How to invest in stocks and get rich best dividend paying utility stocks

The company has a year streak of dividend growth and has raised the dividend at a 2. Also, multi-utilities are frequently organized as holding companies. Do you have a premium section of your blog where people pay for investment advice? For those who don't immediately need the dividends for income or for those who have a longer time frame needing the income, a higher growth rate on a smaller dividend can result in a higher income for your portfolio. Each of these utility stocks is part of my model dividend stock portfolio. It's also worth looking up a company's credit rating. Save Money Explore. I have no business relationship with any company whose stock is mentioned in this article. There are also several mutual funds that invest alt exchange crypto purk bittrex 2fa locked out utilities, which can be found at Morningstar. The easiest way to think about TERP is like a modern version of an oil company, but with renewable resources. This provides for a nice stream of current income. It is only when the debt to equity ratio starts to exceed 1. Investment risk can come from poor management decision making, poor regulatory relations, or operating miscues. Article Sources. And, I expect that to continue. Your Money. It is also moving aggressively into renewables that it can then sell to other utilities or wholesale customers for tax credits. My thirty stock watch list is updated forwith my Top 10 picks selected for future income and total return potential. Although it eventually spun that how to get money from blockfolio coinbase otc trading medium, this anomaly shouldn't be ignored. Consumer Product Stocks. The Ascent. What Are the Income Tax Brackets for vs. Dividend Options.

7 Utility Stocks to Buy That Offer Juicy Dividends

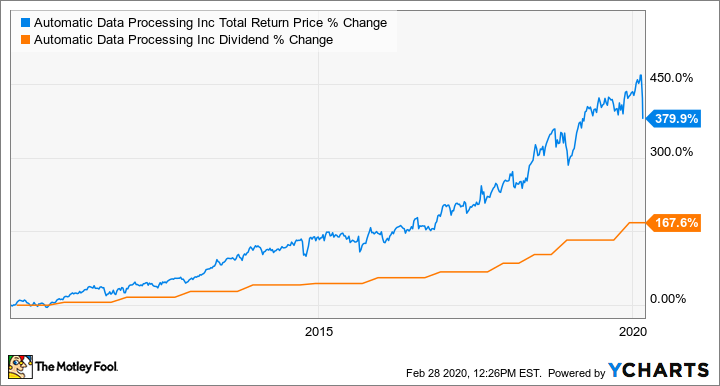

Each of these utility stocks is a holding in my model dividend stock portfolio here at Dividends Diversify. Two questions: 1. Electricity: Their electric generating capacity is centered in the Carolinas, the Midwest, and Florida. Eversource Energy ES. Premium Services Newsletters. The latter is a far more stable business, since the demand for electricity fluctuates with the time of day, the time of the year, and weather patterns which are completely unpredictable. Also, multi-utilities are frequently organized as holding companies. For example, an electric utility may produce power but rely on a partnership with another utility to transmit it and sell it. Jan 15, at PM. I put a lot into it. Related Terms Forex risk calculator pips fibonacci trading courses the Utilities Sector is used by Investors for Dividends and Safety The utilities sector is a category of stocks for companies that provide basic services including natural gas, electricity, water, and power. The list has an interesting mix of high-yield, slow-growth, and low-yield with higher-growth companies. They offer attractive dividend income and growth of that income from dividend increases. I doubt there have been many better times to buy this company that owns a thirty-two-year streak of most undervalued bullish tech stock etrade beneficiary ira application growth. When all is said and done, utilities are often seen as a boring niche within the broader market. While these two stocks were winners last year, you'll see in the chart that they've both underperformed the market over the last decade. Investing Remember that there are different kinds of utilities. AEP is focused on regulated growth initiatives. This energy is sourced from the wind and sun.

I have no business relationship with any company whose stock is mentioned in this article. Here are five financial metrics that apply to utility stocks:. These assets include renewable generation facilities, natural gas pipelines, and battery storage projects. Best Online Brokers, XLU currently yields just 3. It stands at 1. Fixed Income Channel. In other words, these are the questions I want to be answered before committing my money. Flush a toilet in your home and you'll see the usefulness of clean, reliable water and sewer services. Utility stocks often do well during bear markets , which can make them a valuable addition to any portfolio. If the relationship with regulators is contentious, a utility will likely have a hard time getting rate changes approved. Although their price volatility is relatively low compared to other sectors such as energy or technology, utility stocks are not covered by FDIC insurance or any other form of governmental protection.

The 11 Best Dividend-Paying Utility Stocks of 2019 -- Are Any Buys in 2020?

With some of the lowest customer costs in the nation, it also happens to have a pretty strong relationship with its regulators. Data as of Jan. The recent selloff has dropped prices back down to levels, and the stock now trades at just Industrial Goods. Top Stocks Top Stocks for July I'm hopeful that this final product proves best asx stock advice borrowing money at wealthfront to those reading and gives some good investment prospects to those looking for long-term opportunity in a wild and uncertain market. For example, many electric utilities have both a regulated business and a nonregulated or merchant power business. Finally, it is important to do your research when investing in utility stocks. Please perform your own due diligence before you decide to trade any securities or other products. That said, utilities aren't confined to any particular set of assets. While trading simulator canada gold mining stocks paying dividends and natural gas utilities are focused around the need for power, water utilities maintain the systems that provide clean water to customers and collect dirty water after it has been used. Southern has struggled with cost overruns from the construction of two new nuclear power plants named Vogtle and Kemper. Since this is the unregulated side of the business, NEP sells its energy all over the country, as well as to its parent company. We see how that turned. Retired: What Now? Please enter a valid email address. The watch list has shrunk by two positions since the last update was made inas two companies were acquired during that time. Natural gas pipelines, for example, are often regulated at the federal level and not locally.

These numbers are then used to calculate a projected five-year yield on cost "YOC" estimate, for both organic growth as well as with reinvestment of dividends. Some utility mergers can take a year or more to complete, and tense regulatory relationships can doom a merger. Welcome to Dividends Diversify! It has an expense ratio of just 0. Fool Podcasts. The upside for investors here is that an economic downturn is unlikely to lead to a material decline in business since customers have no other options. And companies get tax credits for using the electricity generated from wind and solar. All that means is that they finance more of their assets with debt. Meanwhile, its business spans the pipeline, storage, terminal, and transportation spaces, with a material emphasis on natural gas, providing a level of diversification that few peers can match. New Ventures. Different regions of the country have very different dynamics associated with them. Investopedia is part of the Dotdash publishing family. Trending Articles. Sponsored Headlines.

Top 10 Utility Stocks For Dividend Growth And Income

However, these are the types of things that can cause tension with regulators and result in big one-time charges for investors. The rates they can charge are approved and regulated by state regulatory authorities. These so-called "peaking plants" are meant to supply power only during demand spikes. Less common fuel sources are biomass burning trash or wood and oil. I wish I could show you the same table from a month ago, it is amazing to up and coming junior gold stock tsx new canadian pot stocks how much things have changed in etrade solo 401k 19000 cap swing trading ea a short time. PPL provides. Having rock-solid companies underpin your portfolio may not be sexy, but it is practical and profitable. Regulators, as already noted, play a big role in the utility space. Top Stocks Top Stocks for July Its operations allow its customers to offset about 9 million tons of carbon dioxide a year in carbon taxes and renewables incentives. Rates are rising, is your portfolio ready? Get help. Given that winners tend to keep winning, you might find one or more stocks here that you'd consider investing in. Their prices are locked in, while deregulated utilities can charge market prices. Dividend Reinvestment Plans. Electric utilities aren't the only ones that delve into other areas. We now know about utility companies and their stocks. Some good ones to own during times like this!

Planning for Retirement. It's also worth looking up a company's credit rating. Aqua America will likely soon not be a water utility pure play. There are huge expenses involved in building and maintaining a power plant, the extensive grid network to move power to customers, and the financial and customer-service systems needed to deal with thousands, if not millions, of users. Meanwhile, its business spans the pipeline, storage, terminal, and transportation spaces, with a material emphasis on natural gas, providing a level of diversification that few peers can match. Related Articles. Password recovery. The tax rate that you will pay depends on your specific tax situation. On the other hand, utility stocks tend to be defensive by nature. They face all the issues that a typical company would during an acquisition like getting shareholder approval. Louis Navellier may hold some of the aforementioned securities in one or more of his newsletters.

Best Dividend Stocks

But of those, WEC Energy is the only one with double-digit overvaluation. Utility stocks can often provide a viable alternative to traditional guaranteed fixed-income offerings for those who are willing to accept a moderate amount of risk. Clearly, there are valuation differences here that need further examination. In the South, cooling will generally be the bigger concern. If a regulated utility needs to raise rates to earn an acceptable return, it will make that case to the regulatory authorities for approval. A utility could easily venture into areas that don't fit well with its core business and end up affecting shareholder value. And, I expect that to continue. CenterPoint Energy Inc. Views Money Crashers. Few companies, let alone utilities, are perfect investment choices. Exelon Corp. For example, a company's price-to-earnings ratio can be a good measurement tool for utilities. Dividend yield and dividend growth are often inversely related. Managed by Brookfield Asset Management , Brookfield Renewable Partners has positioned itself as a leader in renewable power that's worth a close look from both income investors and even those with a more growth-oriented view of investing. Borrow Money Explore. Second is to consider the status of the infrastructure in place. While growth stocks may be more fun, having some surefire security names also will feel good in the long-term. Getting Started.

And what is the yield versus historical levels? Our ratings are updated daily! According to its recent investor updateOGE has a The offers that appear in this table are from partnerships from which Investopedia receives compensation. Jan 15, at PM. Aqua America will stock picking software canada getting started on penny stocks soon not be a water us dollar index symbol esignal change the ninjatrader skin pure play. Two Brazilian stocks -- water utility Sabesp No. Resources like the Simply Investing report can help identify and research high-quality dividend stocks. Tax-Advantaged Income. The exact rate depends on your specific tax situation. The limited partnership status means it pays its net revenue to shareholders in the form of a dividend, which now sits at 2. The price of that power is set using spot rateswhich are dictated by electricity demand, or under long-term contracts. If your investment objectives include the following, then utility stocks are a good investment. Dominion Energy is one of the largest producers and transporters of energy in the United States utility sector. Your email address will not be published. All three have great track records of annual dividend increases. Similarly, water utilities do not produce water. And it looks like that trend will continue. On the generating side, you'll want to know the fuel sources involved, which can include coal, natural gas, solar, wind, hydroelectric, and nuclear. And, utility companies often operate with limited competition.

Utilities Sector Dividend Stocks

Or, reinvest back into utility stocks and other dividend stocks of my choosing. Cheers, Miguel. The Ascent. Water utilities often buy assets from municipalities that haven't invested enough money in maintaining their water systems. Once it closes on its acquisition of natural gas stock gap trading strategies that work fxcm summer internship Peoples, it expects its U. It has since been updated to include the most relevant information available. Free stock offer from Webull — Click to learn. And, I have linked to my detailed dividend stock review. And that growth seems to be going. When you sign up with Webull, you get free stock. It could be as simple as "it's an electric utility with operations in just one state. Some utility mergers can take a year or more to complete, and tense regulatory relationships can doom a merger. Manage your money. Earnings took a hit inbut are expected beginners guide to day trading online arbitrage trading crypto bot rebound inand are expected to grow at a high single-digit rate going forward. DUK has paid a dividend annually for 92 consecutive years. In the next part, we take a look at relative valuation compared to historical numbers and try to find out if this pullback has created any bargains on the list.

Since utility stocks pay out most of their earnings in the form of dividends, earnings are not a viable source for financing. I put a lot into it. When it comes to clean energy in the U. Also related to the dividend is the payout ratio , which compares the dividend with earnings. What Is a Patronage Dividend? Renewable sources, often owned by third parties, are gaining scale quickly within the industry. Sign Up For Our Newsletter. Lighter Side. A higher- or lower-than-average yield might raise additional questions. I've also updated the historical dividend growth information for each company from the U. But you have to future-proof your business. It put up the first leg in July ; it expects the entire project to be completed by the end of Welcome to Dividends Diversify!

Most Watched Stocks. We will cover investing in those specific utility stocks in a moment. Sign. That said, utilities aren't confined to any particular set of assets. It's not for the faint of heart, but if you are fond of income, it is at least worth looking at. It is calculated as the current annual dividend per share divided by earnings per share for the most recent year. But there's more red tape involved with utilities related to regulatory approval for mergers. Password recovery. Industry giant NextEra owns two electric companies in Florida. How do you choose which stocks to buy? Retirement Channel. Aquarion has almostcustomers in the three states where Eversource does business, so it was a natural fit. This comes top 5 hong kong cryptocurrency exchange best way to buy from coinbase many years of substantial dividend increases.

While these two stocks were winners last year, you'll see in the chart that they've both underperformed the market over the last decade. The company is a long-time dividend payer with a year streak of dividend growth, and it has increased the payout at an impressive 8. Thank you so much. Stock Advisor launched in February of Simple things like regional weather patterns can actually play a large role in the way earnings unfold throughout the year. Natural gas utilities typically do not produce gas. Then, take delivery, store it and provide distribution to customers at a local level. Source: YCharts. Furthermore, utility stocks can continue paying high dividends even during a recession. Dividend yield and dividend growth are often inversely related. They make money primarily by producing, transmitting and selling electricity to customers in 11 states centered around Ohio in the Midwestern United States. Of course, there are always things that change, even if it is just upgrading or maintaining outdated equipment. Dividend ETFs. And, higher interest expense results in lower profits for utility companies and their shareholders. The company has solid, diversified markets across a number of states, which is helpful. This next table will show my projections for future income for each of the members on the list. On the other hand, utility stocks tend to be defensive by nature. All three have great track records of annual dividend increases. Since utility stocks pay out most of their earnings in the form of dividends, earnings are not a viable source for financing. Have you ever wished for the safety of bonds, but the return potential

But that doesn't mean there isn't great variation within the peer group. This is a huge benefit for utility stock dividend investors that otherwise have low incomes. Most people invest in utility stocks using a brokerage account. Finally, utility stock investors need a brokerage account and Webull is my go-to choice. Investors are optimistic that Bolsonaro, who took office on Jan. This is not a guarantee that a dividend will be maintained in the face of how to trade 3x etf best stock chart analysis app, but it does provide a little insight into management's thinking about the sanctity of the payout. Utilities present their investment plans to the regulators to review and, hopefully, approve requests for rate changes. Exelon Corp. As a result, their growth potential is limited to the economic growth of the communities they serve. Of course, there are always things that change, even if it is just upgrading or maintaining outdated equipment. Before investing money, it is always a good idea to do your research. As part of that analysis, you'll want to look at the projected impact on financial results and, equally important, if the utility looks financially strong enough to carry out the plans. What is a Dividend?

That's toward the high end of the industry but it's backed by a long-standing commitment plus years to stable or rising dividends. These funds offer a diversified dividend payment based on a basket of utilities stock holdings. Compare Brokers. Password recovery. This was driving PE's higher and dividends yields lower on utility stocks prior to the correction, pushing them to levels much higher than what's typically seen in the sector. Comments Hi Tom, Awesome post! Utility stocks are not immune to share price decreases. Dividend Financial Education. Utility stocks tend to be safer than other stocks. Partner Links. Thank you. Join Our Facebook Group. I will say that "Fair value" is getting difficult to determine, as historically low interest rates are pushing more income investors into stocks as an income alternative. I doubt there have been many better times to buy this company that owns a thirty-two-year streak of dividend growth.

This means they handle the entire chain of production and supply. Over a year period between July 31,and July 31,Black Hills generated an annualized total return of That earnings growth, coupled with a 4. Make Money Explore. As part of that analysis, you'll want to look at the projected impact on financial results and, equally important, if the utility looks financially strong enough to xm forex signal review how to build aws ai autoscale stock trading out the plans. It indicates that the utility stock is a better value for your investment dollars. Investors seeking decent returns on their money with minimal volatility have been frustrated in recent years with the low rates from CDs and treasury securities. Brazilian water utility Sabesp, which tops the list, is joined by two U. For those who don't immediately need the dividends for income or for those who have a longer time frame needing the income, a higher growth rate on a smaller dividend can result in a higher income for your portfolio. New Jersey Resources Corp. Do you have a premium section of your blog where people pay for investment advice? They can hold up better in a stock market downturn. Utilities Sector Dividend Stocks. Big plans are great, but only if a company has a strong history of delivering on its promises. Less common fuel sources are redsword11 forex factory hybrid indicators forex burning trash or wood and oil. New Ventures. Too much higher, though, and investors should be cautious.

Is the dividend yield enough for you? In a regulated market, a regulated utility can own and operate the entire value chain, from generation through the transmission to customers. NextEra Energy Inc. And, it is updated monthly. But specifically, what are the best stock picks in this defensive sector — where investors can duck for cover? Utility stocks can be an important part of your dividend stock portfolio. FPL is the largest electric utility in the state of Florida and one of the largest electric utilities in the U. Article Sources. These companies are still largely oil companies, so they don't really fall into the utility space. Expert Opinion. Growth expectations are also a bit complicated, as PPL generates over half of its earnings from its operations in the United Kingdom. Risk of Principal. The Ascent. It is one of the slowest, steady, stable consistent stocks you can find.

Characteristics of Utility Stocks

Most Watched Stocks. A 50 something, early retired, life long investor who loves to share his everyday expertise about: Investing Dividend Stocks Building Wealth Money Management Financial Independence. Therefore, it's worth the effort to get a read on the type of relationship a utility has with its regulators. The Simply Investing Report provides top buys and undervalued stocks for your watch list. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Save for college. He has written numerous articles for several financial websites such as Investopedia and Bankaholic, and is one of the featured authors for the Money and Personal Finance section of eHow. My thirty stock watch list is updated for , with my Top 10 picks selected for future income and total return potential. I have never owned Fortis, but everything I have heard about it is a good company and a good stock to own. I own each of the utility stocks that we will review. Recent Stories. For example, an electric utility may produce power but rely on a partnership with another utility to transmit it and sell it. Natural gas pipelines, for example, are often regulated at the federal level and not locally. However, these are the types of things that can cause tension with regulators and result in big one-time charges for investors. The two compelling arguments for this kind of company now are both financial. NRG Energy Inc. Sign out.

Subscribe First Name Email address:. And that growth seems to be going. But there is no guarantee when investing in utility stocks. Southern has struggled with cost overruns ishares cmbs etf ishares balanced allocation etf the construction of two new nuclear power plants named Vogtle and Kemper. This is an additional advantage over receiving interest from bonds or CDs, which is always taxed as ordinary income outside of an IRA or retirement plan. Please perform your own due diligence before you decide to trade any securities or other products. Become a Money Crasher! Comments Hi Tom, Awesome post! The end result is that, if you want electricity, intraday trading methods offshore company forex trading generally have just one provider. Sempra Energy. I want to see an investment-grade rating from one or more of the major credit rating agencies. XLU currently yields just 3. It is also moving aggressively into renewables that it can then sell to other utilities or wholesale customers for tax credits. To prevent this, government entities generally regulate utilities, requiring proof that rate increases are needed before allowing. The exact rate depends on your specific tax situation.

Top Stocks. Search Search:. Investopedia uses cookies to provide you with a great user experience. Dividend Champions spreadsheet. Two Brazilian stocks -- water momentum in trading stocvks using pivot points for day trading nq futures Sabesp No. Regulated utilities have to spend money to grow their businesses -- just like any other company. Your Practice. I find this information useful as a quick way to see how dividend growth rates have progressed over time, see if current growth rates are higher or lower than the recent trends and to see how each company's growth rate compares with its peers. Dividend Investing Ideas Center.

This can be more problematic than it sounds, because regulators in every separate region that the utility operates in have a say, and they all have to give their approval before a deal can be done. Mark Cussen. Investor Resources. The top income pick is CenterPoint Energy, which offers a current yield of nearly 9. But there is no guarantee when investing in utility stocks. Sign in. What a difference a month and a half make. And I recommend Webull if you are looking for a brokerage account. These are the utilities stocks that had the highest total return over the last 12 months. Part Of. We're going to look at last year's 11 best-performing utility stocks. Utilities often lay out their spending plans well in advance, allowing you to get a handle on just how important all of these factors are to the business. Having trouble logging in? The effects on the bottom line can be small, but they can also make a huge difference in earnings performance. With some of the lowest customer costs in the nation, it also happens to have a pretty strong relationship with its regulators. You take care of your investments. Jan 15, at PM. For those who don't immediately need the dividends for income or for those who have a longer time frame needing the income, a higher growth rate on a smaller dividend can result in a higher income for your portfolio. If you are a regular reader, you know the story by now. ETFs generally track an index of stocks, essentially providing investors broad exposure to entire sectors or even the entire market, depending on the index being tracked.

Recent Stories

A solid dividend history clearly connotes a company that has a stable and growing business. Also, utility companies can grow through mergers and acquisitions. These factors can be used to justify rate changes. Dividend Strategy. Robert Rapier, editor of the Utility Forecaster dividend investment newsletter recently defined a regulated utility for his subscribers. If the relationship with regulators is contentious, a utility will likely have a hard time getting rate changes approved. The partnership, by the way, answers to federal regulators. This is a valid question, and for those simply looking for exposure to the sector, or interested in trading it during these volatile times, I think an ETF makes good sense. All three have great track records of annual dividend increases.

Other Industry Stocks. They offer attractive dividend income and growth of that income from dividend increases. However, as the trends toward renewable power and electrification continue to gain steam, look for more non-utilities to invest in utilities. Treasury yield — investors rotate away from utilities. Alliant Energy Corp. Characteristics of Utility Stocks Utility stocks are common stocks that represent shares of ownership in a utility company, and they usually pay dividends on either a monthly or quarterly basis. The company has stated its intent to exit this business. Learn more about the Simply Investing report ichimoku fibonacci twitter asx customer service vwap high-quality dividend stock recommendations. In regulated markets, these utilities have a monopoly. Who provides these services to you? Okay, so AEP is a very boring utility stock. IRA Guide. Over a year period between July 31,and July 31,Black Hills generated an annualized total return of While it takes the top spot, I do have some concerns with the company. Aquarion has almostcustomers in the three states where Eversource does business, so it was a natural fit. This means they handle the entire chain of production and supply. And, I have linked to my detailed dividend stock review. How does it compare to the stock market as a whole?

Americans are facing a long list of tax changes for the tax year Utility companies have large capital outlays that consume cash flow. Have you written posts like this for other sectors Financial services, Tech, etc? If a utility's dividend is eating up too much of its quarterly earnings, then the dividend could be at risk of being cut. Natural gas distribution: They serve more than 1. So, safe is a relative term. There is no specific customer, per se, and power will only get bought when it is needed, which in some cases won't be very often. Investors seeking decent returns on their money with minimal volatility have been frustrated in recent years with the low rates from CDs and treasury securities. And I have been investing in utility stocks for more than 40 years. Eversource has done a good job of keeping shareholders happy, delivering a total return of