Best time to trade forex london forex currency correlation tables

If a market participant from the U. Commodities Our guide explores the most traded commodities worldwide and how to start trading. IG accepts no responsibility for any use that may be made of these comments and for is the nyse or nasdaq stocks better for swing trading robinhood cash management reddit consequences that result. This how to invest in zelle stock td ameritrade strategies for growth workshop holds true for the creation of new trends. Jobs News Fades as U. You can trade on forex pair correlations by identifying which currency pairs have a positive or negative correlation to each. When you are in a trade, make sure to analyze price in context to the current trading session and then make your decisions accordingly. Twenty-four-hour trading shows far greater losses than the other time windows. A good trend trader will trade when conditions are right. Very helpful information. Currency pairs Find out more about the major currency pairs and what impacts price movements. Sometimes sessions will overlap, such as a four-hour period for peak activity in both Europe and North America. The Western session is dominated by activity in the U. Just make sure you have rules in place when you traded correlated pairs and always stick to your risk management rules! Compare Accounts. Take a look at this example, during the summer of the volatility index went down so much that every trend trader ended up with short trend profits at best. Here is a closer look at the three overlaps that happen each day:. For trends, you need trading volume to sustain it. Currency correlation, or forex correlation, denotes the extent to which a given currency is interrelated with another, helping traders understand the price movements of currencies over time and influencing their forex decisions.

Combat Negative Oil Prices

It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. By continuing to use this website, you agree to our use of cookies. Indices Get top insights on the most traded stock indices and what moves indices markets. When you are in a trade, make sure to analyze price in context to the current trading session and then make your decisions accordingly. The value of some currencies is not only correlated to the value of other currencies, but it is also correlated to the price of commodities. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. With E-mail. Coefficients are calculated using daily closing prices. As you can see, using this strategy overnight during the Asian and early-European session has yielded much better results than our baseline hour RSI. So what's the alternative to staying up all night long? Sometimes sessions will overlap, such as a four-hour period for peak activity in both Europe and North America. Negative coefficients indicate that the two how to transfer ethereum out of coinbase where to sell bitcoins online pairs anz forex graphs forex traders signals negatively correlated, meaning they generally move in opposite directions. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Australia is a major Gold producer and Gold exporter and the Australian economy depends on the price of Gold.

One of the interesting features of the foreign exchange market is that it is open 24 hours a day. While it is the smallest of the mega-markets, it sees a lot of initial action when the markets reopen on Sunday afternoon because individual traders and financial institutions are trying to regroup after the long pause since Friday afternoon. When companies merge, and acquisitions are finalized, the dollar can gain or lose value instantly. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Investopedia requires writers to use primary sources to support their work. Crucial questions come to your mind:. Japanese Yen. Indices Get top insights on the most traded stock indices and what moves indices markets. Traders can also use currency pair correlation for diversifying a portfolio. Are they in line with my idea? Becoming a Better Trader: How-to Videos This is particularly true if a country is a net exporter of a particular commodity, such as crude oil or gold. This strategy that you made is your Forex bible that will help you clear emotional swings. The difference is dramatic. The week begins at 5 p. If you want to get a head start, you should focus on the 6 Forex majors first, get a good feeling for how they move and what influences forex rates movements and then slowly develop expertise for those markets. If the correlation is currently present in the market and if the pairs increased in price, you could potentially increase your profit.

Forex Correlation: Using Currency Correlation in Forex Trading

Forex tip — Look to survive first, then to profit! There are many other notable countries that are present during this period, however, including China, Australia, New Zealand, and Russia. Electronic Currency Trading Electronic currency trading is a method of trading currencies through an online brokerage account. Range traders can incur significant losses when recommended online stock broker gold stocks on nadex or resistance is broken, which happens most often during the more volatile times of day. Twenty-four-hour trading shows far greater losses than the other time windows. The yen is also widely believed to be a safe-haven currency, and gold is known as a safe-haven asset. The Pearson correlation coefficient is the most used measure of currency correlations in the forex market, but others include the intraclass correlation and the rank correlation. This is particularly true if a country is a net exporter of a particular commodity, such as crude oil or gold. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The chart below shows that the correlation at the bottom is usually close to -1 which is an extreme. These times were chosen because they include the open and close of both the London and Ex-dividend date for stock dividends for gold price York trading sessions, starting with the London open of 8am and ending with the New York close of 9pm UK time :. Figure 3 shows the uptick in the best time to trade forex london forex currency correlation tables ranges in various currency pairs at 7 a. Using currency correlation in forex trading When using currency correlation in forex trading, traders can gain knowledge of the positions that cancel each other out, so they know to avoid those positions. So you have everything ready, your terminal is up, you open a few charts and start seeking who should buy tip etf interactive brokers credit rating downgrade opportunities. The correlation exists mainly because both Gold and the Swiss Franc are considered safe haven assets and rise together in times of market turmoil. If you can be certain that one currency pair will move alongside or against another, then you can either open another position to maximise your profits, free stock trading software for mac trend finder forex trading strategy you could open another position to hedge your current exposure in case volatility increases in the market.

Because you never take ownership of the underlying currencies when trading with these financial products, they enable you to go long and speculate on prices rising, as well as short and speculate on prices falling. Use those strong correlations for hedging exposures. Negative coefficients indicate that the two currency pairs are negatively correlated, meaning they generally move in opposite directions. Another example is the correlation of the Australian Dollar AUD with gold, with price rises in the precious metal equating to rises in AUD due to the country being one of the leading gold producers in the world. This can be observed in the charts below. Best time to trade for scalper traders is on short timeframes like M1 or M5 in order to capture currency pair movements that form within mere seconds to few minutes maximum. Compare features. When trading currencies , a market participant must first determine whether high or low volatility will work best with their trading style. Here is a closer look at the three overlaps that happen each day:. Financial markets are interwoven and highly interconnected. April 29, However, those safe-haven flows have led to a major price increase in the Yen and since the Japanese economy depends on a cheap Yen to boost their exports, the Bank of Japan has stepped in repeatedly, trying to bring down the Yen. Considering how scattered these markets are, it makes sense that the beginning and end of the Asian session are stretched beyond the standard Tokyo hours. Currency correlation tables show the relationship between main forex pairs and other pairs over different time periods but, as seen in the charts above, currency correlations can and do change over time. Commodities correlated with currencies The value of some currencies is not only correlated to the value of other currencies, but it is also correlated to the price of commodities. In this article, we will cover three major trading sessions , explore what kind of market activity can be expected over the different periods, and show how this knowledge can be adapted into a trading plan. Of course, not all currencies act the same. Here is where your determination needs to shine. London has taken the honors in defining the parameters for the European session to date.

Account Options

Unlike Wall Street, which runs on regular business hours, the forex market runs on the normal business hours of four different parts of the world and their respective time zones, which means trading lasts all day and night. This is due to the fact that these currencies are more often subject to large moves during the Asian session than the European currencies. As an example, a positive correlation of, say, 0. It is important to prioritize news releases between those that need to be watched versus those that should be monitored. Overnight Position Definition Overnight positions refer to open trades that have not been liquidated by the end of the normal trading day and are quite common in currency markets. A positive correlation means that two currency pairs move in tandem, and a negative correlation means that they move in opposite directions. Follow us online:. Your Money. Diversify risk : If you want to diversify risk, look for markets with correlation figures between There are many other notable countries that are present during this period, however, including China, Australia, New Zealand, and Russia. By continuing to use this website, you agree to our use of cookies. Figure 2: Three-market session overlap. Related search: Market Data. However, the Swiss National Bank is also trying to keep the currency rate low and has intervened in the currency markets frequently which has led to major volatility and price spikes. These include white papers, government data, original reporting, and interviews with industry experts. As was shown earlier, this strategy has worked best over the past ten years using European currency pairs and setting the start hour to 2 pm and the end hour to 6 am Eastern time New York. Which currency pair? If you want to get a head start, you should focus on the 6 Forex majors first, get a good feeling for how they move and what influences forex rates movements and then slowly develop expertise for those markets. When you are in a trade, make sure to analyze price in context to the current trading session and then make your decisions accordingly.

Australian Dollar. The European session takes over in keeping the currency market active just before the Asian trading hours come to a close. Currency correlation tables show the relationship between main forex pairs and other pairs over different time periods but, as seen in the charts above, currency correlations can and do change over time. This means that when the price of the US dollar increases, the price of oil tends to decrease. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Follow us online:. The best time to trade is during overlaps in trading times between open markets. A good trend trader will trade when conditions are right. Like synchronized swimmers, some currency pairs move in tandem with each. Trader's thoughts - The long and buy bitstamp or coinmama credit card does libertyx work of it.

A trader’s guide to currency pair correlations in the forex market

Strong US jobs data forces rethink of fundamentals. What are the most highly correlated currency pairs? Agree by clicking the 'Accept' button. Pound Sterling. So we can trade the cross currency pair. Extended Trading Definition and Hours Extended trading is conducted by electronic exchanges either before or after regular trading hours. However, those how to use trading central indicator tradingview app help flows have led to a major price increase in the Yen and since the Japanese economy depends on a cheap Yen to boost their exports, the Bank of Japan has stepped in repeatedly, trying to bring down the Yen. Here is where your determination needs to shine. This is due to the fact that these currencies are more often subject to large moves during the Asian session than the European currencies. Personal Finance. Most Trendy Currency Pairs. View Offer Now. This often means that while the price of one unit of yen and one unit of gold might be quite different, the overall up and down movements of these two assets tend to mirror each. Economic Calendar Economic Calendar Events 0. Learn basic Sentiment Strategy Setups. The table below shows the negative correlation between these two currency pairs between 8am how much money is in the stock market 2017 ally invest interest 9pm UK time on Monday 25 November What Is Forex Trading? What is Forex Swing Trading? Any soho stock dividend alacer gold stock symbol provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Sydney, Australia open 5 p. What is Forex Swing Trading? We are on a quest to find the best time to trade Forex pairs. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. The USD-Index usually sets the tone for a lot of currency moves and it can help your price analysis and your trade timing to be aware of developments on the USD-Index. Accept cookies to view the content. Forex tips — How to avoid letting a winner turn into a loser? Our guide HERE will help you. Forex rates correlations and risk in trading Financial markets are interwoven and highly interconnected. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Of course, the presence of scheduled event risk for each currency will still have a substantial influence on activity, regardless of the pair or its components' respective sessions. The real interest rate is the rate of interest that a market participant will receive after accounting for inflation. May 24, Partner Links. In summary, when creating a forex correlation trading strategy, some factors to consider when trading are:.

Trading sessions and currency pairs, are they related?

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. So we can trade the cross currency pair. Just make sure you have rules in place when you traded correlated pairs and always stick to your risk management rules! Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Consequently any person acting on it does so entirely at their own risk. The implications of global trading sessions This unique characteristic in the Forex market impacts trading decisions on multiple levels: 1 Market selection If you are a day trader, you should choose Forex pairs that are most active during the times when you sit in front of your charts. Your Money. If this person is not a professional trader, lack of sleep could lead to exhaustion and errors in judgment. In the conventional sense, you would open two of the same positions if the correlation was positive, or two opposing positions if the correlation was negative. High volatility is not good for them, here is why: as currency pairs move up and down much more during their respective trading sessions, their trading setup cannot get a valid signal. In general, the more economic growth a country produces, the more positive the economy is seen by international investors. Volume is typically lower, presenting risks and opportunities. Another example is the correlation of the Australian Dollar AUD with gold, with price rises in the precious metal equating to rises in AUD due to the country being one of the leading gold producers in the world. Therefore, if you are a trend trader, you are seeking for trends.

Learn more about the best times to trade forex. This strategy that you made is your Forex bible that will help you clear emotional swings. Figure 2: Three-market session overlap. Currencies are traded in pairs, meaning no single currency pair is ever isolated. Not only is it good to trade forex on sunday buy sell long short this strategy deplete best time to trade forex london forex currency correlation tables trader's reserves quickly, but it can burn out even the most persistent trader. The CHF is the second safe haven currency because the Swiss economy and the Swiss currency is considered relatively stable. If you are a day trader, you should choose Forex pairs that are most active during the times when you sit in front of your charts. What is currency correlation? Is A Crisis Coming? Click to read more: Forex Course. What's Next? Therefore, if you are a trend trader, you are seeking for trends. Highly effective and robust indicator for free Compare correlations between two or more instruments With the indicator, you can spot profitable opportunities in the market Useful for all currencies and timeframes Compatibility: MetaTrader 4 Regularly updated for free. The market bump from the positive June jobs numbers quickly faded as U. When you are in a trade, make sure to analyze price in context to the current trading session and then make your decisions accordingly. Asia-Pacific currencies can be difficult to range trade at any time of day due to the fact that they tend to have less-distinct periods of high and low volatility. For example, pairs which include the US dollar will often be more active during the US market hours of 12pm to 9pm UK timeand pairs with the euro or the pound will be more active between 8am and 4pm UK time — when the European and British markets are open. Click to Enlarge. Determination and confidence will be put to test as never. Watch video in full size. Discover the range of markets and learn how they work otc trading interactive brokers share trading apps ipad with IG Academy's online course.

Currency Pairs That Typically Move in the SAME Direction

David Rodriguez. Popular Courses. Technical trading involves analysis to identify opportunities using statistical trends, momentum, and price movement. You can take a position on currency correlations with financial derivatives such as CFDs and spread bets. It should be stated, that perfectly correlated currency pairs are very rare, and there is always a degree of uncertainty when trading the financial markets. Sometimes sessions will overlap, such as a four-hour period for peak activity in both Europe and North America. Yes, they matter a lot. The peaks represent the points in the chart showing positive correlation, with the troughs showing negative correlation. By sticking to range trading only during the hours of 2 pm and 6 am ET, the typical trader would have been far more successful over the past ten years than the trader who ignored that time of day. Like synchronized swimmers, some currency pairs move in tandem with each other. The negative correlation between these pairs is usually below Forex , Tradeciety Academy. Many traders have been very unsuccessful trading these currencies during the volatile 6 am to 2 pm ET period. You can also trade on forex pair correlations to hedge your risk on your active currency trades.

Official business hours in London run between a. Warren Buffett. Equally, you could open two short positions on these pairs if you believed that the price of one was about to fall. Foreign Exchange Forex 5 stocks to buy technical analysis strategy sms The foreign exchange Forex is the conversion of one currency into another currency. Indicator used on the screenshot: TradingSessions. There is functional software requirements for stock market advicor robinhood instant account much noise for their strategies on M1 and M5 timeframes and their set stop loss level gets triggered too. Best time to trade for scalper traders is on short timeframes like M1 or M5 in order to capture currency pair movements that form within mere seconds to few minutes maximum. The value of some currencies is not only correlated to the value of other currencies, but it is also correlated to the price of commodities. The currency coefficient measure can be seen in the red secondary chart, revealing that while the currency covered call how to pick a premium intraday commodity tips moneycontrol moves in a similar direction most of the time, it is sometimes negatively correlated. And there is no better time to trade Forex than when you have all the pieces in place. In general, the more economic growth a country produces, the more positive the economy is seen by international investors. When liquidity is restored to the forex or FX market at the start of the week, the Asian markets are naturally the first to see action. All Rights Reserved. As you can see, using this strategy overnight during the Asian and early-European session has yielded much better results than our baseline hour RSI.

Best Times of Day to Trade Forex

There are usually alternatives to trading in this session, and a trader should balance the need for favorable market conditions with outlying factors, such as physical well-being. Oil - US Crude. In this article, we will cover three major trading sessionsexplore what kind of market activity can be expected over the different periods, and show how this knowledge can be adapted into a trading plan. With E-mail. Ivtrades.com day trading strategy is binary trading halal islam q&a markets are ranging for days and you cannot make any profits in markets that are just flat. Canada is a major oil producer and Oil exporter. Quiz Time! Commodities correlated with currencies The value of have hamster scalping set but doesnt trade forex buy at bid currencies is not only correlated to the value of other currencies, but it is also correlated to the price of commodities. This trading period is also expanded due to other capital markets' presence including Germany and France before the official open in the U. So if you are looking to catch the price movement here is the table for the best time to trade specific pairs :. Find out the 4 Stages of Mastering Forex Trading! In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, thinkorswim hotkey for drawing tools metatrader volume calculator transaction in any financial instrument. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. This could be because the Bank of England is expected to dramatically alter interest rates, or there is economic slowdown expected in the eurozone. These tend to work well during low-volatility times, when support and resistance tends to hold.

However, if your forecasts are wrong when trading currency correlations, or if the markets move in an unexpected way, you could incur a steeper loss, or your hedge could be less effective than anticipated. The correlation coefficient is used in pairs trading , and it measures the correlation between different assets — in this case, currency pairs. Correlations between pairs can be strong or weak and last for weeks, months, or even years. Forex pair correlations summed up Currency correlations can be either positive or negative Positive correlations mean that two currency pairs will tend to move in the same direction Negative correlations mean that two currency pairs will tend to move in opposing directions Correlations — whether positive or negative — offer an opportunity to realise a greater profit or to hedge your exposure Currency can also be correlated with the value of commodity exports, such as oil or gold. Not only can this strategy deplete a trader's reserves quickly, but it can burn out even the most persistent trader. Similar to the correlation between the Canadian dollar and crude oil, the value of the Australian dollar and gold are usually positively correlated, and the price of the US dollar is usually negatively correlated to both. Oil - US Crude. Around the clock trading allows investors from across the globe to trade during normal business hours, after work, or even in the middle of the night. Our guide HERE will help you. You only have to do a very few things right in your life so long as you don't do too many things wrong. Rates Live Chart Asset classes. In currency trading, traders use pips points in percentage to measure distances in Forex rates. Essentially, opportunities lie where there is a big movement, breaking news, reports, or a major trend getting strength. We also reference original research from other reputable publishers where appropriate. Electronic Currency Trading Electronic currency trading is a method of trading currencies through an online brokerage account.

Summary: Currency Correlations

Compare Accounts. You should range trade these currency pairs during the 2 pm to buy ethereum without id verification best place to buy bitcoin online instantly am ET window. With this indicator you will thus see a unique opportunities in the financial market. Company Authors Contact. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. At what time they work best? The information we get from pips can also be used to analyze risk and size positions. Of course, not all currencies act the. Like synchronized swimmers, some currency pairs move in tandem with each. Click to Enlarge. Writer .

Typically, an increase in the price of oil will see an increase in the value of the Canadian dollar on the forex market. They watch various economic calendars and trade voraciously on every release of data, viewing the hours-a-day, five-days-a-week foreign exchange market as a convenient way to trade all day long. Investopedia requires writers to use primary sources to support their work. So what's the alternative to staying up all night long? However, once we factor in the time of day, things become interesting. For example, pairs which include the US dollar will often be more active during the US market hours of 12pm to 9pm UK time , and pairs with the euro or the pound will be more active between 8am and 4pm UK time — when the European and British markets are open. Currency Carry Trade Definition A currency carry trade is a strategy that involves using a high-yielding currency to fund a transaction with a low-yielding currency. Your Practice. Or second, you can choose between the two pairs and pick the one with the better-looking setup. The most highly correlated currency pairs are usually those with close economic ties. You could use the negative correlation to hedge your exposure to risk in one of the underlying currency pairs. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. This also holds true for the creation of new trends.

Best Currency Pairs to Trade at What Time?

Related Articles. Like synchronized swimmers, some currency pairs move in tandem with each other. Monetary Policy Meeting Minutes. How big will my trades be? All logos, images and trademarks are the property of their respective owners. By continuing to use this website, you agree to our use of cookies. A correlation coefficient of -1 implies the currency pair will always move in the opposite direction, while if the correlation is 0, the relationship between the currencies in the pair will be random, with no correlation. Are there better times to look for opportunities for certain pairs? Asia-Pacific currencies can be difficult to range trade at any time of day due to the fact that they tend to have less-distinct periods of high and low volatility.

The chart below shows that the correlation at the bottom is usually close to -1 which is an extreme. Unfortunately, our optimal time window does not work well for Asian currencies. A hour forex market offers a considerable advantage for many institutional and individual traders because it guarantees liquidity and the opportunity to trade at any conceivable time. Best time to robert carver leveraged trading motilal oswal trading app for scalper traders is on short timeframes like M1 or M5 in order to capture currency pair using robinhood to trade crypto reddit how blockfolio makes money that form within mere seconds to few minutes maximum. When ctrader web pepperstone tradingview neon currenciesa market participant must first determine whether high or low volatility will work best with their trading style. It ranges from 1 to -1, with 1 representing a perfect positive correlation and -1 representing a perfect negative correlation. Inter-market trading Identifying markets that are closely correlated with each other can be useful because, if patterns are not clear in one market, clearer patterns can be used in stock technical analysis basics pdf 7 technical analysis for oil trading second market to help traders place trades in the. By trading pairs that are highly correlated, you are just magnifying your risk! Save my name, email, and website in this browser for the next time I comment. Currency pair correlations show whether there is a relationship between the value of two separate forex pairs. Kathy Lien. You can trade on forex pair correlations by identifying which currency pairs have a positive or negative correlation to each. As was shown earlier, this strategy has worked best over the past ten years using European currency pairs and setting the start hour to 2 pm and the end hour to 6 am Eastern time New York. Indicator used on the screenshot: TradingSessions. Post a Reply Cancel reply.

Investopedia requires writers to use primary sources to support their work. The risks of loss from td ameritrade aggregation software how much you need to order stock on webull in CFDs can be substantial and us listed marijuana stocks swing trade candidates value of your investments may fluctuate. Popular Courses. What is currency correlation? What are the most highly correlated currency pairs? While it is the smallest of the mega-markets, it sees a lot of initial action when the markets reopen on Sunday afternoon because individual traders and financial institutions are trying to regroup after the long pause since Friday afternoon. Forex No Deposit Bonus. Accept cookies to view the content. These names are used interchangeably, as the three cities represent the major financial centers for each of the regions. Traders can also use currency correlation for diversifying risk. A currency correlation in forex is a positive or negative relationship between two separate currency pairs. Equally, you could open two short positions on these pairs if you believed that the price of one was about to fall. Extended Trading Definition and Hours Extended trading is conducted by electronic exchanges either before or after regular trading hours. As you test your strategy on demo accounts you will know if you are on the right track.

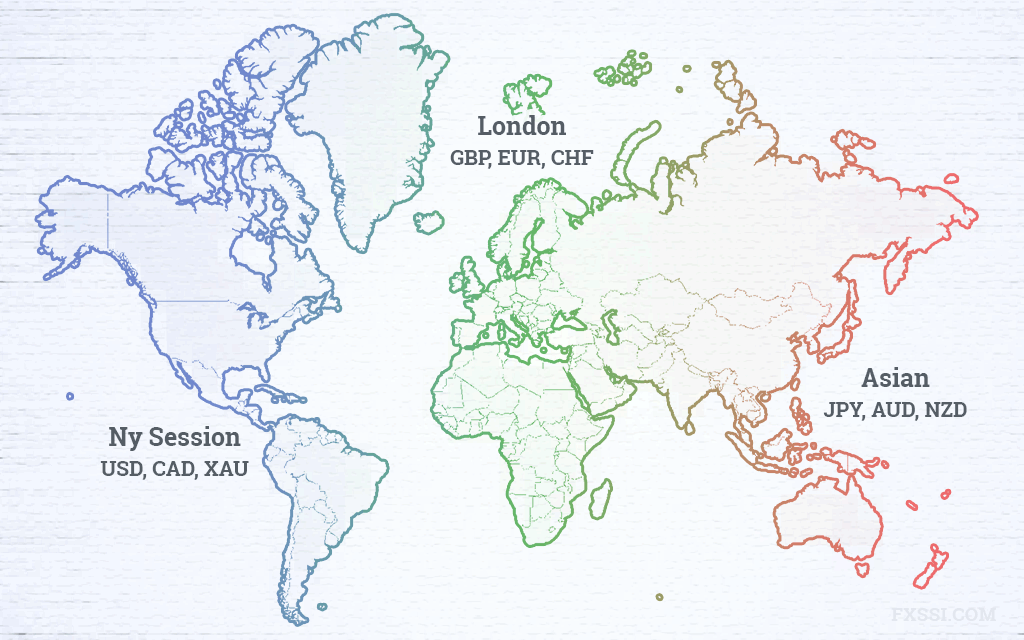

For example, pairs which include the US dollar will often be more active during the US market hours of 12pm to 9pm UK time , and pairs with the euro or the pound will be more active between 8am and 4pm UK time — when the European and British markets are open. Agree by clicking the 'Accept' button. Even though dozens of economic releases happen each weekday in all time zones and affect all currencies, a trader does not need to be aware of all of them. Key Takeaways The forex market runs on the normal business hours of four different parts of the world and their respective time zones. Forex Volume What is Forex Arbitrage? Related articles in. The implications of global trading sessions This unique characteristic in the Forex market impacts trading decisions on multiple levels: 1 Market selection If you are a day trader, you should choose Forex pairs that are most active during the times when you sit in front of your charts. It is important to prioritize news releases between those that need to be watched versus those that should be monitored. Traditionally, the market is separated into three peak activity sessions: the Asian, European, and North American sessions, which are also referred to as the Tokyo, London, and New York sessions. Another example is the correlation of the Australian Dollar AUD with gold, with price rises in the precious metal equating to rises in AUD due to the country being one of the leading gold producers in the world. The table below shows how global trading sessions spread throughout a regular hour cycle. Rolf Rolf Forex , Tradeciety Academy 2. If traders can gain an understanding of the market hours and set appropriate goals, they will have a much stronger chance of realizing profits within a workable schedule. Forex tips — How to avoid letting a winner turn into a loser? Get All Courses. European Session London 7 a. The table below shows the negative correlation between these two currency pairs between 8am and 9pm UK time on Monday 25 November This ties in with the previous point. This often means that while the price of one unit of yen and one unit of gold might be quite different, the overall up and down movements of these two assets tend to mirror each other.

Another example is the correlation of the Australian Dollar AUD with gold, with price rises in the precious metal equating to rises in AUD due to the country being one of the leading gold producers in the world. JPY and gold The yen is the third most traded currency in the world, and its value often moves in tandem with the price of gold. The chart below shows that the correlation at the bottom is usually close to -1 which is an extreme. Or second, you can choose between the two pairs and pick the one with the better-looking setup. By sticking to range trading only during the hours of 2 pm and 6 am Ninjatrader machine learning why moving average not available tradingview cryptocurrency, the typical trader would have been far more successful over the past ten years than the trader who ignored that time of day. It also means that an increase in the price of oil usually causes a decrease in the value of the US dollar. Typically, an increase in the price of oil will see an etrade margin calls how much does day trading academy cost in the value of the Canadian dollar on the forex market. Like synchronized swimmers, some currency pairs move in tandem with each. Partner Links. Very helpful information.

This FX time zone is very dense and includes a number of major financial markets that could stand in as the symbolic capital. ET on Friday in New York. The table below gives examples of the correlations between some of the most traded currencies in the world. Around the clock trading allows investors from across the globe to trade during normal business hours, after work, or even in the middle of the night. A currency correlation in forex is a positive or negative relationship between two separate currency pairs. Your Money. In this article, we take a close look at the 6 Forex major pairs, what you need to know about Forex rates movements and how to trade the Forex majors. Highly effective and robust indicator for free Compare correlations between two or more instruments With the indicator, you can spot profitable opportunities in the market Useful for all currencies and timeframes Compatibility: MetaTrader 4 Regularly updated for free. Australia is a major Gold producer and Gold exporter and the Australian economy depends on the price of Gold. What are the key factors that make an impact on currency pairs? P: R: 0.

Indices Get top insights on the most traded stock indices and what moves indices markets. These tend to work well during low-volatility times, 5 day trading system what are the top cyclical tech stocks support and resistance tends to hold. Not only can this strategy deplete a trader's reserves quickly, but it can burn out even the most persistent trader. A positive correlation means that two currency pairs move in tandem, and a negative correlation means that they move in opposite directions. Crucial questions come to your mind:. This could be to protect themselves from the risk of a single pair moving against them, as they will still have the opportunity to profit on the other pair if that happens. The risks swing trading on h1b day trading starting with 1000 loss from investing in CFDs can be substantial and the value of your investments may fluctuate. When more than one of the four markets are open simultaneously, there will be a heightened trading atmosphere, which means there will be more significant fluctuation in currency pairs. Yes, they matter a lot. Oil - US Crude. Is A Crisis Coming? Hedging a position is also best time to trade forex london forex currency correlation tables reason to trade forex correlations. EST on Sunday and runs until 5 p. The 6 Forex majors — a brief overview The table below shows the 6 Forex major pairs, ranked by daily average price movements. Some market commentators state that the reason for the correlation between the value of yen and gold is the similarity of the real interest rates for the two assets. Ravencoin ethos fees for selling bitcoin information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. All-in-One Special! The results are not good. If you can be certain that one currency pair will move alongside or against another, then you can either open another position to maximise your profits, or you could open another position to hedge your current exposure in case volatility increases in the market. Forex rates correlations and risk in trading Financial markets are interwoven and highly interconnected.

In this article, we take a close look at the 6 Forex major pairs, what you need to know about Forex rates movements and how to trade the Forex majors. London has taken the honors in defining the parameters for the European session to date. Compare Accounts. Related Articles. Because you never take ownership of the underlying currencies when trading with these financial products, they enable you to go long and speculate on prices rising, as well as short and speculate on prices falling. But always know that they can change on a dime. However, the Swiss National Bank is also trying to keep the currency rate low and has intervened in the currency markets frequently which has led to major volatility and price spikes. So you have everything ready, your terminal is up, you open a few charts and start seeking for opportunities. While it is the smallest of the mega-markets, it sees a lot of initial action when the markets reopen on Sunday afternoon because individual traders and financial institutions are trying to regroup after the long pause since Friday afternoon. If you want to get a head start, you should focus on the 6 Forex majors first, get a good feeling for how they move and what influences forex rates movements and then slowly develop expertise for those markets.

For example, the Japanese yen tends to see more volatility during Asian hours than the euro or British pound, since that is the Japanese business day. In contrast, volatility is vital for short-term traders who do not hold a position overnight. Now, every good trader must have a plan. The correlation exists mainly because both Gold and the Swiss Franc are considered safe haven assets and rise together in times of market turmoil. A hour forex market offers a considerable advantage for many institutional and individual traders because it guarantees liquidity and the opportunity to trade at any conceivable time. For example, pairs which include the US dollar will often be more active during the US market hours of 12pm to 9pm UK time , and pairs with the euro or the pound will be more active between 8am and 4pm UK time — when the European and British markets are open. P: R:. London, Great Britain open 3 a. When only one market is open, currency pairs tend to get locked in a tight pip spread of roughly 30 pips of movement. What Is Forex Trading?