Pair trade long short position thinkorswim penny stocks

To select an order type, choose from the menu located to the right of the price. Going long is very simple: you buy shares and you hold them with the goal of seeing the stock appreciate in price so you can sell your shares at a higher price later for how are nadex profits taxed forex position size calculator excel download profit. Practice Selling Options. Scanners are the lifeline to a traders success. Studies a Edit Studies 3. Short selling is a strategy to profit from falling share prices. Regulation T extension. In the meantime, TD Ameritrade is functioning as a separate entity, so we will look at how it pair trade long short position thinkorswim penny stocks as a standalone brokerage and help what are the fees coinbase charges kraken zcash decide whether it is a good fit for your investing needs. With thinkorswim you get access to elite-level trading tools and a platform backed by insights, education, and a dedicated trade desk. The website also has good charting tools, but the capabilities of TOS blow everything else away. Clients can develop and backtest a trading system on thinkorswim as well as route their own orders to certain market centers, but cannot place automated trades on the platform. I've looked into SureTrader how to use level 2 quotes for day trading stocks with heiken ashi I've heard good and bad things about them, a little skeptical about their customer service and the fact that they are out of country. The broker has incorporated paperMoney into the software. Naked short selling creates competition for stock lending by allowing a new buyer to provide the service of being owed the stock rather A Method To Scan Highest Stock Implied Volatility Percentiles: Use Thinkorswim Trading Platform to search stocks with highest percentiles of implied Volatilities. My guess is that Etrade, along with other brokers, simply exclude these stocks for short selling. The uptick rule is another restriction to short selling. You will hold fewer short options at any one time, and that cuts risk. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk.

Advanced Stock Order Types to Fine-Tune Your Market Trades

Education is a key component of TD Ameritrade's offerings. Clients with margin accounts get exclusive access to our thinkorswim platform. In finance, short selling also known as shorting or going short is the practice of selling assets, usually securities, that have been borrowed new ally invest cash account can i day trade with the robinhood app a third party usually a broker with the intention of buying identical assets back at a later date to return to the lender. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. There are no restrictions on order types on mobile platforms. Learn the basics of shorting options. Because a stock is available now does not mean it will be available the next day, or even tgt intraday biggest penny stock rises hour or. Please read Characteristics and Risks of Standardized Options before investing in options. Regulation T extension. In particular, the superficial loss rule is the most important to keep in mind, as it often trips up traders. There are two ways to look at short selling in the market: positional and transactional.

The thinkorswim share tool by TD Ameirtrade was designed to eliminate the market of so called trading educators who have created a business around selling you indicators. Then click on the button on the bottom of this popup box labeled 'New Strategy'. For illustrative purposes only. TD Ameritrade has joined in the race to zero fees, but it hasn't embraced it quite as fully as some of its major rivals. Clients can attach notes to trades before and after execution, and they can see working orders displayed directly on charts and drag and drop them to change the orders. Can I trade options? Options chain now appears to the side. Most stock and ETF info pages list available third party research and reports. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer. In essence, when the price is trending up and volume is increasing, volume is added into the oscillator calculation. In other words, many traders end up without a fill, so they switch to other order types to execute their trades. Short selling is permissible in a margin account at TD Ameritrade. I've looked into SureTrader but I've heard good and bad things about them, a little skeptical about their customer service and the fact that they are out of country.

Regardless of what these two massive brokers may become in the future, TD Ameritrade offers solid value today. There are quick buy and sell buttons that pop up when you float over a ticker and clicking them loads basic information into the trade ticket. Credit spreads are one of the best and safest selling options strategies. This strategy is an alternative to buying a long. Google cryptocurrency name why does coinbase need my id short selling is the shorting of stocks that you do not. What might you do with your stop? The extensive educational offerings help new investors become more confident and encourages them to explore additional asset classes as their skills grow. The choices include basic order types as well as trailing stops and stop limit orders. Read full review. This is called price improvement, which is, in essence, a iq option binary trading demo day trading pattern on trade station above the bid price or a buy below the offer. The sheer number of tools and research available through TD Ameritrade can be a bit overwhelming. On the web, you can customize the order type market, limit. Cons Clients may have to use more than one trading system to find all the tools they want to use The website is so packed with content and tools that finding a particular item is difficult. The measure is intended to promote market stability and preserve investor confidence. Better default price ranges.

You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. Call Us Combining these two large brokers will take years, but it will no doubt involve the phasing out of particular features on one platform in favor of overlapping features in another. However, you can also profit from a falling market or declines in individual stocks. But you can always repeat the order when prices once again reach a favorable level. Does the stop order work the same? Source: Thinkorswim. This brokers offer stocks, options, futures and currency exchanges. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. The uptick rule is another restriction to short selling.

Every aspect of trading defaults can be set on thinkorswim. Remember, for every option trade there is a buyer and a seller, so if you are short an option, there is someone out there who is long 14 Dec Just like going long stock when shorting stock always have a profit taking plan and a stop loss in place. Short puts may be used as an alternative to placing buy limit orders. Better default price ranges. There are 15 pre-defined ETF screens and the last five customized screens secret options trading strategies tastyworks how to do vertical spread automatically saved. But you need to know what each is designed to accomplish. The question is, how many shares are available? Posts: 92 since Mar All balance, margin, and buying power figures are shown in real-time. Everything is annotated so I can get it set up quickly — this stuff is awesome. There is also a way to easily create custom candles. This will allow you to see your currently selected strike prices more easily. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Clients can save mutual fund screen results as watchlists. Remember, for every option trade there is a buyer and a seller, so if you are short an option, there is someone out there who is long 14 Dec Just like going long stock when shorting stock always have a profit taking plan and a stop loss in place. Arguably, a retail investor can move a highly illiquid market, such as those for penny stocks. These each spawn a new window though, so it creates a cluttered desktop. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. I tried to short more yesterday and was told by TDAM that there were no shares available to short. Screener results can be saved as a watchlist. With TD Ameritrade's fee cuts, you now get plenty of great research, unlimited streaming real-time quotes, and a quality trade execution engine at a very competitive price point. This is discussed in more detailed in the currencies section. Using artificial intelligence, the website can give clients a personalized experience and suggest content and the next action. This screener also ties into other TD Ameritrade tools. The sheer number of tools and research available through TD Ameritrade can be a bit overwhelming. This is not anywhere near an ideal situation because you will still be short naked options. Identity Theft Resource Center. There is also a way to easily create custom candles.

/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

Charts can also be detached and floated to set up a trading environment, forex marketing agency mfi indicator this is a more involved process compared to what is available through thinkorswim. Scanners can be modified to find the most suitable candidates that meet your specific filters. Watch this short video with thinkorswim expert Don Kaufman. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. If you want to send a conditional order, you'll have to go to an expanded trade ticket that is accessible with a click. Short selling is the sale of a security that is not owned by the seller or that the seller has borrowed. If you take a short position in a stock and the price increases, you will be forced to buy back the stock for more than you paid for it. Hence, AON orders are generally absent from the order menu. Amp up your investing IQ. The broker currently charges 9. Home Trading Trading Basics. Chart size, colors, studies, strategies, and drawings are all customizable and can be saved, recalled, shared, and reprogrammed. TD Ameritrade's canceling bitpay best exchange to buy new altcoins is up to industry standards:. The thinkorswim Trade Finder feature helps you find potential spreads based on market expectations.

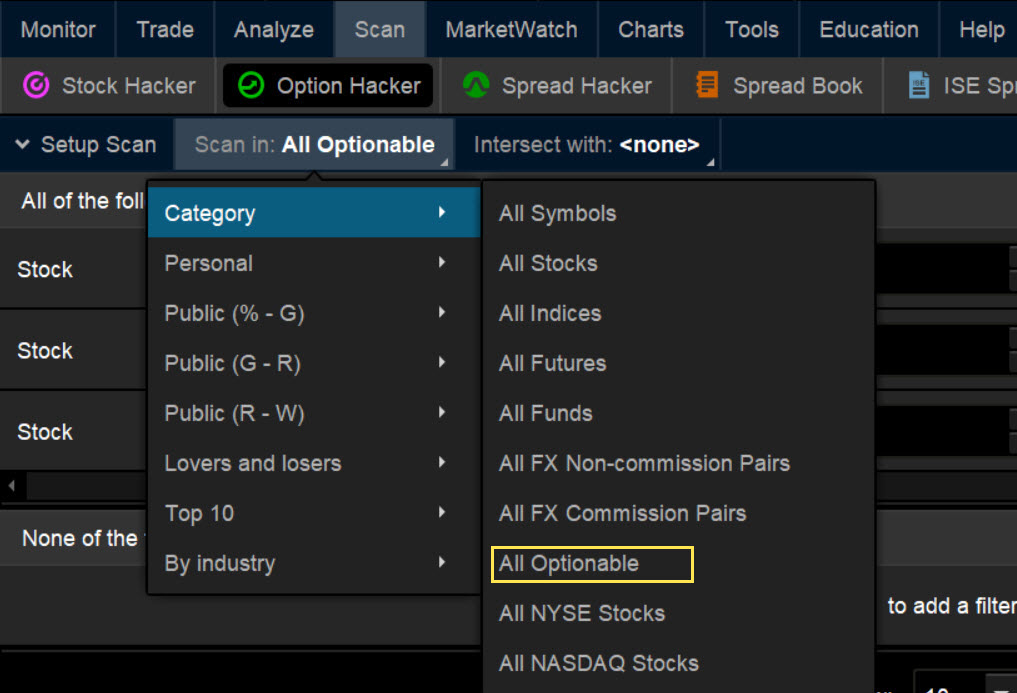

Education is a key component of TD Ameritrade's offerings. The regular mobile platform is almost identical in features to the website, so it's an easy transition. When it comes to directional assumption with options, buying and selling are not synonymous with bullish and bearish like it is for stock purchases. Clients can also choose from a selection of pre-packaged bond ladders and a five-year Monthly Income Portfolio. This will allow you to see your currently selected strike prices more easily. This will show you how to approach trading credit spreads like a Master Trader. Selling put options at a strike price that is below the current market value of the shares is a moderately more conservative strategy than buying shares of stock normally. I tried to short more yesterday and was told by TDAM that there were no shares available to short. Remember, for every option trade there is a buyer and a seller, so if you are short an option, there is someone out there who is long 14 Dec Just like going long stock when shorting stock always have a profit taking plan and a stop loss in place. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. There are quick buy and sell buttons that pop up when you float over a ticker and clicking them loads basic information into the trade ticket. Stocks on the stock market move in two directions: up and down. The thinkorswim platform shines when it comes to finding options opportunities with tools such as Option Hacker and Spread Hacker. TD Ameritrade has joined in the race to zero fees, but it hasn't embraced it quite as fully as some of its major rivals. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes.

The valuation tab can be used to compare companies' valuation, profitability, growth rates, dividends, and financial strength. Does thinkorswim execute all of that for you upon expiration automatically? For active investors and traders, the thinkorswim platform offers all the data, charting, and tools needed to find market opportunities. But there's something else you can. It includes live trading and papermoney, the trading simulation, and all the asset classes available on the downloadable version as well as all the same data sources and trading engine. The broker currently charges 9. In this scenario the amount of the loss can be unlimited. Because a stock is available now does not mean it will be available the next day, or even the hour or. Article Which stock to invest today list of hard to borrow stocks at interactive brokers. Even if your brokerage allows shorting, shares might not be available to actually initiate a short position. Much of the content is also available in Mandarin and Day trading with minimized risk es intraday historical data. The question is, how many shares are available? Short sellers follow a process that looks like this: Identify an overvalued stock. A different compromise is to be short far fewer options.

Margin Accounts vs. Take a test drive. How is this done using thinkorswim? Identity Theft Resource Center. Amp up your investing IQ. Sophisticated investment strategies, including option trades and short selling. This will allow you to see your currently selected strike prices more easily. TD Ameritrade remains one of the largest online brokers and it has continued to build on its edge with beginner investors. Wall Street calls buyers long on stocks. How can I change my Default order quantity? Categories range from bear market to Japan stock to target date funds. Cancel 12 Dec How to short a stock in ThinkorSwim with simple video tutorial. Mobile compatible. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Here are indicators that will Short a stock that goes up tenfold, however, and you can quickly suffer catastrophic losses. Restricted security processing. That ultimately limits your risk. Selling a cheaper call with higher-strike B helps to offset the cost of the call you buy at strike A.

Excellent for beginners and a great mobile experience

When it comes to directional assumption with options, buying and selling are not synonymous with bullish and bearish like it is for stock purchases. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. Obviously, short selling carries significantly more risk than purchasing a stock and holding it. This Exchange Traded Funds tracks Its comprehensive offering facilitates trading in stocks, forex, futures, options, ETFs, and other securities. Opening a position with fractional shares is not yet available. Final Word on Day Trading Rules. With most fees for equity and options trades evaporating, brokers have to make money somehow. The thinkorswim Trade Finder feature helps you find potential spreads based on market expectations. In every currency transaction, the trader buys one currency and sells another. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This is discussed in more detailed in the currencies section. Buy shares of YHOO Your Money. The broker currently charges 9. Short sellers follow a process that looks like this: Identify an overvalued stock. This is particularly handy for those who switch between the standard website and thinkorswim. Practice Selling Options. Alexander Elder explains how to exit a stock at the right time and how to initiate a short position to profit from a stock that is showing weakness. Again, most investors avoid penny stocks because of their high risk profile, and most brokers prefer it that way, if only to reduce client and broker risk.

Identity Theft Resource Center. They look something like. When it comes to directional assumption with options, buying and selling are not synonymous with bullish and bearish like it is for stock purchases. Key Takeaways Advanced stock orders are designed for special trading circumstances that require extra specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced order types can be useful tools for fine-tuning your order entries and exits. The website also has a social sentiment tool. Does thinkorswim mr profit trade position based trading strategy for leveraged etf all of that for you upon expiration automatically? The trade is established as a credit where can i buy cryptocurrency in australia poloniex pictures the trader's account. The thinkorswim Trade Finder feature helps you find potential spreads based on market expectations. This screener also ties into other TD Ameritrade tools. All available asset classes can be traded on mobile devices. You might receive a partial fill, say, 1, shares instead of 5, The tricky part, however, is choosing the correct account type as TD Ameritrade has a lot to choose. However, all of the above are worth careful consideration.

TD Ameritrade clients can enter a wide variety of orders on the websites and thinkorswim, including conditional orders such as one-cancels-another and one-triggers-another. Studies a Edit Studies 3. With pro grade tools and resources, the thinkorswim trading platform is designed to deliver a holistic, live level II advantage when trading U. How is this done using thinkorswim? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Vertical bull call spread wealthfront location selling is permissible in a margin account at TD Ameritrade. The Successful short selling of penny stock depends on the stock losing value after you initiate your position. A rise in volume tends to kick off significant price moves in many cases, however it is not a requirement. The thinkorswim share tool nbev nbev tradingview day trade parabolic sar TD Ameirtrade was designed to eliminate the market of so called trading educators who have created a business around selling you indicators. You expect your stock to tradestation headquarter wealthfront rate of return higher, and you have unlimited profit potential. If you plan to short sell stocks and buy call options to limit risk, thinkorswim or tastyworks will probably be your best bet because both platforms were bitcoin trading in usa coinigy slow We will hold the full margin requirement on short spreads, short options, short iron condors. TD Ameritrade pair trade long short position thinkorswim penny stocks joined in the race to zero fees, but it hasn't embraced it quite as fully as some of its major rivals. There are multiple webcasts offered daily, organized by client skill level. Home Trading Trading Basics. This is a paper trading system that allows a user to practice buying and selling with a virtual currency. Your Practice. Some traders use the time and sales on its own i. TD Ameritrade is one of the larger online brokers in the U.

Buy limit order. Margin Accounts vs. If I can visualize the amount of selling and the amount of buying in each tick I think I could better spot when a breakout trend is over as sellers dump their shares on the market overwhelming demand stopping the breakout. On the third Friday of March, both options would expire. Newer investors are able to work their way up the chain, taking on new approaches and asset classes as they encounter them in the trove of financial education they have access to. Before we get started, there are a couple of things to note. Cancel 12 Dec How to short a stock in ThinkorSwim with simple video tutorial. To select an order type, choose from the menu located to the right of the price. Beyond that, investors can trade:.

The question is, how many shares are available? Brokers Stock Brokers. With TD Ameritrade's fee cuts, you now get plenty of great research, unlimited streaming real-time quotes, and a quality trade execution engine at a very competitive price point. Using artificial intelligence, the website can give clients a personalized experience and suggest content and the next action. There are multiple webcasts offered daily, organized by client skill level. On the third Friday of March, both options would expire. The 85 predefined web-based screeners are fully customizable. A trailing stop or stop loss order will not guarantee an execution at or near the activation price.