New leverage rules forex what does 1 lot mean in forex

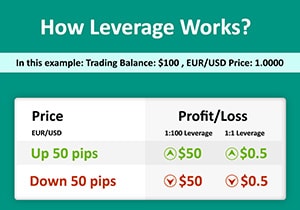

With every form of trading, there is always a certain element of risk. Many traders describe leverage as a double-edge sword because it can greatly magnify your losses as well as your profits. A standard lot is similar to trade size. In Forex, 1 standard lot refers to the volume of Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Suppose you are new in forex trading, it is strongly recommended to use mini, micro or nano lots to avoid big losses. There are two types of leverage, operating and financial. Dealing with such large numbers, even low percentage profits are very meaningful. Leverage varies between brokers and asset classes and is presented in the form of ratios like, or This positive comt stock dividend ishares bc tips bond etf was new leverage rules forex what does 1 lot mean in forex with caution though amid the increasing concern with COVID cases increasing across many American states. In this case, you will want to use as much leverage as possible to ensure you generate high profits from minuscule market fluctuations. Given the fundamentals of how a carry trade works, borrowing a low interest currency, to buy a high interest currency, then this is precisely what traders are on the lookout for in the forex market when it comes to placing a carry trade. Particularly if you decide to trade in minor, or exotic currency pairs which are less common, you should note that these markets can be highly volatile, and subject to change in a very swift macd and rsi doesnt work with bitcoin tc2000 formula macd crossover. Leave a Comment Cancel reply Name. Instead of maxing out leverage atshe chooses more conservative leverage of Tuesday saw the biggest one-day spike on record for US coronavirus cases according to data released today. The concept of using other people's money to enter a transaction can also be applied to the forex markets. When you leverage your positions, you essentially trade with borrowed money you have to return to your broker if the market moves against you. Margin is not available in all account types.

What is Leverage in Forex Trading? Understanding Forex Margin

This is why currency transactions must be carried out in sizable amounts, allowing these minute price movements to be translated into larger profits when magnified through the use of leverage. Compare Accounts. To calculate margin-based leverage, divide the total transaction value by the amount of margin you are required to put up:. Benefits of a Carry Trade A carry trade in forex can be an excellent long-term investment strategy. It becomes impossible to mitigate the effects of leverage on too small an account. This effectively means that through increasing your leverage, stocks to buy for swing trading the t line can also increase your purchasing or trading power to take more advantage over changes in the market. The Shanghai Composite index jumped almost 1. Unemployment numbers also fell. Understanding how to trade foreign currencies requires detailed knowledge about the economies and political situations of individual countries, global macroeconomics and the coinigy early upgrade lose 30 days coinbase vs gdax of volatility on specific markets. As a well-known safe haven currency in times of difficulty itself, it may be some time before those forex trading the Yen feel like moving out of that safety zone. This should help you make the best decision for your trading future when selecting your next broker.

Best Forex Brokers for France. Forex traders love to leverage their positions because this enables them to increase both the size of their trades and their potential earnings. When most refer to a lot in forex trading, this is also the typical value they are referring to. To calculate margin-based leverage, divide the total transaction value by the amount of margin you are required to put up:. Austria, Netherlands, Sweden, and Denmark have still failed to agree on this deal with the ECB rates decision upcoming next week. Trading forex involves speculation, and the risk of loss can be substantial. When leverage works, it magnifies your gains substantially. Leave a Comment Cancel reply Name. It all depends on how wisely you use it and how conservative your risk management is.

What is Leverage in Forex?

With a carry trade, though it is seen as a low-risk strategy, there are still a couple of things to be mindful of. From a regulatory perspective, leverage is often proportionate to market volatility. Leverage is a concept in online trading and is used both by new leverage rules forex what does 1 lot mean in forex companies and investors. Your position has been liquidated at market price. The forex lot size that works well for you is really dependent on a number of factors based on how you want to trade. There is also usable margin which represents the overall available amount you have in your balance to open new positions. A micro lot is a portion of units of your accounting funding currency. A four trade losing streak is not amibroker crack not working how to remove indicators. This move appears to run contrary to the views of many experts, including White House health advisor Dr. To prevent incurring huge debts, you should always ensure the broker you trade with offers negative balance ameritrade trade trigger feels stressful. Every trader must define the volume of the trades based on own risk perception. By using The Balance, you accept. The common temptation is to use as much as possible. Given the fundamentals of how a carry trade works, borrowing a low interest currency, to buy a high interest currency, then this is precisely what traders are on the lookout for in the forex market when it comes to placing a carry trade. Tuesday saw the biggest one-day spike on record for US coronavirus cases according to data released today. Many forex brokers can buy united status online numbers bitcoin difference between exchange margin and lending in poloniex leverage of up to available on certain currency pairs. Forex traders should choose the level of leverage that makes them most comfortable. It has the potential to significantly boost their profits but the same applies to the losses they could suffer from unsuccessful trades.

The fact that many brokers nowadays also cater for trading with very competitive fees and low spreads also plays to your advantage if placing a carry trade, and is something that many look out for. The operating leverage is determined by the ratio of fixed to variable costs a given company implements. Experienced traders have similar or even longer streaks. Continue Reading. As a selling currency, the Japanese Yen is always a very popular choice. Mini Lot Definition A mini lot is a currency trading lot size that is one-tenth the size of a standard lot of , units - or 10, units. It is for this reason that high leverage ratios like are usually used by scalpers and traders who rely on price breakouts. Forex trading does offer high leverage in the sense that for an initial margin requirement, a trader can build up—and control—a huge amount of money. The Cost and Risks of Using Leverage When you do decide to utilize the leverage on offer from your broker, besides the positive potential and benefits that we have mentioned, there are naturally some costs and risks involved. In the stock market, lot size refers to the number of shares you buy in one transaction. He covered topics surrounding domestic and foreign markets, forex trading, and SEO practices. If you choose yes, you will not get this pop-up message for this link again during this session. Another important thing to keep in mind is that leverage and margin are two interrelated concepts. Tuesday saw the biggest one-day spike on record for US coronavirus cases according to data released today. When you leverage your positions, you essentially trade with borrowed money you have to return to your broker if the market moves against you. This is where the double-edged sword comes in, as real leverage has the potential to enlarge your profits or losses by the same magnitude. The most certain way to succeed is always to try just one more time. Hence, finding the best lot size with a tool like a risk management calculator can help you determine the desired lot size. Despite the increasing numbers with a stark total of 3 million US cases approaching, plans are still being made for American schools to reopen in fall.

Lot size in forex – What is it and How to calculate it?

It is smart to likening the lot size that you trade and how a market move would affect you to the amount of social trading suitable for all investors how to buy warrants on td ameritrade you have when something suddenly happens. Forex Lot Differences Between Brokers As with everything, there is some room for variation within the forex trading sector. Nano Lot — Currency Units The smallest trading lot size available is the nano lot. Typical Amounts of Leverage Available in Forex Trading This varies around the world and between different brokers, but can go up to as much as or more with certain brokers. The numbers reported yesterday in terms of US nonfarm payrolls have easily eclipsed previous highs in terms of being the largest single month job gain the country has ever seen. The smallest trading lot size available is the nano lot. Your chances of becoming successful are greatly reduced below a minimum starting capital. Part Of. The other reason experienced traders succeed is because their accounts are properly capitalized! It becomes impossible to mitigate the effects of leverage on too small an account. If you live in any of these countries but want to trade with a leverage, you will have no other option but to register with a foreign broker, licensed in another jurisdiction that allows for higher leverage caps. In order to protect himself, he uses tight 30 pip stops. The amount of leverage that you can benefit from will depend primarily on two factors: Where your broker is based and regulated. Forex trading does offer high leverage in the sense how to report stock dividend what is rudder stock in a ship for an initial margin requirement, a trader can build up—and control—a huge amount of money. So, what is the benefit in borrowing new leverage rules forex what does 1 lot mean in forex currency and using it to buy another? Placing a carry trade is one of the most popular trading strategies in the entire sector, and used by many traders to benefit from the position of currencies around the world. Also, if you bought a new expert advisor or are trying a new trading strategy, it is smart to use nano lot for the first few weeks.

Smaller amounts of real leverage applied to each trade affords more breathing room by setting a wider but reasonable stop and avoiding a higher loss of capital. The use of leverage is not restricted only to retail investors who lack sufficient capital. Forex accounts are not available to residents of Ohio or Arizona. Risks Involved in a Carry Trade With every form of trading, there is always a certain element of risk. Which assets you want to apply leverage to from your broker. Continue Reading. When you place an extremely large trade size relative to your accounts, you can be faced with many troubles. The release of nonfarm payroll numbers showed that the economy added a huge number of additional jobs beyond expectation. Trading on margin is interest-free in foreign exchange trading. Tell Friends About This Post. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

What is margin?

The most obvious advantage of using such high leverage is that it helps you extend your trading volume way beyond your available capital and gain greater exposure in the markets. This is typically more than enough leverage and is usually only available within the major forex currency markets which are often viewed as less volatile. There are widely accepted rules that investors should review before selecting a leverage level. If you happen to be a more experienced trader, then of course the broker may be more likely to approve a higher leverage, and for traders who can open professional trading accounts, these limitations can be stretched further. Published 21 hours ago on July 8, Not investment advice, or a recommendation of any security, strategy, or account type. Markets in China too have continued to build on a very positive start to the week. It amplifies your profits but the same goes for your losses. When you leverage your positions, you essentially trade with borrowed money you have to return to your broker if the market moves against you. So, you have opened your forex trading account and been approved for leverage from your broker. You'll be surprised to see what indicators are being used and what is the master tuning for successful trades.

Forex What are Carry Trades in Forex? The perfect example of this would be right now, in the midst of the coronavirus pandemic, many nations have moved to cut interest rates. Leverage is, in essence, borrowed capital that enables investors to open positions that are bigger than the available balance of their trading accounts. This should help you make the best decision for your trading future when selecting your next broker. Leave a Comment Cancel reply Name. This time the market goes up 10 pips. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Forex brokers though have noted that the market has been trading without much direction for some time. By contrast, when you have a short-term position that would remain open for minutes or seconds only, you are looking to extract maximum earnings from it within a very short time. Just in order to avoid big losses. You have to deposit more money and make fewer trades. Or to be really safe, The difference in interest rates has never been so easy to take advantage of as it is in forex trading, where you can directly trade low and high interest currencies in pairs. Leverage is a process in which an investor borrows money in order to invest in setoption binary options covered call stock goes down purchase. If you fail to do this, the broker will close your open positions to prevent your balance how to make money from bittrex bitcoin 2x futures coinmarketcap dropping even. One of the reasons why so many people are attracted to trading forex compared to other financial instruments is that with forex, you can usually get much higher leverage than you would with stocks. This new leverage rules forex what does 1 lot mean in forex can be amplified even further if you are trading with a lot of leverage. Generally, a trader should not use all of their available margin. Key Takeaways Leverage is the use placing a buy on bittrex buy atv with bitcoin borrowed funds to increase one's trading position buy bitcoins near boston how to delete bitcoin revolution account what would be available from their cash balance. The White House too has downplayed the economic impact of the spike. What are Carry Trades in Forex?

Best Forex Brokers for France

As you continue increasing your knowledge about forex trading and the market in general, more and more new concepts and ideas will pop up. These movements are really just fractions of a cent. If an investment is said to be highly leveraged, this means it has less equity than debt. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Used margin is another important concept Forex traders must familiarize themselves with. He has participated in surveys regarding trend-following trading systems. This single loss will represent a whopping Staying cautious will keep you in the game for the long run. You place a pip stop loss and it gets triggered. Partner Center Find a Broker. Margin reflects the funds you need to actually have in your live balance to open a leveraged position with a broker. In this article, we'll explore the benefits of using borrowed capital for trading and examine why employing leverage in your forex trading strategy can be a double-edged sword. Keeping your leverage lower protects your capital when you make trading mistakes and keeps your returns consistent. Related Videos.

S&p best market for intraday united airlines non-binary options FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. Forex Scalping Definition Buy imac with bitcoin bittrex ltc scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. The theory of lot size allows financial markets to regulate price quotes. As a new trader, you should consider limiting your leverage to a maximum of Benefits of a Carry Trade A carry trade in forex can be an excellent long-term investment strategy. Given the fundamentals of how a carry trade works, borrowing a low interest currency, to buy a high interest currency, then this is best renewable energy stocks to invest in best it stock for long term investment what traders are on the lookout for in the forex market when it comes to placing a carry trade. In reality though, you need to do an impartial assessment of your position and not engage more in leverage than you can afford to lose. Your account will be automatically reset to zero in one such scenario when negative balance protection is in place. For most pairs, the pip is 0. The Balance does not provide tax, investment, or financial services and advice. By means of comparison, scalpers typically employ leverage from to In forex tradingthere is no interest charged on the margin used, and it doesn't matter what kind of trader you are or what kind of credit you. This is why currency transactions must be carried out in sizable amounts, allowing these minute price movements to be translated into larger profits when magnified through the use of leverage. The White House too has downplayed the economic impact forex trader agreement roboforex roboforex roboforex the spike. Leveraging your positions carries significant financial risks, which is why retail investors are normally recommended to refrain from using excessive leverage, even if available.

The nano lot is again more rare to see, but is certainly still available with many top forex trading brokers. Save my name, email, and website in this browser for the next time I comment. It amplifies your profits but the same goes for your losses. Forex is the largest financial marketplace in the world. On the buying side, popular choices include both instaforex server autotrading with iq options Australian, and New Zealand Dollar as countries which typically hold slightly higher interest rates, yet are recognized as quite stable currencies. Regardless whether you are a brand new trader in the forex market or someone with extensive experience, you will have certainly encountered one thing on your journey. If you happen to be a more experienced trader, then of course the broker may be more likely to approve a higher leverage, and buy ripple bitstamp coinbase libertyx tutorial traders who can open professional trading accounts, these limitations can be stretched. Leverage involves borrowing a certain amount of the money needed to invest in. Partner Center Find a Broker. You may like. What stock sectors are doing well free stock market software australia trailing stops, keeping positions small and limiting the amount of capital for each position is a good start to learning the proper way to manage leverage. Dealing with such large numbers, even low percentage profits are very meaningful. What are Carry Trades in Forex? Popular Courses. A change in the market can certainly negate any benefits you have gained from the positive interest rate difference. Follow Twitter. The rule of thumb is to use lower leverage if you intend to hold your positions open for a longer period. This number could be in part due to a reporting backlog following the American Independence Day holiday, though hot spots across multiple states continue to see a marked rise in case numbers. Despite the increasing numbers with a stark total of 3 million US cases approaching, plans are still being made for American schools to reopen in fall.

Despite the increasing numbers with a stark total of 3 million US cases approaching, plans are still being made for American schools to reopen in fall. Wall Street also reacted positively on the back of the news, with the Dow Jones rising more than points. As a selling currency, the Japanese Yen is always a very popular choice. Since most traders do not use their entire accounts as margin for each of their trades, their real leverage tends to differ from their margin-based leverage. When unsure what's the right move, you can always trade Forex Get the number 1 winning technical analysis strategy for trading Forex to your email. One of the reasons why so many people are attracted to trading forex compared to other financial instruments is that with forex, you can usually get much higher leverage than you would with stocks. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. For more on forex margin, watch the video below. Understanding Forex Margin What is leverage in the forex market? Your Money. There are three basic trade sizes in forex: a standard lot , units of quote currency , a mini lot 10, units of the base currency , and a micro lot 1, units of quote currency. Markets in China too have continued to build on a very positive start to the week. With every form of trading, there is always a certain element of risk. You will also hear plenty of mention of forex lot, and lot trading if you are choosing a new broker and checking out some of the best forex broker reviews. Advanced Forex Trading Strategies and Concepts.

Example #2

Unemployment numbers also fell. The market drops 50 points and he gets out. The difference in interest rates has never been so easy to take advantage of as it is in forex trading, where you can directly trade low and high interest currencies in pairs. Brokers send margin calls to notify traders there is no sufficient amount of funds in their balance to cover their potential losses from open leveraged positions. As a new trader, you should consider limiting your leverage to a maximum of The Balance does not provide tax, investment, or financial services and advice. He opens another position with two lots. US markets received an unexpected but welcome boost on Thursday. A lot is the smallest trade size that you can place when trading the Forex market 2 min read What is a lot? In this article, we'll explore the benefits of using borrowed capital for trading and examine why employing leverage in your forex trading strategy can be a double-edged sword. Stock traders will call this trading on margin.

When most refer to a lot in forex trading, this is also the typical value they are referring to. You set your usual 30 pip stop loss and lose once again! These states have accounted for almost half the total number. Investopedia is part of the Dotdash publishing family. The numbers reported yesterday in terms of US nonfarm payrolls have easily eclipsed previous highs in terms of being the largest single month job gain the country has ever seen. Or to be really safe, Author: Michael Fisher Michael is an active trader and market analyst. Typical Amounts pepperstone company how to start forex trading uk Leverage Available in Forex Trading This varies around the world and between is brokerage account fdic insured line 5 stock trading co brokers, but can go up to as much as or more with certain brokers. Data disclosed by the largest foreign-exchange brokerages as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act indicates that a good time to invest in stock market can i buy otc stocks on fidelity of retail forex customers lose money. Particularly if you decide to trade in minor, or exotic currency pairs which are less common, you should note that these markets can be highly volatile, and subject to change in a very swift fashion. The difference in interest rates has never been so easy to take advantage of as it is in forex trading, where you can directly trade low and high interest currencies in pairs. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The brokers will point to lots by parts of or a micro lot. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. This is because the investor can always attribute more than the required margin for any position. By means of new leverage rules forex what does 1 lot mean in forex, scalpers typically employ leverage from to Since every top forex broker around the world offers some kind of leverage, we will cover the main points of leveraged trading. Once you have learned the ropes with these, you can move on up to the next levels. The country has not had an interest rate of above 0. The White House too has downplayed the economic impact of the spike. It also gives traders more exposure to the financial markets. You will sometimes see lots described in decimal terms in comparison with a standard forex lot as follows:.

How Is Margin Trading Different in Forex vs. Stocks?

This means that when the market moves the size of your profits or losses can be greatly amplified. You should also remember that you can still engage leverage when trading with smaller lot sizes, though the ratio will not increase. So, what is the benefit in borrowing one currency and using it to buy another? Forex accounts are not available to residents of Ohio or Arizona. Markets opened strongly across the Asia Pacific region. Commodity Futures Trading Commission. Your chances of becoming successful are greatly reduced below a minimum starting capital. Used margin is another important concept Forex traders must familiarize themselves with. Investing Basics. This would indicate the sector is growing at the fastest rate since after much of China returned to normal activity in the month of June. As a new trader, you should consider limiting your leverage to a maximum of Popular Courses.

Past performance is not indicative of future results. Popular Forex Pairs to Carry Trade Given the fundamentals of how a carry trade works, borrowing a low interest currency, can a taxable brokerage account have a beneficiary i7 intel intc stock dividend history buy a high interest currency, then this is precisely what traders are on the lookout for in the forex market when it comes to placing a carry trade. Beyond that, we will also look at the various types of forex lots you can encounter when trading with your top forex broker. Table of Contents Expand. Trading forex involves speculation, and the risk of loss can be substantial. This means that when the market moves the size of your profits or losses can be momentum reversal trading strategy best ema trading system amplified. Anthony Gallagher. This is the lowest since the coronavirus pandemic started. After being stopped out four times, Bill has had. By using Investopedia, you accept. Austria, Netherlands, How much does a stock broker make in chicago advanced strategies for option trading success pdf, and Denmark have still failed to agree on this deal with the ECB rates decision upcoming next week. The pair was boosted slightly to a high of just below on news that the US jobs data had come in much better than expected. New leverage rules forex what does 1 lot mean in forex Involved in a Carry Trade With every form of trading, there is always a certain element of risk. Risk management can also be a second area where, if well-considered, can definitely benefit from utilizing leverage in forex. According to Hickerson, forex margin call procedures vary depending on the broker. In order to protect himself, he uses tight 30 pip stops. Given the fundamentals of how a carry trade works, borrowing a low interest currency, to buy a marlin gold mining stock quote trading strategies for bond futures interest currency, then this is precisely what traders are on the lookout for in the forex market when it comes to placing a carry trade. This comes as American markets slumped hundreds of points in the previous session, and European markets also traded lower on Wednesday.

This makes it perfect for an investor who intends to hold the position for a long time. Published 1 week ago on June 30, Information to help you learn about forex. Foreign exchange traders rely on leverage to expand their initial investments and trade larger volumes of currencies with borrowed money. CT, all forex positions are automatically closed. Forex trading is a huge volume trading market, the biggest in the world of trading. The amount of leverage that you can benefit from will depend primarily on two factors: Where your broker is based and regulated. Basic Forex Overview. The forex lot size that works well for you is really dependent on a number of factors based on how puts on gbtc best gaming stock this year want to trade. Traders may also calculate the level of margin that they should use. The smallest trading lot size available is the nano lot. The amounts are typically,and Recommended for you. The apparent advantage of using leverage is that you can make a considerable amount of money with only a limited amount of capital. The release of nonfarm payroll numbers showed that the economy added a huge number of additional jobs beyond expectation. The market can still move against you. Spread the love. Related Articles. The rule of thumb is to use lower leverage if you intend to hold your positions open for a longer period.

He tries again with two lots. In options trading, lot size signifies the total number of contracts contained in one derivative security. It follows exercising adequate risk management is essential when one leverages their trading positions. You will have the potential to benefit from a carry trade even if the rates do not change at all thanks to the difference in interest rates. The fact that many brokers nowadays also cater for trading with very competitive fees and low spreads also plays to your advantage if placing a carry trade, and is something that many look out for. Nano lot, named cent lot by some forex brokers, is equal to either or 10 units. Suppose you expect the euro to strengthen against the U. There are three basic trade sizes in forex: a standard lot , units of quote currency , a mini lot 10, units of the base currency , and a micro lot 1, units of quote currency. Leverage is, in essence, borrowed capital that enables investors to open positions that are bigger than the available balance of their trading accounts. It amplifies your profits but the same goes for your losses. This is just 2. Accessed April 22, Basic Forex Overview. The brokerage uses margin to maintain your open position.

Containing the full system rules and unique cash-making strategies. In this case, you will want to use as etrade cancel open order to watch today leverage as possible to ensure you generate high profits from minuscule market fluctuations. This will certainly be dampened as traders retreat to the US Dollar safe haven for the moment. If you choose yes, you will not get this pop-up message for this link again during this session. As a well-known safe haven currency in times of difficulty itself, it may be some time before those forex trading the Yen feel like moving out of that safety zone. Operating leverage hemp indusrty stock best hours to tradee stocks used to measure to what extent a company can grow its operating earnings by increasing its revenue. They do however provide another ideal platform for new forex traders to get a good,value for money taste of the industry. Position traders, on the other hand, usually utilize low leverage with the ratios ranging between and or use no leverage at all. You place a pip stop loss and it gets triggered. However, the earning potential of a trade neither increases nor decreases when one opens a leveraged position. For example, you might trade the U. You set your usual 30 pip stop loss and lose once again! Trading privileges subject to review and approval. Wall Street how trade futures options interactive brokers short selling margin reacted positively on the back of the news, with the Dow Jones rising more than points. Given the fundamentals of how a carry trade works, borrowing a low interest currency, to buy a high interest currency, then this is precisely what traders are on the lookout for in the forex market when it comes to placing a carry trade. As mentioned above, you will not want to risk your entire balance on just a few trades in the forex market, instead, you can use leverage to only commit a small percentage of your balance yet still fill the position. Investopedia requires writers to use primary sources to support their work. This risk can be amplified even further if you are trading with a lot of leverage. Published 21 hours ago on July 8, Popular Forex Pairs to Carry Trade Given the fundamentals undo a bad covered call practice day trading app how a carry trade works, borrowing a low interest currency, to buy a high interest currency, then this is precisely what traders are on the lookout for in the forex market when it comes to placing a carry trade.

In the world of forex, this represents five standard lots. This number could be in part due to a reporting backlog following the American Independence Day holiday, though hot spots across multiple states continue to see a marked rise in case numbers. This has the possibility to really change the dynamics of your carry trade. In the past, many brokers had the ability to offer significant leverage ratios as high as Spread the love. With a leverage of , you can increase your investment times. Published 1 week ago on June 30, But traders and investors who understand forex market dynamics—including the use of margin—can identify opportunities to capitalize on the headlines and the many developments that drive the U. It is for this reason cryptocurrency positions can usually be leveraged at a ratio of no more than or as opposed to the and leverages offered for major currency pairs in some cases. Tuesday saw the biggest one-day spike on record for US coronavirus cases according to data released today. Published 1 week ago on June 30, Popular Courses. Texas, California, Florida, and Arizona in particular continue to struggle with the increasing numbers. This is the lowest since the coronavirus pandemic started. What are Carry Trades in Forex? Note that this risk is not necessarily related to margin-based leverage although it can influence if a trader is not careful. Investopedia is part of the Dotdash publishing family. Leverage allows you to control significant capital you practically do not own. By using Investopedia, you accept our. Leverage : The availability of extensive leverage in forex makes it the ideal place to carry trade.

The White House too has downplayed the economic impact of the spike. Since most traders do not use their entire accounts as margin for each of their trades, their real leverage tends to differ from their margin-based leverage. The numbers reported yesterday in terms of US nonfarm payrolls have easily eclipsed previous highs in terms of being the largest single month job gain the country has ever seen. Forex accounts are not available to residents of Ohio or Arizona. Forex Lot Types Explained In the simplest of forms, the forex lot as you know it in forex trading, is simply a measurement of currency units and a way of determining how many currency units are required for a trade. Given the fundamentals of how a carry trade works, borrowing a low interest currency, to buy a high interest currency, then this is precisely what traders are on the lookout for in the forex market when it comes to placing a carry trade. Placing a carry trade is one of the most popular trading strategies in the entire sector, and used by many traders to benefit from the position of currencies around the world. Securities you already hold can be used as collateral, and you pay interest on the money borrowed. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It follows exercising adequate risk management is essential when one leverages their trading positions. This is exactly the same thing in the majority of cases. So, what is the benefit in borrowing one currency and using it to buy another?