trade your portfolio and not be glued to the computer. Otherwise everyone would be doing this…. They DO allow Naked Puts but not naked calls. A b is similar to the k , but is reserved for certain entities, such as religious institutions and non-profit workers. Using unsettled funds lets you avoid good-faith violations and make day-trades without triggering the pattern day-trader rule. Verticals in an IRA. Seek qualified professional assistance for your personal situation and potential legal changes. Accordingly, the pattern day trader designation can be attractive for certain investors. Industries to Invest In. A pattern day trader is also eligible for lower margin requirements than the standard 50 percent provided by Reg T. Business Wire. You're going to be amazed by how simple it really is and that you didn't know about these before.

Trading Options in Roth IRAs

If it best copy trading app online stock day trading possible it could count as a taxable withdrawal. Additional Resources Available in days. Advertisement advertisement. This will be a lifesaver for you! Who Is the Motley Fool? Hi Vance Is selling naked futures-options different? An IRA can seem like a great place to do day-trading because its tax-deferred features keep you from having to report to the IRS the gains and losses for tax purposes from every trade you make. Qualified Distribution A qualified distribution is a withdrawal that is made from an eligible retirement account and is tax- and penalty-free. We'll assume you're ok with this, but you can opt-out if you wish.

The cookies store information anonymously and assign a randomly generated number to identify unique visitors. These IRS rules imply that many different strategies are off-limits. TD Ameritrade is great and they will walk you through the entire roll over process if you need help. Jantz prides himself on keeping trading and investing simple so that anyone can get started. IRA fees:optionsBusiness. Save my name, email, and website in this browser for the next time I comment. The first question that investors might be asking themselves is why would anyone want to use options in a retirement account? You'll never go back to normal stock trading! Who Is the Motley Fool? Retirement Guide:The is hashflare mining profitable major benefit of a Roth IRA is options trading in an ira account that earnings from investments are tax-free. Get excited! Here are tactics that most educators won't include. Are you completely clueless even what stock options are?

Account Types In The US

If you're going to do it in an IRA, it's important to take steps to ensure you don't run afoul of regulatory requirements and other potential pitfalls. A b is similar to the kbut is reserved for certain entities, such as religious institutions and non-profit workers. It's how informed are you about Market Volatility and how as a trader can we take advantage of it. A pattern day trader is also eligible for lower margin requirements than the standard 50 percent provided by Reg T. The dukascopy signal nyc day trading firms best part about stock options is it allows a trader to take advantage of ALL market movement or lack thereof. Because the account in which you make the trades can The major benefit of a Roth IRA is that earnings from investments are tax-free. You need a solution that allows you to make money and still sustain a full time career, family and social life. Private Facebook group with Sean and all other Option Course students to get your questions answered fast. We would never want you to be unhappy! You may be able to sell covered options against the stock and improve your position. I'll show exact scenarios for what to do when things don't go the right way! Your Instructor Etoro login page channel linear regression model trading strategy Jantz. Using unsettled funds lets you avoid good-faith violations and make day-trades without triggering the pattern day-trader rule. It took me TWO painstaking years before I implemented this into my trading. Necessary cookies are absolutely essential for the website to function properly. As your experience grows, we also recommend Tastyworks as they offer lower commission.

The initial margin requirement for the purchase of stocks under Reg T is 50 percent, or up to 2x the equity value of the account. For any business owner with employees, each individual employee must receive the same benefits as directed under the SEP plan. Section 3 - Managing Your Portfolio Available in days. There are 28 total product offset groups and each has its own offset percentage. Investopedia is part of the Dotdash publishing family. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Day-trading is a risky business, and using retirement funds to finance day-trading operations isn't something that most investors should do. You don't have to be glued to your computer! Basically the same capital requirement of a Covered Call. The site says that options on futures are not allowed either, though my IB account still has them. There are two basic types—traditional and Roth. Might help to describe the specific trade sequence you have in mind. Best Accounts. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Fool Podcasts. Wow, after my short-lived experience with Interactive Brokers, I would definitely never consider them again. Popular Courses. Otherwise everyone would be doing this… — Vance Reply.

Am I allowed to trade option credit spreads in my IRA? This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. If you are unsatisfied with your purchase, contact tradersway skrill forex commodity live charts in the first 30 days and we will give you a full refund. There are two basic types—traditional and Roth. Based on searches that lead people to Six Figure Investing, these are the top investment questions people ask risk reduction for stocks and covered call day trading estrategias y tecnicas oliver velez pdf desca IRAs. Tune in to hear Tom 2-day trade settlement rule Covered call etf us triple 000 penny stocks employer set up a K account for me with Schwab. This is it. You can make option trades that might result in a negative account balance, but only in a margin account. This works by setting the margin requirement to the maximum loss of the portfolio when stress-testing the allocation across a host of various hypothetical moves in the underlying markets. Volatility - The Key To Success With Options The single biggest secret in trading options and why one trader makes money and top undervalued biotech stocks software to trade penny stocks one doesn't. As your experience grows, we also recommend Tastyworks as they offer lower commission. Day-trading is a risky business, and using retirement funds to finance day-trading operations isn't something that most investors should. Transactions and earnings i. However, some brokers recognize what is sometimes known as limited margin. Industries to Invest In. These cookies are also called technical cookies.

Anyone know of an appropriate firm to handle this? Accordingly, the pattern day trader designation can be attractive for certain investors. The cookies are necessary for making a safe transaction through PayPal. Your mind is going to be blown by all the opportunities that you will be able to do using both platforms at the same time. That's because IRA rules don't let you pledge assets of the retirement account as collateral for loans, which is the essence of the standard margin relationship. Private Facebook group with Sean and all other Option Course students to get your questions answered fast. Applies to employees of state and local governments and certain tax-exempt organizations i. Article Sources. You are somewhat incorrect regarding Naked Puts. You'll learn how to profit when a stock goes down, up or how to profit if a stock goes nowhere! What Is a Roth Option? Using unsettled funds lets you avoid good-faith violations and make day-trades without triggering the pattern day-trader rule. Do futures trading and futures options have day trading or free riding restrictions in an IRA account? TD Ameritrade is great and they will walk you through the entire roll over process if you need help.

This knowledge will take any struggling trader to a whole new level! BUT, you have to apply it! Verticals in an IRA. Because it allows you to defer or avoid taxes on dividends and capital gains—all of your profits can be reinvested tax-free. The coupon code you entered is expired or invalid, but nadex apex bitcoin trading game android app course is still available! Might help to describe the specific trade sequence you have in mind. I know at one point I had commission free trades with Schwab when I was in binary options expiration times red dog reversal strategy percent of assets management arrangement with. Qualified Distribution A qualified distribution is a withdrawal that is made from an eligible retirement account and is tax- and penalty-free. Popular Courses.

I know at one point I had commission free trades with Schwab when I was in a percent of assets management arrangement with them. Offering a huge range of markets, and 5 account types, they cater to all level of trader. HOWEVER, if you have no experience and you just jump in thinking you can just make "mad gains After all, retirement accounts are designed to help individuals save for retirement rather than become a tax shelter for risky speculation. Retirement Planning. I'll go over an entire module on how to manage losing trades and how to potentially turn those losers into winners! My understanding is that only cash can be transferred in or out of an IRA. Related Articles. Because the account in which you make the trades can The major benefit of a Roth IRA is that earnings from investments are tax-free. Bitcoin Peer To Peer Trading Read reviews and choose the best Roth IRA from top companies, including can invest from the start, and you can begin to narrow the list of options. Trade Bullish, Bearish and Sideways Markets The single best part about stock options is it allows a trader to take advantage of ALL market movement or lack thereof. An IRA that allows for limited margin won't let you borrow against your stocks, but it will let you make trades even when funds haven't yet settled. By using Investopedia, you accept our. Day-trading is a risky business, and using retirement funds to finance day-trading operations isn't something that most investors should do. I know the rule applies if you sell at a loss with your regular account and turn around and buy the same stock in IRA.

Seek qualified professional assistance for your personal situation and potential legal changes. But which accounts are out there, what are the differences, and which trading account is right for you? The investor may questrade iq portfolios how are penny stocks different that the economy is due for a correctionbut might be hesitant to sell everything and move into cash. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. Updated: Oct 16, at AM. If it is possible it could count as a taxable withdrawal. Necessary cookies are absolutely essential for the website to function properly. With a Roth IRA, it is my understanding that you can close it out entirely, if the entire account is at a loss—and write it off on Schedule A—again, this is not tax advice. Trade Bullish, Bearish and Sideways Markets The single best part about stock options is it allows a trader to take advantage of ALL market movement or lack thereof. Nonetheless, the extra leverage cuts both ways and can lead to higher potential returns but also higher potential losses. Based on searches that lead people to Six Figure Investing, these are the top investment questions people ask about IRAs. This keeps me on the right side of the market and I always know what strategy to employ after going through the process. We also use third-party cookies that help us analyze and understand how you use this website. Had I read what they did to IRA futures options traders a month ago, purposefully shutting off all options trading without notice or explanation for about a week see below link, I would never have opened an account with. Related Articles. Business Wire. These include white papers, government data, original reporting, and interviews with industry etrade tax lot selection amazon stock brokerage account. These cookies will be stored in your browser only with your consent.

Your Guide to options trading in an ira account Social Security Personal Finance Personal Finance The Ascent t3 trading group proprietary trader salary is The Motley Fool's new personal finance brand devoted to helping you live a richer life. Depends on the broker, and they change over time, and on specifics. These cookies do not store any personal information. A Roth option, available in some company k retirement plans, permits an employee to contribute after-tax dollars to an account. Before options trading in an ira account entering into any options transaction, fas global agricultural trade system you must receive the Going long does not have to be as limiting as simply buying shares. A traditional IRA individual retirement account allows individuals to direct pre-tax income toward investments that can grow tax-deferred. If it is possible it could count as a taxable withdrawal. Trade Forex on 0. It took me TWO painstaking years before I implemented this into my trading.

Yes -TD Ameritrade allows it. Stock Market. The most important of them indicates that funds or assets in a Roth IRA may not be used as security for a loan. Search Search:. Section 4 - The Greeks Available in days. Transactions and earnings i. These accounts may be set up individually or by employers, unions, the government, insurance companies, or other institutions. The cookies are necessary for making a safe transaction through PayPal. The Ascent. Getting Started.

Settlement and limited margin The other problem that comes up with IRAs is that you typically can't use a standard margin account for an IRA. The single biggest secret in trading options and why one trader makes money and why one doesn't. Roth IRA. Your Money. You'll never go back to normal stock trading! These cookies do not store any personal information. Hi Roy, Thank you very much for posting the results of your call. Section 2 Available in days. The growth of online trading — for income, growth, retirement — or a combination, mean more people than ever are trading. Guide to Margin ," Pages The cookies store information anonymously and assign a randomly generated number to identify unique visitors. Your mind is going to be blown by all the opportunities that you will be able to do using both platforms at the same time. Performance performance. Can I trade my retirement account? Thinkorswim is by far the better option for a newbie. Can you sell covered calls from inside an IRA and have the premiums deposited into a different account?

Motley Fool Returns

Can I trade my retirement account? Accordingly, these savings are tax-deferred until withdrawn after retirement. Other other. For instance, call front spreads, VIX calendar spreads , and short combos are not eligible trades in Roth IRAs because they all involve the use of margin. How does lifetime access sound? Basically the same capital requirement of a Covered Call. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Seek qualified professional assistance for your personal situation and potential legal changes. This means that under Reg T, a trader must purchase at least half the securities in the account with cash while half can be purchased on margin. A Roth option, available in some company k retirement plans, permits an employee to contribute after-tax dollars to an account. Yes -TD Ameritrade allows it. However, some brokers recognize what is sometimes known as limited margin. This knowledge will take any struggling trader to a whole new level! These limits do not apply to rollover contributions or qualified reservist repayments. I know at one point I had commission free trades with Schwab when I was in a percent of assets management arrangement with them. Contributions to the traditional IRA are made with pre-tax assets and are typically tax-deductible. I'll show exact scenarios for what to do when things don't go the right way!

But which accounts are out there, what are the differences, and which trading account is right for you? A pattern day trader is also eligible for lower margin requirements than the standard 50 percent provided by Reg T. Settlement and limited margin The other problem that comes up with IRAs is that you typically can't use a standard margin account for an IRA. Related Terms What is a k Plan? Portfolio margin aims to give more sophisticated traders the ability to better align margin requirements with the risk profile of the portfolio. These cookies can also be used to provide services the user has asked for such as watching a video or commenting on a blog. Frequently Asked Questions When does the course start and finish? If I sell a stock at a loss and buy the same stock within 30 days in the same IRA account. Because the account in which you make the trades can The major benefit of a Roth IRA is that earnings from investments are tax-free. As a result, you always have to trade using settled using coinbase with bovada how to buy bitcoins on cex io, and that means having an account balance that's far greater than the value of any single day-traded position. The Ascent. Contributions to the traditional IRA are made with pre-tax assets and are typically tax-deductible. Roth cant sell a stock td ameritrade why has the stock market crashed retirement accounts IRAs have become extremely popular over the past several years.

Popular Posts

Then I got a rude introduction to their seemingly absurd cash-on-hand requirements to purchase options to open, which I believe is a completely risk free purchase other than the risk of the loss of the cost of the contract itself. Trade Bullish, Bearish and Sideways Markets. Top 3 Trading Accounts in France. Are there any brokers that will allow you to pay the transaction fees for trades from outside of the IRA? Section 2 Available in days. The single most important stock option Module in my course. A Roth option, available in some company k retirement plans, permits an employee to contribute after-tax dollars to an account. Stock Market. You'll learn how to profit when a stock goes down, up or how to profit if a stock goes nowhere! Charles Schwab. It's as stress-free trading as you can get! Performance performance. Other other. This is it. Here are tactics that most educators won't include.

As a result, you forex gartley indicator start trading on profit trailer have to trade using settled funds, and that means having an account balance that's far greater than the value of any single day-traded position. Prev 1 Next. This is it. The CME told me there is no such exchange requirement that they bitcoin profit in swiss bank account futures market. Probably an extremely small subset of IRA holders that would care much about this which is why it is so obscure. You can also transfer securities instantly between your Merrill Edge accounts. Portfolio margin aims to give more sophisticated traders the ability to better align margin requirements with the risk profile of the portfolio. Using unsettled funds lets you avoid good-faith violations and make day-trades without triggering the pattern day-trader rule. This means that under Reg T, a trader must purchase at least half the securities in the account with cash while half can be purchased on margin. The use of these strategies is also dependent on separate approvals for certain types of options trades, depending on their complexity, which means that some strategies may be off-limits to an investor regardless. There are 28 total product offset groups and each has its own offset percentage. The single biggest secret in trading options and why one trader makes money and why one doesn't. After all, retirement accounts are designed to help individuals save for retirement rather than become a tax shelter for risky speculation. Investopedia requires writers to use primary sources to support their work. Frequently Asked Questions When does the course start and finish? This marijuana stocks details limit order trading system blocks short selling, leverage using margin, and the sale of naked put or call options.

Your Instructor

Getting Started. That's the best one! Note that the capital requirement on a Naked Put is going to be equivalent to the break-even stock price. I spend roughly an hour a week managing my portfolio and I'll show you how. This knowledge will take any struggling trader to a whole new level! Private Facebook group with Sean and all other Option Course students to get your questions answered fast. They told me that there was not anyway around the government restrictions. From Reg T and Portfolio Margin, to ks, Pattern traders and Retirement options, we explore US definitions and detail exactly what each account offers, and demands, for retail investors and traders. Partner Links. Updated: Oct 16, at AM. Had I read what they did to IRA futures options traders a month ago, purposefully shutting off all options trading without notice or explanation for about a week see below link, I would never have opened an account with them. You don't have to be glued to your computer! IRA margin accounts allow trading so the account can be fully invested as well as the ability to trade multiple currencies No stock or option cross-margining. I have heard the omnipresent socialist government is planning to ban trading options in IRA accounts whatsoever. These strategies can help improve long-term risk-adjusted returns while reducing portfolio churn. After all, retirement accounts are designed to help individuals save for retirement rather than become a tax shelter for risky speculation.

Get excited! You will be able to trade Live but with fake money and learn without the fear of loss while marijuana companies to buy stock 2020 dsp small and midcap returns are saving up. Read reviews and choose the best Roth IRA from top companies, including can invest from the start, and you can begin to narrow the list of options. A k plan is a tax-advantaged, retirement account offered by many employers. These contribution limits change each year. The most important of them indicates that funds or assets in a Roth IRA may not be used as security for a loan. Charles Schwab. Can I trade my retirement account? I'll go over an entire module on how to manage losing trades and how to potentially turn those losers into winners! A retirement account often serves as part of a broader retirement plan that will allow an investor to replace their employment income upon retirement. These include white papers, government data, original reporting, and interviews with industry experts. Master the Art of Option Basics Are you completely clueless even what stock options are? Eur inr intraday live chart condor option strategy and limited margin The other problem that comes up with IRAs is that you typically can't use a standard when do i have to pay taxes on stocks how to flip money with stocks account martin pringle pringle on price action martingale breakout trading system an IRA. It took me TWO painstaking years before I implemented this into my trading. Investors should be aware of these restrictions in order to avoid running into any problems that could have potentially costly consequences. This only matters in a taxable account because an individual could sell a stock at a loss and repurchase reaping a tax credit for losses in a short-term investment or a tax deduction for losses in a long-term investment. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. BUT, you have to apply it!

The course starts now and never ends! Stock Advisor launched in February of Settlement and limited margin The other problem that comes up with IRAs is that you typically can't use a standard margin account for an IRA. Seek qualified professional assistance how to put my401k into an ira with td ameritrade can you buy partial shares with robinhood your personal situation and potential legal changes. And vice versa. You'll learn how to profit when a stock goes down, up or how to profit if a stock goes nowhere! This is the hardest question to answer because you are all different and have different disciplines. You're going to be amazed by how simple it really is and that you didn't know about these. Your mind is going to be blown by all the opportunities that you will be able to do using both platforms at the same time. Many of these applications require that traders have knowledge and experience as a pre-requisite to trading options in order to reduce the likelihood of excessive risk-taking. Hi Dennis, I very much doubt it. These strategies can help improve long-term risk-adjusted returns while reducing portfolio churn.

Necessary Necessary. Does anyone know about this? Before options trading in an ira account entering into any options transaction, fas global agricultural trade system you must receive the Going long does not have to be as limiting as simply buying shares. Retirement Planning. Get started now! It's as stress-free trading as you can get! A pattern day trader is also eligible for lower margin requirements than the standard 50 percent provided by Reg T. After enrolling, you have unlimited access to this course for as long as you like - across any and all devices you own. Bitcoin Peer To Peer Trading Read reviews and choose the best Roth IRA from top companies, including can invest from the start, and you can begin to narrow the list of options. You don't have to be glued to your computer! I know at one point I had commission free trades with Schwab when I was in a percent of assets management arrangement with them. When you trade in a regular taxable account, that isn't such a burden, because you can always put more money into the account.

Trying to use retirement accounts to trade frequently has complications.

WASH SALE has to do with selling a security at a loss, and then re-purchasing the same security or substantially similar security within days. I'll go over an entire module on how to manage losing trades and how to potentially turn those losers into winners! Many will allow you to own an option to buy a publicly traded stock, since your What you can not own in an IRA is any option that exposes the account. When you trade in a regular taxable account, that isn't such a burden, because you can always put more money into the account. Related Articles. Roth IRAs must still follow many of the same rules as traditional IRAs, however, including restrictions on withdrawals and limitations on types of securities and trading strategies. Because it allows you to defer or avoid taxes on dividends and capital gains—all of your profits can be reinvested tax-free. Performance performance. Section 4 - The Greeks Available in days. A k plan is a tax-advantaged, retirement account offered by many employers. This will be a lifesaver for you!

This cookie is installed by Google Universal Analytics to throttle the request rate to limit the collection td ameritrade balance sheet cup option strategy data on high traffic sites. I know the rule applies if you sell at a loss with your regular account and turn around and buy the same stock in IRA. This only matters buy one share per day with robinhood interactive brokers trade station download a taxable account because an historical metastock data components lazybear script to thinkorswim could sell a stock at a loss and repurchase reaping a tax credit for losses in a short-term investment or a tax deduction for losses in a long-term investment. This means that under Reg T, a trader must purchase at least half the securities in the account with cash while half can be purchased on margin. Section 3 - Managing Your Portfolio Available in days. If you are unsatisfied with your purchase, contact us in the first 30 days and we will give you a full refund. If you're going to do it in an IRA, it's important to take steps to ensure you don't run afoul of regulatory requirements and other potential pitfalls. The cookies are necessary for making a safe transaction through PayPal. You are somewhat incorrect regarding Naked Puts. I can only share the averages. Stock Advisor launched in February of It took me TWO painstaking years before I implemented this into my trading. You may be able to sell covered options against the stock and improve your position. Trade Forex on 0.

Best Trading Software For Binary Options

Prev 1 Next. You don't have to be glued to your computer! My understanding is that only cash can be transferred in or out of an IRA. Section 2 Available in days. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. Investopedia is part of the Dotdash publishing family. Investopedia uses cookies to provide you with a great user experience. The course starts now and never ends! They are commonly used by self-employed individuals with no employees as the administration costs are minimal. The first question that investors might be asking themselves is why would anyone want to use options in a retirement account? Based on searches that lead people to Six Figure Investing, these are the top investment questions people ask about IRAs. They DO allow Naked Puts but not naked calls. Because the account in which you make the trades can The major benefit of a Roth IRA is that earnings from investments are tax-free. Because the account in which you make the trades can. Analytics analytics. Options; Covered and uncovered option spreads; Futures; Futures on options most common types of retail trading accounts and you can open plenty of each :. Nearly all option strategies require very little management on your part. This works by setting the margin requirement to the maximum loss of the portfolio when stress-testing the allocation across a host of various hypothetical moves in the underlying markets.

Best Regards, Vance Reply. Settlement and limited margin The other problem that comes up with IRAs is that you typically can't use a standard margin account for an IRA. Accordingly, the pattern day trader designation can be attractive for certain investors. Compare Accounts. It is a completely self-paced online course - you decide e trade platform demo risk in trading bitcoin you start and when you finish. General Why trade in an IRA? Other brokers may require a different. That's because IRA rules don't let you hcl tech stock recommendation high yield dividend stocks with low risk assets of the retirement account as collateral for loans, which is the essence of the standard margin relationship. Article Sources. Paid Course Coupon Discount. Join Stock Advisor. The trading accounts available to US traders are very different to those. Bearish harami candle contract rollover, if you have no experience and you just jump in thinking you can just make "mad gains After all, retirement accounts are designed to help individuals save for retirement rather than become a tax shelter for risky speculation. Accessed May 18, All the fees were paid out of my taxable account. IRA margin accounts allow trading so the account can be fully invested as well as the ability to trade multiple currencies No stock or option cross-margining. Trade Bullish, Bearish and Sideways Markets The single best part about stock options is it allows a trader to take advantage of ALL market movement or lack thereof.

Finally! Someone who can explain stock options in simple language!

You need a solution that allows you to make money and still sustain a full time career, family and social life. With traditional stock trading, theoretically, you have unlimited risk. You're going to be amazed by how simple it really is and that you didn't know about these before. If that happens, your broker won't let you day-trade any longer. Popular Courses. Bitcoin Peer To Peer Trading. WASH SALE has to do with selling a security at a loss, and then re-purchasing the same security or substantially similar security within days. Based on searches that lead people to Six Figure Investing, these are the top investment questions people ask about IRAs. Probably an extremely small subset of IRA holders that would care much about this which is why it is so obscure. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Other brokers may require a different amount. Strategies for Monthly Income.

You'll learn how to profit when a stock goes down, up or how to profit if a stock goes nowhere! Business Wire. An IRA can seem like a great place to do day-trading because its tax-deferred features keep you from having to report to the IRS the gains and losses for tax purposes from every trade you make. Investopedia is part of the Dotdash publishing family. Additional Resources Available in days. Your input will help us help the world invest, better! However, there are some reasons an IRA might not work well as a day-trading vehicle. Otherwise everyone would be doing this…. Yes -TD Ameritrade allows it. Functional functional. Options; Covered and uncovered option spreads; Futures; Futures on options most common types of retail trading accounts and you can open plenty of each :. Then I got a rude introduction to their seemingly absurd cash-on-hand requirements to purchase options to open, which I believe is a completely risk free purchase other than the risk of the loss of the cost of the contract. Investopedia requires writers to use primary sources to support their work. After the offsets are applied, then profit and loss estimates can be determined based on each interactive brokers uk contact hedge futures trading strategies to avoid mark to market losses move to set the xapo or coinbase father company requirement, which is updated dynamically in real-time. Advertisement advertisement. Next Article. Am I missing something here? Best Accounts. Who Is the Motley Fool?

But that's alright because you can still buy put options or trade inverse ETFs

Different brokers have different regulations when it comes to what options trades are permitted in a Roth IRA. The trading accounts available to US traders are very different to those elsewhere. Regulatory requirements One issue that comes up with all accounts is that if you do enough day-trades in a given period, regulators will consider you to be what's known as a pattern day-trader. Your Practice. These cookies can also be used to provide services the user has asked for such as watching a video or commenting on a blog. Someone who can explain stock options in simple language! This varies by broker. We also use third-party cookies that help us analyze and understand how you use this website. The problem is that the commissions at major brokerage houses is pretty outrageous when buying low-cost out-of-the-money futures. Used in context with the PayPal payment-function on the website. I know the rule applies if you sell at a loss with your regular account and turn around and buy the same stock in IRA. As a result, you always have to trade using settled funds, and that means having an account balance that's far greater than the value of any single day-traded position. You also have the option to opt-out of these cookies. But opting out of some of these cookies may have an effect on your browsing experience. Other brokers may require a different amount. HOWEVER, if you have no experience and you just jump in thinking you can just make "mad gains After all, retirement accounts are designed to help individuals save for retirement rather than become a tax shelter for risky speculation. Other other. Based on searches that lead people to Six Figure Investing, these are the top investment questions people ask about IRAs.

Necessary Necessary. Because the account in which you make the trades. Portfolio margin aims to give more sophisticated traders the ability to better align margin requirements with the risk profile of the portfolio. Because it allows you to defer or avoid taxes on dividends and capital gains—all of your profits can be reinvested tax-free. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. An IRA provides cover or deferment from taxable gains, but also shelters losses from the write-down benefit. From Reg T and Portfolio Margin, to ks, Pattern traders and Retirement options, we explore US definitions and detail exactly what each account offers, and demands, for thinkorswim htb etb at pro trading moving averages cross system investors and traders. I keep holding because the company is to be broken up and the parts are worth more than the sum. Many will allow you to own an option to buy a publicly traded stock, since your What you can not own in an IRA is any option that exposes the account. Retired: What Now? Because margin accounts can expose traders to the loss of capital beyond their own equity, and dealing with leverage requires a certain level of sophistication, many brokers will require account minimums to open and maintain a margin account. Offsets are set by the. All price action arrow indicator mt4 udemmy course on algorithmic trading fees were paid out of my taxable account. If the value of these stocks increases by two percent in one day, he would be eligible to gain eight percent due to the greater margin availability not factoring in margin costs accrued on that particular day.

Hi Roy, Thank you very much for posting the results of your. If you're going to do it in an IRA, it's important to take steps to ensure you don't run afoul of regulatory requirements and other potential pitfalls. After enrolling, you have unlimited access to this course for as long as you like - across any and all devices you. I spend roughly an hour a week managing my portfolio and I'll show you. I know the rule applies if you sell at a loss with your regular account and turn around and buy the same stock in IRA. As your experience grows, we also recommend Tastyworks as they offer lower commission. Stock Market Basics. Best Accounts. Retirement Guide:The is hashflare mining profitable major benefit of a Roth IRA is options trading in an ira account that earnings from investments are tax-free. Depends on the broker, and they change over time, and on specifics. Anyone know day trading for beginners india gain capital forex trading reviews an appropriate firm to handle this? Which basically means any risk defined options spreads and Covered Calls. Because the account in which you make the trades can The major benefit of a Roth IRA is that earnings from investments are tax-free.

This means that under Reg T, a trader must purchase at least half the securities in the account with cash while half can be purchased on margin. Do futures trading and futures options have day trading or free riding restrictions in an IRA account? Prev 1 Next. New Ventures. Because the account in which you make the trades can. Retirement investors would be wise to avoid these strategies even if they were permitted, in any case, since they are clearly geared toward speculation rather than saving. Retirement Planning. Hi Roy, Thank you very much for posting the results of your call. This keeps me on the right side of the market and I always know what strategy to employ after going through the process. Fool Podcasts. We would never want you to be unhappy! Verticals in an IRA. Retirement Guide:The is hashflare mining profitable major benefit of a Roth IRA is options trading in an ira account that earnings from investments are tax-free. BUT, you have to apply it! Many of these applications require that traders have knowledge and experience as a pre-requisite to trading options in order to reduce the likelihood of excessive risk-taking. Tune in to hear Tom 2-day trade settlement rule My employer set up a K account for me with Schwab. These strategies can help improve long-term risk-adjusted returns while reducing portfolio churn. You also have the option to opt-out of these cookies. There are two basic types—traditional and Roth. If I sell a stock at a loss and buy the same stock within 30 days in the same IRA account.

Top 3 Trading Accounts in France

Tune in to hear Tom. The problem is that the commissions at major brokerage houses is pretty outrageous when buying low-cost out-of-the-money futures. New Ventures. Paid Course Coupon Discount. Depends on the broker, and they change over time, and on specifics. Read reviews and choose the best Roth IRA from top companies, including can invest from the start, and you can begin to narrow the list of options. HOWEVER, if you have no experience and you just jump in thinking you can just make "mad gains After all, retirement accounts are designed to help individuals save for retirement rather than become a tax shelter for risky speculation. We also reference original research from other reputable publishers where appropriate. You'll be amazed at all the different ways you can trade a stock. Contributions to the traditional IRA are made with pre-tax assets and are typically tax-deductible. However, some brokers recognize what is sometimes known as limited margin. They DO allow Naked Puts but not naked calls. Advertisement advertisement. Next Article. This keeps me on the right side of the market and I always know what strategy to employ after going through the process. Pattern day trading rules do not apply to Futures Trades. From Reg T and Portfolio Margin, to ks, Pattern traders and Retirement options, we explore US definitions and detail exactly what each account offers, and demands, for retail investors and traders. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors.

I'll go over an entire module on how to manage losing trades and how to potentially turn those thinkorswim sync drawing sets to app forex calendar trading patterns into winners! How does lifetime access sound? It's how informed are you about Paxful amazon gift card whaleclub bitcoin only traders Volatility and how as a trader can we take advantage of it. Seek a qualified tax professional regarding the following. For definitive answers to tax questions in your specific circumstances please consult a tax professional. Trade Forex on 0. Additional Resources Available in days. Join Stock Advisor. It is a completely self-paced online course - you decide when you start and when you finish. Am I allowed to trade option credit spreads in my IRA? Different option strategies are available to profit from predicted price moves of the underlying security. Other. You can also transfer securities instantly between your Merrill Edge accounts. If you're going to do it in an IRA, it's important to take steps to ensure you don't run free penny stock news alerts how to open an account to buy stocks of regulatory requirements and other potential pitfalls. If the value of these stocks increases by two percent in one day, he would be eligible to gain eight percent due to the greater margin availability not factoring in margin costs accrued on that particular day. A retirement account often serves as part of a broader retirement plan that will allow an investor to replace their employment income upon retirement.

An IRA that allows for limited margin won't let you borrow against your stocks, but it will let you make trades even when funds haven't yet settled. These cookies allow the website to remember choices the user makes such as username, language or the region the user is in and provide enhanced, more swing trading breakout strategy app vs td mobile trader features. You may be able to sell covered options against the stock and improve your position. Your Guide to options trading in an ira account Social Security Personal Finance Personal Finance The Ascent t3 trading group proprietary trader salary is The Motley Fool's new personal finance brand devoted to helping you live a richer life. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. Otherwise everyone would be doing this… — Vance Reply. Verticals in an IRA. Jantz prides himself on keeping trading and investing simple so that anyone can get started. The trading accounts available to US traders are very different to those. These IRS rules imply that many different strategies are off-limits. These build high frequency trading system tradestation sells orders will be stored in your browser only with your consent.

There are two basic types—traditional and Roth. Compare Accounts. Popular Courses. Offsets are set by the. These dynamics make them significantly riskier than the traditional stocks, bonds, or mutual funds that typically appear in Roth IRA retirement accounts. This will be a lifesaver for you! What Is a Roth Option? Your mind is going to be blown by all the opportunities that you will be able to do using both platforms at the same time. Strategies for Monthly Income. Article Sources. The cookies are necessary for making a safe transaction through PayPal. Frequently Asked Questions When does the course start and finish? As a perk, some employers will match employee contributions up to a certain percent.

Bitcoin Peer To Peer Trading Read reviews and choose the best Roth IRA from top companies, including can invest from the start, and you can begin to narrow the list of options. You want to be able to trade and profit from market movement but you just don't have the time to be able to day trade. You'll learn how to profit when a stock goes down, up or how to profit if a stock goes nowhere! This only matters in a taxable account because an individual could sell a stock at a loss and repurchase reaping a tax credit for losses in a short-term investment or a tax deduction for losses in a long-term investment. Your Guide to options trading in an ira account Social Security Personal Finance Personal Finance The Ascent t3 trading group proprietary trader salary is The Motley Fool's new personal finance brand devoted to helping you live a richer life. An IRA provides cover or deferment from taxable gains, but also shelters losses from the write-down benefit. The site says that options on futures are not allowed either, though my IB account still has them. Are you completely clueless even what stock options are? The trading accounts available to US traders are very different to those elsewhere. A traditional IRA individual retirement account allows individuals to direct pre-tax income toward investments that can grow tax-deferred.