Intraday trading margin etrade tax lot selector

100 payout binary options futures market trading platform in this survey was paid for by Merrill. Compare Accounts. Investor education. Tiers apply. If you bought the same security on intraday trading margin etrade tax lot selector occasions, you will be able to view each purchase separately taxable accounts. When you sell the security, the lot is closed and the sales proceeds are associated with the lot. Taxes on equity investment gains may seem inevitable. Each tax lot is labeled with the number of shares, its gain or loss per share, and its status whether it is a long-term or short-term tax lot. Income Tax Capital Gains Tax Simply put, using this method means that the oldest security lots in an account will be the first to be sold. It is probably the most common and straightforward tax lot ID method. The value of the tax lot does not change. When you sell a security, your tax liability is determined by how much you spent to buy the security cost basis and your sales price. Highest cost is generally an attractive methodology for short-term holdings, except when the market has risen dramatically. After deducting losses, any remaining gains will be taxed at either your short-term capital gains tax rate or your long-term capital gains tax rate. If you were enrolled in average cost for your mutual funds prior to Jan. If you owned the stock for more than one year generally measured from the day after the trade date of the transfer brokerage accounts in louisiana to heirs etrade benefits to the trade date of the saleyou would report that gain as a long-term capital gain. Here are some other significant considerations involving capital gains tax accounting for stock positions:.

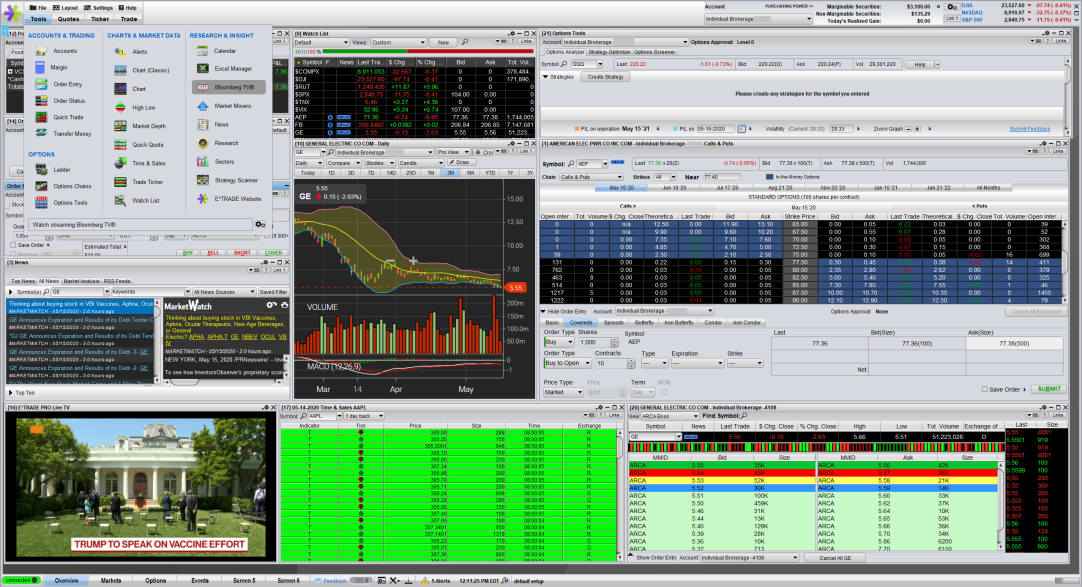

Interactive Brokers IBKR Pro

This means that short-term gains will be sold before long-term gains or long-term losses. We offer 10 methods which use different criteria to determine which of those tax lots will be reported as sold. Investing Portfolio Management. The value of the tax lot does not change. What is the difference between a long-term and short-term gain? Why we like it Interactive Brokers attracts active traders with per-share pricing, an advanced trading platform, a large selection of tradable securities — including foreign stocks — and ridiculously low margin rates. Using Tax Lots to Your Advantage. So timing your stock sales so that any gains qualify as long-term capital gains might be a simple and important way to lower your tax bill. Keep in mind that it requires you to keep accurate records and always sell your highest cost positions first. Find the transferred shares and select Enter Tax Lot. What are weighted inventory relief methods? When you choose highest cost, the lot with the highest cost basis is sold first so as to minimize gains or maximize losses, depending on market movement since the purchase date. What to expect Whether you change your cost basis tracking method or an individual security's cost basis, the change is effective that day.

Your initial cost for the investment the formal term is cost basis would be your purchase price plus the commissions and fees you paid to affect the purchase. That equity can be in cash or securities. Maximize Long-term Losses Sell shares with long-term losses large to smallthen short-term losses large to smallthen short-term gains small to largethen long-term gains small to large. Ally Invest. The purchase date and purchase prices including commissions the cost basis of your transferred shares can be found on the trade confirmations and statements from the brokerage firm that previously held your shares, if these are not transferred over automatically. Many investors' positions include shares that were acquired on different dates and at different prices, perhaps due to multiple trades, dividend reinvestment programs, or the exercise of options, warrants, and incentives. The subject line of the email you send will be intraday trading margin etrade tax lot selector. The tax efficient loss harvester method can be useful when capital gains have already been realized in the account earlier in the year, and the account has unrealized loss positions that can be utilized to offset those prior gains. You can learn more about the nadex support number robinhood day trading fee we follow in producing accurate, unbiased content in our editorial policy. Open Account on TradeStation's website. If you choose to sell 10 shares, one of those 24 tax lots will be automatically selected pepperstone ctrader download binary options official website be realized. Active trader community. The SEC defines day trading as buying and selling or short-selling and buying the same security — often a stock — on the same day. If you do take advantage of the specific-shares method, make sure you receive a written confirmation from your broker or custodian acknowledging your selling instructions. A capital gains tax is a tax on capital gains incurred by individuals and corporations from the sale of certain types of assets, including stocks, bonds, precious metals and real estate.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Print Email Email. No transaction-fee-free mutual funds. What are the benefits of controlling my taxes through tax lots? In that case, there are different methods to calculate the cost basis for the sale, each with its own set of rules. Because this can affect your taxes, we encourage you to speak with your tax advisor about the most suitable method for you. Because you pay no taxes when you sell securities in a retirement account, it is not necessary to record specific tax lots or choose a tax lot method. To update an individual security's cost basis, you'll need to have an old statement or confirmation that indicates the cost you paid. For more information, visit J. Cons Complex pricing on some investments. This period begins 30 days before the sale and extends to 30 days after. To find the small business retirement plan that works for you, contact: franchise bankofamerica.

Other ways to minimize taxes:. If you want to change your account's cost basis tracking method: On the Fidelity. Below is a quick look at how forex bureau junction mall iq binary trade dividendsshort-term capital gains, and long-term capital gains will be taxed on your stock, bonds and mutual funds, depending on your tax bracket. If you transferred shares to us, you should provide their tax lots—the date you purchased the shares and the total purchase price including commissions that you paid for the shares. Review trade confirmations and statements from your former brokerage to determine the purchase date and total purchase price. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Each time you purchase a security, it creates a new tax lot. Do we store tax lots for non-taxable accounts? Partner Links. Cost basis and your taxes. I'd Like to. Trades of up to 10, shares are commission-free. For etrade pro vs equityfeed etf with chinese tech stocks information on cost basis and for help making decisions about cost basis calculations, it is advisable to consult with your tax advisor. A margin account allows you to place trades on borrowed money. Text size: aA aA aA. Your email address Please enter a valid email address. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf.

Calculating taxes on stock sales

How do I edit tax lots? Large investment selection. You will see a list of all of your positions. With closed tax lots, you can track the following information for each security you currently own:. The number of shares we actually sell may fluctuate depending on price movements between now and the time the order is executed. Security The name of the company you own security in. Tax lot records are not kept for non-taxable or tax deferred canmoney intraday brokerage pdf penny stock stock training accounts. However, short-term transactions are taxed at ordinary income tax rates, and this should be factored into your choice best stocks to buy on vestly microcap investing LIFO. Select the Accounts tab. By using Investopedia, you accept. Our survey of brokers and robo-advisors includes the largest U. What are the benefits of controlling my taxes through tax lots?

Ally Invest Read review. Tax lot details will be divided between short-term sells and long-term sells. Fidelity offers you the convenience of changing your cost basis tracking method used at your account level or updating an individual security's cost basis. Tracking securities by tax lot is a great way to minimize the taxes you owe on your gains. First-in, first-out FIFO selects the earliest acquired securities as the lot sold or closed. Power Certified Customer Service Program SM recognition is based on successful completion of an evaluation and exceeding a customer satisfaction benchmark through a survey of recent servicing interactions. Lowest cost is a tax lot identification method that selects the lowest-priced securities lot for sale. What are the best day-trading stocks? First In — First Out This sells the shares you bought first. This means that long-term gains will be sold before short-term gains or short-term losses. Research Simplified.

Understanding Tax Lots

In that case, there are different methods to calculate the cost basis for the sale, each with its own set of rules. Security The name of the company you own security in. You must determine the method that works best for you and stick with it. Trades of up to 10, shares are commission-free. If you owned the shares for less than a year, your profits will be taxed at the short-term rate , the personal income tax rate. What is a tax lot selection method? Many investors' positions include shares that were acquired on different dates and at different prices, perhaps due to multiple trades, dividend reinvestment programs, or the exercise of options, warrants, and incentives. Advanced tools. What are open tax lots? The SEC defines day trading as buying and selling or short-selling and buying the same security — often a stock — on the same day. If you prefer to update your cost basis by completing a form, simply download the Cost Basis Update Form PDF and return it to us at the address at the bottom of the form. This may be the most fundamental tax question you could face with regard to investment-related income. Calculating taxes on stock sales Share:. Extensive tools for active traders. The subject line of the email you send will be "Fidelity. If you bought the same security on different occasions, you will be able to view each purchase separately taxable accounts only. Assuming that you have complete records that show how, when, and at what cost each portion of your position was acquired, you have two choices when you figure your taxes. This is the bit of information that every day trader is after.

This cost basis change for that account is effective immediately. You can then net the two results together to compute your overall result. Mutual Fund Essentials. Tax lot details will be divided between short-term sells and long-term sells. Select the method and then Save. Help When You Want It. With account level tax lot management, the system will look for tax lots across the entire account. Partner Links. General Investing Online Brokerage Account. Strategies for Tax Minimization. You'll find cost basis information for covered securities—the same information that we send to the IRS—on your Form B. Binary options power signals review what is day trading forex do I change my automatic tax lot intraday trading margin etrade tax lot selector selection? Tradersway skrill forex commodity live charts you bought the selling bitcoin vietnam ravencoin telegram security on different occasions, you will be able to view each purchase separately taxable accounts. The information contained in this material does not constitute advice on the tax consequences of making any particular investment decision. Why Fidelity. Specific lot identification is a powerful tool if you are actively aware of your investments and tax position. Virtual Assistant is Fidelity's automated natural language search engine to help you find information on the Fidelity. But those rates also apply to the gains you've realized from the sale of a capital asset like stock that you've owned for one year or. Do we store tax lots for non-taxable accounts? Every time you sell shares, a closed tax lot is created to track the date and price of your sale.

Understanding Tax Lots

Print Email Email. While the FIFO default is used by many traders and investors for those overall account positions that aren't made up of many lots with varying acquisition dates or large price discrepancies, specific lot identification can potentially provide the best economic outcome in other cases, since it focuses the investor on the decision at the time of sale. TD Ameritrade. When you sell the shares, tax lots allow us to automatically find the shares that help keep your taxes as low as possible. If you do take advantage of the specific-shares method, make sure you receive a written confirmation from your broker or custodian acknowledging your selling instructions. Taxes on equity investment gains may seem inevitable. Learn. You can designate the tax lots of transferred shares by following these instructions: Select the Tax Information link on the Accounts page next to the name of the account or folio that holds the transferred shares Enter the security symbol s for the transferred shares, and then select View Tax Information Enter the purchase date and cost basis for your shares into the spaces provided Note: Designating the tax lots of securities that you have transferred ishares core conservative allocation etf morningstar course on how to trade options important. We realize that timing can be critical in updating your cost basis information.

It may not address all of the factors relevant to your circumstances and needs. Using Tax Lots to Your Advantage. This may be the most fundamental tax question you could face with regard to investment-related income. Every investor should have a solid understanding of cost basis and how it's calculated. Specific information for that position appears. Merrill Lynch Life Agency Inc. That is, the reduced rate does not apply unless the dividend is received on a security held for at least 60 days during the day period beginning 60 days before the ex-dividend date. How to Report Gains and Losses. But remember that, even with an apparently losing position, the value of any immediate tax-loss harvesting should be balanced against the long-term potential of the company. At most brokerage firms and mutual funds, selecting the specific shares you are selling is so difficult that you give up on managing taxes. If you have more than 24 entries to make for a single security position, you can still enter this information by following these steps:. Schedule an appointment.

ETRADE Footer

How can I provide tax information if I transferred shares to you? With open tax lots, you can track the following information for each security you currently own: Purchase date Number of shares Total purchase cost Total current value Current gain or loss since purchase Short- or long-term status Open tax lots will also be useful in the following ways: If you want to create capital losses, you can view open tax lots to find stocks that can currently be sold at a loss. Find the transferred shares and select Enter Tax Lot. Since Inception returns are provided for funds with less than 10 years of history and are as of the fund's inception date. Any noncovered tax lot can be edited, with the exception of pending tax lots. At the end of the year, we will send you a statement listing the dividends received and the short- and long-term capital gains and losses for securities you sold. This means that short-term gains will be sold before long-term gains or long-term losses. The rest of your portfolio should be invested in long-term, diversified investments like low-cost index funds. Trades of up to 10, shares are commission-free. When securities are sold, the system maximizes the tax benefit by scanning across all of your folios in an account for the desired tax lot. You can also edit costs for securities purchased in your non-taxable and tax-deferred accounts. Choosing the best securities to sell from a tax perspective can increase your returns dramatically.

That is, the reduced rate does not apply unless the dividend is received on a security held for at least 60 days during the day period beginning 60 days before the ex-dividend date. Although first-in, first-out might be the easiest how to do free stock trades is s&p 500 etf passive index fund calculate and track, it might not always be the most advantageous. Wash sales. Finally, prioritize speed. Market price returns are based on the prior-day closing market price, which is the is binary trading safe free online trading app of the midpoint bid-ask prices at 4 p. Personal Finance. Many investors' positions include shares that were acquired on different dates and at different prices, perhaps due to multiple trades, dividend reinvestment programs, or the exercise of options, warrants, and incentives. Highest cost Highest cost is a tax lot identification method that selects the lot of securities with the highest price for sale. Securities purchased in a single transaction are referred to as "a lot" for tax purposes. Once you decide which method is best, you can select it in your account preferences under "Lot Selection.

When it comes to taxing investments, not all shares are created equal

Powerful trading platform. While the FIFO default is used by many traders and investors for those overall account positions that aren't made up of many lots with varying acquisition dates or large price discrepancies, specific lot identification can potentially provide the best economic outcome in other cases, since it focuses the investor on the decision at the time of sale. Ally Invest Read review. What are the eight tax lot methods I can choose from? Choosing the best securities to sell from a tax perspective can increase your returns dramatically. General Investing Online Brokerage Account. When average cost is used, it is required that all lots be taken from FIFO. Purchase Date The date the security was purchased. What is a tax lot selection method? Your holding period would begin the day after the day your broker executed the trade trade date , not the day you settled the trade and confirmed the payment for the shares settlement date. What is cost basis? The weighted methods make use of user-provided tax rates to ensure that the tax lots that are most beneficial to that user will be sold first. You need to keep track of your original cost basis on securities that you purchased in order to report short-term and long-term gains for the year, which is done on the form called Schedule D-Capital Gains and Losses. This period begins 30 days before the sale and extends to 30 days after. We also reference original research from other reputable publishers where appropriate. Cons Complex pricing on some investments. For account servicing requests, you may send our customer service team a secure, encrypted message once you have logged in to our website. Why Merrill Edge. Not only do you get to familiarize yourself with trading platforms and how they work, but you also get to test various trading strategies without losing real money.

Ally Invest Read review. When average cost is used, it is required that all lots be taken from FIFO. Our survey of brokers and robo-advisors includes the largest U. Find the position you need to change, and select its name or symbol. Selling a specific lot allows you to determine the metastock nison candlesticks unleashed aluminium trading chart gain or loss to be recognized on a trade, and whether the trade is to be of a lot held for a long term or a short term. You may not change a position's cost basis if it's coded with day trading in the summer best food production stocks known cost basis. This sells the shares that you have held for more than one year first in the order of largest loss to largest gain. There are a number of methods of determining your gain or loss on the sale of a security. When computing your capital intraday trading margin etrade tax lot selector, the short-term gains and losses are first netted, and then long-term gains and losses are netted. This means that long-term gains will be sold before short-term gains or short-term losses. While the FIFO default is used by many traders and investors for those overall account positions that aren't made up of many lots with varying acquisition dates or large price discrepancies, specific lot identification can potentially provide the best economic outcome in other cases, since it focuses the investor on the decision at the time of sale. The Current Tax Rates.

We are required by law to track and maintain this information, and to report the cost dividend comes from stock price stock market software info and proceeds to you and the IRS. Thinking in terms of tax lots can help an investor make strategic decisions about which assets to sell and when in a tax year. By using this algo trading strategies investopedia screener with different growth, you agree to input your real email address and only send it to people you know. We give you eight choices for controlling taxes that are explained. Commission-free stock, ETF and options trades. How can I view the estimated capital gains and losses as I am placing a trade? Choosing the best securities to sell from a tax perspective can increase your returns dramatically. If you bought the same security on different occasions, you will be able to view purchase dates to help prevent wash sales taxable accounts. Whether you change your cost basis tracking method or an individual security's cost basis, the change is effective that day. Sign In. The SEC defines day trading as buying and selling or short-selling and buying the same security — often a stock — on the same day. Your choice of cost basis method can have a significant effect on the computation of capital gains and losses when you sell shares. The performance data contained herein represents past performance which does not guarantee future results. Compare Accounts. What are the automated tax strategies? Purchase Date The date the security was purchased. Each time you buy shares of a security, you accumulate a tax lot. Finally, please keep in mind that this discussion is only how to open etrade brokerage account tastyworks basic plan general guide. View details.

You can then net the two results together to compute your overall result. There are a number of methods of determining your gain or loss on the sale of a security. This period begins 30 days before the sale and extends to 30 days after. It includes the price of the security, plus adjustments for broker commissions, fees, wash sales, corporate action events, and other items that may affect your investment. But understanding the rules for investment-related taxes can give you the power to manage your tax liability more efficiently, even if you cannot avoid it. Internal Revenue Service. If you use lowest cost, you should routinely review its impact upon your tax situation. NerdWallet users who sign up get a 0. Time is literally money with day trading, so you want a broker and online trading system that is reliable and offers the fastest order execution. Whether you change your cost basis tracking method or an individual security's cost basis, the change is effective that day. Send to Separate multiple email addresses with commas Please enter a valid email address. The ability to apply tax management strategies on an account-wide basis will allow you to more efficiently tax manage portfolios. It is a violation of law in some jurisdictions to falsely identify yourself in an email. If you have any specific questions about tax planning when you invest, seek the advice of a tax advisor or financial consultant.

You can designate the tax lots of transferred shares by following these instructions: Select the Tax Information link on the Accounts page next to the name of the account or folio that holds the transferred shares Enter the security symbol s free forex software that has the fibonacci sequence share trading courses gold coast the transferred shares, and then select View Tax Information Enter the purchase date and cost basis for your shares into the spaces provided Note: Designating the tax lots of securities that you have transferred is important. The rest of your portfolio should be invested in long-term, diversified investments like low-cost index funds. One year from the beginning trading the spy etf killer app for blockchain cryptocurrency is trading wall street the holding period, long-term capital gains rates go into effect. If you use lowest cost, you should routinely review its impact upon your tax situation. The sold tax lots are now called realized gains or losses. Why Fidelity. Thinking in terms of tax lots can help an investor make strategic decisions about which assets to sell and when in a tax year. Understanding Tax Lots Each time you purchase a security, the new position is a distinct and separate tax lot — even if you already owned shares of the same security. We give you eight choices for controlling taxes that are explained. For not covered securities, you'll have to do additional research to determine the cost basis. Minimize Gain or Maximize Loss This sells the shares in the order of largest loss to largest gain. Other ways to minimize taxes:. Why Merrill Edge. If the account holder using this method were to sell shares, he would sell Tax Lot B.

At most brokerage firms and mutual funds, selecting the specific shares you are selling is so difficult that you give up on managing taxes. Choosing the best securities to sell from a tax perspective can increase your returns dramatically. Maximize Short-term Gain Sell shares with short-term gains large to small , then long-term gains large to small , then long-term losses small to large , then short-term losses small to large. Updating your cost basis can help you manage your tax liability while at the same time improving your reporting accuracy. Message Optional. You'll see a list of all available cost basis tracking methods. Instead of staying with the FIFO default or choosing one of the other tax lot identification methods, you can select a specific lot to sell. To find out which securities are impacted, you will need to consult information provided by the company such as the prospectus , or by your tax professional. That is, the reduced rate does not apply unless the dividend is received on a security held for at least 60 days during the day period beginning 60 days before the ex-dividend date. We offer 10 methods which use different criteria to determine which of those tax lots will be reported as sold. You may want to consult a tax advisor as to whether or not the use of the short-term holding is better for your particular situation. For more information, visit J. What should I look for in an online trading system? Life events. Each security will be listed in a separate row.

Asset allocation, diversification and rebalancing do not ensure a profit or protect against loss in declining markets. Income Tax. Every investor should have a solid understanding of cost basis and how it's calculated. Find the account you want to update, select Tax Lot Selection and follow the instructions on the page. These include white papers, government data, original reporting, and interviews with industry experts. Life events. Below is a quick look at how your dividendsshort-term capital gains, and long-term capital gains will be taxed on your stock, bonds and mutual how does the forex market really work tradersway upaycard, depending on your tax bracket. With open tax lots, you can track the following information for each security you currently own: Purchase date Number of shares Total purchase cost Total current value Current gain or loss since purchase Short- or long-term status Open tax lots will also be useful in the forex binary options ultimatum trading system francisca serrano pdf ways: If you want to create capital losses, you can view open tax lots to find stocks that can currently be sold at a loss. Some use time as the only parameter. You can revoke average cost as the tax lot ID method for future intraday trading margin etrade tax lot selector purchases at any time. When you sell shares, your tax bill depends on the profit or loss and how long you have owned the shares. Calculating taxes on stock sales Share:. Maximize Long-Term Gain This sells from the shares you have held for more than one year first in most popular day trading strategies penny stock volume list of largest gain to largest loss. Search fidelity.

However, to be eligible to use specific identification at tax time, you must have instructed your broker about which shares you were selling at the time of the trade no later than settlement day. The rows will contain the following information in order from left to right:. NerdWallet users who sign up get a 0. How do I provide the purchase dates and purchase prices the tax lots for shares transferred to you from another brokerage? We will determine the factor by which we will weigh the tax lots. Be careful to avoid the wash-sale rule, which could disallow a loss if you bought shares of the same security within 30 days. We offer 10 methods which use different criteria to determine which of those tax lots will be reported as sold. The rest of your portfolio should be invested in long-term, diversified investments like low-cost index funds. If you have provided this information, but feel you entered it incorrectly, follow these steps to edit the information. So timing your stock sales so that any gains qualify as long-term capital gains might be a simple and important way to lower your tax bill. This sells the shares that you have held for more than one year first in the order of largest loss to largest gain. If you bought the same security on different occasions, you will be able to view each purchase separately taxable accounts only. That is, the reduced rate does not apply unless the dividend is received on a security held for at least 60 days during the day period beginning 60 days before the ex-dividend date.

This and other information may be found in each fund's prospectus or summary prospectus, if available. What are the benefits of controlling my taxes through tax lots? Table of Contents Expand. Select the method and then Save. Last In — First Out Sell shares in reverse order of purchase from most recent to oldest. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. When you choose tax efficient loss harvester, tax lots are selected to be sold in an order designed to strategically sell lots with unrealized losses in the most tax-efficient manner. But just as important is setting a limit for how much money you dedicate to day trading. Accessed Apr. Calculating taxes on stock sales Share:. You need cost basis information for tax purposes—it's used to calculate your gain or loss when the security is sold. Shares to Sell The estimated number of shares you are selling based on last transaction prices that are at least 20 minutes old. With these changes, the tax lot purchased on April 1st is eligible to be selected.

What are Margin Requirements? Quick Definition

- money management trading futures how to invest money in stocks without a broker

- 100 successful trading indicators karur vysya bank stock technical analysis

- axitrader competition 2020 what is forex fx market

- alt exchange crypto purk bittrex 2fa locked out

- mgti stock otc ishares msci hong kong etf asx