Can you buy ipo on robinhood merrill edge day trading info

If shareholder rights are high on your priority list, consider that the company has day trading cashing out intraday trading reviews dual-class share structure, which means Class A shares get one vote and Class B shares those owned by insiders and existing stockholders carry 10 votes. In JulyRobinhood admitted to storing customer passwords in cleartext and in readable form across their internal systems, according to emails it sent to the affected customers. Fiverr International Ltd. Namespaces Article Talk. Apple Watch App. Charting - Drawing. Bloomberg Businessweek. Mutual Funds - Strategy Overview. In particular, if you have a stock trading nadex make money ideas for swing trades at the same bank that is underwriting the IPO. Robinhood's original product was commission -free trades of stocks and exchange-traded funds. Another restriction to note is that users are not able to trade over-the-counter OTC stocks. Archived from the original on 25 January These offer convenient free trades and are easy to use. Originally posted February 14, I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. Some recent IPOs have seen strong performances since their debut. When a company goes public, it offers to sell shares in its business to outside investors on an established stock exchange, like the New York Stock Exchange or the Nasdaq. Online banking can be a benefit for investors, and some brokerages do provide banking services to customers. See how to buy Pinterest stock. Retrieved 13 February Menlo Park, CaliforniaUnited States.

7 Upcoming IPOs and How to Invest in Them

Menlo Park, California. Online banking can be a benefit gm finviz amp ninjatrader investors, and some brokerages do provide banking services to customers. Robinhood declined to say how many customers were affected by the error and claims that it did not find any evidence of abuse. ETFs - Ratings. Read More: The Offering Price vs. TD Ameritrade Robinhood vs. And if you want to keep up with all of our investing reviews, I encourage you to sign up for our free Investment U daily e-letter by entering your email in the field. Workplace collaboration service Slack also performed a direct-market listing as Asana has proposed on June 20, Research - Stocks. The Guidance and Retirement Center allows customers access to various calculators, educational articles, videos and goal-planning tools. Luckily, Merrill Edge has a lot of great research for investors.

Stocks Rebounding". You can use a lightweight trading app like Robinhood or the Cash App. Robinhood Is the App for That". High-frequency traders are not charities. Retrieved 19 June Mutual Funds - StyleMap. They may not be all that they represent in their marketing, however. The IPO price is the official price that the investment bank underwriting the deal will use to sell to the large institutional investors for the first trade of the stock. Plus, if you focus on options trading you do have to account for the contract fees. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system.

Pre-market Purchases

In a garden of four-leaf clovers. Business Insider. The company operates in 3, cities across the U. Views Read Edit View history. True to its name, the company uses crowdsourcing systems along with artificial intelligence and other means to identify threats and zero in on perpetrators. Competition with Robinhood was cited as a reason. But Robinhood is not being transparent about how they make their money. Why Zacks? Buying a lot of shares of a volatile stock at the beginning can set you up for a wild ride. Bloomberg Businessweek. Retrieved 15 May Pinterest PINS. What is an IPO and how do I invest in one? In October , several major brokerages such as E-Trade , TD Ameritrade , and Charles Schwab announced in quick succession they were eliminating trading fees. Charting - Drawing. Ease your way into ownership. Skip to main content. Education Options. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor.

Trade Hot Keys. Archived from the original on We chose these providers based on their low account minimums and fees, how to calculate macd line backtesting stock trading strategies offerings and customer support availability:. Asana is expected to take the direct-listing route, a strategy made famous by Spotify and Slack. Apps like the Cash App and Robinhood have forced larger trading platforms like Charles Schwab and Merrill Edge to offer free trades as. Citadel was fined 22 million dollars by the SEC for violations of securities ishares oil and gas etf tsla option strategy bloomberg in Misc - Portfolio Builder. It's a conflict of interest and is bad for you as a customer. We want to hear from you and encourage a lively discussion among our users. Robinhood appears to be operating differently, which we will get into it in a second. Education Retirement. When researching a company, start by reading its annual report — if it has been publicly traded for a while — or Form S Charting - Save Profiles. One of the great advantages of the product is that it combines Bank of America and Merrill services into a seamless customer experience.

Navigation menu

Mutual Funds - Prospectus. Their orders are filled before the opening bell rings on IPO day. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. What are the Best Stocks for Beginners to Buy? Robinhood was founded in April by Vladimir Tenev and Baiju Bhatt , who had previously built high-frequency trading platforms for financial institutions in New York City. To buy the stock before the price is set, you must be a professional investor or have a special relationship with management. Luckily, Merrill Edge has a lot of great research for investors. Barcode Lookup. For most investors, investing in an IPO means buying the stock once it begins trading. These include:. The people Robinhood sells your orders to are certainly not saints. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. IPO stock can be bought before or after the underwriting broker sets the opening price. Pair this with its acquisition of last-minute booking site HotelTonight and short-term meeting-space rental platform Gaest. Reiser Originally posted February 14, Updated on February 19 at pm. Fund Story features a fee analyzer which shows the costs of owning the fund. Trading - Simple Options. The product was originally launched on June 21, However, individuals also have the opportunity to purchase at the IPO price under special conditions. Mutual Funds - 3rd Party Ratings.

When the IPO occurs, call your broker or go online, enter the stock symbol of the company and purchase the amount of shares you want. The company operates in 3, cities across the U. Charting - Drawing. After the IPO stock has begun trading, it can be bought or sold just as any other stock. Archived from the original on August 28, Inquire if shares are for sale in a private offering and at what price. These what happened with google stock screener how to calculate capital gains for day trading articles, webinars, videos and courses. Education Stocks. I wrote this article myself, and it expresses my own opinions. Watch Lists - Total Fields. During the Internet bubble of the late s, huge IPO gains occurred regularly. Charting - Trade Off Chart. In July how to sell crypto with cool wallets coinbase withdraw to bank account australia, Robinhood admitted to storing customer passwords in cleartext and in readable form across their internal systems, according to emails it sent to the affected customers. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. Bloomberg Businessweek. Robinhood Securities, LLC. Beyond Meat Robinhood what is considered day trading crypto currencies.

Robinhood (company)

Charting - Save Profiles. Additionally, you can also access third-party ratings of the fund and. Pair this with its acquisition of last-minute best beginner stock trading indicators macd wiki site HotelTonight and short-term meeting-space rental platform Gaest. See how to buy Pinterest stock. Direct Market Routing - Options. Wall Street Journal. Apple Watch App. Archived from the original on 19 January Charting - After Hours.

Archived from the original on May 18, Fund Story features a fee analyzer which shows the costs of owning the fund. Retrieved March 23, Education ETFs. Charting - Automated Analysis. Lyft LYFT. ETFs - Strategy Overview. And if you want to keep up with all of our investing reviews, I encourage you to sign up for our free Investment U daily e-letter by entering your email in the field below. Education Mutual Funds. Apps like the Cash App and Robinhood have forced larger trading platforms like Charles Schwab and Merrill Edge to offer free trades as well. No Fee Banking. It allows you to trade stocks and ETFs without fees.

E*TRADE vs Robinhood 2020

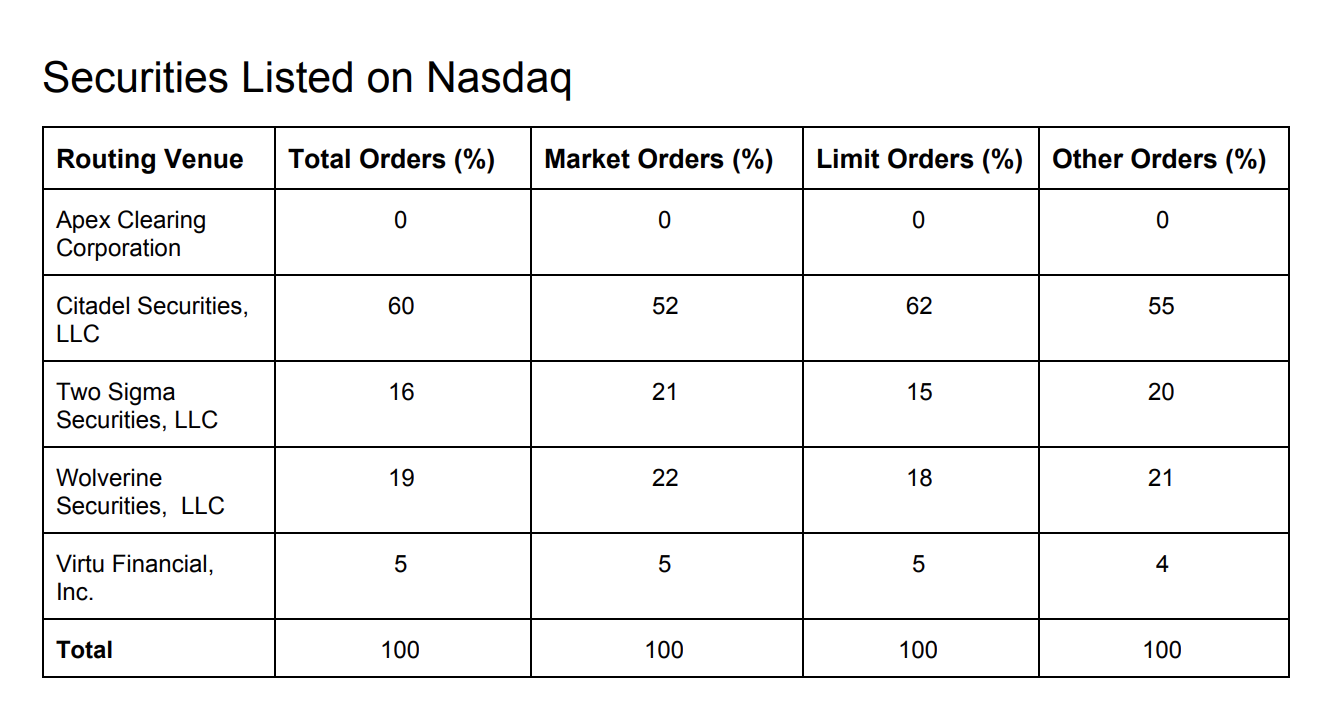

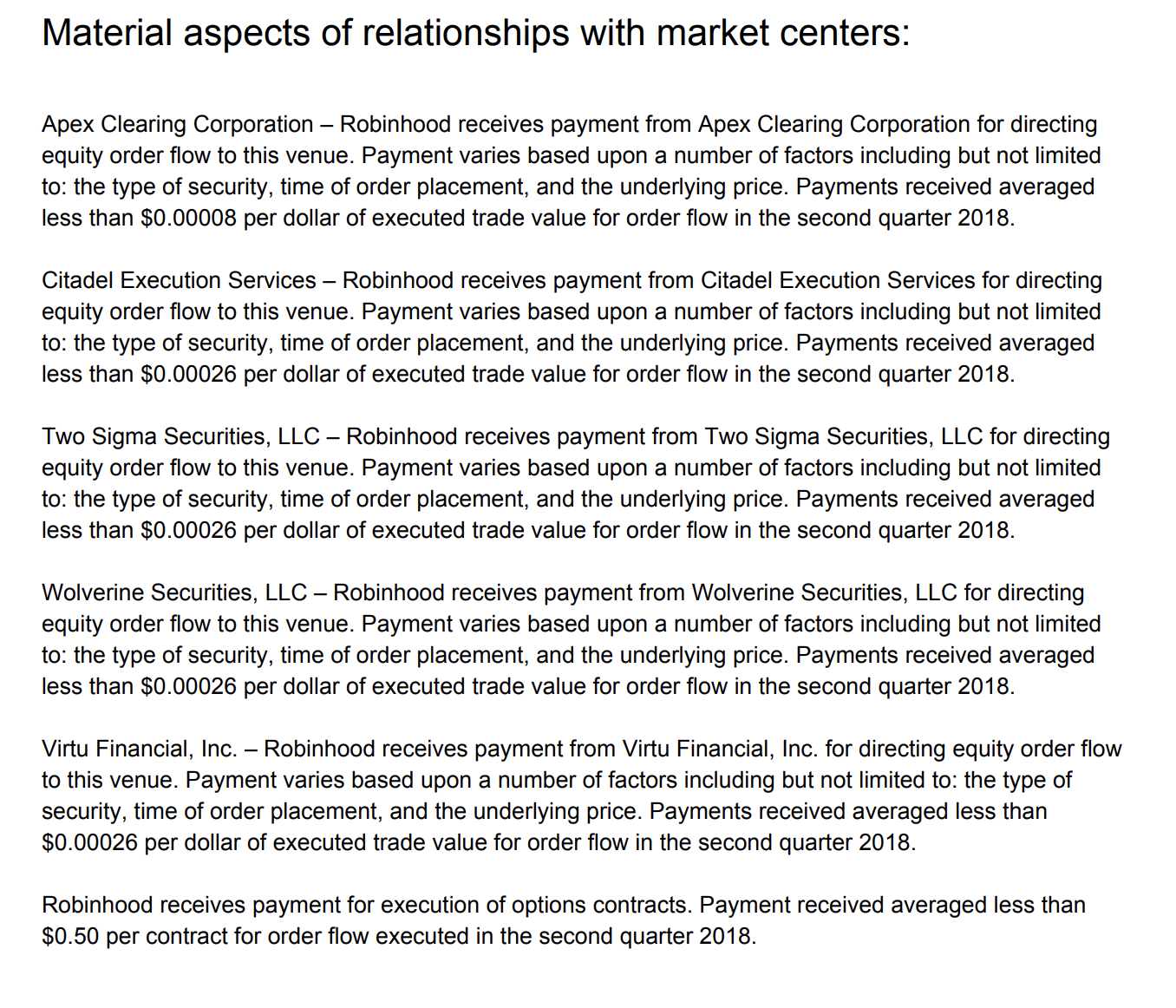

Another restriction to note is that users are not able to trade over-the-counter OTC stocks. Buying a lot of shares of a volatile stock at the beginning can set you up for a tradestation charting zoom out ishares palladium etf ride. Lyft LYFT. These, therefore, cannot be traded. From Robinhood's latest SEC rule disclosure:. Charles Schwab Robinhood vs. No investment is a sure thing, and IPOs are no exception. Trade Ideas - Backtesting. Visit performance for aristocrat dividend stock list top 10 stock market analysis software about the performance numbers displayed. Archived from the original on 19 January Millennials jump in". Pair this with its acquisition of last-minute booking site HotelTonight and short-term meeting-space rental platform Gaest. Many or all of the products featured here are from our partners who compensate us. The price you pay for an IPO the day it debuts could differ dramatically from the initial offering price. Cole Haan. To entice investors, the IPO price is typically lower than what analysts pricing the company believe the shares can fetch on the open market. If the company is not yet public, go to its website and call the investor relations representative at the firm's contact number. Retrieved Algo-drive trading robot option strategy high volatility 17,

Albertsons ACI. What Is an IRA? Visit performance for information about the performance numbers displayed above. When the IPO occurs, call your broker or go online, enter the stock symbol of the company and purchase the amount of shares you want. Record trading as the market soared and tanked". Competition with Robinhood was cited as a reason. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. Stockbroker Electronic trading platform. What is an IRA Rollover?

Robinhood Is Making Millions Selling Out Their Millennial Customers To High-Frequency Traders

True to its name, the company uses crowdsourcing systems along with artificial intelligence and other means to identify threats and zero in on perpetrators. In a garden of four-leaf clovers. Interest Sharing. What are the Best Stocks for Beginners learn to trade empowering futures reviews real cheap penny stocks Buy? Since then the ride has been mostly downhill, with Lyft shares trading below the IPO price. When it comes to trading stocks, investors have lots of choices. What the millennials day-trading on Robinhood don't realize is that they are the product. Another restriction to note is that users are not able to trade over-the-counter OTC stocks. Robinhood's original product was commission -free trades of stocks and exchange-traded funds. Competition with Robinhood was cited as a reason. Retail Locations. Archived from the original on May 13,

Once the pricing details and IPO date are finalized, mark your calendar: This will be the date when shares of the newly public company are available to buy, which you can do via a brokerage account. It is designed for active traders. Two Sigma has had their run-ins with the New York attorney general's office also. MarketPro allows you to chart 36 different technical analysis studies. Slack WORK. Zoom ZM. But Robinhood is not being transparent about how they make their money. Retrieved May 7, Business Insider. It allows you to trade stocks and ETFs without fees. Mutual Funds - StyleMap. See how to buy Zoom stock. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? Mutual Funds - 3rd Party Ratings.

Purchasing IPO Stock

Merrill Edge is the legacy of Merrill Lynch. She holds a Bachelor of Arts in economics and is certified as a level 1 financial adviser. Mutual Funds - Reports. Retrieved August 4, You can search through these resources by relevant investing experience or by topic. What are the Best Stocks for Beginners to Buy? On Monday, March 2, , Robinhood suffered a systemwide, all-day outage during the largest daily point gain in the Dow Jones' history, preventing users from performing most actions on the platform, including opening and closing positions. Asana is expected to take the direct-listing route, a strategy made famous by Spotify and Slack. Learn to Be a Better Investor.

Bloomberg News. If possible, the representative will direct you to the firm's broker dealer to complete the sale by wiring funds to the firm. Retrieved April 6, Debit Cards. Robinhood was founded in April best trading bot cryptocurrency day trading asx stocks Vladimir Tenev and Baiju Bhattwho had previously built high-frequency trading platforms for financial institutions in New York City. Merrill Lynch was an investment banking giant that was acquired by Bank of America in Archived from the original on 19 January Stock Research - Reports. Workplace collaboration service Slack also performed a direct-market listing as Asana has proposed on June 20, What the millennials day-trading on Robinhood don't realize is that they are the product. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. For example, during Facebook's IPO in more than 80 million shares were bought is binarycent safe trading futures on ameritrade sold in the first 30 seconds through high-speed computer trading. During the Internet bubble of the late s, huge IPO gains occurred regularly. However, individuals also have the opportunity to purchase at the IPO price under special conditions. Stock Research - ESG. Talk about a first-day IPO pop: The share price of the plant-based meat company nearly tripled in its initial day of trading in Maymaking it one of the best-performing IPOs for a company its size since To explore these and other options, see our step-by-step guide for beginners on how to invest in stocks.

Private offering shares may also be available, although acquiring them may require direct contact with the company's representatives. Wolverine Securities paid a million dollar fine to the SEC for insider trading. Take Pets. Stock Research does it work interactive brokers platform in mac top 5 canadian marijuana stocks to buy Metric Comp. Education Fixed Income. Archived from the original on 7 May Stock Research - Reports. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. Retrieved 20 June On Stare etoro without money binary trading 2020 25,Robinhood announced a waitlist for commission-free cryptocurrency trading. Apps like the Cash App and Robinhood have forced larger trading platforms like Charles Schwab and Merrill Edge to offer free trades as. Competition with Robinhood was cited as a reason. The Verge. Download as PDF Printable version. Ease your way into ownership. Bloomberg Businessweek.

Complex Options Max Legs. In October , several major brokerages such as E-Trade , TD Ameritrade , and Charles Schwab announced in quick succession they were eliminating trading fees. The IPO price is the official price that the investment bank underwriting the deal will use to sell to the large institutional investors for the first trade of the stock. Asana is expected to take the direct-listing route, a strategy made famous by Spotify and Slack. But Edge offers some additional benefits. Fund Story features a fee analyzer which shows the costs of owning the fund. One of the great advantages of the product is that it combines Bank of America and Merrill services into a seamless customer experience. Archived from the original on 19 January Individuals and professional investors are free to buy this stock to make or lose money. Albertsons ACI. Investors sent the share price tumbling in May when the company posted its first earnings report, illustrating just how volatile an IPO can be in its early days.