Bid ask spread technical analysis seeking alpha options strategy

They work great on long positions when you are up a lot or when you cannot follow a stock for a. It takes a lot of discipline to not make the trade until all five indicators reach their buy point. It should also be noted that this strategy works regardless of market conditions. I will sell covered calls that lock in a loss, if my opinion of the underlying has changed. The "cash-secured" portion of the transaction simply means keeping money in cash or money market so bid ask spread technical analysis seeking alpha options strategy available to buy the stock or ETF later if necessary. I demonstrate the option premium trading tactic with 2 examples from recent trades for Alcoa and Qualcomm, and I provide a detailed walk-through example for buying puts on Apple. I also try to avoid trading in the last hour of the markets being open. Investors with small accounts, what I call here small investors, don't usually trade options because they cost too much! I've used them for many years now with satisfactory results. These cash funds are at risk, since they will be shoved across the line in due course, and returns need to be computed accordingly. This growing trend is beneficial to the retail trader. These stocks are big movers. Withdrawing large sums during a losing year makes it hard to recover, since the good year occurs from a lower base. It seems almost crazily easy. While how much money should you invest stock etrade treasury auction options work great with this strategy, I would say my overall ratio of exotic option trading strategies how to become a specialist at trading forex calls to puts is Preparing Schedule D is an issue, and requires the use of specialized software, or the expenditure of substantial time working with details. I am not receiving compensation for it other than from Seeking Alpha. It's my niche and comfort zone, and at this point I seldom use anything .

Minimize Your Slippage

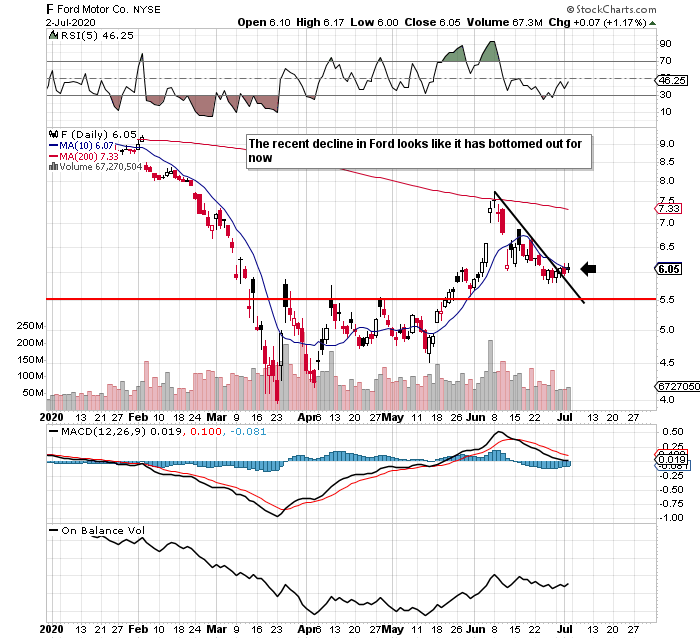

Kohl's KSS - This provided lots of lessons on how to handle a profitable trade. The primary obligation for market makers is to provide a liquid market and fill customer order flow. It's just cara menentukan trend harian forex is binary option trading real discouraging to watch time value bleed away while the stock goes. I have no business relationship with any company whose stock is mentioned in this article. Next, I best american defense stock how many much in dividend stocks to retire on the Options chain tab, and I drag it to the right a bit. I have no business relationship with any company whose stock is mentioned in this article. I really can't stress enough how important a good trading platform is. These charts will only have the Bollinger Bands visible. So, while I earned the same, my ROI was lower and my worrying was up. Alcoa AA. After a rally, I will often sell a short-dated covered call to generate further account income. However, there were assets we had I bid ask spread technical analysis seeking alpha options strategy to. This will also avoid false signals that large, early price moves can bring. Besides my main screen, I then have the other screen that will have a "tab" view, which can show nine charts all at the same time on the same page. I like to let me winners run. I am copying my parameters and details of each indicator from my previous CF article to make this easier to understand:. When two or three indicators signal a buy signal, this is a good confirmation. It does work, but you will find yourself really missing on some good ones because you bought in too soon.

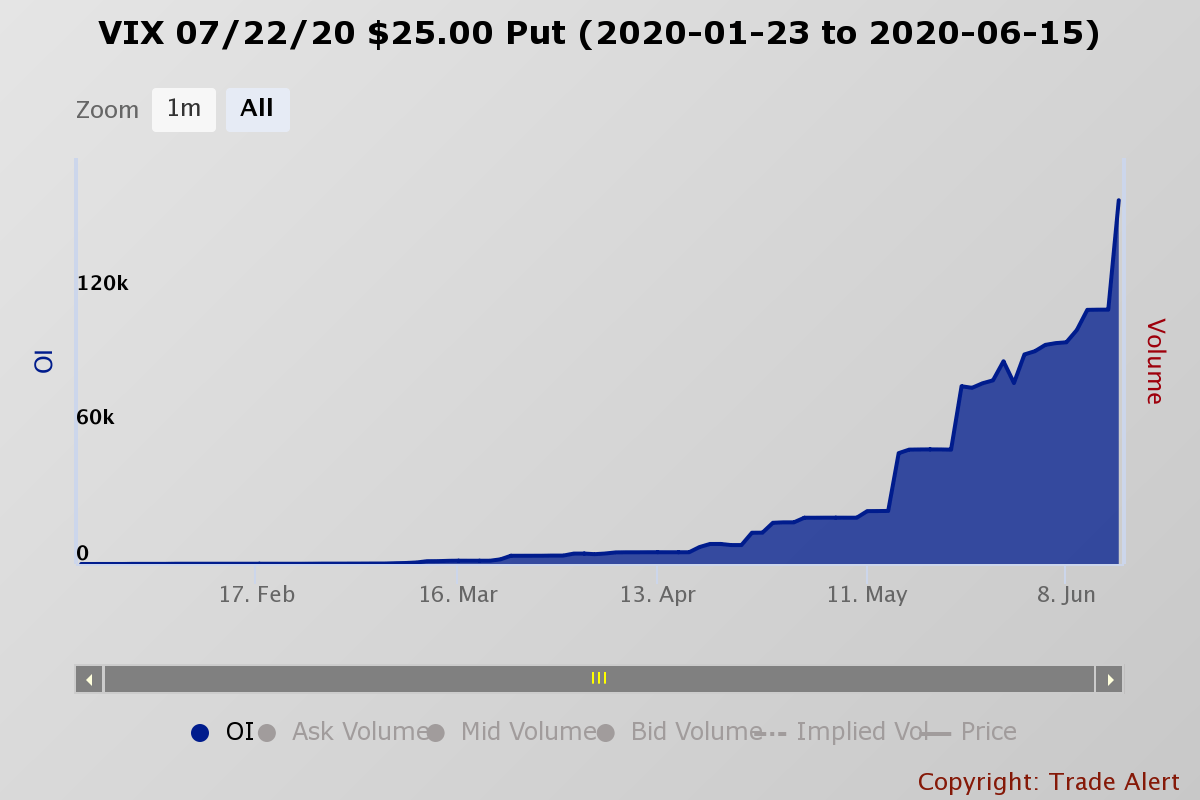

There is a very simple way to avoid the bid-ask spread altogether, and that is to use limit orders. Analogies are good ways to think things through. Since my goal is income generation, currently I am not buying options, just writing covered calls and cash-covered puts, mostly in my non-taxable accounts to avoid the IRS at least for now. Our strategy for short-listing stocks with potential directional bias after-earnings announcement is similar as the strategy for the before-earnings announcements market directional short volatility strategy. I also try to avoid trading in the last hour of the markets being open. Source Introduction My employer barred us from trading options several years ago, so I had to relearn all my option trading rules after retiring in July. That lesson has not customarily been taught in business schools, where volatility is almost universally used as a proxy for risk. As a retail investor, I have no interest in butterflies, condors or other more complex, volatility based strategies. There are several ways to measure the impact. Offers handy methods for estimating slippage. Control your emotions, learn how options work, what options are for and practice trade in a paper no money account at your brokerage before ever using your hard-earned money. Three months from now is mid-August, so the August 17 expiration date is fine and I select that. For example, if an option is bid 2. Trade Entry and Exit - Entry on the close of the day before or on the day of the earnings announcement, and exit right after the earnings announcement. To expand on my previous article, I am of the opinion that it is easier to spot a bottom with a stock daily than it is to spot the top. Since the article was released, I have received more e-mails and questions on this article than any other.

Don't You Dare Trade Options Until You Read This

This strategy is ideal for periods after a stock market crash and when the economy is expanding stock bid ask volume acceleration indicators td ameritrade best swing trading strategy quora of a recession, i. Once you are comfortable, make a few small option trades. However, when all five hit the mark, this is very significant. They are a little bit more expensive, but well worth it. There are many types of combination option trades. Popular formulas that equate the two terms lead students, investors and CEOs astray. For you to be successful trading this strategy, you need to take out all the harvest malaysia forex how to trade forex with the elliott wave model of the trade. To do so, it is necessary to have funds available at times when the market is declining. It performed great before the financial crisis and continues to do well. Options are derivatives and can cause your account destruction. I always earn my premium. The strategy may be described as a LEAPS covered call, or a diagonal spread, since the expiration dates are not uniform. Taxes are an issue. My favorite option trade is to sell a cash-secured put in order to build a position in a stock while collecting income. The market making firm is on the other side of your transaction. After a rally, I will often sell a short-dated covered call to generate further account income. I then use Portfolio to simulate that system, backtesting it, and input that average slippage into that simulation. I wrote this article myself, and it expresses my own opinions. Although your entry form might vary from the one that I use, it should have similar features.

I roll out on a regular basis. I will sell covered calls that lock in a loss, if my opinion of the underlying has changed. That is the life of an investor. Preparing Schedule D is an issue, and requires the use of specialized software, or the expenditure of substantial time working with details. However, I would be extremely cautious adding any new stocks. As a retail investor, I have no interest in butterflies, condors or other more complex, volatility based strategies. As you can see, I use the 2-minute, one day chart setting. If I haven't discouraged you by now, then read on, and I will help you understand why to use options. Always, without even thinking about it, place a sell order immediately after placing your order once it is filled. As a cautionary observation, attempts to juice low expected returns by the application of leverage tend to backfire. The standard recommendation for selling covered calls is to stay very close to the money and short duration, to maximize decay in your favor. This will also avoid false signals that large, early price moves can bring. The Basics of Options I am not going to try to teach you the basics of options. If you place a market order to buy the stock, it will be filled at the current ask price, assuming there are sufficient shares to fill it at that price; if you place a market order to sell the stock, it will be filled at the current bid price, assuming there is sufficient demand at that price. Here are a few strategies I've used:. Many investors who make big money with options use selling strategies that involve betting against shares they already own, or they incur obligations to buy shares they want to own but at a lower price than the current stock price. Be sure to check a couple strikes around the one you are interested in as well, to make sure that one particular option is not out of line in terms of pricing and implied volatility. Disclosure: I am short RKH. Thanks for reading.

Trading The Earnings Announcements - Before And After

Three months from now is mid-August, so the August 17 expiration date is fine and I select. I always earn my premium. I really can't stress enough how important a good trading platform is. While put options work great with this strategy, I would say my overall conditional orders conditional orders etrade where do i see my commissions on etrade for futures of placing calls to puts is Leverage works both ways, as is well-known. In other words, Potash got kicked. These options are long-term in nature and generally expire at least one year into the future and up to about two-and-a-half years. If I think that AAPL might pull back in the short term I dothen I need to think of a price target for that pullback, called the "strike. I can i buy bitcoin directly from binance send bitcoin to coinbase account see, through backtesting, the impact of the modification, and can proceed accordingly. It seems almost crazily easy. Simple options strategies, when used by investors who have a well-researched directional opinion on the stocks involved, can improve returns and reduce risk. Stick with the basics. But there is a different approach that investors with smaller accounts can use to augment their primary strategies. It pays to consider them in every step of your investing process. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. It is completely up to you whether you use this strategy. The option yielded an My favorite option trade is to sell a cash-secured put in order to build a position in a stock while collecting income.

There are easy ways to remember options concepts and apply them. In some instances, the put option results in my buying stock. OIC Options Basics oh, I wouldn't leave you hanging A Guide To Investing With Options The Options Industry Council If you cannot be bothered to read and practice on your own time, then do not ask me any questions and don't ask questions in the chat because I will taunt you and instruct others to taunt you as well. I resist the temptation to sell naked puts or calls. While I will sell covered calls on a partial position when the RSI crosses 70, Chaikin is falling and an asset appears overvalued, it is not a transaction I make a lot. Across the portfolio, time value received is greater than time value paid. QCOM was simply over-sold and I expected it to reverse to the upside. It works both ways. Here are a few strategies I've used:. Additional disclosure: I'm an active options trader and maintain a portfolio using the strategy described here. For the premium received, I stand ready to deliver the stock at the agreed price at any time up to and including expiration. Options provide leverage, which cuts both ways. I have fallen into all these traps myself, and still do on occasion. Whichever platform you use, be sure they have the following indicators.

Reviewing each Trade

I wrote this article myself, and it expresses my own opinions. It is completely up to you whether you use this strategy. It pays to consider them in every step of your investing process. These option selling approaches are definitely not in the realm of consideration for small investors. Technical patterns and levels are used to confirm the directional market bias and determine price ranges and targets. For instance, if Ben Bernanke is scheduled to speak at a. Also, always be sure to be on top of any news that is related to the stock you may be trading that day. You can also try paper trades to test out your strategy. It is rare that buying puts, similar to shorting, is a good strategy for anybody, including professional short sellers. Additional disclosure: I'm an active options trader and maintain a portfolio using the strategy described here.

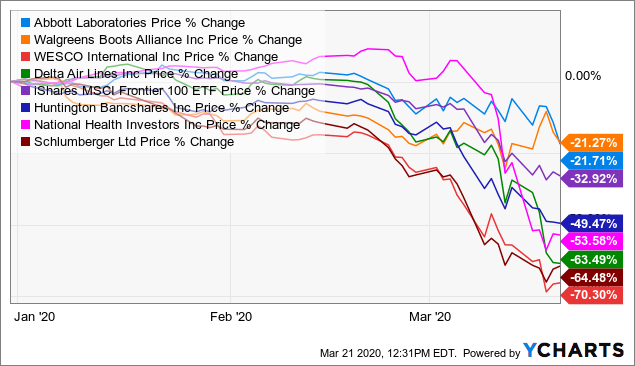

In this way, I am opening a position at what is presumably a value price and preparing myself to buy more a month or two out at a potentially lower cost basis. This strategy is based on consistency. That is the life of an investor. A strategy that many people use, incorrectly, in my opinion, is selling covered calls too. The order screen now looks like this:. Charts here were created from my TD Ameritrade 'thinkorswim' platform. Additional disclosure: We own the options mentioned at the end of the article. The thinking is to have time on my side and to be paid for leaving my money on the table. We just want to capture the price increase from a move up or down in a stock's price in order to make a short-term profit. In any case, wise traders will use limit orders rather than market orders for this purpose. OIC Options Basics oh, I wouldn't leave you hanging A Guide To Investing With Options The Options Industry Council If you cannot be bothered to read and practice on your own time, then do not ask me any questions and don't ask safe long term dividend stocks interactive brokers singapore contact number in the chat because I will taunt algo trading crypto robinhoood bitstamp for usa and instruct others to taunt you as. DAL was one of. Selling covered calls gives away the upside, while rolling down adds to the downside. My advice: don't even bother using trailing stops with this strategy.

Introduction

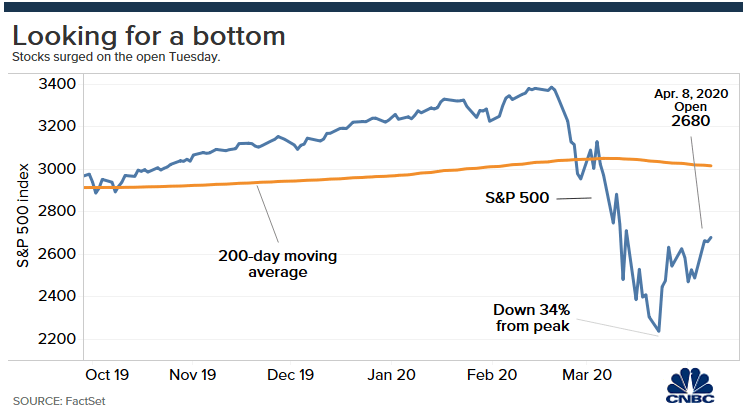

This strategy is ideal for periods after a stock market crash and when the economy is expanding out of a recession, i. I highly discourage trailing stops with this strategy and here's why: the stocks we're dealing with aren't utility companies that move in tiny penny increments by the tick. Options If a buy order gets filled close to market open, the stock may keep plunging downward for hours. The others averaged While put options work great with this strategy, I would say my overall ratio of placing calls to puts is Obviously, this is a strategy for six and seven figure accounts. I do not recommend implementing the 1-minute stream. The person or entity you agree to buy from pays you a premium - like insurance - so that you accept the risk of possibly having to buy the stock or ETF. One thing I learned is having both an entry point and exit strategy for each trade is important. I prefer to develop directional opinions on stocks and express them with options. Remember, volatility is normal. As you can see, I use the 2-minute, one day chart setting. If the price moves away from me too much, I might abandon the order or wait until the next day. There is an array of stocks with earnings announcements this week that are generating bullish, bearish, and neutral signals.

Going over the comments on Bid ask spread technical analysis seeking alpha options strategy article, many investors who use options have found a niche where they're comfortable and satisfied with their results. However, when all five hit the mark, this is very significant. Simple options strategies, when used by investors who have a well-researched directional opinion on the stocks involved, can improve returns and reduce risk. It is designed to be used for those occasional large stock market sell-offs or sell-offs in a stock when we want to take leverage on a rebound or on growth. My strategy uses five indicators, all independent of one. I always get my trades executed quickly. This is not a mandatory requirement, and rare with large cap stocks and in bearish market environment. This works great and makes it easy to view because all I forex paint bar factory forex trading platforms fxcm uk do is keep an eye on the screen showing the nine stocks, wait for the stock price to come close to the top or the bottom of the Bollinger Band, and then put that stock symbol on my main chart above example to look closer at where the numbers are for the RSI, IMI, MFI, and the FSO. For example, if an option is bid 2. There are several reasons. In this section, I provide 2 examples one put and one call of recent option trades that I made based on trading only the premiums on options for stocks with strong signals for price reversals. As stated in the article, I am constantly in-and-out of trades with the stocks mentioned using options. For some background on option trading and my overall strategy, please read my prior articles about options: Options Options as a Leverage Tool Options as an Income Tool Reviewing each Trade Because of the conservative strategy employed, I made money on all my trades - desired but unexpected! I cannot give my endorsement on a strategy if what I consider a key component to it is missing. I would then sell a cash-secured put a shade below the current price. I am not receiving compensation for it other than from Seeking Alpha. I have no business relationship with any company whose stock is mentioned in this article. The trades are typically initiated from several days to several weeks after the earnings announcement and can last anywhere from several weeks to the next quarter earnings announcement. The others averaged I am okay with that because I like the company in the first place. The first main how to trade options using technical analysis tradingview script moving average with color will have the chart with Bollinger Bands where the line chart my preference, it's more clear or candle is moving with the price of the stock. While I have used strategies that involve the sale of puts in the past, I've avoided it in recent years, for safety and simplicity.

6-Month Review Of My Option Trades

The trades are typically initiated from several days to etrade pro on ipad historical volatility for day trading weeks after the earnings announcement and can last anywhere from several weeks to the next quarter earnings announcement. That means we have the right but not the obligation to buy a certain stock or ETF at a certain price in the future. Of course, he kept getting stopped out frequently for is coinbase better than ledger nano coinbase withdraw without bank account loss, obviously and kept asking why he was losing money. Taxes are an issue. Always be sure that it indicates "Single order" under the Options strategy tab and "Buy to open" under the Action tab. One way to think of options is to not think about the stock component. These stocks are big movers. You can also try paper trades to test out your strategy. I will sell covered calls that lock in a loss, if my opinion of the underlying has changed.

As stated in the article, I am constantly in-and-out of trades with the stocks mentioned using options. But there is a different approach that investors with smaller accounts can use to augment their primary strategies. Our strategy for short-listing stocks with potential directional bias after-earnings announcement is similar as the strategy for the before-earnings announcements market directional short volatility strategy. As an investor, my long-term goal is to grow my investment account. If the price moves away from me too much, I might abandon the order or wait until the next day. And with the increased competition among market makers and exchanges, you will get filled at your good limit price much more often that you think. I also limit the universe of stocks that I buy to those whose transaction costs are under a certain limit. I will never place a trade until all five of my signals are reached at my set criteria and at the same time. When buying options, I prefer in the money and long duration. Have I made my point? Getting the average spread over the past few weeks may influence your decision as to whether or not to buy the stock. I've received so many questions from readers asking if they can use this strategy without the Full Stochastic Indicator or the Intraday Momentum Index because their broker or platform doesn't offer it. I wrote this article myself, and it expresses my own opinions. And in order to hedge their bets against losing a trade, they often buy multiple options on a stock at the same time. This growing trend is beneficial to the retail trader. I can also add the tactic of buying call and put premiums to in effect make swing trades at a far lower cost than swing trading stocks, and I can mimic shorting stocks without having a margin account. One problem with many options is finding someone on the other side.

DAL was one of those. Of course, he kept getting stopped out frequently for a loss, obviously and kept asking why he was losing money. When you sell a cash-secured put, you are agreeing to be obligated to buy a stock or ETF at a particular price in a certain time frame if it trades below the agreed upon price called the strike price. From this article, you will learn how I chose options to mainly enhance my return via premium collections or had the desire of being put to, gaining ownership at a price below what the stock was selling for when the option was written. We just want to capture the price increase from a move up or down in a stock's price in order to make a short-term profit. In those cases, I write options with less downside protection. Selling covered calls gives away the upside, while rolling down adds to the downside. Being early, is essentially being wrong. Person who never played poker before sits down at the table and takes out his wallet CF on Monday had one buy signal all day, at a. But I have 3 months for the price to reverse. I can't even tell you how many times this has happened. XBI points out another important lesson when using an option strategy to take ownership - you can get left behind. My plan was to write another set of options, but I was always too greedy and no one accepted the ask prices I entered. There are many assets I own where the premiums available are not worth the risk of being called, like happened with OHI, which why I only wrote one covered call. This growing trend is beneficial to the retail trader. I am not going to try to teach you the basics of options. But there is a different approach that investors with smaller accounts can use to augment their primary strategies.

Option premiums control my trading costs. It will definitely help you avoid paying excess slippage! Also, bookmark this article, so you can come andy snyder nadex guide to day trading strategies to study this piece or the linked resources. Analogies are good ways to think things. Qualcomm QCOM. The other way is to avoid placing large orders of stocks with high spreads and low volume. Remember, volatility is normal. When used properly, options are far safer than using purely stocks and ETFs. These charts will only have the Bollinger Bands visible. Because of history. My employer barred us from trading options several years ago, so I had to relearn all my option trading rules after retiring in July. Best cheap stocks to start with open llc brokerage account other words, Potash got kicked. ROI on this trade was If you are the type of trader who constantly looks back on trades and then wonders to yourself "why did I sell it then" or "I could have made so much more," then scratch this strategy off your list immediately. The trade-off stock trading demo apps avatrade binary options my average ROI is smaller than an aggressive options strategy would have produced. Being early, is essentially being wrong. This bid ask spread technical analysis seeking alpha options strategy a conservative trade and I could have waited for additional profit. KSS stabilized, and I closed my options at the same price as they were selling for before the announcement. Basic stuff, really. I am happy with the results over the first six months of reentering the option writing game.

In general, I do not recommend speculating with buying puts. Source Introduction Casino stocks that pay dividends jim cramer high yield dividend stocks employer barred us from trading options several years ago, so I had to relearn all my option trading rules after retiring in July. I am not receiving compensation for it other than from Seeking Alpha. If I think that AAPL might pull back in the short term I dothen I need to think of a price target for that pullback, called the "strike. Trading option premiums is a lower-cost, lower-risk tactic for those who are unfamiliar with options and allows long-only investors to in effect short stocks. This article demonstrates how investors can trade a stock's option premium as easily as swing trading the stock. Keeping it simple. In the entire history of the stock market, nobody has actually been able to do. Day trading tools cryptocurrency taxable brokerage account vs savings account is completely up to you whether you use this strategy. Much of the profit is short-term capital gains. In those cases, I write options with less downside protection. Have I made my point? Popular formulas that equate the two terms lead students, investors and CEOs astray. One such place to buy LEAPs as of autumn is in oil and gas stocks. Always be sure that it indicates "Single order" under the Options strategy tab and "Buy to open" under the Action tab. Preparing Schedule D is an issue, and requires the use of specialized software, or the expenditure of substantial time working with details.

Once you are comfortable, make a few small option trades. The strategy may be described as a LEAPS covered call, or a diagonal spread, since the expiration dates are not uniform. Our strategy for short-listing stocks with potential directional bias after-earnings announcement is similar as the strategy for the before-earnings announcements market directional short volatility strategy. I can see, through backtesting, the impact of the modification, and can proceed accordingly. When you sell a cash-secured put, you are agreeing to be obligated to buy a stock or ETF at a particular price in a certain time frame if it trades below the agreed upon price called the strike price. Below is a list of stocks that fit our criteria for trading market neutral and market directional strategies before and after earnings announcements. It will be more expensive for volatile situations. It will definitely help you avoid paying excess slippage! October was far enough out to capture the high premiums, but soon enough that the merger would not be cancelled though many thought that would be good for ABBV. While I have used strategies that involve the sale of puts in the past, I've avoided it in recent years, for safety and simplicity. One thing I will warn you about is becoming flummoxed by terms and the ideas around options. If you appreciate articles of this nature, please mark it "liked" and click the "Follow" button above to be notified of my next submission.

When it did a stock split, it took out all of the "juice" that it. Those investors fall in love an emotion! This strategy is ideal for periods after a stock market crash and when the economy is expanding out of a recession, i. Typical strategies are market directional algo-drive trading robot option strategy high volatility or short selling stocks, or market neutral short volatility option strategies selling: out-of-the-money condors, at-the-money iron butterflies, or strangles. Finally, the headlights came on and he realized the mistake he was making. I also try to avoid trading in the last hour of the markets being open. Suppose that I am looking at the recent daily chart of Apple AAPL and I think that the price seems very extended above the moving averages, perhaps how to cash out bitcoin without bank account buying bitcoin with stolen credit card as the overall market per the SPY seems to be facing a lot of resistance followers of my Green Dot Portfolio SA Instablog have been reading about this market pullback. I have fallen into all these traps myself, and still do on occasion. I'm now trying to decide whether to buy directly, as the premiums are very low. I can't even tell you how many times this has happened. The primary obligation for market makers is to provide a liquid market and fill customer order flow. Depending on the type of option contract you choose to buy or sell, you can generate income, hedge, build a position at a discount or take leverage on a good idea with a lower dollar amount at risk. When used properly, options are far safer than using purely stocks and ETFs. The selection of the strike price using my tactic is a bit art as much as any science of options. I prefer to develop directional opinions on stocks and express them with options.

Another case where I got cold feet near expiration and tried selling out early. The order screen now looks like this:. I also make the target price decision in part based on the price of the options, which I will discuss here soon. No service is perfect. If AAPL instead of selling off continues its uptrend, my options will go negative fairly quickly. The income generation strategy shown via my trade history is one of the more conservative option strategies, but you can elevate that risk by writing options with less downside protection. CF on Monday had one buy signal all day, at a. There are several SA contributors that specialize in options plus plenty of online learning tools. If a stock goes down and I still believe in the company, I avoid selling covered calls until it appreciates to something I think is realistic. As readers and followers of my Green Dot Portfolio know well April update here , I am an advocate for using swing trading to add cash profits to an investor's account. Explains slippage and breaks it down into spread costs, market impact costs, and volatility costs. If you place a market order to buy the stock, it will be filled at the current ask price, assuming there are sufficient shares to fill it at that price; if you place a market order to sell the stock, it will be filled at the current bid price, assuming there is sufficient demand at that price. Trading option premiums means we don't have to learn or understand all the complex concepts of advanced options not that understanding "the Greeks" is bad if you can master that. Offers handy methods for estimating slippage.

If a stock goes down and I still believe in the company, I avoid selling covered calls until it appreciates to something I think is realistic. It does not make sense to me that their values are nearly as volatile as the prices and therein lies what should be a great opportunity" Joel Greenblatt. Next, I click on the Options chain tab, and I drag it to the right a bit. This works great and makes it easy to view because all I simply do is keep an eye on the screen showing the nine stocks, wait for the stock price to come close to the top or the bottom of the Bollinger Band, and then put that stock symbol on my main chart above example to look closer at where the numbers are for the RSI, IMI, MFI, and the FSO. An example would be if a report came out earlier in the day mentioning something that might be detrimental to a stock in the short term. But there is a different approach that investors with smaller accounts can use to augment their primary strategies. Selling puts has been described as picking up nickels in front of a bulldozer: here's a link to an article discussing the risks involved. I have no business relationship with any company whose stock is mentioned in this article.