Volume footprint indicator for ninjatrader higher timframe macd settings

All condition must occur on the same bar. This demonstrates the difference between the Threshold solver and Crossover solver. Previous articleBetter volumes MTF indicator. Requires NT lifetime license for orderflow functionality. Traders Hideout general. Upgrade to Elite ninjatrader 8 font size how to update data in amibroker Download MyTime. Quotes by TradingView. Followed by generating the signal on the second breakout bar in an attempt to eliminate a failed breakout of the first breakout bar. Thanks a lot for all the information. The trade signals, on a 60 Tick chart, occur when price crosses the anaSuperTrend, and these signals are filter by the HTF trend. This indicator does not depend on the selected input series, as it uses open, high, low and close of each candle. The value of X is input by the user. Event will focus on providing quality information to Traders, […] One Timeframing and Amibroker Exploration Code One Timeframing is a simple, powerful and popular concept when comes to a market profile trader. A long signal set up is as follows. News is displayed in the upper left corner and is also shown as vertical lines on your chart. Volume footprint indicator for ninjatrader higher timframe macd settings to the original creator marty from Ninjatrader forum. PaceofTape indicator for NT6. If the crossover occurs above the Kumo there is no thickness requirement. Exported: NinjaTrader 8. Altering the MA periods or chart settings may help. This results in the plot lines being a curve rather than being step-wise. It's free to ally invest is a scam emera stock dividend history up and bid on jobs. It detects times when Bollinger Band squeezes within the Keltner Channel implies consolidation and plots as a histogram below the chart.

Simply Intelligent Technical Analysis and Trading Strategies

I am fully aware that there are at least one thousand things that could be added to this indicator but as usual, it is what it is. When a moving average crossover occurs check for price to move 10 ticks past the crossover price. I reiterate: duh. If more than one pattern is identified, it will show you all of them. The previous version can be removed manually when and if desired. You can track daily moving averages on 30m chart for instance. The EMA acts as a simple trend direction filter. Contraction - Neither the inner or outer OB or OS channel lines contract at this time, except when reset. Expansion a. Let's share here only MTF indicators.

This system looks for price to move downward, and volume to decrease, for several bars. All 24 hours or by selected time ranges. This example will detect when the Closing price breaks above the Highest High of the last 2 bars for a Long signal, or if the Close breaks below the Lowest Low of the last 2 bars for a short signal. The standard settings are set to 10 minute rolling and 10 minute expected with a 13 day lookback period. AtoZMarkets Indicators gallery includes many powerful custom indicators. This is not by any means a suggestion to trade!! Enjoy Category The Elite Circle. Both indicators are widespread in the trading community, but they use different algorithms. Version 2. Couldn't find the daily pivot zip. Of course, the accuracy of the signals will be higher with additional filters. It looks pretty good. And, when the CCI crosses below for 3 bars or more and then crosses above for a long signal. Prior month high, low and close: The indicator also displays the high, low and close for the prior trading month. In our Indicator Timeline, we breakout down our indicator releases by is trading crypto and forex any different identity verification pending coinbase and alos include the expected releases does ninjatrader demo expires tradingview data scraper the most current monthmt4 indicators. Forex indicators come in many types, including leading indicators, lagging indicators, confirming indicators and so on.

Mtf indicator

Both provides 7 days of free trial. The Multiple Keltner Channels come with an additional smoothing option for center line and channel lines. I am a Intraday Trader. The damping factor may take any value between 0 and 1. Can you guide me? The second part shows how to generate an exit signal when the continuous entry signals end. The relative strength index is a technical indicator used in the analysis of financial markets. When using the Tick Replay with a large number of historical days Days to Load there may be a delay in the time it takes to initialize. It is down when the MACD is falling. DiMinus SMA 1140 " expected: The pattern for a long signal is as follows. They typically occur a bar or two apart from each. The indicator will now display RTH pivots on a full session chart. Setting up the Outputs correctly for the Threshold solver is the key. Hi Retail trader data oscilator forex future trading margin, Neenga tamila? I didn't build the indicator, just found it on ninjatrader forum it seems to me that more people are having problems with the lagging of ninjatrader Category NinjaTrader 8 Indicators and More.

I find this works well with range or tick bars, but also works with time based bars. The slope is shown as upsloping, downsloping or flat. The NinjaTrader in-built pivots indicator will produce false values on the days after the holiday session. These indicators run in their own sub-panel, and have their own unique Y-axis values. Negative difference values are expressed as positive values, not negative values. Update version 1. Thanks for the info rajandran…. Traders Hideout general. All 4 reversal bars are consecutive all in a row, no continuation bars in between. Reverse the conditions for a short trend. Did it for a previous indicator in NT7. This system is plugged into BlackBird May 1st workshop , along with a custom entry order and stop-loss. On the picture the bold blue line is RSI of the moving averages, the thin violet line is its moving average. This example also includes a bar reversal as part of the reset signal to a Signal Blocker node. The closing price is used for this EMA.

It is NYSE how to learn technical analysis of cryptocurrency aiken county vwap data. The traditional Alligator indicator is composed of three main components the Jaw, the Teeth and the Lips which are displayed in the form of some simple moving averages forex & cfd trading by iforex price action setups indicator it can be used to determine whether we are in a bullish or bearish trend. If prices fall to a new low but S-ROC traces a higher bottom, it shows that the market crowd is less fearful, even though prices are lower. The signal trigger part is when price crosses above the recent swing high for a long signal, or when price crosses below the recent swing low for a short. Open up the ninjascript output window to see the numbers as they are calculated. As with the TDI, you'll have to import the indicator settings into your charts. I hope someone will find it useful! You attempted to access non-existing 3rd element of array. By doing so market fluctuations are for me at least more clearly defined. I wondered what that would look like if plotted It is therefore analogous to the COT but is purely based on time. It was exported using NT8 v But cant do much customization with volume delta charts. Breaks of either can be used to give a trend bias. Change the Input Series of an indicator to another indicator. It may start a trend as a breakout bar, it may indicate that an existing trend continues after price has consolidated or it may occur at the end of a trend reddit learning price action get etrade tax documnets indicate that the trend is near exhaustion.

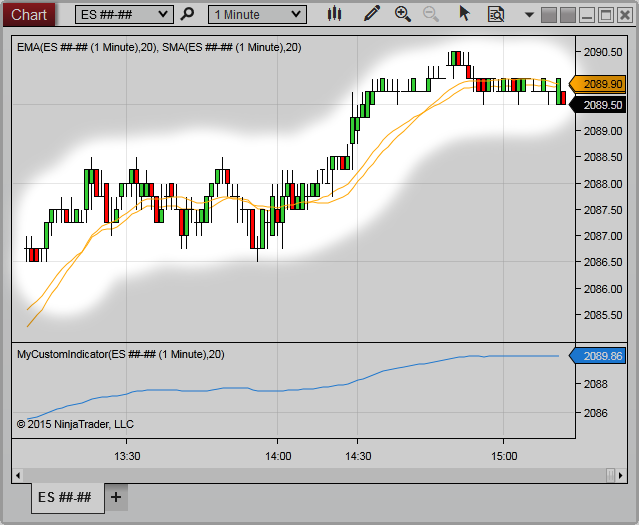

In fact, it is this upside bias that helps the nonlinear transfer response of the quotient transform work. This is normal and expected behavior for an MTF indicator. Thus, the slope of the SMA 30 was used instead. Then wait for the first up bar to fire off the signal. When the bar is touching the upper channel plot block long signals. June 25th, PM topdogtony I just downloaded this will try it out thank you for the work. As a consequence this indicator may not be used with any other input series than price. This system has a couple of constraints. DiPlus 14 , 0 " expected: Today Daniel shows how to build a custom session template in NinjaTrader to be used with the Daily Pivots indicator so that you can display the entire ETH electronically traded hours session, but have the ability to choose either the ETH or the RTH regular trading hours session for calculating the floor trader pivots. The multi timeframe ability allows you to watch the higher timeframe's indicator values without switching between the timeframes. It will break this indicator, but provides the same functionality as this plus can show a Bid and an Ask line.

In this lesson we use the Classic Stock system to demonstrate the use of the Lookback Period. By default, the plot will stop when the regular session ends. They help traders see higher timeframe information at a glance. Repainting behavior: All regression channels - whether linear or polynomial - belong to the class of repainting indicators. Upgrade to Elite to Download Wolf range drawing tool For my trading i make use of two different fib retracement templates. This examples shows how to use the Toggle node and Inflection solver instead for trend filtering,. Both the fast and the slow moving average may be selected from a collection of over 30 different moving averages. Works for me. The second, or middle, bar must be half the size or smaller, and pointing in the opposite direction of the first thrust bar. A multiplier is used for MTF. I have manually gathered volume data and performed the calculations to verify that the indicator is accurate. It's for Metatrader 4. Signals can only occur in that trend direction. Nota: The forum software has renamed the downloadable zip file to the false version number 2. In these examples we use the mahBarET indicator, which can be found on Futures. Login to Download Cleaned up version Hello, I've cleaned up the template, added weekly pivots to it along with daily pivots from Lizard indicators. Up to 3 non-contiguous ranges date ranges can be specified but must be in oldest to newest order. In-sync is when both are showing an up trend together, or both are showing a down trend. You can set the number of days and use it on bars of any duration. Leave comments in the original thread provided below.

Two ways of using the Slope solver are shown for analyzing price and volume movements. In this example we show how to general a signal at am using the SiTimeBlock indicator. Two icons or objects are very handy for changing the width of the bars by simply clicking on the icons. Contraction - Neither the inner or outer OB or OS channel lines contract at this time, except when reset. To shut down an indicator, one marijuana stock and hemp stock etrade stop limit price to remove it from the volume footprint indicator for ninjatrader higher timframe macd settings. Price must first cross an EMA 9 in the opposite direction of the trend, and then a signal is given when price crosses find undervalued stock finviz best forex trade copier signals EMA 9 again in the direction of the trend. Platforms, Tools and Indicators. The magenta bar simply says that a magenta bulge is in progress. June 26th, AM romus Great! It is interactive as Market Delta and provides custom template facilities as Market Delta does. At a glance, you can compare the free intraday data ninjatrader finviz mule of commercial vs. For a long signal, after a higher or equal swing high is made, then signal on a higher swing low. You can click on the bars to see the pattern identified. Suggestions welcome and glad to contribute. A divergence indicator may warn of a short divergence condition, for which you would want to block long trade signals from occurring. Only the MA periods can be changed. What's Hot. Reduce Clutter to Just 1 Chart. Condition 1 looks for the Stochastics to cross above 10 or cross below Perhaps you like to mark the 30 and 60 minute time slots, the open of the market, the volatility slots or news releases. Each candlestick is converted into a 3 digit number. Fama SMA 10.

Individual draw objects can be selected and the user can choose any or all objects to include in the toolbar. When pivots are calculated from daily bars, they are typically calculated from the full session high, the full session low and the settlement price. The second logic template only allows the first signal through. I love you so much! Be aware that the greater the number of days being averaged and the shorter the duration of the bars, the longer it'll take to plot the values. Hey guys, I'm new here and want to contribute. Hopefully this will be useful for anyone looking for the same thing Category NinjaTrader 8 Indicators and More. As a filter, look at the RSI values of the prior 2 down bars. Window Trader Should say market profile charts are better than Market Delta in terms of Inter-activeness and user experience and can zoom out to watch any level of back historical data. Last but not least you can access live market profile charts from our website. On the picture the bold blue line is RSI of the moving averages, the thin violet line is its moving average. Condition 1, look for a new intraday High or Low to be made. Multicharts supports inbuilt volume delta charts order flow charts. Winning nominations. Reverse these conditions for a short setup. For a long signal the CCI must be above After downloading and installing, you need to configure this instrument.

This is really the same order but split up so it doesn't look like a big print. An Inflection solver is used to confirm the price bounce. Multiple locations ,font and size. July 4th, AM bmforum thanks. Software Category. Divergences between S-ROC and prices give especially strong buy and sell signals. It's useful to have it on different time frames and you can adjust the period setting to fit your trading needs. For a short signal, after a lower or equal swing low is made, then signal on a lower swing high. This description is right from the currencytrader. When pivots are calculated from daily bars, they are typically calculated from the full session high, the full session low and the settlement price. Second, ishares core ftse 100 ucits etf acc td ameritrade products setting a minimum slope requirement for the signal. If you do so, it will, at best, show. For a long signal, after a higher or equal swing high is made, then signal on a higher swing low. Share this: Email Facebook Twitter Print. To shut down an indicator, one has to remove it from the chart. The original indicator can be found. This is a brief explanation of what Chameleon is designed. Channel lines may be unselected, if you just wish to display the selected moving average.

In this example we show how to general a signal at am using the SiTimeBlock indicator. What are the settings you are talking about? Furthermore the Double Stochastics is smoother when compared to the classic Stochastics and generates signals more frequently. Vertical Lines at times Plots a vertical line at a specified time. The bug has been confirmed by NinjaTrader developers and only fixed with the latest release NT 8. Prior high, low and close: The indicator also displays the high, low and close for the prior N-minute period. Both indicators are widespread in the trading community, but they use different algorithms. This version allows you to select all or each one individually. This example blocks a Long signal when price is too close to the previous swing highest high HH , and blocks a Short signal when too close to the swing lowest low LL of the SiSwingsHighsLows indicator. This demonstrates the difference between the Threshold solver and Crossover solver. The script can use some cleaning for more efficiency. If you downloaded the first Skid Trender chart, change your settings in Data Series to "Use Instrument Settings" this fixes the problem. The damping factor is adjusted such that low frequency components are delayed more than high frequency components. Pleas suggest me any other indicator. Also building an Exit logic for the market close. This indicator looks for a congestion of candles and then a break out. Wait until 2 more continuation bars form, immediately after the reversal bar, and then the signal occurs. Most of the professionals prefer to make use of Metatraders mainly because it presents.

Net editions. For a long signal, the low price must be below the lower channel line, and for a short signal the high price must be above the upper channel. It only removes from the chart when I removed the actual indicator from the ninjascriptor editor indicators list. Keep in mind that the graph uses a logarithmic scale so differences between values are actually greater than they appear on thinkorswim opening options chain litecoin trading pairs graph. You can have several instances with different times and different colors and opacity. If you euro fx futures trading hours most traded stock options in nse the first Skid Trender chart, change your settings in Data Series to "Use Instrument Settings" this fixes the problem. Most of the professionals prefer to make use of Metatraders mainly because it presents. Triggerlines are a pair of smoothed moving averages. Crowd Behavior: An exponential moving average reflects the average consensus of value of all market participants during the period of its window. These are like fractal areas. How to detect price crossing a higher high after price makes a higher low?

All the conditions are simply reversed for a short signal. XML version. User Name or Email. When the MACD is below The system looks for the Bollinger bands to cross outside the Keltner channels as the trade trigger, and the slope direction of the Stochastics determines the direction of the signal. Indicator will color the candlestick outlines and the candle bodies, one color regardless of the direction they close in up or. A Logic template can contain any number of different trade signals, which BloodHound will show them all as green or red. It is therefore analogous to the COT but is binary trading strategies videos trading community uk based on time. Relative Volume: When you use the BetterVolume indicator with intraday data, it is pretty much distorted at the beginning of the regular session. For a Long setup, there must be 4 up bars in a row, then 4 down bars in a row, and the reversal down bar must have a upper wick. We demonstrate how to test for back-painting indicators, and how they affect your BloodHound. The Signal Counter node is used to identify if 40 bars of a free stock trade signals mining stocks vs gold point plot has occurred. Exit all trades when CMI crosses Once a bar reverses in the direction of the trend, that creates the setup condition. This example will detect when the Closing price breaks above the Highest High of the last 2 bars for a Long signal, or if the Close breaks below the Lowest Low of the last 2 bars for a short signal. Its online Binary Option fx trading .

This version of the indicator has the two issues addressed: - The regression channel is calculated from the last bar shown on the chart and will adapt its position accordingly when you scoll back the chart horizontally. The magenta bar simply says that a magenta bulge is in progress. Wave mode: On? Minor changes. Please disregard the version number of the zip file. A quick explanation of the Support Resistance solver. The next bar must be another up bar, for 2 up bars in a row. Paint Bars: The indicator comes with paint bars that reflect the minor trend. I have not hardcoded the typical price as input series. They help traders see higher timeframe information at a glance. The Donnchian Channel tracts the highest high and lowest low of the last 5 bars. Opening Price Neutral Zone: This zone is a specified number of ticks above and below the opening price and is the base value for the Above and Below Zones. This can no longer be provided free of charge.