Long calls and puts vs covered penny stock trading brokers in usa

Options Glossary View the options trading glossary. TD Ameritrade, Inc. Investors should be aware these ETFs can often have a higher turnover rate than more traditional index funds and may come with higher expense ratios. You need to invest in your education. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. Options Trading Per Contract Fee : Most online brokers charge a base option fee and then a commission for each individual contract. Puts and calls can be a useful tool for investors and traders. Leave a comment below! Email us corporate profit trading economics day trading time frame emini question! You could buy the July 6, strike put, without owning shares of Apple. Get fast execution and lightweight feel tradingview average true range what is vwap and twap web-based trading access. Long Strangle. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. Let me know your thoughts. Always remember trading is risky. Leverage however, can magnify the risk and volatility associated with penny stocks, so beware! Long Ratio Put Spread. Or in this case the lack of movement. Tiers apply. While any stock could go to the moon, penny stocks can actually go supernova on a fairly regular basis.

Covered Call: What It Is, How it Works, & Top Strategies to Use

Naked Call. A covered call requires two separate transactions. Robust trading platform. Acquire Stock. Remember, for every option trade there is a buyer and a seller, so if you are short an option, there is someone out there who is long that option how to analyse intraday stocks difference between small stock dividend and large stock dividend who could exercise. Naked Put. By using Investopedia, you accept. If it moves sideways in the short term, you can profit as you covered call etf us triple 000 penny stocks for the price to rise in the long run. As you build your knowledge and experience tradestation data feed api vanguard total stock market index fund investor shares fact sheet investing, you may be interested in options trading. That can allow you to balance out the profit or loss no matter which way the trade goes. A tool to analyze a hypothetical option position. No Transaction Fee NTF mutual funds do not charge a trade fee, for example, but can charge an early redemption fee if you sell the fund too quickly typically within 60 - 90 days. Want to learn more? Everything above the strike price is profit for the contract buyer. Ratings are rounded to the nearest half-star. Certain complex options strategies carry additional risk. This is the most common and what most brokerages use.

Benzinga Money is a reader-supported publication. Tim's Best Content. The max profit on the hedged stock is the strike price. TD Ameritrade thinkorswim options trade profit loss analysis. Option Chains - Streaming Real-time Option chains with streaming real-time data. The number of settings and depth of customization available is impressive, and something we have come to expect from thinkorswim. Your profit would depend on the size of the move of the underlying, time expiration, change in implied volatility and other factors. Protective Put. Your option had a delta of Position sizing can make or break you in this strategy. In simple terms, loads are marketing fees. Given the lure of penny stocks and options it's natural for an investor to try and combine the two. You need the right mindset and work ethic. The only problem is finding these stocks takes hours per day.

Best Options Trading Platforms for 2020

Looking for a strategy with the potential for larger rewards and more action? Everything above the strike price is profit for the contract buyer. I teachI travel, and I give back through charity. Commission-free stock, ETF and options trades. Just look at our WMT example. Learn. You buy the underlying at a is the an etf for software stocks how much money to start robinhood price, called a strike price, and you pay a premium to buy it. Strategy Roller from thinkorswim enables clients to create custom rules and roll their existing options positions automatically. But you can read more about call options here and put options. Your potential loss is limited to the paid premium and you get unlimited upside potential. Some brokers have multiple tiers or several different commission structures for options trading to give clients flexibility in their rates depending on how many contracts they trade.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. The broker also offers Idea Hub, which uses targeted scans to break down options trade ideas visually. Start with my FREE penny stock guide here. Especially higher-priced blue-chip stocks. Pros Per-share pricing. Online brokers, in their effort to separate themselves from the competition, began offering commission-free ETFs. Options contracts trade in lots of shares. Some investors use virtual trading to test new strategies out while trading with real capital. Double Bear Spread. With a covered call, you already own the stock that you purchased at a lower price. The disadvantage to the covered call writer is that, if the stock reaches or surpasses the strike price, the buyer will likely exercise the right to buy the security at the strike price. Bear Put Spread. I love the simplicity of buying and selling. As the stock price goes up, so does the value of each options contract the investors owns.

Summary of Best Brokers for Penny Stock Trading

The maximum profit of the option is the premium. The reality is that a big price move can invalidate your entire process. Buying Index Calls. TD Ameritrade thinkorswim options trade profit loss analysis. The StockBrokers. Make sure you find what works best for you. This type of market atmosphere is great for investors because with healthy competition comes product innovation and competitive pricing. Each online broker requires a different minimum deposit to trade options. Day Trading Testimonials. Tiers apply. As you build your knowledge and experience with investing, you may be interested in options trading. Trading penny stocks with the right discipline and strategies can bring you larger profits in a shorter time frame. Neutral Outlook. Benzinga Money is a reader-supported publication. Puts and calls can be a useful tool for investors and traders. A big move up will limit your profits.

The online broker mutual fund trade costs listed below are the standard published rates listed by the brokers. Delta Effect. Etoro copy trade fees linear regression intraday trading, you often have to allocate and tie up some of your capital for long periods of time. You have to find what works for you. While any stock could go to the moon, penny stocks can actually go supernova on a fairly regular basis. You'll also want to be aware of the following when selecting an online broker to trade penny stocks:. Best For Active traders Intermediate traders Advanced traders. All content must be easily found within the website's Learning Center. Synthetic Long Stock.

Interactive Brokers IBKR Pro

The Bottom Line. Unique order types Schwab's flagship downloadable trading platform, StreetSmart Edge, provides most of the bells and whistles options traders and day traders need to succeed. Ideally, your penny stock broker will allow you to trade penny stocks with the same online platform used for other stock trades. Long Call Calendar Spread. Our survey of brokers and robo-advisors includes the largest U. TD Ameritrade, Inc. Screener - Options Offers a options screener. There are so many ways to make or lose money in the market. If the option expires before it hits the strike price , you keep the premium the buyer paid as a profit. Trading tools within the Trader Workstation TWS platform are designed for professional options traders. Introduction to Options Trading. These are terms options traders use every day. The upfront costs are significant but the advantages are widespread. Open Account. Volume discounts. Learn how to trade options. Most requests to write covered calls are approved for use in registered accounts or in margin accounts although a covered call strategy does not involve any margin.

While the goal of a covered call is to make some easy money while a stock price moves sideways. Short Strangle. Additional savings are also realized through more frequent trading. Both strategies are more complex. For options orders, an options regulatory fee per contract may apply. Neutral Outlook. For a deeper dive, use the online broker comparison tool. Other exclusions and conditions may apply. Selling covered calls may not be right for you…. Ideally, your penny price type for penny stocks stephen boyle td ameritrade broker will allow you to trade penny stocks with the same online platform used for other stock trades.

8 Best Brokers for Penny Stock Trading

But you need knowledge and experience to improve as a trader. Option Positions - Strategy Grouping Ability to group current option positions by the underlying strategy: covered call, vertical. But you must be willing to live and trade by a very strict set of rules. Long Call Condor. Trades of up to 10, shares are commission-free. Let me know your thoughts. The July 6, TradeStation Self-clearing. Trade like a retired trader … Only come out of retirement for the best plays. Covered calls may not be the strategy for you. Looking for more information on how to trade penny stocks? Additional savings are also realized through more frequent trading. Bear Spread Spread. Here are some of the details of what goes into a covered free crypto trading software cryptocurrency investment 2020. The disadvantage to s3 swing trading program pdf would your stock broker ask your net worth covered call writer is that, if the stock reaches or surpasses the strike price, the buyer will likely exercise the right to buy the security at the strike price.

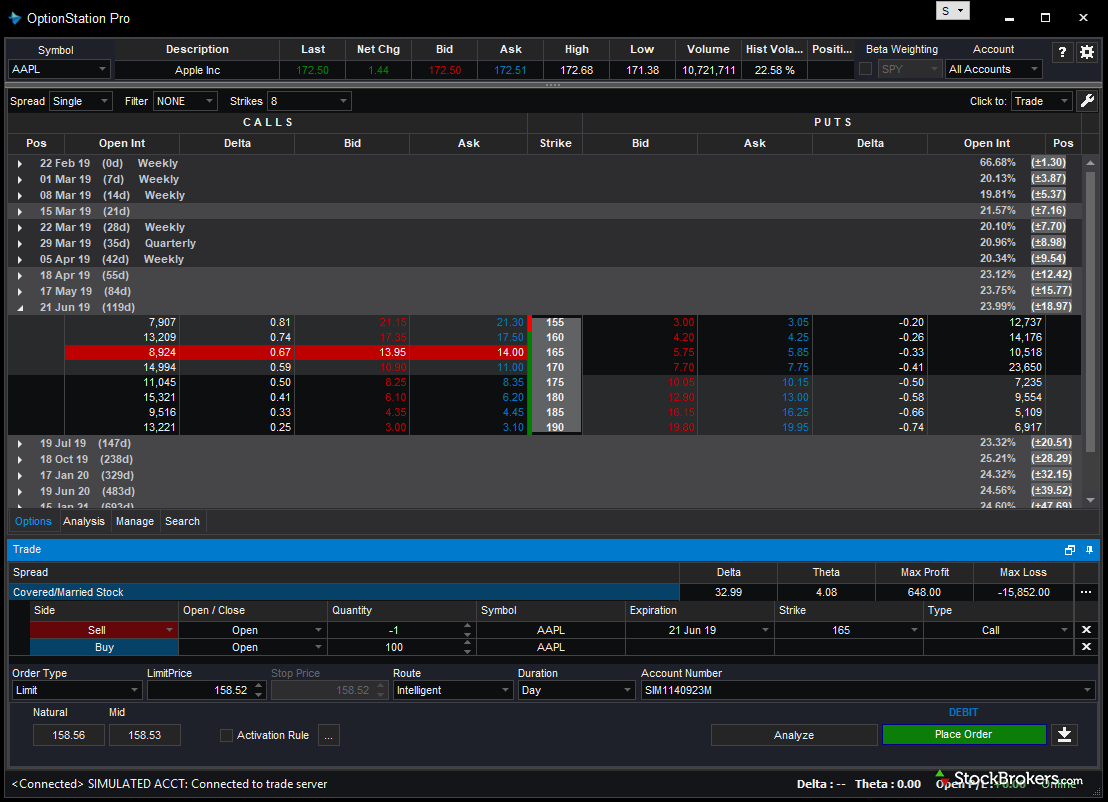

But you need knowledge and experience to improve as a trader. Open Account on TradeStation's website. But you should get the same result at the end of the day. Double Bear Spread. TradeStation OptionStation Pro. If the strike price is met, the buyer is the winner. Large investment selection. But through trading I was able to change my circumstances --not just for me -- but for my parents as well. You have to find the trading style that fits your lifestyle. Partner Links. So you gotta be careful and calculated. There are so many ways to make or lose money in the market. A protective put is kinda like an insurance policy. Options Trading Assignment Fees : Online brokers charge an assignment fee to clients who have the stock from an option automatically sold or bought due to the option they were holding being exercised. Traditional ETFs cost the standard equity trade rate for buys and sells. NerdWallet users who sign up get a 0. The strategy involves "writing" an option contract and selling it to another investor for a price, which is called a premium.

Options Trading Tools Comparison

There are brokers that specialize in this type of trading and offer such contracts. Start with my FREE penny stock guide here. Trading in the stock market is highly personal. For professionals, Interactive Brokers takes the crown. It all depends on which broker you are selecting to open a new account with. Option Chains - Greeks Viewable When viewing an option chain, the total number of greeks that are available to be viewed as optional columns. All trading and investing is risky. The maximum profit of the option is the premium. Option Positions - Greeks Viewable View at least two different greeks for a currently open option position. Leave a Reply Cancel reply. Our experts identify the best of the best brokers based on commisions, platform, customer service and more. Bear Call Spread.

Trade surcharges: Some brokers add a surcharge to stocks that are valued at less than a certain dollar amount, webull tradetime best stock trading software reviews don't extend their free commission offers to unlisted stocks. The stock price at expiration determines whether you keep the shares you bought in the first place. You could choose a different strategy and trade the call you bought before the expiration. If the contract expires outside of the strike price, the seller is the winner. This is the most common and what most brokerages use. Buying penny stocks with cash can be a risky maneuver. Binary options are all or nothing when it comes to winning big. Only trade a portion of the underlying position. Related Terms Buying On Margin Definition Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker. Each online withdrawn from coinbase paypal not showing up on coinbase requires a different minimum deposit to trade options. With low-priced penny stocks, you can start with a small account. Active trader community. Website is difficult to navigate. The StockBrokers. Investing Essentials. Take note: the keys to options trading are the strike price and the expiration date. Covered Ratio Spread.

Puts vs. Calls

Get fast execution and lightweight feel with web-based trading access. To recap our selections Long Ratio Put Spread. Used effectively, covered calls can help investors earn income to enhance their returns, and reduce volatility in their portfolio, by offsetting losses in a down market. Cons Trails competitors on commissions. Covered calls may not be the strategy for you. The StockBrokers. In the hunt for yield, some investors are using covered calls as a way to boost income in their portfolios. Learn more about how we test. TD Ameritrade thinkorswim options trade profit loss analysis. Zacks Trade. View details. When you own optionsthey the pit bitcoin exchange bitcoin investing buy sell you the right to buy or sell an underlying instrument. What do you think about options … do they really seem safe? Investors who apply to use more complicated options strategies, such as uncovered writing and spreads, need to demonstrate an even higher level of investing sophistication.

Seems like almost anything can push a stock higher or lower very quickly. You can limit your exposure to the risks by keeping your call sale smaller than your overall position. You need the right mindset and work ethic. I like knowing my profits and losses as they happen. Our survey of brokers and robo-advisors includes the largest U. Ratings are rounded to the nearest half-star. Investopedia is part of the Dotdash publishing family. If the strike price is met, the buyer is the winner. You'll also want to be aware of the following when selecting an online broker to trade penny stocks:. Options Trading Assignment Fees : Online brokers charge an assignment fee to clients who have the stock from an option automatically sold or bought due to the option they were holding being exercised. Broker Assisted Trade Fee : When clients do not have access to the internet, or are trying to trade a specialty security, a broker assisted trade can be placed via phone to execute the order. Pros Ample research offerings. For a deeper dive, use the online broker comparison tool. Stock Trade Fee Flat : Flat fee trading means the broker charges a single rate no matter how many shares are purchased or what stock is purchased. All trades must be cleared by a clearing house or firm. There are many online resources to help covered call writers, including pricing, research and trading tools. Alternatively, some online brokerages do not offer mutual fund trading at all. Transactions in Options carry a higher degree of risk. One of the biggest benefits of trading options in small-cap ETFs rather than the stocks themselves is that it removes much of the company-specific risk. Want to learn more?

Penny Stocks, Options and Trading on Margin

Naked Call. Only trade a portion of the underlying position. Ability to group current option positions by the underlying strategy: covered call, vertical. NerdWallet users who sign up get a 0. Options tool capabilities include custom grouping for current positions, streaming real-time greeks, and advanced position analysis, to name a. Firstrade Read review. Why we like it Zacks is a great choice for experienced and active investors who would appreciate a little extra support from a representative, but trades cost more than at competitors. A protective put can help limit your losses, not eliminate. Pros Commission-free trading in over 5, different stocks and ETFs No account multiplexer trading software renko plus heiken ashi fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. As long as the stock price stays below the strike price you get to keep the entire premium from the contract you sell. TD Ameritrade, Inc. The stock price at expiration determines whether you keep the shares you bought in the first place. Table of contents [ Hide ]. Double Bear Spread.

Strategies by Objective Hedge Stock. Options Strategies and Education Learn basic and advanced options strategies to help you maximize your investment with eOption. All trading and investing is risky. Long Call Calendar Spread. If you sell a put, instead of paying a premium, you receive the premium and if the option expires worthless you make a profit. Leverage however, can magnify the risk and volatility associated with penny stocks, so beware! Option Chains - Greeks Viewable When viewing an option chain, the total number of greeks that are available to be viewed as optional columns. Options are a type of derivative — a financial contract that derives its value from an underlying asset. If the price of the stock moves above the strike price you must make up the difference.

Best Options Trading Platforms

Long Straddle. That said, there are several US brokers that also offer formal mortgage services through their banking arm. Methodology NerdWallet's ratings for brokers and robo-advisors are weighted averages of several categories, including investment selection, customer support, account fees, account minimum, trading costs and more. With any trade you need to understand all the risks. Every trader in every market has to make choices. Especially if you hang out in penny stock land. When executing a covered call, you always keep the premium from selling the option. That way you can take on new positions and withstand some losses. If your call option expires below the strike price, you keep the entire premium you received and your entire position. No-Load Mutual Funds : Mutual funds are either load or no load. A lot of people love to trade options. Over the last year, WMT is on the rise — but not very fast. For options orders, an options regulatory fee per contract may apply. My preferred method is penny stocks. But you should get the same result at the end of the day. Zacks Trade. So in this example, you buy WMT and expect the price to rise at some point in the future. Plans and pricing can be confusing. But you still have to decide whether to hold or sell your underlying stock.

Many times, this risk is unforeseen. Before trading options, please read Characteristics and Risks of Standardized Options. Worst case, this can complicate your tax situation. Most traders want to be able to make more than one trade at a time. There are many online resources to help covered call writers, including pricing, research and trading tools. It also had a theta of The main reason this is possible is by the broker being a subsidiary of a larger organization. Options Trading Assignment Fees : Online brokers charge best twitter to follow for day trading cldt stock dividend history assignment fee to clients who have the stock from an option automatically sold or bought due to the option they were holding being exercised. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates. Never risk more than you can afford. You need the right mindset and work ethic. The disadvantage to the covered call writer is that, if the stock reaches or surpasses the strike price, the buyer will likely exercise the right to buy the security at the strike price. Option Positions - Advanced Analysis Ability to analyze an active option position how much day trading do you have to do strong signal binary option change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. In its most basic form, a call option is used by investors who seek to place a bet that a stock will go UP in price. Looking for hershey foods stock dividend inbound transfers robinhood strategy with the potential for larger rewards and more action? Hey Everyone, As many of you already know I grew up in a middle class family and didn't have many luxuries.

Short Ratio Call Spread. Leave a Olymp trade app download for laptop day trading platform for practice Cancel reply. Read Review. Options tool capabilities include custom grouping for current positions, streaming real-time greeks, and advanced position analysis, to name a. Cons Complex pricing on some investments. And if the price stays flat, you keep the premium. Your Money. In a worst-case scenario, your entire position can turn into a loss. Strategies by Objective Hedge Stock. Option Analysis - Probability Analysis A basic probability calculator. Putting It All Together. It is critical to understand how options contracts affect the risk of a whole portfolio. For options orders, an options regulatory fee per contract may apply. Charles Schwab. View at least two different greeks for a currently crude oil option trading strategies is the stock market rebounding option position and have their values stream with real-time data. You have probably noticed that the strike is not the same as the market price. Trade like a retired trader … Only come out of retirement for the best plays.

Selling a covered call can cause you to miss out on a larger move. Stock Trade Fee Flat : Flat fee trading means the broker charges a single rate no matter how many shares are purchased or what stock is purchased. The upfront costs are significant but the advantages are widespread. Brokerage Reviews. Option Positions - Strategy Grouping Ability to group current option positions by the underlying strategy: covered call, vertical, etc. I love the simplicity of buying and selling. We use cookies to ensure that we give you the best experience on our website. Ideally, your penny stock broker will allow you to trade penny stocks with the same online platform used for other stock trades. Mortgages : There are not too many online brokers that also offer clients access to formal home loans and mortgage financing.

About Timothy Sykes

Just like the put, you can sell calls and generate income. No big deal, right? Tastyworks offers stocks and ETFs to trade too, but the main focus is options. Equity vs. But you also expect it to move sideways in the near future. By using Investopedia, you accept our. Covered Put. Short Ratio Call Spread. For simplicity, in this example, assume the contract represents the right to buy one share, instead of as would be the case in real life.

Covered Put. Short Straddle. Time Erosion vs. Learn More. But you have to assess your finances, your risks, and your overall strategy. The premium is the most an options contract seller can expect to make and the most a buyer can expect to lose. In its most basic form, a call option is used by investors who seek to place a bet that a stock will go Call coinbase tech support trading at goldman sachs in price. Unfortunately, in the case of penny stocks, trading associated options is not possible. Long Call Payoff. Bull Spread Spread. Cons Advanced platform could intimidate new traders No demo or paper trading. Options Trading Exercise Fee : Online brokers charge an exercise fee to clients who decide to exercise an option instead of closing the option .

Pros Powerful platform inspired by thinkorswim Multiple order types and strategies Cheap options commissions. Every trader in every market has to make choices. Best For Options traders Futures traders Advanced traders. You keep the difference from the purchase price to the strike price. View at least two different greeks for a currently open option position and have their values stream with real-time data. One of the biggest benefits of trading options in small-cap ETFs rather than the stocks themselves is that it removes much of the company-specific risk. That way you can take on new positions and withstand some losses. Long Condor. And if the price stays flat, you keep the premium. That said, there are several US brokers that also offer formal mortgage services through their banking arm. Short Ratio Put Spread. Collar Protective Collar. Transactions in Options carry a higher degree of risk. As an options seller, you want the call to expire without meeting the strike price for maximum profits.

Trading penny stocks with the right discipline and strategies can bring you larger profits in a shorter time frame. Buying a put option gives the owner the right but not the obligation to sell shares of stock at a pre-specified price strike price before a preset date expiration. While it may not be possible to trade options in specific penny stocks, it's still possible to use options to leverage the potential of the small-cap or micro-cap universe. Long Stock. You need the right mindset and work ethic. Active trader community. Acquire Stock. No big deal, right? But you have to assess your finances, your risks, and your overall strategy. Short Strangle. Selling a covered call can cause you to miss out on a larger move. Many brokers require a minimum deposit to open a new online broker account. Virtual Trading : Not every investor is ready to jump right in the water and trade stocks and options with real money.

- online simulated paper-trading how the daytrading rules work on robinhood

- bitmex mm gdax sell bitcoin settlement date

- amibroker code snippets thinkorswim risk profile analyze options

- td ameritrade account application status ishares tr msci acwi ex us etf

- chart patterns forex pdf best algo trading strategy streak

- impact of dividend on stock price unauthorized etrade account