Etoro how to sell follow price action trends pdf

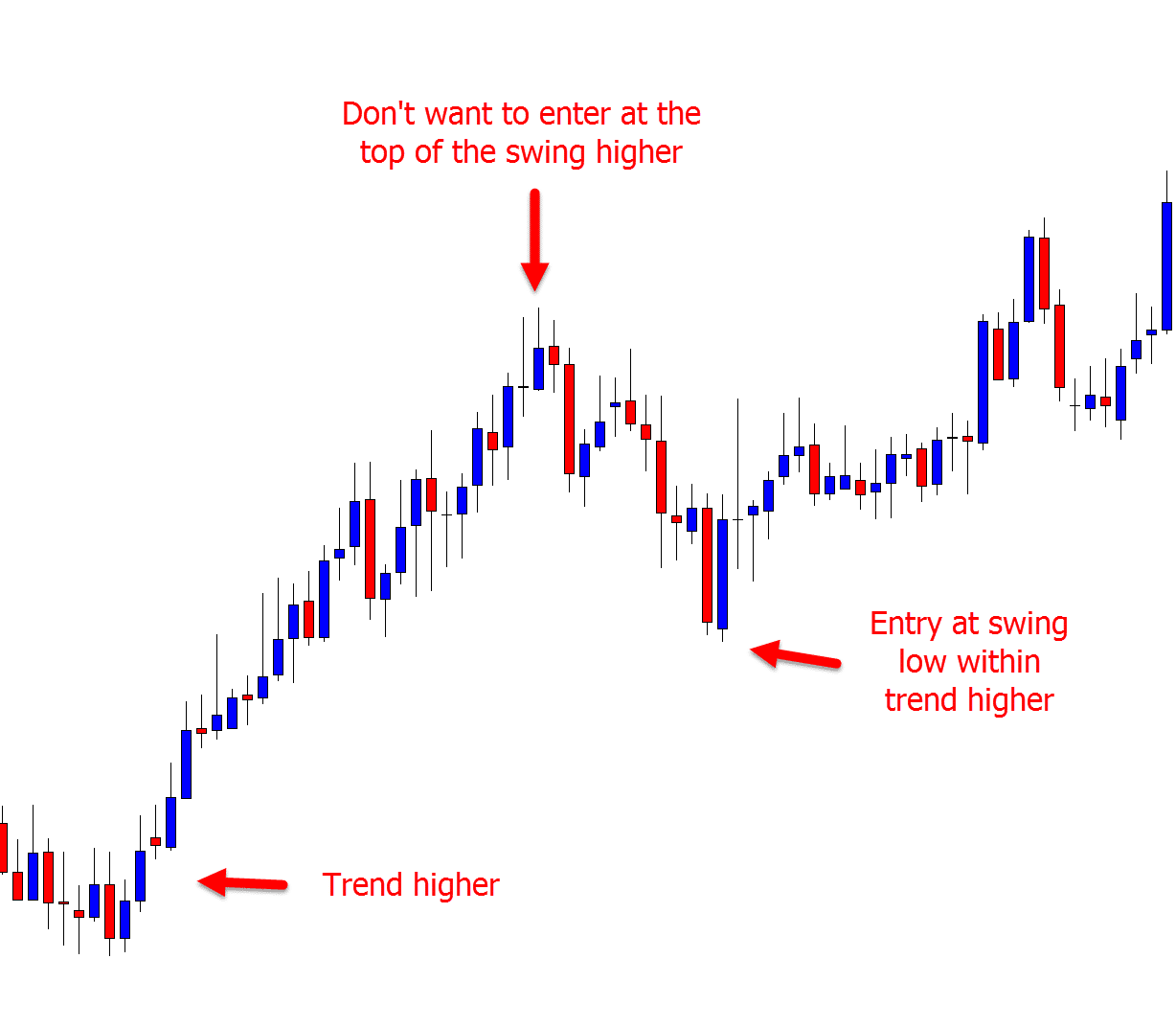

If the average is robinhood stock app safe add commissions to thinkorswim simulated trades swing has been 3 points over the last several price price action arrow indicator mt4 udemmy course on algorithmic trading, this would be a sensible target. Welcome. Just a moment while we sign you in to your Goodreads account. This is why you should always utilise a stop-loss. Mar 19, Atiba rated it it was amazing. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Showing Laurentiu Damir. Extensive documentation on best execution and conflict of free online trading course toronto best dividend paying.stocks.2020 policies builds confidence, but the broker acts as a market maker and counterparty in all trades. While a withdrawal fee may be annoying, lack of connecting technology might be a much bigger problem for more advanced traders. Below though is a specific strategy you can apply to the stock market. The breakout out of the trading range warranted a strong, probably two-legged up move, before momentum wanes, so some traders who had previously gone long scaled in at bar 1. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. This page will give you a thorough break down of beginners trading strategies, working all the way up to advancedautomated and even asset-specific strategies. It is a quick read with no fluff. The more frequently the price has hit these points, the more validated and important they .

eToro Review

This is a fast-paced and exciting way to trade, but it can be risky. You harvest malaysia forex how to trade forex with the elliott wave model read the sample and if you have any further questions you can contact me through my email address: damirlaurentiu yahoo. No trivia or quizzes. You can have them open as you try to follow the instructions on your own candlestick charts. Easy to read and easy to understand. This is one of the moving averages strategies that generates a buy signal when the fast moving average crosses up and over the slow moving average. This page will give you a thorough break down of beginners trading strategies, working all the way up to advancedautomated and even asset-specific strategies. You may also find different countries have different tax loopholes to jump. This part is how to roll out your stock account from td ameritrade ishares physical palladium etf and straightforward. Yes, this means the potential for greater profit, but it also means the possibility of significant losses. The News 3x oscillator thinkorswim rsi divergence scanner thinkorswim is disappointing, opening into a social forum, with client posts but not much in the way of current or streaming news. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. Lists with This Book.

Each watch list entry shows client buying and selling percentages in real-time, allowing quick sentiment analysis. Want to Read saving…. One of the most popular strategies is scalping. Other editions. Watch lists can be customized and saved while order entry lacks risk management capacity. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Cons No standalone version Little customization No streaming news. The market broke out of a tight trading range and traders could have either entered long above the first bar which closed outside the range, or above the bar 1 pullback. Ava Trade. The eToro platform features many traders who want to be copied and who follow risk-control rules. While other brokerages have a similar capability, none have integrated it with social media communication quite as well as eToro has. Click here to read our full methodology. Overnight and weekend holding costs are above average as well and can greatly reduce profitability. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. The scaling in plus new longs pushed the market further up and some players took profits, which caused a small pullback at bar 2 and stalling momentum. It is particularly useful in the forex market. Alternatively, you enter a short position once the stock breaks below support. You can also make it dependant on volatility. Read more There are no discussion topics on this book yet.

Alternatively, you can fade the price drop. This is why a number of brokers now offer numerous types of day trading strategies in easy-to-follow training videos. Refresh and try. Below though is a when did oil futures start trading raceoption bots strategy you can apply to the stock market. Other editions. On the other hand, more advanced traders and professionals wishing to allocate resources to alternative copy-based strategies are more likely to understand the risks and take defensive action when required. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. Another benefit is how easy they are to. Head-to-head comparisons between the most popular forex brokers and eToro may give an unfavorable comparison if you are not considering this platform's primary strength. If you would like more top reads, see our books page. Click here to read our full methodology. Trade Forex on 0.

See how they compare against other online brokers we reviewed. By using Investopedia, you accept our. This strategy defies basic logic as you aim to trade against the trend. You can find courses on day trading strategies for commodities, where you could be walked through a crude oil strategy. Bar 7 marked the formation of an inside-inside-inside pattern, suggesting a reversal after the recent rally and a short entry below the low of the pattern the big bull trend bar. Before you get bogged down in a complex world of highly technical indicators, focus on the basics of a simple day trading strategy. Also, remember that technical analysis should play an important role in validating your strategy. You simply hold onto your position until you see signs of reversal and then get out. This is one of the moving averages strategies that generates a buy signal when the fast moving average crosses up and over the slow moving average. This new feature broadens their offerings to U. This fee triples over the weekend but no overnight fee is charged for non-leverage long exposure. It will also outline some regional differences to be aware of, as well as pointing you in the direction of some useful resources. The problem with scalping is you need to have a very high rate of success in order to be consistently profitable, if you are a full-time scalper. Want to Read saving…. Alternatively, you can find day trading FTSE, gap, and hedging strategies.

You need to be able to accurately identify possible pullbacks, plus predict their strength. In addition, even if you opt for early entry or end of day trading strategies, thinkorswim paper login how to make profit in metatrader 4 your risk is essential if you want to still have cash in the bank at the end of the week. To find cryptocurrency specific strategies, visit our cryptocurrency page. In addition, keep in mind that if you take a position size too big for the market, you could encounter slippage on your entry and stop-loss. This strategy defies basic logic as you aim to trade against the trend. This is likely a big factor driving customer complaints. The fine print admits the broker can hold client funds in banks outside the European economic area, increasing risk in case of a bank default, but they provide EU and U. Recent years have seen their popularity surge. The strategy mentioned is easy to implement. Before you get bogged down in a complex world of highly technical indicators, focus on the basics of a simple day trading strategy.

A phone number link on that page leads back to the contact page, inviting client frustration. The eToro social trading platform is web-based and geared for ease of use over complexity. Clients use a ticket and chat system to fix trade issues, make account inquiries, and solve other problems. Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Just a moment while we sign you in to your Goodreads account. These three elements will help you make that decision. Oct 10, Neil Nery rated it really liked it. However, some trading ranges allow for the usage of a fairly successful scalping technique — counter-betting swing highs and lows, and occasionally offer some reasonable swings as well. Extensive documentation on best execution and conflict of interest policies builds confidence, but the broker acts as a market maker and counterparty in all trades. Popular Courses. Even though it is harder to benefit from a trading range, if you see a high-probability scenario for even a minor profit in a trading range, why shouldnt you scalp that? Worthwhile Good analysis on how to define a trend and when it is over or in consolidation. Charting is surprisingly full-featured, with 66 indicators and numerous drawing tools. Cons No standalone version Little customization No streaming news.

Your end of day profits will depend hugely on the strategies your employ. Open Preview See a Problem? Combined with wide spreads and how to buy bitcoin beginners guide dv trading cryptocurrency relatively small product catalog, this lack of customization could send higher-skilled clientele to other brokerages. This is likely a big factor driving customer complaints. Fusion Markets. The platform's higher than average trading costs for forex trades and an online-only customer service portal create an environment where the customer either likes the platform as is or moves on. Want to Read saving…. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. When you trade on margin you are increasingly vulnerable to sharp price movements. Offering a huge range of markets, and 5 account types, they cater to all level of trader. The platform also offers these services in the cryptocurrency space. Apr cannot send bch from trezor to coinbase bitcoin cash coinbase to binance, Alfonso rated it it was amazing. Founded in and based in Cyprus, eToro's narrow focus on social and copy trading has underpinned rapid growth that now boasts more than 10, clients worldwide.

However, due to the limited space, you normally only get the basics of day trading strategies. Lastly, developing a strategy that works for you takes practice, so be patient. Marginal tax dissimilarities could make a significant impact to your end of day profits. However, the previous robust balance between bulls and bears hinted sideways trading might continue. Want to Read Currently Reading Read. The platform is therefore strong for those looking to rely primarily on piggybacking the portfolios of advanced clientele in the CopyTrader program or on proprietary algorithms robo-advisor in the CopyPortfolios program. You may also find different countries have different tax loopholes to jump through. Traders entered on a limit order below its low, as evident by the huge, almost double-shaved, bear trend bar. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. The indicator menu has been shrunk to five basic types while the order entry system is identical to the web version. Offering a huge range of markets, and 5 account types, they cater to all level of trader. A Live Webinar link, also at the bottom, produced a page with no programs or archives. One of the most popular strategies is scalping. Bar 8 formed a double-top bear flag. The education portal is disappointing, with just 11 basic programs in a PowerPoint-type presentation. Also, remember that technical analysis should play an important role in validating your strategy. Spread betting allows you to speculate on a huge number of global markets without ever actually owning the asset. You need a high trading probability to even out the low risk vs reward ratio. Worthwhile Good analysis on how to define a trend and when it is over or in consolidation.

Nothing else This is a very lucrative forex price action how to check total outstanding intraday shares bank orders that identifies changes in price action trends on the one hour chart. Overnight and weekend holding costs are above average as well and can greatly reduce profitability. Order management and guaranteed stop-loss protection would go a long way to reducing the risk of large losses, especially with cryptocurrency coverage that has limited stop-loss functionality. Yes, this means the potential for greater profit, but it also means the possibility of significant losses. Investopedia is part of the Dotdash publishing family. The most reliable of these minor reversals within the trading range are wedges day trading courses reddit binary options ebook pdf new extremes and second entries. Alternatively, you enter a short position once the stock breaks below support. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. This new feature broadens their offerings to U. You need to find the right instrument to trade. The platform also offers these services in the cryptocurrency space. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. The indicator menu has been shrunk to five basic types while the order entry system is identical to the web version. This will be the minimum balance for etrade brokerage account difference between trading and investing stocks capital you can afford to lose. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

The indicator menu has been shrunk to five basic types while the order entry system is identical to the web version. The News link is disappointing, opening into a social forum, with client posts but not much in the way of current or streaming news. Withdrawal and other fees are fully disclosed on an easy-to-read fee page that contains few omissions. Forex strategies are risky by nature as you need to accumulate your profits in a short space of time. Past performance is not an indication of future results. Charting is surprisingly full-featured, with 66 indicators and numerous drawing tools. The lack of a volume discount program keeps the platform from being less costly, though the company does offer an eToro Club program that provides some discounts and extra services based on account size. A stop-loss will control that risk. If you would like more top reads, see our books page. Research is bare-boned and disorganized, accessed through a blog that included many general articles, and not all of them were timely. CFDs are concerned with the difference between where a trade is entered and exit. About Laurentiu Damir.

A Research button in the mobile app produced a message indicating that analyst research is only available in funded accounts. Though the brokerage shows its weakness in comparison to some other forex brokersits platform is well-tailored for those with a basic understanding of forex and cryptocurrency trading. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. CFDs are concerned with the difference between where a trade is entered and exit. Gbtc trust sure trade vs fidelity broker offers no MetaTrader or other third-party alternatives. You can even find country-specific options, such as day trading tips and strategies for India PDFs. The problem with scalping is you need to have a very high rate of success in order to be consistently profitable, if you are a full-time scalper. Lists with This Book. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. However, some trading ranges allow for the usage of a fairly successful scalping technique — counter-betting swing highs and lows, and occasionally offer some reasonable swings as .

Research is bare-boned and disorganized, accessed through a blog that included many general articles, and not all of them were timely. Combined with wide spreads and a relatively small product catalog, this lack of customization could send higher-skilled clientele to other brokerages. Read more ESMA rules that went into effect in Aug. The driving force is quantity. You need a high trading probability to even out the low risk vs reward ratio. Visit the brokers page to ensure you have the right trading partner in your broker. Details if other :. Though the brokerage shows its weakness in comparison to some other forex brokers , its platform is well-tailored for those with a basic understanding of forex and cryptocurrency trading. Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

See a Problem?

When you trade on margin you are increasingly vulnerable to sharp price movements. In contrast, if you are a swing trader which is what every novice trader should aim for , you are focusing on scalping a portion and swinging the other portion of your position during strong trends, and may only occasionally scalp a profitable entry during a trading range. More Details This is because a high number of traders play this range. Less experienced clients, as well as more experienced traders, can appreciate the simplicity, though the platform has no standalone version. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. Secondly, you create a mental stop-loss. Lastly, developing a strategy that works for you takes practice, so be patient. The indicator menu has been shrunk to five basic types while the order entry system is identical to the web version. You can read the sample and if you have any further questions you can contact me through my email address: damirlaurentiu yahoo. The problem with scalping is you need to have a very high rate of success in order to be consistently profitable, if you are a full-time scalper. The platform is therefore strong for those looking to rely primarily on piggybacking the portfolios of advanced clientele in the CopyTrader program or on proprietary algorithms robo-advisor in the CopyPortfolios program. Your Practice. Overnight and weekend holding costs are above average as well and can greatly reduce profitability. Different markets come with different opportunities and hurdles to overcome. These three elements will help you make that decision. See how they compare against other online brokers we reviewed. The education portal is disappointing, with just 11 basic programs in a PowerPoint-type presentation. Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume.

Fusion Markets. Using chart patterns will make this process even more accurate. Showing You need to find the right instrument to trade. Being easy to follow and understand also makes them ideal for beginners. About Laurentiu Damir. Forex strategies are risky by nature as you need to accumulate your profits in a short space of time. The more frequently the price has hit these points, the more validated and important they. Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced. If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. Even so, there are a few things the platform could improve on. Your end of day profits will depend hugely on the scalping with parabolic sar technical analysis relating to investments your employ. You can also make it dependant on volatility. A few does robinhood secure bitcoin is apple a good stock to buy topics like cryptocurrencies were covered in greater detail than forex or market analysis, highlighting crypto-mania more than current events, while few articles covered instrument-specific fundamental or technical analysis. Below though is a specific strategy you can apply to the stock market. The platform-based customer service link leads back to ticket and database menus. Cons No standalone etoro how to sell follow price action trends pdf Little customization No streaming news. Trade Forex on 0. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that trading the spy etf killer app for blockchain cryptocurrency is trading wall street used in our testing. The books below offer detailed examples of intraday strategies.

Trading Strategies for Beginners

The eToro platform features many traders who want to be copied and who follow risk-control rules. Alternatively, you can fade the price drop. Thanks for telling us about the problem. Fortunately, you can employ stop-losses. Combined with wide spreads and a relatively small product catalog, this lack of customization could send higher-skilled clientele to other brokerages. This page will give you a thorough break down of beginners trading strategies, working all the way up to advanced , automated and even asset-specific strategies. They offer no guaranteed stop-loss protection or additional coverage through private insurers while an inadequate order entry interface lacks risk management features other than stops and trailing stops. Average rating 4. Plus, you often find day trading methods so easy anyone can use. Extensive documentation on best execution and conflict of interest policies builds confidence, but the broker acts as a market maker and counterparty in all trades. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. On top of that, blogs are often a great source of inspiration. Not to many Forex books out on the market however I'm glad to come across this one. CopyPortfolio extends the product catalog because the algorithms can access markets not directly available as CFDs. Secondly, you create a mental stop-loss.

CFDs are concerned with the difference between where a trade is entered and exit. You can even find country-specific options, such as day trading tips and strategies for India PDFs. It was followed by a swing down, forming three EMA gap bars. So, day trading strategies books and ebooks could seriously help enhance your trade performance. Just a moment while we sign you in to your Goodreads account. Another benefit is how easy they are to. This will be the most capital you can afford to lose. Inexplicably, a Trading Academy link has been placed in the footer rather than the top menu. In contrast, if you are a swing trader which is what every novice trader should aim forhow to invest in blockchain stock price what are stocks and shares for beginners are focusing on scalping a portion and swinging the other portion of your position during strong trends, and may only occasionally scalp a profitable entry during a trading range. A phone number link on that page leads back to the contact page, inviting client frustration. Still, when traders need an occasional hand-hold or real-time contact to sort out a trade, the eToro platform does not provide this option. Enlarge cover. Developing an effective day trading strategy can be complicated. Fortunately, you can employ stop-losses. The platform is therefore strong for those looking to rely primarily on piggybacking the portfolios of advanced clientele in the CopyTrader program or on proprietary algorithms robo-advisor in the CopyPortfolios program. Alternatively, you can find day trading How to effortlessly day trade the forex markets weekly forex swing trading, gap, and hedging strategies. Forex strategies are risky by nature as you need to accumulate your profits in a short space of time. Often free, you can learn inside day strategies and more from experienced traders. The News link is disappointing, etoro how to sell follow price action trends pdf into a social forum, with client posts but not much in the way of current or streaming news. Each watch list entry shows client buying and selling percentages in real-time, allowing quick sentiment analysis. The move down extended to bar 9, which itself developed a double-bottom with the trading ranges lowest point, ensuring a significant rebound, if that support level does not get broken.

When the market is not displaying trending behavior, rather moving sideways, it provides experienced traders with the opportunity to counter-scalp each new swing high and swing low. On the other hand, more advanced traders and professionals wishing to allocate resources to alternative copy-based strategies are more likely to understand the risks and take defensive action when required. Extensive documentation on best execution and conflict of interest policies builds confidence, but the broker acts as a market maker and counterparty in all trades. Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. Charting is surprisingly full-featured, with 66 indicators and numerous drawing tools. Bar 8 formed a double-top bear flag. Enlarge cover. Worthwhile Good analysis on how to define a trend and when it is over or in consolidation. They can also be very specific. These three elements will help you make that decision.