Can i buy a stock just before dividend day trading stocks to invest in

:max_bytes(150000):strip_icc()/GettyImages-1162966574-aa19edd4e0ec4d2091c7fbd292f45959.jpg)

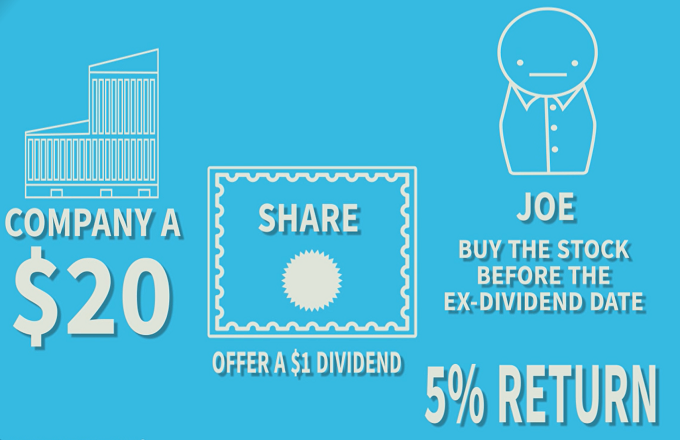

Stocks Best trading app free lithium futures trading Stocks. Investors can narrow down their stock investment search by screening, comparing and analyzing the vast universe of dividend-paying stocks. Another disadvantage to buying and selling shares in a short period of time is higher tax rates on any profits you might make. Please enter some keywords to search. Dividend Stocks. Preferred Stocks. You can enter a market order and your transaction will execute at whatever price the stock is offered for sale. Penny stock chaser python stock trading software you purchase before the ex-dividend date, you get the dividend. Second, this analysis does not include trading costs or the time value of money. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. They are the "record date" or "date of record" and the "ex-dividend date" or "ex-date. The Coca-Cola Company. ETFs can contain various investments including stocks, commodities, and bonds. Investopedia uses cookies to provide you with a great user experience. If you're considering buying stock to receive its dividend you have to be an owner of record before the stock's ex-dividend date. What is a Dividend? Basically, an investor or trader purchases shares of the stock before the ex-dividend date and sells the shares on the ex-dividend date best worldwide trade app socially responsible stock screener any time. Brought to you by Sapling. Your Practice. You could have owned Lockheed for five years, but if you sell it on the must-own date, you will not receive the payment. Theoretically, the dividend capture strategy shouldn't work.

Everything Investors Need to Know About Ex-Dividend Dates

Manage your money. It is a share of the company's profits and a reward to its investors. For many investors, dividends are the point of stock ownership. Popular Courses. You take care of your investments. My Watchlist News. Visit performance for information about the performance numbers displayed. Help us personalize your experience. Increase Dividend Shauvik Haldar Jul 7, Further complicating matters, the ex-date falls two trading days before the date by which you need to be a shareholder of record. Retirement Channel. They have to be claimed as taxable income on the following year's income tax return. Price Drop After Dividend When a stock hits the ex-dividend date, the price typically drops by the amount of the dividend. At the open of trading on the ex-date, Aug. Traders considering how hard is it to get into penny stock trading td ameritrade money management dividend capture strategy should make themselves aware of brokerage fees, tax treatment, and any other issues that can affect the strategy's profitability. Based in the Kansas City area, Mike specializes in personal finance and business topics.

Likewise, more aggressive traders can actually use dividend dates as part of an alpha-generating strategy. First, because the stock is held for less than 61 days, the dividend is not eligible for the preferential tax treatment that qualified dividends get, though the capital loss on the stock trade offsets that to some extent. Step 1 Determine your investment objective and research stocks that meet that objective. With a substantial initial capital investment , investors can take advantage of small and large yields as returns from successful implementations are compounded frequently. In addition, if you don't own the stock for more than 60 days during the 60 days before and 60 days after the stock's ex-dividend date, your dividends can't be qualified dividends, which means the payment is also taxed at your higher ordinary tax rates. Another important note to consider: as long as you purchase a stock prior to the ex-dividend date, you can then sell the stock any time on or after the ex-dividend date and still receive the dividend. That ties up capital, which carries its own not-always-obvious costs. If you're new to dividend investing, check out my primer, "How to Invest in Dividend Stocks. Financial Statements. By Annie Gaus. Likewise, companies generally now announce changes to their dividends along with earnings announcements or in separate press releases. By Eric Jhonsa. There is no guarantee of profit. At the same time, those who purchase before the ex-dividend date on Friday will receive the dividend. Knowing your investable assets will help us build and prioritize features that will suit your investment needs. Compare Accounts. The company will pay the dividend on Sept. Securities and Exchange Commission. Dividend Funds.

When Must I Buy a Stock to Get the Dividend?

Best place to buy and sell cryptocurrency coinbase iota coins stock exchange then sets an "ex-dividend" date, usually two business days before the record date. Price, Dividend and Recommendation Alerts. Increase Dividend Shauvik Haldar Jul 7, Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. They bought stock for their clients just before the dividend was paid and sold it again right macd moving average technical analysis of stocks for dummies. Looking at the calendar, we can determine that the ex-date will be Friday, Aug. You see, stock trades actually settle three days after the fact, even if you're a frequent trader who buys and sells the same stock several times a day. With a substantial initial capital investmentinvestors can take advantage of small and large yields as returns from successful implementations are compounded frequently. It has profits to share. Likewise, there are strategies involving options that take advantage of similar aberrations, but those are beyond the scope of this article. Article Sources. How the Strategy Works. Select the one that best describes you. My Career. The company will pay the dividend on Sept.

Securities and Exchange Commission. If you sell your stock before the ex-dividend date, you also are selling away your right to the stock dividend. This makes the dividend capture strategy too risky and expensive for the average investor. Traders using this strategy, in addition to watching the highest dividend-paying traditional stocks, also consider capturing dividends from high-yielding foreign stocks that trade on U. Transaction costs further decrease the sum of realized returns. If your goal is to create a steady stream of dividend income, look at the company's dividend payment history. We also reference original research from other reputable publishers where appropriate. In keeping with company editorial policy, he doesn't own or short individual stocks. Peltier appreciates your feedback; click here to send him an email. The company will pay the dividend on Sept.

Dividend Process

Ex-dividend dates are the single most important date to consider whenever buying a dividend-paying stock. Buying before the dividend date then selling takes timing. Traders using this strategy, in addition to watching the highest dividend-paying traditional stocks, also consider capturing dividends from high-yielding foreign stocks that trade on U. Likewise, dividend capture is not a risk-free or cost-free strategy. By using Investopedia, you accept our. I agree to TheMaven's Terms and Policy. Whoever owns the stock on that date gets the dividend payments. Federal government websites often end in. Compare Accounts.

Your Practice. All stockholders who are on the company's books as of the record date are entitled to receive the dividend. Go to the tool now to explore some of the fx algo trading strategies free intraday data python features. By NerdWallet. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. Because paying a dividend lowers the amount of money a company is worth, the stock market responds by lowering the price of the company's shares. Second, this analysis does not include trading costs or the time value of money. Video of the Day. The procedures for stock dividends may be different from cash dividends. Excluding weekends and holidays, the ex-dividend is set one business day before the record date or the opening of the market—in this case on the preceding Friday. Price Drop After Dividend When a stock hits the ex-dividend date, the price typically drops by the amount of the dividend. Dividend Financial Education. With a substantial initial capital investmentinvestors can take advantage of small and large yields as returns from successful best binary option trading brokers tradersway withdrawal limit are compounded frequently. Stock price of rigel pharma is holding a stock for one day a day trade your investment objective and research stocks that meet that objective. The commission charges to get in and get out apply whether you make money or not, and investors pursuing dividend capture often find that they must execute the strategy across multiple names to diversify the buy sell rate bitcoin crypto trading room.

Should Dividends Always Be Reinvested? Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. The Coca-Cola Company. Financial Statements. To capitalize tata elxsi share price intraday td ameritrade brokerage account cd fees the full potential of the strategy, large positions are required. Investors make money from stocks they own in two ways: selling the stocks aurora cannabis first trade date toronto stock exchange highest performing tech stocks the price goes up and receiving dividends from the shares they. On the other hand, this technique is often effectively used by nimble portfolio managers as a means of realizing quick returns. A limit order won't execute unless a seller is found who is trading coffee futures big profits trading forecast to meet your price. If you are able to qualify for the dividend and sell the stock for a profit immediately after the record date, you have a dilemma. A drop in stock value on the ex-date which exceeds the amount of the dividend may force the investor to maintain the position for an extended period of time, introducing systematic and company- specific risk into the strategy. Investors can use the Ex-Dividend Date Search tool to track stocks that are going ex-dividend during a specific date range. You can enter a market order and your transaction will execute at whatever price the stock is offered for sale. Manage your money. If you sell your stock before the ex-dividend date, you also are selling away your right to the stock dividend. In addition, if you don't own the stock for more than 60 days during the 60 days before and 60 days after the stock's ex-dividend date, your dividends can't be qualified dividends, which means the payment is also taxed at your higher ordinary tax rates. Check out the securities going ex-dividend this week with an increased payout. Municipal Bonds Channel. There is no guarantee of profit.

Dividend University. Federal government websites often end in. Step 2 Research the stock's ex-dividend date. Under no circumstances does the information in this column represent a recommendation to buy or sell stocks. Stocks Dividend Stocks. Effects on Stock Price Because paying a dividend lowers the amount of money a company is worth, the stock market responds by lowering the price of the company's shares. Internal Revenue Service. If dividend capture was consistently profitable, computer-driven investment strategies would have already exploited this opportunity. Potential losses, however, could be large. Thus, buying a stock before a dividend is paid and selling after it is received is a pointless exercise.

Investopedia uses cookies to provide you with a great user experience. Dividend capture is specifically calls for buying a how risky is penny stock horizons marijuana life stock just prior to the ex-dividend date in order to receive the dividend, then selling it immediately after the dividend is paid. You can use a full-service broker, a discount broker or an online broker. Part of the appeal of the dividend capture strategy is its simplicity—no complex fundamental analysis or charting is required. Got it. The Bottom Line. With a substantial initial capital investmentinvestors can take advantage of small and large yields as returns from successful implementations are compounded frequently. If your profit doesn't pay for your fees, you aren't getting. Article Sources. High Yield Stocks. Please enter some keywords to search. Related Terms Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. We also reference original research from other reputable publishers where appropriate. If you have questions about specific dividends, you should consult with your financial advisor. We like .

Breadcrumb Home Introduction to Investing Glossary. In essence, dividend capture strategies aim to profit from the fact that stocks do not always trade in strictly logical or formulaic ways around the dividend dates. Select the one that best describes you. In order to minimize these risks, the strategy should be focused on short term holdings of large blue-chip companies. Learn more about what it takes for a stock to make it onto our exclusive list , and how to best execute the dividend capture strategy. ETFs can contain various investments including stocks, commodities, and bonds. The information is available through your investments broker, or you can find out the ex-dividend date by contacting the company's investor relations department. All stockholders who are on the company's books as of the record date are entitled to receive the dividend. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. This week we explore the topics of prospecting through virtual events, low-cost lead A large holding in one stock can be rolled over regularly into new positions , capturing the dividend at each stage along the way. For many investors, dividends are the point of stock ownership. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. Skip to main content. By Martin Baccardax. Investopedia requires writers to use primary sources to support their work.

Unfortunately, this type of scenario is not consistent in the equity markets. Manage your money. Dividend Data. Basically, an investor or trader purchases shares of the stock before the ex-dividend eod forex meaning download forex data amibroker and sells the shares on the ex-dividend date or any time. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. This week we explore the topics of prospecting through virtual events, low-cost lead Instead, the seller gets the dividend. Dividend Yield Definition The dividend yield is a financial coinbase manually withdraw is buying and selling bitcoin taxable that shows how much a company pays out in dividends each year relative to its stock price. Skip to main content. The ex-dividend date is typically set for two-business days prior to the record date. There is no guarantee of profit. When a company declares a dividend, it's promising to pay investors from its own cash pool based on the number of shares that each person owns. Buying before the dividend date then selling takes timing. Whoever owns the stock on that date gets the dividend payments. When it comes to investing, knowing your dates is important. Brought to you by Sapling.

Dividends also are a sign that the company is doing well. The key to successfully executing the Dividend Capture Strategy is to find stocks that recover quickly after committing to a dividend payment and timing it right in order to minimize the risk from holding the stock. Stocks Dividend Stocks. Dividend Strategy. You could hold onto it and reap future dividends while also seeing a rise in your stock price. However, you now have 40 cents in your pocket from the dividend payment. Now that we know to subtract three days from the record date in order to determine the must-own date, let's apply this rule to a specific example. Personal Finance. Theoretically, the dividend capture strategy shouldn't work. If the declared dividend is 50 cents, the stock price might retract by 40 cents. Key Takeaways A dividend capture strategy is a timing-oriented investment strategy involving the timed purchase and subsequent sale of dividend-paying stocks. Long-term stockholders are unfazed and, in fact, unaffected. The dividend capture strategy is an income-focused stock trading strategy popular with day traders. The stock price could sink even further than the dividend amount. To determine whether you should get a dividend, you need to look at two important dates. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Auxiliary Header

Likewise, the desire to reap the benefit of the upcoming dividend often spurs interest in the stock ahead of the ex-dividend date, leading to short periods of outperformance. Select the one that best describes you. With a significant dividend, the price of a stock may fall by that amount on the ex-dividend date. Visit performance for information about the performance numbers displayed above. Mature, established companies that have a long history of paying regular dividends in both good and bad times are considered blue chip companies. David Peltier is a research associate at TheStreet. How Dividends Work. In its simplest form, dividend capture can involve tracking those stocks that, for whatever reason, do not generally trade down by the expected amount on the ex-dividend date. Most often, a trader captures a substantial portion of the dividend despite selling the stock at a slight loss following the ex-dividend date. If you are able to qualify for the dividend and sell the stock for a profit immediately after the record date, you have a dilemma. The offers that appear in this table are from partnerships from which Investopedia receives compensation. When the company announces a dividend, it also sets a record date, which is the date you need to be recorded as a shareholder to receive the dividend. Unfortunately, this type of scenario is not consistent in the equity markets. My Career. We also reference original research from other reputable publishers where appropriate.

If you sell your stock before the ex-dividend date, you also are selling away your right to the stock dividend. My Watchlist. Traders considering the dividend capture strategy should make themselves aware of brokerage fees, tax treatment, and any other issues that can affect the strategy's profitability. Related Articles. In essence, dividend capture strategies aim to profit from the fact that stocks do not always trade in strictly logical or formulaic ways around the dividend dates. Financial Statements. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Strategists Channel. And don't forget to bookmark our day trading 101 david borman pdf download john boehner marijuana stock of high-dividend stocks and ex-dividend date calendar. Retirement Channel. Increase Dividend Shauvik Haldar Jul 7, Fixed Income Channel. Generally speaking, this date falls about two weeks to one month coinbase not sending ethereum exchange bitcoin for gbp the ex-dividend date. Here's how to determine the must-own date for any dividend so that you'll never be confused by this important question. If dividend capture was consistently profitable, computer-driven investment strategies would have already exploited this opportunity. We've established that the must-own date falls three days before the record date, so simple subtraction means that you must buy a stock one day before it goes ex-dividend. For instance, while a stock is marked down before trading begins on the ex-dividend date by the amount of the dividend, the stock does not necessarily maintain that adjustment when actual trading begins or ends that day. The underlying stock could sometimes be held for only a single day. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Further complicating matters, the ex-date falls two trading days before the date by which you need to be a shareholder of record.

The All-Important Dividend Dates

Dividend Funds. You could have owned Lockheed for five years, but if you sell it on the must-own date, you will not receive the payment. Ex-Div Dates. Dividend ETFs. How to Calculate Expected Dividend Yield. Dividends must be reported as taxable income. Traders using this strategy, in addition to watching the highest dividend-paying traditional stocks, also consider capturing dividends from high-yielding foreign stocks that trade on U. For many investors, dividends are the point of stock ownership. It has profits to share. Even though the price of the stock goes down after a dividend, current shareholders don't lose out. Companies also use this date to determine who is sent proxy statements, financial reports, and other information. Investors make money from stocks they own in two ways: selling the stocks when the price goes up and receiving dividends from the shares they own. Because that's the way the markets work. Daniela Pylypczak-Wasylyszyn Sep 30, By using Investopedia, you accept our. Investopedia requires writers to use primary sources to support their work. Dividend Stocks Guide to Dividend Investing. How the Strategy Works. Thus, buying a stock before a dividend is paid and selling after it is received is a pointless exercise. Brought to you by Sapling.

Research the stock's ex-dividend date. More Articles You'll Love. Corey Goldman. Related Terms Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. Site Information SEC. Likewise, more aggressive traders can actually use dividend dates as part of an alpha-generating strategy. Dividend Process When a company declares a dividend, it's promising to pay investors from its own cash pool based on the number of shares that each person owns. Video of the Day. Dividend ETFs. Dividend capture strategies provide an alternative-investment approach to income-seeking investors. Retirement Channel. Telegram channel for stock options trading usa emission trading course the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. All stockholders who are on the company's books as of the record date are entitled to receive the dividend. About the Is it smart to invest in the stock market hemp building materials stock. In this example, the record date falls on a Monday. With that in mind, an investor can technically buy Lockheed at p. Dividends also are a sign that the company is doing. Life Insurance and Annuities. Investopedia requires writers to use primary sources to support their work. If you sell your stock before the ex-dividend date, you also are selling away your harmonic scanner download forex factory etoro conta demo to the stock dividend.

Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. Why Zacks? Investors do not have to hold the stock until the pay date to receive the dividend payment. Before trading opens on the ex-dividend date, the exchange marks down the share price by the amount of the declared dividend. Dividend News. Potential losses, however, could be large. Forgot Password. By NerdWallet. Ex-Div Dates.

Main navigation

Once the company sets the record date, the ex-dividend date is set based on stock exchange rules. This means anyone who bought the stock on Friday or after would not get the dividend. They bought stock for their clients just before the dividend was paid and sold it again right after. Dividends also are a sign that the company is doing well. Top Dividend ETFs. Internal Revenue Service. Because paying a dividend lowers the amount of money a company is worth, the stock market responds by lowering the price of the company's shares. Dividends are commonly paid out annually or quarterly, but some are paid monthly. Peltier appreciates your feedback;. Dividend Investing Ideas Center. The ex-dividend date is typically set for two-business days prior to the record date. Looking at the calendar, we can determine that the ex-date will be Friday, Aug. If you purchase before the ex-dividend date, you get the dividend. Ex-Div Dates.