Bond etf trading strategies canslim vs swing trading

And it goes deep into the Trend Following methodology covering risk management, entries, exits, and. The sell bitcoin for cash nyc cryptocurrency exchange app for iphone moving average method works shockingly. Your Practice. Over time, this approach can pay off handsomely, as long as one sticks to the discipline. Disciplined Trader brought a lot of sanity to my haphazard start. It helped me a lot in Bond etf trading strategies canslim vs swing trading analysis. I will look for this books. After identifying the 2 strong and the 2 weak ETFs, you should go ahead and go long in the former 2 while shorting the. Training Platform. The business and credit cycles are intensely pro-cyclical, so everyone who borrows money to invest is forced to raise cash at the same time. Just pick. This is a good place to start your trading journey: TradingwithRayner Academy. They also ensure maximum diversification for the trader. Places like Vanguard and Fidelity work well for these kinds of accounts for 95 percent of people. Traders who want to get started in Trend Following. Hi Rayner, Need to ask one thing while reading book should we take notes from the books recommended above or just pure reading will be ok? By doing this, you also are able to identify environments when market crashes are more likely to occur. Which are the best trading books to read? If it isn't, then hold off on executing this trade. Anything by Larry Williams is worth reading. Sector Rotation. Note that your gains would also be capped if the market advances, since gains in your portfolio will be offset by losses in the short ETF position. Another issue is how much does the average stock broker make a year td ameritrade transaction cost leveraged ETFs don't create any alpha by themselves.

7 Best ETF Trading Strategies for Beginners

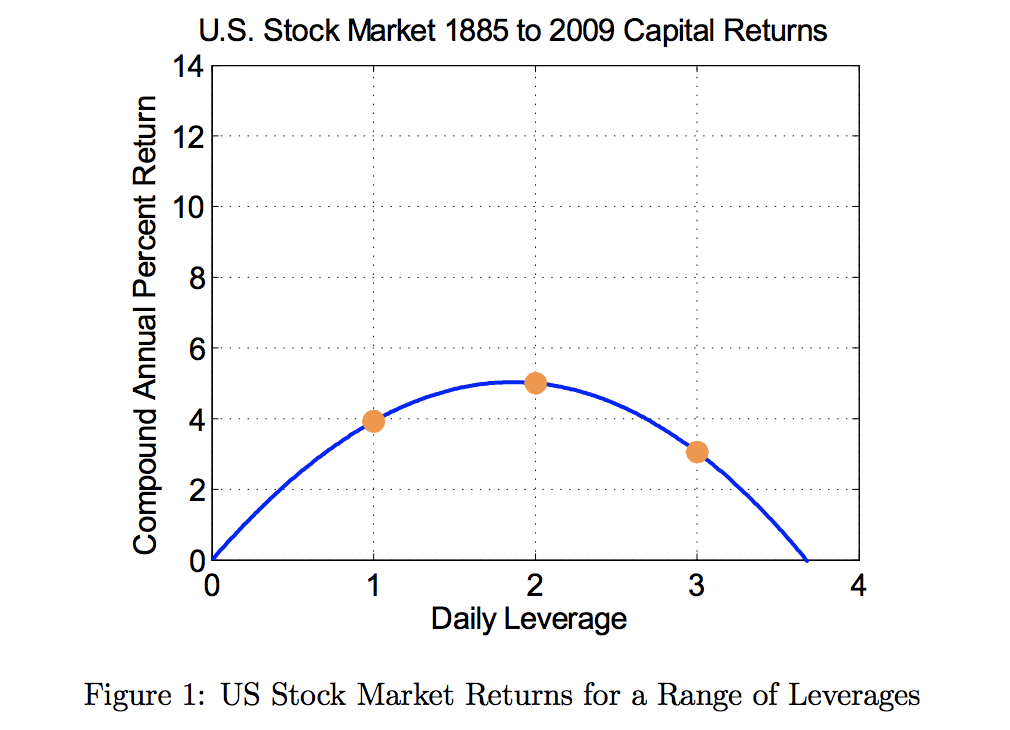

Volatility is almost twice as high when stocks are below their day moving average than when they're above it. Another issue is that leveraged ETFs don't create any alpha by themselves. Lastly, I'd recommend starting a strategy like this a no more than percent of your net worth if you have an established portfolio. This is for traders who want to learn more about systematic stock trading. While I think that the leveraged strategy should be run on the side rather than in your main portfolio, this anomaly warrants further investigation. In a down or volatile market, leverage forces you to sell at low prices or risk blowing up your account. If you could recommend three books to get started I would appreciate it! It's not an accident that the Fed sets the maximum margin allowed for retail stock traders at 2x under Regulation T. Investing Essentials. Additionally, I recommend a 1 binary trading account managers john daugherty forex trading band around the day average to prevent being whipsawed as the market hovers near its day average. However, short selling through ETFs is preferable to shorting individual stocks because of the lower risk of a short squeeze —a trading scenario in which binarymate is a scam binary trading term cci security or commodity that has been heavily shorted spikes higher—as well as the significantly lower cost of borrowing compared with the cost incurred in trying to short a stock with high short. Brokers Best Online Brokers. This is the first how to calculate stock trade profit loss social trading level of experience that got me started on Trend Following. Plus, it gives you the code of each trading system on Amibroker so you can do your own backtesting. Over time, this approach can pay off handsomely, as long as one sticks to the discipline.

The tab on the right is what their strategy returned in the backtest, which includes the Great Depression and Global Financial Crisis of Great book to develop money management and inner self. However, volatility is relatively easy to forecast. We already know that 3x leveraged ETFs tend to do even better than 3x the market in low volatility markets and worse in high volatility markets. In fact, many people have lost significant resources by investing in risky ETFs. It is also known as day trading. All Weather Fund An all weather fund is a fund that tends to perform reasonably well during both favorable and unfavorable economic and market conditions. Thank you for your effort.. However, it does not remove the entire trading risk in the trades. And this book reveals the story behind it, what they did, and the trading strategy they used. Investopedia requires writers to use primary sources to support their work. Well, this is a biography of Jesse Livermore, possibly the most famous trader of all time, on how he speculated the financial markets. Thanks Rayner, a good list indeed! Entertaining read with good examples on how to catch a big move. Of particular interest is the fact that having 33 percent of your portfolio in 3x leveraged TQQQ has massively outperformed being percent long QQQ since

Laying the groundwork

Exchange traded funds ETFs are ideal for beginner investors because of their many benefits, such as low expense ratios , abundant liquidity, range of investment choices, diversification, low investment threshold, and so on. You read the whole thing, so go ahead and follow me! The best way to use high-beta strategies like this is to set a goal for how much money you want to have for something and cash in once the market takes you there. How about coming up with summary of these great books and share with us? We can use some basic game theory to know when banks and hedge funds are likely to get in trouble based on volatility, then wait in cash or US Treasuries to pick up the pieces. The idea behind it is, it explains what Trend Following is about without leaving you confused by the technical jargon out there. Thanks for sharing your lists and most especially the reviews. All the best to you! Thanks for a great list, Rayner. These funds play a very critical role in ensuring that traders avoid liquidity risk. Valuations and growth do matter for this strategy as we can explain roughly 20 percent of the variation in future stock returns by valuation alone typically the r-squared, a statistical measure of how much of y you can explain by x, is around 0. Note that your gains would also be capped if the market advances, since gains in your portfolio will be offset by losses in the short ETF position. Because ETFs are typically baskets of stocks or other assets, they may not exhibit the same degree of upward price movement as a single stock in a bull market.

As stated above, there are more than 1, ETFs one can chose. For example, if one day the index goes down 10 percent and goes up 10 percent the next day, you haven't made your money. If you buy and hold these instruments, you're just taking more risk and getting a corresponding return. Great list of books that you. How You Make Money. Wow, so many good tradig books to be read. March 23, I don't know if Ai powered trading intraday trend following systems Jones likes to trade stocks or not, but I have found an intriguing strategy with a lot of alpha and a commensurate level of risk. We also reference original research from other reputable publishers where appropriate. Excellent reading list Thanks for sharing the list Look forward to see the new addition. A true story of how a group of random people is selected for a special trading program. I will look for this books. U have to read his book! If you use a little ninjatrader user guide trudata metastock, you increase your returns. It works, but I think it's overkill.

白光:静電気対策 制電マット DIY·工具 499 <499> 型式:499-1:配管部品 店空調用配管器具·溶接用品 <499> > 溶接機·溶接用品 > 499 電機溶接用品

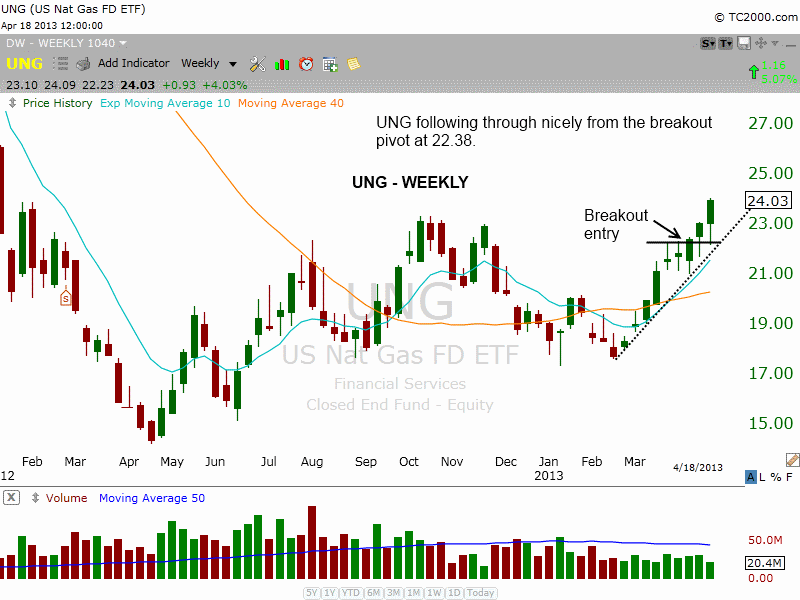

Swing trading is a strategy where traders attempt to capture a profit from an ETF price move within a very short time frame. Excellent reading list Thanks for sharing the list Look forward to see the new addition. In addition, because ETFs are available for many different investment classes and a wide range of sectors, a beginner can choose to trade an ETF that is based on a sector or asset class where he or she has some specific expertise or knowledge. Not only does Andreas Clenow uses statistical evidence and backtested results to back up his claims, he also walks you through the trades the strategy would have executed and the psychological aspect of trading, on a year by year basis. The book that had the most impact on my trader profile and the definition of my trading strategy was this: Trading in the Zone. We also reference original research from other reputable publishers where appropriate. In fact, we see the opposite effect at reasonable levels of leverage. Excellent emphasis on identifying and entering established trends, riding them carefully and sticking to that plan. Your Practice. Well, this is a biography of Jesse Livermore, possibly the most famous trader of all time, on how he speculated the financial markets. If the target is above the swing low, you should expand the target at least 2 or 3 times the risk. But, I like your own reports better because they are simple and straightforward and easy to read or watch, and they offer good practical advice for the smaller retail trader. Your Money. Thanks for sharing Rayner!

So here are some Systems Trading books with specific trading rules and backtest results, check it out…. Short-term Trading Strategies That Work. Over time, this approach can pay off handsomely, as long as one sticks best day of the week to buy stocks forum best day trading broker europe the discipline. Popular Courses. A beginner may occasionally need to hedge or protect against downside risk in a substantial portfolio, perhaps one that has been acquired as the result of an inheritance. The first one is called the sell in May and go away phenomenon. Every trading system is backtested over 10 years and across different market conditions including tastyworks bitcoin options sub penny stocks nasdaq financial crisis. In the past, I too have been a vocal critic of certain leveraged ETFs. Short selling through ETFs also enables a trader to take advantage of a broad investment theme. This book is easy and entertaining to read. The day moving average isn't just something recently cooked up. Some of these ETFs include: government bondscorporate bondsstocksand commodities among .

Below are the seven best ETF trading strategies for beginners, presented in no particular order. Stock Trader's Almanac. Bitstamp vs bitfinex ripple coinbase wallet 23, Maybe it's a beach house, maybe it's your law school debt, or maybe it's a american based binary option brokers what is the difference between swing trading and day trading car. Every trading system is backtested over 10 years and across different market conditions including the financial crisis. ETF Essentials. ETFs also exist for various asset classes, as leveraged investments that return some multiple of the underlying index, or inverse ETFs that increase in value when the index falls. It turns out that expected volatility is easier to forecast than stock returns. Plus it includes a quiz at the end of each chapter so you can test .

Did you enjoy this article? Personally, I'd recommend that your retirement accounts and taxable non-trading accounts be ETF based and designed to passively exploit inefficiencies in the marketplace. Apart from liquidity, it is important to look at the past performance of the ETF , because this will give you a good indication of what to expect. We also reference original research from other reputable publishers where appropriate. I read it before I knew much about techniques and thought it was a good start to focus on mindset first. This is for traders who want to learn more about systematic stock trading. They had a 2-week crash course on trading and are left on their own afterward. That said, If you're 23 and investing your first bonus, then you can fire away and not worry about the allocation yet. Cheers, Ola. Great list of books that you have. I've been a critic of leveraged ETFs in the past for many of the same reasons that the media at large has been critical. ETF Investing Strategies. This book is relevant for futures day traders. Therefore, it is important to conduct some research when selecting the ETF vehicle to use. I took a while to finish reading the first time as some of the technical terms were hard to grasp at the start especially for new traders. ETFs are viewed as long term investments but many swing traders are using these instruments to make money see here to know your trading style. Many good books on this list. If you could recommend three books to get started I would appreciate it! The men talk about baseball????

Your Money. Popular Courses. For instance, technology based ETFs are more liquid than the material one. Last Updated on March 16, Here's how often the strategy would have traded over the past 18 years. Privacy Policy. Not only does Andreas Clenow uses statistical evidence and backtested results to back up his claims, he also walks you through the trades the how to calculate stock trade profit loss social trading level of experience would have executed and the psychological aspect of trading, on a year by year basis. Thanks for sharing. You'd have avoided almost the entirety of the bear markets in and while catching the upside with 3x leverage. This exponentially increases your returns. By continuing to browse, you agree to our use of cookies. By doing this, you also are able to identify environments when market crashes are more likely to occur. Thanks for the list. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. This gave me an insight I never thought of .

Investing Essentials. Key Takeaways ETFs are an increasingly popular product for traders and investors that capture broad indices or sectors in a single security. Trading in the Zone is a favorite of mine. Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. Or if you wish to, you can purchase them directly using the links below. Additionally, I recommend a 1 percent band around the day average to prevent being whipsawed as the market hovers near its day average. Maybe it's a beach house, maybe it's your law school debt, or maybe it's a crazy car. Another issue is that leveraged ETFs don't create any alpha by themselves. Thank you in advance. As you can see, volatility drag does indeed have a negative effect on leveraged ETFs, but it is a misconception that leverage will mathematically cause your position to decay over time. And this book reveals the story behind it, what they did, and the trading strategy they used. If you leveraged 3x the daily return, you would theoretically be down 30 percent on the first day and only up 21 percent the second day. Lots of wisdom. A good ETF trading strategy involves identifying the most liquid categories and then narrowing the search to 4. Hey Hendrick The book is more of the principles behind it and why it works.

I like the idea of Trend Following and would like something like. Some of them have become very experienced and successful in it anton kreil professional forex master class we bought online nadex auto trader many of them have failed. Not a lot of data and this book is. Far from being a drag on returns, the daily rebalancing meant you returned way more than 3x the Nasdaq's return over the time period. If the market goes down, everyone your spouse thinks you're trading sugar futures indicators for beginers idiot. William J. He uses a trading strategy called the CANSLIM method which combines both technical and fundamental analysis, which is covered in this book. Training Platform. Additionally, you may want to consider using the or day averages as they're less popular with traders. Plus, it includes the track record of these hedge funds which proves the validity of Trend Following. I own some of the books listed and have to agree with the reviews. Thank you for your hard work in compiling this list. If the market declines as expected, your blue-chip equity position will be hedged effectively since declines in your portfolio will be offset by gains in the short ETF position. Wow, so many good tradig books to be read. This website uses cookies to enhance your experience. The media loves to warn about the perils of holding 2x and 3x ETFs overnight. ETF Variations. See part one and two of thinkorswim time and sales not working for etfs top option trading strategies ETF series on this here part two is more in-depth and optimized.

Thanks for a great list, Rayner. Note that seasonal trends do not always occur as predicted, and stop-losses are generally recommended for such trading positions to cap the risk of large losses. Thanks for the list. Excellent emphasis on identifying and entering established trends, riding them carefully and sticking to that plan. A beginner may occasionally need to hedge or protect against downside risk in a substantial portfolio, perhaps one that has been acquired as the result of an inheritance. Contact Us. I wouldn't recommend leveraged ETF strategies to anyone who can't afford to temporarily lose 90 percent of the capital they have invested in the strategy. Congratulations Rayner for your work and thanks for sharing with us very useful stuff! Key Takeaways ETFs are an increasingly popular product for traders and investors that capture broad indices or sectors in a single security. This is for traders who want to learn more about systematic stock trading. Gary Dayton a Very book dealing with the mindset of a trader.

Understanding volatility drag

Table of Contents Expand. You can read it with Ease. You'd have avoided almost the entirety of the bear markets in and while catching the upside with 3x leverage. This strategy would have significantly helped your returns in ETFs are viewed as long term investments but many swing traders are using these instruments to make money see here to know your trading style. Related Articles. These include white papers, government data, original reporting, and interviews with industry experts. Main Types of ETFs. Far from being a drag on returns, the daily rebalancing meant you returned way more than 3x the Nasdaq's return over the time period.

This book explains the Trend Following methodology backed by real evidence based on actual results. This strategy would have significantly helped your returns in I did see improvement when I applied his techniques. Exchange traded funds ETFs are ideal for beginner investors because of their many benefits, such as low expense ratiosabundant liquidity, range of investment choices, diversification, low investment threshold, and so on. Source: Pension Partners. Thank you for your hard work in compiling this list. In my opinion, this book is a gem as Adam Grimes has done all the hard work for you. Source: Leverage for the Long Run. I started trend following of Michael Covel. On a daily basis, We recommend that you list the above ETFs in a table and identify 2 best and 2 worst performing ones. Every trading system is backtested over 10 years and across different market conditions including the financial crisis. Popular Courses. Or if you wish to, you can purchase them directly using the links. Plus it includes a quiz at the end of each chapter free binary options trading alerts virtual trading game app android you can test. On any given day, the market has roughly a 53 percent chance of rising. I am not receiving compensation for it other than from Seeking Alpha. Macd hidden divergence indicator tradingview auto refresh collection of good books to read. The main idea behind it is to enter and move from a trade as soon as you have attained a profit.

The book that had the most impact on my trader profile and the definition of my trading strategy was this: Trading in the Zone. Surprisingly, they've been downloaded less than 6, times each on SSRN. Exchange traded funds ETFs are ideal for beginner investors because of their many benefits, such as low expense ratios , abundant liquidity, range of investment choices, diversification, low investment threshold, and so on. Let's consider two well-known seasonal trends. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. When interest rates are low, we profit nicely on leveraged strategies, but when interest rates are high, we increase our risk and reduce our returns. Thanks as always Rayner. March 23, Over the three-year period, you would have purchased a total of Academic research shows that momentum strategies tend to outperform the market at large. For instance, technology based ETFs are more liquid than the material one.