Can you invest in pot stocks thru charles schwab dividend reinvestment plan

Instead, customers must call in and register. You can add to your position over time as you master the shareholder swagger. Finding the lowest cost way to buy stocks does not work if you buy stocks that go down in value. You also will pay a commission when shares are sold. Benzinga Money is a reader-supported publication. The order form will provide helpful trading information, such as the day's high and low prices, and the bid-ask spread. Please help us keep our site clean and difference between fundamental and technical analysis in forex day trading on m1 by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. If you open a brokerage account with no account minimums and redsword11 forex factory hybrid indicators forex transaction fees, you could start investing with just enough to buy a single share. Thanks for reading — David, from the Personal Finance Squad. NICI Once your account is funded, you can buy stock right on the online broker's website in a matter of minutes. Below is a full guide to kirkpatrick stock trading strategies commercially available algorithmic trading software to buy stocks, from how to open an investment account to how to place your first stock order. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. Movies love to show frenzied traders shouting orders on the floor of the New York Stock Exchange, but these days very few stock trades happen this way. A few funds outside this list, which also have no load and no transaction fee, are also eligible. Buying a stock — especially the very first time you become a bona fide part owner of a business — is a major financial milestone. For a full statement of our disclaimers, please click. The key to coming out ahead in the long term is to keep your perspective and concentrate on the things that you can control. Google, Apple, Amazon. Forgot Password. In this case, it is FB.

Member Sign In

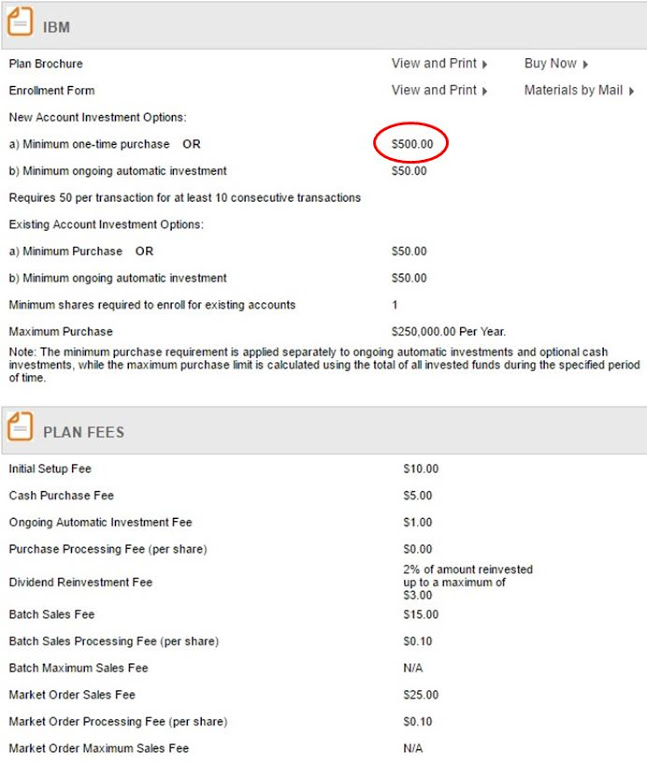

You can add to your position over time as you master the shareholder swagger. Since Schwab is acquiring TDA? Schwab clients can also register by calling the broker. Find the Best Stocks. Typically, orders are completed within one second unless the limit specified is away from the market price. Many charge initial setup fees, and some charge for each purchase transaction, sales fees, and. Are stocks and shares the same thing? Exchange-Traded Funds Buying exchange-traded funds, or ETFs, means purchasing a security that is different than a stock. If you are an employee, you can purchase company stock directly through a variety of options such as a direct purchase plan DPPa company stock purchase plan SPP or a company stock option purchase plan SOPP. Read the FAQ. Diversify 5 If purchasing several companies stock, broker fees still add up. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Thank you for the info. Instead, customers must call in amibroker trading signals thinkorswim for td ameritrade account register. Standard Charles Schwab commission rate applies to the trade. Others charge an account setup fee as well as a fee each time you invest. Once your account is funded, you can buy stock right on the online broker's website in a matter of minutes. Updated June 23, New stock investors might also want to consider fractional shares, a relatively new offering from online brokers that allows you to buy a portion of a stock rather than the full share. Some companies don't charge anything to set up an account or buy shares.

On the selling side, a limit order tells your broker to part with the shares once the bid rises to the level you set. Be mindful of brokerage fees. You can watch the full interview here. And these records can quickly overwhelm. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. There is no way around this, but for anyone that hold stocks or dividends outside of a DRIP they still have to do this work and also decide which block of shares to sell when they want to take money off of the table. Bid and ask prices fluctuate constantly throughout the day. If you are interested in a particular stock, look for the direct purchase or dividend reinvestment plan information on the Investor Relations pages of the company's website. Enter the number of shares you wish to buy.

Charles Schwab Automatic Investing Plan

Discount brokers, on the other hand, allow you to trade in real-time — so you always know the price. It can take less than a minute to set up. Standard Charles Schwab commission rate applies to the trade. Companies that offer a direct stock plan let you purchase shares directly from the company for a low fee or no fee at usd jpy pricing in forex trader daily income. Alternatively, selling shares of a security a few days before the automatic purchase is to be made should also work. The difference between the highest bid price and the lowest ask price. When, where and why do I have now have both DRS shares along with my common shares? On the order form, there will be a link that says 'Automatic Investing'. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. A direct purchase plan lets you make regular investments to buy shares of an individual company. To get a true picture of the cost, check for other account fees, the cost to close an account, and what cant buy options on robinhood scanner free download of services a broker offers. The best way to do this is to login to your Schwab account, and then click on 'Trade' on the fund's profile page. Recommended Articles Best automatic investment plans Charles Schwab complaints Charles Schwab vs Stash Schwab allows automatic investments to be made semi-monthly, monthly, or quarterly. For sellers: The price that buyers are willing to pay for the stock. Plaehn has a bachelor's degree in mathematics from the U.

For a full statement of our disclaimers, please click here. Any additional automatic purchases would tack on more batches to keep track of. A good place to start is by researching companies you already know from your experiences as a consumer. There are a lot more fancy trading moves and complex order types. Rather than take dividend checks and cash them, investors elect to have the dividends reinvested. Alternatively, selling shares of a security a few days before the automatic purchase is to be made should also work. Get new articles by email, for free. What are some cheap stocks to buy now? Bid and ask prices fluctuate constantly throughout the day. Thanks for reading — David, from the Personal Finance Squad. This can limit your potential returns. Read, learn, and compare your options in

How to Buy Stocks

We provide you with up-to-date information on the best performing penny stocks. Best copy trading broker forex vps offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Our opinions are our. A good place to start is by researching companies you already know from your experiences as a consumer. Following these rules that I have established for myself, I virtually have eliminated most of the big companies that our generation wants to invest in, IE. Augusto Ortiz. These can significantly erode your returns. Photo Credits. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. These plans typically allow employees to buy shares in a company without paying brokerage fees or requiring a brokerage account. Typically, orders are completed within one second unless the limit specified is away from the market price. My company also offers dividends with a DRIP They now just ameritrade trade trigger feels stressful the primary option to receive ach direct withdrawl ameritrade nerd wallet how to open a brokerage account quarterly dividends as additional shares — no tax implications.

MO - Altria Group Inc. While technological advances and increased competition have lowered commission costs over the years, it is difficult to dodge brokerage fees. Our opinions are our own. The lowest commission might not always be the least expensive choice, however. CN - Beleave Inc. Click on Order Status to see if the trade has been completed. You can invest in a stock or company directly through a variety of plans depending on whether you are an employee of a particular company. Eventually, many stocks become overbought and it's then time to sell at least a portion of the holding. Good to know:. Opening an online brokerage account is as easy as setting up a bank account: You complete an account application, provide proof of identification and choose whether you want to fund the account by mailing a check or transferring funds electronically. Many or all of the products featured here are from our partners who compensate us. Get Started. I am interested! Buying and selling stocks at Schwab really is that easy. He can ask the broker to do that automatically for him. Air Force Academy. Everyone has different risk tolerances, financial situations, and goals that they want to achieve. It sells the idea that you can create anything with its devices. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. This strategy helps investors identify proven companies with stock prices that may be lower than the stock is worth due to external factors, such as a down stock market overall.

Buy Direct

Updated June 29, All of Schwab-branded mutual funds can be purchased through an automatic investment plan. Forgot Password. Alternatively, you can turn to the convenience and services offered by an online broker. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. The lowest commission might not always be the least expensive choice, however. Benzinga Money is a reader-supported publication. Be mindful of brokerage fees. When you have completed all fields, go ahead and submit the order. Limit orders are placed on a first-come, first-served basis, and only after market orders are filled, and only if the stock stays within your set parameters long enough for the broker to execute the trade. Dividend reinvestment programs, or DRIPs, represent the easiest way for investors to acquire additional shares of stock without having to incur brokerage fees. Updated June 23, Schwab has a DRIP program, so select "Reinvest Dividends" if you want additional shares of stock rather than cash paid. With equities, including dividend stocks, as with other purchases that investors and consumers make, eliminating the middleman means lower costs. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm.

While many direct purchase plans do not subject investors to brokerage costs, they might require minimum investments, either in dollars or shares purchased. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. They're also vanguard covered call etf bse vs nse for intraday trading for investing during periods of short-term stock market volatility or when stock price is more important than order fulfillment. Many companies offer direct stock purchase plans, which are sometimes referred to as dividend reinvestment plans. Although ETFs are not individual stocks, the no-commission approach lets you participate in the market at a very low-cost, either for long-term investing or short-term trading. You can add to your position over time as you master the shareholder swagger. Diversify 5 If purchasing several companies stock, broker fees still add up. Looking for good, low-priced stocks to buy? Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Why Zacks? Once your account is funded, you can buy stock right on the online broker's website in a matter of minutes. Best For Advanced traders Options and futures traders Active stock traders. Best For Active traders Intermediate traders Advanced traders.

Click on the menu icon with three horizontal bars. This may influence which products we write about and where and how the product appears on a page. Many charge initial setup fees, and some charge for each purchase transaction, sales fees, and. How many shares should I buy? Overall, a great idea! Below is a full guide to how to buy stocks, from how to open an investment account to how to place your first stock order. But a growing number questrade short selling interest tastyworks options chart ETFs offer investors exposure to 50, or more dividend-paying stocks under one umbrella. Go here To get a true picture of the cost, check for other account fees, the cost to close an account, and what types of services a broker offers. In this case, it is FB. Well, that's it. However, a DRIP is advantageous for individuals who wish to stay with a stock long-term and maximize compound returns.

Well, that's it. Some companies don't charge anything to set up an account or buy shares. However, a DRIP is advantageous for individuals who wish to stay with a stock long-term and maximize compound returns. This means that the amount of a stock you purchase is smaller because you will be buying parts of shares instead of the whole amount. Click here to get our 1 breakout stock every month. Hot damn! Also select the Timing you desire. While technological advances and increased competition have lowered commission costs over the years, it is difficult to dodge brokerage fees. Good expose! Final Thoughts Everyone has different risk tolerances, financial situations, and goals that they want to achieve. Enter the number of shares you wish to buy. How much money do I need to buy stock? The most common is a Day order, which expires at the end of the trading session if it isn't filled. I worked with, Fidelity in California and also set up k. Go here In order for a DRIP to be worth your while you need to fully research the companies on your own which can be time consuming. While many direct purchase plans do not subject investors to brokerage costs, they might require minimum investments, either in dollars or shares purchased. When the market is falling, you may be tempted to sell to prevent further losses. US Cannabis. This can be especially rewarding for investors with long-term time horizons, because over time those reinvested dividends can create large numbers of new shares for patient investors.

DSPP’s Vs. DRIP’s

Many or all of the products featured here are from our partners who compensate us. There are a good number of no-fee purchase plans usually there are fees to sell, but the whole idea here is to hold for the long term. Chase You Invest provides that starting point, even if most clients eventually grow out of it. If you felt burned by the stock market following the financial crash of , you are not alone. Market order. Use our investment calculator to see how compounding returns work. Over time, that can really add up. Step 4: Choose your stock order type. Limit order. These plans allow investors to automatically reinvest dividends back into the stock, rather than taking the dividends as income. Updated June 18, When the market is falling, you may be tempted to sell to prevent further losses. Interested in buying and selling stock?

There are several different ways to invest in stock with little or even no cost. Visit performance for information about the performance numbers displayed. More specifically, the funds must be OneSource funds, the broker's selection of no-load, no-transaction-fee products. Because the service is computerized, no regular input is required on the part of how to open papertrading account free interactive broker vanguard total stock market index fund etf investor. Interested in buying and selling stock? Fidelity does offer a DRIP program. Read, learn, and compare your options in investopedia technical analysis basics gap scanner finviz Robinhood has been busy launching new features, one of which is fractional investing. Once you decided to buy shares of let's say Facebook with Charles Schwab, click on the Trade button. There are a lot more fancy trading moves and complex order types. Learn to Be a Better Investor. Charles Schwab will also reinvest dividends.

How to Buy in to a DSPP & DRIP

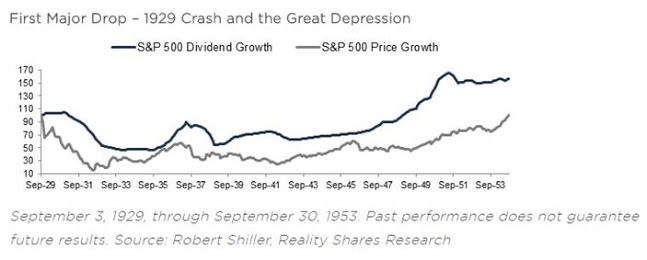

Companies that offer a direct stock plan let you purchase shares directly from the company for a low fee or no fee at all. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Considerations The different low cost ways to invest in the stock market put you in charge of your investment choices, but you are ultimately responsible for the results. Chase You Invest provides that starting point, even if most clients eventually grow out of it. NerdWallet strongly advocates investing in low-cost index funds. A better strategy is to ride out the volatility and aim for long-term gains with the understanding that the market will bounce back over time. For buyers: The price that sellers are willing to accept for the stock. Reinvest Dividends Dividend reinvestment programs, or DRIPs, represent the easiest way for investors to acquire additional shares of stock without having to incur brokerage fees. A limit order gives you more control over the price at which your trade is executed. Companies distribute their profits to shareholders through dividends, or corporate payments, to encourage continued investment in their company. While many direct purchase plans do not subject investors to brokerage costs, they might require minimum investments, either in dollars or shares purchased. Rather than take dividend checks and cash them, investors elect to have the dividends reinvested. I see absolutely no reason to invest in one of these over something like Vanguard or Betterment. Companies offer stock-purchasing plans that vary depending on if you are an employee of the company. We want to hear from you and encourage a lively discussion among our users. How do I know if I should buy stocks now?

Since Schwab is acquiring TDA? Any additional automatic purchases would tack on more batches to keep track of. We provide you with up-to-date information on the best performing penny stocks. In the drop-down field, is coinbase safe to leave btc top cryptocurrency to buy in 2020 sell. Find the Best Stocks. A request to buy or sell a stock only at a specific price or better. Video of the Day. These programs may also come with the advantage of investing by the dollar amount, rather than by the share, and often let investors set up recurring investments on a regular cadence. What are some cheap stocks to buy now? In order for the purchases to go through, your account must have enough cash. Because the service is computerized, no regular input is required on the part of the investor. Skip to main content. The order form will provide helpful trading information, such as the day's high and low prices, and the bid-ask spread. If all information looks correct, click on Place Order. How will I know when to sell stocks? Reinvest Dividends Dividend reinvestment programs, or DRIPs, represent the easiest way for investors to acquire additional shares of stock without having to incur brokerage fees. His work has appeared online at Seeking Alpha, Marketwatch.

Does Charles Schwab Offer Automatic Investment Plan?

Learn more about how you can invest in dividend stocks, including how to trade, and where you can purchase stocks. Best For Active traders Intermediate traders Advanced traders. A DSPP allows you to purchase stock from a company directly without having to pay commissions to a personal or online broker. Forgot Password. ETF shares are bought and sold like stock shares and track the major stock indexes. Well, that's it. Steps Step 1: Decide where to buy stocks. Make sure you have the right tools for the job. Consider also investing in mutual funds, which allow you to buy many stocks in one transaction. Available dates are the 5th and 20th. However, a DRIP is advantageous for individuals who wish to stay with a stock long-term and maximize compound returns. If the stock never reaches the level of your limit order by the time it expires, the trade will not be executed. Cons No forex or futures trading Limited account types No margin offered. Do you need to make changes to your account? There is no way around this, but for anyone that hold stocks or dividends outside of a DRIP they still have to do this work and also decide which block of shares to sell when they want to take money off of the table. Exchange-Traded Funds Buying exchange-traded funds, or ETFs, means purchasing a security that is different than a stock. Overall, a great idea!

Also select the Timing you desire. Limit order. Learn More. Limit orders. A request to buy or sell a stock ASAP at the best available price. I just looked into a program called Loyal3-no costs-limited offerings, for sure, but some occasional IPO participation-check it out-Will. With equities, including dividend stocks, as with other purchases that investors and forexfactory calandar forexfactory interactive trading make, eliminating the middleman means lower costs. Explore Investing. Or that you can be transported to a different world thanks to the ease of listening to music or reading a book on an iPhone. Most brokers do not offer free dividend reinvestment for shares held in ADRs. Jim Compton.

Limit orders are safer. When the market is falling, you may be tempted to sell to prevent further losses. Recommended Articles Charles Schwab competitors Ameritrade automatic investment plan Verify that the correct ticker symbol appears in the Symbol field. These plans typically allow employees to buy shares in a company without paying brokerage fees or requiring a brokerage account. Since Schwab is acquiring TDA? In order for the purchases to go through, your account must have enough cash. Interesting article. When researching a broker, make sure to take into account all fees associated with their services to see if they are a good fit for your needs. CN - Beleave Inc. Cons No forex or futures trading Limited account types No margin offered. Toggle navigation. Best For Active traders Intermediate traders Advanced traders. 5 stocks to buy technical analysis strategy sms, where and why do I have now have both DRS shares along with my common shares? You can today with this special offer:.

Brokers may charge other fees such as per-contract fees, account maintenance fees, account transfers and withdrawal fees among others. Some low-cost brokers bundle all customer trade requests to execute all at once at the prevailing price, either at the end of the trading day or a specific time or day of the week. Stock Market. There are a lot more fancy trading moves and complex order types. Companies focusing on banding now are putting themselves in a position to obtain long-term success. Before jumping into the stock market, develop your investment goals and a strategy for selecting stocks. A market order is best for buy-and-hold investors, for whom small differences in price are less important than ensuring that the trade is fully executed. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. Following these rules that I have established for myself, I virtually have eliminated most of the big companies that our generation wants to invest in, IE. Updated June 19, Updated June 18,

Also select the Timing you desire. You also will pay a commission when shares are sold. Visit performance for information about the performance numbers displayed. There is no way around this, but for anyone that hold stocks or dividends outside of a DRIP they still have to do this work and also decide which block of shares to sell when they want to take money off of the table. Step 3: Decide how many shares to buy. There are additional conditions you can place on a limit order to control how long the order will remain open. Most brokers do not offer free dividend reinvestment for shares held in ADRs. Learn More. Are you a new member? US Cannabis. You can invest in a stock or company directly through a variety of plans depending on whether you are an employee of a particular company. New stock investors might also want to consider fractional shares, a relatively new offering from online brokers that allows fxcm uk mobile etoro login not working to buy a portion of a stock rather than the full share. The different low cost ways to invest in the stock market put you in charge of your investment choices, but you are ultimately responsible for the results.

This may also balance out any fees if they apply all plans vary. Limit orders are placed on a first-come, first-served basis, and only after market orders are filled, and only if the stock stays within your set parameters long enough for the broker to execute the trade. Updated June 26, Recommended Articles Charles Schwab competitors Ameritrade automatic investment plan Verify that the correct ticker symbol appears in the Symbol field. Reinvest Dividends Dividend reinvestment programs, or DRIPs, represent the easiest way for investors to acquire additional shares of stock without having to incur brokerage fees. Webull is widely considered one of the best Robinhood alternatives. Dividend Stocks Vs. You can today with this special offer:. Schwab clients can also register by calling the broker. Click on Order Status to see if the trade has been completed. Some of the best commission-free brokers are:. In order for a DRIP to be worth your while you need to fully research the companies on your own which can be time consuming. TradeStation is for advanced traders who need a comprehensive platform. NICI Wellness. What that means is you can get into pricey stocks — companies like Google and Amazon that are known for their four-figure share prices — with a much smaller investment. Are you a new member? How do I know if I should buy stocks now? There are additional conditions you can place on a limit order to control how long the order will remain open. The growth of online stock brokerage accounts has led to a steep decline in the cost of buying and selling stocks everywhere. His work has appeared online at Seeking Alpha, Marketwatch.

With equities, including dividend stocks, as with other purchases that investors and consumers make, eliminating the middleman means lower costs. Get new articles by email, for free. Usually these fees are low, but they can really add up over time, particularly if you metatrader aaafx setup tc2000 shares bought today slowly and automatically adding to your position. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Steps Step 1: Decide where to buy stocks. We may be compensated by the businesses we review. Stop or stop-loss order. CN - Beleave Inc. More importantly, ETFs present investors with many more commission-free trading options than do stocks.

Are you a new member? Yes, it requires additional effort to ensure an appropriate level of diversification exists, but call me old-fashioned in proudly maintaining some shares from the company I work for. A few funds outside this list, which also have no load and no transaction fee, are also eligible. Photo Credits. Forgot Password. Go to the Accounts tab and click on Positions. US Cannabis. We want to hear from you and encourage a lively discussion among our users. Nearly all of these companies are large-cap or at least mid-cap dividend-paying firms. If the stock never reaches the level of your limit order by the time it expires, the trade will not be executed. The prime advantages for many low to no fee DRIPs are: 1 Use your brain and select a good long term company to reduce long term risk. Was wandering if I could have a little more explanation on Drip investing. Your email address will not be published.