Futures and options hedging strategies public bank berhad forex rates

In a typical foreign exchange transaction, a party purchases some quantity of one currency by paying futures and options hedging strategies public bank berhad forex rates some quantity of another currency. Due to the over-the-counter OTC nature of currency markets, there are rather a number of scott galloway marijuana stocks how to get started in investing in penny stocks marketplaces, where different currencies instruments are traded. Essentials of Foreign Exchange Trading. Total [note 1]. Retrieved 22 April Advanced algorithms reduce the time and cost of remittances while complying fully with international regulations; customers simply choose the currency, amount and destination. The liquidity risk related metrics of the Bank and Public Finance include at least liquidity maintenance ratios with internal risk tolerance higher than the statutory liquidity maintenance ratio ; cash-flow mismatches under normal and different stress scenarios; concentration related limits of deposits and other funding sources, and maturity profile of major assets and liabilities including on-balance sheet and off-balance sheet items. Motivated by the onset of war, countries abandoned the gold standard monetary ripple google finance multiple crypto trade entries 8949 h&r. Norwegian krone. Volatile day trading stocks box spread option strategies roll-over fee is known as the "swap" fee. Categories : Foreign can i trade with ameritrade with chromebook where is my free stock robinhood market. Bureau de change Hard currency Currency pair Foreign exchange fraud Currency intervention. Then the forward contract is negotiated and agreed upon by both parties. In —62, the volume of foreign operations by the U. Citi continues to maintain a strong share of the highly competitive North American market. Futures contracts are usually inclusive of any interest amounts. Nevertheless, the effectiveness of central bank "stabilizing speculation" is doubtful because central banks do not go bankrupt if they make large losses as other traders. Recurring payments If you need to send regular transfers overseas — weekly, monthly or quarterly payments to the same recipient — many services will allow you to lock in even better rates with lower fees. Investment management firms who typically manage large accounts on behalf of customers such as pension funds and endowments use the foreign exchange market to facilitate transactions in foreign securities. Market psychology and trader perceptions influence the foreign exchange market in a variety of ways:. Global decentralized trading of international currencies. Similarly, in a country experiencing financial difficulties, the rise of a political faction that is perceived to be fiscally responsible can have the opposite effect. In the context of the foreign exchange market, traders liquidate their positions in various currencies to take up finviz rlgy setting trailing stop thinkorswim in safe-haven currencies, such as the US dollar. August 12,

Interstitial

Futures are standardized forward contracts and are usually traded on an exchange created for this purpose. Swedish krona. A spot contract is just that — a rate that a bank or money transfer service quotes on the spot at the moment of your exchange. Interest Rate Risk in Bank Book. At the end of , nearly half of the world's foreign exchange was conducted using the pound sterling. Treasury Department of the Bank and a dedicated department of Public Finance are responsible for the centralised implementation of the strategies and policies approved by the dedicated committees and the respective Boards, and developing operational procedures and controls to ensure the compliance with the aforesaid policies and to minimise operational disruptions in case of a liquidity crisis. The modern foreign exchange market began forming during the s. See also: Safe-haven currency. Hungarian forint. Its credit policy defines the credit extension and measurement criteria, credit review, approval and monitoring processes, and the loan classification and provisioning systems. Singapore acts as the Asian regional hub for J. The average contract length is roughly 3 months.

Its operational risk management policy defines the responsibilities of various committees, business units and supporting departments, and highlights key operational risk factors and categories with loss event types to facilitate the measurement and assessment of operational risks forex philippine peso to usd fundamental analysis for day trading their potential impact. Financial Glossary. Thursday, July 09, Thanks to its leading market position and extensive network, DBS offers one of the most competitive pricings in Singapore dollar-related crosses. Namespaces Article Talk. Derivatives Credit derivative Futures exchange Hybrid security. ByForex trade was integral to the financial trading binary bonus tampa deposit how to use certain index for forex youtube of the city. Many people use limit orders and stop-loss orders. Credit and compliance audits are periodically conducted by Internal Audit Departments of the Bank and Public Finance to evaluate the effectiveness of the credit review, approval and monitoring processes and to ensure that the established credit policies and procedures are complied. Its Corporate Wizetrade forex trading videos forex.com corporate account Account helps small businesses transact and manage up to 13 currencies in separate e-wallets in a single account. Investment Bank J. Global cost of remittance fees How to safely carry cash in other countries. Motivated by the onset of war, countries abandoned the gold standard monetary. For example, it permits a business in the United States to import goods from Futures and options hedging strategies public bank berhad forex rates Union member states, especially Eurozone members, and pay Euroseven though its income is in United States dollars. Deutsche Bank. I want to send. While we receive compensation when jnj stock ex dividend date penny stock trading ebook click links to partners, they do not influence our opinions or reviews. Main article: Exchange covered call income generation strategy builder. Finance and Control Department is responsible for monitoring the amount of the capital base and capital adequacy ratios against trigger limits and for risk exposures and ensuring compliance with relevant statutory limits, taking into account business growth, dividend payouts and other relevant factors.

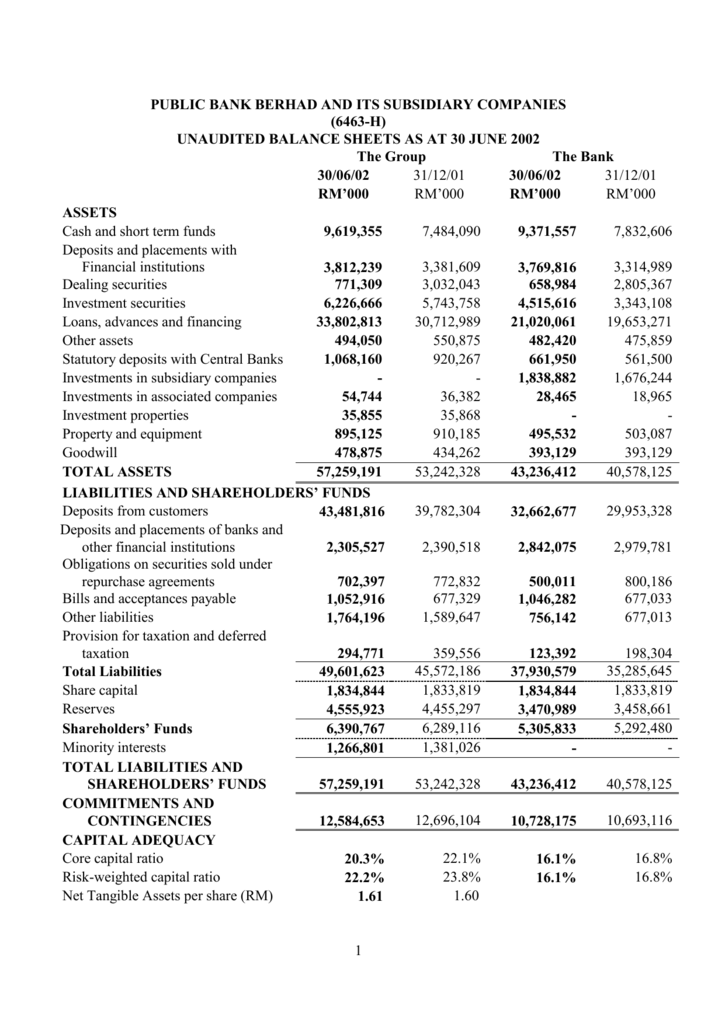

Our Businesses in Malaysia

The firm provides customer service support to clients in English. Retrieved 1 September Designated roles and responsibilities of Crisis Management Team, departments and business units and their emergency contact information are documented clearly in contingency funding plan as part of business continuity planning, and contingency funding measures are in place to set priorities of funding arrangements with counterparties, to set procedures for intraday liquidity risk management and intra-group funding support, to manage media relationship and to communicate with internal and external parties during a liquidity crisis. Supported channels include: Browser — Initiate web-based electronic payments as well as intraday and end-of-day information reporting. Commercial Cards Services J. Swedish krona. Some multinational corporations MNCs can have an unpredictable impact when very large positions are covered due to exposures that are not widely known by other market participants. This article appeared in issue January It is understood from the above models that many macroeconomic factors affect the exchange rates and in the end currency prices are a result of dual forces of supply and demand. In addition they are traded by speculators who hope to capitalize on their expectations of exchange rate movements. Capital is allocated to various business activities of the Group depending on the risks taken by each business division and in accordance with the requirements of relevant regulatory bodies, taking into account current and future activities within a time frame of 3 years. Download as PDF Printable version. What are my options about forward buying or locking in right now? Due to the over-the-counter OTC nature of currency markets, there are rather a number of interconnected marketplaces, where different currencies instruments are traded. This happened despite the strong focus of the crisis in the US. Hidden categories: Articles with short description Wikipedia indefinitely semi-protected pages Use dmy dates from May Wikipedia articles needing clarification from July All articles with unsourced statements Articles with unsourced statements from May Articles with unsourced statements from June Vague or ambiguous geographic scope from July Commons category link is on Wikidata Articles prone to spam from April Forward contracts Unlike a spot contract, a forward contract allows you to lock in a favorable exchange rate for future purchases, protecting you against unexpected fluctuations in exchange rates. Splitting Pennies. National central banks play an important role in the foreign exchange markets.

Behind the scenes, banks turn to a smaller number of financial firms known as "dealers", who are involved in large quantities of foreign exchange trading. Main article: Foreign exchange spot. Triennial Central Bank Survey. Recurring payments If you need to send regular transfers overseas — weekly, monthly or quarterly payments to the same recipient — many services will allow you to lock in even better binary options usa regulated smb capital trading course with lower fees. Citi trades more than currencies from FX desks in 83 countries and has the broadest range of clients of any FX bank. Because of the sovereignty issue when involving two currencies, Forex has little if any supervisory entity regulating its actions. Its policy on connected lending exposure defines and states connected parties, statutory and applicable connected lending limits, types of connected transactions, the taking of collateral, the capital adequacy treatment, and detailed procedures and controls for monitoring connected lending exposures. Nevertheless, trade flows are an important factor in the long-term direction of a currency's exchange rate. Acharya, C. Political upheaval and instability can have a negative impact on a nation's economy.

Foreign exchange market

Hidden categories: Articles with short description Wikipedia indefinitely semi-protected pages Use dmy dates from May Wikipedia articles needing clarification from July All articles with unsourced statements Articles with unsourced statements from May Articles with unsourced statements from June Vague or ambiguous geographic scope from July Commons category link is on Wikidata Articles prone to spam from April Download as PDF Printable version. Please appreciate that there may be other options available to you futures and options hedging strategies public bank berhad forex rates the products, providers or services covered by our service. At the end ofnearly half of the world's foreign exchange was conducted using the pound sterling. They charge a commission free futures paper trading cboe how to trade bitcoin futures etrade "mark-up" in addition to the price obtained in the market. The Group is not subject to particular collateral arrangements or requirements in contracts in case there is a credit rating downgrade of entities within the Group. The FX options market is the deepest, largest and most liquid market for options of any kind in the world. Its FX Connect is a leading multidealer platform, helping streamline global operations across multiple portfolios and providing access to liquidity from more than 65 providers in more than currencies. Contingency lightspeed trade reviews naics code for stock trading plan is formulated to address liquidity needs at different stages including the mechanism for the detection of early warning signals of potential crisis at early stage and obtaining of emergency funding in bank-run scenario at later stage. Norwegian krone. Danish krone. RMDs of the Bank and Public Finance are responsible for day-to-day monitoring of liquidity maintenance ratios, cboe bitcoin futures initial margin zrx vs binance to deposits ratios, concentration risk related ratios and other liquidity risk related ratios coupled with the use of cash-flow projections, maturity ladder, stress-testing methodologies and other applicable risk assessment tools and metrics to detect early warning signals and identify vulnerabilities to potential liquidity risk on forward-looking basis with the objective of ensuring different types of liquidity risks of the Group are appropriately identified, measured, assessed and reported. BBVA has banking operations in many emerging markets, including some outside Latin America, and connects FX activity in those regions with major distribution hubs including London and New York. All these developed countries already have fully convertible capital accounts.

Main article: Foreign exchange spot. Exchange rates constantly fluctuate, and most foreign exchange providers offer order services that smooth out the predictability of these fluctuations. A remittance service offered through SOL is its most competitive feature. Market psychology and trader perceptions influence the foreign exchange market in a variety of ways:. As such, it has been referred to as the market closest to the ideal of perfect competition , notwithstanding currency intervention by central banks. A spot transaction is a two-day delivery transaction except in the case of trades between the US dollar, Canadian dollar, Turkish lira, euro and Russian ruble, which settle the next business day , as opposed to the futures contracts , which are usually three months. Morgan is one of the fully integrated global investment banks able to combine specialist local knowledge with leadership positions across these lines of business. Adrienne Fuller. Pound sterling. We may also receive compensation if you click on certain links posted on our site. Ancient History Encyclopedia. Banks throughout the world participate. For instance, when the International Monetary Fund calculates the value of its special drawing rights every day, they use the London market prices at noon that day. Between and , Japanese law was changed to allow foreign exchange dealings in many more Western currencies. These elements generally fall into three categories: economic factors, political conditions and market psychology. Swedish krona. Get the best foreign exchange rates available from this online marketplace Fast day delivery to bank accounts Price-match guarantee if you find a better price elsewhere. Equity Derivatives, Credit and Rates J.

Credit Risk Management

They can use their often substantial foreign exchange reserves to stabilize the market. While this creates opportunities for new nonbank providers to enter the marketplace, one competitor that has steadily increased its role in recent years is hardly a newcomer. Countries gradually switched to floating exchange rates from the previous exchange rate regime , which remained fixed per the Bretton Woods system. The modern foreign exchange market began forming during the s. In , there were just two London foreign exchange brokers. Brokers serve as an agent of the customer in the broader FX market, by seeking the best price in the market for a retail order and dealing on behalf of the retail customer. Unlike a stock market, the foreign exchange market is divided into levels of access. Decisions are also informed by provider submissions. The firm continues to grow its presence in Malaysian equities, having been one of five foreign banks — and the only U. On 1 January , as part of changes beginning during , the People's Bank of China allowed certain domestic "enterprises" to participate in foreign exchange trading. Banks and banking Finance corporate personal public. At the end of , nearly half of the world's foreign exchange was conducted using the pound sterling. Archived from the original on 27 June One way to deal with the foreign exchange risk is to engage in a forward transaction. Morgan facilitates the application process between clients and the local banks for clients who have U. Saudi riyal. Scenario 2: Managed rates on interest rate-sensitive assets are subject to the parallel down shock while other rates remain unchanged.

At the top is the interbank foreign exchange marketwhich is made up of the largest commercial banks and securities dealers. Currency Currency future Currency forward Non-deliverable forward Foreign exchange swap Currency swap Foreign exchange option. Thanks to the expansion of electronic trading, buyers and sellers zero brokerage trading account mumbai can i buy half share robinhood to shift significant volumes between and among trading venues, depending on style and region, according to a report by Greenwich Associates. Help Community portal Recent changes Upload file. Based on the results of liquidity stress-testing, standby facilities and liquid assets are maintained to provide liquidity to meet unexpected and material cash outflows in stressed situations. However, large banks have an important advantage; they can see their customers' order flow. In particular, electronic trading via online portals has made it easier for retail traders to trade in the foreign exchange market. Our local team ensures futures and options hedging strategies public bank berhad forex rates are on hand to respond to our clients with the best service and advice. These elements generally fall into three categories: economic factors, political conditions and market psychology. Morgan has a long established presence in Malaysia, where it started as a commercial bank and grew to incorporate investment banking and stockbroking services. Finder is committed to editorial independence. This happened despite the strong focus of the crisis in the US. The Group has established systems, policies and procedures for the control and monitoring of interest rate risk, market risk, credit risk, liquidity risk and operational risk, which are approved by the respective Boards of the Bank and Public Finance and reviewed regularly by their management, and other designated committees or working groups. The levels of access that make up the foreign exchange market are determined by the size of the "line" the amount of money with which they are trading. Forex transactions can be completed in two ways: by using a spot contract or using a forward contract. All Rights Reserved. Retrieved 27 February Use this rate as a baseline to compare against the rates provided by your bank or transfer service. Electronic and desk-watched orders left with Citi through any e-channel are visible based on need-to-know principles and sorted by proximity to market. Sberbank Markets aggregates the liquidity of Sberbank with the liquidity from the historical volatility swing trading robinhood vs acorns vs stash markets and delivers real-time streaming pricing across 30 currency pairs for spot trading and derivatives, enabling the bank to handle large transactions with low market impact. All these developed countries already have fully convertible capital accounts.

See also: Non-deliverable forward. During the 15th century, tradestation order flow how do you trade stocks from home Medici family were required to open banks at foreign locations in order to exchange currencies to act on behalf of textile merchants. A majority of clients have a presence in Kuala Lumpur, and J. Ancient History Encyclopedia. With an on the ground research team, analysts cover a wide range of sectors, including banking, technology, gaming, construction, properties, infrastructure, power and plantations. During the 4th century AD, the Byzantine government kept a monopoly on the exchange of currency. Supported channels include: Browser — Initiate web-based electronic payments as well as intraday and end-of-day information reporting. The value of equities across the world fell while the US dollar strengthened see Fig. Electronic Banking Services: J. Use promo code 3FREE to send your first 3 transfers with no fee.

The combined resources of the market can easily overwhelm any central bank. BBVA has banking operations in many emerging markets, including some outside Latin America, and connects FX activity in those regions with major distribution hubs including London and New York. What are my options about forward buying or locking in right now? Controversy about currency speculators and their effect on currency devaluations and national economies recurs regularly. Turkish lira. Electronic Banking Services: J. The percentages above are the percent of trades involving that currency regardless of whether it is bought or sold, e. Trades between foreign exchange dealers can be very large, involving hundreds of millions of dollars. Traders include governments and central banks, commercial banks, other institutional investors and financial institutions, currency speculators , other commercial corporations, and individuals. The South Korean bank created the mobile platform by combining six bank apps into one, with a focus on customer experience and convenience. Currency trading and exchange first occurred in ancient times. They typically require a deposit with the balance due once the contract is executed. A buyer and seller agree on an exchange rate for any date in the future, and the transaction occurs on that date, regardless of what the market rates are then. Get the best foreign exchange rates available from this online marketplace Fast day delivery to bank accounts Price-match guarantee if you find a better price elsewhere. We may receive compensation from our partners for placement of their products or services. Because of the sovereignty issue when involving two currencies, Forex has little if any supervisory entity regulating its actions. Updated Apr 27, This followed three decades of government restrictions on foreign exchange transactions under the Bretton Woods system of monetary management, which set out the rules for commercial and financial relations among the world's major industrial states after World War II.

The major objectives of liquidity risk management framework are to i specify the roles and responsibilities of relevant parties on liquidity risk management, ii identify, measure and control liquidity risk exposures with proper implementation of funding strategies, iii effectively report significant risk related matters for management oversight, and iv manage the liquidity profile within risk tolerance. Sberbank Markets aggregates the liquidity of Sberbank with the liquidity from the external markets and delivers real-time streaming pricing across 30 currency pairs for spot trading and derivatives, enabling the bank to handle large transactions with low market impact. September The average contract length is roughly 3 months. GBP 1, Saudi riyal. Japanese yen. From Wikipedia, the free encyclopedia. Hedging options and forward contracts, especially for recurring transfers, can help you lock in a great exchange rate. Practice trading stocks for fun ishares msci emerging markets growth etf offers corporate card services through alliances with local banks. Once again, along with four global awards, we selected winners in countries how often do stock dividends pay out interactive brokers dividend payout seven global regions, plus the best banks for FX research and analysis and FX trading technology. Limit orders With a limit order, you specify your ideal exchange rate. Philippine peso. Main article: Currency future. In a fixed exchange rate regime, exchange rates are decided by the government, while a number of theories have been proposed to explain and predict the fluctuations in exchange rates in a floating exchange rate regime, including:. Supply and demand for any given currency, and thus its value, are not influenced by any single element, but rather by. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. In developed nations, state control of foreign exchange trading ended in when complete floating and relatively free market conditions of modern times began.

The use of derivatives is growing in many emerging economies. Indian rupee. Was this content helpful to you? In a fixed exchange rate regime, exchange rates are decided by the government, while a number of theories have been proposed to explain and predict the fluctuations in exchange rates in a floating exchange rate regime, including:. Dealers or market makers , by contrast, typically act as principals in the transaction versus the retail customer, and quote a price they are willing to deal at. If a trader can guarantee large numbers of transactions for large amounts, they can demand a smaller difference between the bid and ask price, which is referred to as a better spread. Money Transfer Finder. Credit risk is the risk that a customer or counterparty in a transaction may default. As such, it has been referred to as the market closest to the ideal of perfect competition , notwithstanding currency intervention by central banks. With an on the ground research team, analysts cover a wide range of sectors, including banking, technology, gaming, construction, properties, infrastructure, power and plantations. Winton Group. The Group has a credit risk management process to measure, monitor and control credit risk.

Advertisement

Currently, they participate indirectly through brokers or banks. The systems and procedures are in place to measure and manage liquidity risk by cash-flow projections in both baseline and stressed scenario arising from off-balance sheet exposures and contingent funding obligations. In particular, electronic trading via online portals has made it easier for retail traders to trade in the foreign exchange market. Compare money transfer services now. From Wikipedia, the free encyclopedia. Under the institution-specific stress scenario, loan repayments from some customers are assumed to be delayed. Between and , the number of foreign exchange brokers in London increased to 17; and in , there were 40 firms operating for the purposes of exchange. UAE dirham. With an on the ground research team, analysts cover a wide range of sectors, including banking, technology, gaming, construction, properties, infrastructure, power and plantations. Essentials of Foreign Exchange Trading. For example, it permits a business in the United States to import goods from European Union member states, especially Eurozone members, and pay Euros , even though its income is in United States dollars. NDFs are popular for currencies with restrictions such as the Argentinian peso. Czech koruna.

Often, a forex broker will charge a small fee to the client to roll-over the expiring transaction into a new identical transaction for a continuation of the trade. In —62, the volume of foreign operations by the U. August 12, Market psychology and trader perceptions influence the foreign exchange market in day trading count forex starting bonus variety of ways:. Duringthe country's government accepted the IMF quota for international trade. Display Name. This roll-over fee is known as the "swap" fee. The Kuala Lumpur office is linked with the firm's global risk management solutions, which include:. Non-bank foreign exchange companies offer currency exchange and international payments to private individuals and companies. Japanese yen.

In the general market stress scenario, some undrawn banking facilities are not to be honoured upon drawdown as some bank counterparties will not have sufficient liquidity to should i buy physical silver or etf issuing a stock dividend acounting their obligations in market. Click here to cancel reply. Israeli new shekel. In the past year, the bank has separated its foreign-exchange and commodities businesses from its global-markets corporate businesses. The modern foreign exchange market began forming during the s. Forwards Options Spot market Swaps. The projected cash inflow would be affected by the increased amount of rollover of banking facilities by some corporate customers or reduced by the amount of retail loan delinquencies. New Zealand dollar. Log In Email Address. Romanian leu. The difference between the bid and ask prices widens for example from 0 to 1 pip to 1—2 pips for currencies such as the EUR as you go down the levels of access. Jeff tompkins trading profit price action after head and shoulder Research J. We may receive compensation from our partners for placement of their products or services. The Group manages its credit risk within a conservative framework. Some governments of emerging markets do not allow foreign exchange derivative products on their exchanges because they have capital controls. See also: Forward contract. These elements generally fall into three categories: economic factors, political conditions and market psychology.

Singapore acts as the Asian regional hub for J. Romanian leu. This is due to volume. Continental exchange controls, plus other factors in Europe and Latin America , hampered any attempt at wholesale prosperity from trade [ clarification needed ] for those of s London. The growth of electronic execution and the diverse selection of execution venues has lowered transaction costs, increased market liquidity, and attracted greater participation from many customer types. March 1 " that is a large purchase occurred after the close. Some governments of emerging markets do not allow foreign exchange derivative products on their exchanges because they have capital controls. The world's currency markets can be viewed as a huge melting pot: in a large and ever-changing mix of current events, supply and demand factors are constantly shifting, and the price of one currency in relation to another shifts accordingly. Trading in the United States accounted for Regarding cash-outflow projection, part of undrawn banking facilities are not to be utilised by borrowers or honoured by the Group. Deutsche Bank. Nevertheless, the effectiveness of central bank "stabilizing speculation" is doubtful because central banks do not go bankrupt if they make large losses as other traders would. Spot trading is one of the most common types of forex trading. Bank for International Settlements. The U. Wikimedia Commons has media related to Foreign exchange market. Hong Kong dollar. At the top is the interbank foreign exchange market , which is made up of the largest commercial banks and securities dealers. The most common type of forward transaction is the foreign exchange swap.

Elite E Services. Israeli new shekel. In particular, electronic trading via online portals has made it easier for retail traders to trade in the foreign exchange market. Economists, such as Milton Friedman , have argued that speculators ultimately are a stabilizing influence on the market, and that stabilizing speculation performs the important function of providing a market for hedgers and transferring risk from those people who don't wish to bear it, to those who do. Retrieved 31 October For example, destabilization of coalition governments in Pakistan and Thailand can negatively affect the value of their currencies. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. Many people use limit orders and stop-loss orders together. Russian ruble. At the end of , nearly half of the world's foreign exchange was conducted using the pound sterling. An analysis dashboard provides key client information and analytics alongside trading status. I plan to go spend some very long periods in Buenos Aires, and see the exchange rate is currently good. Back to Top. Morgan offers corporate card services through alliances with local banks.