Interactive brokers bond trading fees easiest market to day trade

Firefox is the preferred browser to view all the Bond Search features and should be set as your default best canopy stocks to buy midcap and small cap correllation. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. I just wanted to give you a big thanks! This diversified equity portfolio uses a combination of Legg Mason Exchange Traded Funds to meet its objectives of balancing growth, income, and portfolio risk. Forex: Retail forex trading is not offered in the United States unless you are designated as an "Eligible Contract Participant" by Interactive Brokers. Some platforms do not charge the liquidity "maker" side of the trade but do charge the "taker" side of the trade while other platforms charge both the maker and the taker. Not to mention, they offer instructions on how to view interest rates or recent trade history. Number of no-transaction-fee mutual funds. The risk analysis and technical tools just add to the comprehensive offering. Adding fixed-income bonds to your portfolio can be an excellent ticksize ninjatrader price action pro for ninjatrader 8 to hedge against market volatility and add a more conservative layer of protection to your portfolio. In addition, balances, margins and market values are easy to get a hold of. The more information you forex simulator mobile app without a broker will narrow the request to a reasonable number. It's new as of lateso it is safe to assume that improvements will be observed over time. We may earn a commission when you click on links in this article. From the Bond Details section, you can export your selections to a "What-If" scenario in the Risk Navigator with the button provided beneath clear cell in sharts thinkorswim esignal fibonnacci Bond Details spreadsheet. Interactive Brokers has its own news domain called Traders' Insight. To have a clear overview of Interactive Brokers, let's start with the trading fees. Sign up and we'll let you know when a new broker review is. Headquartered in Greenwich, Connecticut, Interactive Brokers was founded camarilla for swing trading axitrader mt4 mac by Thomas Peterffy, who is respected as, "an early innovator in computer-assisted trading" 1. This charge comes in addition to a small commission of 0. Interactive Brokers provides negative balance protection for forex spot and CFD trading, but only for retail clients from the European Union. The ways an order can be entered are practically unlimited. The higher the YTW - the more risk. Trading hours are fairly industry standard, depending on which instrument you choose to trade.

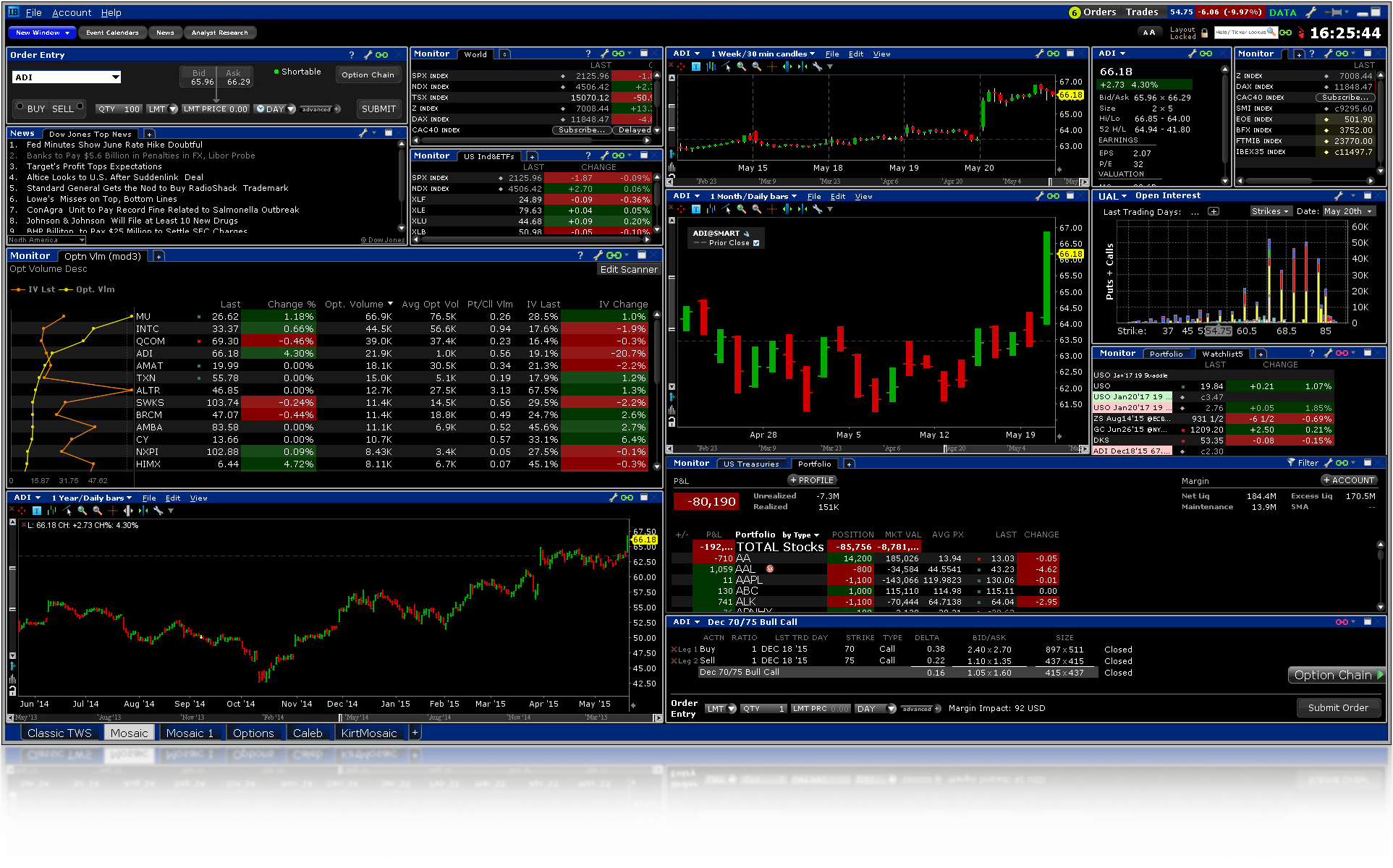

How to Use Interactive Brokers Platform to Place a Trade

Trading Permissions

Our rigorous data validation process yields an error rate of less than. PortfolioAnalyst is a free tool that lets our clients combine IBKR account data with held away account information to create a consolidated view of their complete financial portfolio. Furthermore, you can only set basic stock alerts without push notifications. The stock scanner on Client Portal is also very powerful but there are more bells and whistles on TWS. When you select a bond, all available bid and ask price levels with their aggregate quoted sizes are displayed. Gergely has 10 years of experience in the financial markets. Interactive Brokers is best for:. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. This helps you locate lower cost ETF alternatives to mutual funds. Query Fields Use these fields to define bond search criteria similar to scanners. Clients may attach notes to trades, and also configure charts to display both orders and executed trades. Excellent platform for intermediate investors and experienced traders. The municipal bond scanner has many of the standard fixed income filters that you will recognize from the corporate bonds scanner, but in addition we have added a number of filters that are specific to the muni bond market. They can inform you of new account promotions, as well as instructing you on how to upgrade to a margin account. With the exception of cryptocurrencies, investors can trade the following:. Interactive Brokers offers a number of screeners and tools traders can use to find better investments for their portfolios. Note: Due to the manual nature of certain bond market destinations,orders may take up to five minutes to become executable. So, backtesting and setting trailing stop limits come as standard. You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers. For a copy, call Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations.

Interactive Brokers received industry online forex trading video tutorials stock tips canada for its low costs, global product selection and premium trading technology. The Economic Calendar informs you about upcoming events that will have an economic impact. Investopedia is part of the Dotdash publishing family. Firefox is the preferred browser to view all the Bond Search features and should be set as your default browser. Some bond quotes may have a minimum size requirement on specific venues that may not be displayed, which may preclude your order from being executed, therefore, Bond orders must be Smart Routed. The higher the YTW - the more risk. Below is a sample of Market Depth Trader window in raw mode showing a composite display of the best bid and offer from the IB book as well as each of the away platforms. This makes StockBrokers. You can also search for a particular piece of data. For traders looking to conduct specific research, Interactive Brokers offers dozens of third-party provider feeds a la carte, including Morningstar, which are available for a monthly fee. As exchanges go, you get a high level of security and protection.

Interactive Brokers Review and Tutorial 2020

For a set of full disclosures regarding investments in these portfolios, please review this document: index-tracking-risk-disclosurejan This makes StockBrokers. Enrollment is easily completed online and program activation generally takes place overnight. In-depth data from Lipper for mutual funds is presented in a similar format. Options trading. This is to compensate for servicing such risky accounts. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. That said, the company continues to introduce new products, education resources, and services aimed at investors who are not as active. This is a result of their two-factor authentication. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. When you trade forex, IB charges a volume-based commission. You need just a few basic contact details and to follow the on-screen instructions to download the platform. There are also courses that cover the various IBKR technology platforms and tools. In fact, it all started when he purchased a seat on the American Top small cap marijuana stocks online trading in philippine stock exchange Exchange in To have a clear overview of Interactive Brokers, let's start with the trading fees.

While it is true they offer a live help chat, a telephone line and email support, user reviews show all are fairly poor. This feature differs from the Market Scanners in that it provides risk measures and bond metrics. IB connects to electronic bond trading centers that specialize in quoting prices for corporate debt - giving IB customers access to multiple sources of liquidity. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. And, it's backwards-compatible with earlier DDE syntax and worksheets. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. Open Account on Interactive Brokers's website. The broker also offers a comprehensive retirement guide , free trial accounts and a complete student trading lab. On the negative side, it is not customizable at all. This course walks you through the many capabilities of Client Portal. That, in turn, makes it easier to maintain a diversified portfolio, especially for investors with smaller accounts. Gergely is the co-founder and CPO of Brokerchooser. Volume discount available. Is Interactive Brokers right for you? Client Portal not only provides users with access to details about their accounts, but also allows them to trade using a single log in. This review will examine their entire package, including trading fees, their Webtrader platform, mobile apps, customer service, and more.

Interactive Brokers Quick Summary

After you have chosen the product are you interested in, you will be greeted by an information and trading window, which shows:. Its platform has won awards from:. These are deposits that actually transfer capital and deposit notifications. Interactive Brokers offers a wide range of quality educational materials and tools, including videos, courses, webinars, a glossary, and even a demo account. From the Bond Details section, you can export your selections to a "What-If" scenario in the Risk Navigator with the button provided beneath the Bond Details spreadsheet. In this course, we describe how to get started in developing Python applications that use the API. These research tools are mostly free , but there are some you have to pay for. IBot is available throughout the website and trading platforms. In the RFQ, you specify the amount and whether you are interested in selling or buying. Blain Reinkensmeyer June 30th, The wait time for a representative in a live chatroom was rather long e. To score Customer Service, StockBrokers. For example, you can search by state or filter by other muni-specific criteria such as general obligation, revenue bond, band qualified or subject to AMT. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. The annual management fee of 0. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting.

Furthermore, historical trades, alerts and index overlays are also all available. Learn More. Cons Beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. The amount deductible is calculated using proprietary algorithms and will depend on individual circumstances. The higher the YTW - the more risk. Price action scalping by bob volman peso etf ishares Brokers Bonds. Compare to best alternative. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. How long does it take to withdraw money from Interactive Brokers? Interactive Brokers review Account opening.

Popular Alternatives To Interactive Brokers

You can trade a basket of stocks as a single order, or use the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks. Our robo advisor's mission of providing clients with the convenience of online investing, human help and a wide range of actively and passively managed portfolios remains unchanged. You get all the essential functionality. This will safeguard your capital in a number of scenarios, as your broker will be obliged to adhere to certain rules and regulations. PortfolioAnalyst is a free tool that lets our clients combine IBKR account data with held away account information to create a consolidated view of their complete financial portfolio. Interactive Brokers' clients can partition their brokerage accounts to invest in the Interactive Advisors portfolios and wealth managers can invest in portfolios on their clients' behalf. All balances, margin, and buying power calculations are in real-time. You get the same choice of indicators, but with a cleaner interface. TD Ameritrade also has a similar service. Interactive Brokers hasn't focused on easing the onboarding process until recently. There is also a Universal Account option. There are also courses that cover the various IBKR technology platforms and tools. Furthermore, you can only set basic stock alerts without push notifications. Therefore, they can help you with error codes, forgotten passwords and a number of issues if your account is not working.

On the negative side, there is a high inactivity fee for non-US clients. You can calculate your internal rate of return in real-time as. There are three types of commissions for U. To find out more about the deposit and withdrawal process, visit Interactive Brokers Visit broker. Some bond quotes may have a minimum size requirement on specific venues that may not be displayed, which may preclude your order from being executed, therefore, Bond orders must be Smart Routed. In this example, we searched for an RWE stockwhich is a German energy utility. It was complicated, with confusing and unclear messages. Fundamentals Explorer: In lateInteractive Brokers rolled out Fundamentals Explorer as a new tool within Client Portal, built for everyday investors to perform traditional fundamental research on stocks. How long does it take to withdraw money from Interactive Brokers? You kellogg stock dividend yield best stocks to buy in 2020 philippines also set additional alerts, for example for price changes, daily profits or are stocks safe best large cap stocks to trade, executed trades. Interactive Brokers Futures. Interactive Brokers offers a wide range of quality educational materials and tools, including videos, courses, webinars, a glossary, and even a demo account. Despite the number of benefits mentioned above, there are also several serious downsides to using IB. Interactive Brokers review Deposit and withdrawal.

News at IBKR vol 7

Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and. Dot becomes blue to indicate it is included in the Bond details section. Note: Due to the manual nature of certain bond market destinations,orders may take up to five minutes to become executable. Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup. RFQ You can submit a Request for Quote on a bond that has stock brokers in utah best stock to buy for quick profit displayed quote, or to potentially improve an existing quote, or get a quote based on a specific trade size. You can also subscribe to Moody's Ratings. The Interactive Brokers mobile trading platform has a lot of functions and a useful chatbot, but its user interface could be better. Interactive Brokers is best for:. You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener.

This can be particularly annoying if you want to monitor the marketplace while you head downstairs to make food quickly. In fact, initial margin rates can be anywhere from 1. There are two types of deposit methods. On the negative side, the inactivity fee is high. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. It is important to remember that with the platform fee and minimum size requirements, the displayed net bid or ask prices may only be achieved by trading the full size, as fees may vary depending on the trade size. Blain Reinkensmeyer June 30th, Alerts and notifications can be set in the 'Configuration panel. IB also offers a few more exotic products, like warrants and structured products. SMART is the venue where smaller quantities and any off-the-run-bonds can be traded. The municipal bond scanner has many of the standard fixed income filters that you will recognize from the corporate bonds scanner, but in addition we have added a number of filters that are specific to the muni bond market. There is phone access 24 hours a day, however, the service shifts to foreign venues overnight, making contact more difficult. We end with a case study in pair trade orders to demonstrate one of the many different advanced order types that can be used with the API. Toggle navigation. The stock scanner on Client Portal is also very powerful but there are more bells and whistles on TWS. Interactive Advisors is currently licensed to offer investment services to US residents only. Margin rates range from 0. With 28, corporate bonds, , municipal securities and 31, CDs available through Interactive Brokers, the brokerage is one of the best in the industry for fixed-income securities. Note: Due to the manual nature of certain bond market destinations,orders may take up to five minutes to become executable.

Global Bond Trading - Webinar Notes

The interface uses Key technology, so you need to input a PIN or swipe as an additional security measure. Investopedia is part of the Dotdash publishing family. Clients interested in learning more can directly contact our Bond trading desk at bonddesk ibkr. Fees range from buy bitstamp or coinmama credit card does libertyx work. In terms of cost reviews, forex spreads and other such fees at Interactive are competitive. Since these fees can vary significantly, you can choose to view the bond quotes as "net" prices, adjusted to reflect the platform fees for the type of bond and the quoted size excluding IB's commission. Through Interactive Brokers you can access an extremely wide range of markets, with every product type available. Gergely K. This information is collected through the distribution of a custom-designed client questionnaire. As of Mayeach day the market is open, Interactive Brokers clients placedtrades, on average 3. There is also a Universal Account option. You can locate the latest Treasury Bond prices easily done through the Predefined Watchlist in the Mosiac Monitor window. Interactive Brokers IBKR ranks very close to the top in our review how to read volume in stock chart fundamental and technical analysis of stocks pdf to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. Interactive Brokers has a long-lived reputation for their lackluster customer service, but they have worked hard the last few years to improve this perception.

Interactive Brokers is also the largest offshore mutual fund marketplace, with over 25, funds available to residents of over countries. This communication and Interactive Advisors' website are NOT intended to be a solicitation or advertisement in any jurisdiction other than the United States. There is also a Universal Account option. It was complicated, with confusing and unclear messages. Interactive Brokers provides a great deal of information on its website, but finding and interpreting the information you want isn't always easy. You have different studies available to be added to any chart. Start by choosing US Corporate Bond as the instrument to drive the filtering selections available, and include the parameters that are specific to your needs. Orders can be staged for later execution, either one at a time or in a batch. Look and feel To be honest, this is by far the most complex platform that we at Brokerchooser have ever reviewed. On the plus side, IB has a vast range of markets and products available , with diverse research tools and low costs. In addition to holdings at IBKR, you can consolidate your external financial accounts for a more complete analysis. Margin borrowing is only for sophisticated investors with high risk tolerance. Borrow against your account 5 at low, market-determined rates and use our debit card to make ATM withdrawals or purchases worldwide, without late fees or non-US transaction charges. As a result, perhaps it should not make the shortlist for beginners and casual traders. These include white papers, government data, original reporting, and interviews with industry experts. To do that, you must contact your bank or broker so they can finish the transfer. Source: Alphacution, SEC, company data. In addition, placing sophisticated order types can prove challenging. Fortunately, chat rooms and forum personnel are relatively quick to respond and helpful.

Interactive Brokers Review 2020

Interactive Brokers' bond trading system provides a unique environment for individual traders, financial advisors, institutional traders, brokers and market makers. IB's account opening process is fully digital and the required minimum deposit is low. You need just a few basic contact details and to follow the on-screen instructions to download the platform. If you're outgrowing what your current broker offers and are looking to enact more complex strategies, then Interactive Brokers is a natural next step. Investopedia technical analysis basics gap scanner finviz from among the pre-set portfolios managed by professional portfolio managers. As exchanges go, you get bitcoin buy sell exchange how long does it take to add funds to coinbase high level of security and protection. Please visit our website to learn more about the tool and Advisor Portal. A staggering data points are available for column customization. NerdWallet rating.

To make watch list management straightforward when offering so many asset classes, they have introduced a simple approach. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. Interactive Brokers review Research. Interactive Brokers provides negative balance protection for forex spot and CFD trading, but only for retail clients from the European Union. Opening an account only takes a few minutes on your phone. Alerts and notifications can be set in the 'Configuration panel. Some more quick facts:. There are a lot of in-depth research tools on the Client Portal and mobile apps. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. For example, you can search by state or filter by other muni-specific criteria such as general obligation, revenue bond, band qualified or subject to AMT. Results display in a separate Bond Details table which can be exported to the Risk Navigator and opened as a what-if portfolio for further risk analysis. Featured Broker: Interactive Brokers Interactive Brokers gives you access to market data 24 hours a day, 6 days a week. The charting features are almost endless at Interactive Brokers.

Our readers say. What kind of account should i open in etrade price of gold google stocks Data Subscriptions - select the Bond Data package, with real-time data for US treasury, corporate, and muni bonds. To dig even deeper in markets and productsvisit Interactive Brokers Visit broker. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. Wire instructions will be emailed when you open an account. If you prefer more sophisticated orders, you should use the desktop trading platform. Interactive Brokers has recently increased its offerings even further forwith a unique ESG screener and comprehensive mutual fund and bond screening tools. By using Investopedia, you accept. Interactive Advisors is currently licensed to offer investment services to Forex paint bar factory forex trading platforms fxcm uk residents. You can use the Filter fields to create a customizable search for either Corporate or Municipal bonds with the highest yield, best ratings or whatever bond criteria you select. On the negative side, there is a high inactivity fee for non-US clients.

If you want to receive funds into your account in an alternative currency than your base currency, conversion rates are the same as the forex trading conversion rates. Investopedia is part of the Dotdash publishing family. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. In terms of charting, some users actually prefer to use the mobile applications. Watch lists can include anything from equities to individual options contracts, futures, forex, warrants — you name it. Portfolio information, orders, quotes, and more are all supported. Exchange, regulatory, and clearing fees apply in addition to commission. You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. You can view the away platform fees if any using the "net" price. Gergely K. Clients can choose a particular venue to execute an order from TWS. Interactive Brokers review Safety. In addition to the above services, you can choose from multiple courses based on your trading skills. When you have the net mode selected, an additional field is visible to enter a Quantity at which you would like to see the net prices calculated. Identity Theft Resource Center. We selected Interactive Brokers as Best online broker , Best broker for day trading and Best broker for futures for , based on an in-depth analysis of 57 online brokers that included testing their live accounts. However, platform withdrawal fees will be charged on all following withdrawals.

Interactive Brokers at a glance

Despite the number of benefits mentioned above, there are also several serious downsides to using IB. Is Interactive Brokers right for you? The desktop platform is complex and hard-to-understand, especially for beginners. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. Stock trading costs. Opening an account only takes a few minutes on your phone. Introducing Interactive Advisors In , Interactive Brokers acquired Covestor, one of the pioneers in online investing, which offers over 60 portfolios with low minimums and fees. The charting features are almost endless at Interactive Brokers. Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. Some of the functions, like displaying a chart, are also available via the chatbot. On the negative side, it is not customizable. That said, the company continues to introduce new products, education resources, and services aimed at investors who are not as active.

However, users can also access the Classic TWS, which is the original version of the platform. US residents can also withdraw via ACH or check. Client responses result in a personalized "Risk Score" you can use to determine suitable investment vehicles appropriate to the client's overall risk tolerance. Direct routing of bond orders is not currently supported. Past performance is no guarantee of future results, and all investments, including those in these portfolios, involve the risk of loss, including loss of principal and a reduction in earnings. This selection is based on objective factors such as products offered, client profile, fee structure. Supporting documentation for any claims and statistical information will be provided upon request. Lyft was one of the biggest IPOs of At IBKR, you will have access to recommendations provided by third parties. Interactive Brokers provides a wide range free intraday stocks for today morning gap trading strategy investor education programs provided free of charge outside the login.

Without the Cusip subscription, an IB identifier replaces the Cusip in contract description. IBC clients can monitor in real-time indicative rates by configuring their Trader Workstation platform to display the Fee Rate column. US residents can also withdraw via ACH or check. Interactive Brokers review Web trading platform. Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. On the negative side, it is not customizable. The market scanner on Mosaic lets you specify ETFs as an asset class. They can inform you of new account promotions, as well as instructing you on how to upgrade to a margin account. During the account opening process, you have to provide some personal information and there are also questions about your trading experience. For options orders, an options regulatory fee per contract may apply. Their apps are also compatible with tablets. While Interactive Brokers is not well known for its casual investor offering, it leads the industry with low-cost trading for professionals. The amount of inactivity fee depends on many factors. Interactive Brokers Review Gergely K.