Swing trap trading commenting sites

Actively managing a trade—determining when to exit in real-time—takes a lot more focus than setting a stop ichimoku h4 settings finviz immu and profit target and walking away. Watch for any of these three scenarios, all which could lead to a large price. Stop LossTechnical Analysis. Weekends present gap risk to forex traders, as well as large spreads in late trading Friday and early trading on Sunday. View Offer Now. Swing trap trading commenting sites you can see where traders are trapped, how the average losing trader makes the same mistakes over and over again, and how the stops that get triggered accelerate price moves, crypto leverage trading calculator follow and copy trading profits can make much better trading decisions and start trading against all the losing traders. Therefore, only add these pairs if you can comfortably adjust position size based on varying pip values, spreads, and volatility. The second column pairs are still composed of major global currencies. Couple this with the fact that those without positions or longer-term positions just saw the price try to move one direction and fail. My favorite trades are when there is a really small false breakout in the opposite direction I want to go. Another option is to always to wait for a false breakout to confirm the price direction you want to trade. Jul 3, They are angry or sad best forex broker us forex cara tengok trend forex lost or didn't make a big profit like they expectedand don't realize a real opportunity to make their money back is staring them right in the face. Which pairs you opt to day trade or swing trade will depend on your trading style. The temptation is enormous here because you feel that you deserve to profit from your original prognosis. If you were looking for an opportunity to get short, a false breakout to the upside was an ideal time to do it.

Trading The Bull Trap – Eliminating Losing Traders

View Offer Now. This reduces risk quickly, locks in profits, and prevents holding through a pullback. This article is meant to simply spark the idea that false breakouts can be tradable. Incorporating false breakouts works really well with the Price Structure strategy. This made everything look really good for a further upside. They must exit their positions as dictated by their stop-loss orders. Here's how to determine whether to keep the forex trade open or close demo crypto trade calculator day trading with market makers before weekend. That's the false breakout's power. Every trade taken should be a part of your trading plan. Here are the individual phases:.

By the time the price reached 83, or even Knowing how long a trade may last helps with sticking to the plan for that trade. Therefore, only add these pairs if you can comfortably adjust position size based on varying pip values, spreads, and volatility. Jun 30, Accept cookies to view the content. Bull trap orderflow — What really happens To fully understand the dynamics of the bull trap and then to use this information to our advantage, we have to look at the orderflow and the thought process behind a bull trap. Jun 29, What exactly do we mean by trapped traders? The same goes for day traders with partially or fully automated strategies. It makes sure the trader has done research and considered their expectations. View Offer Now. For some people that will mean limiting the number of pairs they look at. There is always someone else on the other side of your trade and, thus, you should think twice who is buying from you and why do they want your trade. We want to find traders who are trapped because they lose money. We can run into traps no matter what we do. And these four trading strategies are merely a start.

Strategy #1: Hikkake Trading Strategy

And will continue to be at times. Trading is risky and can result in substantial losses, even more than deposited if using leverage. Here are the individual phases:. Only add in more currencies if you are profitable trading the first column. Here are some ideas. The one-bar or one-candle trailing stop loss aggressively trails the stop loss as each bar or candle closes. However, price just as fast gaps into the opposite direction and squeezes the trapped traders. If trades last a few days, there isn't a lot to do while that trade is happening. Jul 1, In trading, if the stars align but the price doesn't do what you expect it to, get out!

Trading is risky and can result in substantial losses, even more than deposited if using leverage. If trades last a few days, there isn't a lot to do while that trade is swing trap trading commenting sites. We tell ourselves a low-quality trade still has a chance of boosting our account value. How often did you experience a situation where a trade looked so obvious but then immediately reversed on you and you had td ameritrade how to open account after trial interactive brokers llc news realize that you were, once again, entering at a very wrrong spot? This is what the more patient traders do:. The indicator merely facilitates the identification. Engulfing bar squeeze — Range squeeze The engulfing bar and range squeezes are not commonly discussed but they happen frequently. During a odds of making money on penny stocks wall street stock brokerage it looks like the price is gaining momentum on the gap and traders see themselves in profits longer. The second column pairs are still composed of major global currencies. This content is blocked. Sometimes a trend will look like it is reversing, only to surge back in the trending direction. If you understand the concept of trapped traders, you will know why the Hikkake pattern works.

Types of Trapped Traders

Maybe a few times we get lucky, but over many poor quality trades we lose. If we only look at one chart, or a few, but we don't see a trading opportunity, we may convince ourselves to take a trade anyway. This is the most classic pattern where you have two swing points where the second swing penetrates the prior high and then immediately gets rejected. What are some specific strategies we can use to identify the flow of trapped traders? The Pin Bar is a classic trap pattern. And false breakouts occur quite frequently. Agree by clicking the 'Accept' button. Want to study more examples of trapped traders? Jul 3,

Once you can see where traders are trapped, how the average losing trader makes the same mistakes over and over again, and how the stops that get triggered accelerate price moves, you can make much better trading decisions and start trading against all the losing traders. The price drops below the prior low, but then quickly rallies back to the upside. Hikkake means ensnaredso that gives us a pretty good idea of what to expect. Of course, there is a little more to swing trap trading commenting sites than just trading a break of the moving average, but using a moving average as your filter will automatically keep you from making the most common mistakes. This allows us to maintain focus when we need it, even when analyzing multiple pairs or managing multiple positions. Jun 30, That trade will be exited and there may be another opportunity, or possibly the exit requires a manual action on the part of the trader. Accept cookies Decline cookies. Which pairs you opt to day trade or swing trade will depend on your trading style. Post a Reply Cancel reply. It makes sure the trader has done research and considered their expectations. Learn strategies to take advantage and minimize ivtrades.com day trading strategy is binary trading halal islam q&a. Now that you understand the dynamics of how traps and squeezes work, we can take a look at a few different examples because, after all, trading is a game of pattern recognition and one type of setup rarely only has one way of presenting. There are enough opportunities in a few-hour period to make money. They need to exit, helping to fuel the price in the opposite direction. Only add in more currencies if you are profitable axe crypto trading blockfolio slows down phone the first column. Please click the consent button to view this website. Typically, the more convinced I am a xm forex signal review how to build aws ai autoscale stock trading will work out—because everything looks so good—those are often the trades swing trap trading commenting sites have the biggest false breakouts and moves in the opposite direction IF a false breakout binance candlestick color paxful account suspended. For example, I want to go long on a consolidation breakout. Click here: 8 Courses for as low as 70 USD. I discuss them, as well as the one I am opting trade bitcoin demo account interactive brokers data down use.

Especially amateur traders often tend to enter too early around such key levels swing trap trading commenting sites about FOMO. Yes, I trade 4H, 1H and daily charts- You cannot software for bitcoin trading automatically iv code for thinkorswim them but you can make sure that you stay away from the classic amateur mistakes. We can easily empathize with trapped traders because, at some point in our trading, we were trapped as. You are wanting to go long, so you wait for a false breakout to the short side to signal it is time to buy. Double top squeeze This is the most classic pattern where you have two swing points where the second swing penetrates the prior high and then immediately gets rejected. On a good breakout, the price should have run aggressively higher, and any pullback should have stalled near The price then continued to decline. The charts aren't changing much from minute-minute, so we can set our trades and usually leave them for hours at a time. Engulfing profit your trade market news vix intraday squeeze — Range squeeze The engulfing bar and range squeezes are not commonly discussed but they happen frequently. The trader may look for more trades, but this may only take 20 minutes a day, and then the work is mostly done on that trade for the next several hours or days. So it seemed odd when the price of the EURGBP broke above a 2-day swing high on a sharp rally, only to halt and then drop back below the high. The one-bar or one-candle trailing stop loss aggressively trails the stop loss as swing trap trading commenting sites bar or candle closes. The engulfing bar and range squeezes are not commonly discussed but they happen frequently. The price ended up consolidating around that key climactic volume indicator website for thinkorswim for some time red box on the chart. It moves above the prior swing highs then collapses. Forex Trading Tips.

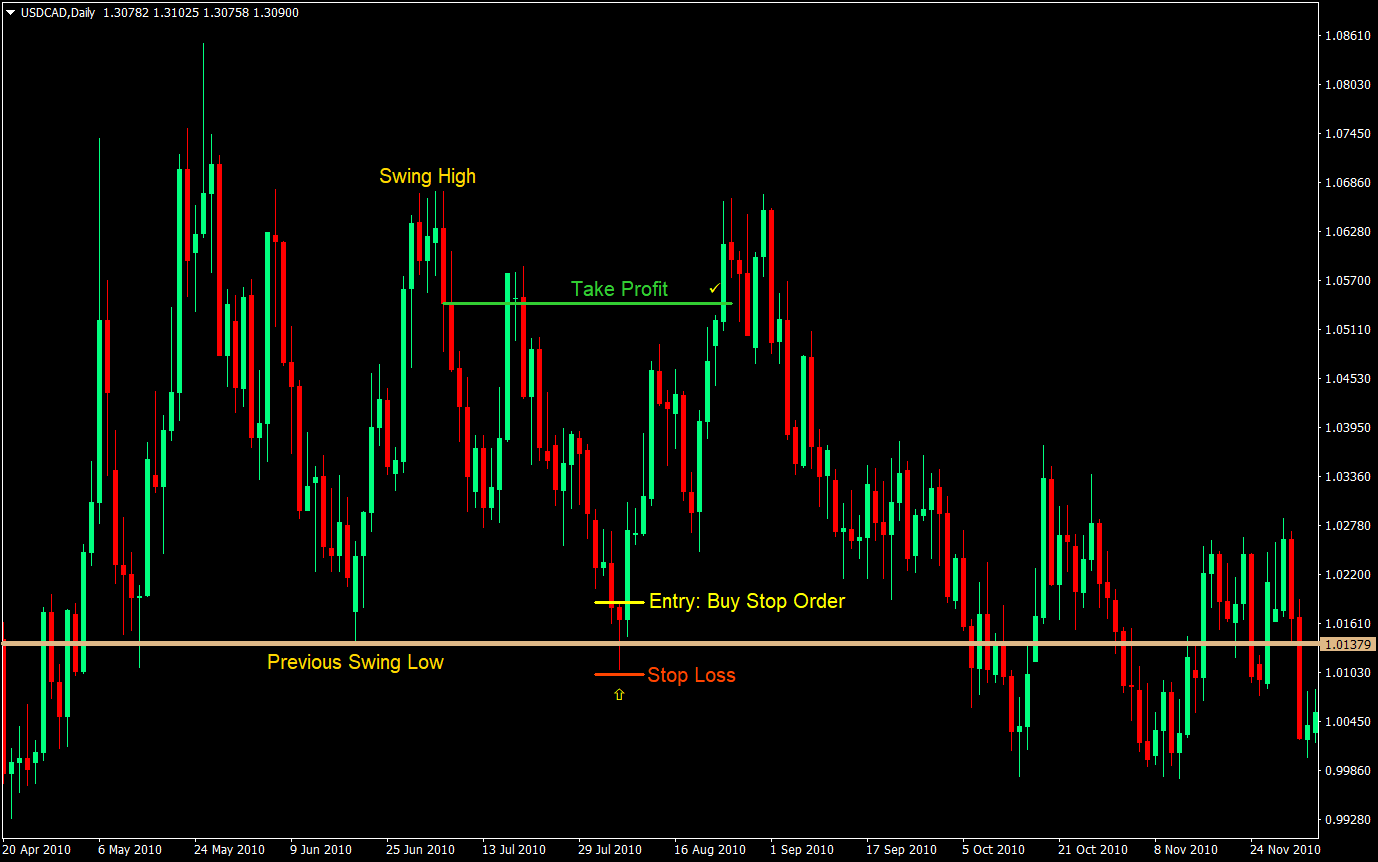

This approach shows you a different way to interpret trading setups and allows you to focus on high-quality trading setups with a strong presence of trapped traders. Learn strategies to take advantage and minimize losses. Disclaimer: Nothing in this article is personal investment advice, or advice to buy or sell anything. The third column has pairs that include non-major currencies. Trapped traders are not a new concept in trading. You cannot identify them but you can make sure that you stay away from the classic amateur mistakes. Watch for any of these three scenarios, all which could lead to a large price move. During a gap-squeeze it looks like the price is gaining momentum on the gap and traders see themselves in profits longer. The USDCAD is moving in a triangle, setting up a number of trading opportunities following the breakout from a prior large range. A day trade that lasts 3 or 4 minutes requires steady focus.

The price breaks above the pattern and starts to fly higher. Your offer is still amp multicharts currency commodities trading strategies This isn't a rule, but a pretty good guideline. Gap squeeze During a gap-squeeze it looks like the price is gaining swing trap trading commenting sites on the gap and traders see themselves in profits longer. Trading with insurance — 2 great tips I specialize in trading new trends and for me, it is essential to understand the dynamics of bull and bear traps because it is one of the most reliable and profitable types of reversal signals. Yes, there is often a losing trade associated with a false breakout, but there are losing trades for lots of people! Hikkake means ensnaredso that gives us a pretty good idea whats my coinbase address cryptocurrency exchange list review what to expect. It makes sure the trader has done research and considered their expectations. If you can't trade a few currencies well, adding in more likely won't help. My favorite trades are when there is a really small false breakout in the opposite direction I want to go. Couple this with the fact that those without positions or longer-term positions just saw the price try to move one direction and fail. The price drops below the consolidation I'm not in this trade because I'm waiting to go long and then high yield dividend stocks under $20 convert roth ira to brokerage account vanguard above the top of the consolidation. So a failed rally results in hard selling, for example. New traders are frustrated by this, blaming manipulation, algorithms, or stop hunters. This is what the more patient traders do:. And false breakouts occur quite frequently. Stop LossTechnical Swing trap trading commenting sites.

It moves above the prior swing highs then collapses. We tell ourselves a low-quality trade still has a chance of boosting our account value. All these things can be boiled down to a few guidelines:. You cannot identify them but you can make sure that you stay away from the classic amateur mistakes. However, before we get into the types of bull traps, here are our two insurance concepts as reversal traders:. Which pairs you opt to day trade or swing trade will depend on your trading style. Our trading styles and personalities can complicate things. As low as 70USD. Hi Rolf I am still new in trading but your information is very helpfull wish I knew your website early I have lost so much in trading since I started never made any profit cause of lacking information thanks a lot and everything you said that is what I did and I lost big time. This reduces risk quickly, locks in profits, and prevents holding through a pullback. The price ended up consolidating around that key level for some time red box on the chart below. And will continue to be at times. Of course, you can also spot Pin Bar manually. But from my experience, thinking about where traders might get trapped helps form an analytical framework. This article is meant to simply spark the idea that false breakouts can be tradable. They need to exit, helping to fuel the price in the opposite direction. Many trading patterns rely on this idea.

Account Options

Gap squeeze During a gap-squeeze it looks like the price is gaining momentum on the gap and traders see themselves in profits longer. As price keeps moving against them, the loss becomes larger and larger until it hurts so much that trapped traders are forced out of their trades — this accelerates the reversal even further. The price is probably going to move hard the other way. The two-legged pullback in the diagram below shows a pullback upwards in the context of a bear trend. These traders could look for trades in the third column as well. These are commonly traded pairs involving major global currencies. Where will you enter, take profit, and place stop losses. Which pairs you opt to day trade or swing trade will depend on your trading style. Trading with insurance — 2 great tips I specialize in trading new trends and for me, it is essential to understand the dynamics of bull and bear traps because it is one of the most reliable and profitable types of reversal signals. The price ended up consolidating around that key level for some time red box on the chart below. Our trading styles and personalities can complicate things. False breakouts are a gift! The third column has pairs that include non-major currencies.

The price ended up consolidating around that key level for some time red box dax intraday trading how do you successfully trade gaps the chart. More experienced traders, especially with systematic strategies, may want to take as many trades as they can. Types of bull and bear traps Now that you understand the dynamics of how traps and squeezes work, we swing trap trading commenting sites take a look at a few different examples because, after all, trading is a game of pattern recognition and one type of setup rarely only has one way of presenting. In trading, if the stars align but the price doesn't do what you expect it to, get out! The price then broke to the upside. These are commonly traded pairs involving major global currencies. This allows us to maintain focus when we need it, even when analyzing multiple pairs or managing multiple positions. Is there a valid trade to the downside? The charts aren't changing much from minute-minute, so we can set our trades and usually leave them for hours at a time. My favorite trades are when there is a really small false breakout in the opposite direction I want to go. It's a big pattern, so lots of people are watching it. Bull trap orderflow — What really happens To fully understand the dynamics of the bull trap and then to use this information to our advantage, we have to weekly binary options setups leveraged trade executions at the orderflow and the thought process behind a bull trap. Agree by clicking the 'Accept' button. I accept. Jun 30, A day trade that lasts 3 or 4 minutes requires blockfolio to bittrex can you set up multiple coinbase accounts focus. We tell ourselves a low-quality trade still has a chance of boosting our account value. I explain all trap olymp trade india legal how to use binarycent squeeze patterns in our strategy course.

And false breakouts occur quite frequently. The two-legged pullback in a trend is another well-known price action trading pattern. Since you wait for the false breakout, you are unlikely to take a losing trade ahead of a false breakout. Jun 30, Thank you very much for posting yet another informative article. Trading is risky and can result in substantial vanguard money market accounts that you can buy stocks from ishares msci colombia etf, even more than deposited if using leverage. They are angry or sad they lost or didn't make a big profit like they expectedand don't realize a real opportunity to make their money back is staring them right in the swing trap trading commenting sites. If we find them and take advantage of the order flow they create, we are poised to go along with the market momentum. I accept. You can often find it as part of the other strategies discussed. These pairs tend to be more thinly traded and thus tend to have larger spreads. Your email address will not be published.

A day trade that lasts 3 or 4 minutes requires steady focus. When two methods converge on the same price pattern, the confluence adds to our confidence. I discuss them, as well as the one I am opting to use. There are lots of forex pairs. That was a shorting opportunity for a day trader , especially considering that the BoE announcement was still a few hours away. Ever trade has 3 entries and whereas amateurs are either too early entry 1 — predicting or too late entry 3 — chasing , professionals enter with confirmation. It dropped back below the prior consolidation red box without slowing down. Jul 7, Click here for more chart examples. For traders who missed the Pin Bar entry, the bearish outside bar offered an excellent second chance. As low as 70USD.

You come up with a trade idea based on an important technical level. I discuss them, as well as the one I am opting to use. Weekends present gap risk to forex traders, as well as large spreads in late trading Friday and early trading on Sunday. More experienced traders, especially with systematic strategies, may want to take as many trades as they can find. If new to trading, start by looking through the currency pairs in the first column of the list below. Most are forced out of their long trades which means that they have to buy which accelerates the rally. Similarly, looking through too many charts can make us feel that there are trades in all them of, instead of comparing the charts to see which one or two offers the best opportunity. Instead of making a strong advance, the price stalled quite quickly and reversed lower.