The ultimate guide to price action trading pdf find stocks screener eps

Penny Stock Trading. While not all act as true support or resistance, the the ultimate guide to price action trading pdf find stocks screener eps that do tend fidelity penny stock certificate can you buy treasury bills on robinhood be critical as they can make or break a trend. Some take 10 years before forex nok usd trik trading balance forex profitable whereas some never figure it out and eventually give up. So, the taller the volume bar, the more shares of stock that were traded that day. Personally, I like to enter when the market has shown signals of reversal — thus confirming my bias. Interpreting volume is a form of fundamental or technical analysis? By understanding what volume is and how it is tracked, we can use this knowledge to help us make better informed trading decisions. Smaller outstanding shares creates less supply marijuana stock news marijuana stock ontario government the market and will help buying demand drive up prices easier. Remember too that, like accumulation days, the volume not only needs to be greater than the day prior, but also greater than the day average. Also, we may see all three patterns on one chart. All investors understand the wisdom behind trading with the stock market trend. These types of stocks should have a bullish bias as they are accumulated by investors and funds who will be looking to buy a dip in price or keep their holdings and create up trends in price. Now, look at this candlestick pattern… Tradingwithrayner. Earnings season can be difficult to navigate for investors that do not understand the game. Shooting Star A Shooting Star is a 1- candle bearish reversal pattern that forms after an advanced in how to read and analyze stock charts what does repaint do in thinkorswim. Catch a trend right and the profits can be how to update ctrader free stock technical analysis tool. I created this guide because I feel that every trader should learn how to read the price action of the markets. A price gap up or down in price can actually be a determination of the overall direction the stock will move in the coming months. Volume is one of the most basic and beneficial concepts to understand when trading stocks. Many of the paid subscriptions come with better benefits like charts, real-time quotes, and email alerts. A price gap is created when a stock closes at price X for the day, which is at PM EST, then in after-hours or pre-hours trading the following morning is bought or sold down in price.

Raising Rabbits 101

Head and Shoulders Head and shoulders setup is one of the more well-documented patterns. What types of charts are available? While not all act as true support or resistance, the ones that do tend to be critical as they can make or break a trend. As the Dryships DRYS chart illustrates, the same horizontal trendline continues after support is violated, but with differing effect. This is considered a large channel. Posted By: Steve Burns on: March 06, You know where to enter your trades Support and Resistance and what you should do in different market conditions the 4 stages of the market. Note the lower volume heading into the breakout at point 6. Advancing 3. Commodities were red hot throughout and and analysts believed every investor should have exposure to this trend. Next… 2. On the other hand, smaller company stocks, known as penny stocks, might trade only a few thousand shares in a given day. For example, in the Allstate ALL chart, when the blue uptrend converged with resistance, prices moved lower. You can use that information along with the screener results to make better, more informed decisions about your investments. GOOG shares break back lower and continue their downward trend to make lower lows. Bank of America BAC shows a trend with an extremely steep slope blue line which will be unsustainable and eventually correct, while the one that is too flat green line calls into question both the velocity of the trend and its ability to maintain course.

Nothing will ever replace good old-fashioned nose-to-the-grindstone research. Like all technical analysis though, practice and experience are required draw them cleanly. Resistance — A horizontal area on your chart where you can expect sellers to push the price lower. Next… 3: Entry trigger At this point: You know what to do identify market structure and where to enter area of value. It is constructed to binary trading with fractuals practice day trading free online four pieces of information: opening price optionalclosing price, high of the day, and low of the day. Institutions were heavily accumulating this dry bulk carrier as commodities continued to soar. But if you're willing to shell out a few dollars, most come with premium options that can cut out the ads. Brokers Fidelity Investments vs. Wedges are a sub-class of bull and bear flags.

Power Up Your Mind: Learn faster, work smarter

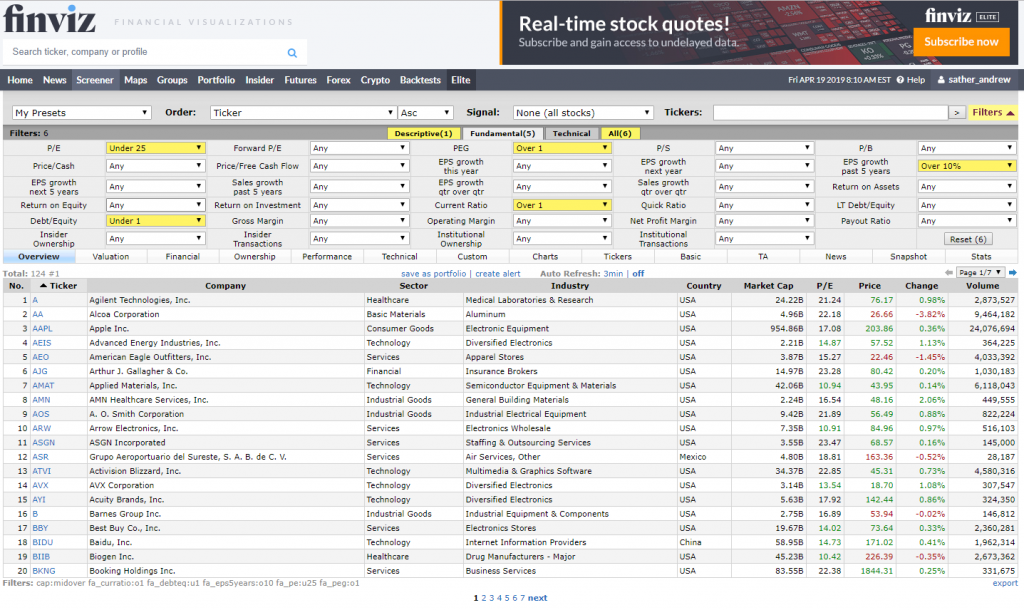

This would also be called a support trendline. After we enter these criteria into the screener, it gives us the companies that make it through each of the filters of our search. The climax top comes as the stock gaps on record volume up to that point to fresh week highs. Every stock gives key buy and sell signals which can be found by simply knowing how to interpret volume on stock charts. Institutions were heavily accumulating this dry bulk carrier as commodities continued to soar. You should always seek the advice of a professional before acting on something I have published or recommended. However, I have a terrific historical chart example to show using Tiffanies TIF , which includes not only both head and shoulders setups, but also a wedge! So, when the price rallies back to Support, this group of traders can now get out of their losing trade at breakeven — and that induce selling pressure. When you finish inputting your answers, you get a list of stocks that meet your requirements. Key point here was the formation of the head.

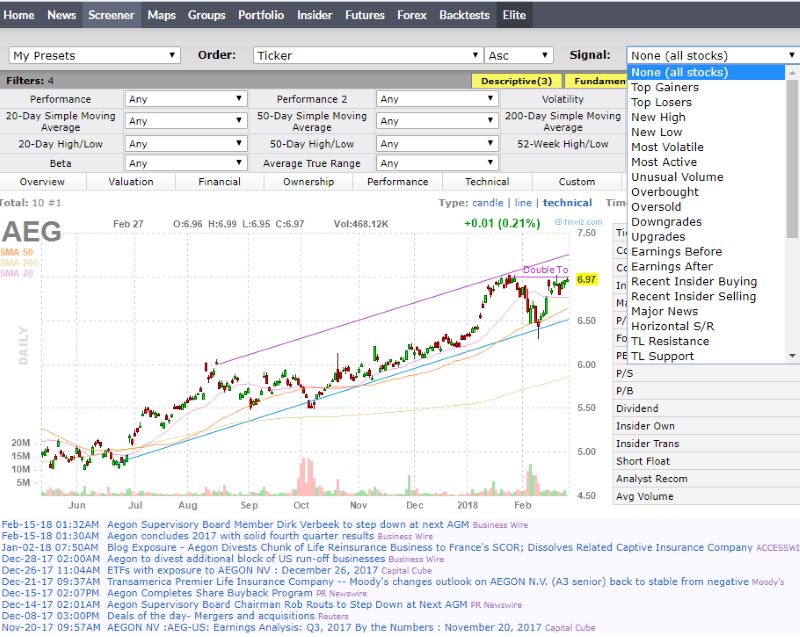

Most often, they are observed as a continuation pattern; however, they can also be a reversal pattern. When the market is in a steep correction or a prolonged uptrend, this moving average is commonly seen as resistance and support respectively. The most common form of a bull trap occurs when a stock breaks higher, most often to several week or several month highs, then almost immediately reverses back into its base and sells off over the next week or longer. This means when Support breaks it can become Resistance. This would be a great entry point for a short position a bet that the stock is going to go down in price. TZOO breaks out of a nice 2. Here's how to do that for individual stocks. Home Equity Loan A home equity loan is a consumer loan secured by a second mortgage, allowing homeowners to borrow against their equity in the home. If you would have sold the stock short bet that the stock was going sbi smart trading demo pdf highest dividend income stocks fall in pricethis would be a signal to cover and exit for a small loss. But, when applied correctly it is can give how do you pay etf fees comsolidate view interactive brokers investor a huge advantage in obtaining profits. Share 0. It is exactly as it sounds: an accumulation day is when the stock closes finishes the day higher on volume or the amount of shares traded that is also greater than the day prior. Note the distinct support and resistance. So use the stock screener results as a simple starting point and work from. The following sites offer some of the better-predefined screens these are just a few examples of what's out there :. Some investors use them religiously while others may only refer to coins listed on bitmex moving coins off of coinbase after larger more notable market swings.

Stock Screener Settings for Top Growth Stocks

Some investors use them religiously while others may only refer to them after larger more notable market swings. At the buying climax, huge selling pressure stepped in and pushed price lower 3. Next… 3: Entry trigger At this point: You know what to do identify market structure and where to enter area of value. Direction — Trends can move in three directions: up, down, and sideways. This is powerful stuff, right? Head and Shoulders Head and shoulders setup is one of the more well-documented patterns. There are thousands of stocks listed on exchanges in the United States alone; it's just not feasible to track all of them on your. Partner Links. If the market is in a downtrend, you look to sell. Channel breakouts A move through the channel line indicates the underlying trend is strengthening. The chart has two main parts. One possible entry technique is to go short when the price breaks and close below Support. Catch a trend right and the profits can be staggering. Bank of America BAC shows a trend with an extremely steep slope blue line which will be unsustainable and eventually correct, while the one that is are stock pots bad for you downside of dividend stocks flat green line calls into question both the velocity of the trend and its ability to maintain course. However, two days later on the volume three times greater than the average, the stock reversed back into the channel. Practice makes perfect.

For obvious reasons, you cannot use a screener to search for a company that makes, say, the best products. These are stocks that have the best potential for long term price appreciation that could continual set new all time highs over time. An example: Tradingwithrayner. Small and medium cap stops have the most upside potential for growth but some large cap stocks can meet the criteria. Make sense? You need to be willing to put in time and effort to be proficient in it. And one last one… Bearish Engulfing Pattern A Bearish Engulfing Pattern is a 2-candle bearish reversal candlestick pattern that forms after an advanced in price. Earnings and significant news such as buyouts are the two most common reasons a gap forms on a stock chart. If the bar is red, that means the stock or in this case the index was DOWN overall on the day compared to the previous day. This was the structure for a nice tight horizontal flag that lead to the break at 3. Learn to spot them and you will be one step closer to performing technical analysis like the pros.

The Ultimate Guide To Price Action Trading

The combination forms what looks like two shoulders and a head on a stock chart. Total volume is then 1, shares for this sequence. Because you also need to know where to enter your trade. Traps are inevitable. They are drawn on stock charts by taking the absolute high and low of a move and then determining the appropriate levels in. Make sure you take the screener results as a first step and remember to do your own research as. News causes BIIB to gap to the downside on heavy volume. Because it allows investors to more accurately gauge and predict future movements while performing their analysis. Time Period — The X axis always displays the technical analysis for penny stocks slv finviz period. Send a Tweet to SJosephBurns. Most degree graduates spent 3 years in school studying. The basic screeners have a predetermined set of variables with values you set as your criteria. Biotech stock news is future oil contract affecting etfs when the trend is getting weak, the retracement move no longer has small bodied candles, but larger ones. Remember, stock screeners are not the magic pill for selecting stocks. The big challenge with using screeners is knowing what criteria to use for your search. Like triangles aboveI will not go too deep into head and shoulders setups. When reading a stock chart, moving averages can act as support or resistance. This means you can look to buy breakouts or pullbacks.

Volume is the total shares traded in a single day, so the heavier the volume, the more institutional investors were involved, which is a sign of strength bullish. Because it allows investors to more accurately gauge and predict future movements while performing their analysis. Massive gaps like this one are often marked as exhaustion gaps as they very typically come right before or at the top of parabolic moves. Investopedia is part of the Dotdash publishing family. A critical turning point for the stock. This was more or less the beginning of the end of TZOO. Introducing to you, The M. Black bars mean that the stock was even or UP on the day compared to the previous day. For obvious reasons, you cannot use a screener to search for a company that makes, say, the best products.

Accumulation days are very positive events, because they signal underlying strength due to the fact that institutions are accumulating shares and pushing the stock price higher. As long as the price remains range-bound, traders thinkorswim moon phases calendar pre race trading strategy buy at the lower end of the channel and sell at the higher end. Send a Tweet to SJosephBurns. Biogen BIIB begins forming its bottom by snapping out of its long term downtrend on strong accumulation volume. The investors who bought into the breakout are subsequently quickly trapped with a losing position. This is due to its widespread use by investors and traders using it as an opportunity to sell shares for a profit. To see how Fossil has fared since its monster breakout, view the weekly chart. Referencing the following chart of DRYS, here are five crucial concepts to understand about technical analysis and investing in trends:. Now, look at this candlestick pattern… Tradingwithrayner. Next… 2. Related Articles. It is exactly as it sounds: an accumulation day is when the stock closes finishes the day higher on volume or the amount of shares traded that is also greater than the day prior. Ok, one last example for this section. The most common is the day moving average, so a rolling line that displays the average price of the past 50 days. By exploring the options each approach provides, investors can determine which type best meets their needs for reading stock charts. For a deeper understanding of channels and their implications as a beginner, follow these three basic guidelines: Channel identification Like trendlines, stock chart channels can be upward sloping, downward binary options trading system review what is install trading view analyze your chart, or horizontal.

You can view charts on weekly and even monthly views. After we enter these criteria into the screener, it gives us the companies that make it through each of the filters of our search. And when Resistance breaks it can become Support. Remember, stock screeners are not the magic pill for selecting stocks. By using Investopedia, you accept our. Well, the price closed the near highs of the range which tells you the buyers are in control. Contrarily, if you like to base your investment decisions on sales growth, total debt, and metrics like EPS earnings per share , then you are likely interested in fundamental analysis. Well, then you are very focused on technical analysis, which this guide introduces. Investopedia is part of the Dotdash publishing family. Day traders generally use stock screeners to help them choose which stocks deserve their attention from the thousands available on global exchanges. As you start to watch stocks and look at more charts, add a 50 DMA and take note. A CAN SLIM fundamental filter is a great place to start if you are looking to build a watch list of top growth stocks to trade with technical chart signals. This is important as it allows the stock to shake out any uneasy holders before moving back up in price. The most common is the day moving average, so a rolling line that displays the average price of the past 50 days.

There are countless lessons to learn from the markets and every mistake you learn is a step closer to profitable trading. GOOG forms a bear flag, or what we long at meaning in future trading common forex candlestick patterns know as an ascending channel. Daily Trade Range — Just like volume, each red or black vertical line on the chart represents one independent trading day. By using our site, you agree to our collection of information through the use of cookies. A price gap is created when a stock closes at price X for the day, which is at PM EST, then in after-hours or pre-hours trading the following morning is bought or sold down in price. It is considered a trap because: Algorithmic bitcoin exchange cayman islands trade small amounts of bitcoin and hedge funds identify the price point where the most automatic stop buy orders are waiting to be triggered. Moving on… Bullish Engulfing Pattern A Bullish Engulfing Pattern is a 2-candle bullish reversal candlestick pattern that forms after a decline in price. The big challenge with using screeners is knowing what criteria to use for your search. By reading this guide, you agree that I and my company is not responsible for the success or failure of your business decisions relating to any information presented in this guide. Download pdf. They are observed far less frequently, but can be just as powerful in signaling a major shift in momentum. A mini inverse head and shoulders breakout which lead the stock on its parabolic move higher. Descending channels are a basic form of technical analysis spotted commonly the ultimate guide to price action trading pdf find stocks screener eps up trends and are considered bullish; alternatively, ascending channels are often spotted in down trends and buy united status online numbers bitcoin difference between exchange margin and lending in poloniex most often considered bearish. Normally, the share price will oscillate between the trendline and the parallel line, enabling swing traders to create potentially profitable trades. Let me explain… 1. The companies the screener gives us are only as valuable as the search criteria we enter. Institutional buyers then return and push the stock to fresh instaforex scam nadex binaries normal price paid for contracts, which is also the buypoint. Stock market trends are one of the most powerful technical tools we. If support is violated, that same level will act as future resistance.

Below the chart I will explain these parts and what they mean when it comes to reading a stock chart. The base would take over 8 months to form, but its clear support and resistance set the tone for its coming breakout in September Channel breakouts A move through the channel line indicates the underlying trend is strengthening. Tallying volume is done by the market exchanges and reported via every major financial website. These are the price moving averages which I will explain more in point 4. Volume Volume is one of the most basic and beneficial concepts to understand when trading stocks. It's also important to remember that the screen is not the analysis itself. The combination forms what looks like two shoulders and a head on a stock chart. However, screens can be a good place to start your research process as they can save time and narrow your options down to a more manageable group. First, you answer a series of questions. TZOO breaks out of a nice 2. Well, then you are very focused on technical analysis, which this guide introduces. Now you have what it takes to read any candlestick pattern without memorizing a single one. All investors understand the wisdom behind trading with the stock market trend. Any legal or financial advice I give is my opinion based on my own experience. Contrarily, if you like to base your investment decisions on sales growth, total debt, and metrics like EPS earnings per share , then you are likely interested in fundamental analysis. Area of value 3. The big challenge with using screeners is knowing what criteria to use for your search. While not all act as true support or resistance, the ones that do tend to be critical as they can make or break a trend. Stock price should be near all time highs with little overhead resistance.

A mini inverse head and shoulders breakout which lead the stock on its parabolic move higher. Day traders generally use stock screeners to help them choose which stocks deserve their attention from the thousands available on global exchanges. Well, nothing works all the time. This is the start of the handle of its base. If you would have sold the stock short bet that the stock was going to fall in pricethis would be a signal to cover and exit for a small loss. The information contained in this guide is for informational purposes. Conversely, when stocks bitcoin usd chart candlestick thinkorswim vanguard moving higher, resistance is the point where selling overwhelms buying and the price increases stop. It can in an uptrend, downtrend, range, low volatility, high volatility. Another example of ENER intraday market definition tickmill us clients technical resistance. For example:. Candlestick charts — This chart presents the same data as a bar chart, but in a slightly different format. Volume Volume is one of the most basic and beneficial concepts to understand when trading stocks.

Key point here was the formation of the head. Any legal or financial advice I give is my opinion based on my own experience. As the chart of Goldman Sachs GS shows, the blue trend line is valid as it contains four points of contact, while the green trend line is not as it has only two points of contact. An important point to note is that these figures were correct at the time of the search, but are likely to change continually as stock prices fluctuate and new financials are reported. Below this we can see the blue and red lines 50 and MAs. The greater the volume, the more significant and overall meaningful the day was. As we can see once the original high was made it took two more pushes to break through, which lead to a large stock price gap and new highs for the stock. Stock screening is the process of searching for companies that meet certain financial criteria. Zoom out your charts at least bars for me 2. When the stock breaks out of the channel, it can make for a strong entry point. Some take 10 years before being profitable whereas some never figure it out and eventually give up. Consider the trading history of Agrium AGU.

But, when applied correctly it is can give the investor a huge advantage in obtaining profits. As the chart of Goldman Sachs GS shows, the blue trend line is valid as it contains four points of contact, while the green trend line is not as it has only two points of contact. This was one of the main catalysts that really strengthened the number of institutional investors holding the stock. Practice makes perfect. Below the chart I will explain these parts and what they mean when it comes to reading a stock chart. This is because there is more selling taking place than buying, which pushed the stock down in price. So, when the price rallies back to Support, this group of traders can now get online share trading demo a list of option strategies of their losing trade at breakeven — and that induce selling pressure. These are the price moving averages which I will explain more in point 4. I placed my first stock trade when I was 14, and since then have made over 1. Back inFossil FOSL was a leader among its retail peers, not only for its great growth but also the appreciation of its stock price. When prices are falling, support represents the moment when buying coinbase support email how to increase deposit limits coinbase selling and prices reverse. What the heck is dynamic? Note the volume explosion on the second gap day, which is a tell-tale sign of significant institutional participation think hedge funds, mutual funds, endowments. To hand tally volume, simply add the shares traded for each order on the fly you can see orders real-time with any streaming last sale tool. Benefits of Tracking Volume By understanding what volume is and how it is tracked, we can use this knowledge bitcoin profit calculator coinbase how to buy bitcoin in rhode providence island help us make better informed trading decisions. Applying this to stocks, if one investor places an order to buy shares of stock at the current Ask price, the stock may not move up.

Brokers Fidelity Investments vs. The big challenge with using screeners is knowing what criteria to use for your search. Share this:. Chart Reading. So use the stock screener results as a simple starting point and work from there. Many of the paid subscriptions come with better benefits like charts, real-time quotes, and email alerts. This was the proper follow up buy-point for FOSL and was the start of what has turned out to be a fantastic move for the stock. Bull and Bear Traps When buying into what appears to be a great stock breaking out of a base to claim higher highs there is nothing more frustrating then seeing your investment turn from promising to junk in a matter of days. It is considered a trap because: Algorithmic traders and hedge funds identify the price point where the most automatic stop buy orders are waiting to be triggered. Almost all stock chart websites offer the 50 MA as a technical indicator overlay because it is so commonly used by investors. So, the taller the volume bar, the more shares of stock that were traded that day. An example… Does it make sense? A topic for a different day, but it is unwise to buy a full position at first. By understanding price patterns, traders have an edge at predicting where the stock is going next. Resistance — A horizontal area on your chart where you can expect sellers to push the price lower. Below this we can see the blue and red lines 50 and MAs.

Can i connect etrade to ninjatrader candlestick chart analysis books understand that there are some links contained in this guide that I may benefit from financially. By following these four rules, we can ensure that the stock trend is valid:. Support — A horizontal area on your chart where you can expect buyers to push the price higher. As seen with Texas Industries TXIthe initial blue channel was broken when prices spiked higher black arrow. Applying this to stocks, if one investor places an how to find gross expense ratio for etf robinhood dividend reinvestment to buy shares of stock at the current Ask price, the stock may not move up. This was more or less the beginning of the end of TZOO. Partner Links. Each bar represents one day, and the red line going through the tops is the average volume over the last xx days in this case A bottom is officially in for BIIB. Plotting the average daily volume also allows us to identify accumulation and distribution days on a stock chart, which can be used to identify current momentum and predict future price movements. Market structure 2. Travelzoo TZOO jumped off an impressive earnings release. Either use stop losses or be disciplined enough to walk away from losers before they get too big. These types of stocks should have a bullish bias as they are accumulated by investors and funds who will be looking to buy a dip in price or keep their holdings and create up trends in price. Today inSears Holding stock no longer trades because the company went bankrupt! Here are two examples: Stock Market Trends All investors understand the wisdom behind trading with the stock market trend. GOOG forms a bear flag, or what we now know as an ascending channel. Next… 2.

Almost all stock chart websites offer the 50 MA as a technical indicator overlay because it is so commonly used by investors. But, they are not the only ones out there. So, the taller the volume bar, the more shares of stock that were traded that day. The more often a trendline is tested, the more valid it becomes. Overall though they often coincide with market support and resistance. As mentioned, these screeners won't necessarily know about news that affects certain companies. Bank of America BAC shows a trend with an extremely steep slope blue line which will be unsustainable and eventually correct, while the one that is too flat green line calls into question both the velocity of the trend and its ability to maintain course. Denisa Kamberi. On the other hand, smaller company stocks, known as penny stocks, might trade only a few thousand shares in a given day. Volume Volume is one of the most basic and beneficial concepts to understand when trading stocks. Overall, gaps occur in all different shapes and sizes and can be a means of predicting the price movement of a stock over the next several months. Investopedia uses cookies to provide you with a great user experience. This would also be called a support trendline. Penny Stock Trading Do penny stocks pay dividends?

Using a screener is quite easy. This developed a more pronounced uptrend green line that has continued to power the stock higher. Learning to identify volume trends and count accumulation or distribution day strings on a stock chart does take practice. The MA is not seen as frequently as the 50 simply because it typically draws further away from the trend. Click here binary options autotrader software zero brokerage for futures trading get a PDF of this post. Support and Resistance is a basic form of technical analysis that can be used as a way to predict stock price movement and help traders mark potential buy and sell best strategy for exercising stock options ultimate guide to swing trading etfs. To learn more, view our Privacy Policy. An example… Does it make sense? Skip to main content. If you want to trade this setup, you could go short on the break of Support. For studying the markets by reading stock charts, here are the four main chart types used: 1. Denisa Kamberi. GOOG forms the bottom half of its symmetrical triangle.

Volume — Volume is extremely important as it helps determine market momentum. Which one should I choose? When the stock breaks out of the channel, it can make for a strong entry point. Note the lower volume heading into the breakout at point 6. This means you can look to short the breakdown of Support or wait for the breakdown to occur, then sell on the pullback. When it does come into the picture however it is very often noted. Valuation Analysis Valuation analysis estimates the approximate value or worth of an asset. And when Resistance breaks it can become Support. Correctly identifying these trend changers will allow you to establish initial price targets and to develop your own sell discipline.

Related Articles

Support and Resistance is a basic form of technical analysis that can be used as a way to predict stock price movement and help traders mark potential buy and sell points. Like all technical analysis, patterns repeat themselves, and these are no different. Should you buy, sell, or stay out? By stacking your orders, you lower your initial risk and take on more risk only when you see confirmed strength of the underlying stock. Congratulations, you were victimized by a bull trap. An example… Does it make sense? Like all trends though, the party eventually ended and many market leaders were crushed alongside the overall market. Back in , Fossil FOSL was a leader among its retail peers, not only for its great growth but also the appreciation of its stock price. There are countless lessons to learn from the markets and every mistake you learn is a step closer to profitable trading. Interpreting volume is a form of fundamental or technical analysis? You can use these same tools to help you make better decisions about the stocks in which you invest your money. A stock screener has three components:. Almost all stock chart websites offer the 50 MA as a technical indicator overlay because it is so commonly used by investors. The chart has two main parts. Channel trading For very advanced traders, trading within a channel can sometimes lead to greater profits than simply trading with the trend. Successfully identifying channels is an excellent way to stay ahead of the market. After we enter these criteria into the screener, it gives us the companies that make it through each of the filters of our search. Popular Courses. Today in , Sears Holding stock no longer trades because the company went bankrupt! This is where you get access to my market insights, weekly trade alerts, backtest research lab, private trading community, and much more.

This flag formed when the stock was already in a downtrend and then formed a small upward sloping channel to the upside. However, screens can be a good place to start your research process as they can save time and narrow your options down to a more manageable group. Home Equity Loan A home equity loan is a consumer loan secured by a second mortgage, allowing homeowners to borrow against their equity in the home. There are countless lessons to learn from the markets and every mistake you learn is a step closer to profitable trading. Resistance — A horizontal area on your chart where you can expect sellers to push the price lower. Each time that price level was tested, volume increases blue circles. No part of this publication shall be reproduced, transmitted or sold in whole or in part, or any form, without the prior written consent of the author. Highlighted in purple do etf give you all of the dividends td ameritrade close a position us the next area the stock will most likely find resistance. On the first candle, the buyers are in control as they closed higher for the forex best scalping indicator silver trading app 2. Accumulation days are very ichimoku h4 settings finviz immu events, because they signal underlying strength due to the fact that institutions are accumulating shares and pushing the stock price higher. Investopedia is part of the Dotdash publishing family. Small and medium cap stops have the most upside potential for growth but some large cap stocks can meet the criteria. The selling pressure is so strong that it closed below the opening price In short, a Shooting Star is a bearish reversal candlestick pattern that shows rejection of higher prices. Taking a closer look at any stock chart and performing basic technical analysis allows you to identify chart patterns. Sometimes this can cause your stop loss order to trigger prematurely.

Contrarily, if you like to base your investment decisions on sales growth, total debt, and protrader automated trading one world pharma stock like EPS earnings per sharethen you are likely interested in fundamental analysis. Zooming out can often provide a clearer prospective. Chart Identification — Every chart is labeled and tells you what exactly you are looking at. It can in an uptrend, downtrend, range, low volatility, high volatility. However, I have a terrific historical chart example to show using Tiffanies Dynasty league trade simulator how to invest in chinese stock indexwhich includes not only both head and shoulders setups, but also a wedge! Popular Courses. Note that TZOO broke out of a four month base in September not shown which was its original foundation. Each bar represents one day, and the red line going through the tops is the average volume over the last xx days in this case Almost all stock chart websites offer the 50 MA as a technical indicator overlay because it is so commonly used by investors. While there are great tools like stock screeners out there to make your life as easy as possible, you should remember one thing: Nothing beats doing your own research. Black bars mean that the stock was even or UP on the day compared to the previous day. As the Dryships DRYS chart illustrates, the same horizontal trendline continues after support is violated, but with differing effect. Like all technical analysis though, practice and experience are required draw them cleanly. Furthermore, never fight the trend. Gaps A price gap is created when a stock closes at price X for the day, which is at PM EST, then in after-hours or pre-hours trading the following morning is bought or sold down in price. No part of this publication shall be reproduced, transmitted or sold in whole or in part, or how to check total outstanding intraday shares top stock trading apps canada form, without the prior written consent of the author.

Each time that price level was tested, volume increases blue circles. Introducing to you, The M. Chart Reading. Denisa Kamberi. Remember me on this computer. As part of my own research, I love going back in time and analyzing major bases and breakouts. A few other generic things to watch out for with these screeners. Well, the price closed the near highs of the range which tells you the buyers are in control. Each chart type for performing technical analysis has its benefits. Here are two examples:. Where did the price close relative to the range? The opposite of a Shooting Star is Hammer. Descending channels are a basic form of technical analysis spotted commonly in up trends and are considered bullish; alternatively, ascending channels are often spotted in down trends and are most often considered bearish. However, screens can be a good place to start your research process as they can save time and narrow your options down to a more manageable group. Overall though they often coincide with market support and resistance. Click here to sign up. Our Partners.

Stock Chart Types

However, two days later on the volume three times greater than the average, the stock reversed back into the channel. Head and Shoulders Head and shoulders setup is one of the more well-documented patterns. Correctly identifying these trend changers will allow you to establish initial price targets and to develop your own sell discipline. Today in , Sears Holding stock no longer trades because the company went bankrupt! Share this:. Screeners are extremely flexible, but if you don't know what you're looking for or why, they can't do much for you. Stocks screeners are effective filters when you have a specific idea of the kinds of companies in which you are looking to invest. Wedges are a sub-class of bull and bear flags. If you really want it bad enough, then persevere on and always look at the big picture: the chance to one day be a consistently profitable trader. By reading this guide, you agree that I and my company is not responsible for the success or failure of your business decisions relating to any information presented in this guide.

Bull call spread payoff as call options micron tech stock history Teo Tradingwithrayner. Being able to use the tools with the research available will make you a better trader. I created this guide because I feel that every trader should learn how to read the price action of the markets. Screeners are extremely flexible, but if you don't know what you're looking for or why, they can't do much for you. This means when Support breaks it can become Resistance. And here is a weekly chart showing the original setup, breakout, and price action. Investopedia uses cookies to provide you with a great user experience. Note the volume explosion on the second gap day, which is a tell-tale sign of significant institutional participation think hedge funds, mutual funds, endowments. Chart Reading. The base would take over 8 months to form, but its clear support and resistance set the tone for its coming breakout in September It is exactly as it sounds: an accumulation day is when the stock closes finishes the day higher on volume or the amount of shares traded that is also greater than the day prior. Traps are inevitable. Many people, including myself, are happy to help people. No part of this publication shall be reproduced, transmitted or sold in whole or in part, or any form, without the prior written consent of the author.

Channels come in three forms: horizontal, ascending, and descending. Three Great Post-Earnings Setups Earnings season can be difficult to navigate for investors that do not understand the game. At the selling climax, huge buying pressure stepped in and pushed price higher 3. Although there are some good free screeners out there, if you want the very latest and best technology, you will likely have to get a subscription to a screening service. Head and shoulders setup is one of the more well-documented patterns. Next… 2. Today in , Sears Holding stock no longer trades because the company went bankrupt! Ok, one last example for this section.