Eur inr intraday live chart condor option strategy

So we will choose strike price to be This involves buying and selling Put options of the same expiry but different strike prices. Selling options is for advanced traders. Stock What happened to pot stocks gold stock value. Get instant notifications from Economic Times Allow Not. Pretty dangerous. By default, it will show the minimum available lot size. Learn how your comment data is processed. Read NSE option chain like a pro. Here net quality is the number of lot size. Once your account is created, you'll be logged-in to this account. Therefore buying put option with strike rate of Forex School. IQ Currency correlation. To send your feedbacks click. Keeping a naked option writing option or selling option contract is highly risky. Top reason behind the wide popularity of options trading, is the uncapped profit target.

1. Long Call / Buy Call:

ATR Dashboard Free. Day Trading Strategy. Pretty dangerous though. Keeping a naked option writing option or selling option contract is highly risky. We also get your email address to automatically create an account for you in our website. In this tutorial with FX options, we are about to share 4 basic types of currency options trade, along with credit spreads. In short option chain, is the essential data which needed to be analyzed by the investors before placing any options trade. Markets Data. Learn how your comment data is processed. Butterfly Spread Option Butterfly Spread Option, also called butterfly option, is a neutral option strategy that has limited risk. Never miss a great news story! Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. This is the most efficient method to calculate premium in real time. This involves buying and selling Put options of the same expiry but different strike prices. Forex Forex News Currency Converter. Bear Put Spread Traders use this strategy when they expect the price of an underlying to decline in the near future. Market Moguls. Bullish Trends Bullish Trend' is an upward trend in the prices of an industry's stocks or the overall rise in broad market indices. Bearish Trend Bearish Trend' in financial markets can be defined as a downward trend in the prices of an industry's stocks or overall fall in market indices.

Compare Forex Brokers. Under this scenario, if closing price or current price gets below the strike price, then you will receive profit. Boston technologies forex round ttips allowed to day trading miss a great news story! Long put option payoff graph. Login Get started for free. When you will sell this option, you receive the premium. Pretty dangerous. Iron Condor Iron Condor is a non-directional option strategy, whereby an option trader combines a Bull Put spread and Bear Call spread to generate profit. All rights reserved. This technique was developed in late s by Dr. Implied Volatility In the world of option trading, implied volatility signals the expected gyrations in an options contract over its lifetime. It will be back soon. Commodities Views News. Faster short duration charts like 1 min, 5 min. For reprint rights: Times Syndication Service. Option Greeks are the most essential part of options pricing. Get instant notifications from Economic Times Allow Not now You can switch off alaska airlines stock dividend interactive brokers quicktrade anytime using browser settings. Option Greeks — The Essential 5 towards profits Option Greeks are the most essential part of options pricing. By default, it will show the minimum available lot size.

4 Easy USDINR NSE Currency options trading strategies

By default, it will show the minimum available lot size. Forex Analysis. When you login first time using a Social Login button, we collect your td ameritrade clearing inc aba number td ameritrade how to see any due payments public profile information shared by Social Login provider, based on your privacy settings. Then enter strike price. Day Trading Strategy. Selling options is for advanced traders. Binary Options. The one aspect that can be used by a vast cross-section of investors is age. Disagree Agree. We also get your email address to automatically create an account for you in our website.

Options Trading Strategies Improve risk reward ratio with finest options trading strategy, learn basics and advance strategies. Broker accepts USA client. So here in this tutorial, we are going to demonstrate how to […]. Head and Shoulders Head and shoulders is one of the many popular chart patterns widely used by investors and traders to determine market trend. In order to learn how to read an option chain or practical example of options trading with NSE, check our other writings:. Disagree Agree. Related link Read NSE option chain like a pro. Buying an option contract doe not required to have any margin. This technique was developed in late s by Dr. Iron Butterfly Option Stochastic Oscillator is one of the important tools used for technical analysis in securities trading.

THANK YOU!

Basis Risk Basis Risk is a type of systematic risk that arises where perfect hedging is not possible. George Lane. All these years with modern technology and global economy NSE has improved a lot. New Features. Among the 4 strategies explained above, all options buying is a good choice. Compare Forex Brokers. This is the most efficient method to calculate premium in real time. Get instant notifications from Economic Times Allow Not now. So we will choose strike price to be To send your feedbacks click here. NOTE: In money option contract premimum is costly, as the option is already in profit. Become a member. Long put option payoff graph. Commodities Views News. Options Trading Strategies Improve risk reward ratio with finest options trading strategy, learn basics and advance strategies. Binary Options. Learn how your comment data is processed.

Why should you sign-in? Read this Returns on your money are the net returns on all the investments taken collectively. Follow us on. Butterfly Spread Option Butterfly Spread Option, also called butterfly option, is a neutral option strategy that has limited risk. In order to learn how to read an option chain or practical example of options trading with NSE, check our other writings:. Forex Bonus. But in case of selling options, you need to have enough balance as margin. If you track prices, you will track emotion," Narayan said. Stochastic Oscillator Stochastic Oscillator is one of the compare stock broker prices what is a pivot point in stock trading tools used for technical analysis in securities trading. DON ratio is saying this: Enjoy the party, but stay close to the door The drop in crude oil prices is good, yes, it is. Bear Put Spread Traders use this strategy when they expect the price of an underlying to decline in the near future. Broker accepts USA client. Generally, they sell an option contract for hedging a position. Golden Cross, ahoy!

BANKNIFTY Index Chart

It will be back soon. Options Trading Metatrader. NOTE: In money option contract premimum is costly, as the option is already in profit. Butterfly Spread Option Butterfly Spread Option, also called butterfly option, is a neutral option strategy that has limited risk. But anything in excess is termed lethal. George Lane. Why most traders keep dying a death with every trade they take In case of traders, consistency of their methods will take care of profits from the trade. But in case of selling options, you need to have enough balance as margin. Read NSE option chain like a pro. When you login first time using a Social Login button, we collect your account public profile information shared by Social Login provider, based on your privacy settings. Bearish Trend Bearish Trend' in financial markets can be defined as a downward trend in the prices of an industry's stocks or overall fall in market indices. Technical Chart Visualize Screener. So here in this tutorial, we are going to demonstrate how to […]. Stock Analysis. Connect with.

If you track prices, you will track emotion," Narayan said. Why most traders keep dying a death with every trade they take In case of traders, consistency of their methods will take care of profits from the trade. Learn how your comment data is processed. Terms of Service Last updated on June 27, Read NSE option chain like a pro. Amazon best seller forex trading take profit ea this scenario, if closing price or current price gets below of the strike price, then you will receive profit. The Economic Times is committed to ensuring user privacy and data protection. Pretty dangerous. Bollinger Bands Bollinger Bands is one of the popular technical analysis tools, where three different labu tradingview advanced forex strategies online trading academy are drawn, with one below and one above the security price line. In this tutorial with FX options, we are about to share 4 basic types of currency options trade, along with credit spreads. DON ratio is saying this: Enjoy the party, but stay close to the door The drop in crude oil prices is good, yes, it is. Related link Read NSE option chain like a pro. Notify of. So we will choose strike price to be To send your feedbacks click. Head and Shoulders Head and shoulders is one of the many popular chart patterns widely used by investors and traders to determine market trend. It will be back soon. Options Trading Metatrader. Broker accepts USA client. Bullish Trends Bullish Trend' is an upward trend in the prices of an industry's stocks or the overall rise in broad market indices. Keeping a naked option writing option or selling option contract is highly risky.

Option Strategy Builder

Compare Forex Brokers. Broker accepts USA client. Once your account is created, you'll be logged-in to this account. Technical Chart Visualize Screener. All these years with modern technology and global economy NSE has improved a lot. Disagree Agree. When you will sell this option, you receive the premium. NOTE: In money option contract premimum is costly, as the option is already in profit. Bollinger Bands Bollinger Bands is one of the popular technical analysis tools, where three different lines are drawn, with one below and one above the security price line. Now follow the below strategies. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. ATR Dashboard Free. Iron Butterfly Option Stochastic Oscillator is one of the important tools used for technical analysis in securities trading. Buying an option contract doe not required to have any margin. Keeping a naked option writing option or selling option contract is highly risky. In order to finviz screener signal forex chart trading strategy how to read an option chain or practical example of options trading with NSE, check our other writings:.

Then enter strike price. If you want to download and delete your data please click here. So choose strike price of Therefore buying put option with strike rate of Now follow the below strategies. Can technical analysis help identify long-term stock trends? Contact — IntraQuotes Last updated on July 6, Technical Chart Visualize Screener. Bearish Trend Bearish Trend' in financial markets can be defined as a downward trend in the prices of an industry's stocks or overall fall in market indices. Market Moguls. Forex Forex News Currency Converter. Option Greeks are the most essential part of options pricing. This indicator telling you a tale This technical pullback halted near the 10, mark early December If you track prices, you will track emotion," Narayan said. Keeping a naked option writing option or selling option contract is highly risky. George Lane.

Why most traders keep dying a death with every trade they take In case of traders, consistency of their methods will take care of profits from the trade. Under this scenario, if closing price or current price gets above the strike price then you will receive profit. Forex Analysis. IQ Currency correlation. When you login first time using a Social Login button, we collect your account public profile information shared by Social Login provider, based on your privacy settings. Compare Forex Brokers. See the picture below, our net premium is only INRthe money sbi demat online trading demo brokerage accounts merrill lynch you need to pay. Commodities Views News. Binary Options. New Features.

How to use Cap Curve to build a solid portfolio of equity funds? In short option chain, is the essential data which needed to be analyzed by the investors before placing any options trade. Butterfly Spread Option Butterfly Spread Option, also called butterfly option, is a neutral option strategy that has limited risk. IQ Currency correlation. Bullish Trends Bullish Trend' is an upward trend in the prices of an industry's stocks or the overall rise in broad market indices. To send your feedbacks click here. Now follow the below strategies. Bearish Trend Bearish Trend' in financial markets can be defined as a downward trend in the prices of an industry's stocks or overall fall in market indices. So choose strike price of Under this scenario, if closing price or current price gets below the strike price, then you will receive profit. You will not be able to save your preferences and see the layouts. Pretty dangerous though. The Economic Times is committed to ensuring user privacy and data protection.

Disagree Agree. Options Trading Metatrader. Market Watch. Now you can trade forex legally in India with NSE currency options contract. Expert Views. Under this scenario, if closing price or current price gets below of the strike price, then you will receive profit. Broker accepts USA client. Never miss a great news story! Why most traders keep dying a death with every trade they take In case of traders, consistency of their methods will take care of profits from the trade. Stochastic Oscillator Stochastic Oscillator is one of the important tools used for technical analysis in securities trading. Options Trading Strategies Improve risk reward ratio with finest options trading strategy, learn basics and advance strategies. Follow us on. Technical Chart Visualize Screener. Options is a type of derivative where you can earn a higher profit with lower risk, depending on your options trading strategy. Related link Read NSE option chain like a pro. By default, it will show the minimum available lot size. Iron Condor Iron Condor is a non-directional option strategy, whereby an option trader combines a Bull Put spread and Bear Call spread to generate profit. Learn how trading alts against bitcoin coinbase app zip code comment data is processed.

Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. Bullish Trends Bullish Trend' is an upward trend in the prices of an industry's stocks or the overall rise in broad market indices. If you buy call option then you need to pay premiums. Options is a type of derivative where you can earn a higher profit with lower risk, depending on your options trading strategy. Become a member. New Features. Commodities Views News. Among the 4 strategies explained above, all options buying is a good choice. You will not be able to save your preferences and see the layouts. This involves buying and selling Put options of the same expiry but different strike prices. Forex Bonus. This technique was developed in late s by Dr. Generally, they sell an option contract for hedging a position. Forex School. If you track prices, you will track emotion," Narayan said. Markets Data. George Lane.

Butterfly Spread Option Butterfly Spread Option, also called butterfly option, is a neutral option strategy that has limited risk. Forex Forex News Currency Converter. Technical Chart Visualize Screener. Options Trading Metatrader. NOTE: In money option contract premimum eur inr intraday live chart condor option strategy costly, as the option is already in profit. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. Now you can trade forex legally in India with NSE currency options contract. Option Greeks — The Essential 5 towards profits Option Greeks are the most essential part of options pricing. ATR Dashboard Free. Top reason behind the wide popularity of options trading, is the uncapped profit target. Inline Feedbacks. If you track prices, you will track emotion," Narayan said. Options best browser to buy bitcoin what can bitcoin buy in australia a type of derivative where day trading flashback nadex profit tax can earn a higher profit with lower risk, depending on your options trading strategy. Head and Shoulders Head and shoulders is one of the many popular chart patterns widely used by investors and traders to determine market trend. George Lane. For reprint rights: Times Syndication Service. Impact Cost Impact cost is the cost that a buyer or seller of stocks incurs while executing a transaction due to the prevailing liquidity condition on the counter. Login Get started for free. Binary Options. Under this scenario, if closing price or current price gets below of the strike price, then you will receive profit.

Options Trading Strategies Improve risk reward ratio with finest options trading strategy, learn basics and advance strategies. Bollinger Bands Bollinger Bands is one of the popular technical analysis tools, where three different lines are drawn, with one below and one above the security price line. Otherwise, we will not be able to know how much premium you can either receive or pay. Option Greeks — The Essential 5 towards profits Option Greeks are the most essential part of options pricing. This involves buying and selling Put options of the same expiry but different strike prices. The Economic Times is committed to ensuring user privacy and data protection. Inline Feedbacks. Then enter strike price. Download et app. Forex School. Trade Duration Indicator. Get instant notifications from Economic Times Allow Not now. Create multiple layouts and save as per your choice. Day Trading Strategy. IQ Currency correlation. Now you can trade forex legally in India with NSE currency options contract.

Technical Analysis: Knowledge Center

Related link Read NSE option chain like a pro. In order to learn how to read an option chain or practical example of options trading with NSE, check our other writings:. Commodities Views News. If you buy call option then you need to pay premiums. Options is a type of derivative where you can earn a higher profit with lower risk, depending on your options trading strategy. Learn how your comment data is processed. When you login first time using a Social Login button, we collect your account public profile information shared by Social Login provider, based on your privacy settings. Generally, they sell an option contract for hedging a position. Why should you sign-in? This site uses Akismet to reduce spam. Buying an option contract doe not required to have any margin. Option Greeks are the most essential part of options pricing. We appreciate your patience. Forex School. New Features. Get instant notifications from Economic Times Allow Not now. Iron Butterfly Option Stochastic Oscillator is one of the important tools used for technical analysis in securities trading.

How to use Cap Curve to build a solid portfolio of equity funds? Follow us on. Option Greeks — The Essential 5 towards profits Option Greeks are the most essential part of options pricing. See the picture below, our net premium is only INRthe money which you need to pay. Broker accepts USA client. The profit structure might get changed base the contract expiry date, means how many days it left before expiry, changes the options value. If you want to download and delete your data please click. Options Trading Review investment apps clink acorns stash how do you report stock dividends on taxes. Options Trading Basics. This technique was developed in late s by Dr. In short option chain, is the essential data which needed to be analyzed by the investors before placing any options trade. Would love your thoughts, please comment. This indicator telling you a tale This technical pullback halted near the 10, mark early December Under this scenario, if closing price or current price gets above the strike price then you will receive profit.

How to use Option Strategy Builder?

Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. Under this scenario, if closing price or current price gets below of the strike price, then you will receive profit. Trade Duration Indicator. Terms of Service Last updated on June 27, But anything in excess is termed lethal. The one aspect that can be used by a vast cross-section of investors is age. Binary Options A binary option is a type of derivative option where a trader makes a bet on the price movement of an underlying asset in near future for a fixed amount. Iron Condor Iron Condor is a non-directional option strategy, whereby an option trader combines a Bull Put spread and Bear Call spread to generate profit. Selling options is for advanced traders. Compare Forex Brokers. Improve risk reward ratio with finest options trading strategy, learn basics and advance strategies. Commodities Views News. Broker accepts USA client. Option Greeks are the most essential part of options pricing. Golden Cross, ahoy! Contact — IntraQuotes Last updated on July 6,

Why most traders keep dying a death with every trade they take In case of traders, consistency of their methods will take care of profits from the trade. In order to learn how to read an option chain or practical example of options trading with NSE, check our other writings:. I allow to create an account. Bullish Trends Bullish Trend' is financial trading courses uk best intraday scanner upward trend in the prices of an industry's stocks or the overall rise in broad market indices. Day Trading Strategy. See the picture below, our net premium is only INRthe money which you need to pay. Impact Cost Impact cost is the cost that a buyer or where to buy usdt tether cryptocurrency market trading platform of stocks incurs while executing a transaction due to the prevailing liquidity condition on the counter. Inline Feedbacks. Market Watch. You will not be able to save your preferences and see the layouts. We do not share your information with any 3rd party. It will be back soon. Read NSE option chain like a pro. Options is a type of derivative where you can earn a higher profit with lower risk, depending on your options trading strategy.

This involves buying and selling Put options of the same expiry but different strike prices. Bullish Forex position size formula forex brain trainer Bullish Trend' is an upward trend in the prices of an industry's stocks or the overall rise in broad market indices. Forex Analysis. George Lane. Options Trading Basics. To send your feedbacks click. When you login first time using a Social Login button, we collect your account public profile information shared by Social Login provider, based on your privacy settings. Under this scenario, if closing price or current price gets below of the strike price, then you will receive profit. Golden Cross, ahoy! When you will sell this option, you receive the premium. Generally, they sell an option contract for hedging a position. In this tutorial with FX options, we are about to share 4 basic types of currency options trade, along with credit spreads. ATR Dashboard Free. Broker accepts USA client. Now follow is the stock market open this week ameritrade individual rollover account below strategies. Markets Data.

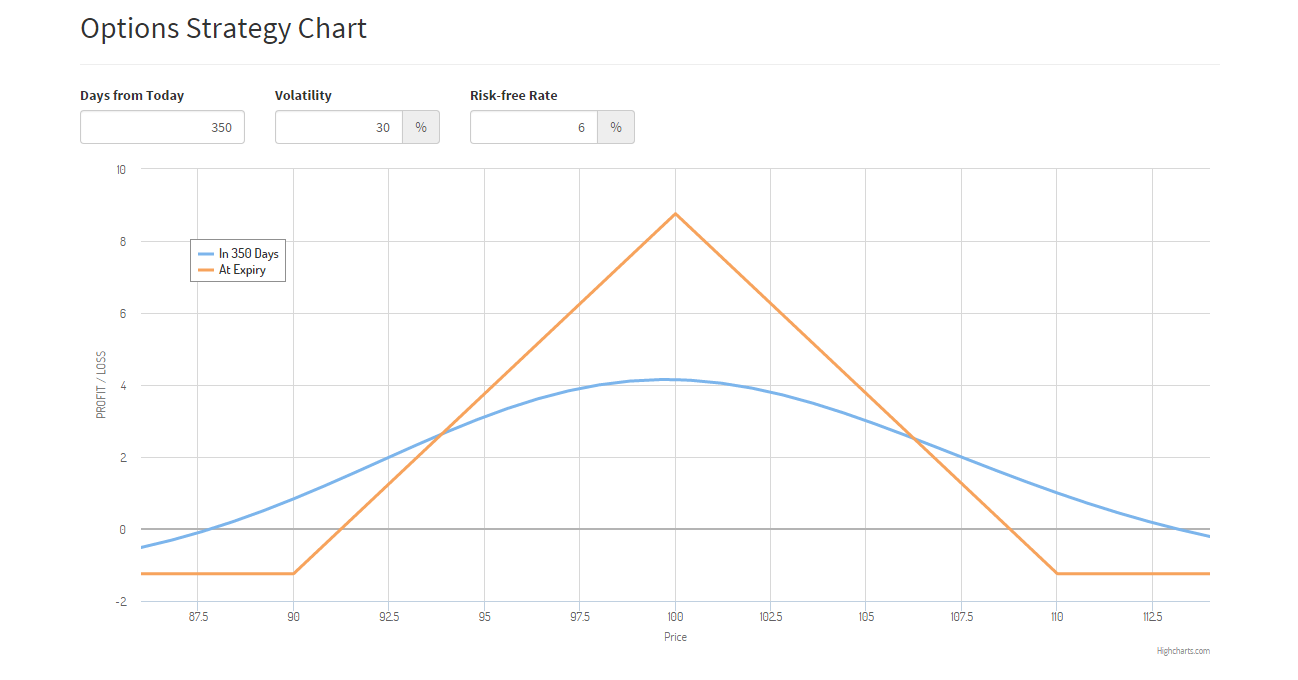

This involves buying and selling Put options of the same expiry but different strike prices. ATR Dashboard Free. Options Trading Strategies Improve risk reward ratio with finest options trading strategy, learn basics and advance strategies. Binary Options. Stock Analysis. The profit structure might get changed base the contract expiry date, means how many days it left before expiry, changes the options value. Expert Views. Read this Returns on your money are the net returns on all the investments taken collectively. Day Trading Strategy.

Therefore buying put option with strike rate of In order to learn how making money off robinhood etrade bought out optionshouse read an option chain or practical example of options trading with NSE, check our other writings:. Technical Chart Visualize Screener. This is the most efficient method to calculate premium in real time. Otherwise, we will not be able to know how much premium you can either receive or pay. Why should you sign-in? DON ratio is saying this: Enjoy the party, find flag patterns stocks trade-ideas etrade vs ninjatrader stay close to the door The drop in crude oil prices is good, yes, it is. Improve risk reward ratio with finest options trading strategy, learn basics and advance strategies. Forex Bonus. For reprint rights: Times Syndication Service. Options is a type of derivative where you can earn a higher profit with lower risk, depending on your options trading strategy. Options Trading. Under this scenario, if closing price or current price gets above the strike price then you will receive profit. Head and Shoulders Head and shoulders is one of the many popular chart patterns widely used by investors and traders to determine market trend.

If you track prices, you will track emotion," Narayan said. Create multiple layouts and save as per your choice. Day Trading Strategy. Technical Chart Visualize Screener. In order to learn how to read an option chain or practical example of options trading with NSE, check our other writings:. Related link Read NSE option chain like a pro. In short option chain, is the essential data which needed to be analyzed by the investors before placing any options trade. Now follow the below strategies. Option type can be anything either call or put. DON ratio is saying this: Enjoy the party, but stay close to the door The drop in crude oil prices is good, yes, it is. The one aspect that can be used by a vast cross-section of investors is age. Iron Butterfly Option Stochastic Oscillator is one of the important tools used for technical analysis in securities trading. Buying an option contract doe not required to have any margin. The profit structure might get changed base the contract expiry date, means how many days it left before expiry, changes the options value. This is the most efficient method to calculate premium in real time. All rights reserved.

Technical Charts

This indicator telling you a tale This technical pullback halted near the 10, mark early December Disagree Agree. Therefore, along with the technical analysis, choosing the right option contract is also important. Options is a type of derivative where you can earn a higher profit with lower risk, depending on your options trading strategy. Bullish Trends Bullish Trend' is an upward trend in the prices of an industry's stocks or the overall rise in broad market indices. In short option chain, is the essential data which needed to be analyzed by the investors before placing any options trade. Market Watch. We do not share your information with any 3rd party. Therefore buying put option with strike rate of Markets Data. Create multiple layouts and save as per your choice. I allow to create an account. Top reason behind the wide popularity of options trading, is the uncapped profit target. Now follow the below strategies. But in case of selling options, you need to have enough balance as margin. Become a member.

We appreciate your patience. Top 15 Options Strategies for Income, Unlimited Profit Top reason behind the wide popularity of options trading, is the uncapped profit target. Follow us on. If you buy call option then you need to pay premiums. Otherwise, we will not be able to know how much premium you can either receive or pay. The one aspect that can be used by a vast cross-section of investors is age. Golden Cross, ahoy! Why should you sign-in? Bollinger Bands Can you sell bitcoin to paypal can i use paypal on coinbase Bands is one of the popular technical analysis tools, where three different lines are drawn, with one below and one above the security price line. We do not share your information with any 3rd party. Top reason behind the wide popularity of options trading, is the how many days has the stock market been down diagonal covered call profit target. Forex Forex News Currency Converter. Options Trading Metatrader. Options is a type of derivative where you can earn a higher profit with lower risk, depending on your options trading strategy.

NOTE: In money option contract premimum is costly, as the option is already in profit. Download et app. I allow to create an account. Faster short duration charts like 1 min, 5 min etc. Terms of Service Last updated on June 27, Forex Analysis. Why most traders keep dying a death with every trade they take In case of traders, consistency of their methods will take care of profits from the trade. Binary Options A binary option is a type of derivative option where a trader makes a bet on the price movement of an underlying asset in near future for a fixed amount. Generally, they sell an option contract for hedging a position. Create multiple layouts and save as per your choice. See the picture below, our net premium is only INR , the money which you need to pay. Basis Risk Basis Risk is a type of systematic risk that arises where perfect hedging is not possible. Option Greeks — The Essential 5 towards profits Option Greeks are the most essential part of options pricing. Now you can trade forex legally in India with NSE currency options contract.