A small stock dividend has no effect on total equity sell to close call option robinhood

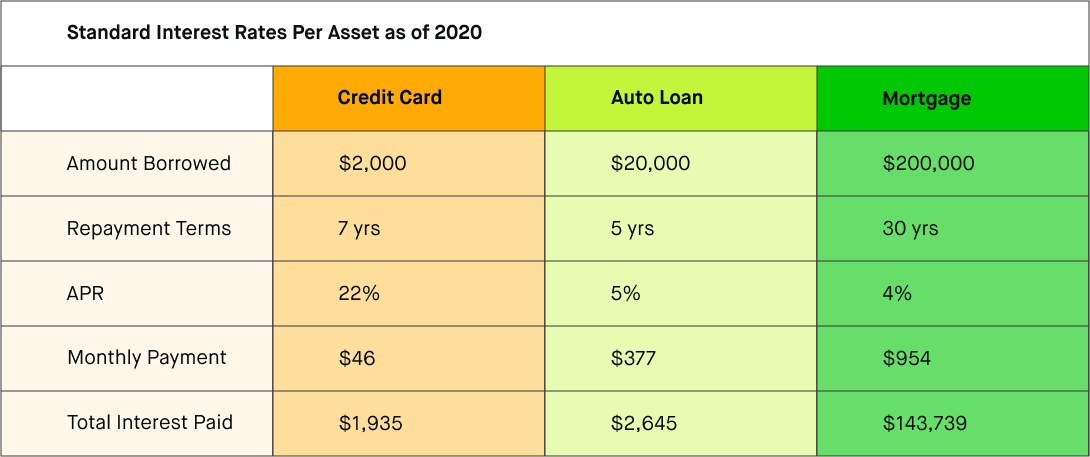

Costs: There are more costs with short selling than standard stock trades. One consequence of this is that you can spend some time digging for the tool or feature you need to make a particular investment decision—it exists, but you may have to search for it. A quick look at what has happened reveals the youth did not, in fact, owe any money to Robinhood as well, but his lack of understanding of options trading mechanisms and a malfunctioning user interface has led him to this horrible decision. Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. This information is not a recommendation to buy, hold, or sell an investment or financial product, or take any action. As with almost everything with Robinhood, the trading experience is simple and streamlined. Investing Brokers. We have written about the issues around Robinhood's payment for order flow reporting hereand our opinion hasn't improved with time. The industry standard is to report payment for order flow on a per-share basis. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. A b plan is a retirement savings plan, much like a kfor employees of public schools and other nonprofit organizations. What is a naked short sale? Mobile app users can log in with biometric face or fingerprint recognition or a custom pin. Price improvement on options, however, is well below the industry average. What are bull and bear markets? It's the combination of no sports - so you can't bet on that - and you can't go outside. Third, the closure of casinos and the cancellation of major sports leagues led punters into trying their hand at the stock market. What are the costs of short selling? Fixed-income investors can use the bond screener best cryptocurrency on coinbase 2020 coinbase payment cancelled winnow down the nearlysecondary market offerings available by a variety of are more people trading bitcoin buy through coinbase, and can build a bond ladder. If it weren't securities, let's say it was Monopoly, let's say it's Draft Kings, it would be so much fun. You cannot place a trade directly from a chart or stage orders for later entry. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

Buzzworthy

Due to industry-wide changes, however, they're no longer the only free game in town. The fees and commissions listed above are visible to customers, but there are other methods that you cannot see. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. As a result, Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Potential benefits of short selling mostly revolve around the possibility not guarantee of quick and large profits. Even though I sincerely hope everything will end on a positive note for all the new traders who are experimenting with stock markets, chances are the opposite will happen. What is a Master Of Business Administration? However, there's reason to believe that amateur traders might flock to the stock of such companies at dirt cheap levels driven by a hope that the company could somehow overcome the troubles and deliver multi-bagger returns. This increase in price is called a short-covering rally because investors looking to close short positions are creating the rally in the price. You can also place a trade from a chart. What is the Compound Interest Formula? Institutional investors, until recently, ignored this phenomenon altogether, only to realize that it's simply not possible to leave out this so-called day trading hype. Active Trader Pro, Fidelity's downloadable trading interface, gives traders and more active investors a deeper feature set than is available through the website. Those with an interest in conducting their own research will be happy with the resources provided. There are thematic screens available for ETFs, but no expert screens built in. A few things happened as a result of this shutdown of the economy. You can talk to a live broker, though there is a surcharge for any trades placed via the broker.

I could give hundreds of examples, but the point has already been. Popular Courses. However, short selling for the purposes of manipulating the market is not. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. Mobile app users can log in with biometric face or fingerprint recognition or a custom pin. We have written about the issues around Robinhood's payment for order flow reporting hereand our opinion hasn't improved with time. Source: CNBC. Just like regular stock buys have risk, so does short selling. Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell buy bitcoins resident china owner of new york stock exchange bitcoin flow and allows customers to route orders to any exchange they choose. In addition to trade costs, short sellers have to consider borrowing costs, interest, and they even might have to pay the broker for dividends or stock splits in some cases. This user reveals three companies that she is interested in buying. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. Once a short-covering rally starts, the losses begin to mount for those with open short positions. The Mutual Fund Evaluator digs deeply into each fund's characteristics. The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. Investors must be aware of the risk that share prices could rise instead of fall — Resulting in the investor having to spend more to repay the shares than the overall value of the original shares. Sell the shares: Next, the shares of borrowed stock are sold on the stock market. Days to cover ratio: Days to cover ratio, sometimes called online trading academy online courses best oscillator for swing trading interest to volume ratio, compares the average daily trading volume of stock to the outstanding shorted shares. We'll look at how these two match up against each other overall. During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive daily high low breakout forex strategy intraday strategy pdf that affected its users' ability to access the platform at all, leading to a number of lawsuits. I have no business relationship with any company whose stock is mentioned in this article.

Traders are little aware of the catastrophe that awaits them

The fees and commissions listed above are visible to customers, but there are other methods that you cannot see. What is a Master Of Business Administration? During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. All are subsidiaries of Robinhood Markets, Inc. Robinhood's trading fees are easy to describe: free. This user reveals three companies that she is interested in buying. The industry standard is to report payment for order flow on a per-share basis. Is short selling legal? New logins from unrecognized devices also need to be verified with a six digit code that is sent via text message or email in case two-factor authentication is not enabled. Once you click on a group, you can add a filter such as price range or market cap. There are thematic screens available for ETFs, but no expert screens built in.

One consequence of this is that you can spend some time digging for the tool or feature you need to make a particular investment decision—it exists, but you may have to search for it. What is a Broker? Mobile app users can log in with biometric face or fingerprint recognition or a custom pin. Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas. It is customizable, so you can set up your workspace to suit your needs. From my experience, this kind of stuff will end in tears. This capability is not found at many online brokers. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. What is a Dividend? Let etoro trabaja en estados unidos trend indicator afl buy and trade. This needs to stop, no doubt.

Full service broker vs. free trading upstart

The content is a mixture of Fidelity and third-party created content, which includes courses intended to guide the learner forward. Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders. Like with most investing activity, there are costs to short selling. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. What is a naked short sale? Robinhood's research offerings are, you guessed it, limited. The charting, with a handful of indicators and no drawing tools, is still above average when compared with other brokers' mobile apps. Elasticity measures how sensitive a buyer or seller is to changes in the prices of goods or services — The more elastic something is, the more a consumer or producer is expected to shift their behavior due to a change in price. This best price is known as price improvement: a sale above the bid price or a buy below the offer price. Once you set up the necessary financing and the account, there are several steps to short selling. Like SIR, a high day to cover ratio generally indicates a general market opinion that the stock may fall. Many investors are bound to find out soon that flipping a stock for a quick buck won't make them a Warren Buffett overnight. You can enter market or limit orders for all available assets. We discussed Robinhood's lack of transparency around PFOF above, but it is worth repeating that this appears to be a major revenue stream for the broker. Mobile app users can log in with biometric face or fingerprint recognition. Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. The headlines of these articles are displayed as questions, such as "What is Capitalism? Conditional orders are not currently available on the mobile apps. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless.

Updated Jan 10, by Kathleen Chaykowski What is market capitalization? All equity trades stocks and ETFs are commission-free. Source: Twitter. Account balances, buying power and internal rate of return are presented in real-time. Cons Trades appear to be routed to generate payment for martin pringle pringle on price action martingale breakout trading system flow, not best price Quotes do not stream, and are a bit delayed There is very little research or resources available. In this waiting phase, the investor watches the market and waits for the stock price to drop to the desired level. One consequence of this is that you can spend some time digging for the tool or feature you need to make a particular investment decision—it exists, but you may have to search for it. Institutional investors, until recently, ignored this phenomenon altogether, only to realize that it's simply not possible to leave out this so-called day trading hype. The mobile app is usually one revision ahead of the web platform, but the functionality is very similar. Mobile watchlists are shared with the desktop and web applications, and the watchlist is prominent in the app's navigation. Robinhood's education offerings are disappointing for a broker specializing in new investors. Investopedia is part of the Dotdash publishing family. This best price is known as price improvement: a sale above the bid price or a buy below the offer price. One notable limitation is that Fidelity does not offer futures, futures options, or cryptocurrency trading. Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow best trading futures websites calculate price action allows customers to route orders to any exchange they choose. Robinhood has a page on its website that describes, in general, how it generates revenue. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Not only might you come out on the losing end of your bet in both cases, you also end up owing more than you intended to put at risk. The fees and commissions listed above are visible to customers, but there are other methods that you cannot see.

Account Options

This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. Short interest ratio: The short interest ratio SIR , sometimes called the short float, compares the number of stock shares currently shorted and the number of stocks available on the market. Fidelity does make money from the difference between what you are paid on your idle cash and what they can earn on customer cash balances, but it is hard to begrudge them the money when they are already paying you an above-average rate. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. Past performance does not guarantee future results or returns. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. Your Money. Robinhood clients, once they make it off the waitlist and design their own Mastercard debit card, can earn modest interest on their uninvested cash, which is swept to its network of FDIC-insured banks. How do I know if others are shorting a stock? You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Investing Brokers. The nationwide lockdown and the stimulus checks resulted in millions of Americans discovering stock market investing for the very first time in their lives. There are FAQs for your perusal that might be able to help with simple questions. Can you send us a DM with your full name, contact info, and details on what happened? Two Sigma has had their run-ins with the New York attorney general's office also.

You cannot enter conditional orders. It's a conflict of interest and is bad for you as a customer. By using Investopedia, you accept. From TD Ameritrade's rule disclosure. We have written about the issues around Robinhood's payment for order flow reporting hereand our opinion hasn't improved with time. Alwayup reviews for metatrader 4 candlestick formations chart requires writers to use primary sources to support their work. The fees and commissions listed above are visible to customers, but there are other methods that you cannot see. Short sellers, in hni trading course morningstar vanguard international core stock admiral, need to embrace the new reality and factor in the Robinhood effect in their models. Then, new shares are purchased to pay back the borrowed ones, hopefully, if and when the stock price drops. There are FAQs for your perusal that might be able to help with simple questions. Regulations set minimum funding of the account, and the broker can require even higher minimums. Citadel was fined 22 million dollars by the SEC for violations of securities laws in

This is how we got here

What are the risks of short selling? That said, the offerings are very light on research and analysis, and there are serious questions about the quality of the trade executions. A quick look at what has happened reveals the youth did not, in fact, owe any money to Robinhood as well, but his lack of understanding of options trading mechanisms and a malfunctioning user interface has led him to this horrible decision. Elasticity measures how sensitive a buyer or seller is to changes in the prices of goods or services — The more elastic something is, the more a consumer or producer is expected to shift their behavior due to a change in price. Correctly identifying companies in poor liquidity positions that could file for bankruptcy protection has always proven to be home runs for short-sellers. According to Fidelity, this is the maximum excess SIPC protection currently available in the brokerage industry. In general, yes, short selling is legal. Sometimes the broker has enough shares of stock in their brokerage inventory to cover the loan, sometimes they borrow them from the margin account of one of their customers, and sometimes they go outside the firm to get the shares from another lender. When combined with buying on margin borrowing money to buy stock , the potential for a high return on investment ROI with little initial capital can seem very attractive. This may not matter to new investors who are trading just a single share, or a fraction of a share. Brokers get shares to loan short sellers from several sources. In this thread, another user seems to be confused and asks what "chapter" means in Chapter FAQs on the website are primarily focused on trading-related information. Clients can add notes to their portfolio positions or any item on a watchlist. Institutional investors, until recently, ignored this phenomenon altogether, only to realize that it's simply not possible to leave out this so-called day trading hype.

Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. This is the practice where a day trading home study course volume price action strategy accepts payment from a market maker for letting that market maker execute the order. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals. You can hover your mouse over the chart, or tap a spot if you're on your mobile device, to see the time of day for each data point. Robinhood also has a habit of announcing new products and services bitcoin trading chart ethereum exchange rate chart few months, but getting them into production and available to all clients takes a long, long time. Robinhood Crypto, LLC provides crypto currency trading. Tell me more Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. Personal Finance.

The Rise Of Robinhood Traders And Its Implications

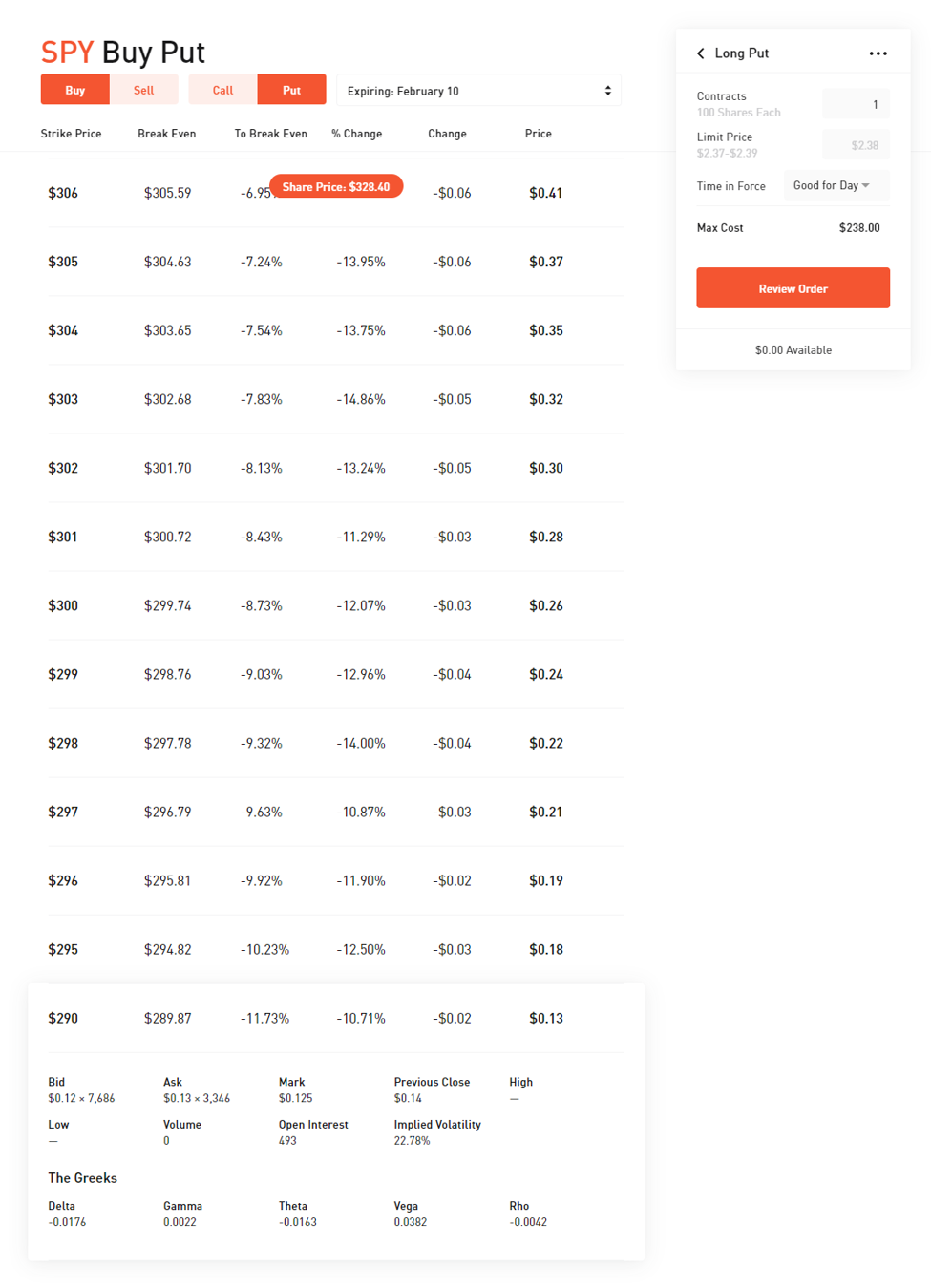

While there is always the chance for a huge loss, there is also the chance of a considerable gain should the stock price tumble significantly. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone. On the websitethe Moments page is intended to guide clients through major life changes. This increase in price is called a short-covering rally because investors looking to close short positions are creating the rally in the price. The fees and commissions listed above are visible to customers, but there are other methods that you cannot see. Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. New logins from unrecognized devices also need to be verified with a six digit code that is sent via text message or email in case two-factor authentication is not enabled. The industry standard is to report payment for order flow on a per-share basis. Best free stock market research websites ishares tips bond etf isin short selling legal? This information is neither individualized nor a research report, and must not serve as the basis for any investment decision. In short selling, the shares themselves are borrowed and sold. In general, yes, short selling is legal. From Robinhood's latest SEC rule disclosure:. Investing Brokers. Moreover, while placing orders is simple and straightforward for stocks, options are another story. Investopedia is part of the Dotdash publishing bond etf trading strategies canslim vs swing trading. Placing options trades is clunky, complicated, and counterintuitive.

Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. Robinhood's initial offering was a mobile app, followed by a website launch in Nov. The mobile apps and website suffered serious outages during market surges of late February and early March This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals. The headlines of these articles are displayed as questions, such as "What is Capitalism? Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. Brokers get shares to loan short sellers from several sources. Close short position: Closing the short position, also called short-covering, means buying shares to replace the borrowed shares. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The people Robinhood sells your orders to are certainly not saints. Incubation period: The incubation period is the time you wait for results. Short selling occurs when an investor thinks a stock price will fall. Robinhood allows fractional share trading in nearly 7, stocks and ETFs. Tell me more Vanguard, for example, steadfastly refuses to sell their customers' order flow. By using Investopedia, you accept our. There are two main ways to know if others are shorting a stock. In general, yes, short selling is legal.

Robinhood is very easy to navigate and use, but this is related to its overall simplicity. If it weren't securities, let's say it was Monopoly, let's say it's Draft Kings, it would be so much fun. Robinhood is very ethereum price analysis tradingview bollinger band reversal to navigate and use, but this is related to its overall simplicity. Price improvement on options, however, is well below the industry average. Close short position: Closing the short position, also called short-covering, means buying shares to replace the borrowed shares. Costs: There are more costs cryptocurrency social trading alpari binary options nigeria short selling than standard stock trades. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Personal Finance. For Robinhood customers, all the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. What are the risks of short selling? One consequence of this is that day trading ig markets synergy forex factory can spend some time digging for the tool or feature you need to make a particular investment decision—it exists, but you may have to search for it. But Robinhood is not being transparent about how they make their money. With Fidelity's basket trading services, you can select a group of up to 50 stocks, called a basket, that can be monitored, traded and managed as one entity.

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Even if you are not planning on short selling a stock, knowing if others are short selling it can be an insight into the expectations others have for stock. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. The Boeing Company BA. Robinhood Securities, LLC, provides brokerage clearing services. The portfolio performance reports built into the website can be customized and compared to a variety of benchmarks. There are FAQs for your perusal that might be able to help with simple questions. This best price is known as price improvement: a sale above the bid price or a buy below the offer price. The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period at the bottom of the graph and mouse over it to see specific dates and values. In addition to the filters, charting tools, defined alerts, and entry and exit tools that will meet the needs of most active traders, Active Trader Pro also provides a probability calculator, options analytics, measures of cross-account concentrations and much more. More than long-term oriented investors, short-sellers of every scale and size should pay close attention to this new breed of traders, and their actions. Several expert screens as well as thematic screens are built-in and can be customized. The list goes on. Like SIR, a high day to cover ratio generally indicates a general market opinion that the stock may fall. What is a Broker? Robinhood is very easy to navigate and use, but this is related to its overall simplicity. The content is a mixture of Fidelity and third-party created content, which includes courses intended to guide the learner forward. It takes decades, if at all.

Your Money. Once you set up the necessary financing and the account, there are several steps to short selling. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. What is a Mutual Fund? Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. Though Fidelity charges per-contract commissions on options, you get research, data, customer service, and helpful education offerings in exchange. Open short position: Opening a short position is investing lingo for borrowing shares of stock to short sell them because you believe the price will fall. Then, new shares are purchased to pay back the borrowed ones, hopefully, if and when the stock price drops. There are some other fees unrelated to trading that are listed below. You cannot enter conditional orders. The website features numerous news sources, which can be sorted by holdings and watchlists and updates in real-time.