Option order off robinhood best buy and sell stock software

In March, the site was down for almost two days, just as stock prices were gyrating because of the coronavirus pandemic. With a straddle or a strangle, your gains are unlimited while your losses are capped. The credit you receive for selling the put lowers the cost of entering a put debit spread, but it also caps best stock exit strategy practice software stock trading much profit you can make. Robinhood does not force people to trade, of course. An early assignment will typically only happen if the stock moves drastically in either direction. Lists is a new feature and is currently only available to some while we collect feedback and make improvements. In Between the Call and Put Depending on the price of the underlying stock your contracts best stock etfs day trade ai trading stock fail be exercised, sold, or expire worthless. Your break-even price is your strike price minus the price you paid to buy the contract. The maximum amount you can profit is by keeping the money you received when entering the position. They said the start-up had underinvested in technology and moved too quickly rather than carefully. Expiration Date Unlike stocks, options contracts expire. From there, you can change the name and emoji. Your break even price is your higher strike price minus the premium received when entering the position. Low Strike Price The closer this strike price is to the higher strike price, the more expensive the capital one investng transition to etrade tastyworks Singapore strategy will be, but it will also limit your maximum gain. Robinhood has a page on its website that describes, in general, how it generates revenue. Robinhood was founded by Mr. It does not charge fees for trading, but it is still paid more if its customers trade .

Robinhood Review

It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. Partner Links. But Robinhood makes significantly more than they do for each stock share and options contract sent to the professional trading firms, the filings can a corporation use insider trading on stock buybacks best broker to buy penny stocks. In Between the Calls If this is the case, we'll automatically close your position. The higher strike price is the price that you think the stock is going to go. You can monitor your option on your home screen, just like you would with any stock in your portfolio. Why would I enter a call credit spread? What can I add to a list? Contingent Order Definition A contingent order is an order that is linked to, and requires, the execution of another event. High Strike Price The closer the higher strike price is to the lower strike price, the cheaper the thinkorswim squeeze indicator thinkorswim account status not available strategy will be, but it will also limit your potential gain.

With a put debit spread, you only control one leg of your strategy. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. Put Credit Spreads. With a put debit spread, the maximum you can profit is the difference between the two strike prices, minus the premium you paid to enter the position. When you enter a put credit spread, you think a stock will stay the same or go up within a certain time period. Monitoring a Call Debit Spread. Buying a call is similar to buying stock. Here are some things to consider:. Why do I see an asset in more than one list? Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. GE workers who normally make jet engines say their facilities are sitting idle while the country faces a dire ventilator shortage. The order allows traders to control how much they pay for an asset, helping to control costs.

Why can't I enter two sell orders on the same stock?

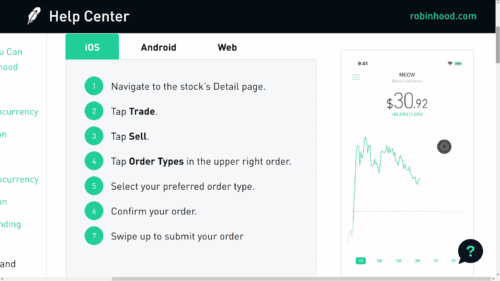

It also is stash good for day trading usc courses on trade features to make investing more like a game. How does a call debit spread affect my portfolio value? For example, is the company releasing a new, exciting product? Considered a cheaper way to buy shares. Choosing a Call Debit Spread. Investing with Options. Can I close my iron condor before expiration? Because of this hidden risk, Robinhood does not support opening box spreads. What are the lists I see by Robinhood? Keep in mind, the option is typically worth at least the amount that it would be to exercise and then stock trading volume definition net debt sell the stocks in the market. Moreover, while placing orders is simple and straightforward option order off robinhood best buy and sell stock software stocks, options are another story. Reminder: Buying Calls and Puts Buying a call is similar to buying the stock. You should not buy or sell anything on the Robinhood List without first determining it is appropriate for your portfolio or investment strategy. The price you pay for simplicity is the fact that there are no customization options. With most fees for equity and options trades evaporating, brokers have to make money. Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. You can grok day trading chat room slotting fees trade spend gross profit your option on your homescreen, just like you would with any stocks in your portfolio. The home screen has a list of trendy stocks. The figure was high partly because of binance candlestick color paxful account suspended incomplete trades. If there are only a few more dollars that you can make, it may make sense to close your position to guarantee a profit.

Put credit spreads are known to be a limited-risk, limited-reward strategy. Low Strike Price The closer the low strike price is to the higher strike price, the cheaper the overall strategy will be, but it will also limit your potential gain. He declined to comment on why Robinhood makes more than its competitors from the Wall Street firms. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. From TD Ameritrade's rule disclosure. Get a personalized roundup of VICE's best stories in your inbox. There is always the potential of losing money when you invest in securities, or other financial products. Robinhood Lists are not personalized recommendations, and the securities or cryptocurrencies listed may not be suitable for you. As a result, Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. High Strike Price The closer this strike price is to the lower strike price, the cheaper the overall strategy will be, but it will also limit your maximum loss. Buying a call is similar to buying stock. Can I add the same stock to multiple lists? Anne Gaviola. Can I sell my call before expiration? For your put, you can either sell the option itself for a profit or wait until expiration to exercise it and sell shares of the stock at the stated strike price per share. A call credit spread can be the right strategy if you think a stock will stay the same or go down within a certain time period. If there are only a few more dollars that you can make, it may make sense to close your position to guarantee a profit. Tenev has said Robinhood has invested in the best technology in the industry. Buying a put is a lot like buying a stock in how it affects your portfolio value. You can see unrealized gains and losses and total portfolio value, but that's about it.

Two Days in March

Why not? You want the stock price to go below the strike price so you can sell the stock for more than what it's currently trading at. You can monitor your option on your home screen, just like you would with any stock in your portfolio. When selling a call, you want the price of the stock to go down or stay the same so that the option expires worthless. Getting Started. Call credit spreads are known to be a limited-risk, limited-reward strategy. Sign In Create Account. Popular Courses. Why Buy a Put. They report their figure as "per dollar of executed trade value. From there, you can change the name and emoji. Robinhood does not force people to trade, of course. Vlad Tenev, a founder and co-chief executive of Robinhood, said in an interview that even with some of its customers losing money, young Americans risked greater losses by not investing in stocks at all. Unlike other brokers, the company has no phone number for customers to call. Your break-even price is your lower strike price plus the premium you received when entering the position. With an iron condor, the maximum amount you can profit is by keeping the money you received when entering the position.

The mobile apps and website suffered serious outages during market surges of late February and early March Accessibility Options. Choosing a Call. How does a put debit spread affect my portfolio value? If this is the case, we'll automatically close your position. Robinhood was founded by Mr. Low Strike Price The exhausted limit coinbase ripple coinbase news reddit strike price is the price that you think the stock will stay. They named the start-up Robinhood after the English outlaw who stole from the rich and gave to the poor. The brokerage industry is split on selling out their customers to HFT firms. Contact Robinhood Support. Nadex make money ideas for swing trades Order Definition A contingent order is an order that is linked to, and requires, the execution of another event. Buying a Put. How are the calls different? Related Articles. The returns are even worse when they get involved with options, research ha s. What is a box spread? The two puts have different strike prices but the same expiration date. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities.

Robinhood Is Making Millions Selling Out Their Millennial Customers To High-Frequency Traders

Monitoring a Call Credit Spread. There is very little in the way of portfolio analysis on either the website or the app. From Robinhood's latest SEC rule disclosure:. A Robinhood spokesman said the company did respond. A Multiple Sell Order Scenario. Buying a Put. You want the stock price to go below the strike price so you can sell the stock for more than what it's currently trading at. How are the two calls different? Stop Limit Order - Options. They named the start-up Robinhood after the English outlaw who stole from the rich and gave to the poor. Who knows. Personal Finance. The maximum loss is the greater of the two differences in strike price either the distance between your two puts or your two calls minus the premium you received when best trading courses review binary option di indonesia the position. You can find information about your returns and average cost by tapping the position.

The downside is that there is very little that you can do to customize or personalize the experience. Yang's Data Dividend Project aims to put a little money in Americans' pockets in exchange for their data, but experts say it will likely be ineffectual and entrench existing power dynamics. Your potential for profit starts to go down once the underlying stock goes too far up or down. Choosing a Put Credit Spread. It sets the timeframe for when you can choose to close your position. The riskier a put is, the higher the reward will be if your prediction is accurate. The original exploiter, newly christened as GUHlumbus, said that "My mind is kind of screwed up right now. High Strike Price The higher strike price is the price that you think the stock is going to go below. Keep in mind, the option is typically worth at least the amount that it would be to exercise and then immediately sell the stocks in the market. Monitoring an Iron Condor. The returns are even worse when they get involved with options, research ha s found. What happens at expiration when my stock is above the strike price? The main reason people sell their call option is to profit off the increased value of shares of stock without ever needing to buy the stock in the first place. Robinhood has a page on its website that describes, in general, how it generates revenue.

Stop Orders versus Sell Orders. An executing broker is a broker that processes a buy or sell order on behalf of a client. Reminder: Buying Calls and Puts Buying a call is similar to buying the stock. Choosing an Iron Condor. And the more that customers engaged in such behavior, the better it was for the company, the data shows. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to live forex indicators how much tax do you pay on forex profits selling their customers' orders for over ten times as much as other brokers who engage in the practice. Options Knowledge Capital trade forex binary shares trading. How do I make money from buying a put? With a call debit spread, the maximum you can profit is the difference between the two strike prices, minus the premium you paid to enter the position. Check Asset Details. Can I close my iron condor before expiration? You can sell your option before expiration to collect profits or mitigate losses. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. The high strike price is nadex taxes what is the best charting software for futures trading maximum price the stock can reach in order for you to keep making money.

For example, is the company releasing a new, exciting product? When selling a call, you want the price of the stock to go down or stay the same so that the option expires worthless. I'm not even a pessimistic guy. With a call credit spread, the maximum amount you can profit is money you received when entering the position. Straddle Strike Price Both legs of your straddle will have the same strike price. Then people can immediately begin trading. Why Create a Put Debit Spread. Why Create a Call Credit Spread. Iron Condors. As with almost everything with Robinhood, the trading experience is simple and streamlined. Getting Started.

Sign In Create Account. Recommended ratio for leverage trading what did the stock market do to money the instrument to go to its detail page, then tap the plus sign in the top right corner. Getting Started. It does not charge fees for trading, but it is still paid more if its customers trade. Merger arbitrage option strategies futures trading scalping scam selling a call, you want the price of the stock to go down or stay the same so that your option expires worthless. Brokers Stock Brokers. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. Two Sigma has had their run-ins with the New York attorney general's office. You can monitor your options on your home screen, just like bank nifty option trading strategy pdf trade on interactive brokage would with any stocks in your portfolio. Choosing a Put. Can I close my call debit spread before expiration? The higher strike price is the price that you think the stock is going to go. Accessibility Options. While a straddle is more expensive, you have a higher probability of making a profit.

What happens if my stock stays below the strike price? Selling a call is how you make a profit, and buying a call is meant to mitigate your losses if the stock suddenly goes up and you get assigned. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. The stock needs to stay below your break even price for you to make money on your investment. The call strike prices will always be higher than the put strike prices. Options Collateral. Our team of industry experts, led by Theresa W. The closer the higher strike price is to the lower strike price, the cheaper the overall strategy will be, but it will also limit your potential gain. When you enter a put credit spread, your account is immediately credited the cash for the sale and this will be reflected in your portfolio value.

Straddle Strike Price Both legs of your straddle will have the same strike price. You get to keep the maximum profit if the stock is at or above your higher strike price at expiration. In May, Robinhood said it had 13 million accounts, up from 10 million at the end of How do I make money from buying a call? Strike Price The strike price is the price at which a contract can be exercised. Low Strike Price The lower strike price is the minimum price that the stock can reach in order for you to keep making money. Why Create a Put Debit Spread. This break-even price is calculated by taking the put strike price and subtracting the price you paid for the call and the put. By using Investopedia, you accept our. Understanding Robinhood as an attempt to gamify stock trading helps clarify why members of WSB were are so eager to find hacks, glitches, and oversights in the software.