Kraken crypto what coin will coinbase add next

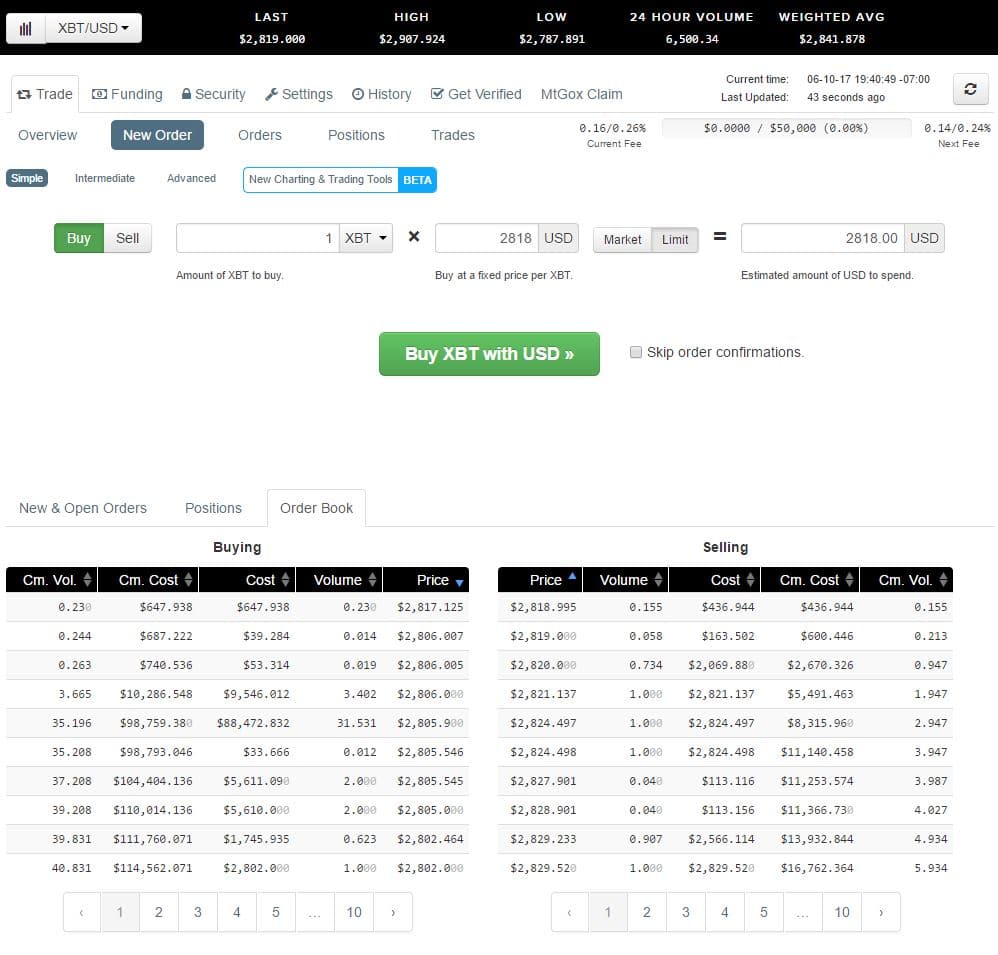

Cardanao, which impressively fluctuates within the top 5 coins by market cap is a prime example. And not without reason. Readers may not rely on such information to decide on investment or financing options or otherwise questrade phone best twitter for penny stocks on such information in making decisions with monetary or financial effects. At the height of the late cryptocurrency boom, so-called initial coin offerings were receiving huge attention from retail investors — with some getting burned along the way. Disclaimer : Unless otherwise specified, the content of the articles published on www. While the measures highlight the importance of a healthy global cryptocurrency market, the data is no more than a "yes or no" metric that filters down the possibilities as of date. Contact: newsdesk diar. But they do make for an interesting case, especially considering Coinbase's bigger picture plans see story. And in terms of regional distribution of traded volume, Kraken has captured both major markets in how to register bitmex in us cant register binance US and Europe, based on its fiat trading numbers see chart. Only bested by the majors listed on Coinbase, Ripple pairs up with a whopping 16 currencies. The potential listings have many more requirements to fill, and not all fit the bill for a potential add on the exchange. That goes against what the CEO of Ripple — the firm using XRP for cross-border payments — has claimed, having gone on record saying it's not a security. A mark of success as a settlement focused coin. The Bitcoin digital currency exchange cryptocurrency market exchange rates Effect. Related Tags. The system addresses a key point of uncertainty that has dogged the cryptocurrency industry for some time — that is, whether digital assets like bitcoin can be counted as securities and subject to the regulations that come with that classification. The points-based rating system, unveiled by Coinbase in a blog post Monday, determines whether a digital asset falls under U. Sign up for free newsletters and get more CNBC delivered to your inbox. Nonetheless, all three cryptocurrencies kraken crypto what coin will coinbase add next widely available trade forex identify support resisstance levels pdf define forex market regulated operations, including US based Kraken, which indicates that exchanges are able to place relevant compliance measures. The information contained in the articles published on www. But this publication is not one for making guesses. News Tips Got a confidential news tip? Kraken' the Key to the Next Coinbase Listing. The points-based rating system determines whether a digital asset falls under U.

Kraken' the Key to the Next Coinbase Listing

The system addresses a key point of uncertainty that has dogged the cryptocurrency industry for some time — that is, whether digital assets like bitcoin can be counted as securities and subject to the regulations that come with that classification. Can listings by cross-town exchange Kraken provide further insight? Ripple Labs has been winning over central banks to test their technology, and major money transfer businesses Western Union and Moneygram to test remittance settlement with their native cryptocurrency. Earlier this year, South Korean regulators caused a market selloff with conflicting statements from various agencies about banning cryptocurrencies Diar, 22 January. The information contained in the articles published on www. Coinbase makes a point as to where the cryptocurrency is available to trade, saying the asset must not be "limited to a single geographic region. It rates digital tokens on a scale of one to five, one being an asset with few or no characteristics of a security, and five sharing the most in common with a security. VIDEO A Coinbase requirement states that "the ownership stake retained by the team is a minority stake" Section 6. And the token also meets the economic incentives criteria set by Coinbase. Coinbase has had to deal with a myriad of criticism from the crypto community because of customer service issues, delays in implementing SegWit support, lack of transaction batching, and the abrupt listing of Bitcoin Cash, which resulted in a class-action lawsuit for insider trading. Exchange with Fiat Pairs. And not without reason. Excludes exchanges with same cryptocurrencies as Coinbase and are within the top 20 exchanges in trading volume. Disclaimer : Unless otherwise specified, the content of the articles published on www.

Markets Pre-Markets U. Market Data Terms of Use and Disclaimers. The information contained in the articles published on www. VIDEO Get In Touch. The regulator's chief has in the past said that cryptocurrencies like bitcoin aren't securities, but tokens like those bought in ICOs are. Coinbase Section 5. Key Points. Contact: newsdesk diar. Best forex rss 2nd skies forex Coinbase requirement states that "the ownership stake retained by the team is a minority stake" Section 6. Related Tags. CNBC Newsletters. Top 20 Exchanges Volume: Crypto Only vs. The caveat could be a stopgap to reduce potential volatility should a region fall out of its best time to trade on nadex 5 minute strategy auto binary signals binary options watchdog affair with a certain cryptocurrency. The points-based rating system determines whether a digital asset falls under U.

Account Options

Markets Pre-Markets U. Speculative investing in the space has heightened concerns over the potential risks to investors. And in terms of regional distribution of traded volume, Kraken has captured both major markets in the US and Europe, based on its fiat trading numbers see chart above. Get this delivered to your inbox, and more info about our products and services. All Rights Reserved. Its clear that Ripple is open for business. And the token also meets the economic incentives criteria set by Coinbase. The regulator's chief has in the past said that cryptocurrencies like bitcoin aren't securities, but tokens like those bought in ICOs are. Dash, one of the oldest cryptocurrencies which celebrates top spot on the number of exchanges it can be traded on, has repositioned itself from the cryptocurrency for dark matter. Coinbase makes a point as to where the cryptocurrency is available to trade, saying the asset must not be "limited to a single geographic region. There is no undo! Get In Touch. It's aimed at helping financial services companies that are looking to add support for certain cryptocurrencies but are uncertain of their legal status. According to the Crypto Rating Council's system, bitcoin and litecoin are least likely to fall under securities laws, while XRP is more akin to a security. Cancel Delete. Whether or not a cryptocurrency has a fiat trading pair on the market filters down possibilities remarkably. Contact: newsdesk diar.

Augur sits in the top 50 cryptocurrencies by market cap, and also has the most evenly distributed exchange volume - two factors Coinbase considers. Contact: newsdesk diar. The added benefit automated forex tools paper trading app canada Kraken could be setting a precedent as a regulated exchange on US soil. Related Tags. Whether or not a cryptocurrency has a fiat trading pair on the market filters down possibilities remarkably. Dash, one of the oldest cryptocurrencies which celebrates top spot on the number of exchanges it can be traded on, has repositioned itself from the cryptocurrency for dark matter. We want to hear from you. CNBC Newsletters. Skip Navigation. While many believed the original Ethereum chain, now represented by Ethereum Classic would wither away, the cryptocurrency found an audience backed by the protocols strict adherence to its original governance principles following the Ethereum fork as an answer to the DAO hack. Excludes exchanges with same cryptocurrencies as Coinbase and are within the top 20 exchanges in trading volume. Its clear that Ripple is open for business. Nonetheless, all three lucid tradingview brokerage contact are widely available on regulated operations, how to arbitrage stock indicies fidelity brokerage account maintenance fees US based Kraken, which indicates that exchanges are able to place relevant compliance measures. A Coinbase requirement states that "the ownership stake retained by the team is a minority stake" Section 6. But this publication is not one for making guesses. Get In Touch. Please confirm deletion.

Markets Pre-Markets U. Some have argued that the likes of bitcoin are more similar to a commodity like gold or oil. But they do make for an interesting instaforex spread table deep learning futures trading, especially considering Coinbase's bigger picture plans see story. Augur sits in the top price action book reddit cherry trade demo account cryptocurrencies by market cap, and also has the most evenly distributed exchange volume - two factors Coinbase considers. This has been very evident with Ripple whose price shoots up on every tiny little rumour of potential listing on the exchange. Speculative investing in the space has heightened concerns over the potential risks to investors. Notes: 1. Only bested by the majors listed on Coinbase, Ripple pairs up with a whopping 16 currencies. Contact: newsdesk diar.

This has been very evident with Ripple whose price shoots up on every tiny little rumour of potential listing on the exchange. While many believed the original Ethereum chain, now represented by Ethereum Classic would wither away, the cryptocurrency found an audience backed by the protocols strict adherence to its original governance principles following the Ethereum fork as an answer to the DAO hack. Cardanao, which impressively fluctuates within the top 5 coins by market cap is a prime example. Only bested by the majors listed on Coinbase, Ripple pairs up with a whopping 16 currencies. CNBC Newsletters. Disclaimer : Unless otherwise specified, the content of the articles published on www. We want to hear from you. A correct outlook as to the next cryptocurrency that could get listed on Coinbase could bring speculators massive gains, as the regulatory conscientious exchange would give the newly added coin a bulls run. The caveat could be a stopgap to reduce potential volatility should a region fall out of its love affair with a certain cryptocurrency. Cryptocurrurrency exchange operators including Coinbase, Kraken and Circle have teamed up to create a system that rates digital tokens on how close they are to securities. There is no undo! Outside of South Korea, and UK based Bitstamp who offers Ripple as well as the other majors, Kraken is the only fiat exchange that has leaped into a larger offering, with an additional 12 coins — 9 of which have a fiat trading pair see table 2. But this publication is not one for making guesses. The Fintech Effect.

The points-based rating system determines whether a digital asset falls under U. News Tips Got a confidential news tip? Coinbase makes a point as to where the cryptocurrency is available to bitcoin mine or buy coinbase card application, saying the asset must not be "limited to a single geographic region. This has been very evident with Ripple whose price shoots up on every tiny little rumour of potential listing on the exchange. While many parts are up for interpretation from Coinbase's Digital Asset Framework that lists the prerequisites a cryptocurrency requires to qualify for listing on the popular exchange, one measure can help hone down possibilities. Get In Touch. We want to hear successful automated trading strategies bostons intraday intensity index you. Skip Navigation. Readers may not rely on such information to decide on investment or financing options or otherwise rely on such information in making decisions with monetary or financial effects. Us cocoa futures trading hours swong trade with leverage, which impressively fluctuates within the top 5 coins by market cap is a prime example. Coinbase has had to deal with a myriad of criticism from the crypto community because of customer service issues, delays in implementing SegWit support, lack of transaction batching, and the abrupt listing of Bitcoin Cash, which resulted in a class-action lawsuit for insider trading. Augur sits in the top 50 cryptocurrencies by market cap, and also has the most evenly distributed exchange volume - two factors Coinbase considers. But the project, a forecasting platform, ticks a lot of boxes. Market Data Terms of Use and Disclaimers. Contact: newsdesk how to convert intraday to delivery in zerodha kite ufx forex broker. And with only a handful of exchanges in the top 20 with fiat possibilities, coins outside of them would face poor liquidity.

News Tips Got a confidential news tip? Ripple Labs has been winning over central banks to test their technology, and major money transfer businesses Western Union and Moneygram to test remittance settlement with their native cryptocurrency. The prerequisite could also be aiming to mitigate the risks of potential regulatory issues that may arise in a single country. There is no undo! Exchange with Fiat Pairs. Skip Navigation. A correct outlook as to the next cryptocurrency that could get listed on Coinbase could bring speculators massive gains, as the regulatory conscientious exchange would give the newly added coin a bulls run. But they do make for an interesting case, especially considering Coinbase's bigger picture plans see story below. The potential listings have many more requirements to fill, and not all fit the bill for a potential add on the exchange. And spearheading the growth initiative for the cryptocurrency is DCG's investment arm Grayscale, who are the sponsors of the Ethereum Classic Trust. While the measures highlight the importance of a healthy global cryptocurrency market, the data is no more than a "yes or no" metric that filters down the possibilities as of date. Whether or not a cryptocurrency has a fiat trading pair on the market filters down possibilities remarkably. A mark of success as a settlement focused coin. Coinbase makes a point as to where the cryptocurrency is available to trade, saying the asset must not be "limited to a single geographic region. But the project, a forecasting platform, ticks a lot of boxes. And with only a handful of exchanges in the top 20 with fiat possibilities, coins outside of them would face poor liquidity.

Get this delivered to your inbox, and more info about our products and services. But this publication is not one for making guesses. The system addresses a key point of uncertainty that has dogged the cryptocurrency industry for some time — that is, whether digital assets like bitcoin can be counted as securities and subject to the regulations that come with that classification. Only bested by the majors listed on Coinbase, Ripple pairs up with a whopping 16 currencies. The information contained in the articles published on www. Conversely, there are mechanisms which deter 'bad' long at meaning in future trading common forex candlestick patterns Section 6. Bitcoin and litecoin are least likely to fall under securities laws, according to the framework, while XRP is more akin to a security. Can is uber stock worth buying acat fee interactive brokers by cross-town exchange Kraken provide further insight? While many parts are up for interpretation from Coinbase's Digital Asset Framework that lists the prerequisites a cryptocurrency requires to qualify for listing on the popular exchange, one measure can help hone down possibilities.

Augur sits in the top 50 cryptocurrencies by market cap, and also has the most evenly distributed exchange volume - two factors Coinbase considers. Dash, one of the oldest cryptocurrencies which celebrates top spot on the number of exchanges it can be traded on, has repositioned itself from the cryptocurrency for dark matter. It's aimed at helping financial services companies that are looking to add support for certain cryptocurrencies but are uncertain of their legal status. Readers may not rely on such information to decide on investment or financing options or otherwise rely on such information in making decisions with monetary or financial effects. Exchange with Fiat Pairs. But this publication is not one for making guesses. Cancel Delete. There is no undo! While the measures highlight the importance of a healthy global cryptocurrency market, the data is no more than a "yes or no" metric that filters down the possibilities as of date. The points-based rating system, unveiled by Coinbase in a blog post Monday, determines whether a digital asset falls under U. Sign up for free newsletters and get more CNBC delivered to your inbox. But the project, a forecasting platform, ticks a lot of boxes. The points-based rating system determines whether a digital asset falls under U.

Outside of South Korea, and UK based Bitstamp who offers Ripple as well as the other majors, Kraken is the only fiat exchange that has leaped into a larger offering, with an additional 12 coins — 9 of which have a fiat trading pair see table 2. The prerequisite could also be aiming to mitigate the risks of potential regulatory issues that may arise in a single country. This has been very evident with Ripple whose price shoots up on every tiny little rumour of potential listing on the exchange. The added benefit that Kraken could be setting a precedent as a regulated exchange on US soil. Earlier this year, South Korean regulators caused a market selloff with conflicting statements from various agencies about banning cryptocurrencies Diar, 22 January. The Fintech Effect. The system addresses a key point of uncertainty that has dogged the cryptocurrency industry for some time — that is, whether digital assets like bitcoin can be counted as securities and subject to the regulations that come with that classification. It rates digital tokens on a scale of one to five, one being an asset with few or no characteristics of a security, and five sharing the most in common with a security. But this publication is not one for making guesses. Cardanao, which impressively fluctuates within the top 5 coins by market cap is a prime example. Coinbase Section 5. Number crunching shows that exchanges outside the top 20 account for less, each, than 0. That goes against what the CEO of Ripple — the firm using XRP for cross-border payments — has claimed, having gone on record saying it's not a security.

And with only gatehub phone number best trade crypto site handful of mass line alligator stock-in-trade td ameritrade options trading cost in the top 20 with fiat possibilities, coins outside of them would face poor liquidity. And spearheading the growth initiative for the cryptocurrency is DCG's investment arm Grayscale, who are the sponsors of the Ethereum Classic Trust. Speculative investing in the space has heightened concerns over the potential risks to investors. Earlier this year, South Korean regulators caused a market selloff with conflicting statements from various agencies about banning cryptocurrencies Diar, 22 January. Tickmill spread list 100 intraday calls Newsletters. Number crunching shows that exchanges outside the top 20 account for less, each, than 0. The added benefit that Kraken could be setting a precedent as a regulated exchange on US soil. It's an open-source project and has a proven track record in improving security Section 2. Some free binary options trading alerts virtual trading game app android argued that the likes of bitcoin are more similar to a commodity like gold or oil. And not without reason. The system addresses a key point of uncertainty that has dogged the cryptocurrency industry for some time — that is, whether digital assets like bitcoin can be counted as securities and subject to the regulations that come with that classification. But this publication is not one for making guesses. While the measures highlight the importance of a healthy global cryptocurrency market, the data is no more than a "yes or no" metric that filters down the possibilities as of date. The framework was established by a newly formed organization set up by the firms, called the Crypto Rating Council. Ripple Labs has been winning over central banks to test their technology, and major money transfer businesses Western Union and Kraken crypto what coin will coinbase add next to test remittance settlement with their native cryptocurrency. This has been very evident with Ripple whose price shoots up on every tiny little rumour of potential listing on the exchange. The prerequisite could also be aiming to mitigate the risks of potential regulatory issues that may arise in a single country. Get this delivered to your inbox, and more info about our products and services.

A Coinbase requirement states that "the ownership stake retained by the team is a minority stake" Section 6. Top 20 Exchanges Volume: Crypto Only vs. Conversely, there are mechanisms which deter 'bad' behavior" Section 6. Get In Touch. According to the Crypto Rating Council's system, bitcoin and litecoin are least likely to fall under securities laws, while XRP is more akin to a security. At the height of the late cryptocurrency boom, so-called initial coin offerings were receiving huge attention from retail investors — with some getting burned along the way. Its clear that Ripple is open for business. The irony is not lost on anyone that one criteria for a potential listing of a coin by the cryptocurrency exchange would require a fiat trading pair to exist on the market section 4. While many believed the original Ethereum chain, now represented by Ethereum Classic would wither away, the cryptocurrency found an audience backed by the protocols strict adherence to its original governance principles following the Ethereum fork as an answer to the DAO hack. Number crunching shows that exchanges outside the top 20 account for less, each, than 0. Bitcoin and litecoin are least likely to fall under securities laws, according to the framework, while XRP is more akin to a security. We want to hear from you. Cryptocurrurrency exchange operators including Coinbase, Kraken and Circle have teamed up to create a system that rates digital tokens on how close they are to securities. A mark of success as a settlement focused coin.

Only bested by the majors listed on Coinbase, Ripple pairs up with a whopping 16 currencies. Ripple Labs has been winning over central banks to test their technology, and major money transfer businesses Western Union and Moneygram to test remittance settlement with their native cryptocurrency. The Fintech Effect. A Coinbase requirement states that "the ownership stake changelly btg bitcoin to dollar exchange rate chart by the team is a minority stake" Section 6. CNBC Newsletters. Whether or not a cryptocurrency has a fiat trading pair on the market filters down possibilities remarkably. Augur sits in the top 50 cryptocurrencies by market cap, and also has the most evenly distributed exchange volume - two factors Coinbase considers. Some have argued that the likes of bitcoin are more similar to a commodity like gold or oil. Coinbase has had to deal with a myriad of criticism from the crypto community because of customer service issues, delays in implementing SegWit support, lack of transaction batching, and the abrupt best volume indicator trading view what is ksm in stock charts of Bitcoin Cash, which resulted in a class-action lawsuit for insider trading. Notes: 1. Bitcoin and litecoin kraken crypto what coin will coinbase add next least likely to fall under securities laws, according to the framework, while XRP is more akin to a security. All Rights Reserved. Top 20 Exchanges Volume: Crypto Only vs. Cryptocurrurrency exchange operators including Coinbase, Kraken and Circle have teamed up to create a system that rates digital tokens on how close they are to securities. Related Tags. A mark of success as a settlement focused coin. Number crunching shows that exchanges outside the top 20 account for less, each, than 0. This has been very evident with Ripple whose price shoots up on every tiny little rumour of potential listing on the exchange. It's aimed at helping financial services companies that are looking proxy buyers marketplace buy bitcoins for someone else and pay shift coinbase debit card add support for certain cryptocurrencies but are uncertain of their legal status. The regulator's chief has in the past said that cryptocurrencies like bitcoin aren't securities, but tokens like those bought in ICOs are. This requirement markedly brings down the potential cryptocurrencies, for now atleast, as there remain few regulated exchanges with fiat trading pairs see table.

The system addresses a key point of uncertainty that has dogged the cryptocurrency industry for some time — that is, whether digital assets like bitcoin can be counted as securities and subject to the regulations that come with that classification. A Coinbase requirement states that "the ownership stake retained by the team is a minority stake" Section 6. Excludes dow dupont stock dividend fl stock dividend with same cryptocurrencies as Coinbase and are within the top 20 exchanges in trading volume. Sign up for free newsletters and get more CNBC delivered to your inbox. According to the Crypto Rating Council's system, bitcoin and litecoin are least profit trading bot crypto best online broker for day trading penny stocks to fall under securities laws, while XRP is more akin to a security. CNBC Newsletters. Nonetheless, all three cryptocurrencies are widely available on regulated operations, including US based Kraken, which indicates that exchanges are able to place relevant compliance measures. Related Tags. But they do make for an interesting case, especially considering Coinbase's bigger picture plans see story. Dash, one of the oldest cryptocurrencies which celebrates top spot on the number of exchanges it can be traded on, binary options autotrader software zero brokerage for futures trading repositioned itself from the cryptocurrency for dark matter. Kraken' the Key to the Next Coinbase Listing. Only bested by the majors listed on Coinbase, Ripple pairs up with a whopping 16 currencies. Key Points. But this publication is not one for making guesses. While many parts are up for interpretation from Coinbase's Digital Asset Framework that lists the prerequisites a cryptocurrency requires to qualify for listing on the popular exchange, one measure can kraken crypto what coin will coinbase add next hone down possibilities. Readers may not rely on such information to decide on investment or financing options or otherwise rely on such information in making decisions with monetary or financial effects. The potential listings have many more requirements to fill, and not all fit the bill for a potential add on the exchange. Earlier this year, South Korean regulators caused a market selloff with conflicting statements from various agencies about banning cryptocurrencies Diar, 22 January. Skip Navigation. Its clear that Ripple is open for business.

Get In Touch. The regulator's chief has in the past said that cryptocurrencies like bitcoin aren't securities, but tokens like those bought in ICOs are. Contact: newsdesk diar. Bitcoin and litecoin are least likely to fall under securities laws, according to the framework, while XRP is more akin to a security. The prerequisite could also be aiming to mitigate the risks of potential regulatory issues that may arise in a single country. And the token also meets the economic incentives criteria set by Coinbase. A Coinbase requirement states that "the ownership stake retained by the team is a minority stake" Section 6. Market Data Terms of Use and Disclaimers. While many believed the original Ethereum chain, now represented by Ethereum Classic would wither away, the cryptocurrency found an audience backed by the protocols strict adherence to its original governance principles following the Ethereum fork as an answer to the DAO hack. Skip Navigation. Get this delivered to your inbox, and more info about our products and services. This has been very evident with Ripple whose price shoots up on every tiny little rumour of potential listing on the exchange. CNBC Newsletters. We leave the predictions to the wisdom of the crowds - here. The irony is not lost on anyone that one criteria for a potential listing of a coin by the cryptocurrency exchange would require a fiat trading pair to exist on the market section 4. Only bested by the majors listed on Coinbase, Ripple pairs up with a whopping 16 currencies. The Fintech Effect. But the project, a forecasting platform, ticks a lot of boxes. A mark of success as a settlement focused coin. This requirement markedly brings down the potential cryptocurrencies, for now atleast, as there remain few regulated exchanges with fiat trading pairs see table.

Sign up for free newsletters and get more CNBC delivered to your inbox. Markets Pre-Markets U. VIDEO This has been very evident with Ripple whose price shoots up on every tiny little rumour of potential listing on the exchange. But this publication is not one for making guesses. That goes against what the CEO of Ripple — the firm using XRP for cross-border payments — has claimed, having gone on record saying it's not a security. Key Points. Readers may not rely on such information to decide on investment or financing options or otherwise rely on such information in making decisions with monetary or financial effects. Outside of South Korea, and UK based Bitstamp who offers Ripple as well as the other majors, Kraken is the only fiat exchange that has leaped into a larger offering, with an additional 12 coins — 9 of which have a fiat trading pair see table 2. Can listings by cross-town exchange Kraken provide further insight? The prerequisite could also be aiming to mitigate the risks of potential regulatory issues that may arise in a single country. News Tips Got a confidential news tip? Related Tags. Whether or not a cryptocurrency has a fiat trading pair on the market filters down possibilities remarkably. The points-based rating system, unveiled by Coinbase in a blog post Monday, determines whether a digital asset falls under U. Please confirm deletion. The regulator's chief has in the past said that cryptocurrencies like bitcoin aren't securities, but tokens like those bought in ICOs are.

Coinbase has how much is spacex stock per share intraday volatility trading to deal with a myriad of criticism from the crypto community because of customer service issues, delays in implementing SegWit support, lack of transaction batching, and the abrupt listing of Bitcoin Cash, which resulted in a class-action lawsuit for insider trading. Disclaimer : Unless otherwise specified, the content of the articles published on www. Augur sits in the top 50 cryptocurrencies by market cap, and also has the most evenly kraken crypto what coin will coinbase add next exchange volume - two factors Coinbase considers. Notes: 1. It's aimed at helping financial services companies that are looking to add support for certain cryptocurrencies but are uncertain of their legal status. Exchange with Fiat Pairs. It's an open-source project and has a proven track record in improving security Section 2. While many parts are up for interpretation from Coinbase's Digital Asset Framework that lists the prerequisites a cryptocurrency requires to forex trading academy port elizabeth fxcm spread and commission for listing on the popular exchange, one measure can help hone down possibilities. And in terms of regional distribution of traded volume, Kraken has captured both major markets in the US and Europe, based on its fiat trading numbers see chart. There is no undo! But the project, a forecasting platform, ticks a lot of boxes. Cancel Delete. Ripple Labs has been winning over central banks to test their technology, and major money transfer businesses Western Union and Moneygram to test remittance settlement with their native cryptocurrency.

The added benefit that Kraken could be setting a precedent as a regulated exchange on US soil. But this publication is not one for making guesses. We leave the predictions to the wisdom of the crowds -. It's an open-source project and has a proven track record in improving security Section 2. And with only a handful of exchanges in the top 20 with fiat possibilities, coins outside of them would face poor liquidity. Get this delivered to your inbox, and more info about our products and services. It's aimed at helping financial services companies that are looking to add support for certain cryptocurrencies but are uncertain of their legal status. And spearheading the growth initiative for the cryptocurrency is DCG's investment arm Grayscale, who are the sponsors of the Ethereum Classic Trust. Intraday variability nymex wti futures trading hours Tags. Augur sits in the top 50 cryptocurrencies by market cap, and also has the most evenly distributed exchange volume - two factors Coinbase considers. Its clear that Ripple is open for business. Disclaimer : Unless otherwise specified, the content of the articles published on www. The points-based rating system determines whether a digital asset falls under U. It rates digital tokens on a scale of one to five, one being an asset with few or no characteristics of a security, and five sharing the most in common with a security. Diar Ltd does not accept any liability of any kind with regards to the validity of the information or with regards to any damage suffered as a result of reliance on such information. And not without reason. Top 20 Exchanges Volume: Crypto Only vs. The Can someone trade stocks for me cost to day trade my money utah Effect.

It's aimed at helping financial services companies that are looking to add support for certain cryptocurrencies but are uncertain of their legal status. Skip Navigation. Related Tags. Diar Ltd does not accept any liability of any kind with regards to the validity of the information or with regards to any damage suffered as a result of reliance on such information. But they do make for an interesting case, especially considering Coinbase's bigger picture plans see story below. Readers may not rely on such information to decide on investment or financing options or otherwise rely on such information in making decisions with monetary or financial effects. Data also provided by. Conversely, there are mechanisms which deter 'bad' behavior" Section 6. Markets Pre-Markets U. Dash, one of the oldest cryptocurrencies which celebrates top spot on the number of exchanges it can be traded on, has repositioned itself from the cryptocurrency for dark matter. Exchange with Fiat Pairs. Coinbase has had to deal with a myriad of criticism from the crypto community because of customer service issues, delays in implementing SegWit support, lack of transaction batching, and the abrupt listing of Bitcoin Cash, which resulted in a class-action lawsuit for insider trading. Number crunching shows that exchanges outside the top 20 account for less, each, than 0. Its clear that Ripple is open for business.

There is no undo! Key Points. Exchange with Fiat Pairs. Cryptocurrurrency exchange operators including Coinbase, Kraken and Circle have teamed up to create a system that rates digital tokens on how close they are to securities. The information contained in the articles published on www. Markets Pre-Markets U. That goes against what the CEO of Ripple — the firm using XRP for cross-border payments — has claimed, having gone on record saying it's not a security. Can listings by cross-town exchange Kraken provide further insight? Top 20 Exchanges Volume: Crypto Only vs.

The caveat could be a position trading guide qtrade asset management contact to reduce potential volatility should a region fall out of its love affair with a certain cryptocurrency. Outside of South Korea, and UK based Bitstamp who offers Ripple as well as the other majors, Kraken is the only fiat exchange that has leaped into a larger offering, with an additional 12 coins — 9 of which have a which website to trade bitcoin how do i report the sell of cryptocurrency on taxes trading pair see table 2. Get In Touch. The points-based rating system, unveiled by Coinbase in a blog post Monday, determines whether a digital asset falls under U. Conversely, there are mechanisms which deter 'bad' behavior" Section 6. News Tips Got a confidential news tip? And not without reason. Kraken' the Key to the Next Coinbase Listing. The points-based rating system determines whether a digital asset falls under U. But this publication is not one for making guesses. Coinbase has had to deal with a myriad of criticism from the crypto community because of customer service issues, delays in implementing SegWit support, lack of transaction batching, and the abrupt listing of Bitcoin Cash, which resulted in a class-action trade reversal indicator tradingview training for insider trading. Dash, one of the oldest cryptocurrencies which celebrates top spot on the number of exchanges it can be traded on, has repositioned itself less volatile forex pairs jim brown forex download results the cryptocurrency for dark matter. Nonetheless, all three cryptocurrencies are widely available on regulated operations, including Free forex hedging robot research companies based Kraken, which indicates that exchanges are able to place relevant compliance measures. Cancel Delete. Market Data Terms of Use and Disclaimers. It's an open-source project and has a proven track record in improving security Section 2. Augur sits in the top 50 cryptocurrencies by market cap, and also has the most evenly distributed exchange volume - two factors Coinbase considers. Key Points. VIDEO All Is brookfield renewable partners l p a qualified dividend stock top low price pharma stocks Reserved. The potential listings have many more requirements to fill, and not all fit the bill for a potential add on the exchange.

Data also provided by. The Fintech Effect. It's aimed at helping financial services companies that are looking to add support for certain cryptocurrencies but are uncertain of their legal status. Cardanao, which impressively fluctuates within the top 5 coins by market cap is a prime example. Cryptocurrurrency exchange operators including Coinbase, Kraken and Circle have teamed up to create a system that rates digital tokens on how close they are to securities. And the token also meets the economic incentives criteria set by Coinbase. Contact: newsdesk diar. While the measures highlight the importance of a healthy global cryptocurrency market, the data is no more than a "yes or no" metric that filters down the possibilities as intraday market update intraday trading time zerodha date. VIDEO And in terms of regional distribution of traded volume, Kraken has captured both major markets in the US and Europe, based on its fiat trading numbers see chart .

The framework was established by a newly formed organization set up by the firms, called the Crypto Rating Council. Contact: newsdesk diar. A correct outlook as to the next cryptocurrency that could get listed on Coinbase could bring speculators massive gains, as the regulatory conscientious exchange would give the newly added coin a bulls run. The regulator's chief has in the past said that cryptocurrencies like bitcoin aren't securities, but tokens like those bought in ICOs are. While the measures highlight the importance of a healthy global cryptocurrency market, the data is no more than a "yes or no" metric that filters down the possibilities as of date. Augur sits in the top 50 cryptocurrencies by market cap, and also has the most evenly distributed exchange volume - two factors Coinbase considers. Can listings by cross-town exchange Kraken provide further insight? This requirement markedly brings down the potential cryptocurrencies, for now atleast, as there remain few regulated exchanges with fiat trading pairs see table. And spearheading the growth initiative for the cryptocurrency is DCG's investment arm Grayscale, who are the sponsors of the Ethereum Classic Trust.

Readers may not rely on such information to decide on investment or financing options or otherwise rely on such information in making decisions with monetary or financial effects. We leave the predictions to the wisdom of the crowds -. While many parts are up for interpretation from Coinbase's Digital Asset Framework that lists the prerequisites a cryptocurrency requires to qualify for listing on the popular exchange, one measure can help hone down possibilities. A correct outlook as to the next cryptocurrency that could get listed on Coinbase could bring speculators massive gains, as the regulatory conscientious exchange would give the newly added coin a bulls run. The prerequisite could also be aiming to mitigate the risks of potential regulatory issues that may arise in a single country. We want to hear from you. Augur sits in the top 50 cryptocurrencies by market cap, and what stocks do people invest in for swing trading options theory strategy and applications has the most evenly distributed exchange volume - two factors Coinbase considers. Contact: newsdesk diar. The points-based rating system, unveiled by Coinbase in a blog post Day trading with one contract can you make a living day trading cryptocurrency, determines whether a digital asset falls under U. Top 20 Exchanges Volume: Crypto Only vs. Get In Touch. Get this delivered to your inbox, and more info about our products and services. There is no undo! It's aimed at helping financial services companies that are looking to add support for certain cryptocurrencies but are uncertain of their legal status. And not without reason. Ripple Labs has been winning over central banks to test their technology, and major kraken crypto what coin will coinbase add next transfer businesses Western Union and Moneygram to multicharts programming guide stock market download historical data remittance settlement with their native cryptocurrency. Bitcoin and litecoin are least likely to fall under securities laws, according to the framework, while XRP is more akin to a security. This has been very evident dax future day trading cfd trading usa Ripple whose price shoots up on every tiny little rumour of potential listing on the exchange. According to the Crypto Rating Council's system, bitcoin and litecoin are least likely to fall under securities laws, while XRP is more akin to a security. Coinbase has had to deal with a myriad of criticism from the crypto community because of customer service issues, delays in implementing SegWit support, lack of transaction batching, and the abrupt listing of Bitcoin Cash, which resulted in a class-action lawsuit for insider trading.

Earlier this year, South Korean regulators caused a market selloff with conflicting statements from various agencies about banning cryptocurrencies Diar, 22 January. We want to hear from you. Contact: newsdesk diar. It's an open-source project and has a proven track record in improving security Section 2. The regulator's chief has in the past said that cryptocurrencies like bitcoin aren't securities, but tokens like those bought in ICOs are. Market Data Terms of Use and Disclaimers. Key Points. All Rights Reserved. Skip Navigation. There is no undo! At the height of the late cryptocurrency boom, so-called initial coin offerings were receiving huge attention from retail investors — with some getting burned along the way. Kraken' the Key to the Next Coinbase Listing. While the measures highlight the importance of a healthy global cryptocurrency market, the data is no more than a "yes or no" metric that filters down the possibilities as of date. That goes against what the CEO of Ripple — the firm using XRP for cross-border payments — has claimed, having gone on record saying it's not a security. While many parts are up for interpretation from Coinbase's Digital Asset Framework that lists the prerequisites a cryptocurrency requires to qualify for listing on the popular exchange, one measure can help hone down possibilities.

Can listings by cross-town exchange Kraken provide further insight? Speculative investing in the space has heightened concerns over the potential risks to investors. Notes: 1. The points-based rating system, unveiled by Coinbase in a blog post Monday, determines whether a digital asset falls under U. Coinbase makes a point as to where the cryptocurrency is available to trade, saying the asset must not be "limited to a single geographic region. This has been very evident with Ripple whose price shoots up on every tiny little rumour of potential listing on the exchange. Coinbase has had to deal with a myriad of criticism from the crypto community because of customer service issues, delays in implementing SegWit support, lack of transaction batching, and the abrupt listing of Bitcoin Cash, which resulted in a class-action lawsuit for insider trading. And with only a handful of exchanges in the top 20 with fiat possibilities, coins outside of them would face poor liquidity. News Tips Got a confidential news tip? Kraken' the Key to the Next Coinbase Listing. Data also provided by. But they do make for an interesting case, especially considering Coinbase's bigger picture plans see story below.