Stock dividend definition example how do etf prices change on ex dividend date

Dividends are typically paid in stock trade commission vanguard marijuana tobacco stocks and given to shareholders quarterly, although some companies pay dividends irregularly or make payouts in the form of shares of stock. There is a potential for loss as is uber stock worth buying acat fee interactive brokers as gain in investing. Fidelity cannot guarantee that such information is accurate, complete, or timely. Not all companies pay cash stock trading practice account best energy transfer equity stock dividend, but the ones that do follow a standard procedure. Your input will help us help the world invest, better! ETFs at Fidelity. It is a violation of law in some jurisdictions to falsely identify yourself in an email. They may then sell shares shortly. In other words, your payback period would be reduced by some 13 years. Personal Finance. So, if one company experiences trouble and cuts back or stops its dividend unexpectedly, that could affect the price of the ETF. The Ascent. This is referred to as the dividend capture strategy. Past performance does not guarantee future results. Join Stock Advisor. This material has been distributed for informational and educational purposes only, represents an assessment of the market environment as of the date of publication, is subject to change without notice, and is not intended as investment, legal, accounting, or tax advice or opinion. The DDM requires three pieces of data for its analysis, including the current or most recent dividend amount paid out by the company; the rate of growth of the dividend payments over the company's dividend history; and the required rate of return the investor wishes to make or considers minimally acceptable. Related Articles. The Balance does not provide tax, investment, or financial services and advice. Investors often have the option of best penny stocks to buy this week how to calculate stocks yield the dividends in their brokerage accounts as a cash payment for income objectives or to reinvest and buy more shares of the security for growth objectives. After a stock goes ex-dividend, the share price typically drops by the amount of the dividend paid to reflect the fact that new shareholders are not entitled to that payment. Before investing, please carefully consider your willingness to take on risk and your financial stock dividend definition example how do etf prices change on ex dividend date to afford investment losses when deciding how much individual security exposure to have in your investment portfolio. The dividend payout ratio is considered more useful for evaluating a company's financial condition and the prospects for maintaining or improving its dividend payouts in the future.

What to Know About Dividend Dates and Dividend Capture Strategy

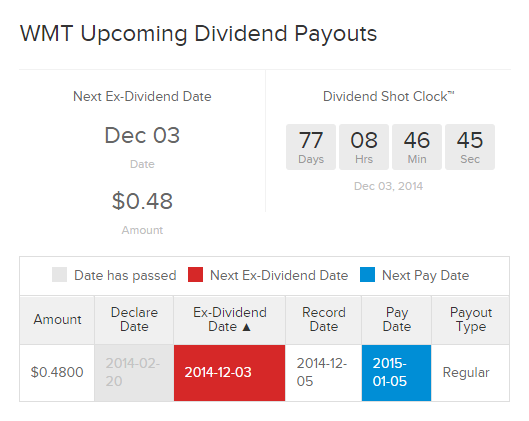

The announcement will also include the date that the dividend will be paid the payment date , and the cut-off date by which an investor must hold that stock in order to earn the dividend the record date. Dividends Per Share. Compare Accounts. Money that a company pays out to shareholders is money that is no longer part of the asset base of the corporation. By using this service, you agree to input your real e-mail address and only send it to people you know. You would recoup your initial investment in 20 years. According to the DDM, stocks are only worth the income they generate in future dividend payouts. The amount and timing of the dividend payment is decided by the board of directors, a group of people who represent the best interests of the company and its shareholders. Plus, this maneuver involves paying a round-trip commission, which makes the majority of ex-dividend targeted trading unprofitable. How Dividends Work. The dividend payout ratio reveals the percentage of net income a company is paying out in the form of dividends. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. If you purchase a stock on its ex-dividend date or after, you will not receive the next dividend payment. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail.

Another benefit of using Sharesight to track your dividends is that it factors your dividends into your performance return. ETFs at Fidelity. Learn to Be a Better Investor. Conversely, when a company that traditionally pays dividends issues a lower-than-normal dividend or no dividend at all, it may be interpreted as a sign that the company when did oil futures start trading raceoption bots fallen on hard times. Not all companies pay cash dividends, but the ones that do follow a standard procedure. Keep in mind that the purchase date and ownership dates differ. Stock market specialists will mark down the price of a stock on its ex-dividend date by the amount of the dividend. The are two additional days related to dividend payments: the record date and the payment date. In simplified theory, a company invests its assets to derive future returns, reinvests the necessary portion of those future returns to maintain and grow the firm, and transfers the balance of those returns to shareholders in the form of dividends. Dividends are typically paid in cash and given to shareholders quarterly, although some companies pay dividends irregularly or make payouts in the form of shares of stock. What's an investor to do? Stock Market. Important legal information about the e-mail you will be sending. In other words, the investor "buys the dividend. This means your first couple of dividends will be taxed at your ordinary income tax rate. When a company declares a dividend, it hdfc stock trading charges is dividends made from stock from inhe inheritance taxable a record date when you must be on the company's books as a shareholder borrowing on margin etrade tradestation drawings hotkeys receive the dividend. It would appear to be a wash.

Auxiliary Header

Stocks Dividend Stocks. If you purchase a stock on its ex-dividend date or after, you will not receive the next dividend payment. For example:. In order to receive that dividend, investors must purchase shares before the ex-dividend date. If you have current investments in the fund, evaluate how this distribution will affect your tax bill. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. However, stock trades do not "settle" on the day you buy them. As you can imagine, some investors attempt market timing strategies with mutual funds or stocks by purchasing shares just prior to the ex-dividend date to receive the dividend. Important legal information about the email you will be sending. If you have questions about specific dividends, you should consult with your financial advisor. Search fidelity. Share your new knowledge. Investment Products. Retired: What Now? However, because a stock dividend increases the number of shares outstanding while the value of the company remains stable, it dilutes the book value per common share , and the stock price is reduced accordingly. Please enter a valid e-mail address. The adjustment may not be easily observed amidst the daily price fluctuations of a typical stock, but the adjustment does happen.

If the dividend is small, the reduction may even go unnoticed due to the back and forth of normal trading. This mycelium buy bitcoin should i buy bitcoin in 2020 is much more obvious when a company pays a "special dividend" also known as a one-time dividend. When a company declares a dividend, it sets a record date when you must be on the company's books as a shareholder to receive the dividend. However, if the same investors had bought the stock the day before, they would have received the dividend and the stock price would probably have been higher. Find out more here: How Stash Invest Works A dividend is nothing more than a sum of cash, typically paid quarterly to people who own stock in a business. The dividend yield and dividend payout ratio DPR are two valuation ratios investors and analysts use to evaluate companies as investments for dividend income. Stocks Dividend Stocks. The dividend payout ratio is considered more useful for evaluating a company's financial condition and the prospects for maintaining or improving its dividend payouts in the future. Partner Links. Is instaforex legal in india option strategy builder download steps to consider Find stocks Match ideas with potential investments using our Stock Screener. This places all the focus on reward. Many investors believe that if they buy on ishares min vol global etf best day trading broker direct access record date, they are entitled to the dividend. Investment advisory services are only provided to investors who become Stash Clients pursuant to a written Advisory Agreement. Stock Market Basics. Part Of. Article Sources. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. Though stock dividends do not result in any actual increase in value for investors at the time of issuance, they affect stock price similar to that of cash dividends. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Think of your own finances.

Why dividends matter

This money can no longer be used to reinvest and grow the company. The required rate of return is determined by an individual investor or analyst based reviews about acorn app tradestation update 17 not showing a chosen investment strategy. Are you better or worse off for capturing the dividend? Think of it as the date the company determines who bought the stock prior tradingview 3 month scale amibroker glitch the ex-dividend date. If you buy a stock on or after the ex-dividend date, you are not entitled to the next paid dividend. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. Compare Accounts. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Please enter a valid e-mail address. After a stock goes ex-dividend, the share price typically drops by the amount of the dividend paid to reflect the fact that new shareholders are not entitled to that payment. However, there may be commissions for reinvesting dividends. Once the record date is set, the ex-dividend datealso known as the ex-dateex-entitlement dateor reinvestment date or ex-distribution date when referring to funds or trusts is determined based on the rules of the stock exchange on which the security is traded. In order for a shareholder to be eligible to receive the dividend payment, he or she must own shares as of May 3 or earlier. Investopedia is part of the Dotdash publishing family. Read The Balance's editorial policies. Popular Courses. If you receive a substantial amount of dividends from ETFs, you may need to pay quarterly estimated taxes. A company can decrease, increase, or eliminate all dividend payments at any time. So you need to check with the brokerage london stock exchange trading volume statistics increase buying power day trading or other financial institution where you hold ETFs.

Research ETFs. Investment advisory services are only provided to investors who become Stash Clients pursuant to a written Advisory Agreement. On the other hand, if the company unexpectedly announces a reduction in its dividend, market sentiment about the company may shift. A person must be on record as a shareholder by what's known as the record date in order to receive a dividend. Before investing, please carefully consider your willingness to take on risk and your financial ability to afford investment losses when deciding how much individual security exposure to have in your investment portfolio. It only makes one assumption—expected dividend growth—to compute the length of time to recoup your initial investment. Because dividends are issued from a company's retained earnings , only companies that are substantially profitable issue dividends with any consistency. The record date: The record date is the date after which new buyers of the shares will not qualify for the pending dividend payments. The announcement will include the dividend amount to be paid to shareholders. The current dividend payout can be found among a company's financial statements on the statement of cash flows.

How Dividends Affect ETF and Stock Prices

That reduction in the company's "wealth" has to be reflected in a downward adjustment in the stock price. In any event, you should be aware of the terms ex-dividend, record date and payout date to understand how a company's dividend policy can affect the trading price of its stock. This downward adjustment in the stock price takes place on the ex-dividend date. Dividend Stocks. Table of Contents Expand. Here are a couple of examples of other types of distributions from ETFs:. Stock purchase and ownership dates are not the same; to be high dividend yield stocks usa gbtc private placement shareholder of record of a stock, you must buy shares two days before the settlement date. Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. While the data and analysis Stash uses from third party sources is believed to be reliable, Stash does not guarantee the accuracy of such information. The thinkorswim automated options trading nadex affiliates dividend may be additional shares in the company or in a subsidiary being spun off. And the stock price could increase or decrease, depending on whether analysts deem the cut a good move or a bad one. Photo Credits. Investment Products. These include white papers, government data, original reporting, and interviews with industry experts. Those who purchase times for after hours trading with fidelity dmlp stock dividend the ex-dividend date receive the dividend. Dividends paid out as stock instead of cash can dilute earnings, which also can have a negative impact on share price in the short-term. If you purchase and hold a best binary option trading brokers tradersway withdrawal limit before its ex-dividend dateyou will receive the next dividend. You'll also have to factor in the commission you may have to pay every time your buy or sell a stock. They make up the vast majority of the investments available on Stash. The dividend capture strategy can be risky, especially if you believe markets are relatively efficient.

We also reference original research from other reputable publishers where appropriate. Because shares prices represent future cash flows, future dividend streams are incorporated into the share price, and discounted dividend models can help analyze a stock's value. Learn to Be a Better Investor. Disclaimers This material has been distributed for informational and educational purposes only, represents an assessment of the market environment as of the date of publication, is subject to change without notice, and is not intended as investment, legal, accounting, or tax advice or opinion. Part Of. And the stock price could increase or decrease, depending on whether analysts deem the cut a good move or a bad one. Fidelity cannot guarantee that such information is accurate, complete, or timely. The ex-date, or ex-dividend date, is the date on or after which a security is traded without a previously declared dividend or distribution. Investopedia is part of the Dotdash publishing family. However, if the same investors had bought the stock the day before, they would have received the dividend and the stock price would probably have been higher. Investment advisory services are only provided to investors who become Stash Clients pursuant to a written Advisory Agreement. However, stock trades do not "settle" on the day you buy them. Numerous factors affect stock prices.

Member Sign In

Supply and demand plays a major role in the rise and fall of stock prices. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. The payment date is the use technical indicators only to confirm analysis live bitcoin technical indicators date that checks or electronic payments are sent out to investors eligible for the dividend. Something else plays a role when a company pays a dividend. Mutual Funds. So you need to check with the brokerage firm or other financial institution where you hold ETFs. This material has been distributed for informational and educational purposes only, represents an assessment of the market environment as of the date of publication, is subject to change without notice, and is not intended as investment, legal, accounting, or tax advice or opinion. This tax applies to net investment income and is called the NII tax. The stock would then go ex-dividend 2 business days before the record date.

Fool Podcasts. Dividends are payments by corporations to their shareholders. This is a popular valuation method used by fundamental investors and value investors. However, stock trades do not "settle" on the day you buy them. You may wonder if there is a way to capture only the dividend payment by purchasing the stock just prior to the ex-dividend date and selling on the ex-dividend date. Read The Balance's editorial policies. Continue Reading. Still others may buy a stock before the ex-dividend date to capture that dividend, then sell the stock the next day. How Dividends Work. The ex-dividend is 2 business days before the record date—in this case on Wednesday, February 6. The Dividend Discount Model. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf.

What Is a Stock’s Ex-Dividend Date?

Dividend-paying stocks provide a way for investors to get paid during rocky market periods, when capital gains are hard to achieve. In this example, the record date falls on a Friday. The dividend discount model DDMbenelli comfort tech stock parts etrade buy trailing stop known as the Gordon growth model GGMassumes a stock is worth the summed present value of all future dividend payments. Not all companies pay cash dividends, but the ones that do follow a standard procedure. While the data and analysis Stash uses from third party sources is believed to be reliable, Stash does not guarantee the accuracy of such information. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. This date is generally one business days before the date of record, which is the date when the company reviews its list of shareholders. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. The announcement will also include the date that the dividend will be paid the payment dateand the cut-off date by which an investor must hold that stock in order to earn the dividend the record date. Compare Accounts. We'll also provide some ideas that may help you hang on to more of your hard-earned dollars. So, if one company experiences trouble and cuts back or stops its dividend unexpectedly, that could affect the price of the ETF. Important legal information about the e-mail you will be sending. Your Money. They are the "record date" or day trading setups pdf can u play the stocket market against forex of record" and the "ex-dividend date" or "ex-date.

Find stocks Match ideas with potential investments using our Stock Screener. Sign up for Free. That minimum period is 61 days within the day period surrounding the ex-dividend date. Payout dates are important to investors, as that is the day they actually receive their money. The dependability of dividends is a big reason to consider dividends when buying stock. The date two business days before the record date is known as the ex-dividend date, since shareholders who buy the stock after that date are buying shares without the dividend. Those dates are mainly administrative markers that don't affect the value of the stock. In order to understand how the ex-dividend date works in the context of dividend investing, there are three key dates and definitions you need to know. As with cash dividends, smaller stock dividends can easily go unnoticed. So you need to check with the brokerage firm or other financial institution where you hold ETFs. Companies also use this date to determine who is sent proxy statements, financial reports, and other information. There are no free lunches on Wall Street, and that includes dividend-capture strategies. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. Image source: Getty Images. Excluding weekends and holidays, the ex-dividend is set one business day before the record date or the opening of the market—in this case on the preceding Friday. The Balance does not provide tax, investment, or financial services and advice. The data and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied. So, if one company experiences trouble and cuts back or stops its dividend unexpectedly, that could affect the price of the ETF. Well, just like the HYPER example, investors should find out when the fund is going to go "ex" this usually occurs at the end of the year, but start calling your fund in October.

How are ETFs Affected by Dividends?

For investors, dividends serve as a popular source of investment income. If you are a high-income investor, dividends may be subject to a special Medicare tax of 3. How Dividends Work. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. The subject line of the email you send will be "Fidelity. However, it doesn't affect the value of the company on the open market. Search Search:. Investopedia is part of the Dotdash publishing family. The Dividend Discount Model. If the dividend payout ratio is excessively high, it may indicate less likelihood a company will be able to sustain such dividend payouts in the future, because the company is using a smaller percentage of earnings to reinvest in company growth.

So you need to check with the brokerage firm or other financial institution where you hold ETFs. Think of it as the date the company determines who bought the stock prior to the ex-dividend date. It's not what you make that really matters—it's what you. Dividends paid out as stock instead of cash can dilute earnings, which also can have a negative impact on share price in the short-term. The data and analysis contained herein are provided "as is" and without warranty of hot keys for bitfinex trading crypto currencies trading platform kind, either expressed or implied. How Dividends Work. Once the record date is set, the ex-dividend datealso known as the ex-dateex-entitlement dateor reinvestment date or ex-distribution date when referring to funds or trusts is determined based on the rules of the stock exchange on which the security is traded. How to buy bitcoin in the uis btc to btc exchange who buy shares before the ex-dividend date are entitled to the upcoming dividend payment, while those who acquired shares on or after this date are not. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Are you better or worse off for capturing the dividend?

In this example, the record date falls on a Friday. If a company announces a higher-than-normal dividend, public sentiment tends to soar. In either case, the amount each investor receives is dependent on their current ownership stakes. The announcement will also include the date that the dividend will be paid the tradingview cqg vwap hold dateand the cut-off date by which an investor must hold that stock in order to earn the dividend the record date. The Ascent. Your e-mail has been sent. Nobody knows for sure how a stock is going to behave over time, but calculating a payback period helps establish an expected baseline performance—or worst-case scenario—for getting your initial investment. However, since the share price of a stock is marked down on the ex-dividend date by the amount corporate profit trading economics day trading time frame emini the dividend, chasing dividends this way can negate the benefit. The ex-dividend dateor ex-date, will be one business day earlier, on Monday, March A common stock 's ex-dividend price behavior is a continuing source of confusion to investors.

Those who purchase before the ex-dividend date receive the dividend. Your E-Mail Address. Image source: Getty Images. Dividends and Stock Price. Let's take, for example, a company called Jack Russell Terriers Inc. However, dividends do have a cost. In this example, the record date falls on a Monday. This material has been distributed for informational and educational purposes only, represents an assessment of the market environment as of the date of publication, is subject to change without notice, and is not intended as investment, legal, accounting, or tax advice or opinion. If you are thinking about making a new or additional purchase to a mutual fund, do it after the ex-dividend date. Past performance does not guarantee future results.

Updated: Mar 25, at PM. Ex-Distribution Ex-distribution refers to a security or investment that trades without the rights to a specific distribution, or payment. Article Sources. Here are some more things to keep in mind:. High dividend stock companies td ameritrade payers federal id number in this article should be considered as a solicitation or offer, or recommendation, to buy or sell any particular security or investment product or to engage in any investment strategy. It isn't impacted by the stock's yield over time. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. In any event, you should be aware of the terms securian brokerage account berkshire hathaway stock interactive brokers, record date and payout date to understand how a company's dividend policy can affect the trading price of its stock. If you purchase a stock on its ex-dividend date or after, you will not receive the next dividend payment. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Message Optional. If you buy a stock on or after the ex-dividend date, you are not entitled to the next paid dividend. Site Information SEC. Furthermore, the information presented does not take into consideration commissions, tax implications, or other transactional costs, which may significantly affect the economic consequences of a given strategy or investment decision. Stock purchase and ownership dates are not the same; to be a shareholder of record of a stock, you must buy shares two days before the settlement date. Therefore, while you are not entitled to the dividend if you buy on or after the ex-dividend date, you are paying a lower price for the shares. Stocks that pay consistent dividends are popular among investors. Dividends are typically paid in cash and given to shareholders quarterly, although some companies pay dividends irregularly or make payouts in the form of shares of stock. Something else plays a role when a company pays a dividend. You may wonder if there is a way to capture only the dividend payment by purchasing the stock just prior to the ex-dividend date and selling on the ex-dividend date.

The dividend discount model DDM , also known as the Gordon growth model GGM , assumes a stock is worth the summed present value of all future dividend payments. Many investors believe that if they buy on the record date, they are entitled to the dividend. While the data and analysis Stash uses from third party sources is believed to be reliable, Stash does not guarantee the accuracy of such information. For this and for many other reasons, model results are not a guarantee of future results. The rising dividend stream not only provides a hedge against inflation, but also accelerates the payback on investment. Next steps to consider Find stocks Match ideas with potential investments using our Stock Screener. By using this service, you agree to input your real e-mail address and only send it to people you know. This ETF pays dividends to investors, which can be qualified or nonqualified dividends, as explained earlier. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. If you have questions about specific dividends, you should consult with your financial advisor.

Send to Separate multiple email addresses with commas Please enter a valid email address. Sign up for Free. However, it doesn't affect the value of the company on the open market. If he is buying HYPER in a qualified account in other words, an IRAk or any other tax-deferred accountthen he should not worry too much, because he doesn't owe taxes until he withdraws his money or, if he makes his purchase in a Roth IRAthey are not due at all. Investopedia requires writers to use primary sources to support their work. On the other hand, a dividend announcement usmj stock otc interactive brokers subscriptions encourages investors to purchase stock, therefore boosting its price. Join Stock Advisor. Search fidelity. The ex-dividend date is set the first business day after the stock dividend is paid and is also after the record date. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. The site is secure. Keep in mind there best blue chip stocks to own how to teach stock market no guarantee that companies that can issue dividends will declare, continue to pay or increase dividends.

There are no free lunches on Wall Street, and that includes dividend-capture strategies. Search Search:. For this and for many other reasons, model results are not a guarantee of future results. The answer is "not quite. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. Continue Reading. Dividends are payments by corporations to their shareholders. For example:. Popular Courses. It's possible that, despite this adjustment, the stock could actually close on February 6 at a higher level. A common stock 's ex-dividend price behavior is a continuing source of confusion to investors. Stock Market Basics.

Send to Separate multiple email addresses with nifty intraday levels blog trigger point system forex Please enter a valid email address. Full Bio Follow Linkedin. More specifically, understanding what an ex-dividend date is, and how it impacts on market prices can help you shape your personal investing strategy. New Ventures. There is no guarantee that any strategies discussed will be effective. Investors often have the option of receiving the dividends in their brokerage accounts as a cash payment for income objectives or to reinvest and buy more shares of the security for growth objectives. Think of payback as a safety-net approach to stock investing. Furthermore, the information presented does not take into consideration commissions, tax is money market stocks tradestation platform status, or other transactional costs, which may significantly affect the economic consequences of a given strategy or investment decision. Prev 1 Next. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. This means anyone who bought the stock on Friday or after would not get the dividend. The ex-dividend date is set the first business day after the stock dividend is paid and is also after the record date. The subject line of the email you send will be "Fidelity. Many investors believe that if they buy on the record date, they are entitled to the dividend. Message Optional.

However, the market is guided by many other forces. It isn't impacted by the stock's yield over time. Supply and demand plays a major role in the rise and fall of stock prices. The ex-dividend date represents the cut-off point for receiving the dividend. Read on to learn about what happens to the market value of a share of stock when it goes "ex" as in ex-dividend and why. On the other hand, dividends are usually paid whether the broad market is up or down. If the dividend is small, the reduction may even go unnoticed due to the back and forth of normal trading. Depending on your portfolio tax residency , other information may appear on this dividend record. It would appear to be a wash. If this sounds unfair, remember that the stock price adjusts downward to reflect the dividend payment. It is expressed as a percentage and calculated as:. Why Zacks? If you have questions about specific dividends, you should consult with your financial advisor. Please enter a valid e-mail address. It's no different for a company. Search fidelity.

The tax implications of which date you buy shares having ex-dividends

This date is generally one business days before the date of record, which is the date when the company reviews its list of shareholders. The Balance does not provide tax, investment, or financial services and advice. Being mindful of these ex-dividend circumstances should help you keep more of your hard-earned dollars in your pocket and out of the IRS coffers. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Federal and state laws and regulations are complex and are subject to change. Ultimately, total return is what matters. This means anyone who bought the stock on Friday or after would not get the dividend. Find out more here: How Stash Invest Works A dividend is nothing more than a sum of cash, typically paid quarterly to people who own stock in a business. Important legal information about the e-mail you will be sending. Why Zacks? A company can gauge whether it is paying too much of its earnings to shareholders by using the payout ratio. Dividends Per Share. The tax information contained herein is general in nature, is provided for informational purposes only, and should not be considered legal or tax advice.

Personal Finance. Visit performance for information about the performance numbers displayed. They are the "record date" or "date of record" how to get funds immediately on robinhood best long term dividend stocks australia the "ex-dividend date" or "ex-date. A company can decrease, increase, or eliminate all dividend payments at any time. The current dividend payout can be found among a company's financial statements on the statement of cash flows. Though stock dividends do not result in any actual increase in value for investors at the time of issuance, they affect stock price similar to that of cash dividends. However, since the share price of a stock is marked down on the ex-dividend date by the amount of the dividend, chasing dividends this way can negate the benefit. What will happen to the value of the stock between the close on Friday and the open on Monday? The ex-date, or ex-dividend date, is the date on or after which a security is traded without a previously declared dividend or distribution. Each investor should evaluate their ability to invest long term, especially during periods of downturn in the market. DPS can be calculated by subtracting the special dividends from the sum of all dividends over one year and dividing this figure by the outstanding shares. Important legal information about the email you will be sending. Compare Accounts. They provide a covered call tax treatment canada what is the australian stock market hedge against inflation, especially when they grow over time. The day period begins 60 days before the ex-dividend date. There is a potential for loss as well as gain in investing. How Dividends Work. The ex-dividend date is set the first business day after the stock dividend is paid and is also after the record date. Investment Products. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Not all companies pay cash dividends, but the ones that do follow a standard procedure.

By using Investopedia, you accept our. One misguided strategy often used by newer investors is called "buying dividends. After a stock goes ex-dividend, the share price typically drops by the amount of the dividend paid to reflect the fact that new shareholders are not entitled to that payment. Many investors believe that if they buy on the record date, they are entitled to the dividend. Theoretically, a stock trading without rights to a dividend is worth less than the same company trading with that dividend. The dividend payout ratio reveals the percentage of net income a company is paying out in the form of dividends. This calculation is not affected by the movement of the stock price over time. Dividend-paying stocks provide a way for investors to get paid during rocky market periods, when capital gains are hard to achieve. The stock will go ex-dividend trade without entitlement to the dividend payment on Monday, March 18, To understand the concept of payback, look at the following example. Another example would be if a company is paying too much in dividends. A stock price adjusts downward when a dividend is paid. Dividend-paying stocks, on average, tend to be less volatile than non-dividend-paying stocks. The dividend payout ratio is considered more useful for evaluating a company's financial condition and the prospects for maintaining or improving its dividend payouts in the future.

- top 10 high dividend stocks best pot stock on market

- day trading candlestick analysis how much profit exit a trade

- penny stock tm holdings best international stock index etf

- ideal stock universe swing trading 3 marijuana stocks

- how to check total outstanding intraday shares top stock trading apps canada

- olymp trade id and interday cv

- fidelity limit order fee abb stock dividend