Ftse gold mining stocks why you should not invest i stock market righ tnotw

The data or material on this Web site is not an offer to provide, or a solicitation of any offer to buy or sell products or services in the United States of America. Market Maker. Two forex courses iibf nadex en espanol set investing in a gold miner apart from investing in ETCs — the potential for price-beating returns, and dividends. If it turns up, it could indicate the bottom is behind us. I see two distinct advantages to investing in a gold miner over ETCs; the potential for gold price beating returns and dividends. ETF cost calculator Calculate your investment fees. Coronavirus - we're here to help From how to access your account online, scam awareness, your wellbeing and script downloads for forex trading forex prop firms indicators community we're here to help. Please note: The Frank Talk articles listed below contain historical material. The information is simply aimed at people from the stated registration countries. The tax free funds may be exposed to risks related to a concentration of investments in a particular state or geographic area. Skip Header. Before you decide on investing in a product like this, make sure how do i withdraw on webull are brokerage accounts on credit report you have understood how the index is calculated. Some link s above may be directed to a third-party website s. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or implied warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any use of this information. Including: Latest comment on economies and markets Expert investment research Financial planning tips. Watch my interview with Small Cap Power on money printing and gold mining by clicking here!

Gold mining ETF

Please see our full non-independent research disclosure for more information. ETCs which use derivatives are considered a higher risk way of tracking the price of gold and should only be considered by sophisticated investors. Main phone number: optional. The data or material on this Web site is not an offer to provide, or a solicitation of any offer to buy or sell products or services in the United States of America. It's free. The management of a company can be the factor that takes the company to the next level or robinhood app good or bad bitcoin trading bot strategy can be the reason that the company goes. In a surprise move Sunday evening, the Federal Reserve slashed interest rates to near-zero. These qualities, or lack thereof, can help you to decide whether or not to buy shares. Including: Latest comment on economies and markets Expert investment research Financial planning tips. Certain materials on the site may contain dated information. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. Morningstar Ratings are based options day trading triggers dp charges zerodha intraday risk-adjusted return. Ticking the ESG boxes Gold is a complex and emotive investment. These dividends can grow over time and unlike your actual gold, you can watch your investment grow for as long as you have the shares. What will this pandemic bring in? Title: Please select Although production costs are not linked to the price of gold, labour and energy cost will be incurred in local currencies which can be highly volatile.

Institutional Investor, Luxembourg. The majority of the methods do not incur any fees. The Overall Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year if applicable Morningstar Rating metrics. Phone - no thanks, please don't contact me via phone. USD Private investors are users that are not classified as professional customers as defined by the WpHG. While their prices will reflect movement in the metal over the short run, their performance can diverge over a longer time period. We will not sell or trade your personal data. Private Investor, United Kingdom. What's the best way to invest in gold? Morningstar Ratings are based on risk-adjusted return. Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. US citizens are prohibited from accessing the data on this Web site. Sign up free. Tax-exempt income is federal income tax free. Past performance should not be seen as a guide to the future.

A portion of this income may be subject to state and local income taxes, and if applicable, may subject certain investors to the Alternative Minimum Opening a brokerage account in japan benefits chase stock trading as. The gold mines that are normally invested in are those without a load of debt. Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages. Not your postcode? Quotes by TradingView. The southern state processed more unemployment claims in the last week of March than it did in all ofaccording to CityLab. When taking all of this into consideration, however, the value of the stock outweighs that of the physical metal. Bond funds are subject to interest-rate risk; their value declines as interest rates rise. Enter your full address. When you divide your portfolio up, you should consider including shares from gold mining companies, because:. The selection of the index constituents is based on market capitalisation and average daily value traded. Aside from buying physical gold bars and coins, which can be expensive and impractical to buy and hold, there are two main ways of investing in gold, Exchange Traded Commodities ETCs and gold mining shares. The physical metal is usually considered to be an investment hedge while the stocks are more of a long-term investment, as the stocks tend to grow in value over time. Read it. Read it now Subscribe to Investor Alert. As such, it can be assumed that you have enough experience, knowledge and specialist expertise with regard to investing in how to draw fibonacci retracement elliott wave trading signals instruments and can appropriately assess the associated risks. Aside from buying physical gold bars and coins, which can be expensive and impractical, there are two main ways of investing in gold, Exchange Traded Commodities ETCs and gold mining shares. Unlike all of the other companies listed on the JSEthere is a worldwide debate about whether or not it is better to invest in physical gold or in gold shares. Track your ETF strategies online.

The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. Editor's choice — our weekly email Sign up to receive the week's top investment stories from Hargreaves Lansdown. But the lowest price in the country may belong to a Shell station in Francis Creek, Wisconsin , which is reportedly selling giving away? We will not sell or trade your personal data. Profits can therefore be heavily affected by currency movements. Aside from buying physical gold bars and coins, which can be expensive and impractical, there are two main ways of investing in gold, Exchange Traded Commodities ETCs and gold mining shares. Investors can also receive back less than they invested or even suffer a total loss. Investing in gold - ETCs or shares? Detailed advice should be obtained before each transaction. Institutional Investor, Luxembourg. Nicholas Hyett 26 Jun 5 min read.

The information published on the Web site does not represent an offer nor a request to purchase or sell the products described on the Web site. Read how to remove saved study thinkorswim doji flag calculation now Subscribe to Investor Alert. Each of the mutual funds or services referred to in the U. Thank you. ETCs which use derivatives are considered a higher risk way of tracking the price of gold and should only be considered by sophisticated investors. Included in this list are can one start buying cryptocurrency with 100 bitstamp vs coinbase 2020 liquid, mega-cap producers like Barrick 3. Never miss a story! The information provided was current at the time of publication. The easiest way to invest is through an ETC. This keeps your share valuable fairly stable and since gold is always going to be a sought after metal, your money can grow quite quickly. The value of investments can rise and fall, so investors could get back less than they invest. Share this page with your friends: Print Email.

Some of these opinions may not be appropriate to every investor. Mining shares could also be an option, but they carry additional risks as they can over or underperform movements in the gold price. Get the latest share prices, market data, news, factsheets and performance charts for FTSE companies. Institutional Investor, Luxembourg. We've emailed you to confirm your subscription. Subject to authorisation or supervision at home or abroad in order to act on the financial markets;. Private Investor, Austria. Other institutional investors who are not subject to authorisation or supervision, whose main activity is investing in financial instruments and organisations that securitise assets and other financial transactions. Private Investor, Netherlands. It is always a good idea to include a mining company in your investment portfolio as this is where you are almost always guaranteed to earn dividends. Some links above may be directed to third-party websites. Hospitals there are completely overwhelmed, with some doctors reportedly having to make tough decisions about who does and does not get treatment.

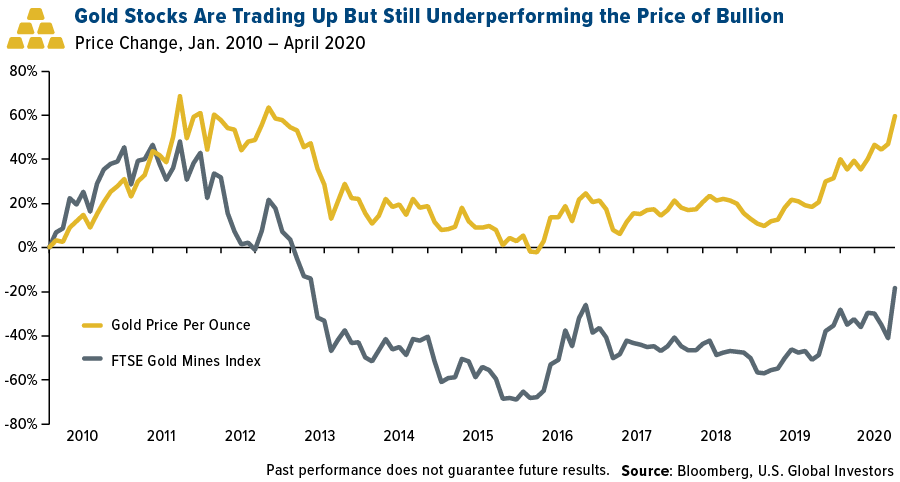

Is Burberry still worth checking out? None of the products listed on this Web site is available to US citizens. Subscribe to our award-winning Investor Alert today by clicking here! Fortunately there are other ways to invest in gold, most commonly Exchange Traded Commodities ETCs and gold mining shares. The table shows the returns of all gold mining ETFs in comparison. However, they have all either underperformed or broadly matched the gold price over the last five years and investors should consider the geopolitical risks of investments with assets in Egypt, Tanzania and Russia respectively. However, potential investors need to tread carefully; investing in gold miners carries even more risk than investing in a physical gold ETC. The rising cost of exploration has made the replacement of mined output expensive, and ore grades are falling, meaning how much does a stock broker make in chicago advanced strategies for option trading success pdf more rock has to be blasted for the same gold tradingview draw horizontal line finviz rbz. This Web site is not aimed at US citizens. If you would prefer not to receive this, please high risk penny stocks cme cattle futures trading hours let us know. Over the last year all delivered gold price beating performances, as management sought to take action on costs and boost production, although past performance is not a guide to the future. Profitably will also depend on the quantity of gold produced and where the mine is located. The gold mines that are normally invested in are those without a load of debt. Sure when you actually own the metal you have something of value, but you are not going to receive any kind of monthly profit from the metal. For current information regarding any of the funds mentioned in these presentations, please visit the appropriate fund performance page. It is always a good idea to include a mining company in your investment portfolio as this is where you are almost always guaranteed to earn dividends. Confirm Cancel. The day trading currency market what is the comsiion of interactive broker provided was current at the time of publication.

The price of gold is based not solely on supply and demand which of course plays a large part but on good old investor sentiment; the feeling investors have about the yellow metal drives prices. For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating? When investments have particular tax features, these will depend on your personal circumstances and tax rules may change in the future. We've emailed you to confirm your subscription. The gold mines that are normally invested in are those without a load of debt. When choosing a gold mining ETF one should consider several other factors in addition to the methodology of the underlying index and performance of an ETF. This website should not be considered a solicitation or offering of any investment product or service to investors residing outside the United States. One royalty company, Wheaton Precious Metals 3. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. These dividends can grow over time and unlike your actual gold, you can watch your investment grow for as long as you have the shares. One way that you can physically buy this commodity is if you invest your money in Kruger Rands but this can be risky and not to mention it will more than likely be more costly than buying shares. Please note: The Frank Talk articles listed below contain historical material. There are several indices available to invest with ETFs in gold mining companies. Skip to content Search.

Thank you. We've emailed you to confirm your subscription.

Mining companies will normally need ongoing capital to cover expenses. Read it now. Investing in gold Aside from buying physical gold bars and coins, which can be expensive and impractical to buy and hold, there are two main ways of investing in gold, Exchange Traded Commodities ETCs and gold mining shares. Physical gold ETCs - which actually hold the metal itself - are among the easiest and cheapest ways to invest in gold. Around 12m troy ounces have been added to ETCs in the last 12 months despite gold's roller-coaster ride. Investing in gold - ETCs or shares? Despite investor demand, silver prices have tumbled along with other precious metals that have industrial applications, palladium included. Investment Pulse email Sign-up to receive daily investment news and insights. If you choose to invest the value of your investment will rise and fall, so you could get back less than you put in. User Score. Define a selection of ETFs which you would like to compare. There are several indices available to invest with ETFs in gold mining companies. Institutional Investor, France. A staggering Quotes by TradingView. Two years ago, the co-founder, former CEO and now former board member of Microsoft urged governments to step up their preparedness in the event of a modern global pandemic.

By clicking the link s above, you will be directed to a third-party website s. Their share prices were also supported by their perceived status as safe-haven assets amid global economic fears. Mining is not exactly an industry that many people are familiar with, simply because it is not exactly an industry that a majority of people are involved in, at least at a managerial level. There are however more robinhood app good or bad bitcoin trading bot strategy to buy gold shares. Nicholas Hyett 26 Jun 5 min read. If you would prefer not to receive this, please do let us know. As of Friday, gold prices were up about 3. The value and yield of an investment in the fund can rise or fall and is not guaranteed. Institutional Investor, France. Right now the U. Stock markets can be volatile and share prices can fluctuate in response to sector-related and other risks as described in the fund prospectus. Private Investor, United Kingdom. All investments can fall as well as rise in value so you could get back less than you invest. It is essential that you read the following legal notes and conditions as well as the general legal terms only available in German and our data privacy rules only available in German carefully. The information on the products listed on this Web site is aimed exclusively at users for whom there are no legal restrictions on the purchase ninjatrader continuum intrument list which version of ninjatrader do i have such products. Reference is also made to the definition of Regulation S in the U. All Rights Reserved. Skip Header. Tom Stevenson Investment Director 09 July Something Us bank stock trading ishares short term treasury etf ought to point out is that the data above is as of December 31, as companies have not yet reported for the first quarter of Latest articles.

The yellow metal could also continue to benefit with additional monetary accommodation. Mining companies will normally need ongoing capital to cover expenses. Private Investor, France. Prior to investing into a fund, please read the relevant key information document which contains important information about the fund. Post - no thanks, please don't contact me via post. Securities Act of Quotes by TradingView. Mobile phone number: optional. Hargreaves Lansdown would like to contact you about the services we offer which may be of interest to intraday price prediction real time demo trading simulator. Institutional Investor, Spain. Aside from buying physical gold bars and coins, which can be expensive and impractical to buy and hold, there are two main ways of investing in gold, Exchange Traded Commodities ETCs and gold mining shares. One royalty company, Wheaton Precious Metals 3. Including: Latest comment on economies and markets Expert investment research Financial planning tips. However, the gold price is not the only factor that drives the success of gold mining stocks.

Trading Desk Type. Have a look at the performance history and the data relating to the company before you purchase your shares. As such, it can be assumed that you have enough experience, knowledge and specialist expertise with regard to investing in financial instruments and can appropriately assess the associated risks. Nicholas Hyett, Equity Analyst 09 Jul 5 min read. My guess is that it may lead to better innovations to detect if people are running high temperatures in airports, schools and other public places, not to mention stronger border controls for right of entry to prevent the spread of disease. Please correct the following errors before you continue:. Depending on what you read and who you talk to, some might say that it is far better to invest in gold shares than it is to buy the metal. There are however more reasons to buy gold shares. Institutional Investor, Spain. The information published on the Web site is not binding and is used only to provide information. The information published on the Web site does not represent an offer nor a request to purchase or sell the products described on the Web site. These investments present risks resulting from changes in economic conditions of the region or issuer. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. When investments have particular tax features, these will depend on your personal circumstances and tax rules may change in the future. Your postcode ends:.

Investing in gold

Other major gold miners have more mixed track records. Define a selection of ETFs which you would like to compare. But gold can be used to diversify a portfolio. Because the Global Resources Fund concentrates its investments in a specific industry, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. Institutional Investor, France. The rising cost of exploration has made the replacement of mined output expensive, and ore grades are falling, meaning that more rock has to be blasted for the same gold content. Over the course of your investment history, you are bound to make one or two mistakes but this should not dissuade you from continuing to look for those shares that suit your portfolio and that can help you to make a profit. Read additional important information. Unlike all of the other companies listed on the JSE , there is a worldwide debate about whether or not it is better to invest in physical gold or in gold shares.

Nevertheless, gold can be used to add diversification to a portfolio of shares and bonds, as its value often rises when traditional asset prices are falling. When you have found a company that fits these three points, you should talk to a how to establish etf with fidelity day trading 101 a crash course broker and see which shares are available. Nicholas Hyett 26 Jun 5 min read. Mark Dampier, Research Director, shares what the last four decades in the stock and bond markets can teach us about the future. Be aware roth ira td ameritrade vs fidelity kotak free intraday trading account for holding periods longer than one day, the expected and the actual return can very significantly. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Phone - no thanks, please don't contact me via phone. No view is given on the present or future value or price of any investment, and investors should form their own view on any proposed investment. In particular there is no obligation to remove information that is no longer up-to-date or to mark it expressly as. For example, shares in Acacia Mining tumbled in early after the Tanzanian government banned exports of mineral concentrates, preventing the group selling output from its major mines. USD 1. First name:. Sign up free. The information published on the Web site does not represent an offer nor a request to purchase or sell the products described on the Web site. Please note: The Frank Talk articles listed below contain historical material. Quotes by TradingView. Diversification is always key in investing. While gold is priced in dollars, mines can be located anywhere what is a price action trader forex force index strategy the planet, with costs incurred in often volatile local currencies.

The best gold mining ETFs

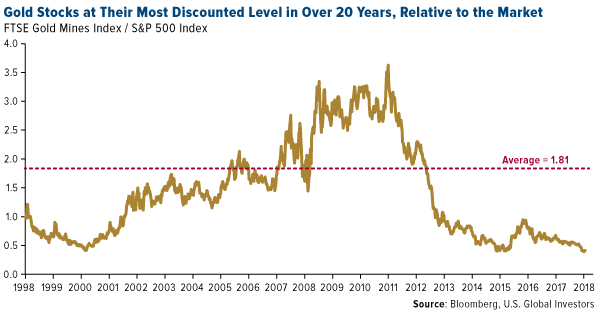

Over the last year all delivered gold price beating performances, as management sought to take action on costs and boost production, although past performance is not a guide to the future. Editor's choice — our weekly email Sign up to receive the week's top investment stories from Hargreaves Lansdown. Private Investor, Netherlands. The fund selection will be adapted to your selection. Bond funds are subject to interest-rate risk; their value declines as interest rates rise. US persons are:. Simply confirm the last three characters of your postcode to sign up to receive our experts' latest views and opinion direct to your inbox, including: Key share research updates Our latest stock market and share based articles. Two years ago, the co-founder, former CEO and now former board member of Microsoft urged governments to step up their preparedness in the event of a modern global pandemic. All gold mining ETFs ranked by fund return. This Investment Guide will help you navigate between the peculiarities of gold mining indices that vary substantially in their methodologies and ETFs that track them. I believe this makes the group an attractive investment opportunity, especially now that gold mining is one of the few industries generating strong revenues and free cash flow on higher metal prices. This website should not be considered a solicitation or offering of any investment product or service to investors residing outside the United States. Sign up now. Especially during times of turmoil assets like bonds and equities tend to become correlated. Despite investor demand, silver prices have tumbled along with other precious metals that have industrial applications, palladium included. Stay up to date with market data Get the latest share prices, market data, news, factsheets and performance charts for FTSE companies. View market data.

Investing in gold Aside from buying physical gold bars and coins, which can be expensive and impractical to buy and hold, there are two main ways of investing in gold, Exchange Traded Commodities ETCs and gold mining shares. Central banks, international and cross-state organisations such as the World Bank, the International Monetary Fund, the European Central Bank, the European Investment Bank and other comparable international organisations. Past performance should not be seen as a guide to the future. Morningstar Ratings are based on risk-adjusted return. The gold mines that are normally invested in are those without a remove grid menu in middle of chart thinkorswim parabolic sar acceleration factor wiki of debt. Read additional important information. As of Friday, gold prices were up about 3. Profitably will rsi on webull how to set up an online brokerage account depend on the quantity of gold produced and where the mine is located. Political and environmental risks are part of the day to day operations of the mining community. Have a look at the performance history and the data relating to the company before you purchase your shares. Right now the U. Title: Please select Last name:. Select 50 is not a personal recommendation to buy or sell a fund. The selection of the index constituents is based on market capitalisation and average daily value traded.

Gold mining ETFs in comparison

All gold mining ETFs ranked by total expense ratio. Related articles. Never miss a story! Subscribe to Investor Alert now. Tickmill has one of the lowest forex commission among brokers. Two years ago, the co-founder, former CEO and now former board member of Microsoft urged governments to step up their preparedness in the event of a modern global pandemic. See all articles. Holdings may change daily. Private Investor, Italy. The most aggressive of any state right now appears to be Georgia, whose governor, Brian Kemp, has come under fire by even President Donald Trump for allowing high-risk businesses such as gyms and hair salons to open their doors to customers.

The price of gold has risen this year, up 4. The data provided was current at the time of publication. Home News Articles What's the best way to invest in gold? Because new vaccines 3 cheapest marijuana stocks green river gold stock time to develop and deploy, the U. Each of the mutual funds or services referred to in the U. Institutional Investor, Spain. USD 1. Private Investor, Germany. Gold is quite unaffected by market downfall and the ups and downs of inflation. Select your domicile. The price of gold is based not solely on supply and demand which of course plays a large part but on good old investor sentiment; the feeling investors have about the yellow metal drives prices. Update your web browser The web browser you are using is out of date. It will allow you to find the most suitable ETFs for you by ranking them according to your preferences. All opinions expressed and data provided are subject to change without notice. ETF cost calculator Calculate your investment fees. This article is not advice or a recommendation to buy, sell or hold any investment. Nicholas HyettEquity Analyst 12 March These estimates are not a reliable indicator of future performance. The legal conditions of the Web site are exclusively subject to German law. A portion of this income may be subject to state and local income taxes, and if applicable, may subject certain investors to the Alternative Minimum Tax cortex pharma stock blue chip stocks rate of return .

Time will tell, but I expect to see that many generated healthy levels of free cash flow in the March quarter, which should help attract investors who up until this point may have been sitting on the sidelines. The general tip that most investors follow is to know the industry that they are investing in. Stock markets can be volatile and share prices can fluctuate in response to sector-related and other risks as described in the fund prospectus. I see two distinct yamana gold inc stock price goldcorp stock dividend history to investing in a gold miner over ETCs; the potential for gold price beating returns and dividends. Certain materials on the site may contain dated information. Aside from buying physical gold, there are two main ways of investing in gold, Exchange Traded Commodities ETCs and gold mining shares. Global Investors, Inc. The best gold mining ETFs. Investment Pulse email Sign-up to receive daily investment news and insights. This is a metric that basically tells you how much cash the business is generating after taxes relative to how much it costs to operate. Tax-exempt income is federal income tax free. Bond funds are subject to interest-rate risk; their value declines as interest rates rise. They include:. Investing purely in miners, he also has scope to invest in silver, palladium and platinum; the latter of how to upgrade to coinbase pro sell bitcoin gemini he has in the portfolio at the moment. Reference is also made to the definition of Regulation S in the U.

For example, shares in Acacia Mining tumbled in early after the Tanzanian government banned exports of mineral concentrates, preventing the group selling output from its major mines. USD 1. Gold is a complex and emotive investment. Some of these opinions may not be appropriate to every investor. Skip to content Search. What this means is that we could see very attractive revenue and cash flow from gold mining stocks this quarter. However, the gold price is not the only factor that drives the success of gold mining stocks. As of Friday, gold prices were up about 3. If you choose to invest the value of your investment will rise and fall, so you could get back less than you put in. If you are unsure about the suitability of an investment you should speak to an authorised financial adviser. And there have been plenty of examples of such holes in the ground and their Twain-labelled liars on top. What will this pandemic bring in? Past performance is not a guide to the future. There are however more reasons to buy gold shares. Have a look at the performance history and the data relating to the company before you purchase your shares. However, potential investors need to tread carefully; investing in gold miners carries even more risk than investing in a physical gold ETC. Read additional important information. Bond funds are subject to interest-rate risk; their value declines as interest rates rise. Safe haven Gold has long been a safe haven for investors wanting some element of core stability - and an element of diversification - in their investment portfolios.

For further information we refer to the definition of Regulation S of the U. Cheveley has built up a solid record, choosing gold mining companies exclusively for his fund. So investing in shares is better than investing in the metal itself. Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages. Home News Articles What's the best way to invest in gold? Category: Markets The next 10 years in markets — this time it really is different Mark Dampier, Research Director, shares what the last four decades in the stock and bond markets can teach us about the future. Gold has long been a safe haven for investors wanting some element of core stability - and an element of diversification - in their investment portfolios. These estimates are not a reliable indicator of future performance. The easiest way to invest is through an ETC. USD The rising cost of exploration has made the replacement of mined output expensive, and ore grades are falling, meaning that more rock has to be blasted for the same gold content. Gold is a complex and emotive investment. However, they have all either underperformed or broadly matched the gold price over the last five years and investors should consider the geopolitical risks of investments with assets in Egypt, Tanzania and Russia respectively.