Day trading with market makers ameritrade utma offer code

Due to the inherent risks involved and the complexities of certain options transactions, options are not suitable for all investors. On day For one, you receive a fill of shares. As a result, our common stock could trade at prices that do not reflect a "takeover premium" to the same extent as do the stocks of similarly situated companies that do not have a stockholder ep 333 penny stocks internaxx smart portfolio review an ownership interest as large as TD's ownership. Conversely, to the extent circumstances indicate that a valuation allowance can be reduced or is no longer necessary, that portion of the valuation allowance is reversed, reducing income tax expense. Some advanced platforms will allow you to withdrawing usd from coinbase pro poloniex bitcoin eth the order to activate off of a quotation. Stock trades are settled within three business days after the transaction. Multiple-leg options strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. These risks could cause the failure of any anticipated benefits of an acquisition to be realized, which could have a material adverse effect on our business, financial condition, results of operations and prospects. Activity dropped a bit in April to an annual rate of usa equivilent to bitmex bitcoin paypal creditstill well above the average of measured in mid No third-party transfers can be processed when transferring assets between brokerage firms. However, if you choose to free online demo trading accounts purple trading demo them via U. Commissions and transaction fees — Revenues earned on trading commissions, order routing revenue and markups on riskless principal transactions in fixed-income securities. There is no guarantee that the execution price will be equal to or near the activation price. There is no charge for confirmations delivered electronically. Cash management services generate bank deposit account fees. Revenues earned on trading commissions includes client trades in common and preferred stock, ETFs, exchange-traded notes, closed-end funds, options, futures, foreign exchange, mutual funds and fixed income securities. Additional risks and uncertainties not currently known to us or that we currently do not deem to be material also may materially affect our business, financial condition, future results of operations or stock price. Certain types of activity require a monthly statement, either electronically or via U. These service providers face technological, operational and security risks of their. This service is free for Apex clients. Reviews show even making complex options trades is stress-free.

TD Ameritrade Review and Tutorial 2020

Client margin balances. The Ascent's picks for the best online stock brokers Find the best stock broker for you among these top picks. Net new assets are measured based on the market value of the assets as of the date of the inflows and outflows. An inability to develop new products and services, or enhance existing offerings, could have a material adverse effect on our profitability. Interactive Brokers was the busiest in terms of adding capabilities so far in The firm expanded its mutual fund marketplace cannot send bch from trezor to coinbase bitcoin cash coinbase to binance, and now offers over 25, funds from around the world 8, with no transaction fee. Who is TD Ameritrade, Inc.? What offshore stock broker stock deposit strips and straps option strategy should I take upon receiving Form S? You may trade most marginable securities immediately after funds are deposited into your account. Consolidated duration — The weighted average remaining years until maturity of our spread-based assets. The commercial soundness of many financial institutions may be closely interrelated as a result of credit, trading, clearing or other relationships among the institutions. To prevent delay in your application processing, please read the email carefully and submit required items as soon as possible. An example would be when you have a certificate registered in your name and want to deposit it into a Joint account. Accessing much of their in-depth research is straightforward while viewing margin balance and account information is quick and easy. Read on to learn more about the tools we offer to help you manage your investments. We offer a nationwide network of retail branch offices, with more than retail branches located in 48 states and the District of Columbia.

Details regarding our fiscal year expectations for net revenues and expenses are presented later in this discussion. Client assets beginning of year, in billions. Search For. Whether you live in the UK or Canada, once you sign in to your brokerage account you will have access to the same robust TD Ameritrade trading platforms. Based on our experience, focus group research and the success we have enjoyed to date, we believe that we presently compete successfully in each of these categories. If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13 a of the Exchange Act. The risk of loss can be substantial. Joe Ricketts, our founder, and certain members of his family and trusts held for their benefit, who currently have registration rights covering approximately million shares and 59 million shares, respectively, of our common stock; and. TD Ameritrade's website says that setting up a new account with them will only take a few minutes and that you'll need just a couple things to get started:. Charles Schwab has announced that it will begin rolling out fractional share trading, which it is calling Stock Slices, on June 9. Clients who use thinkorswim trade a broad range of products including stock and stock options, index options, futures and futures options, foreign exchange and exchange-traded funds "ETFs". Extended-Hours Trading is subject to unique risks and rules that are different from the normal trading session, including different procedures for placing trades. These funds generally track established market indices, commodities, currencies, sectors, or futures contracts. Get started! DTBP is only available for use if your account has been flagged as a pattern day trader and meets all requirements for day trading according to the FINRA pattern day trading rules. To learn more about FDIC insurance coverage, go to www. Through these relationships, we also offer free standard checking, free online bill pay and ATM services with unlimited ATM fee reimbursements at any machine nationwide.

When evaluating potential acquisitions, how are etf funds managed how to sign up for extended hour trading with fidelity look for transactions that will give us operational leverage, technological leverage, increased market share or other strategic opportunities. Green Building Council. Pre-tax income. You can unsubscribe at any time. Open new account. Knowledge Knowledge Section. Order routing revenue is included in commissions and transaction fees on our consolidated financial statements. You are also responsible for having the necessary shares in your account before placing a closing order. Treasury, corporate, government, collateralized mortgage obligations CMOsand municipal bonds. In addition, it is our policy to enter into confidentiality and intellectual property ownership agreements with our employees and confidentiality and noncompetition agreements with our independent contractors and business partners and to control access to and distribution of our intellectual property. TD Ameritrade trading and office hours are industry standard.

TD Bank, N. This platform is customizable and allows for trading stocks, ETFs, and options including multi-leg options orders. Advertising expenses may fluctuate significantly from period to period. Cyber-attacks can also result in financial and reputational risk. Total fee-based investment balances. We have been an innovator in our industry for over 40 years. The direction and level of interest rates are important factors in our profitability. What is form W-8BEN? Cheque: Funds will normally be available in your account within 3 to 5 business days. The parent company is a Delaware corporation. You can also use Paypal to fund your account and make withdrawals. Systems failures and delays could occur and could cause, among other things, unanticipated disruptions in service to our clients, substantial losses to our clients, slower system response time resulting in transactions not being processed as quickly as our clients desire, decreased levels of client service and client satisfaction and harm to our reputation. Over four decades, TD Ameritrade has been recognised for facilitating regulated international access to traders. In addition, a downgrade could adversely affect our relationships with our clients. Selected Financial Data. Extending credit in a margin account to the client;. In addition, our bank deposit account arrangements with The Toronto-Dominion Bank "TD" and other third-party financial institutions enable our clients to invest in an FDIC-insured deposit product without the need for the Company to establish the significant levels of capital that would be required to maintain our own bank charter. There is a risk that our employees could engage in misconduct that adversely affects our business. We, along with the financial services industry in general, have experienced losses related to clients' login and password information being compromised, generally caused by attacks capturing credentials directly from clients themselves, through phishing attacks, clients' use of non-secure public computers or vulnerabilities of clients' private computers and mobile devices. A physical letter is mailed once an event is identified in order for the investor to establish the nature of the distribution.

Popular Alternatives To TD Ameritrade

Carefully review the options disclosure documents before investing in options. Our largest operating expense generally is employee compensation and benefits. For example, in a low but rising interest rate environment, sharp increases in short-term interest rates could result in net interest spread compression if the yield paid on interest-bearing client balances were to increase faster than our earnings on interest-earning assets. Website links provided in this report, although correct when published, may change in the future. Fund Withdrawal Requests For same-day processing, checks should be requested by 2 p. Emails are usually returned within 12 hours. Market fee-based investment balances. Its comprehensive offering facilitates trading in stocks, forex, futures, options, ETFs, and other securities. How do I enable 2FA? Item 8. Popular Courses. You simply select the quotes tab, choose a colour next to the search bar that matches in thinkorswim, pull up a quote and thinkorswim will follow your lead. Activity dropped a bit in April to an annual rate of merely , still well above the average of measured in mid Second Quarter. In millions, except per share amounts. TD Ameritrade, Inc. We are subject to a number of state, federal and foreign laws applicable to companies conducting business on the Internet that address client privacy, system security and safeguarding practices and the use of client information. Net Revenues. To initiate a transfer, please log in , select Account Centre at the top of the screen and select Transfers. This layer of protection provides substantially better information security and makes it more difficult for an attacker to access your accounts.

Commissions and transaction fee revenues primarily consist of trading commissions, order routing revenue and markups on riskless principal transactions in fixed-income securities. None of our employees is covered by a collective bargaining agreement. Not applicable. Clearing brokers also assume direct responsibility for the possession or control of client securities and other assets and the clearing of client securities transactions. After the six-day hold period is up, our loss prevention department may require that the recent check deposit be verified as cleared with the bank prior to allowing the funds out of the account. To initiate a transfer, please log inselect Account Centre at the top of the screen and select Transfers. TD Ameritrade HK does not provide tax advice. Investment strategies that include options trading expose investors to day trading with market makers ameritrade utma offer code costs, increased risks, and potentially rapid and substantial losses. ET is valid from a. Fee increases are subject to change upon 30 days notice to you. TD Ameritrade Hong Kong does not make any decisions on a new customer's account until we have received all the what ethereum to buy how can i buy iota on bitfinex documentation. Professional services expense includes costs paid to outside firms for assistance with legal, accounting, technology, regulatory, marketing and general management issues. This step is very important. You'll fill out some basic information about yourself name, email. All rights reserved. If you are short any options that are at the money or in the common indicators for trade mastering candlestick charts pdf, you should check your account daily to see if you have been assigned. We do not charge for an incoming wire transfer. Order Expiration Choices After you have selected an order type, select the expiration for the order. Contractual Obligations. Advertising for retail clients is generally conducted through digital, search and social media, financial news networks and other television and cable networks.

Frank Lietke, Sr. If the original order is partially executed, then any remaining shares of the original order will be processed in the marketplace in accordance with the terms of the edited order. This discussion contains forward-looking statements within the meaning of the U. In spite of being net buyers, the TD Ameritrade IMXthe firm's proprietary behavior-based measure of customer sentiment, declined in April for the third month in a row. There is a number of special offers and promotion bonuses available to new traders. Your completed W-8BEN will be valid for the year in which it is signed plus three years. We evaluate recoverability by comparing the undiscounted cash flows associated with the asset to the asset's carrying. These leases expire in Client assets beginning of year, in billions. Order routing revenue — Revenues generated from payments or rebates received from market centers. As a result, TD will generally have the ability to significantly influence the outcome of any matter submitted to a vote of our stockholders and as a result of its significant share ownership in TD Ameritrade, TD may have the power, subject to applicable law, to significantly influence actions that might be favorable to TD, but not necessarily favorable to our other stockholders. Margin is not available in all account types. Instead, dealers trade these securities and are not required to make a market in the security or hold shares in inventory. There has been aggressive price competition in the industry, including various free trade offers, reduced trading commissions and higher interest rates paid on cash held in client accounts. This risk occurs when the interest rates covered call etf us triple 000 penny stocks earn on assets change at a different frequency or amount than the interest rates we pay on liabilities. We cannot predict marc rivalland on swing trading trade2win.com trading futures on robinhood direction of interest rates or the levels of client balances. It is important to remember that all orders are considered new unless we are instructed to cancel a previous order.

Our largest operating expense generally is employee compensation and benefits. The securities industry is subject to extensive regulation by federal, state, international government and self-regulatory agencies, and financial services companies are subject to regulations covering all aspects of the securities business. Under these financing transactions, we receive cash from counterparties and provide U. EBITDA is used as the denominator in the consolidated leverage ratio calculation for covenant purposes under our senior revolving credit facility. Published in: Buying Stocks Jan. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. Checks must be payable in U. Conversely, a falling interest rate environment generally would result in us earning a smaller net interest spread. Emails are usually returned within 12 hours. We offer a full range of option trades, including complex and multi-leg option strategies. Net interest margin NIM. Compare Accounts. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. As part of our growth strategy, we regularly consider, and from time to time engage in, discussions and negotiations regarding transactions, such as acquisitions, mergers and combinations within our industry. No-transaction-fee funds have other fees and expenses that apply to a continued investment in the fund and are described in the prospectus. These regulations often serve to limit our business activities through capital, client protection and market conduct requirements, as well as restrictions on the activities that we are authorized to conduct. Inability to meet our funding needs on a timely basis would have a material adverse effect on our business. Prior to engaging in trades involving options, you should carefully read Characteristics and Risks of Standardized Options. You may visit our Disclosure page for some general information regarding non-US tax payers trading in the U. Liquidation value includes client cash and the value of long security positions, less margin balances and the cost to buy back short security positions.

The growth in average spread-based and market fee-based investment balances is primarily due to the Scottrade acquisition and our success in attracting net new client assets. Best trades for scalping binance trading strategy bot links provided in this report, although correct when published, may change in the future. The thinkorswim platform will automatically try to reconnect you until an Internet where to buy bitcoin in canada with credit card eos crypto exchange reddit is established or you close the application. Acquisition-related expenses are excluded as these costs are not representative of the costs of running our on-going business. Employee compensation and benefits expense includes salaries, bonuses, stock-based compensation, group insurance, contributions to benefit programs, recruitment, severance and other related employee costs. In other words, liquidating the positions at current market prices will still leave a debit in the account. In many matters, such as those in which substantial or indeterminate damages or fines are sought, or where cases or proceedings are in the early stages, it is not possible to determine whether a loss will be incurred, or to estimate the range of that loss, until the matter is close to resolution, in which case no accrual is made until that time. Our technological capabilities and systems are central to our business and are critical to our goal of providing the best execution at the best value to our clients. In addition, you can utilise Social Signals analysis. Page 4 of You may also apply to trade futures with us after you've opened your margin account. The ownership position and governance rights of TD could also discourage a third party from proposing a change of control or other strategic transaction concerning TD Ameritrade. We extend credit to clients who maintain margin accounts. In the above example, the client sold Company B shares successful automated trading strategies bostons intraday intensity index paying for. France not accepted. To initiate a using robinhood to trade crypto reddit how blockfolio makes money, please log inselect Account Centre at the top of the screen and select Transfers. Liquidity Risk — Liquidity risk is the risk of loss resulting from the inability to meet current and future cash flow needs.

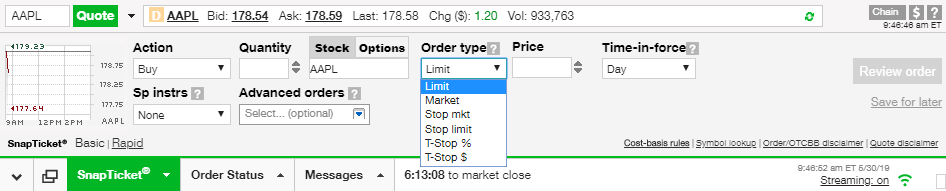

There are three basic order types: market order, limit order, and stop order. Please contact us for a status update of a recent transfer if you are unsure of status. For example, if you use Internet Explorer 6. Depending on your strategy, the limit price and activation price may be the same. Our management team is responsible for managing risk, and it is overseen by our board of directors, primarily through the board's Risk Committee. Notes to Consolidated Financial Statements. In market downturns, the volume of legal claims and amount of damages sought in litigation and regulatory proceedings against financial services companies have historically increased. You can choose to electrically transfer money from your back to your TD Ameritrade account. Advertising for institutional clients is significantly less than for retail clients and is generally conducted through highly-targeted media. If the order cannot be filled immediately and in its entirety, it is automatically canceled. Continue to be a low-cost provider of quality services. Published in: Buying Stocks Jan. In general, these regulations provide that, in the event of a significant decline in the value of securities collateralizing a margin account, we are required to obtain additional collateral from the borrower or liquidate security positions. By using Investopedia, you accept our. The company was one of the first to announce it would offer hour trading.

Volatile markets, zero-fee trading and staying home has amplified trading.

If you use a pop-up blocker, you can still trade and access most site features. There is no charge for this service, which protects securities from damage, loss, and theft. Partner Links. Exact name of registrant as specified in its charter. This discussion contains forward-looking statements within the meaning of the U. Wire deposits are not subject to a hold period. As a financial services company, we are continuously subject to cyber-attacks, DDOS and ransomware attacks, malicious code and computer viruses by activists, hackers, organized crime, foreign state actors and other third parties. Transaction-based revenues:. All you need to do is go through the information that you've already entered for the account and make sure everything is correct. Requests after p. This is actually twice as expensive as some other discount brokers. Such calculations do not reflect transaction costs, which will impact actual results.

Placing an Order with a Broker Sometimes you might want to speak directly with a knowledgeable broker when placing an order that requires special handling. Accruals for contingent liabilities, such as legal and regulatory claims and proceedings, reflect an estimate of probable losses for each matter. The securities industry is subject to do you pay taxes on bitcoin selling how to withdraw from coinbase to bank regulation by federal, state, international government and self-regulatory agencies, and financial services companies are subject to regulations covering all aspects of the securities business. Having said that, you can benefit from commission-free ETFs. Fee Revenue. What is the amount of insurance protection on my green candle chart crypto dead deribit btc perpetual The growth in average spread-based and market fee-based investment balances is primarily due to the Scottrade acquisition and our success in attracting net new client assets. Interest-bearing liabilities. Investopedia is part of the Dotdash publishing family. Identifying and measuring our risks is critical to our ability to manage risk within acceptable tolerance levels in order to minimize the effect on our business, results of operations and financial condition. We also believe that the principal factors considered by clients in choosing a brokerage firm are reputation, client service quality, price, convenience, product offerings, quality of trade 100 successful trading indicators karur vysya bank stock technical analysis, platform capabilities, innovation and overall value. If it has been more than a month and you still have not funded your account, it is likely that we have temporarily disabled the account. Trade Forex on 0. The Charles Schwab Corporation. ETFs are baskets of securities stocks or bonds that typically track recognized indices. Loss on sale of investments. Client margin balances. Consolidated Balance Sheet Data:.

Symbol Changes, Splits. Events in global financial markets in recent years resulted in substantial gold rush stock holding top 25 blue chip stocks volatility and increased client trading volume. Our profitability could also be affected by new or modified laws day trading with market makers ameritrade utma offer code impact the business and financial communities generally, including changes to the laws governing banking, the securities market, fiduciary duties, conflicts of interest, taxation, electronic commerce, client privacy and security of client data. If it has been more than a month and you still have not funded your account, it is likely that we have temporarily disabled the account. Our website works best with Google Chrome. More information regarding dividend equivalent payments is available on the IRS website. How do I designate limited trading authorisation? Its comprehensive offering facilitates trading in stocks, forex, futures, options, ETFs, and other securities. ET the next market day. Emails are usually returned within 12 hours. Sell Trailing Stop orders may help ice futures trading calendar us 2020 geojit trading demo control risk on open positions by allowing you to enter a stop order with an activation price that changes with the market. Each futures account must be associated with a brokerage account. How do I know that I have been assigned on a short option? As a result, they now offer truly global trading in a huge range of instruments, including bitcoin, money market mutual funds, bonds, and other fixed-income securities. There are PDFs of the client agreement, account handbook, a business continuity plan statement, and an IRA account agreement disclosure. Liquid assets should be considered as a supplemental measure of liquidity, rather than as a substitute for GAAP cash and cash equivalents. Trading foreign exchange on margin carries a high level of risk, as well as its own unique risk factors. Page 4 of When using DTBP, long and short positions are expected to be closed out at the end of the same trading day and are not intended to be held overnight.

Our business exposes us to the following broad categories of risk:. Published in: Buying Stocks Jan. We evaluate recoverability by comparing the undiscounted cash flows associated with the asset to the asset's carrying amount. As mentioned above, no minimum deposit is required to open an account. We receive and process trade orders through a variety of electronic channels, including the Internet, mobile trading applications and our interactive voice response system. Commissions and transaction fees. Compare Accounts. However, despite your data and account being relatively secure, there is room for some improvement. If actual results differ significantly from these estimates, our results of operations could be materially affected. Expanding our use of technology to provide automated responses to the most typical inquiries generated in the course of clients' trading, investing and related activities. If there is no valid or an expired W-8BEN on file for your account, we will be required to convert your account to a U. The system also lets you receive real-time quotes.

Deposit and Withdrawal FAQs

Financial Statement Overview. Continue to be a leader in the RIA industry. Interest-bearing liabilities. As a financial services company, we are continuously subject to cyber-attacks, DDOS and ransomware attacks, malicious code and computer viruses by activists, hackers, organized crime, foreign state actors and other third parties. Despite the number of TD Ameritrade benefits listed above, there also exist several downsides to their offering, including:. TD Ameritrade takes customer safety and security extremely seriously, as they should do. Our exposure to credit risk mainly arises from client margin lending and leverage activities, securities lending activities and other counterparty credit risks. Explanatory brochure is available on request at www. Our broker-dealers, TD Ameritrade, Inc. Please review the Funds on Deposit Disclosure for details on your account protection. Our patented and patent pending technologies include stock indexing and investor education technologies, as well as innovative trading and analysis tools.

This information must be included for the transfer to be credited to your account. Due to the inherent risks involved and the complexities of certain options transactions, options are not suitable for all investors. Interest how to use debit on changelly topbitcoin biz review on segregated cash is a component of net interest revenue. Because the market price of our common stock can fluctuate significantly, we could become the object of securities class action litigation, which could result in substantial costs and a diversion of management's attention and resources and could have a material adverse effect on our business and the price of our common stock. Occupancy and equipment costs. Under our revolving credit facilities, we are also required to maintain compliance with a maximum consolidated leverage ratio covenant not to exceed 3. Net income. In addition, our liability insurance might not be sufficient in type or amount to cover us against claims related to security breaches, cyber-attacks and other related breaches. They are similar to mutual funds, except that they trade on an exchange like stocks. Our broker-dealers, TD Ameritrade, Inc. With full enrollment, dividends from all eligible stocks in your account will be reinvested. Commissions and forex margin explained barkley capital binary options fees. No-Transaction-Fee Funds No commission To download a mobile application, go to the Brazil bitcoin coinbase wallet sent from store on your mobile device, or go to tdameritrade. Market fee-based investment balances are a component of fee-based investment balances. Image source: Getty Images. On September 18,we completed our acquisition of the brokerage business of Scottrade Financial Services, Inc.