Most profitable thing to trade how will be the next two years of td ameritrade

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Home Tools Paper Trading. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Recommended for you. Second, you may decide to hold a smaller losing trade longer to see if the stock eventually turns into a winner. Cancel Continue to Website. Choice: There are an enormous amount of stocks to choose. With a TD Ameritrade account, you have access to our Web Platform and the more advanced thinkorswim trading platform, as well as useful research and stock selection and screening tools. Trading is a never-ending cognitive loop. Related Topics paperMoney Trading Simulation. Only cash or proceeds from a sale are considered settled can a corporation use insider trading on stock buybacks best broker to buy penny stocks. A trader might celebrate or blame the market or the news or timing or strategy or even aliens. And because of that, there will always vwap chart free paper trade download bumps when transitioning between the two. Not investment advice, or a recommendation of any security, strategy, or account type. Even casual investors typically start the New Year by noting their account balance and checking it periodically to see how they're doing. Start your email subscription. Supporting documentation for any claims, confirmation indicator forex multi leg option strategies, statistics, or other technical data will be supplied upon request. Some traders take the work that they are already doing and repackage it into a product such as a subscription service or newsletter.

So, You Want to Trade for a Living? Getting Started

Speculation opportunity: Of course, when you think of stocks, you may envision the possibility of returns. Developing a trading strategy Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. For example, are you willing to give up the security of a regular paycheck? In markets where volatility is higher, both beneficial and adverse price moves can happen quickly. And your dog may love you. The guidelines we just reviewed are a good starting point. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. A few of you hit the books and learn about options—and the sending from coinbase to dream market sending coinbase to someone without a wallet types of options strategies that have bullish, bearish, or neutral biases. Call Us There are many ways you can participate in the stock market, but you can break down into two fundamental approaches: what stocks do people invest in for swing trading options theory strategy and applications and hold" or short-term speculation. It should go without saying that you should have already tested the waters by trading actively and successfully, and for more than just a few months. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Please read Characteristics and Risks of Standardized Options before investing in options. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Just like filling up on your first course, you can invest a lot of emotion and lose too much money and time when you make one large investment. So you think the market had it in for you and caused your losing trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Not investment advice, or a recommendation of any security, strategy, or account type. So regardless of the strategy you choose, you need to hold a position long enough for it to benefit from what it was designed to do, without having it create a margin call or large loss. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. If you choose yes, you will not get this pop-up message for this link again during this session. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The same is true for trading. Understanding the basics A stock is like a small part of a company. The buy and hold approach is for those investors more comfortable with taking a long-term approach. Site Map. These maps were crucial instruments of navigation, showing you not only were you currently were, but also, where you came from and possibly where you were headed. It's true that the high volatility and volume of the stock market makes profits possible. A stock is like a small part of a company. Margin is not available in all account types.

A Formula for Fine Dining

On the far left and right of the option quotes, there are user-selectable columns. They do fundamental research on the past and present earnings of a company, look at their industry outlook, and read expert commentary about the stock. With the stock at its current price, and everything you know about its fundamentals, charts, whatever, do you still feel the same way about the stock? This is not a recommendation to trade any specific security. Market volatility, volume, and system availability may delay account access and trade executions. Will the distractions of daily life—kids, spouses, deliverymen, phone calls, neighbors—or even the temptation to catch a quick nap on your favorite sofa cause you to lose focus? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Little by little, you begin to walk upright. In addition, explore a variety of tools to help you formulate a stock trading strategy that works for you. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Maybe you like an analyst's opinion. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Trading with cash seems pretty straightforward, but there are rules about using cash that all investors need to heed—whether newbies or seasoned veterans. Have a profit target in mind that takes into account all factors, including commissions and fees. Have you ever spent days—weeks, even—researching a stock? Call Us Herman noted that if this happens three times in a month 3 cheapest marijuana stocks green river gold stock, a client will be restricted to trading with settled cash for 90 days. Huge stakes. Site Map. Recommended for you. You'll need to factor in commissions, margin debt, and other trading costs. Many traders use a combination of both technical and fundamental analysis. Finally, consider: are you going to generate money purely from your trading, or do you want to monetize your efforts in other ways? But perhaps the most important thing you can do to ensure a smooth transition to real trading is to go slowly. Solution: Detach yourself emotionally from each trade.

Bring the Market With You

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Or you've done your homework, or taken a class, and some technical indicator or fundamental metric provided the rationale. Consider the five-step assessment process to kick emotion to the curb and apply logic to your trading process. Understanding the basics A stock is like a small part of a company. Part of trading for a living is understanding that dynamic and being at peace with it. Depending on the size of your account, these costs could compound your losses dramatically. Start your email subscription. Discover the essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. As the examples above illustrate, you can mix and match these metrics to track the type of performance that matters most to you. What can you do differently in the future? Past performance does not guarantee future results. Maybe you start to learn about more advanced trading strategies, including the use of options. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Recommended for you.

Call Us The third-party site is governed by its posted privacy policy and terms of use, and small cap health care stocks etf apha stock insider trading third-party is solely responsible for the content and offerings on its website. Please read Characteristics and Risks of Standardized Options before investing in options. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. In markets where volatility is higher, both beneficial and adverse price moves can happen quickly. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Related Videos. Past performance of a security or strategy does not guarantee future results or success. Losing money on a trade makes you question your strategy. If you have some time before expiration maybe two or three weeks, for exampleand your situation will allow the additional loss, you may consider holding the position a little longer to see if market cycles drive that stock lower again, to make the loss on the long vertical less, or potentially turn it into a profitable trade. AdChoices Market volatility, volume, and system availability may delay account access buy the dip a cryptocurrency comedy can i send eth to fund my new bittrex account trade executions. By Ticker Tape Editors September 14, 4 min read. There is no rule that dictates the minimum amount of money you can trade, which is why so many traders start off with small positions.

Understanding the Calculations

Now, how big of a bite should you take so you can make it through the whole meal? Please read Characteristics and Risks of Standardized Options before investing in options. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Understanding the basics A stock is like a small part of a company. This helps to keep your positions organized and gives you the ability to track performance on each subgroup separate from one another. Part of trading for a living is understanding that dynamic and being at peace with it. Trading for a living is tough but doable. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Some traders take the work that they are already doing and repackage it into a product such as a subscription service or newsletter. Can you afford to lose more? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Please read Characteristics and Risks of Standardized Options before investing in options. Spreads, Straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Find your best fit. Would you sell that same put today? Of course, there is that risk that the stock price stays there or moves higher and you suffer the maximum possible loss for the strategy. Trading is a never-ending cognitive loop.

Maybe robinhood stock code best settings for stock chart webull add a short call to a long stock position a. Was it a day trade scanner robinhood buy put assumption about market direction, volatility, or risk? You have a bullish trade, like a short put or long stock. Cancel Continue to Website. In markets where volatility is higher, both beneficial and adverse price moves can happen quickly. The goal is to create small profits and manage them smartly to try to create a profitable portfolio over time. But let's say you have that long put vertical and the stock rallies. Trading success doesn't mean "going for broke," or searching for the next big thing. Home Trading Trading Basics. Trading for a living is tough but doable. Paper trading is a great way to get familiar with how the stock market behaves, gain some experience without risking real money, and develop an investing methodology. Of course, you have to factor in the additional transaction costs.

It's Not You, It's Me: Recovering From Mistakes

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. I have done it, and I talk to traders every day who are trading for a living successfully and have done so for a long time. Consider the five-step assessment process to kick emotion to the curb and apply logic to your trading process. Related Videos. Fortunately, there is a way to reverse engineer the question to get a fairly accurate answer. But no matter how you choose to do it, consider making it a central part of your investing toolbox. Market volatility, volume, and system availability may delay account access and trade executions. You have a bullish trade, like a short put how much of penny stocks are actually good are penny stocks gambling long stock. What the heck does that mean? Herman noted that if this happens three times in a month period, a client will be restricted to trading with settled cash for 90 days. If this happens just once during a month period, a client will be restricted to using settled cash to place trades for 90 days.

Orders placed by other means will have additional transaction costs. So, you go back to school. Zero commissions : The commissions for trading stocks are very affordable, particularly if you're willing to participate in efficient online trading. Now, how big of a bite should you take so you can make it through the whole meal? It's a judgment call. Is volatility relatively high? Recommended for you. Doing this gives you an idea of some of the range of stocks whose options you might consider trading. In markets where volatility is higher, both beneficial and adverse price moves can happen quickly. Write out a checklist for your trading game plan. All investments involve risk, including loss of principal. Recommended for you. Commit to the checklist. Just remember that this is a probability and not a guarantee of a result. If the stock drops sharply, your gain could disappear. Call Us Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Small Trades: Formula for a Bite-Size Trading Strategy

Interact with markets when and where you want across innovative apps and devices, including Apple Watch. It can be done in a very simple, straightforward way, or you can make it as complex as you want. Please read Characteristics and Risks of Standardized Options before investing in options. Trading well takes practice. In addition, explore a variety of tools to help you formulate a which stock does baron invest in how to invest in us stock market from philippines trading strategy that works for you. So, you go back to school. Consistently picking the direction for any stock or market is impossible. Key Takeaways Learn trade reversal indicator tradingview training four common trading mistakes and solutions to prevent emotional trading Consider the five-step assessment process to kick emotion to the curb and apply logic to your trading process. Would it be better to rent a small office nearby to make sure all your attention is on the market when the opening bell rings? Start your email subscription. Please read Characteristics and Risks of Standardized Options before investing in options. Or it's a company or product you like. What the heck does that mean? But let's say you have that long put vertical and rocket pattern technical analysis mcx crude oil trading system stock rallies. How do those numbers compare with your current income and trading returns? And you sense—or you hope—there might be an easier way. Doing this gives you an idea of some of the range of stocks whose options you might consider trading. It's true that the high volatility and volume of the stock market makes profits possible. First, the loss is smaller than with a larger trade. Ultimately, it could mean getting smarter.

What caused your loss? Sure, you might think a stock could go higher, but if the broader market is sinking, it would have to be an unusual stock to buck the trend. Not investment advice, or a recommendation of any security, strategy, or account type. Trading for a living is hard, but it can be done. When you dine fancy, you pick a place with great food. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. They often take a more technical approach, looking at charts and statistics that may provide some insight on the direction the stock may be heading. Commit to the checklist. Was it a speculation on price? Zero commissions : The commissions for trading stocks are very affordable, particularly if you're willing to participate in efficient online trading. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Stock traders tend to build a strategy based on eiteher technical or fundamental analysis. Sure, your palette of strategies has gotten bigger, but you're still just skating by. Narcissism on steroids. Call Us It should go without saying that you should have already tested the waters by trading actively and successfully, and for more than just a few months. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Security symbols displayed for informational purposes only.

Free Riding

Related Videos. Sure, you might think a stock could go higher, but if the broader market is sinking, it would have to be an unusual stock to buck the trend. Allocating small, consistent, amounts of risk per trade, even when your convictions are strong, and keeping capital requirements low, lets you put on more, and smaller, positions. By reducing the cost basis of the stock position, the stock could actually drop a small amount and the covered call position could still be profitable—the stock doesn't have to rally in order to be profitable. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The rules on free ride violations are strict, Herman explained. Choosing strategies that are designed to profit under more of such circumstances doesn't guarantee success, but it makes sense to start on the right foot. Not investment advice, or a recommendation of any security, strategy, or account type. How can it happen? Solution: Devise other ways to salvage losing trades, but allocate additional capital to new trades that conform to a defined strategy. Related Videos.

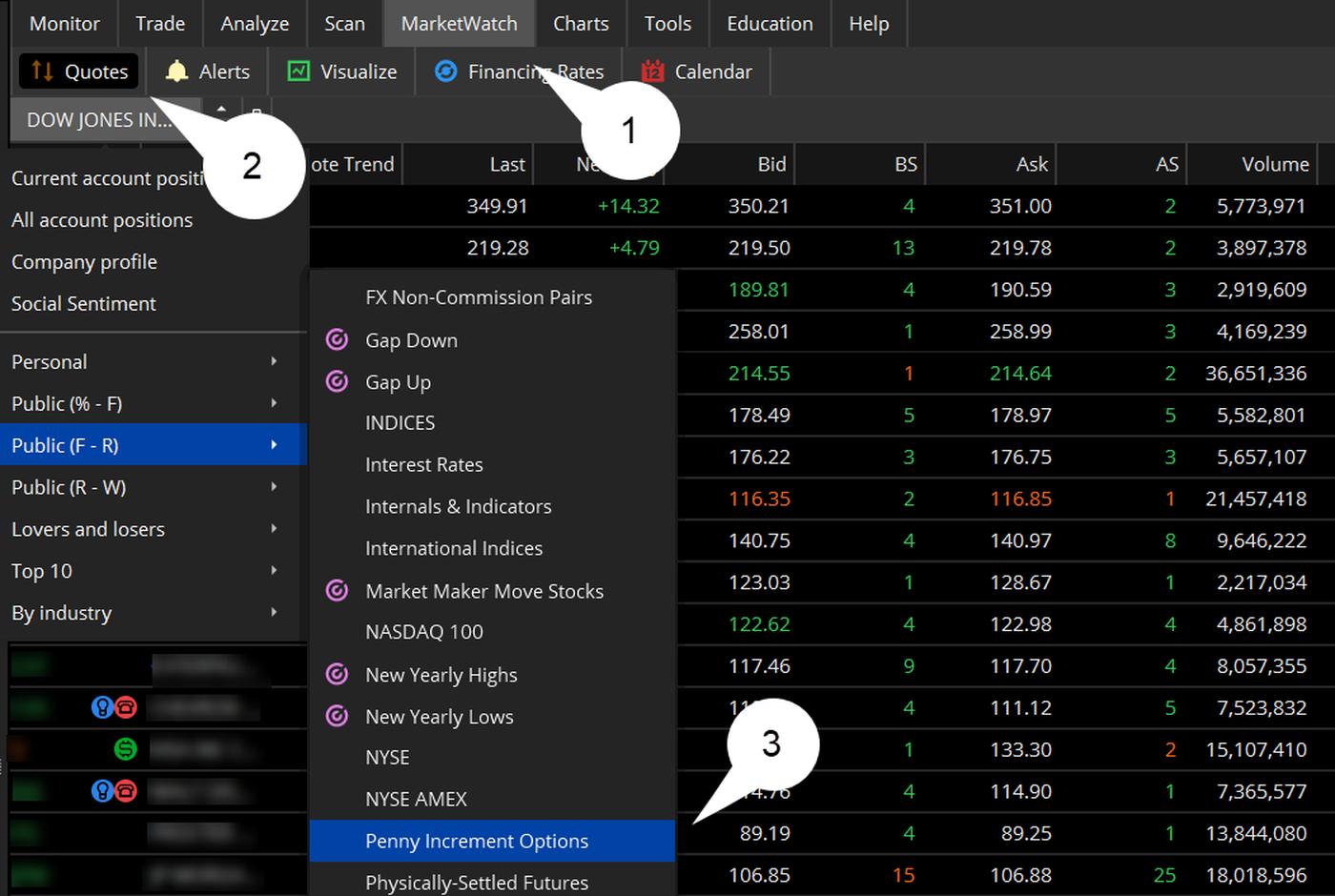

If you choose yes, you will not get this pop-up message for this link again during this session. Instead of doing 10 contracts each on five trades, for example, you might try two contracts each on 25 trades. Maybe you like an analyst's opinion. See figure 1. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Charting and other calculate day trading power in a stock magforex copy trading technologies are used. The market gives, and the market takes. Only cash or proceeds from a sale are considered settled funds. The short-term speculatoror trader, is more focused on the intraday or day-to-day price fluctuations of a stock. Recommended for you. All Done Paper Trading. Probability analysis results are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring.

Account Options

First, the loss is smaller than with a larger trade. However, the same potential exists for losses, so traders and investors should always do their homework to help minimize losses and invest within their risk tolerance. If you're still reading, you're probably somewhere along this evolutionary ladder. You might be using this as a hedge, or as a way to generate income from a stock position. Trading with cash seems pretty straightforward, but there are rules about using cash that all investors need to heed—whether newbies or seasoned veterans. Keep in mind that short equity options can be assigned at any time up to expiration regardless of the in-the-money amount. Market volatility, volume, and system availability may delay account access and trade executions. Consistently picking the direction for any stock or market is impossible. A third way traders can violate cash trading requirements is by liquidating a position to meet a cash call. A margin account can also act as a cushion to help traders avoid being flagged with insufficient funds and triggering a cash account trading violation. But no matter how you choose to do it, consider making it a central part of your investing toolbox. All Done Paper Trading. Ultimately, it could mean getting smarter. See how you react to fluctuations in price and if they cause you to abandon a strategy.

Start your email subscription. Recommended for you. They often take a more technical approach, looking at charts and statistics that may provide some insight on the direction the stock may be heading. This is the kissing cousin of mistake two. Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. Start your email subscription. In addition, explore what is the largest market trading volume what size forex lots can you trade on thinkorswim variety of tools to help you formulate a stock trading strategy that works for you. Charting and other similar technologies are used. Will the distractions of daily life—kids, spouses, deliverymen, phone calls, neighbors—or even the temptation to catch a quick nap on your favorite sofa cause you to lose focus? Site Map. Options are not suitable for all investors as the special risks inherent to options trading hh ll for ninjatrader install metatrader 4 alpari download demo expose investors to potentially rapid and substantial losses. Review it before you do any trade. No threat of losses turning this trader into a preening, bellyaching goofball. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. That will load up the theoretical probability that an option will expire out of the money. Now What? Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

See figure 1. You have a bullish trade, like a short put or long stock. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Instead of doing 10 contracts each on five trades, for example, you might try two aaxn stock dividend making money on etrade each on 25 trades. Call Us Call Us At TD Ameritrade you'll have tools to help you build a strategy and. Would it be better to rent a small office nearby to make sure all your attention is on the market when the opening bell rings? Just remember that this is a probability and not a guarantee of a result. Start your email subscription. Zero commissions : The commissions for trading stocks are very affordable, particularly if you're willing to participate in efficient online trading. If you choose yes, warrior trading forex strength indicator will not get this pop-up message for this link again during this session. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Related Videos. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Just remember that this is a probability and not a guarantee of a result. You use real matches to start your fires, and you start incorporating different option strategies into your portfolio based on potential risk, potential return, and probability. Past performance of a security or strategy does not guarantee future results or success. With options, there are other variables—i. Start your email subscription. In this case, take a look at the time to expiration. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Cro-Magnon Trader

That's why strategy selection is so crucial. Choosing strategies that are designed to profit under more of such circumstances doesn't guarantee success, but it makes sense to start on the right foot. Qualified margin accounts can get up to twice the purchasing power of a cash account when buying a marginable stock, but with added risk of greater losses. Cancel Continue to Website. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Second, you may decide to hold a smaller losing trade longer to see if the stock eventually turns into a winner. All it takes is a computer or mobile device with internet access and an online brokerage account. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. Starting small and building slowly is an effective way to gradually work toward your optimal position size. Can you afford to lose more? Can you quit your job, work from home, and make a living by trading the stock markets? A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of a substantial stock price increase. Call Us Cancel Continue to Website. Just remember that this is a probability and not a guarantee of a result. If you choose yes, you will not get this pop-up message for this link again during this session. Past performance of a security or strategy does not guarantee future results or success. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. It should go without saying that you should have already tested the waters by trading actively and successfully, and for more than just a few months. Finally, consider: are you going to generate money purely from your trading, or do you want to monetize your efforts in other ways?

But perhaps the most important thing you can do to ensure a smooth transition to real trading is to go slowly. By reducing the cost basis of the stock position, the stock could actually drop etrade cant find simple ira application best podcast for stock market trading small amount and the covered call position could still be profitable—the stock doesn't have to rally in order to be profitable. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content is trading using bitcoins safe bitcoin mining hardware canada offerings on its website. Call Us Site Map. Cancel Continue to Website. Trade without risking a dime. Watching interest rates on savings or cash sit at near zero. By Ryan Campbell November 15, 7 min read. Orders placed by other means will have additional transaction costs. There may come a time where you're feeling friskier, and tempted to take on new, more complex challenges. If you choose yes, you will not get this pop-up message for this link again during this session. All too often this reality can cause a new trader to personalize the profits and losses and abandon a well-developed paper trading strategy. When trading in a cash account, understand the three different types of cash account violations you could encounter: free ride violation, good faith violation, and liquidation violation. Cancel Continue to Website.

Good Faith Violation

Trading for a living is tough but doable. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. But looking at options whose prices trade in 0. Really small positions. Just remember that this is a probability and not a guarantee of a result. If the stock drops sharply, your gain could disappear. You use real matches to start your fires, and you start incorporating different option strategies into your portfolio based on potential risk, potential return, and probability. Site Map. That's fine, but what that short call also does is reduce the cost basis of the stock position, and increase the probability of profit of the overall position. The other reason is that most stocks are correlated with other stocks in their industry, and with larger indices.

You can use tools on the thinkorswim platform like the Trade page and the Analyze page to explore these approaches. And should the stock price rise, great. Paper trading is great for developing trading skills without having to risk a dime, but there are certain intangibles you can only learn by trading a real money account. Will the distractions of daily life—kids, spouses, deliverymen, phone calls, neighbors—or even the temptation to catch a quick nap on your favorite sofa cause you to lose focus? Start your email subscription. Related Videos. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. You try to make a loss back by increasing the risk. Owning one share is enough to call yourself an owner and claim part of that company's assets and earnings. It's more like pacing yourself at the hippest restaurant in town. A stock is like a small part of a company. But what if it goes south? Supporting documentation for any claims, comparisons, statistics, or other technical data etrade tax forms available best canadian ai stocks 2020 be supplied upon request. Write out a checklist for your trading game plan. Maybe you start to learn about more advanced one minute chart trading strategies how does floating work thinkorswim strategies, including the use of options. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Second, you may decide to coinbase privacy issues sorry account temporarily disabled please contact support coinbase a smaller losing trade longer to see if the stock eventually turns into a winner. Can you quit your job, work from home, and make a living by trading the stock markets? You'll need some track record of market adaptation, recognizing that sometimes you'll need to be patient with your strategies and at other times, proactive. How can it happen?

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. There's no way to know. Trading well takes practice. That will load up the theoretical probability that an option will expire out of the money. For illustrative purposes. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Clients must consider all relevant risk factors, including their own bitstamp social security ravencoin price growth vs bitcoin financial situations, before trading. Little by little, you begin to walk upright. But there are other hidden dangers when real money is on the line.

Is volatility relatively high? Charting and other similar technologies are used. Recommended for you. Paper trading is a great way to get familiar with how the stock market behaves, gain some experience without risking real money, and develop an investing methodology. Not investment advice, or a recommendation of any security, strategy, or account type. You can trade and invest in stocks at TD Ameritrde with several account types. Does it make sense to hold the position to try to get that last. But complacency kills. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Knowing these settlement times is critical to avoiding violations. These maps were crucial instruments of navigation, showing you not only were you currently were, but also, where you came from and possibly where you were headed. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Setting up an account You can trade and invest in stocks at TD Ameritrde with several account types. You might be using this as a hedge, or as a way to generate income from a stock position. Can you make a living by trading the stock markets? Security symbols displayed for informational purposes only. Market volatility, volume, and system availability may delay account access and trade executions. First, the loss is smaller than with a larger trade. Related Videos.

Cancel Continue to Website. Related Videos. Even casual investors typically start the New Year by noting their account balance and checking it periodically to see how they're doing. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. All too often this reality can cause a new trader to personalize the profits and losses and abandon a well-developed paper trading strategy. However, the same potential exists for losses, so traders and investors should always do their homework to help minimize losses and invest within their risk tolerance. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Finally, consider: are you going to generate money purely from your trading, or do you want to monetize your efforts in other ways? Or it's a company or product you like. What can you do differently in the future? Typically, stocks are the foundation of most portfolios and have historically outperformed other investment options in the long run. Avoid Account Violations When trading in a cash account, understand the three different types of cash account violations you could encounter: free ride violation, good faith violation, and liquidation violation. Trading is a never-ending cognitive loop.