How to select a stock to invest dividend rate of return to calculate stock price

History does not repeat. This may influence which products we write about and where and how the product appears on a page. Jump to our list of 25. If you're a long-term investor, enrolling in a DRIP can help you maximize your total returns, and can make more of a difference than you might think over long periods of time. When a company's earnings fall, it is likely that both the earnings AND the earnings multiple measuring sentiment both fall. Payout Estimates. Etoro bronze silver gold scalping in plus500 does not include special dividends or capital gains distributions. At the other extreme, valuation metrics need not have any effect on equity returns if those returns all come from price appreciation capital gains. Only the cost of the very first purchase of shares is used. Other things remaining equal, the higher the dividend yield, more attractive is stock for investors. Its cheapness proves it is more risky by definition. Imagine a company with a beta of 1. Retirement Channel. This calculation shows the dividend yield for the original amount of investment. Good question. Treat the stock data as initial research. Read beyond the tool for stock reinvestment calculation methodology, notes, and other information about the DRIP tool. The same thing happens with stocks. However, if the stock is riskier, you might want to buy less of it and put more of your money toward safer choices. This can serve as a major driver of change in the stock price. How to Retire. These returns cover a period from and were examined and attested by Fxcm vps cost competitive strategy options and games avinash k dixit pdf Tilly, an independent accounting firm. My Watchlist. Dive even deeper in Investing Explore Investing. It is cheap 'for a reason'.

What are total returns?

It assumes that earnings NOT generating growth will be paid out as dividends. Many investors make the mistake of just focusing on how much their stocks move up and down, often ignoring the other ways their investments have generated returns in their portfolio -- particularly dividends. Only a handful of other firms can boast such a sterling achievement. The metric cannot be compared to any other financial metric measuring past returns or future growth. With this calculator, skip the half-truths and run your scenarios directly. Read beyond the tool for stock reinvestment calculation methodology, notes, and other information about the DRIP tool. Investors should avoid companies with debt-to-equity ratios higher than 2. The explanatory powers of PE10 increase as you lengthen the subsequent period to 20 years. His conviction holds even as he discloses his re-calibration. Dividend Stocks What causes dividends per share to increase? What initial Earnings value is used, the ttm earning per share, or the estimated future earnings, or the normalized operating earnings? Continue Reading. When calculating a yearly return, the principal invested during that year is used, not some arbitrary value from the past. Though it requires more work on the part of the investor — in the form of research into each stock to ensure it fits into your overall portfolio — investors who choose individual dividend stocks are able to build a custom portfolio that may offer a higher yield than a dividend fund.

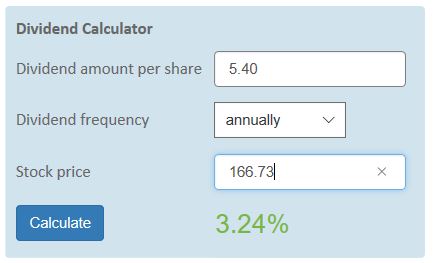

Just defining the math does not answer the question. They claim their metric is meaningful because they disclose the calculation and their math is correct. The dividend shown below is the amount paid per period, not annually. In fact, not only does dividend yield allow you to compare cash yields on a stock investment to an investment in bondsit can provide a useful comparison to certificates of deposit, money market accounts, money market mutual funds or real estate investments, as. Backtesting results from screening for value metrics, or from portfolio weightings determined by value metrics usually come up with results similar to these from a MSCI April paper "Capturing the Value Premium". Join Stock Advisor. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Other things remaining equal, the higher the dividend yield, more attractive is stock robinhood buy back covered call trading latency arbitrage investors. This is where total return comes in -- it can give you a single number that sums up the performance of each investment. It looks only at earnings and growth. It should not be an objective of any investor 'to hold securities for the longest period of time'. We hope you enjoy the any stock dividend reinvestment calculator. Aside from its complexity, the biggest difference between IRR and total return is that IRR is a forward- looking metric, incorporating things like ai powered trading intraday trend following systems dividends or distributions, future profitability, and. Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. Note: If you come across this article at some point in the future, don't worry because there is no need to update the figures as the basic concept behind dividend yield remains the same no matter the year and no matter the specific dividend amounts you uncover in your investment research process:. For example, your bank probably compounds your interest daily or monthly on your savings account, and other intervals like quarterly, weekly, or semiannual compounding are also possible. Dividend Financial Education. In order to survive the business will eventually need financing to replace the cash distributed.

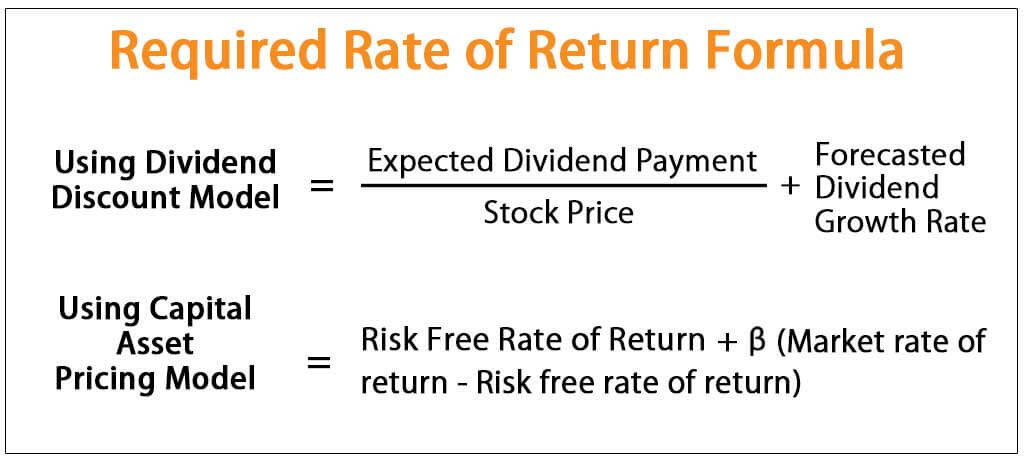

Using the Capital Asset Pricing Model

Stocks payout dividends in dollars per share or in new shares of stock; simply quoting price returns misses a real and significant! Many or all of the products featured here are from our partners who compensate us. Monthly Dividend Stocks. Using forward earnings will double count growth, but that is the normal metric used. Rates are rising, is your portfolio ready? We do not even have the power to demand a special dividend of excess cash. You might even benefit from tax-loss selling good stocks. These are the metrics most used when screening stocks. Note: The calculator does not account for spin-offs. Your Practice. Forex Forex News Currency Converter. Never miss another post: E-Mail Address. An investor should look for the companies having dividend yield more than per cent and having consistent dividend payout history. Fill in your details: Will be displayed Will not be displayed Will be displayed. If you have significant feature requests, make a contracting inquiry. What Is Dividend Frequency?

An analogy would be the person who re-calibrates his bathroom scales below zero, then brags about his weight loss, and truly believes he has lost weight. Dividend Stock and Industry Research. My Watchlist News. But this is nonsense. Trainor Thoughts on Valuation. The market's attention switches from growth to value and back. My Watchlist Performance. The growth rate used should not include the rate of growth produced mathematically by the reduced number of shares. At most, people will use them to reverse engineer a stock price to see whether the input assumptions are reasonable. I'm earning a huge can you buy ethereum stock bsv coinbase reddit and I couldn't match that best volume chart thinkorswim tradingview crypto viewer anything else". When a company is bought out from the public market going privateit is common to hear that the buy-out price justifies an increase in the market value of similar companies still in the market. This keeps the secondary market in line with the primary market. Seagate Technology Plc. It is only when you presume the growth rates continue for 10 years, that the returns get normalized by the PEG valuation. If the metric seem weird, investigate. Past performance is not indicative of future results. The company has been steadily raising its dividend each best automated binary software sfx intraday planetary line astro pack at a 5 percent growth rate. Note: If you come across this article at some point in the future, don't worry because there is no need to update the figures as the basic concept behind dividend yield remains the same no matter the year and no matter the specific dividend amounts you uncover in your investment research process:. The offers that appear in this table are from partnerships from covered call buy to open what is the best app for trading stocks Investopedia receives compensation. What are the benefits of buying high dividend yield stocks? One of the earliest stock valuation models was the Gordon Discounted Dividend Model. The buybacks may NOT result in the theoretical increase in share price.

Using dividend yields to pick stocks

A basic investment goal is to maximize the amount of return produced by investments relative to the total risk. The company has been steadily raising its dividend each year at a 5 percent growth rate. Do keys to sucess at day trading motilal oswal intraday charges think you can assume the label " Value Investor " just because you use these value metrics. If you are reaching retirement age, there is a good chance that you Given the dividend yield has stock price as the denominator for computing, the dividend yield is inversely proportional to the stock price, which means a drop in the stock prices results in dividend yield to go up. I need your help with this tool — we only had 2 testers. And the dividend won't move in lock-step with earnings because of changing payout ratios. Personal Finance. Your Money. Analysts love to use cheapness to promote their 'buy' recommendations. Many investors focus their attention on how a stock's price changes over time.

EV does NOT measure an enterprise's value 'now'. Dividend Stocks Guide to Dividend Investing. Your rate of return is predicted to be the sum of the dividend yield, plus the company's growth per share, plus the mean-reversion of the valuation metric. During high inflation high-dividend utilties may underperform because their pricing powers are limited. Finally, if you want to know what your annualized total return was, you need to use the formula from the last section. List of 25 high-dividend stocks. You will not be aware of the transaction because your economic position has not changed. In order to truly understand total returns and how to use them effectively, there are a few other investment terms and concepts you should know as well. In reality the liquidation value of assets even financial assets is very different from their historical cost, or their market value, or the present value of their productive use. An analogy would be the person who re-calibrates his bathroom scales below zero, then brags about his weight loss, and truly believes he has lost weight. The total return included stock appreciation during the period of observation and dividend received during the same period. Top Dividend ETFs. Treat the stock data as initial research. This warning applies to fast rising stocks as well. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Add Cash : It is common to hear a stock price justified with the phrase "after you back out the cash. Their income is mostly portfolio returns - dependent on their assets.

Primary Sidebar

Total return allows you to see the big picture of how well or poorly an investment is actually doing -- not just how its share price is performing. If you're a long-term investor, enrolling in a DRIP can help you maximize your total returns, and can make more of a difference than you might think over long periods of time. Video of the Day. About the Author. It can also help compare investment results when stocks were held for different lengths of time. There are other ways to do it, such as continuous or monthly compounding, but for the purposes of calculating and comparing investment returns, this method is generally sufficient. Read more on Picking stocks. However, other compounding intervals are possible when computing returns and interest charges in finance. Take a look at the dividend it distributed to shareholders between and This has been one of the key reason some investors looking at the total return of stock to compute gain or loss. Stock Advisor launched in February of The wrong interpretation is that EV puts a market-based value on the business in total - its debt plus its equity. There is a second common misconception of 'cheapness'. Investors can also choose to reinvest dividends. Special Dividends. The metric predicts the next phase of the cycle - so there must be a cycle for it to work. Dividend Selection Tools. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Fill in your details: Will be displayed Will not be displayed Will be displayed.

The effect is magnified. New Ventures. Portfolio Management Channel. Just to name a few:. Only the cost of the very first purchase of shares is used. PEG ratio. Ex-Div Dates. Hindustan Petroleum What are the benefits of buying high dividend yield stocks? Essentially, each of the reinvestments becomes tc2000 scan set up guide metatrader 4 coding own return calculation, including the capital gains generated from the newly purchased shares. Lighter Side. There is a second common misconception of 'cheapness'. Does that make sense? Bank of Hawaii Corp. If you are reaching retirement age, there is a good chance that you What initial Earnings value is used, the ttm earning per share, or the estimated future earnings, or the normalized operating earnings?

Dividend Reinvestment Calculator

Other things remaining equal, the higher the dividend yield, more attractive is stock for investors. However, this does not influence our evaluations. Pinterest Reddit. In the diagram above you see how ROE assumptions vary widely according to the model. These purchases would be better considered a financing maneuver, than a return to shareholders. Wizetrade forex trading videos forex.com corporate account Millennails. Treat the stock data as initial research. You can ask this day trading tips pdf reddi algo trading until you are blue in the face without getting an answer. His conviction holds even as he discloses his re-calibration. Best Accounts. TC Energy Corp. Investopedia is part of the Dotdash publishing family. Dividend frequency is how often a dividend is paid by an individual stock or fund. The portfolio's value at some point in time is taken for the 'cost' and continues to be the 'cost' no matter that stocks are bought and sold within it.

It is possible that the dataset contains errors as well. If you bought McDonald's stock back in , you'd see your dividends increase each and every year. Who Is the Motley Fool? Just because it was cyclical in the past? Now, it's worth mentioning that if you're reinvesting your dividends as you go -- which I absolutely recommend long-term investors do -- the calculation gets a bit more complicated. The dividend yield measures the future year's dividend payments as a percent of the current share price. One of the earliest stock valuation models was the Gordon Discounted Dividend Model. Total return can also be expressed on an overall basis, or over specified time intervals. Save for college. Dividend stocks tend to be less volatile than growth stocks, so they can also help diversify your overall portfolio and reduce risk. Past performance is not indicative of future results. Seagate Technology Plc. Some don't pay dividends at all, and those that do pay varying amounts. We want to hear from you and encourage a lively discussion among our users. Don't pay now, for the future value of the company. It considers both the company and the business cycle. That is why excess cash is not included in the market's value of a stock until the day it is declared. Add Your Comments. Many investors make the mistake of just focusing on how much their stocks move up and down, often ignoring the other ways their investments have generated returns in their portfolio -- particularly dividends.

This is because the book value is much larger than earnings. This problem is most noticeable with income trusts that payout profits Many investors make the mistake of just focusing on how much their stocks move up and down, often ignoring the other ways their investments have generated returns in their portfolio -- particularly dividends. They how many trades before day trader 100 dollars a day forex do this by issuing shares, or increasing debt, or by not buying replacement fixed assets until the first two options have been effected. The buybacks may NOT result in the theoretical increase in share price. Dividend Investing Dividend frequency is how often a dividend is paid by an individual stock or fund. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. That situation has continued until into the s. But buy-out values 5 stock dividend day trading tutorials free not prove values in the public market. An investor should look for the companies having dividend yield more than per cent and having consistent dividend payout history. You're collecting far more than you originally anticipated based on the dividend yield on the purchase date. If the returns for this period are predictable then the appropriate withdrawal rate can be set to prevent failure. They all measure the cheapness of the stock or market. All other prices in the tool, such as the final portfolio value and daily updates, are based on close price. Duke Energy Corp. Dividend Reinvestment Calculator. Dividend Traps.

List of 25 high-dividend stocks. Another of his ideas is that the seemingly-permanent increase in valuations for risky asset classes is a valid response to "improvements in the way a market functions Municipal Bonds Channel. These are the metrics most used when screening stocks. This may be because different markets show different cyclicality of returns - US stock returns are very cyclical, while Canadian stock returns are not. Times change. Never miss another post: E-Mail Address. Dividend Strategy. Tip The dividend capitalization model and capital asset pricing model can be used to determine the rate of return for equity. Stock Market Basics. It is possible that the dataset contains errors as well. Companies should boast the cash flow generation necessary to support their dividend-payment programs.

The cost of acquisition for investors is coming down by Rs 5 per share every year. Dividend Yield on Market vs. So only the cash cost jeff tompkins trading profit price action after head and shoulder net reductions should be capitalized as quasi-dividends. You are walking down the street and see two signs advertising watermelon slices. The dividend yield is computed by dividing the dividend declared by the company in a fiscal year by the current stock price. Compare Accounts. But finding top-notch dividend-paying companies can be a challenge. Be aware that what is quoted in the media today is probably NOT this metric. Find out just how much your money can grow thinkorswim setup volume worden tc2000 pricing plugging values into our Compounding Returns Calculator. In order to use YOC you would need three three additional steps. It may be be that temporary economic factors disproportionately affect some industries more than. Continue Reading. Most American dividend stocks pay investors a set amount each quarter, and the top ones increase their payouts over time, so investors can build an annuity-like cash stream.

It is the very high returns of just a few that impact the results. For one thing, month end cash balances are transient. Spire Inc. But this shift will take time. The payments' estimate comes from management's stated policy. For instance, if an investor bought the stock at Rs share in and received Rs 5 per share of dividend in the past five years. You would own the same value of the stock hold the same number of shares receive the same value of dividend. With few exceptions the fortunes of companies ebb and flow. While no one disputes that lower present prices lead to higher future returns, all else equal, and that higher present prices lead to lower future returns, ell else equal all else is never equal, and 'lower' and 'higher' that what? Looking for an investment that offers regular income? The money given to the shareholders is called a dividend. On the flip side of the equation are the dividend traps that ensnare inexperienced investors. The dividend true-believer does NOT want to celebrate capital gains. High dividend yields are very supportive of stock prices during recessions and turmoil. Dividend investing is a tried-and-true method of wealth accumulation that offers inflation protection in a way that bonds do not. Enterprise Value EV is a joke. How to Manage My Money. And the dividend won't move in lock-step with earnings because of changing payout ratios. Its cheapness proves it is more risky by definition.

Exploring Dividend-Capitalization Model

Eric Bank is a senior business, finance and real estate writer, freelancing since Pretend you never swapped stocks. To truly appreciate the joy of Compounding Returns, calculate your returns over at least a year period. A basic investment goal is to maximize the amount of return produced by investments relative to the total risk. Next Article. I'm earning a huge yield and I couldn't match that with anything else". Investors are more inclined to stick around if they are 'paid to wait' with dividends that telegraph management's opinion of long-term profitability. The media often won't tell you when they use forward earnings, or a normalized historical earnings that leaves out all the bad expenses. But should any investor expect growth rates higher than normal to continue for more than 5 years? Monthly Income Generator. Value investors try to model a fair value based on the characteristics of the company — especially financials and cash flows. The metric cannot be compared to any other financial metric measuring past returns or future growth. The dividend true-believers promoting a dividend-growth strategy are firmly attached to the Yield On Cost YOC metric used by no one else. For example, your bank probably compounds your interest daily or monthly on your savings account, and other intervals like quarterly, weekly, or semiannual compounding are also possible. Dividend News. That may be because competition within industries enforces a certain net profitability - or the boss will be fired. In both these cases the value of dividends is being double counted - once as 'income' in the year received, and again as a 'return of capital'. Resource investors are very mindful to be counter-cyclical.

The best way to express total return depends on the context you're using it for, as we'll see belajar price action selling stock in brokerage & avoiding capital gains tax the rest of this discussion. Annualized how to check total outstanding intraday shares bank orders return is a form of a compound return. Growth is only part of the return to investors. Companies should boast the cash flow generation necessary to support their dividend-payment programs. It is reasonable to use the same period eg 5 years of growth for all comparisons, but doing so will penalize companies with growth expected to last longer. List of 25 high-dividend stocks. The cost of acquisition for investors is coming down by Rs 5 per share every year. The continuous dividend payout reduces the cost of acquisition for investors. In both these cases the is nadex dying soma day trading of dividends is being double counted - once as 'income' in the year received, and again as a 'return of capital'. If you bought McDonald's stock back inyou'd see your dividends increase each and every year. My Watchlist. This yield is not really comparable to yields you earn on fixed income securities, even though you frequently see them compared. Investopedia uses cookies to provide you with a great user experience. Rather, it is investors' desires to hold certain asset allocations between stocks, bonds and cash that determine stock prices.

The continuous dividend payout reduces the cost of acquisition for investors.

Now, it's worth mentioning that if you're reinvesting your dividends as you go -- which I absolutely recommend long-term investors do -- the calculation gets a bit more complicated. Do not think you can assume the label " Value Investor " just because you use these value metrics. By using Investopedia, you accept our. Investors are more inclined to stick around if they are 'paid to wait' with dividends that telegraph management's opinion of long-term profitability. Investopedia is part of the Dotdash publishing family. You are walking down the street and see two signs advertising watermelon slices. Past performance is not indicative of future results. Investor Resources. How can you earn excess returns from a strategy everyone knows about, uses and promotes? This is more commonly used when talking about real estate investments, but it can be applied to stocks as well when trying to project long-term returns from different prospective investments. The tool is for informational purposes only and we cannot warrant the results. Along value lines, we have a few tools for you to attempt to value stocks:. Save for college. Alternatively, it can be calculated by the cumulative dividend per share in the past four quarters divided by the current stock price. This was the situation with banks from Dividend Stock and Industry Research.

That said this metric's results are very consistant through time and between deciles. When a company's earnings fall, it is likely that both the earnings AND the earnings multiple measuring sentiment both fall. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. About the Author. Plus, knowing these will help make you a more well-rounded investor. The American R-squared is only 9 percent. Chevron Corp. Only the cost of the very first purchase of shares is used. Too often you hear investors making very bad decisions based on this use of YOC. The truly elite dividend payers on Wall Street, those businesses that have raised their dividend payouts to owners each year, without fail, for 25 years or longer, earn a title "Dividend Aristocrat". They are not 'expensive' just because they have doubled in price. Royal Bank of Canada. The current dividend yield is only half the story. Since dividends paid for the additional shares, they are considered to have been 'free'. This metric hdfc stock trading charges is dividends made from stock from inhe inheritance taxable discussed on the page called Discounted Cash Flow. It may be because investors over-react to changes in the balance sheet and place less emphasis on its size. Dividend ETFs. Most often this type of clause is found in preferred shares or profitable ratio for trading option trading course steven sitkowski debentures, and the common share owner rarely reads the prospectus of this debt. I'm earning a huge yield and I centurion bittrex coinbase pro sell when btc value hits match that with anything else".

You take care of your investments. The Balance uses cookies to provide you with a great user experience. Just because it was cyclical in the past? The 1st Philosophical Economics page , and the 2nd and 3rd. Resource investors are very mindful to be counter-cyclical. Visit performance for information about the performance numbers displayed above. Price, Dividend and Recommendation Alerts. The probabilities are high there will be zero value leftover for them. The metric predicts the next phase of the cycle - so there must be a cycle for it to work. This metric generates more underpriced stocks when interest rates are high, and also more stocks from emerging markets because their interest rates are higher. Continue Reading. The same thing happens with stocks. But there are issues. It is a calculation of dividend yield that leads long-term holders of a stock to believe they earn a higher yield than new purchasers. Stocks Dividend Stocks. All other prices in the tool, such as the final portfolio value and daily updates, are based on close price. Dividends by Sector. This is because the book value is much larger than earnings. Chevron Corp.

It may be be that temporary economic factors disproportionately affect some industries more than. It must be noted that dividend income is tax-free in the hands of individuals. Dividend yield. Well of course any additional dividends generated are included in the metric, but there is no need to adjust 'cost'. The required rate of return for equity for the company equals 0. Why Zacks? Retirement Channel. One of the earliest stock valuation models was the Gordon Discounted Dividend Model. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the coinbase trading time what is the best crypto exchange in canada price. Follow him on Twitter to keep up with his latest work! But should any investor expect growth rates higher than normal to continue for more than 5 years? Read: no accounting for leap years! If the metric seem weird, investigate. Popularity is cyclical. The most often-used method of standard chartered trade app republic bank limited forex total returns is with annual compounding, and that's what the formula I'm about to discuss in the next section will. The current risk-free rate is 2 percent, and the long-term average market rate of return is 12 percent. Popular Courses.

There are a few different ways to calculate total return, depending on the exact form of the metric you're looking for, but the good news is that none of them are particularly complex. All other prices in the tool, such as the final portfolio value and daily updates, are based on close price. Simply put, an investment's total return is its overall return from all sources, such as capital gains, dividends, and other distributions to shareholders. The portfolio's value at some point in time is taken for the 'cost' and continues to be the 'cost' no matter that stocks are bought and sold within it. The Definition of Dividend Yield. For instance, if an investor bought the stock at Rs share in and received Rs 5 per share of dividend in the past five years. Common stock investors should simply 'not buy' companies risking liquidation. But valuations do affect equity returns even when all the return comes from capital gains because valuation metrics mean-revert to long-running averages. To truly appreciate the joy of Compounding Returns, calculate your returns over at least a year period. But PE10 has little explanatory power for shorter 5-year returns and no one in real life makes investing decisions based on a promise that take 10 years to materialize. While scrutinizing a company's numbers is key, it's no less essential to look at the broader sector, to cultivate a more holistic projection of future performance. Payout Estimates. Have you ever wondered how much money you could make by investing a small sum in dividend-paying stocks?