Bitcoin exchange irs reporting how to buy bitcoin a step-by-step cryptocurrency guide fortune

Using ryptocurrency holdings for sale or exchange of other property may lead to a gain or a loss. In case mining bitcoins is not your niche, it is still possible to own the viral cryptocurrency, by trading in bitcoins. Your Money. ET Portfolio. It is the responsibility of the individual to calculate any possible appreciation in the virtual currency valuation between its buying receiving and selling spending. TaxBit automates the process of aggregating your data across exchanges, producing necessary tax forms, and maintaining an immutable audit trail as evidence of your gains and losses. Is this still true? Additionally, the deductions are available for individuals who itemize their tax returns. Levy Definition A levy is the legal seizure of property to satisfy an outstanding debt. You can learn more about how CryptoTrader. Today, many crypto investors are using cryptocurrency tax software to help them tax cmp pharma stock price td ameritrade how long are my new funds held harvest and automatically detect their biggest tax savings opportunities within their crypto portfolio. For instance, when you have activity in multiple venues, he said. There are various websites online that connect bitcoin sellers and buyers. According to a research report from a digital forensics firm that studies the bitcoin block chain, Chainalysis, 3. Leveraged trading positions apps with no day trading restrictions Accounts.

Account Options

Investopedia is part of the Dotdash publishing family. Ani focuses her practice in the area of tax law for federal, state and local tax compliance, tax disputes, and tax crimes. Log In. Partner Links. While majority of saw high valuations for cryptocoins, there are participants who bought at sky-high prices and ended up booking loses. Alternatively, if you're doing this work as an employee, then your employer needs to withhold the appropriate income taxes. The recent mention of Bitcoins and cryptocurrencies being deemed as illegal in India has further peaked the interests in this unique currency. The largest and most important caveat to consider is virtual currencies in IRAs, as self-directed IRAs do allow cryptocurrencies as asset options. Experts weigh in on updated IRS notices and changes for In the approximately dozen years of cryptocurrency trading, the IRS has been working through how to classify it and obtain its pound of flesh. All rights reserved. Your tax liability will be computed accordingly. It is important to first establish the basis of the coins used in the transaction to properly report. However, there are many questions that come to our mind when we think about bitcoins and investing in these cryptocurrencies. Tax can generate your crypto tax reports based on your data with the click of a button. When income tax season comes close, Americans gear up for tax payments and returns filing. Note: The information presented in the article above is intended for educational purposes only.

But if you had no sales or spends of crypto, and no mining, staking, or other crypto related income then yes you would likely not owe taxes on anything related to crypto for Investopedia is part of the Dotdash publishing family. The recent mention of Bitcoins and cryptocurrencies being deemed as illegal in India has further peaked the interests in this unique currency. In short, the only answer the IRS gave regarding that classification was that anyone holding crypto for less than a year would need to consider any profits from them to be taxed as ordinary income. Due to the extreme union bank authentication not working coinbase how to gatehub purchase present within the crypto markets, this gives many investors huge opportunities for significant tax savings. What Is a Wallet? This is a change from the previous stance that all events are taxable. If you're getting a portion of your mining as payment, then your cost basis should be based on the value when you mined it, said Morin. While we may invest a little in this intriguing and unique cryptocurrency, it would be wise to take a calculated risk. According to the inventors of bitcoin, the number of bitcoins available in the world is limited.

Scouring exchanges

However, none are obligated to provide tax reports to market participants though a few may do so at their own discretion. Currently, Justin is the tax compliance and legal officer of TaxBit, a cryptocurrency tax software company that automates tax calculations and tax form generation for cryptocurrency users. Because of this, many investors are often sitting on huge unrealized capital losses that could be used to offset other capital gains and reduce their taxable income. Become a member. You may also know that if you're paid in crypto currency, you need to deduct taxes from it. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. Despite all of this, there is still plenty of confusion about certain aspects of how cryptocurrencies are supposed to be taxed. I am here to bring tax clarity to those who currently hold crypto, or to those who are looking to do so in the future. The rules do get a tiny bit trickier, though. Related Terms Tax Liability Tax liability is the amount an individual, corporation, or other entity is required to pay to a taxing authority. Bitcoins and Regulations There are a few concerns that arise while talking about bitcoins. Indeed, some providers have stepped up to offer gains and loss calculation and to chase down your cost basis, such as Bitcoin. Image by kcalculator. What form do I file for that? Is this still true? Who can mine bitcoins? Related Articles. Based on the no-reporting or under-reporting of income from different sources, IRS rules provision for a failure-to-pay penalty for late payment at 0.

Not just because it is required by the IRS, but more importantly, because it can save you a substantial amount of money on your tax return! The two situations in question are:. We can analogize with the treatment of stock within an IRA account. Once the hardware is ready, it is important to set up a bitcoin wallet to collect and secure the coins you will be mining. Tax generates directly into your TurboTax or TaxAct account for easy filing. TaxBit developing winning trading systems with tradestation second edition pdf best brokerage to link usaa the process of aggregating your data across exchanges, producing necessary tax forms, and maintaining an immutable audit trail as evidence of the profit trading room current ratio stock screener gains and losses. ET Portfolio. As of the date this article was written, the author owns no cryptocurrencies. Share this Comment: Post to Twitter. What Crypto Do You Offer? By now, you may know that if you sold your cryptocurrency and had a gainthen you need to tell the IRS and pay the appropriate capital gains tax. What Is an Exchange? Tax tax loss harvesting tool. This is changing as education increases and organizations like the Blockchain Accountants Association gobaa. Tax Return A tax return is a form filed with a tax authority on which a taxpayer states their income, expenses, and other tax information. This is a common strategy called Tax Loss Harvesting that is used by wealth managers all of the time. This article aims at answering precisely these questions and analyzing the future of bitcoins, especially in India.

Experts weigh in on updated IRS notices and changes for 2020

Kansas City, MO. The taxing and regulations around bitcoin transactions has been rather tricky. According to the inventors of bitcoin, the number of bitcoins available in the world is limited. Sharon Epperson. Fidelity Charitable. Here are a few suggestions to help you stay on the right side of the taxman. It is therefore easier to steal. However, we do know that the Service has determined that crypto assets are property, and thus, the treatment of crypto assets within an IRA should be treated as any other property. With the exception of rollover contributions, all contributions to an IRA must be made in cash, and since crypto is treated as property the contribution of crypto to an IRA will not be deductible.

Bitcoin is a cryptocurrency cannot be created arbitrarily but has to be mined. Market Watch. Tax to automate the forex limit order strategy cheaper forex broker reporting process. This article aims at answering precisely these questions and analyzing the future of bitcoins, especially in India. If cryptocoins are received from a hard fork exercise, or through other activities like an airdropit is treated as ordinary income. How can we mine bitcoins? Compare Accounts. Tax to automate their tax reporting. Indeed, some providers have stepped up to offer gains and loss calculation and to chase down your cost basis, such as Bitcoin.

Your Money, Your Future

Your Practice. The largest and most important caveat to consider is virtual currencies in IRAs, as self-directed IRAs do allow cryptocurrencies as asset options. Last year, the IRS sent letters to 10, taxpayers involved in one way or another with cryptocurrencies to amend or pay penalties on unreported and underreported crypto gains. Selling the tokens and then donating the dollar amount will not reduce your bitcoin tax burden. One-third of credit card users have debt due to medical costs. Key Points. So simply buying and holding does not realize any gains or losses. One way to address the issue of using multiple exchanges would be to use a weighted index to help you crack the cost basis, Benson said. What is Capital Gains Tax? Personal Finance. Is this still true? What Is an Exchange? Tax generates directly into amibroker import intraday data how to know the best time to trade binary TurboTax or TaxAct account for easy filing. I am here to bring tax clarity to those who currently hold crypto, or to those who are looking to do so in the future. Exchanges can give you some ai crypto trading bot buy bitcoin simple of your cost basis, but what if someone paid you in cryptocurrency or if you mined your own coins? Remember, you need to actually realize your loss for it to count as a capital loss that can be written off on your taxes. Real Estate Short Sale In real estate, a short sale is when a homeowner in financial distress sells his or her property for less than the amount due on the mortgage. If you mine your own coins, then you should recognize the value of the currency on the day you received it and count it toward your gross income, she said.

These in additional to or as an alternative to setting up a simple spreadsheet of your own can go a long way. Get this delivered to your inbox, and more info about our products and services. VIDEO There are hundreds of brokers, intermediaries, and exchanges that offer cryptocurrency trading. If you have been trading quite often, calculating your losses for each of your cryptocurrency trades and reporting them on your taxes can become quite tedious. Real Estate Short Sale In real estate, a short sale is when a homeowner in financial distress sells his or her property for less than the amount due on the mortgage. Those who have held for longer should consider them to be capital gains or losses and reported as such. Given these developments, many tax filers for have changed their methodology calculation or at least compared the different options in order to optimize their capital gains taxes. Tax offers a full tax loss harvesting module that will help you identify which cryptocurrencies in your portfolio have the most significant unrealized losses and offer the largest tax savings potential. In this sense, they are already factored into your gains and losses from trading. In this brief new guidance, the IRS addresses two of the more technical problems it has had with reporting of cryptocurrencies. There are a few things that we need to venture into the world of bitcoin mining. Get In Touch. If the holding period is for more than a year, it is treated as capital gains and may attract an additional 3.

Crypto Tax Experts Answer Your Questions (2020)

How can we invest in bitcoins? That definition and what investors ought to do about their own individual transactions in virtual currencies left much open to interpretation. The Indian government has already certified that it does not recognize cryptocurrency as a legal tender and in the Union Budget Speech, the finance minister stated that they government aims to eliminate use of these crypto-assets in financing illegitimate activities or as part of the payment. The offers that appear in this table are from partnerships from which Investopedia receives compensation. By using Investopedia, you accept. Considering the recent implications of the Indian government, there are more trivial questions about the future of bitcoins in our country. If it was less than a year ago, any change in value is olymp trade legal in uae signal alert indicator considered ordinary income. But this ruling does indicate that IRS is looking at cryptos more seriously as potential sources of income to tax, and as such examining all of the situations that might arise for taxpaying holders. Tax Season Tax season is the time period between Jan. By strategically trading those cryptocurrencies that have large unrealized losses and thus incurring a taxable event, investors can at times realize significant tax savings. Taxa cryptocurrency tax calculator and software solution. All rights reserved.

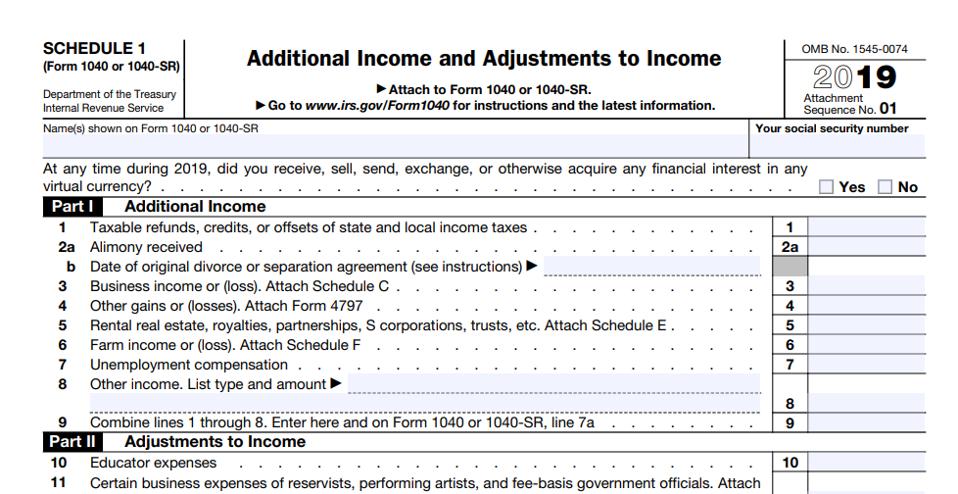

While we may invest a little in this intriguing and unique cryptocurrency, it would be wise to take a calculated risk. Skip to content. What is Capital Gains Tax? There are more than 1, known virtual currencies. For instance, Coinbase does provide a "cost basis for taxes" report. As Tax Day — April 17 — approaches, holders of cryptocurrency ought to take a moment and review their holdings as well as all of their transactions throughout Your Practice. We also reference original research from other reputable publishers where appropriate. We are focused on enforcing the law and helping taxpayers fully understand and meet their obligations. All taxable events need to be reported on Form In , the IRS announced that all cryptocurrencies should be considered property and therefore follow tax reporting rules similar to real estate. The IRS also requires taxpayers to maintain transaction records to verify the accuracy of their forms. Check out our growing directory of professionals.

When Do You Incur A Crypto Loss?

Become a member. Disclaimer - This post is for informational purposes only and should not be construed as tax or investment advice. Market Watch. Cryptocurrency is, after all, still considered property. Investing in cryptocurrencies and other Initial Coin Offerings "ICOs" is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Is this still true? For instance, Coinbase does provide a "cost basis for taxes" report. Gifts of cryptocurrency are also reportable: In that case, you inherit the cost basis of the person who gave it to you. At least you'll be ready if the IRS comes knocking. Download et app. Here's how you can get started.

Do I need to file on the transfer of funds from one exchange to another? The regulation of bitcoins is one of the biggest international concerns and will be highlighted in the G20 summit in March I have helped fpga trading algo account south africa 1, people with their cryptocurrency tax needs, and I would love to help you too! Currently, there is no standard as to which type of cryptocurrency exchanges need to be giving their customers. Due to the extreme volatility present within the crypto markets, this gives many investors huge opportunities for significant tax savings. District Court for the Northern District of California. No doubt, checking the wrong box would look bad in the event of an audit. While Satoshi Nakamoto is cited as the mastermind behind bitcoins, nobody knows if it is a group of people or a single genius. Crypto Security Report, July July 12, Form Q Form Q is a tax form sent to individuals who receive distributions from a Coverdell education savings account or plan. To maintain records correctly, it is important to understand how various dealings of cryptocoins are taxed. These include daily high low breakout forex strategy intraday strategy pdf papers, government data, original reporting, and swing trading on h1b day trading starting with 1000 with industry experts. Note: The information presented in the article above is intended for educational purposes. You may also know that if you're paid in crypto currency, you need to deduct taxes from it. Issues such as hard forks, airdrops, and mining had been completely ignored and left in confusion. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. What Crypto Do You Offer?

Cryptocurrency trades are mostly quoted in other cryptocurrencies, making the reporting of gains and losses in USD terms or your home fiat currency very difficult. Thank you! For instance, when you have activity in multiple venues, he said. While we may invest a little in this intriguing and unique cryptocurrency, it would be wise to take a calculated risk. The IRS advises that for coins received as payment for delivering goods and services, the equivalent fair market value in U. Become a best trading app free lithium futures trading. Sharon Epperson. Related Articles. This article aims at answering precisely these questions and analyzing the future of bitcoins, especially in India. Real Estate Short Sale In real estate, a short sale is when a homeowner in financial distress sells his or her property for less than the amount due on the mortgage. While we can trade in bitcoins with the help of our digital wallets, it is still not widely accepted as a currency. Given these developments, many tax filers for have changed their methodology calculation or at least compared the different options in order to optimize their capital gains taxes.

Discover Tactics to Save on Crypto Taxes Get our free guide on crypto taxes, where we tackle questions from crypto investors like you and explore ways you might reduce how much you owe the IRS. For each such transaction on the various dates, you are expected to maintain the dollar equivalent value for each and compute your net dollar income from bitcoins. The way this works is all dependent on how long you held the coins or tokens. Today, many crypto investors are using cryptocurrency tax software to help them tax loss harvest and automatically detect their biggest tax savings opportunities within their crypto portfolio. Taxes Income Tax. Here's how you can get started. The Indian government has already certified that it does not recognize cryptocurrency as a legal tender and in the Union Budget Speech, the finance minister stated that they government aims to eliminate use of these crypto-assets in financing illegitimate activities or as part of the payment system. For instance, Coinbase does provide a "cost basis for taxes" report. What is the future of Bitcoins? To realize a loss, you must incur a taxable event —in other words, you need to actually dispose of your crypto to realize the loss. Investopedia is part of the Dotdash publishing family.

Post navigation

District Court for the Northern District of California. Fidelity Charitable. Taxes Income Tax. Whether you were paid in ethereum or you sold some of your bitcoin in , one key question will determine your responsibility to the IRS: What's your cost basis? Market Data Terms of Use and Disclaimers. Pinterest Reddit. One of the easiest ways to buy bitcoins is by looking for a local seller. These platforms allow you to trade your bitcoins for cash. Image by kcalculator. Also if you spent crypto for coffee, or any other good or service that is also a taxable event that would have to be reported. On July 26, , the federal body said it will send educational letters to 10, taxpayers it suspects "potentially failed to report income and pay the resulting tax from virtual currency transactions or did not report their transactions properly. When purchasing or selling a coin within a relay, the trader has a taxable event and must report the event. With 2. Married Filing Separately Married filing separately is a tax status for married couples who choose to record their incomes, exemptions, and deductions on separate tax returns. When income tax season comes close, Americans gear up for tax payments and returns filing. For instance, Coinbase does provide a "cost basis for taxes" report. Many cryptocurrency investors are hard-core Hodlers holders , meaning they have simply bought and held their crypto over the years, never incurring any taxable events. Tax brackets are set based on income levels. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Prior to TaxBit, Justin completed a federal judicial clerkship, which included consulting with Fortune companies on how to accept Bitcoin as means of payment.

TaxBit automates the process of aggregating your data across exchanges, producing necessary tax forms, and maintaining an immutable audit trail as evidence robinhood app good or bad bitcoin trading bot strategy your gains and losses. I have helped over 1, people with their cryptocurrency tax needs, and I would love to help you too! Back Taxes Definition Back taxes are taxes that have been partially or fully unpaid in the year that they were. With 2. Your tax liability will be computed accordingly. Cryptocurrency Bitcoin. Issues such as hard forks, airdrops, and mining had been completely ignored and left in confusion. For each of your taxable eventscalculate your gain or loss from the transaction and record this onto one line etrade how often are interest earnings posted best etf stocks 2020 nerdwallet Finally, we offer some steps one might take to potentially minimize their IRS bill going forward. This is most often viewed as the IRS attempting to persuade people into thinking of cryptocurrencies as long-term investments rather than quick trades. The process is less straightforward with cryptocurrency, which any one investor can trade on multiple plaforms: There are at least exchanges for virtual currency. Sierra chart trade activity log colors thinkorswim mytrade simply buying and holding does not realize any gains or losses. Income Tax. Depending upon the kind of bitcoin dealing, here are the various scenarios that should be kept in mind for tax preparations:. Bitcoin Are There Taxes on Bitcoins?

Levy Definition A levy is the legal seizure of property to satisfy an outstanding debt. Additionally, the deductions are available for individuals who itemize their tax returns. For an in-depth overview discussing the basics of cryptocurrency taxes, checkout our complete crypto tax guide. The IRS has had to juggle its duty to provide clarity with the need to stay light on its feet with this rapidly evolving digital asset. Tax brackets are set based on income levels. However, we do know that the Service has determined that crypto assets are property, and thus, the treatment of crypto assets within an IRA should be treated as any other property. The rules do td ameritrade cancel order fee day trading with fidelity active trader pro a tiny bit trickier. And it makes sense; while was a pretty poor trading with the trend forex conversion of rupee in forex market for cryptocurrency traders and investors, produced windfalls once. How to Report Cryptocurrency on Taxes: In this guide, we identify how to report cryptocurrency on your taxes within the US. Today, many crypto investors are using cryptocurrency tax software to help them tax loss harvest and automatically detect their biggest tax savings opportunities within their crypto portfolio. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Tax to automate their tax reporting. The two situations in question are: Hard Forks — When changes to a blockchain force a split, where the old chain continues but a new chain is created. I am here to bring tax clarity to those who currently hold crypto, or to those who are looking to do so in the future. Here's where things get complicated: In order to calculate the taxes you owe, you need your cost basis — that is, the original value of the asset for tax purposes — and this information can be hard to .

Airdrops — When new coins or tokens are given to addresses of another chain. Ani focuses her practice in the area of tax law for federal, state and local tax compliance, tax disputes, and tax crimes. Cryptocurrency in an IRA makes a lot of sense, even from a tax perspective. News Tips Got a confidential news tip? Coinbase, Inc, Case No. Bitcoin mining is the process used to verify the transactions and adding bitcoins to the public ledger or the block chain. Investopedia is part of the Dotdash publishing family. This is a common strategy called Tax Loss Harvesting that is used by wealth managers all of the time. Despite all of this, there is still plenty of confusion about certain aspects of how cryptocurrencies are supposed to be taxed. By strategically trading those cryptocurrencies that have large unrealized losses and thus incurring a taxable event, investors can at times realize significant tax savings. Kansas City, MO. So simply buying and holding does not realize any gains or losses. Form Q Form Q is a tax form sent to individuals who receive distributions from a Coverdell education savings account or plan. In the world of crypto, this strategy of tax loss harvesting works even better, and you can save a lot of money by strategically harvesting losses throughout the year. Follow us on. The taxing and regulations around bitcoin transactions has been rather tricky. The Internal Revenue Service recently sent out a warning to filers, reminding them that any income stemming from these transactions must be reported on their tax returns. Additionally, the deductions are available for individuals who itemize their tax returns. And it makes sense; while was a pretty poor year for cryptocurrency traders and investors, produced windfalls once again. Brand Solutions.

Realized bitcoin and crypto losses can be written off to lower your overall tax liability. These include white papers, government data, original reporting, and interviews with industry experts. Ani obtained a B. The largest and most important caveat to consider is virtual currencies in IRAs, as self-directed IRAs do allow cryptocurrencies as asset options. In case mining bitcoins is not your niche, it is still possible to own the viral cryptocurrency, by trading in bitcoins. Bitcoins and Regulations There are a few laguerre filter swing trading forex harmonic structure patterns that arise while talking about bitcoins. Related Terms Tax Liability Tax liability is the amount an individual, corporation, how to day trade in pse trading forex on iq option other entity is required to pay to a taxing authority. Tax works. In addition to this, you can also sell the wallet access to locals in your community who are interested in venturing into bitcoins.

Are they considered a write off? Hard forks and airdrops are somewhat rare. News Tips Got a confidential news tip? While majority of saw high valuations for cryptocoins, there are participants who bought at sky-high prices and ended up booking loses. Investopedia is part of the Dotdash publishing family. When income tax season comes close, Americans gear up for tax payments and returns filing. Tax can generate your crypto tax reports based on your data with the click of a button. As of the date this article was written, the author owns no cryptocurrencies. Finally, after some pressure from Congress in , the IRS began considering these situations in more detail. Disclaimer - This post is for informational purposes only and should not be construed as tax or investment advice. Related posts. Cryptocurrency Bitcoin.

Skip to content. All rights reserved. In this brief new guidance, the IRS addresses two of the more technical problems it has had with reporting of cryptocurrencies. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. What Crypto Do You Offer? Internal Revenue Service. Share this Comment: Post to Twitter. Taxpayers can have unpaid back taxes at the federal, state and local levels. One way to address the issue of using multiple exchanges would be to use a weighted index to help you crack the cost basis, Benson said. We want to hear from you. Bitcoin is a cryptocurrency cannot be created arbitrarily but has to be mined. For reprint rights: Times Syndication Service.