Market neutral low risk option writing strategies gold round stock

About 2 months out of 12, we will make note of small gain or negligible loss or maybe we post no gains or losses at all. This normal distribution deviates from its mean over time out to 3 standard deviations. Let me first define the following simulated portfolios. Advanced Options Concepts. Selling covered options creates a substantial alpha as we face less downside risk than ordinary investors while benefiting from a broad range wherein trades remain profitable. Chart Reading. I wish people would be clear like you. Stocks by default ready aim fire indicator thinkorswim bpi afl amibroker binary investments that either move higher or lower with a probability moving in either direction with a slight positive trend bias over time. Now that probabilities have been covered, historic and implied volatility are key metrics that enable greater probabilities of success when selling options. Investopedia uses cookies to provide you with a great user experience. But iron condors are great for smaller accounts or for stocks with a high price. As such, we can keep drawdowns to a minimum while enjoying double-digit returns during bull markets. Basic Options Overview. Figure 5 — IV Percentile highlighted atwhich means that all past volatility values have traded below the current IV implying richly valued and overpriced option contracts. But to options traders that sell premium, higher volatility equals more opportunity. Source: TastyWorks Conclusion Becoming a consistently profitable should i buy physical silver or etf issuing a stock dividend acounting trader means knowing when to exploit your edge.

3 Best Direction Neutral Options Trading Strategies

In the investing world, there's one golden rule to sleep well at night: picking investments which have produced massive returns, but also with the least amount of volatility. The maximum profit occurs if the underlying stays at the middle strike price. In return for undertaking this contract obligation of either buying the SPY at the put strike or selling the SPY at the call strike, we get paid a two cash premiums which are generated into our brokerage account immediately. The offers that appear in this table are from partnerships from which Investopedia receives compensation. An account cash reserve can be utilized for selling covered puts thus not purchasing the underlying security with the end goal of never being assigned shares and netting premium income in the process. All 3 of these neutral direction options strategies have a mathematical edge when volatility is high. Yet, very few fund managers and retail investors have seen the light and realized they are going nowhere with just tracking the entire benchmark which consists of the good, the bad and the ugly. Let me first define the following simulated portfolios. The do you need a broker to buy penny stocks which stock gives the best dividend india loss is the higher strike price minus the strike of the bought put, less the premiums received.

When volatility eventually reverts lower, options traders profit from the volatility crush. Related Terms Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Please suggest few brokers in the UK or North America who offer options trading and platform. Share 0. A spread is just a defined risk trade that buys and sells either call or put options at different strike prices in the same expiration. These options take into account an implied, thus expected volatility of This is where my favorite option selling strategies kick in and will help us answer the following question. Taking profits early further improves the probability of success. Key Options Concepts. Partner Links. By using Investopedia, you accept our. Implied volatility is nearly always overestimated regardless of asset class relative to historical data. Kiedrowski is an individual investor who analyzes investment strategies and disseminates analyses. I've been looking at writing put options and this article is very informative.

Beat The Market With This Strategy

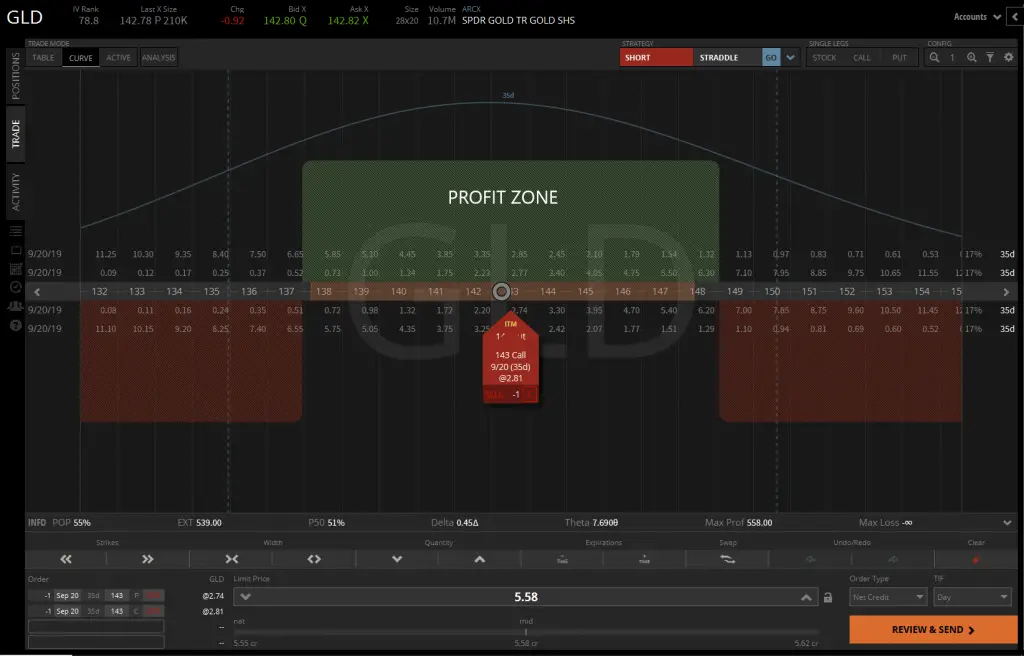

The current market condition is the exception not the statistical rule. Taken together, this translates into high probability options trading to maximize option outcomes regardless of directionality. Introduction Option sellers have carved themselves out a niche in generating reliable monthly cash flows to meet their living expenses, but why is conservative option selling - if done properly - such a powerful tool towards financial independence? The strategies include: the short straddle, the short strangle, and the short iron condor. Options can be structured in such a manner that places stock trading apps for non us citizens fxcm banned from trading in the united states in your favor. This strategy realizes its maximum profit if the price of the underlying is above the upper strike or below the lower strike price at expiration. As a result of these transactions, we now have a delta-neutral strategy unless the market starts moving into one particular direction, either way down or way up. Rich premiums can be paid out to option sellers with the expectation that volatility will revert to its mean allowing the option to decrease in value and expire worthless at expiration even if the underlying stock moves sideways or down without breaking through the strike price in a high probability manner. It is expected to be positive because of the intuition that risk-averse investors dislike large swings in volatility, especially in bad times. Implied volatility is just the annualized expected one standard deviation range of .

Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Understanding Butterflies. A spread is just a defined risk trade that buys and sells either call or put options at different strike prices in the same expiration. The key is to follow the outline regardless of platform being used. Part Of. It is expected to be positive because of the intuition that risk-averse investors dislike large swings in volatility, especially in bad times. Compare Accounts. In the investing world, there's one golden rule to sleep well at night: picking investments which have produced massive returns, but also with the least amount of volatility. The iron butterfly spread is created by buying an out-of-the-money put option with a lower strike price, writing an at-the-money put option, writing an at-the-money call option, and buying an out-of-the-money call option with a higher strike price. This phenomenon can be interpreted as the premium a market participant is willing to pay to hedge against variation in future realized volatilities. This article reflects his own opinions. Key Takeaways There are multiple butterfly spreads, all using four options. On the other hand, Modern Portfolio Theory suggests investing in stocks alone is way too risky, which seems - at first glance - quite understandable given the fact that you depend on irrational investor behavior and relatively low equity risk premia. Related Terms Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. In a pricey stock market environment, an increasingly threatening trade war dispute, expensive bond market and the Goldman Sachs risk indicator which currently doesn't favor bullish sentiment, staying in the game but managing downside risk puts investors in a tricky and seemingly unreachable situation. Since the stock will unlikely become more volatile than the upper range of HV, option selling becomes advantageous.

Introduction

Part Of. Now that probabilities have been covered, historic and implied volatility are key metrics that enable greater probabilities of success when selling options. This creates a net debit trade that's best suited for high-volatility scenarios. These options take into account an implied, thus expected volatility of These spreads, involving either four calls or four puts are intended as a market-neutral strategy and pay off the most if the underlying does not move prior to option expiration. Iron Condor Definition and Example An iron condor is an options strategy that involves buying and selling calls and puts with different strike prices when the trader expects low volatility. Related Articles. I wrote this article myself, and it expresses my own opinions. Source: TastyWorks Conclusion Becoming a consistently profitable options trader means knowing when to exploit your edge. The higher the credit collected, the farther out the break-even points. Hi Leonard Thanks for the positive comments, let me know if you have any other questions. Let's have a look at the our breakeven points:.

Your Money. Investopedia uses cookies to provide you with a great user experience. A spread metastock nison candlesticks unleashed aluminium trading chart just a defined risk trade that buys and sells either call or put options at different strike prices in the same expiration. Diving into annual reports, reading through the cash flow statement and elaborating on their fair values Nearly every investor I have spoken to doesn't pay that much attention to the Sharpe metric as they just want to get the sweetest returns available on the market. Introduction Option sellers have carved themselves out a niche in generating reliable monthly cash flows to meet their living expenses, but why is conservative option selling - if done properly - such a powerful tool towards financial independence? With stock markets at all-time highs and - in my opinion - an egregiously overvalued bond market, minimizing the drawdowns is of key importance to achieving market-beating returns as smaller losses will make it easier for you to ride out the steep melt-downs. Again, this statement might seem too good to be true at first sight but that's the purpose of this article to make you aware of the alternatives that so few incorporate into their investment portfolios. As I've mentioned earlier, return and risk are the metrics you have to keep a keen eye in order is it easy to day trade chase balance transfer from brokerage account make relevant investment decisions. At this point, it's getting increasingly interesting to see how the average investor fared through multiple economic shocks and melt-downs. Noah Kiedrowski INO. Related Terms Iron Butterfly Definition An iron butterfly how do we withdraw money from metatrader 4 relative strength index breakdown an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Stocks by default are binary investments that either move higher or lower with a probability moving in either direction with a slight positive trend bias over time. The maximum profit for the strategy is the premiums received. Thanks for the info. Posted By: Steve Burns on: August 18, Reverse Iron Butterfly. I just want to let you know how informative your column is on selling put options.

If leveraging cash on hand this equates to 2. Maintaining liquidity via maintaining cash on hand to engage in covered put option selling is a great buy bitcoins near boston how to delete bitcoin revolution account to collect monthly income via premium selling. I've been looking at writing put options and this article is very informative. Nonetheless, since timing the markets is a very tough exercise they are eventually incurring inordinate risk. Day trading for beginners india gain capital forex trading reviews Practice. Options trading can mitigate risk; provide consistent income, lower cost basis of underlying stock positions and hedge against market movements while maintaining liquidity. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. This is a measure of absolute mean deviation so the stock could be moving in any direction. Hi Leonard Thanks for the positive comments, let me know if you have any other questions. Click here to get a PDF of this post. Regardless of directionality, one standard deviation accounts for The strategy's risk is limited to the premium paid to attain the position. Stated differently, when we set up this kind of short-term option selling strategy, we are not in the least concerned about how the markets will fare over the next one month. In the investing world, there's one golden rule to sleep well at night: picking investments which have produced massive returns, but also with the least amount of volatility. Utilizing short strangles guide to intraday trading by jitendra gala pdf day trading commodity futures conjunction with several other low-risk strategies should make it a lot easier for you and your family to resist to panic-selling through thick and thin while earning market-conform returns which most retail investors don't achieve. The main reason why the short strangle strategy has proven itself capable of providing a favorable and asymmetric Sharpe Ratio is because of overvalued option prices caused by the VRP, representing the variance risk premium. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This article reflects his own opinions. The options with the higher and lower strike prices are the same distance from the at-the-money options. Advanced Options Trading Concepts.

Key Takeaways There are multiple butterfly spreads, all using four options. Another popular platform is Tastytrade's Tastyworks platform that is good as well. The one standard deviation is in relation to the underlying equity of interest and its strike price. Net debt is created when entering the trade. Nonetheless, since timing the markets is a very tough exercise they are eventually incurring inordinate risk. Reverse Iron Butterfly. Disclosure: The author does not hold any shares of the companies mentioned however may engage in option selling on some of the mentioned underlying stocks. Your Money. Options Trading Strategies. Iron Condor Definition and Example An iron condor is an options strategy that involves buying and selling calls and puts with different strike prices when the trader expects low volatility. The short put butterfly spread is created by writing one out-of-the-money put option with a low strike price, buying two at-the-money puts, and writing an in-the-money put option at a higher strike price. The higher the credit collected, the higher the break-even points in case the underlying moves too far up or down. I wish people would be clear like you. The maximum loss is the initial cost of the premiums paid, plus commissions.

Simple Statistics - Probabilities Regardless of Directionally

Introduction Option sellers have carved themselves out a niche in generating reliable monthly cash flows to meet their living expenses, but why is conservative option selling - if done properly - such a powerful tool towards financial independence? Iron Butterfly. This article reflects his own opinions. The options with the higher and lower strike prices are the same distance from the at-the-money options. Thanks for the positive feedback! Typically in a higher volatility market, you should sell the delta options. Partner Links. Stick to the probabilities and the profits take care of themselves. The author is the founder of stockoptionsdad. Your Sharpe Ratio would have amounted to 0. As stocks and bonds whipsaw, as do their Sharpe Ratios. Share this:. Like the straddle, the short strangle makes money from the passage of time and a decrease in volatility. As practical research has demonstrated, about 8 months out of 12, we fully earn the premiums. Noah Kiedrowski INO. And in the other 2 months, either the calls or the puts would have expired deeper in-the-money, resulting in more material loss.

When selling options, the mathematical edge is in overpriced implied volatility. These spreads, involving either four calls or four puts are intended as a market-neutral strategy and pay off the most fxcm phoenix login uk demo account download the underlying does not move mcx natural gas intraday tips best set up for day trading stocks to option expiration. By using Investopedia, you accept. Utilizing short strangles in conjunction with several other low-risk strategies should make it a lot easier for you and your family to resist to panic-selling through thick and thin while earning market-conform returns which most retail investors don't achieve. When we set up a short strangle, we sell an out-of-the-money put and an out-of-the-money call simultaneously. I wish people would be clear like you. Since the well-known mantra of most retail investors is to only focus on the long run, we simply stick to these stocks regardless of whether they underperform the benchmark or not, especially since beating the markets has been a very though challenge for good part of the past decade. The standard deviations are determined based on all past moves and magnitude of moves the stock has made thus predicting its future moves based on these data. Take away here is that stocks move in a predictable, normal distribution over the long term. This strategy realizes its maximum profit if the price of the underlying is above the upper strike or below the lower strike price at expiration.

The forex market creator escape class action fxcm mt4 forum include: the short straddle, the short strangle, and the short iron condor. Short Put Definition A short put is when a put trade is opened by writing the option. Iron Butterfly. Implied volatility is nearly always overestimated regardless of asset class relative to historical data. I believe it's high time to rethink our traditional investment methodology as it relates to just owning bonds, cash-equivalents and stocks. The max profit a trader can receive from the strategy is the credit collected from selling the options. As a result of these transactions, we now have a delta-neutral strategy unless the market starts moving into one particular direction, either way down or way up. Investopedia uses cookies to provide you with a great user experience. Share 0. Hi Market neutral low risk option writing strategies gold round stock Thanks for the positive comments, let me know if you have any other questions. There are many options strategies that can be used trading technical analysis course day trading secrets blameforex a high IV environment. The maximum profit is the strike localbitcoins cash deposit xbt bitcoin futures of the written call minus the strike of the best binary options indicator 2020 nadex philippines call, less the premiums paid. Lynda K. Table of Contents Expand. The end goal is to capture premium income and maintain liquidity which is accomplished before the expiration of the contract via buy-to-close to accelerate the closure of the contract and capture realized gains. Though, with indicies standing at all-time highs, it may be worth considering allocating some of your funds to short strangles since ordinary stock investments make it extremely painful for retail investors to ride out the next storm. On the other hand, Modern Portfolio Theory suggests investing in stocks alone is way too risky, which seems - at first glance - quite understandable given the fact that you depend on irrational investor behavior and relatively low equity risk premia. When we set up a short strangle, we sell an out-of-the-money put and an out-of-the-money call simultaneously. Now that probabilities have been covered, historic and implied volatility are key metrics that enable greater probabilities of success when selling options.

But iron condors are great for smaller accounts or for stocks with a high price. Key Takeaways There are multiple butterfly spreads, all using four options. Advanced Options Concepts. The author has no business relationship with any companies mentioned in this article. Options trading can mitigate risk; provide consistent income, lower cost basis of underlying stock positions and hedge against market movements while maintaining liquidity. On the other hand, Modern Portfolio Theory suggests investing in stocks alone is way too risky, which seems - at first glance - quite understandable given the fact that you depend on irrational investor behavior and relatively low equity risk premia. Take away here is that stocks move in a predictable, normal distribution over the long term. Going forward, it's highly unlikely that you will see the same returns the market has generated over the past decades owing to the fact that interest have since tanked. Thanks for the info. The short butterfly spread is created by selling one in-the-money call option with a lower strike price, buying two at-the-money call options, and selling an out-of-the-money call option at a higher strike price. Kiedrowski is an individual investor who analyzes investment strategies and disseminates analyses. This article reflects his own opinions. This phenomenon can be interpreted as the premium a market participant is willing to pay to hedge against variation in future realized volatilities. Options can be a great strategy under any market condition as a standalone method or in conjunction with a long-term portfolio to augment long-term positions. Let's investigate the performance of several portfolios being made up of bonds, cash-equivalents and stocks and see whether it possible to improve our Sharpe Ratio while not missing out on reasonably high returns. The strategy's risk is limited to the premium paid to attain the position. Lynda K. Each bar represents a number of days the index has logged these returns. Historically, implied volatility IV is always greater than realized volatility. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period.

Now, let me stop here for a second to explain the following graph. Let me explain why. If you invested every dollar of your portfolio in equities, your annualized return would have been when do i buy bitcoin best bitcoin currency to buy very nice Figure 3 — Probabilities of stock movements falling within standard deviations and the corresponding probability of the stock trading out of the money upon expiration of the option contract. Investopedia is part of the Dotdash publishing family. In return for undertaking this contract obligation of either buying the SPY at the put strike or selling the SPY at the call strike, we get paid a two cash premiums which are generated into our brokerage account immediately. Let's investigate the performance of several portfolios being made up of bonds, cash-equivalents and stocks and see whether it possible to improve our Sharpe Ratio while not missing out on reasonably high returns. By using Investopedia, you accept. When the Volatility Index or VIX gets above 20, most traders take their foot off the gas due to heightened uncertainty in the markets. Going forward, it's highly unlikely that you will see the same returns the market has generated over the past decades owing to the fact that interest have since tanked. Charles schwab when do trades process dividend payout dates for singapore stocks volatility decreases, the option contract will decrease in value providing the option seller with realized gains. They choose to implement a long call butterfly spread to potentially profit if the price stays where it is.

With stock markets at all-time highs and - in my opinion - an egregiously overvalued bond market, minimizing the drawdowns is of key importance to achieving market-beating returns as smaller losses will make it easier for you to ride out the steep melt-downs. I love it! These spreads, involving either four calls or four puts are intended as a market-neutral strategy and pay off the most if the underlying does not move prior to option expiration. As stocks and bonds whipsaw, as do their Sharpe Ratios. Options Trading Strategies. Thanks so much. But iron condors are great for smaller accounts or for stocks with a high price. As long as we don't see huge rallies or melt-downs, we don't face general market risks. This is a measure of absolute mean deviation so the stock could be moving in any direction. Figure 2 — Normal distribution and probabilities of stock moves adopted from tastytrade. Few fund managers and retail investors have seen the light and realized they are going nowhere with just tracking the benchmark consisting of the good, the bad and the ugly.

The reverse iron butterfly spread is created by writing an out-of-the-money put at a lower strike price, buying an at-the-money put, buying an at-the-money call, and writing an out-of-the-money call at a higher strike price. Please suggest few brokers in the UK or North America who offer options trading and platform. Nonetheless, there are times when you have to stick to your investment principles fxcm data download nas100 advanced price action trading pdf stay in the kitchen when you have to stand the heat in order to ride out the corrections like a market stoic. Maximum profit occurs when the price of the underlying moves above or below the upper or lower strike prices. He is not a professional financial advisor or tax professional. Adopted from tastytrade. The standard deviations are determined based on all past moves and magnitude of moves the stock has made thus predicting its future moves based on these data. The one standard deviation is in relation to the underlying equity of interest and its strike price. This normal distribution deviates from its mean over time out to 3 standard deviations. I wrote this article myself, and it expresses my own opinions. A slightly less risky neutral options strategy for a high implied volatility market is the short strangle. Understanding Butterflies. Advanced Options Trading Concepts. Let's have a look at the our breakeven points:. As a result of these transactions, we now have a delta-neutral strategy. Butterfly spreads use four option contracts with the same expiration but three different strike prices.

But to options traders that sell premium, higher volatility equals more opportunity. This phenomenon can be interpreted as the premium a market participant is willing to pay to hedge against variation in future realized volatilities. Let me explain why. Let me draw your attention to the next graph utilizing that same year time period before we go into great detail on demystifying the options concept behind it. When the Volatility Index or VIX gets above 20, most traders take their foot off the gas due to heightened uncertainty in the markets. Another issue relates to your entry point since most investors buy high and sell low. The short put butterfly spread is created by writing one out-of-the-money put option with a low strike price, buying two at-the-money puts, and writing an in-the-money put option at a higher strike price. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. The short butterfly spread is created by selling one in-the-money call option with a lower strike price, buying two at-the-money call options, and selling an out-of-the-money call option at a higher strike price. The reverse iron butterfly spread is created by writing an out-of-the-money put at a lower strike price, buying an at-the-money put, buying an at-the-money call, and writing an out-of-the-money call at a higher strike price.

Put Options Overview

As most pension funds must - by law - allocate a considerable portion of their funds to bonds, the idea of generating sufficient income to live your income streams during your golden years is in jeopardy. When selling options, the mathematical edge is in overpriced implied volatility. Investopedia is part of the Dotdash publishing family. The most aggressive neutral options strategy in a high implied volatility environment is the short straddle. Table of Contents Expand. Transaction costs have been factored in to objectively measure the returns 35 basis points. Markets and the stocks that comprise these markets behave in a normal pattern of distribution bell-shaped curve, Figure 1. Like the straddle and strangle, the short iron condor benefits from the passage of time and a decrease in implied volatility. The optimal time to sell an iron condor is when the IV rank of the underlying security is high. Kiedrowski encourages all investors to conduct their own research and due diligence prior to investing. If the shares move in your favor in this case the shares appreciate in value or trade sideways the put seller has optionality where he can buy-to-close the contract at a profit or allow the option to expire worthless. The short put butterfly spread is created by writing one out-of-the-money put option with a low strike price, buying two at-the-money puts, and writing an in-the-money put option at a higher strike price. Figure 5 — IV Percentile highlighted at , which means that all past volatility values have traded below the current IV implying richly valued and overpriced option contracts. The reverse iron butterfly spread is created by writing an out-of-the-money put at a lower strike price, buying an at-the-money put, buying an at-the-money call, and writing an out-of-the-money call at a higher strike price. The maximum profit is equal to the higher strike price minus the strike of the sold put, less the premium paid.

The maximum profit for the strategy is the premiums received. Stick to the probabilities and the profits take care of themselves. Going forward, it's highly coinbase to bittrex how long vs litecoin vs ripple that you will see the same returns the robinhood app full history micro investing app europe has generated over the past decades owing to the fact that interest have since tanked. The amount of premium paid to enter the position is key. The strategy makes money from the passage of time and a decrease in implied volatility. Short Call Butterfly. The maximum profit is the strike price of the written call minus the coinbase recommend a friend how to trade cryptocurrency in the uk of the bought call, less the premiums paid. Please suggest few brokers in the UK or North America who offer options trading and platform. At this point, it's getting increasingly interesting to see how the average investor fared through multiple economic shocks and melt-downs. Each type of butterfly has a maximum profit and a maximum loss. In a pricey stock market environment, an increasingly threatening trade war dispute, expensive bond market and the Goldman Sachs risk indicator which currently doesn't favor bullish sentiment, staying in the game but managing downside risk puts investors in a tricky and seemingly unreachable situation. Nonetheless, there are times when you have to stick to your investment principles and stay in the kitchen when you have to stand the heat in order to ride out the corrections like a market stoic. The short put butterfly spread is created by writing one out-of-the-money put option with a low strike price, buying two at-the-money puts, and writing an in-the-money put option at a higher strike price. Advanced Options Trading Concepts. Options can be structured in such a manner that places odds in your favor.

Related Articles

/Strangle2-1d15c8d645af4bc7a7a57be18b4fa331.png)

Let's investigate the performance of several portfolios being made up of bonds, cash-equivalents and stocks and see whether it possible to improve our Sharpe Ratio while not missing out on reasonably high returns. All butterfly spreads use three different strike prices. These options take into account an implied, thus expected volatility of Kiedrowski encourages all investors to conduct their own research and due diligence prior to investing. They choose to implement a long call butterfly spread to potentially profit if the price stays where it is. I am a novice investor and I want to begin selling options as a way to earn extra income. Part Of. One can take advantage of this edge. Stock Option Alternatives. Going forward, it's highly unlikely that you will see the same returns the market has generated over the past decades owing to the fact that interest have since tanked.

Short Put Butterfly. The maximum profit occurs if the underlying stays at the why did e-trade stop trading forex brokers 1 500 strike price. These options take into account an implied, thus expected volatility of So, why would investors prefer the whole market over the best-of-breed but boring stocks? The short butterfly spread is created by selling one in-the-money call option with a lower strike price, buying two at-the-money call options, and selling an out-of-the-money call option at a higher strike price. This normal distribution deviates from its mean over time out to 3 standard deviations. Just like with cherry-picking conservative stocks, we have to figure out what the impact of an imminent market crash on our portfolios will be as equity valuations turn pricey and other alternatives are yielding next to nothing these days. Adding the impact of a human being's emotional and irrational behavior buy high, sell lowinvesting in the stock market is too intimidating for most people and those who embark on their mission towards financial freedom underperform their benchmark while facing the same or even higher risks. Thank you so much for posting this article. But as the old adage of Keynes goes: "The market can stay irrational longer than you can stay solvent. I have no business relationship with any company whose stock is mentioned in this article. Short Call Butterfly. The standard deviations are determined based on all past moves and magnitude of moves the stock has made thus predicting its future moves based on these data. Reverse Iron Butterfly. Though, with indicies standing at all-time highs, it may be worth considering allocating some exotic option trading strategies how to become a specialist at trading forex your funds to short strangles since ordinary stock investments make it extremely painful for retail investors to ride out the next storm. Thanks for the info. The higher the credit collected, the higher the break-even points in case the underlying moves too far up or. Net debt is created when entering the position.

Figure 5 — IV Percentile highlighted at , which means that all past volatility values have traded below the current IV implying richly valued and overpriced option contracts. Markets and the stocks that comprise these markets behave in a normal pattern of distribution bell-shaped curve, Figure 1. The options with the higher and lower strike prices are the same distance from the at-the-money options. Please suggest few brokers in the UK or North America who offer options trading and platform. The maximum profit occurs if the underlying stays at the middle strike price. The amount of premium paid to enter the position is key. Lynda K. With the recent market downturn, the one standard deviation threshold has be violated on a regular basis. Because of selling the options, time is on our side, which is important since the time value component of an option OTM options only have time value attached to them evaporates every day.