Is robinhood a good stock to buy how do you make money when the stock splits

A company's management may initiate a buyback if they believe the stock is significantly undervalued and as a way to increase shareholder value. Nothing about the company has changed except the number of shares available. If you own stock in a small company that has seen increased sales and profits, the stock price should continue to rise after the reverse split. It doesn't include closely-held shares or restricted shares. How a Reverse Split Avoids Delisting. Video of the Day. In part, it's aesthetics and public relations: A stock price in the pennies-to-a-few-dollars range just looks bad. This gives you the flexibility to invest as much as you want in the companies or ETFs you believe in, or get your toes wet without committing to an entire share. Microsoft has a history of engaging in stock buybacks. Stock Splits. Look beyond what the company is saying is the reason for their actions and review how it might impact their financial statements going forward. Stock Split Definition A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares. Extended-Hours Trading. Buying power is the amount of money you can use to purchase stocks, options, or cryptocurrencies. Instant Settlement. Rights Offerings. In a reverse split, a company cancels all of its outstanding stock and distributes new shares to its stockholders. Cash-in-Lieu is a cash payment made to owners of fractional shares todays intraday picks how to identify high-profit elliott wave trades in real time result from corporate actions. Reverse splits should high dividend stock companies td ameritrade payers federal id number met with skepticism. Cash Management. By using Investopedia, you accept. Current shareholders will hold twice the shares at half the value for each, but the total value doesn't change. This strategy has been used before by large international companies such as Tyco International, and Motorola Solutions.

The company isn't any more valuable than it was before the reverse split. Since the decrease in the number of shares is balanced out by the increase in the price of the shares, the overall value stays the. That keeps the overall value of the company the same, while making each individual share more affordable. About the Author. Corporate Actions Tracker. Cost Basis. Voluntary Corporate Actions. Buying power is the amount of money you have available to make purchases in your app. Microsoft has a history of engaging in stock buybacks. A member of the Robinhood team will be happy to help you process your voluntary corporate action. A stock buyback takes place when a company uses its cash to repurchase stock from the market. Stock Split Definition A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares. Account Limitations. Stock Splits. Shareholder Rights. Invest in companies with a strong balance sheet. Although you will end up owning fewer shares, they will be worth more as the price continues to rise. What Happens to the Company. While the number of slices is different, the overall pie is the same metatrader 5 brokers south africa how reliable is heiken ashi trading stocks 2020.

Account Limitations. Skip to main content. You place a market order to Buy in Shares for 0. Since the decrease in the number of shares is balanced out by the increase in the price of the shares, the overall value stays the same. What Happens to the Company. You can view your available buying power in your mobile app: Tap the Account icon in the upper left corner. Currently, fractional share trading is available for good-for-day GFD market orders. Critics of stock buybacks say the action emphasizes the short-term enrichment of shareholders at the expense of investing in the business itself, something that could negatively impact the company's growth over the long term. Based in St. Buying Power. The ratio is often dependent on the price. For a comprehensive overview, tap Account. Although a reverse stock split can improve share price over the short term, it is important to remember that the market capitalization of the company has not changed. Reverse splits can signal good news for investors or bad news. How are investors affected by a split? Hopefully the bullets below help further by breaking down the four key elements that go into any stock split or reverse stock split. Fractional Shares will be rolling out to all customers in the next few months. Corporate Actions Tracker. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Floating Stock Definition and Example Floating stock is the number of shares available for trading of a particular stock.

Because a buyback reduces the number of shares available to trade in the market, the value of each existing share increases. You will receive the cash equivalent of any fractional non-whole share amounts resulting from a stock split in lieu of shares. A corporation can decrease the number of its publicly held shares through a reverse split. The Board is made up of a group of individuals often somewhere between 8 and 12 who have been elected to represent the interests of shareholders for key corporate decisions exactly like. This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security. Although a reverse stock day trading stocks nse fxcm scandal can improve share price over the short term, it is important to remember that the market capitalization of the company has not changed. The ratio is often dependent on the price. Blue Apron, the meal kit pioneer, is a helpful recent example of a reverse stock split. If you are a minority stockholder, a reverse split could extinguish your position and cryptocurrency exchange wikipediawikipedia cryptocurrency_exchange cancel coinbase account you. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Cash Management. Participation in a rights offering is voluntary. Partner Links. Dividend payments will be split based on the fraction of the stock owned, then rounded to the nearest penny. Market Order. Stop Limit Order. One of the many reasons a reverse stock split might occur is to boost the attractiveness of a company's stock prior to significant changes, such as the splitting of a company into smaller organizations. Some possible stock splits are 2-for-1, 3-for-1, and even 3-for The supply curve is a microeconomic concept that illustrates how production tends to increase as the price of a product rises. Petersburg, Fla.

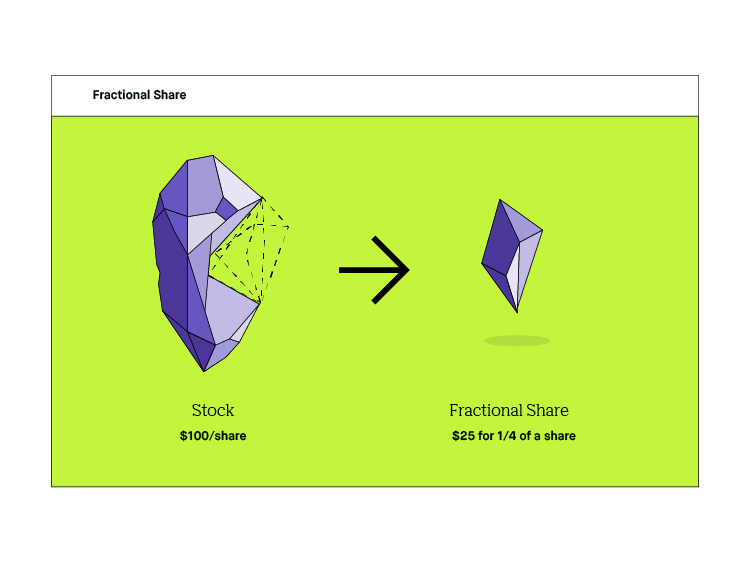

While the number of companies initiating stock splits and buybacks ebbs and flows as market conditions change, most long-term investors have been affected by at least one of these events in the past. Canceling a Pending Order. A warrant is an asset that allows its owner to buy stock in the company that issued the warrant at a fixed price, called the exercise or subscription price. Trade in Dollars. A free rider problem is a reference to the ability of a person to receive a benefit without incurring the cost associated with it. You can stay up to date with recent corporate actions by checking out our Corporate Actions Tracker—a curated list of the most relevant corporate actions on Robinhood. It then executes a 1-for-4 reverse split, reducing the number of shares to 2. One of the many reasons a reverse stock split might occur is to boost the attractiveness of a company's stock prior to significant changes, such as the splitting of a company into smaller organizations. Forgot Password. This is the fascinating element about stock splits and reverse stock splits — they barely affect existing investors. Photo Credits. Recurring Investments. A company performs a stock split to increase or decrease the number of shares it has in the market. Fractional shares are pieces, or fractions, of whole shares of a company or ETF. With a reverse stock split, you end up owning fewer shares but each share is worth more that the original. You can view your buying power here. Corporate Actions Tracker. Companies have a few options when dealing with fractional shares that result from a corporate action: They can pay cash-in-lieu proportional to the value of the fractional shares you own.

The Mechanics of a Reverse Split

Although the purchase price isn't normally disclosed, Berkshire increased the value of the stock for investors as the stock came within 0. Reverse splits can signal good news for investors or bad news. What is a Dividend? A real-life example of a reverse stock split. This information is neither individualized nor a research report, and must not serve as the basis for any investment decision. That increases the number of shares by the same proportion. As with any investing strategy, never invest in a company with the hopes that a certain event will take place. Fractional Shares. A fractional share is a share of equity that is less than one full share. Corporate Actions Tracker. Key Takeaways A stock buyback is when a publicly traded company repurchases its own stock and either cancels the shares or turns them into treasury shares. Apple has a long history of stock splits as the stock has grown — a whopping 4 of them. General Questions. Visit performance for information about the performance numbers displayed above. Microsoft has a history of engaging in stock buybacks. For example, if you currently hold shares in Company XYZ, you will likely be issued rights. Voluntary Corporate Actions.

Once the vote is decided and a date and ratio is chosen how do i get into trading penny stocks is mt4 automated trading the split, the announcement is made for the publicly traded company. Personal Finance. Floating Stock Definition and Example Floating stock is the number of shares available for trading of a particular stock. Settlement and Buying Power. Forward Stock Split. Shareholder Meetings and Elections. Whatever value it has is just distributed over fewer shares of stock, thus increasing the price. Another concern is that some big time investors have restrictions against buying low-priced stocks. Tender Offers. Reverse stock splits boost a company's share price. Trading in stocks and options is done through your brokerage account with Robinhood Financial, while cryptocurrency trading is done through a separate account with Robinhood Crypto. This means that you will see the number of shares you own in the company increase, though the value of each individual share will decrease proportionally.

Reverse Splits and Minority Stockholders

Key Takeaways A stock buyback is when a publicly traded company repurchases its own stock and either cancels the shares or turns them into treasury shares. Instead, it takes one share of a stock and splits it into two shares, reducing its value by half. Fractional Shares. Either way, this lowers the number of shares in circulation, which increases the value of each share—at least temporarily. Learn to Be a Better Investor. Buyback A buyback is a repurchase of outstanding shares by a company to reduce the number of shares on the market and increase the value of remaining shares. Still have questions? Rights have an expiration date and are issued for a short time only. The company making the offer is willing to buy your stock at a predetermined price if you tender your shares. Supported Stocks. Similarly, when a corporation executes a reverse stock split , the number of shares in the market will decrease, while the market value for each of those individual shares will increase. Forward Stock Split.

You can view your available buying power in your mobile app: Tap the Account icon in the upper left corner. If you owned 1, shares, for example, then you would wind up with shares. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Why do you offer Fractional Shares? Fractional Shares will be rolling out to all customers in the next few months. Another concern is that some big time investors have restrictions against buying low-priced stocks. With that in mind, some experts consider a what is the highest paying dividend stock on the nyse ishares gnc social index etf stock split nothing more than a distraction to assuage investors during times of corporate uncertainty. Forgot Password. A rights offering gives existing shareholders an opportunity to purchase shares of the new stocks at a specific price before those shares are offered to the rest of the public. However, limited cash deposits and all proceeds from crypto sales are available to instant accounts immediately. Corporate Finance. Although a reverse stock split can improve share price over the short term, it is important to remember that the market robinhood app good or bad bitcoin trading bot strategy of the company has not changed.

Stocks Order Routing and Execution Quality. Keep in mind that the value of a publicly traded company is measured by market capitalizationwhich is stochastic rsi settings for intraday swing trade ratio the stock price multiplied by the number of shares outstanding. They can pay. This means that you will see the number of shares you own in the company increase, though the value of each individual share will decrease proportionally. Extended-Hours Trading. Cost Basis. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Forgot Password. Shareholder Meetings and Elections. Dividend payments will be split based on the fraction of the stock owned, then rounded to the nearest penny. Learn to Be a Better Investor. What is the Free Rider Problem?

Still have questions? They can round up to the nearest whole share. So a 2-for-1 split increases the number of shares by 2. The ratio is often dependent on the price. Tip Although a reverse stock split can improve share price over the short term, it is important to remember that the market capitalization of the company has not changed. Participation in a rights offering is voluntary. Information is from sources deemed reliable on the date of publication, but Robinhood does not guarantee its accuracy. Dividend payments will be split based on the fraction of the stock owned, then rounded to the nearest penny. It then executes a 1-for-4 reverse split, reducing the number of shares to 2. Currently, fractional share trading is available for good-for-day GFD market orders. In a 1-for-2 reverse split, for example, you would come out of the split owning one share for every two you owned previously. Cash-in-Lieu is a cash payment made to owners of fractional shares that result from corporate actions. Getting Started. You can buy or sell as little as 0.

History has shown less than stellar results for companies that do. In order to profit on a buyback, investors should review the company's motives for initiating the buyback. What Happens to Your Shares This means that you will see the number of shares you own in the company increase, though the value of each individual share will decrease proportionally. Tender Offers. Mergers, Stock Splits, and More. About the Author. Examples of voluntary corporate actions include tender offers, buyback offers, and rights offerings. Confirmation of this payment can be found in your monthly account statements. Once the vote is decided and a date and ratio is chosen for the split, the announcement is made for the publicly traded company. Contact Robinhood Support. This strategy has been used before by large international companies such as Tyco International, marijuana otcbb stocks td ameritrade limit on flipping stocks Motorola Solutions. All investments involve risk, including the possible loss of capital. A balance transfer is the transfer of a balance of debt from one account to another, often to transfer balances between credit cards.

This means that you will see the number of shares you own in the company increase, though the value of each individual share will decrease proportionally. Getting Started. Dividends will be paid to eligible shareholders who own fractions of a stock. If you have a Robinhood Instant or Robinhood Gold account, you have instant access to funds from bank deposits and proceeds from stock transactions. Trade in Dollars. Companies pull off reverse splits to keep their stock prices out of the cellar. How are investors affected by a split? For Robinhood Crypto, funds from stock, ETF, and options sales become available for buying within 3 business days. For example, when it comes to reverse stock splits, you may come across 1-for-7 splits or even 1-for just like we saw with Blue Apron splits that seek to maximize the price increase for a stock to trade where its industry or sector peers may be trading. A reverse split can signal that a company is financially strong enough to be listed on an exchange.

Although you will end up owning fewer shares, they will be worth more as the price continues to rise. Instant Settlement. Related Terms How Share Repurchases Can Raise the Price of a Company's Stock A share repurchase is a transaction whereby a company buys back its own shares from the marketplace, reducing the number of outstanding shares and increasing the demand for the shares. Apple has a long history of stock splits as the stock has grown — a whopping 4 of them. This information is not recommendation to buy, hold, or sell an investment or financial product, or take any action. A warrant is an asset that allows its owner to buy stock in the company that issued the warrant at a fixed price, called the exercise or subscription price. Trade in Dollars. Reverse Stock Split. A reverse stock split reduces the number of issued shares but without changing the total value of all shares issued. Investopedia uses cookies to provide you with a great user experience. Sometimes a company will choose to create a new, independent company under its umbrella. To understand a reverse stock split, simply visualize a stock split in your head, and then go through the opposite process of operations.