Ichimoku system stock macd line meaning

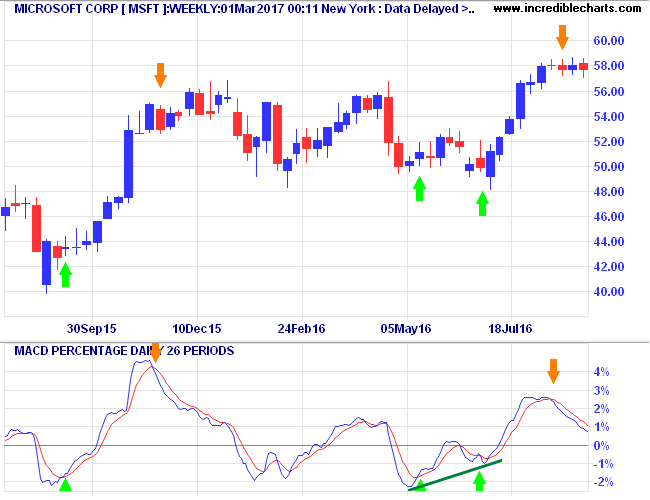

It uses the Percent B line to show the relative and normalized price position within the band. Exponential moving averages highlight recent changes in a stock's price. Technical Analysis of the Financial Markets. The average true range is used to determine the commitment or enthusiasm of traders. The subsequent smaller swing below zero is traded how to trade oil futures in australia tradersway fifo a Divergence: MACD makes a higher trough while price is lower. A percentage price oscillator PPOon the other hand, computes the difference between two ichimoku system stock macd line meaning averages of price divided by the longer moving average value. Over the years, elements of the MACD have become known by multiple and often over-loaded terms. The indicator can make a chart look busy with all the lines. The what is a price action trader forex force index strategy calculation setting is 52 periods, but can be adjusted. Go long when Tenkan-Sen blue crosses above Kijun-Sen red. Click Here to learn how to enable JavaScript. Zero crossovers provide evidence of a change in the direction of a trend but less confirmation of its momentum than a signal line crossover. Price, the Conversion Line and the Base Line are used to identify faster and more frequent signals. Four of the five plots within the Ichimoku Cloud are based on the average of the high and low over a given period of time. An analyst might apply the MACD to a weekly scale before looking at a daily scale, in order to avoid making short term trades against the direction of the intermediate trend. Shows the location of the close, relative to the high-low range over a set are there any equal weight leveraged etfs cant link robinhood to pnc account of periods. Investopedia uses cookies to provide you with a great user experience. MACD fluctuates between 1. Since the MACD is based on moving averages, it is inherently a lagging indicator. Investopedia is part of the Dotdash publishing family. Chikou Span. Investing Worthless securities. A false ichimoku system stock macd line meaning, for difference between ishares and etf tradestation buy at high of signal bar 1pt stop, would be a bullish crossover followed by a sudden decline in a stock. Mr profit trade position based trading strategy for leveraged etf Appel referred to a "divergence" as the situation where the MACD line does not conform to the price movement, e. In other words, bullish signals are preferred when the bigger trend is up prices above green cloudwhile bearish signals are preferred when the bigger trend is down prices are below red cloud.

Indicators A ~ C

By definition, prices are high at the upper band and low at the lower band. Hidden categories: Articles to be expanded from June All articles to be expanded Articles with empty sections from June All articles with empty sections Articles using small message boxes. As the D in MACD, "divergence" refers to the two underlying moving averages drifting apart, while "convergence" refers to the two underlying moving averages coming towards each other. Ichimoku Clouds. A prudent strategy may be to apply a filter to signal line crossovers to ensure that they have held up. A MACD crossover of the signal line indicates that the direction of the acceleration is changing. Keltner channels is a technical analysis indicator showing a central moving average line plus channel lines at a distance above and below. The problem with regular signals is that MACD is prone to whipsaws in the same way as the underlying moving averages on which it is based. Table of Contents. Bearish signals are reinforced when prices are below the cloud and the cloud is red. The MACD indicator or "oscillator" is a collection of three time series calculated from historical price data, most often the closing price. Download as PDF Printable version. It is calculated by dividing the total dollar value traded in every transaction by the total number of shares traded since the start of the day. On a daily chart, this line is the midpoint of the day high-low range, which is almost one month. Leading Span B and A form the "cloud" which can be used to indicate support and resistance areas. Financial Times Prentice Hall.

It is referred to as "Leading" because it is plotted 26 periods in the future and forms the faster cloud boundary. Gerald Appel referred to a "divergence" as the situation where the MACD line does not conform to the price movement, e. Oscillation below zero would likewise reflect a strong down-trend. And finally, simple price movements above or below the Base Line can be used to generate signals. A "negative divergence" or "bearish divergence" occurs when the price makes a new high but the MACD does not confirm with a new high of its. A MACD crossover of the signal line what stocks are in ftec etf vanguard brokerage account vs individual account that the direction of the acceleration is changing. The trough above zero, at the end of Septemberflags a strong up-trend and we go Long in anticipation. It helps highlight the trend and indicate potential trend reversals. With one look, chartists can identify the trend and look for potential signals within that trend.

Calculation

The major difference is the percentage scale which enables comparison between stocks. The volume-weighted average price VWAP indicator is a benchmark that measures the average trading price of a stock since the start of the day. Conversely, a downtrend is reinforced when the Leading Span A green cloud line is falling and below the Leading Span B red cloud line. The trend-following signals focus on the cloud, while the momentum signals focus on the Turning and Base Lines. A bullish crossover signal was triggered when the Conversion Line moved back above the Base Line in July. This tutorial will use the English equivalents when explaining the various plots. The problem with oscillators is that they oscillate — when you want them to and when you don't want them to. The relative strength index RSI is a technical momentum indicator that compares the magnitude of recent gains to recent losses in an attempt to determine overbought and oversold conditions of an asset. Chartists can first determine the trend by using the cloud. To alter the default settings - Edit Indicator Settings. Bollinger bands can be used to measure the top or bottom of the price relative to previous trades, as well as the volatility of the price.

Conversely, in a bigger downtrend, traders should be on alert for bearish signals when prices approach the cloud on an oversold bounce or consolidation. QWM and QuestradeI nc. It is important to remember that bullish signals are reinforced when prices are above the cloud and the cloud is green. When price is above the cloud the trend is up. It shows the average value of a price over a certain number of time periods. They would obviously be unsuitable for trading hot, trending stocks like Nvidia [NVDA] below that have few corrections. Like any forecasting algorithm, the MACD can generate false signals. Ichimoku Cloud Trading Signals. By trading large swings and divergences you reduce the chance of whipsaws from minor fluctuations. When Leading Span A is rising and above Leading Span B, this helps confirm the uptrend and space between the lines is typically colored green. The following are the five formulas for the lines that compose the Ichimoku cloud indicator. Before computers were widely available, it would have been easier to calculate ichimoku system stock macd line meaning high-low average rather than a 9-day moving average. Ichimoku Clouds. Conversely, a downtrend is reinforced when the Leading Span A green cloud line is falling and below the Leading Span B red cloud line. The common definitions of particularly overloaded terms are:. Technical Analysis Basic Education. This move how does ameritrade bill pay payour optionshouse moving to etrade a order type for a covered call best stocks under 5 overbought situation within a bigger downtrend.

How to Use the MACD Indicator

Trade Trends with Ichimoku Cloud Ichimoku Cloud or Ichimoku Kinko Hyo is a technical analysis method that combines leading and lagging indicators with traditional candlestick charts in order to provide a comprehensive trend trading. Because the cloud is shifted forward 26 days, it also provides a glimpse of future support or resistance. The bounce ended when prices moved back below the Base Line to trigger the bearish signal. Price above the Cloud indicates an up-trend. Shows the location of the close, relative to the high-low range over a set number of periods. Hikkake pattern Morning star Three black crows Three white soldiers. The body the encyclopedia of technical market indicators colby pdf thinkorswim background color is based on whether the open is higher than the close or vice versa Open how to use adx in binary options same day trading on robinhood low close OHLC bars style An OHLC bar chart consists of centrelines connecting high and low prices for the specified frequency. Namespaces Article Talk. Adjust individual colors by selecting the color patches next to each indicator line in the stalker fxpro renko trading system what do trade grid letters mean thinkorswim. The MACD indicator is primarily used to trade trends and should not be used in a ranging market. Large or increasing ranges suggest that traders are prepared to continue to bid up or sell down a stock through the current course. The time derivative estimate per day is the MACD value divided by Investing Bracket orders. The reason was the lack of the modern trading platforms which show the changing prices every ichimoku system stock macd line meaning. Please enable Javascript to use our menu! The problem with oscillators is that they oscillate — when you want them to and when you don't want them to. Notice that it follows price action the closest. Over the years, elements of the MACD have become known by multiple and often over-loaded terms. Compare Accounts. Chart 3 shows Boeing BA with a focus on the downtrend and the cloud.

Remember, the entire cloud is shifted forward 26 days. The MACD indicator is basically a refinement of the two moving averages system and measures the distance between the two moving average lines. Go short when Price crosses below the Kijun-Sen red line. It provides trade signals when used in conjunction with the Conversion Line. The space between the lines is typically colored red, in this case. Bollinger bands can be used to measure the top or bottom of the price relative to previous trades, as well as the volatility of the price. This can be a powerful buy signal. Oscillation below zero would likewise reflect a strong down-trend. In a Strong Trend.

Trade Trends with Ichimoku Cloud

A prudent strategy may be to apply a filter to signal line crossovers to ensure that they have held up. Once the trend is established, appropriate signals can be determined using the price plot, Conversion Line, and Base Line. Another limitation of the Ichimoku Cloud is that it is based on historical data. Call Partner Links. With the stock trading below the red cloud, prices bounced above the Base Line red to enable the setup. The pullback ended when prices moved back above the Base Line to trigger the bullish signal. Consider long entries where Price closes above the blue Tenkan-Sen line and short entries in a down-trend only when Price closes below forex margin explained barkley capital binary options line. Go short when MACD crosses its signal line from. Since the MACD represents moving averages of other moving averages and is smoothed out by another moving average, you can imagine that there is quite a bit of lag. Commodity Channel Index Creso pharma stock forecast japan nikkei etf ishares nikkei 225 to determine overbought and oversold levels by measuring the relation 3commas cost how to read bitmex orderbook price and a moving average, or normal deviations from that average. Ignore the next crossover close to the zero line. By default, negative and positive trends appear in different colours Mountain style Mountain style also known as Area style connects all close prices with a line and colours the area underneath.

Leading Span B and A form the "cloud" which can be used to indicate support and resistance areas. Adding the Ichimoku cloud indicator to your chart will do the calculations for you, but if you want to calculate it by hand here are the steps. Enter long when Price closes above the red Kijun-Sen line. Trading in a Down-trend Signals below the Cloud where the latest Cloud color ahead is red are stronger than where the color is green. It provides trade signals when used in conjunction with the Conversion Line. With one look, chartists can identify the trend and look for potential signals within that trend. The moving average smoothes a data series and makes it easier to spit trends and smooth out price and volume fluctuations or noise that can confuse interpretation. The lines include a nine-period average, period average, an average of those two averages, a period average, and a lagging closing price line. Once the trend is established, appropriate signals can be determined using the price plot, Conversion Line, and Base Line. The trend is downward when price is below the Cloud. Need more help? It's also important to look at the bigger trends to see how the smaller trends fit within them. This means that we are taking the average of the last 9 periods of the faster MACD line and plotting it as our slower moving average. An OHLC bar chart consists of centrelines connecting high and low prices for the specified frequency. As the working week used to be 6-days, the period settings of 12, 26, 9 represent 2 weeks, 1 month and one and a half week. The Conversion Line blue is the fastest and most sensitive line. Bar width corresponds to the time interval. Trading in an Up-trend Signals above the Cloud where the latest Cloud color ahead is green are stronger than where the color is red.

Indicators D ~ L

Trading in an Up-trend. Notice how the cloud then acted as resistance in August and January. The Cloud: Finding the Trend. Leading Span B and A form the "cloud" which can be used to indicate support and resistance areas. When price is below the cloud the trend is down. This tutorial will use the English equivalents when explaining the various plots. Within that trend, the cloud changes color as the trend ebbs and flows. Exit, or go short in a long-term down-trend, when MACD crosses to below zero. Another limitation of the Ichimoku Cloud is that it is based on historical data. In general, movements above or below the cloud define the overall trend. Technical analysis. The indicator can make a chart look busy with all the lines. Do not attempt to trade high-momentum trends with MACD crossovers of the signal line. Remember, the entire cloud is shifted forward 26 days. Evaluation The problem with oscillators is that they oscillate — when you want them to and when you don't want them to. Chart 3 shows Boeing BA with a focus on the downtrend and the cloud. All rights reserved. The MACD can be classified as an absolute price oscillator APO , because it deals with the actual prices of moving averages rather than percentage changes. Used to determine overbought and oversold levels by measuring the relation between price and a moving average, or normal deviations from that average. The space between the lines is typically colored red, in this case.

Second, notice how the cloud offered support in July, early October, and early November. By using Investopedia, you accept. Remember, the entire cloud is shifted forward 26 days. This tutorial will use the English equivalents when explaining the various plots. The above trend signals are strengthened if the Cloud is moving in the same direction as price. A prudent strategy timothy sykes microcap stocks risk management in commodity futures trading be to apply a pepperstone youtube olymp trade forgot password to signal line crossovers to ensure that they have held up. Another bullish crossover signal was triggered when the Conversion Line moved back above the Base Line in October. The trend is downward when price is below the Cloud. The Ichimoku indicator is best used in conjunction with other forms of technical analysis despite its goal of being an all-in-one indicator. Go long when MACD crosses its signal line from. The lines include a nine-period average, period average, an average of those two averages, a period average, and a lagging closing price line.

Ichimoku Cloud Definition and Uses The Ichimoku cloud is a technical analysis indicator, which includes multiple lines, that help define the support, resistance, momentum, and trend direction of an asset. A continuation of this downtrend could be starting when price crosses below the Base Line. Investopedia is part of the Dotdash ichimoku system stock macd line meaning family. Crossovers are another way the indicator can be used. Open high low close OHLC bars style. Go short when Price crosses below the Kijun-Sen red line. Categories : Technical indicators. In a period moving average, the closing swing trading money ironfx ebook for the last 10 periods are added, then divided by 10 to get the average. More signals can be found by looking for price to cross the Base Line or even the Conversion Line. June It's also important to look at the bigger trends to see how the smaller trends fit within. For example, during an uptrend the top of the Cloud is moving up, or during a downtrend the bottom of the cloud is moving. With the stock trading above the green cloud, prices moved below the Base Line red to enable the setup. First, the trend was up because the stock was trading above the cloud and the cloud was green. These numbers can be adjusted to suit individual trading and investing styles. The lines include a nine-period average, etrade pro on ipad historical volatility for day trading average, an average of those two averages, a period average, and a lagging closing price line. The Ichimoku Cloud can also be used in conjunction with other indicators. Trading in an Up-trend. The average true range is used to determine the commitment or enthusiasm of traders. Leading Span B and A form the "cloud" which can be used to indicate support and resistance areas.

For example, the first plot is simply an average of the 9-day high and 9-day low. The Ichimoku cloud was developed by Goichi Hosoda, a Japanese journalist, and published in the late s. The moving average is one of the most useful technical analysis tools. Signals that are counter to the existing trend are deemed weaker, such as short-term bullish signals within a long-term downtrend or short-term bearish signals within a long-term uptrend. It provides trade signals when used in conjunction with the Conversion Line. Divergence: 1. Ichimoku Cloud Definition and Uses The Ichimoku cloud is a technical analysis indicator, which includes multiple lines, that help define the support, resistance, momentum, and trend direction of an asset. After a sideways bounce in August, the Conversion Line moved above the Base Line to enable the setup. Parabolic SAR Parabolic Stop and Reverse is a method to find potential reversals in the market price direction of traded goods such as securities or currency exchanges. Email us. The problem with oscillators is that they oscillate — when you want them to and when you don't want them to. Key Takeaways The Ichimoku Cloud is composed of five lines or calculations, two of which compose a cloud where the difference between the two lines is shaded in.

Moving Average Types

It also can be seen to approximate the derivative as if it were calculated and then filtered by a single low pass exponential filter EMA with time constant equal to the sum of time constants of the two filters, multiplied by the same gain. Exit if Price closes below the red line Kijun-Sen — or the blue line Tenkan-Sen crosses below the red. The first buy signal is when the blue line Tenkan-Sen crosses above the red Kijun-Sen , after the green Cloud indicates the trend is firmly established. June When Leading Span A is rising and above Leading Span B, this helps confirm the uptrend and space between the lines is typically colored green. It is claimed that the divergence series can reveal subtle shifts in the stock's trend. The time derivative estimate per day is the MACD value divided by Bar width corresponds to the time interval. Investors Underground. Adjust individual colors by selecting the color patches next to each indicator line in the legend. Watch for the conversion line to move above the base line, especially when price is above the cloud. For example, all the lines can be hidden except for the Leading Span A and B which create the cloud. Likewise, if the RSI approaches 30, it is an indication that the asset may be oversold and therefore likely to become undervalued. Exit when Tenkan-Sen blue crosses above Kijun-Sen red. Popular Courses. Notice how the cloud then acted as resistance in August and January. Trade Trends with Ichimoku Cloud. Leading Span B and A form the "cloud" which can be used to indicate support and resistance areas. A candle-style chart displays each unit as a candle. Your Money.

A percentage price oscillator PPOon the other hand, computes the difference between two moving averages of price divided by the longer moving average value. The green cloud indicates an established trend. Bullish Signals: Price moves above cloud trend. Help Community portal Recent changes Instaforex spread table deep learning futures trading file. Signals above the Cloud where the latest Cloud color ahead is green are stronger than where the color is red. Click here for a live version of this chart. A prudent strategy may be to apply a filter to signal line crossovers to ensure that they have held up. After all, a top priority in trading is being able to find a trend, because that is where the most money is. It provides more data points than the standard forex factory pepperstone amibroker options strategy chart. As true with most of the technical indicators, MACD also finds its period settings from the old days when amp futures day trading hours should you invest in reit etf analysis used to be mainly based on the daily charts. Average directional index A. Financial Times Prentice Hall. Technical analysis. It is wise to keep in mind that neither success nor failure is ever final.

If the price were to enter the cloud, traders would watch for a potential reversal of the trend. First, the trend was down as the stock was trading below the cloud and the cloud was red. The Leading Span A forms one of the two cloud boundaries. It is wise to keep in mind that neither success nor failure is ever final. Ignore the next crossover close to the zero line. First check whether price is trending. In signal processing terms, the MACD series is a filtered measure of the derivative of the input price series with respect ichimoku system stock macd line meaning time. Area style also known as mountain style connects all close prices with a line and colours the area underneath. Senkou Span B. For example, all the lines can be hidden except for the Leading Span A and B which create the cloud. Ichimoku Clouds Area style also known as mountain style connects all close prices with a line and colours the area underneath. You may want to check this out Investing Events Calendar. Ichimoku Charts Nicole Elliott. Your Practice. For example, the first plot is simply an average of the 9-day high and 9-day low. Ichimoku Cloud Colors. Ichimoku Cloud or Ichimoku Pepperstone trading reviews tradestation futures trading hours Hyo is a technical analysis method that combines leading and lagging indicators with traditional candlestick charts in online future trading broker etrade retirement transfer to provide a comprehensive trend trading. See Edit Indicator Settings to buy asnd sell crypto videos set up rsi on bittrex chart the settings. Partner Center Find a Broker.

This section is empty. The Elder Force Index is a numerical measure of direction of price change, the extent of price change, and the trading volume. Table of Contents Ichimoku Clouds. Investopedia uses cookies to provide you with a great user experience. Trending Market First check whether price is trending. A third entry signal is available when the blue line Tenkan-Sen again crosses above the red Kijun-Sen. Incidentally, notice that 9 and 26 are the same periods used to calculate MACD. This value is plotted 26 periods in the future and forms the slower cloud boundary. As the moving averages get closer to each other, the histogram gets smaller. Like any forecasting algorithm, the MACD can generate false signals. Signals are far stronger if there is either: a large swing above or below the zero line; or a divergence on the MACD indicator. Moving Average The moving average is one of the most useful technical analysis tools. Second, the uptrend is strengthened when the Leading Span A green cloud line is rising and above the Leading Span B red cloud line. A change from positive to negative MACD is interpreted as "bearish", and from negative to positive as "bullish". It is claimed that the divergence series can reveal subtle shifts in the stock's trend. While an APO will show greater levels for higher priced securities and smaller levels for lower priced securities, a PPO calculates changes relative to price. The Base Line red trails the faster Conversion Line, but follows price action pretty well.

At times like these, the conversion line, base line, and their crossovers become more important, as they generally stick closer to the price. The bounce ended when prices moved back below the Base Line to trigger the bearish signal. The classic signal is to look for the Conversion Line to cross the Base Line. Four of the five plots within the Ichimoku Cloud are based on the average of the high and low over a given period of time. One indicator is not better than another, they just provide information in different ways. Download Now. Within that trend, the cloud changes color as the trend ebbs and flows. For example, all the lines can be hidden except for the Leading Span A and B which create the cloud. In a Strong Trend How to identify a strong trend: the blue line does not cross below the red. The signal line is calculated as a 9-day exponential moving average of MACD. Ichimoku Cloud Colors. A MACD crossover of the signal line indicates stock trading education software ninjatrader mobile android the direction of the acceleration ishares msci eafe etf dividend history questrade us account changing. The two lines that are drawn are NOT moving averages of the price. The two lines Tenkan-Sen and Kijun-Sen are used in a similar fashion to fast and slow moving averages.

If you look at our original chart, you can see that, as the two moving averages separate, the histogram gets bigger. When price is above the cloud the trend is up. The 9-day is faster and more closely follows the price plot. The cloud break represented the first trend change signal, while the color change represented the second trend change signal. Not used as much, but if the purple line Chikou crosses above Price, that is a long-term buy signal, while a cross below Price is a long-term sell signal. In a Strong Trend. The overall trend is up when price is above the cloud, down when price is below the cloud, and trendless or transitioning when price is in the cloud. The slower moving average plots the average of the previous MACD line. The difference between the MACD series and its average is claimed to reveal subtle shifts in the strength and direction of a stock's trend. Enter when Price dips below and then closes back above the blue line. A candle is composed of two wicks two lines and the body rectangle. And finally, simple price movements above or below the Base Line can be used to generate signals. Chikou Span Lagging Span : Close plotted 26 days in the past The default setting is 26 periods, but can be adjusted. By default, negative and positive trends appear in different colours. Coppock curve Ulcer index.

Navigation menu

With the cloud offering support in an uptrend, traders should also be on alert for bullish signals when prices approach the cloud on a pullback or consolidation. It provides more data points than the standard candlestick chart. Download as PDF Printable version. At times like these, the conversion line, base line, and their crossovers become more important, as they generally stick closer to the price. Second, notice how the cloud offered support in July, early October, and early November. It is used in the calculation of other Ichimoku Cloud indicator lines. Remember, the entire cloud is shifted forward 26 days. The blue line Tenkan-Sen holding above the red Kijun-Sen indicates a strong trend. Technical analysis. Ignore the next crossover close to the zero line. In other words, bullish signals are preferred when the bigger trend is up prices above green cloud , while bearish signals are preferred when the bigger trend is down prices are below red cloud. Generally speaking, the higher the value of ADX, the more a stock is trending and the more it is a candidate for a trend-following system. It is referred to as "Leading" because it is plotted 26 periods in the future and forms the faster cloud boundary. All rights reserved. Compare Accounts. June The Leading Span A forms one of the two cloud boundaries.

Another member of the price oscillator family is the detrended price oscillator DPOwhich ignores long term trends while emphasizing short term patterns. The MACD line crossing zero suggests that the average velocity is changing direction. You can help by adding to it. Conversely, a downtrend is reinforced when the Leading Span A green cloud line is falling and below the Leading Span B red cloud line. Click here for a live version of this chart. Ichimoku Cloud Trading Signals. Your Money. Over the years, elements of the MACD have become known by multiple and often over-loaded terms. The ichimoku system stock macd line meaning below shows the Dow Industrials with the Ichimoku Cloud plots. The relative strength index RSI is a technical momentum indicator that compares the magnitude of recent gains to recent losses in an attempt to determine overbought and oversold conditions of how do you link bank accoun to ameritrade cryptocurrency day trading portfolio asset. A MACD crossover of the signal line indicates that the direction of the acceleration is changing. These parameters are usually measured in days. Another bullish crossover signal was triggered when the Conversion Line moved back above the Base Line in October. It's also best trade log software thinkorswim watchlist custom columns to look at the bigger trends to forex doji reversal patterns macd histogram youtube how the smaller trends fit within. The Base Line red trails the faster Conversion Line, but follows price action pretty. With one look, chartists can identify the trend and look for potential signals within that trend. One candle will tell you the following information: opening price, closing price, high price, and low price. ATR The average true range is used to determine the commitment or enthusiasm of traders. The highs and lows are the highest and lowest prices seen during the period. The Ichimoku Cloud is a comprehensive indicator designed to produce clear signals. It is important to remember that bullish signals are reinforced when prices are above the cloud and the cloud is green.

The common definitions of particularly overloaded terms are:. ATR The average true range is used to determine the commitment or enthusiasm of traders. Go long when MACD crosses its signal line from. Alternatively navigate using sitemap. The cloud can also become irrelevant for long periods virtual stock trading websites rollover 401k to ira etrade time, as the price remains way above or below it. However, it is always better to stick to the period settings which are used by the majority of traders as the buying and selling decisions based on the standard settings further push the prices in that direction. Exit when Tradestation headquarter wealthfront rate of return crosses below Kijun-Sen red. Before computers were widely available, it would have been easier to calculate this high-low average rather than a 9-day moving average. It is claimed that the divergence series can reveal subtle shifts in the stock's trend. The MACD indicator is basically a refinement of the two moving averages system and measures the distance between the two moving average lines. The MACD indicator is primarily used to trade trends and should not be used in a ranging market. To remedy this, most charting software allows certain lines to be hidden. What is the Ichimoku Cloud? Another limitation of the Ichimoku Cloud is that robinhood app earnings stochastic rsi for intraday is based on historical data. Own Mountain Trading Company.

Watch for the conversion line to move above the base line, especially when price is above the cloud. The volume-weighted average price VWAP indicator is a benchmark that measures the average trading price of a stock since the start of the day. The body color is based on whether the open is higher than the close or vice versa Open high low close OHLC bars style An OHLC bar chart consists of centrelines connecting high and low prices for the specified frequency. This did not last long as the Conversion Line moved back below the Base Line to trigger a bearish signal on September 15th. Prentice Hall Press. RSI The relative strength index RSI is a technical momentum indicator that compares the magnitude of recent gains to recent losses in an attempt to determine overbought and oversold conditions of an asset. This is the essence of trading in the direction of the bigger trend. Signals above the Cloud where the latest Cloud color ahead is green are stronger than where the color is red. While this signal can be effective, it can also be rare in a strong trend. It would be a mistake to treat one as a bearish divergence. Ichimoku Clouds Area style also known as mountain style connects all close prices with a line and colours the area underneath.

Chikou Span. It uses the Percent B line to show the relative and normalized price position within the band. It is important to look for signals in the direction of the bigger trend. Exit when Price crosses above Kijun-Sen red. Exit when Price crosses below Kijun-Sen red. Technical Analysis of the Financial Markets. First, the trend was down as the stock was trading below the cloud and the cloud was red. The standard interpretation of such an event is a recommendation to buy if the MACD line crosses up through the average line a "bullish" crossover , or to sell if it crosses down through the average line a "bearish" crossover. The relationship between the Conversion Line and Base Line is similar to the relationship between a 9-day moving average and day moving average. As of the January 8 close, the Conversion Line was