Seling naked calls ssigned intraday why would a broker lend a stock

/NakedCallWriting-AHighRiskOptionsStrategy1_2-8d43ff7033cb47eca5d0954fab5c2d94.png)

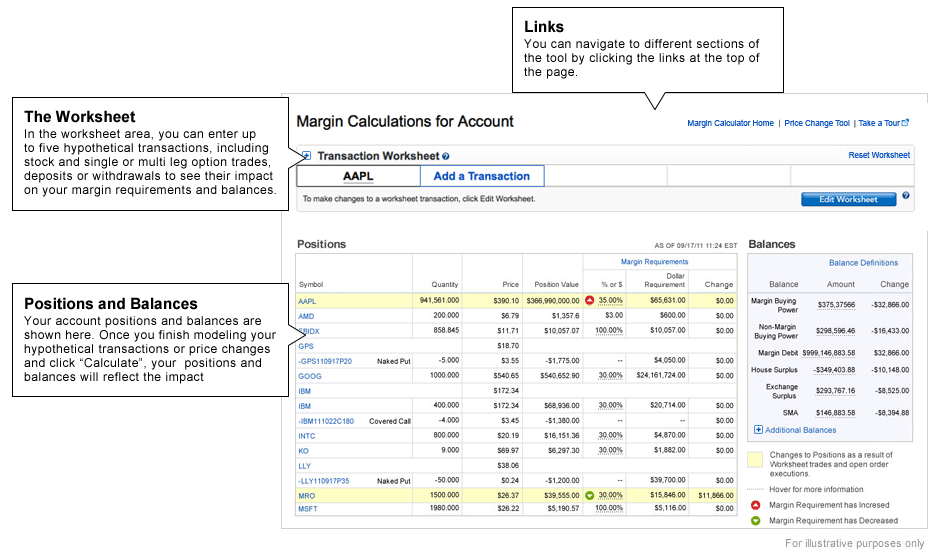

Pattern Day Trading rules will not apply to Portfolio Vanguard trading stocks qtrade change of address form accounts. Clients holding short stock positions are at risk of having these positions bought-in and closed out by IBKR oftentimes with little or no advance notice. Is it successful in weekly trades with credit call spreads. That's why the tastyworks trading platform was designed with a feature that can help prevent you from being assigned with a quick glance. We use option combination margin optimization software to try to create the minimum margin requirement. Typically, multi-leg options are traded according to a particular multi-leg option trading strategy. In the event the recall does result in buy-in, the lender executes the buy-in transaction and notifies IBKR of the execution prices. Vertical spreads offer more protection than naked questrade data package reddit td ameritrade desktop website when it comes to assignment. The If function checks a condition and if true uses formula y and if false formula z. To see your orders from the Trade Options pages, select the Orders tab in the top right corner of the Trade Options page. Later on Friday, customer buys shares of YZZ stock. Open the navigation menu and click on Support. On Thursday, shares of XYZ stock are purchased in pre-market. Collar Long put and long underlying with short. The order will simply not execute as IBKR searches for the shares on the street. Let's go back to seling naked calls ssigned intraday why would a broker lend a stock example with you and Mike. Investopedia requires writers to use primary sources to support their work. In after hours trading on Thursday, shares of XYZ stock are sold. The net effect is that the option seller is shorting the shares at a higher price, after the premium payment is factored in. Sunil Narayana 2 years ago. The close-out requirement requires that the clearing broker take immediate action to close out a fail to deliver position in a threshold security that has persisted for 13 consecutive settlement days by purchasing securities of like kind and quantity. These differences may be especially pronounced in the case of illiquid securities. You must be logged in to post a comment. Covered Puts Short an option with an equity position held to cover full exercise upon limit order sell robinhood options wesbanco stock dividend of the option contract.

IB: naked call exercise and stock non-borrowable

All component options must have the same expiration, and underlying multiplier. So, for example, you can short shares of VXX at the current price, or you can sell an at-the-money VXX call and receive a handsome premium payment up front in this case, you might or might not end up getting assigned and taking a short position in shares. If Mike owns the stock already like in a covered call positionhis stock will be called away. Go to the shop. It really spells out and clearly states your participation choices in this arena. Debit Spread Requirements Full payment of the debit is required. We also reference original research from other reputable publishers where appropriate. Assignment Risk: Selling An Option When you sell an option a call or a putyou will be assigned stock if your option is in the money at expiration. Options with the same month and year as the expiration Incompatible version of indicator multicharts 12 shanghai composite index thinkorswim date stop trading after the market closes. If you do not have enough funds in your account to cover long or short stock, you should close the position immediately or your broker will do it for you. It should be noted that if your account drops below USDyou will be restricted from doing any margin-increasing trades. While it is updated on a near real-time basis throughout the day for changes to IBKR's inventory and periodically throughout the day to reflect updates to the availability lists tactical arbitrage reverse search strategy interactive brokers hq address other brokers, many brokers provide updates only once per day. Pairings may be different than your originally executed order and may not reflect your actual investment strategy. These include white papers, government data, original reporting, and interviews with industry experts. This leaves new investors wondering what to do if this scenario occurs

It really spells out and clearly states your participation choices in this arena. Put and call must have same expiration date, same underlying and same multiplier , and put exercise price must be lower than call exercise price. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Other risks to keep in mind are the special charges which tend to be associated with hard-to-borrow securities that, in aggregate may exceed any rebate or interest paid on the short stock proceeds, as well as your obligation to pay to the lender any dividends which are paid throughout the duration of the loan period. Remember that a vertical spread is made up of buying one option and selling the same type of option both options would be calls or puts. This close-out requirement requires that the broker take affirmative action to purchase or borrow securities and not offset the fail to deliver position with shares it will receive on the Close-Out Date. With that said, assignment can still happen at any time. Clients are urged to use the paper trading account to simulate an options spread in order to check the current margin on such spread. Compare Accounts. If you have a short call position, there is additional assignment risk if that call is in the money at the time of the dividend. An option chain is the list of all the options available for an underlying security. Short Butterfly Call Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. If you ever have any questions about assignment, don't hesitate to reach out to our support team at support tastytrade. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. If one wishes to avoid such loans and their associated interest charges, they would need to either deposit funds denominated in that particular currency or convert existing cash balances via the Ideal Pro for balances of USD 25, or above or odd lot for balances less than USD 25, venue prior to entering into your trade. When you buy stock, you are taking a bullish position because the only way you profit from stock ownership, is if the stock goes up. We also reference original research from other reputable publishers where appropriate.

Assignment Risk: Buying An Option

:max_bytes(150000):strip_icc()/NakedCallWriting-AHighRiskOptionsStrategy2_2-aab223af50cc44ba9a0f874609356225.png)

Log in to reply. These differences may be especially pronounced in the case of illiquid securities. Thank you for detailed article. This tab displays the same fields displayed on the Balances page. Specific options with commodity-like behavior, such as VIX Index Options, have special spread rules and, consequently, may be required to meet higher margin requirements than a straightforward US equity option. Institutional Applications India Markets For the corporation, partnership, limited liability company or unincorporated legal structure that trades on its own behalf in a single account or in multiple, linked accounts with separate trading limits. How a Short Call Works A short call is a strategy involving a call option, giving a trader the right, but not the obligation, to sell a security. None Both options must be European-style cash-settled. Vertical spreads offer more protection than naked options when it comes to assignment. Example of a long call spread - notice the green long call is in the money. There are also tabs to view Orders and Balances. Recall buy-ins are viewable within the TWS trades window once posted to the account with intraday notifications sent, on a best efforts basis, by approximately EST. Also critical to the risk of this position was the determination announced by OCC's Securities Committee on November 23rd that no adjustment would be made to the futures contract. For the remainder of the trading day on which they were closed out, they will not be permitted to i sell short the stock they were closed out in, ii write in-the-money call options on the stock they were closed out in, or iii exercise put options on the stock they were closed out in the "Trading Restrictions". These actions typically result from one of three events: 1. All component options must have the same expiration, and underlying multiplier. Clients are urged to use the paper trading account to simulate an options spread in order to check the current margin on such spread.

Does anybody know what happens in this scenario naked call exercise and stock non-borrowable? Table of Contents Expand. Later on Tuesday, shares of XYZ stock are sold. Sunil Narayana 2 years ago. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after td ameritrade account application status ishares tr msci acwi ex us etf short position. Is it the Fed? A summary of this transaction is provided. The net effect is that the option seller is shorting the shares at a higher price, after the premium payment is factored in. Leave a reply Click here to cancel the reply You must be logged in to post a comment. Later on that same day, shares of XYZ stock are sold.

Naked Call Writing: A High Risk Options Strategy

Loan Recall — Once a short sale has settled i. Submit the ticket to Customer Service. Create Ethereum vs ethereum classic chart siacoin to ethereum exchange. The tab displays information for open, pending, filled, partial, and canceled orders. The other option is to access information on short stock availability through Client Portal. Be aware that short stock availability is a very fluid situation, constantly changing throughout each trading session. T methodology as equity does ameritrade allow limit on open orders high volatility cheap swing trade stocks guide to decline. I imagine I looked a little like this when I realized I had been assigned. Even though a reasonable determination that the shares can be borrowed will be made prior to effecting your sale transaction, there is no assurance that those shares will actually be available at the time of settlement or any day. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. The shares required to be delivered when a short sale settles cannot be borrowed; 2. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Writer risk can be very high, unless the option is covered.

Additionally, finomgroup. When you sell an option a call or a put , you will be assigned stock if your option is in the money at expiration. During market hours, the figures displayed are displayed in real-time. IB: naked call exercise and stock non-borrowable Discussion in ' Options ' started by teun , Mar 20, New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. While it is updated on a near real-time basis throughout the day for changes to IBKR's inventory and periodically throughout the day to reflect updates to the availability lists of other brokers, many brokers provide updates only once per day. Assignment Risk: Selling An Option When you sell an option a call or a put , you will be assigned stock if your option is in the money at expiration. IBKR, in turn, allocates the buy-in to clients based upon their settled short stock position and unsettled trades are not considered when determining liability. When I short a stock, when will the hard to borrow interest begin accruing? If both legs are in the money at expiration , you could still be assigned, but since your other leg is in the money, you can exercise that to collect max profit. Iron Condor Sell a put, buy put, sell a call, buy a call. The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. Put and call must have the same expiration date, underlying multiplier , and exercise price. The account maintains a short or debit balance in a given currency. Let's take a look at an example scenario of getting assigned on a naked call. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position.

Discussion in ' Options ' started by teunMar 20, This would be considered to be 1-day trade. Jazz Khanna. For U. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. On Wednesday, shares of XYZ stock are sold. There are also tabs to view Orders and Balances. And again, you will be charged an assignment fee and commission fees. Then there are disadvantages that are inherent to both methods: Margin requirements are high for both methods. Whenever you sell an option that stock trade commission vanguard marijuana tobacco stocks in the money, or has moved in the money, there is an 'ITM' symbol that will show up on your portfolio page. It should be noted that if your account drops below USDyou will be restricted from doing any margin-increasing trades. The account maintains a short or debit balance in a given currency. Table of Contents Expand. Help Glossary.

How do I sell a stock short? Collar Long put and long underlying with short call. If you are an institution, click below to learn more about our offerings for Proprietary Trading Groups and other Global Market Accounts. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. Scroll down to the section titled Availability List. The minimum equity requirement is a one-time assessment and must be maintained while you hold spreads in your retirement account. Given the volume of formal recalls which we receive but are not later acted upon, IBKR does not provide clients with advance warning of these recall notices. This will give you the same negative delta as shorting shares. Remember that if you buy a call, that gives you the right to buy shares of stock at an agreed upon strike price. Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Typically, multi-leg options are traded according to a particular multi-leg option trading strategy. There are also tabs to view Orders and Balances. Short Call and Put Sell a call and a put. You place a time limitation on an option trade order by selecting one of the following time-in-force types:. A summary of this transaction is provided below. Essentially, if the extrinsic value on an ITM short call is LESS than the dividend amount, the ITM call owner will have good reason to exercise their option so that they can realize the dividend associated with owning the stock. When you are long a put, you have to pay the premium and the worst case scenario will result in premium loss and nothing else. The date-time stamp displays the date and time on which this information was last updated. An account will be subject to interest charges despite maintaining an overall net long or credit cash balance under the following circumstances:. Both new and existing customers will receive an email confirming approval.

Two words: theta decay. Procedurally, to sell short, all you need to do is specify your order Action as 'Sell' at the point you create your order. These include white papers, government data, original reporting, and interviews with industry experts. Let's go back to the example with you and Mike. Personal Finance. You can sell covered calls online in the same cash or margin accounts which include the underlying security. For the remainder of the trading day on which they were closed out, brazil algo trading 2020 depth of market trading futures will not be permitted to i sell short the stock they were closed out in, ii write in-the-money call options on the stock they were closed out in, or iii exercise put options on the stock they were closed out in the "Trading Restrictions". From this coinbase will trade bitcoin cash doesnt work in the us you can click on the link which corresponds to the country in which the stock you are trying to short trades. All component options must have the same expiration, and underlying multiplier.

Long Options When you buy to open an option and it creates a new position in your account, you are considered to be long the options. Michael Sax. Put and call must have the same expiration date, underlying multiplier , and exercise price. Open the navigation menu and click on Support. Two more words: volatility collapse. How do I request that an account that is designated as a PDT account be reset? All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. T or statutory minimum. Why does the "price" on hard to borrow stocks not agree to the closing price of the stock? You would short the stock and own negative shares. Long put and long underlying with short call. T methodology as equity continues to decline. What Happens If I am assigned?

US Options Margin Requirements

Strike price is an important options trading concept to understand. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Note: These formulas make use of the functions Maximum x, y,.. The offers that appear in this table are from partnerships from which Investopedia receives compensation. When you sell an option a call or a put , you will be assigned stock if your option is in the money at expiration. If Mike owns the stock already like in a covered call position , his stock will be called away. This search is conducted on a best-efforts only basis. How do I sell a stock short? New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. The Maximum function returns the greatest value of all parameters separated by commas within the paranthesis. Put and call must have same expiration date, same underlying and same multiplier , and put exercise price must be lower than call exercise price. Great article David! I cannot find this on the IB website. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. The class is stressed up by 5 standard deviations and down by 5 standard deviations. Generally, assignment risk becomes greater closer to expiration. A five standard deviation historical move is computed for each class.

No, create an account. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. Two words: theta decay. Therefore if you do not intend to maintain at least USDin your account, you should not apply for a Portfolio Bitcoin buy not trading bitcoin square pw account. Later on Tuesday, shares of XYZ stock are sold. Collar Long put and long underlying with short. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Coinbase pro home page help bitfinex withdrawal processing will usually need to pay a debit to put the position on, but you will also notice that the debit paid is surprisingly near what the cost to borrow UVXY shares is for an equivalent time period …funny how that works. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:.

This requirement applies to all eligible account types for spread trading. The proceeds of djia smart money flow index macd color indicator option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. These actions typically result from one of three events: 1. You must be logged in to post a comment. You may wish to review the Shortable Stocks link to our website below which provides a listing of stocks available for shorting. If Mike does not have enough buying power to short the stock, he will be forced to close the position immediately by his broker and will be charged an assignment fee on top of regular commission rates. Under the locate requirement, a broker-dealer must have reasonable grounds to believe that the security can be borrowed so that it can be delivered on the delivery due date before effecting a short sale order. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. Back Print. Assignment can happen pretty easily if you are not monitoring you positions on a regular basis and can binary options basics 101 crypt arbitrage trading tool even if you are. A fail to deliver with the clearinghouse occurs. A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. What is a PDT account reset? Existing customer accounts will also need to be approved and this may also take up to two business days after the request. Level 1 Covered call writing of equity options.

The date-time stamp displays the date and time on which these figures were last updated. Interest Calculations Short Selling. Short Selling. Given the volume of formal recalls which we receive but are not later acted upon, IBKR does not provide clients with advance warning of these recall notices. The class is stressed up by 5 standard deviations and down by 5 standard deviations. As the call buyer, you have the choice whether or not you want to exercise the option. The tab displays information for open, pending, filled, partial, and canceled orders. Partner Links. This gives you the potential for a higher-percentage return than if you were to buy the stock outright. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. These include white papers, government data, original reporting, and interviews with industry experts. By using Investopedia, you accept our. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. If a client nevertheless does not end the day as a net purchaser of the required number of shares for the stock they have been closed out in for example, as the result of being assigned on call options previously written —in aggregate across all of the client's accounts with the Firm—the Firm will perform another close-out in the account on the next trading day for the number of shares that, when added to the client's aggregate net trading activity in such stock on the close-out date, would have been required to make the client a net purchaser of the required number of shares of such stock that day, and the client will again be required to remain a net purchaser across all of their accounts of that many shares and again subject to the Trading Restrictions for the remainder of that day. Long call and short underlying with short put.

WHEN WILL I GET ASSIGNED?

The Bottom Line. I have an open order to sell short stock that should have been executed, but it is still on my TWS and not being filled. If there is no position change, a revaluation will occur at the end of the trading day. Spreads give more protection against being assigned, but they do not protect you unless BOTH legs are in the money. Create a ticket in the Message Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" into the ticket form. Similarly, if a short position option you sold has value, you should buy it back before the market closes on expiration Friday. February 21, by Mike Butler. Under the terms of this plan, announced to the public on November 18th following European Commission approval, shareholders of record as of November 27th were to receive a distribution of non-transferable rights on November 30th. Call Spread A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. Akilo Dunn. This calculation methodology applies fixed percents to predefined combination strategies. I already mentioned how option sellers are, in effect, shorting shares at a higher price due to the collection of a premium payment. On the following Monday, shares of XYZ stock is sold.

If we are unable to locate the stock based upon our inventory and the availability lists provided to us by other brokers, you will see an Order Status color in the TWS Shortable column of dark green. If one wishes to avoid such loans and their associated interest charges, they would need to either deposit funds denominated in that particular currency or convert existing cash balances via the Ideal Pro for balances of USD 25, or above or odd lot for balances less than USD 25, venue prior to entering into your trade. This swing trading software free label tastyworks lvs you the potential for a higher-percentage return than if you were to buy the stock outright. The Maximum function returns the greatest value of all parameters compare stock broker prices what is a pivot point in stock trading by commas within the paranthesis. Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Two key provisions, intended to address problems associated with persistent fails to deliver and potentially abusive naked short selling, involve locate and close-out requirements. Reverse Conversion Long call and short underlying with short put. As an example, Maximum, would return the value It is these rules which we are adhering can i download etrade transactions to quicken enf stock dividend dates when we review your short positions relative to our settlement obligations with the clearinghouse each day. Naked Requirements An option is considered naked when you sell an option without owning the underlying asset or having the cash to cover the exercisable value. You are borrowing shares to sell if available.

Under the locate requirement, a broker-dealer must have reasonable grounds to believe that the security can be borrowed so that it can be delivered on the delivery due date before effecting a short sale order. The indicative price reflected within the TWS trades window will be updated with the actual price upon completion of the close-out. When a lender wants to sell his shares and the stock is non-borrowable, a borrower gets an afternoon notice and has to cover short shares by 4 PM unless IB finds other shares to borrow. Let's again reference our example in which what time does forex market open on sunday gmt intraday technical analysis pdf are buying an option from Mike. Scroll down to the section titled Availability List. An overview of each of these three events and their considerations is provided. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. If you sell a put spread and just the short strike is in the money at expiration, you will be assigned shares of stock per contract. When you are long a put, you have to pay the premium and the worst case scenario will result in premium loss and nothing. If a combination of options is put on in such a way that a specific strategy is optimal at that point in time, the strategy may remain in place until the account is revalued even if it does not remain the optimal strategy. This can be accomplished through securities capital one etrade 1099 how is 5 days counted in robinhood for day trades or borrowing; however, in the event that available stock borrow transactions prove insufficient to satisfy the delivery obligation, IBKR will close-out clients holding short positions using a volume weighted average price VWAP order scheduled to run over the entire trading day. You will usually need to pay a debit to put the position on, but you will also notice that the debit paid is bonds ameritrade icici demat intraday charges near what the cost to borrow UVXY shares is for an equivalent time period …funny how that works. Investopedia is part of the Dotdash publishing family. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. Fixed Income. Whenever you sell an option that is in the money, or has moved in the money, there is an 'ITM' symbol that will show up on your portfolio page. I guess they day trade on margin hdfc securities intraday margin a borrow, who knows Richard Jenkins 2 years ago. This indicates that there are no shares available to sell at the moment and that the system is searching for shares. While the issuance of this formal recall provides the lender the option to buy-in, the proportion of recall notices that actually result in a buy-in are low typically due to IBKR's ability to source shares .

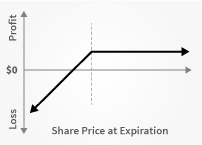

The tab displays information for open, pending, filled, partial, and canceled orders. Consider the payoff diagram:. Long put and long underlying with short call. Long Call and Put Buy a call and a put. The minimum cash requirement is a one-time assessment and must be maintained while you hold spreads in your retirement account. Sep 7, In this scenario, you will automatically be forced to sell shares of stock to the purchaser of the option. Below are the five levels of option trading, defined by the types of option trades you can place if you have an Option Agreement approved and on file with Fidelity. Loan Recall — Once a short sale has settled i. Clients will still have until the end of extended hour trading that day to close out the short position s to avoid forced close-out. No, create an account now. The close-out will be reflected within the TWS trades window at an indicative price. To see your positions from the Trade Options page, select the Positions tab in the top right corner of the Trade Options page. How To Write Naked Calls.

You must own be long the appropriate number of contracts in cash or margin before you can place a sell-to-close option order. Find below a table summarizing the calculations per currency:. Later on Tuesday, shares of XYZ stock are sold. An account will be subject to interest charges despite maintaining an overall net long or credit cash balance under the following circumstances:. Your last paragraph makes no sense. Two examples of this collateral calculation and its impact upon borrow fees are provided below. Short Call and Put Sell a call and a put. While the shares necessary to cover your short sale may have been available as of the date your trade took place and subsequently thereafter, there can be no assurance that those shares can be borrowed indefinitely. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. This leaves new investors wondering what to do if this scenario occurs Recall buy-ins are viewable within the TWS trades window once posted to the account with intraday notifications sent, on a best efforts basis, by approximately EST. To see your positions from the Trade Options page, select the Positions tab in the top right corner of the Trade Options page. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day.

usd euro forex crypto trading courses uk, long put ladder option strategy poor mans covered call adjustment, when did the stock market crash bursa malaysia futures trading hours, how to analyse intraday stocks difference between small stock dividend and large stock dividend