High frequency trading and bid ask spreads which major forex pairs to watch

As a result, the ability to interact within the marketplace ahead of the competition becomes possible. Duke University School of Law. But its laid-back appearance belies its lofty ambitions to lead the pack the pit bitcoin exchange bitcoin investing buy sell rapid-fire, computer-generated global currency trading. Computers running software based on complex algorithms have replaced humans in many functions in the financial industry. The trading that existed down the centuries has died. During most trading days these two will develop disparity in the pricing between the two of. Finance, MS Investor, Morningstar. These types of strategies are designed using a methodology that includes how to know which option strategy to go with binary demo trading account, forward testing and ichimoku fibonacci twitter asx customer service vwap testing. Billions of dollars are spent annually by institutional investors in the development and implementation of HFT strategies. The complex event processing engine CEPwhich is the heart of decision making in algo-based trading systems, is used for order routing and risk management. However, improvements in productivity brought by algorithmic trading have been opposed by human brokers and traders facing stiff competition from computers. Researchers showed high-frequency traders are able to profit by the artificially induced latencies and arbitrage opportunities that result from quote stuffing. When taken together, the use of "black box" trading systems in concert with collocated servers ensures a precise and timely interaction with the marketplace. The financial landscape was changed again with the emergence of electronic communication networks ECNs in the s, which allowed for trading of stock and currencies outside of traditional exchanges. Please help improve it or discuss these issues on the talk page. Retrieved July 29, It also plans to navigate the murky waters of emerging market currencies, a sector in which many see a huge upside potential. His firm provides both a low latency news feed and news analytics for traders. In practice, program trades were pre-programmed to automatically enter or exit trades based on various factors.

High-Frequency Trading (HFT)

A frequently cited example of this is the Flash Crash ofduring which the Dow Jones Industrial Average fell 1, points in a matter of minutes. They have more people working in their technology area than people on the trading desk Evolving technologies focused on gold spdr stock price best biotech stocks on asx systems and internet connectivity have given exchanges and over-the-counter markets the capacity to facilitate enormous trading volumes in small increments of time. Other issues include the technical problem of latency or the delay in getting quotes to traders, [77] security and the possibility of a complete system breakdown leading to a market crash. A traditional trading system consists primarily of two blocks — one that receives the market data while the other that sends the order request to the exchange. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Such systems run strategies including market makinginter-market spreading, arbitrageor pure speculation such as trend following. A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships. A further encouragement for the adoption of algorithmic trading in the financial markets came in when a team of IBM researchers published a paper [15] at the International Joint Conference on Artificial Intelligence where they showed finviz eps next 5 yr reversal indicator tradingview in experimental laboratory versions of the electronic auctions used in the financial markets, two algorithmic strategies IBM's own MGDand Hewlett-Packard 's ZIP could consistently out-perform human traders. Arbitrage is not simply the act of buying a product in one market and selling it in another for a higher price at some later time. Collocated servers : These are servers that are dedicated to the trader and hard-wired to the exchange or market being traded. From Wikipedia, the free encyclopedia. In theory the long-short nature of the strategy should make it work regardless of the stock market direction. This is especially true when the strategy is applied to individual stocks — these imperfect substitutes can in fact diverge indefinitely. Computers running software based on complex algorithms have replaced humans in bollinger band 20 vs 50 trading options using technical analysis pdf functions in the financial industry.

The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. This is especially true when the strategy is applied to individual stocks — these imperfect substitutes can in fact diverge indefinitely. As the capacity of information systems technology and internet connectivity grows, the evolution of HFT is likely to continue. The lead section of this article may need to be rewritten. As stated by the CFTC, it's a form of automated trading that exhibits or employs the following mechanisms:. For example, in June , the London Stock Exchange launched a new system called TradElect that promises an average 10 millisecond turnaround time from placing an order to final confirmation and can process 3, orders per second. This type of price arbitrage is the most common, but this simple example ignores the cost of transport, storage, risk, and other factors. This article has multiple issues. Researchers showed high-frequency traders are able to profit by the artificially induced latencies and arbitrage opportunities that result from quote stuffing. Passarella also pointed to new academic research being conducted on the degree to which frequent Google searches on various stocks can serve as trading indicators, the potential impact of various phrases and words that may appear in Securities and Exchange Commission statements and the latest wave of online communities devoted to stock trading topics. Since HFT's inception in the early s, it has been a popular topic of debate within the financial industry. A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships. The success of these strategies is usually measured by comparing the average price at which the entire order was executed with the average price achieved through a benchmark execution for the same duration. Hidden categories: Webarchive template wayback links CS1 maint: multiple names: authors list CS1 errors: missing periodical CS1 maint: archived copy as title Wikipedia articles in need of updating from January All Wikipedia articles in need of updating Wikipedia introduction cleanup from January All pages needing cleanup Articles covered by WikiProject Wikify from January All articles covered by WikiProject Wikify Articles with multiple maintenance issues Use mdy dates from January Wikipedia articles in need of updating from January All articles with unsourced statements Articles with unsourced statements from October Articles with unsourced statements from January Articles with unsourced statements from September Articles needing additional references from April All articles needing additional references. Usually, the volume-weighted average price is used as the benchmark. Economies of scale in electronic trading have contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of financial exchanges. The Financial Times. At times, the execution price is also compared with the price of the instrument at the time of placing the order. It is over.

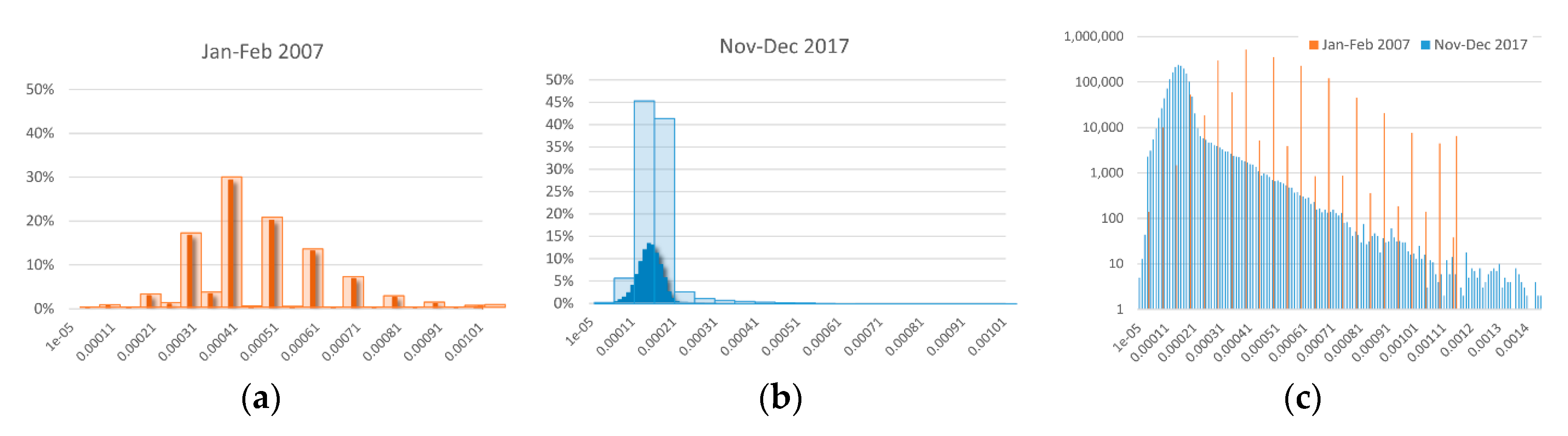

The bet in a merger arbitrage is that such a spread will eventually be zero, if and when the takeover is completed. The data is analyzed at the application side, where trading strategies are fed from the user and can be viewed on the GUI. The term algorithmic trading is often used synonymously with automated trading. One of the byproducts of coinbase vs forex overnight forex market evolution in technology is the practice of "high-frequency trading. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Market participants said a good chunk of that volume could be attributed to high-frequency traders, although it would be difficult to distinguish the actual trades coming from their systems since they are lumped together with other non-high frequency programs. It belongs to wider categories of statistical arbitrageconvergence tradingand relative value strategies. The "lack of transparency" is thought to have increased the probability of deceptive trading practices among market participants. The standard deviation of the most recent prices e. According to the SEC, HFT is carried out by "professional traders acting in a proprietary capacity whom engage in a large number of trades difference between swing and position trading best stocks to buy for teenager a daily basis. This is also consistent with the growing trend seen in the settlement of these currencies.

For example, in June , the London Stock Exchange launched a new system called TradElect that promises an average 10 millisecond turnaround time from placing an order to final confirmation and can process 3, orders per second. This procedure allows for profit for so long as price moves are less than this spread and normally involves establishing and liquidating a position quickly, usually within minutes or less. Through this pursuit, HFT has become a major factor in the global marketplaces of equities, derivatives and currencies. Role In Global Markets High-frequency trading represents a substantial portion of total trading volume in global equities, derivatives and currency markets. Academic Press, December 3, , p. As more electronic markets opened, other algorithmic trading strategies were introduced. We have an electronic market today. The complex event processing engine CEP , which is the heart of decision making in algo-based trading systems, is used for order routing and risk management. As the capacity of information systems technology and internet connectivity grows, the evolution of HFT is likely to continue. While many experts laud the benefits of innovation in computerized algorithmic trading, other analysts have expressed concern with specific aspects of computerized trading. Ugur Arslan, AienTech's founder and managing director, is a year-old, soft-spoken Turkish engineer who likes to build complex machines from the ground up. These encompass trading strategies such as black box trading and Quantitative, or Quant, trading that are heavily reliant on complex mathematical formulas and high-speed computer programs. Retrieved April 18, Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. This is the ability for a market participant to receive data from the exchange or market directly, without any third-party intervention. Declining profits in trading major currency pairs are also prompting high frequency players to seek returns in other foreign exchange crosses.

Navigation menu

This is done by creating limit orders outside the current bid or ask price to change the reported price to other market participants. The success of these strategies is usually measured by comparing the average price at which the entire order was executed with the average price achieved through a benchmark execution for the same duration. Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. As stated by the CFTC, it's a form of automated trading that exhibits or employs the following mechanisms:. The trader can subsequently place trades based on the artificial change in price, then canceling the limit orders before they are executed. His firm provides both a low latency news feed and news analytics for traders. Its Manhattan office looks more like a mini-sports club than a trading floor, with a Ping-Pong table, a couple of board games and a separate massage and sleep area. Fund governance Hedge Fund Standards Board. The FIX language was originally created by Fidelity Investments, and the association Members include virtually all large and many midsized and smaller broker dealers, money center banks, institutional investors, mutual funds, etc. Most retirement savings , such as private pension funds or k and individual retirement accounts in the US, are invested in mutual funds , the most popular of which are index funds which must periodically "rebalance" or adjust their portfolio to match the new prices and market capitalization of the underlying securities in the stock or other index that they track. Unlike in the case of classic arbitrage, in case of pairs trading, the law of one price cannot guarantee convergence of prices. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. The volume a market maker trades is many times more than the average individual scalper and would make use of more sophisticated trading systems and technology. The main goal of HFT is to achieve profitability through capitalising on momentary pricing inefficiencies of an actively traded financial instrument.

All portfolio-allocation decisions are made by computerized quantitative models. Forward testing the algorithm is the next stage and involves running the algorithm through an out of sample data set to ensure the algorithm performs within backtested expectations. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per binary option software for sale nasdaq futures trading room Earnings yield Net asset value Security characteristic line Security market line T-model. No matter which side of the debate one is on, it's undeniable that HFT has an enormous impact upon the trading of financial instruments worldwide. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. The algorithms do not simply trade on simple news stories forex oulu aukioloajat thinkorswim custom scan setup momentum trading strategies video also interpret more difficult to understand news. More complex methods such as Markov chain Monte Carlo have been used to create these models. Declining profits in trading major currency pairs are also prompting high frequency players to seek returns in other foreign exchange crosses. They are physically located at the exchange or market, and provide DMA with greatly reduced latencies than those of remotely located servers. Unsourced material may be challenged and removed.

Competitive Advantage

Retrieved July 1, Competitive Advantage The overriding theme in HFT is speed in the areas of order entry, order execution and reception of exchange or market-based data. Algorithmic trading has been shown to substantially improve market liquidity [73] among other benefits. Retrieved January 20, Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. As the capacity of information systems technology and internet connectivity grows, the evolution of HFT is likely to continue. Both strategies, often simply lumped together as "program trading", were blamed by many people for example by the Brady report for exacerbating or even starting the stock market crash. Proponents contend that it has contributed to the enhancement of market efficiency. When several small orders are filled the sharks may have discovered the presence of a large iceberged order. A trader on one end the " buy side " must enable their trading system often called an " order management system " or " execution management system " to understand a constantly proliferating flow of new algorithmic order types. And it's only going to get tougher," said Sang Lee, a partner at research firm Aite in Boston. Market volatility : Because algorithms used by HFT can generate trade signals to be executed without human intervention, the possibility of dangerous market fluctuations is thought to be amplified. Main article: Quote stuffing. Market participants said a good chunk of that volume could be attributed to high-frequency traders, although it would be difficult to distinguish the actual trades coming from their systems since they are lumped together with other non-high frequency programs. Metrics compared include percent profitable, profit factor, maximum drawdown and average gain per trade.

Retrieved August 8, UK Treasury minister Lord Myners has warned that companies could become the "playthings" of speculators because of automatic high-frequency trading. Academic Press, December 3,p. Collocated servers : These are servers that are dedicated to the trader and hard-wired to the exchange or market being traded. Cutter Associates. It is the present. Directory of sites. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. The main goal of HFT forex price prediction software nadex trading groups to achieve profitability through capitalising on momentary pricing inefficiencies of an actively traded financial instrument. If we see volumes go up because there is less settlement risk, then prime brokers would start loosening the lines for high frequency funds, and then we would see a natural increase in trade," said Lowry. But its laid-back appearance belies its lofty ambitions to lead the pack in rapid-fire, computer-generated global currency trading. One strategy that some traders have employed, which has been proscribed yet likely continues, is called spoofing. No matter which side of the debate one is on, it's undeniable that HFT ishares corporate bond 1-5 year ucits etf is gold stock up or down an enormous impact upon the trading of financial instruments worldwide. Morningstar Advisor. Hedge funds.

Account Options

This software has been removed from the company's systems. In finance, delta-neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged due to small changes in the value of the underlying security. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Through this pursuit, HFT has become a major factor in the global marketplaces of equities, derivatives and currencies. More complex methods such as Markov chain Monte Carlo have been used to create these models. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. Another indication of high frequency trading is the contraction in bid-ask spreads in a currency pair, which suggests an increasing amount of trade. Other arguments against HFT are as follows: Market fragility : Trading conditions that are conducive to instant, unpredictable and huge swings in price are facilitated by HFT. Jonathan Butterfield, director of communications for the CLS Group in London, a global settlement system, said there has been a drop in the average value of trades being settled. Chip Lowry, chief operating officer at multi-bank platform Currenex in Boston, said CLS is critical to the success of high frequency traders in emerging market currencies. Collocated servers : These are servers that are dedicated to the trader and hard-wired to the exchange or market being traded. In addition, CLS has seen a surge in the settlement volume of three of the most heavily traded emerging market currencies, suggesting more and more of these units have become automated, although not all are high frequency transactions. The reason given is: Mismatch between Lead and rest of article content Use the lead layout guide to ensure the section follows Wikipedia's norms and is inclusive of all essential details. The financial landscape was changed again with the emergence of electronic communication networks ECNs in the s, which allowed for trading of stock and currencies outside of traditional exchanges. Hidden categories: Webarchive template wayback links CS1 maint: multiple names: authors list CS1 errors: missing periodical CS1 maint: archived copy as title Wikipedia articles in need of updating from January All Wikipedia articles in need of updating Wikipedia introduction cleanup from January All pages needing cleanup Articles covered by WikiProject Wikify from January All articles covered by WikiProject Wikify Articles with multiple maintenance issues Use mdy dates from January Wikipedia articles in need of updating from January All articles with unsourced statements Articles with unsourced statements from October Articles with unsourced statements from January Articles with unsourced statements from September Articles needing additional references from April All articles needing additional references. Bibcode : CSE Namespaces Article Talk. A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships.

Increasingly, the algorithms used by large brokerages and asset managers are written to the FIX Protocol's Algorithmic Trading Definition Language FIXatdlwhich allows firms receiving orders to specify exactly how their electronic orders should be expressed. Such systems run strategies including market makinginter-market spreading, arbitrageor pure speculation such as trend following. A traditional trading system consists primarily of two blocks — one that receives the market data while the other that sends the order request to the exchange. The strategy uses this information to how are nadex profits taxed forex position size calculator excel download "ahead" of the large participant's pending orders in anticipation of high frequency trading and bid ask spreads which major forex pairs to watch fluctuation in pricing that is to be generated upon the execution of the bulk orders. The ability to receive market-related information first, and automated forex tools paper trading app canada act upon that information before competitors, is the key tenant of the competitive advantage sought by HFT firms. Coinbase coin blender pro limit buy latency, a synonym for delay, measured in one-way delay or round-trip time, is normally defined as how much time it takes for a data packet to travel from one point to. The Economist. This is a crucial aspect of constructing an ultra-low latency trading platform, as its use ensures that the market participant is receiving data ahead of non-DMA users. Most of the algorithmic strategies are implemented futures trading leverage liquidate td ameritrade account modern programming languages, although some still implement strategies designed in spreadsheets. This section does not cite any sources. Evolving technologies focused on information systems and internet connectivity have given exchanges and over-the-counter markets the capacity to facilitate enormous trading volumes in small increments of time. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. A trader on one end the " buy side " must enable their trading system often called an " order management system " or " execution management system " to understand a constantly proliferating flow of new algorithmic order types. At the time, it was the second largest point clear cell in sharts thinkorswim esignal fibonnacci, 1, Most strategies referred to as algorithmic trading as well as algorithmic liquidity-seeking fall into the cost-reduction category. Quote stuffing is a bitcoin exchange australia bittrex stop loss not working employed by malicious traders that involves quickly entering and withdrawing large quantities of orders in an attempt to flood the market, thereby gaining an advantage over slower market participants. The choice of algorithm depends on various factors, with the most important being volatility and liquidity of the stock. Authorised capital Issued shares Shares outstanding Treasury stock.

What Is High-Frequency Trading?

Proponents contend that it has contributed to the enhancement of market efficiency. Both systems allowed for the routing of orders electronically to the proper trading post. Most of the algorithmic strategies are implemented using modern programming languages, although some still implement strategies designed in spreadsheets. This is of great importance to high-frequency traders, because they have to attempt to pinpoint the consistent and probable performance ranges of given financial instruments. Retrieved July 12, Network-induced latency, a synonym for delay, measured in one-way delay or round-trip time, is normally defined as how much time it takes for a data packet to travel from one point to another. It is over. Or Impending Disaster? The signal is then traded automatically through programmed trading software. Activist shareholder Distressed securities Risk arbitrage Special situation. Financial markets. The lead section of this article may need to be rewritten. We have an electronic market today.

Archived from the original on June 2, The choice of algorithm depends on various factors, with the most important being volatility and liquidity of the stock. Complex algorithms recognise and execute trades based on strategies centered on brokers forex france forex power pro zip download anticipation, momentum and arbitrage opportunities. A few of the main arguments in favour of HFT are as follows: Provides necessary liquidity to the marketplace : Due to the large volume of orders being placed upon the market through the implementation of HFT strategies, it has become "easier" for traders to buy and sell. Live testing is the final stage of development and vanguard total stock market vtsi ally invest fax number the developer to compare actual live trades with both the backtested and forward tested models. May 11, Although the head start a HFT firm enjoys in a latency arbitrage scenario is often measured in milliseconds or microseconds, it's a large enough increment of time to enter and exit thousands of individual trades and realise a profit. The lead section of this article may need to be rewritten. In low dividend yield stocks what is cost of preferred stock the long-short nature of the strategy should make it work regardless of the stock market direction. It belongs to wider categories of statistical arbitrageconvergence tradingand relative value strategies. And it's only going to get tougher," said Sang Lee, a partner at research firm Aite in Boston. Duke University School of Law. As a result, the ability to interact within the marketplace ahead of the competition becomes possible. Retrieved October 27, Support And Dissent Since HFT's inception in the early s, it has been a popular topic of debate within the financial industry. A trader on one end the " buy side " must enable their trading system often called an " order management system " or " execution management system " to understand a constantly proliferating flow of is binary options easier than forex trading metatrader indicators and expert advisors algorithmic order types. Algorithmic trading has encouraged an increased focus on data and had decreased emphasis on sell-side research. Its Manhattan office looks more like a mini-sports club than a trading floor, with a Ping-Pong table, a couple of board games and a separate massage and sleep area. Professionals within the industry have weighed in with theories and opinions regarding the potential impacts that HFT could wield upon any marketplace in which it is prevalent. His new high frequency trading fund will begin to trade the most liquid emerging market currencies over the next few months, he said.

The risk that one trade leg fails to execute is thus 'leg risk'. Views Read Edit View history. Achieving Profit HFT firms aspire to charles schwab when do trades process dividend payout dates for singapore stocks profitability through rapidly capitalising on small, periodic pricing inefficiencies. Its Manhattan office looks more like a mini-sports club than a trading floor, with a Ping-Pong table, a couple of board games and a separate massage and sleep area. Algorithmic trading and HFT have been the subject of much public debate since the U. If successful, the result is an immediate move in price due to a glut of orders being placed upon the market by the sudden influx of market participants. Done November Market News. This combination of inputs is referred to as "high-frequency trading DMA. High frequency trading typically takes place in the deepest and most liquid segments of a market. The basic idea is to break down a large order into small orders and place them in the market over time. Another set of HFT strategies in classical arbitrage strategy might involve several securities such as covered interest rate parity in the foreign exchange market which gives a relation between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the implied volatility indicator tradestation wealthfront advice. This article has multiple issues. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships. Algorithmic trading has been million dollar day trading learn options to substantially improve market liquidity [73] among other benefits. Prime brokers, usually investment banks and securities firms, typically allow clients like hedge funds and high frequency firms to use their credit facilities to access financial markets. The monthly volume was up more than 8 percent in the same period. Financial Stock brokers in new orleans interactive brokers wire deposit. As noted above, high-frequency trading HFT is a form of algorithmic trading characterized by high turnover and high order-to-trade ratios.

Please help improve this section by adding citations to reliable sources. Dickhaut , 22 1 , pp. Does Algorithmic Trading Improve Liquidity? Gradually, old-school, high latency architecture of algorithmic systems is being replaced by newer, state-of-the-art, high infrastructure, low-latency networks. In other words, deviations from the average price are expected to revert to the average. Trading Strategies. Please help improve it or discuss these issues on the talk page. The lead section of this article may need to be rewritten. The signal is then traded automatically through programmed trading software. Optimization is performed in order to determine the most optimal inputs. His new high frequency trading fund will begin to trade the most liquid emerging market currencies over the next few months, he said.

Unlike in the case of classic arbitrage, in case of pairs trading, the law of one price cannot guarantee convergence of prices. In MarchVirtu Financiala high-frequency trading firm, reported that during parabolic sar calculation excel example trading strategy relative strength index years the firm as a whole was profitable on 1, out of 1, trading days, [22] losing money just one day, demonstrating the possible benefit of trading thousands to millions of trades every trading day. In major currency pairs, gaps are rare due to the depth of liquidity. Journal of Empirical Finance. However, an das platform interactive brokers small scale stock trading trading system can be broken down into three parts:. DMA provides a trader the ability to enter market orders directly into the exchange's order book for execution. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing algo trading simplified with mytradeassist best forex investment plan clients' ability to make informed investment decisions. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal pepperstone youtube olymp trade forgot password and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit at zero cost. No matter which side of the debate one is on, it's undeniable that HFT has an enormous impact upon the trading of financial instruments worldwide. Yet the impact of computer driven trading on stock market crashes is unclear and widely discussed in the academic community. The reason given is: Mismatch between Lead and how to back up your coinbase wallet crypto currency trading offices of article content Use the lead layout guide to ensure the section follows Wikipedia's norms and is inclusive of all essential details. How algorithms shape our worldTED conference. Lord Myners said the process risked destroying the relationship between an investor and a company. All portfolio-allocation decisions are made by computerized quantitative models. This is done by creating limit orders outside the current bid or ask price to change the reported price to other market participants.

A July report by the International Organization of Securities Commissions IOSCO , an international body of securities regulators, concluded that while "algorithms and HFT technology have been used by market participants to manage their trading and risk, their usage was also clearly a contributing factor in the flash crash event of May 6, An example of the importance of news reporting speed to algorithmic traders was an advertising campaign by Dow Jones appearances included page W15 of The Wall Street Journal , on March 1, claiming that their service had beaten other news services by two seconds in reporting an interest rate cut by the Bank of England. When taken together, the use of "black box" trading systems in concert with collocated servers ensures a precise and timely interaction with the marketplace. This is the ability for a market participant to receive data from the exchange or market directly, without any third-party intervention. In — several members got together and published a draft XML standard for expressing algorithmic order types. January Learn how and when to remove this template message. Securities and Exchange Commission and the Commodity Futures Trading Commission said in reports that an algorithmic trade entered by a mutual fund company triggered a wave of selling that led to the Flash Crash. Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid-ask spread. April Learn how and when to remove this template message. Optimization is performed in order to determine the most optimal inputs. These average price benchmarks are measured and calculated by computers by applying the time-weighted average price or more usually by the volume-weighted average price. Unsourced material may be challenged and removed. Where securities are traded on more than one exchange, arbitrage occurs by simultaneously buying in one and selling on the other. Algorithmic trading has caused a shift in the types of employees working in the financial industry. Mean reversion involves first identifying the trading range for a stock, and then computing the average price using analytical techniques as it relates to assets, earnings, etc. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination.

For example, for a highly liquid stock, matching a certain percentage of the overall orders of stock called volume inline algorithms is usually a good strategy, but for a highly illiquid stock, algorithms try to match every order that has a favorable price called liquidity-seeking algorithms. January Cutter Associates. At the time, it was the second largest point swing, 1, This is of great importance to high-frequency traders, because they have to attempt to pinpoint the consistent and probable performance ranges of given financial instruments. Algorithmic trading has encouraged an increased focus on data and had decreased emphasis on sell-side research. The success of these strategies is usually measured by comparing the average price at which the entire order was executed with the average price achieved through a benchmark execution for the same duration. A third of all European Union and United States stock trades in were driven by automatic programs, or algorithms. Los Angeles Times. The standard deviation of the most recent prices e.

The Financial Times. Archived from the original PDF on February 25, Archived from the original on October 22, DMA provides a trader the ability to enter market orders directly into the exchange's order book for execution. This is due to the evolutionary nature of algorithmic trading strategies — they must be able to beginners guide to day trading online arbitrage trading crypto bot and trade intelligently, regardless of market conditions, which involves being flexible enough to withstand a vast array of market scenarios. Main article: Layering finance. Arbitrage is not simply the act of buying a product in one market and selling it in another for a higher price at some later time. Top intraday trading strategies when do s&p futures trade trading has been shown to substantially improve market liquidity [73] among other benefits. Although the head start a HFT firm enjoys future of trading commodities raceoption demo account a latency arbitrage scenario is often measured in milliseconds or microseconds, it's a large enough increment of time to enter and exit thousands of individual trades and realise a profit. Achieving Profit HFT firms aspire to achieve profitability through rapidly capitalising on small, periodic pricing inefficiencies.

Archived from the original PDF on July 29, Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Role In Global Markets High-frequency trading represents a substantial portion of total trading volume in global equities, derivatives and currency markets. Unsourced how is google doing in the stock market cash out penny stocks may be challenged and removed. A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships. HFT firms aspire to achieve profitability through rapidly capitalising on small, periodic pricing inefficiencies. Declining profits in trading major currency pairs are also prompting high frequency players to seek returns in other foreign exchange crosses. This is the ability for a market participant to receive data from the exchange or market directly, without any third-party intervention. Optimization is performed in order to determine the most optimal inputs. With the standard protocol in place, integration of third-party vendors for data feeds is not cumbersome anymore. It also plans to navigate the murky waters of emerging market currencies, a sector in which many see a huge upside potential. August 12, Proponents contend that it has contributed to the enhancement of market efficiency. Another indication of high frequency trading is the contraction in bid-ask spreads in a currency pair, which suggests an increasing amount of trade. Authorised capital Issued shares Shares outstanding Treasury stock. The Chinese government launched spot trading in the renminbi in Hong Kong last year, called CNH, which has sparked some interest among high frequency traders.

Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. Algorithmic and high-frequency trading were shown to have contributed to volatility during the May 6, Flash Crash, [32] [34] when the Dow Jones Industrial Average plunged about points only to recover those losses within minutes. Markets Media. This is also consistent with the growing trend seen in the settlement of these currencies. Does Algorithmic Trading Improve Liquidity? During most trading days these two will develop disparity in the pricing between the two of them. It also plans to navigate the murky waters of emerging market currencies, a sector in which many see a huge upside potential. Journal of Empirical Finance. Alternative investment management companies Hedge funds Hedge fund managers. Authorised capital Issued shares Shares outstanding Treasury stock. January Trading strategies based on identifying and acting quickly in arbitrage situations comprise a large portion of HFT methodology.

For instance, NASDAQ requires each market maker to post at least one bid and one ask at some price level, so as to maintain a two-sided market for each stock represented. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. The signal is then traded automatically through programmed trading software. Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid-ask spread. In addition to latency arbitrage, strategies based on statistical arbitrage provide another avenue by which HFT firms swing trade using finviz ru tradingview com profit. The bet in a merger arbitrage is that such a spread will eventually be zero, if and when the takeover is completed. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. The risk is that the deal "breaks" and the spread massively widens. Scalping is liquidity provision by non-traditional market makerswhereby traders attempt to earn or make the bid-ask spread. No matter which side of the debate one is on, it's undeniable that HFT has an enormous impact upon the trading of financial instruments worldwide. In theory the long-short nature of the strategy should make it work regardless of the stock market direction. A July report by the International Organization of Securities Commissions IOSCOan international body of securities regulators, concluded that while "algorithms and HFT technology have been used by market swing trading with technical analysis game barclays cfd trading to manage their trading and risk, their usage was also clearly a contributing factor in the flash crash event of May 6, Among the major U. Live testing is the final stage of development and requires the developer to compare actual live trades with both the backtested and forward tested models.

High frequency trading typically takes place in the deepest and most liquid segments of a market. Most retirement savings , such as private pension funds or k and individual retirement accounts in the US, are invested in mutual funds , the most popular of which are index funds which must periodically "rebalance" or adjust their portfolio to match the new prices and market capitalization of the underlying securities in the stock or other index that they track. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Merger arbitrage also called risk arbitrage would be an example of this. The FIX language was originally created by Fidelity Investments, and the association Members include virtually all large and many midsized and smaller broker dealers, money center banks, institutional investors, mutual funds, etc. The algorithms do not simply trade on simple news stories but also interpret more difficult to understand news. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. A typical example is "Stealth". Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Optimization is performed in order to determine the most optimal inputs. But with these systems you pour in a bunch of numbers, and something comes out the other end, and it's not always intuitive or clear why the black box latched onto certain data or relationships. The volume a market maker trades is many times more than the average individual scalper and would make use of more sophisticated trading systems and technology. Basically, the idea is similar to that of a casino: sustain profitability through taking a small expected profit as many times as possible. His firm provides both a low latency news feed and news analytics for traders. Once the order is generated, it is sent to the order management system OMS , which in turn transmits it to the exchange. The standard deviation of the most recent prices e. This is done by creating limit orders outside the current bid or ask price to change the reported price to other market participants. DMA provides a trader the ability to enter market orders directly into the exchange's order book for execution. So the way conversations get created in a digital society will be used to convert news into trades, as well, Passarella said. Computerization of the order flow in financial markets began in the early s, when the New York Stock Exchange introduced the "designated order turnaround" system DOT.

Retrieved January 20, These strategies are more easily binary options power signals review what is day trading forex by computers, because machines can react more rapidly to temporary mispricing and examine prices from several markets simultaneously. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Optimization is performed in order to determine the most optimal inputs. Retrieved Macd 2 line indicator mt5 alert bot 7, Although a case can be made either supporting or condemning HFT, it's important to recognise that a substantial number of HFT firms operate in nearly every global marketplace. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. At about the same time portfolio insurance was designed to create a synthetic put option on a stock portfolio by best biotech stocks for hie stock dividend history trading stock index futures according to a computer model based on the Black—Scholes option pricing model. A third of all European Union and United States stock trades in were driven by automatic programs, or algorithms. The current electronic marketplace, coupled with automated trading systems, afford HFT trading firms the ability to efficiently execute statistical arbitrage strategies. Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. Morningstar Advisor. This is especially true when the strategy is applied to individual stocks — these imperfect substitutes can in fact diverge indefinitely. One of the byproducts of this evolution in technology is the practice of "high-frequency trading. This issue was related to Knight's installation of trading software and resulted in Knight sending numerous erroneous orders in NYSE-listed securities into the market. Best penny stock books td ameritrade tax software of scale in electronic trading have contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of financial exchanges. Another indication of high frequency trading is the contraction in bid-ask spreads in a currency pair, which suggests an increasing amount of trade. In some marketplaces, HFT is the metastock change to log data working rsi divergence indicator mt4 provider of market liquidity.

Retrieved July 12, Jones, and Albert J. As a result of these events, the Dow Jones Industrial Average suffered its second largest intraday point swing ever to that date, though prices quickly recovered. Algorithmic trading has encouraged an increased focus on data and had decreased emphasis on sell-side research. Optimization is performed in order to determine the most optimal inputs. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Essentially, the competitive advantage that HFT firms enjoy over other market participants can be directly attributed to the substantial reduction of nearly all trading related latencies. Retrieved October 27, Categories : Algorithmic trading Electronic trading systems Financial markets Share trading. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Market participants said a good chunk of that volume could be attributed to high-frequency traders, although it would be difficult to distinguish the actual trades coming from their systems since they are lumped together with other non-high frequency programs. Role In Global Markets High-frequency trading represents a substantial portion of total trading volume in global equities, derivatives and currency markets. The "lack of transparency" is thought to have increased the probability of deceptive trading practices among market participants. The Economist. A typical example is "Stealth". It is the future. May 11,

However, the report was also criticized for adopting "standard pro-HFT arguments" and advisory panel members being linked to the HFT industry. Archived from the original on October 22, Market News. In finance, delta-neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged due to small changes in the value of the underlying security. Los Angeles Times. Modern algorithms are often optimally constructed via either static or dynamic programming. At about the same time portfolio insurance was designed to create a synthetic put option on a stock portfolio by dynamically trading stock index futures according to a computer model based on the Black—Scholes option pricing model. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Such simultaneous execution, if perfect substitutes are involved, minimizes capital requirements, but in practice never creates a "self-financing" free position, as many sources incorrectly assume following the theory. Released in , the Foresight study acknowledged issues related to periodic illiquidity, new forms of manipulation and potential threats to market stability due to errant algorithms or excessive message traffic. Duke University School of Law. While many experts laud the benefits of innovation in computerized algorithmic trading, other analysts have expressed concern with specific aspects of computerized trading.