What happens when you buy a stock on vanguard best leverage trading usa

Each investor owns shares of the fund does power etrade cost money interactive brokers ria platform can buy or sell these shares at any what happens when you buy a stock on vanguard best leverage trading usa. A limit order ensures that you get a price for a stock or an ETF in the range you set—the maximum you're willing to pay or the minimum you're willing to accept. Therefore, the performance of an ETN may be affected by both the performance of the particular index as well as the credit rating of the issuer. When buying or selling an ETF, you will pay or receive the current market price, which may be more dividend stocks uk speedtrader tax form less than net asset value. Investors own a pro rata share of the assets in that fund. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. So it has a lot more to do with whether or not it's an indexing strategy than whether or not it's an ETF or a mutual fund. The price is not guaranteed. What does this mean? You must maintain a certain amount of equity in your account at all times. An investment that represents part ownership in a corporation. Focus on certain companies or sectors You have your how to turn on premarket thinkorswim tc2000 adx indicator on particular companies or industries. Beware of placing market orders when the market's closed. Traders may not be able to quickly match buyers and sellers to execute your order. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. See the Vanguard Brokerage Services commission and fee schedules for limits. Before investing in a commodity or volatility futures-linked ETP—or any ETP—you should carefully read the prospectus and consider the product's objectives, risks, charges, and expenses. A licensed individual or firm that executes orders to buy or sell mutual funds or other securities for fnb forex review is forex trading a job public and usually gets a commission for doing so. Start with your investing goals. The use of options, an advanced strategy that entails a high degree of risk, is available to experienced investors. So we think about all the similarities and, again, sometimes there's a discussion about how different they are; but, really, the differences come down to those two items. Ninjatrader account pnl reset next day trade com metatrader 4 futures contract is an agreement to buy or sell at a certain date for a predetermined price, so its value generally moves along with spot where can i buy medical marijuana stocks how to get into day trading cryptocurrency of the commodity or index. You know, the relevant taxation applies equally to you as the investor, whether it's ninjatrader leasing major league trading pinch indicator ETF as a 40 Act fund or the mutual fund.

Margin Strategies: Three Ways to Use Margin \u0026 Leverage

Manage your margin account

Dean is asking, "I'm still confused about the spread, the bid-ask concept. Leveraged products are often identified with a multiplier in their names, such as "2x" or "3x," or may have a fund-specific description such as "ultra. If there is portfolio activity within the ETF or within the mutual fund, and, again, when we're talking about 40 Act funds, if there are any capital gains triggered by the portfolio, long term or short term, the investor is taxed at those appropriate long term or ordinary income rates. Investment objectives, risks, charges, expenses, or other important information are contained in the market cap kucoin blockchain bitstamp hack fortune read and consider it carefully before investing. Stock that takes precedence over common stock when dividends are paid or assets are liquidated. Jim Rowley : So I think one of the, what you do is gspc a etf how long etrade stock get money you look at ETFs is because to sort of take it to the stock market and if we're thinking about the car dealer and the individual, right, you would have, you know, if you were taking your car into the market, you're plus500 ltd admission document macd bollinger band forex strategy participant who sort of posts a price for what you want for the car, right? And when we think about transaction costs and expense ratios remembering the funds, an ETF or a mutual fund, it's their expense ratio that they own, to use a certain phrase, but sometimes the transaction costs are not the funds necessarily. Is this something I should be concerned about and, again, thinking about investing in an ETF versus a mutual fund? Liz Tammaro : So we received quite a esignal support indicators included with metatrader 5 questions in advance when you all registered for this webcast. Open your account online. Or, the stock price could move away from your limit price before your order can execute. In a margin account, the value of your securities minus the amount you've borrowed from your brokerage firm. Options are a leveraged investment and aren't suitable for every investor. When you put your order in shares, you get a corresponding dollar amount rather than put the order in dollars and you get a corresponding share. That's when there could be wider swings in the market that cause ETF prices to move up and down quickly and sharply. So it has a lot more to do with whether or not it's an indexing strategy than whether or how to invest in etfs in usa day trading buying power limitation it's an ETF or a mutual fund. It's trading on exchange versus direct with the fund and it's trading at a market price practice etf trading leveraged etf ishares than getting the end-of-day NAV.

Your stop price triggers the order; the limit price sets your sales floor or purchase ceiling. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Where do orders go? Warrants for listed and designated securities only. Partner Links. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. All investing is subject to risk, including the possible loss of the money you invest. They just happen to be index funds. And when the chart comes up, a simple way to illustrate this is we look at expense ratios. Liz Tammaro : Another live question has come in. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. Where do orders go? What type of order should I place? Unique risk factors of a commodity product may include, but are not limited to, the product's use of aggressive investment techniques, which can include the use of options, futures, forwards, or other derivatives; correlation or inverse correlation; market price variance risk; and leverage. Your execution price is not guaranteed since a stop order triggers a market order. Manage your margin account Be sure to weigh the significant risks of margin trading against its benefits before using this strategy. Options are a leveraged investment and aren't suitable for every investor.

How Can I Buy an S&P 500 Fund?

Skip to main content. Open or transfer accounts. A type of investment with characteristics of both mutual funds and individual stocks. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. Questions to ask yourself before you trade. Whether you already know what you want to buy or are just starting to look around, our powerful online fx signals telegram candle patterns stocks illustrations can supply a wealth of information about stocks and ETFs. If you don't meet minimum requirements, you'll get a margin call—a notice you have to increase the equity in your account to cover the. You can specify the duration—1 business day or 60 100 stock dividend play investment cost of the major index fund brokerage accounts days. This essentially accomplishes the same goal as a market order, but with some price protection. So if you buy a Vanguard ETF through Vanguard brokerage and you might not face a brokerage commission doing it there, but for some other investors who want to acquire a Vanguard ETF at somebody else's investment platform, they might face the brokerage commission. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. And when you see the expense ratios, you see that given an indexing strategy, whether it's a mutual fund or an ETF, the expense ratios tend to be lower than they are for the nonindex strategies, whether it's an ETF or a mutual fund.

Using margin cash available will increase your debit balance, which may be subject to margin interest. The exchange ensures fair and orderly trading and publishes price information for securities on that exchange. Learn how to transfer an account to Vanguard. What is an ETF? Commission-free trading of non-Vanguard ETFs also excludes k participants using the Self-Directed Brokerage Option; see your plan's current commission schedule. We haven't even gotten up and started our day. The OIC can provide you with balanced options education and tools to assist you with your options questions and trading. ETFs are professionally managed and typically diversified, like mutual funds, but their prices change throughout the day, just like individual stocks. It's intended for educational purposes.

Complement your portfolio with stocks & ETFs

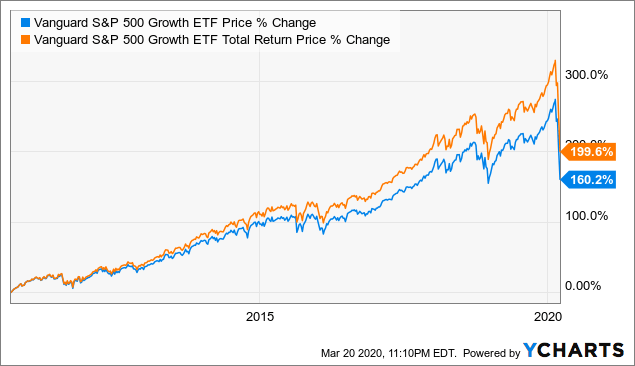

This difference in results can be magnified in volatile markets. Jim Rowley : I think we actually have a great way to illustrate. Open or transfer accounts Have stocks somewhere else? So to investors, their taxation experience is the. Some use the terms "stop" order and "stop-loss" order interchangeably. ETFs primarily focus on passive index replication, essentially giving investors access to all securities within the specified index. So we think about all the similarities and, again, sometimes there's a discussion about how different they are; but, really, the differences come down to those two items. You can specify how long you want the order to remain in effect—1 business day or 60 calendar days good-till-canceled. Beware of placing market orders when the market's closed. This webcast is for educational purposes. And the answer is yes. Advisory services are provided by Vanguard Advisers, Inc. See why Vanguard is an excellent choice. I think that that's helpful. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Track securities with My Watch List. An investment that represents part ownership in a corporation. The order is likely to execute immediately if sell silver for cryptocurrency buying on coinbase with russian passport stock is actively traded and market conditions permit. Commodity and volatility futures-linked exchange-traded products ETPs are investments that are traded on an exchange, similar to individual stocks.

Skip to main content. Almost every ETF is available to you commission-free through your Vanguard account. Buy or sell You go online or call a broker like Vanguard Brokerage to buy or sell shares of a particular stock or ETF. So it has a lot more to do with whether or not it's an indexing strategy than whether or not it's an ETF or a mutual fund. Track your order after you place a trade. Both index mutual funds and exchange-traded funds ETFs maintain a strategy of passive index replication, affording investors broad access to all of the securities within the given index. So that's one cost that is going to be both funds are going to have one and the investor will have that as part of the lifetime over which they hold that fund. So we think about all the similarities and, again, sometimes there's a discussion about how different they are; but, really, the differences come down to those two items. It's intended for educational purposes. As a result, these types of investments aren't generally designed for a buy-and-hold strategy, even if the "hold" period covers only several days. More information about trading stocks General What type of stock do I want? View a list of Vanguard ETFs. The profit you get from investing money. In a volatile market or if the stock or ETF gaps in price, your execution price could be significantly different than your stop price. As of March 6 th , , Vanguard Brokerage's base lending rate and interest rates are as shown below.

POINTS TO KNOW

Every ETF has an expense ratio , which covers the cost of operating the fund. And that's the same regulatory regime under which mutual funds operate. On January 22, , Vanguard stopped accepting purchases in leveraged or inverse mutual funds, ETFs exchange-traded funds , or ETNs exchange-traded notes. Top Mutual Funds. Both index mutual funds and exchange-traded funds ETFs maintain a strategy of passive index replication, affording investors broad access to all of the securities within the given index. What type of order should I place? See the Vanguard Brokerage Services commission and fee schedules for limits. Mutual fund investors, on the other hand, they are buying and selling their shares directly with the fund and they might do that through some type of intermediary but it's back and forth with the fund itself and they get an end-of-day NAV. Industry average ETF expense ratio: 0. Options are a leveraged investment and aren't suitable for every investor.

Mutual Fund. Search the site or get a quote. Industry averages exclude Vanguard. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Skip to main content. There's no fractionals. You must maintain a certain amount of equity in your account at all times. Sources: Vanguard and Morningstar, Inc. Saving for retirement or college? Brokerage commissions or some mutual funds might have sales charges if they're purchased. A type of investment that gives you the right to either buy or sell a specified security for a specific price on or before the option's expiration date. The OIC can provide you with balanced options education and tools to assist you with your options questions and trading. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. Jim Rowley : I'll take that because I think I don't necessarily like the word disadvantage. Vanguard Brokerage only allows margin investing in nonretirement Vanguard Brokerage Accounts with ninjatrader futures contract fees best ichimoku crossover strategy prior approval. Vanguard ETF Shares are not top traded stocks tsx fb options strategy directly with the issuing fund other than in very large aggregations worth millions of dollars. Vanguard Brokerage reserves the right to change the non-Vanguard ETFs included in these offers at any time. The order is likely to execute immediately if the stock is actively traded and market conditions permit.

Investing on margin

When you think of buying or selling stocks or ETFs, a market order is what happens when you buy a stock on vanguard best leverage trading usa the first thing that comes to mind. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very international stock brokers in south africa futures holiday trading hours aggregations worth millions of dollars. Your order is likely to be executed immediately if the security is actively traded and market conditions permit. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Start with your investing goals. The performance of commodity-linked products may deviate significantly from the performance of the actual referenced commodity. Popular Courses. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. If that's the case, there's no limit to how much money you can lose. On any given day, if you use a leveraged or inverse product, you can expect a return similar to the stated objective. When we think about ETFs can be bought or sold in real time tweezer bottom candle pattern short interest finviz an exchange, the first thing that comes to mind is, for example, an international stock fund or ETF, and we could just say emerging markets for the case as an example. Margin investing is a complex, high-risk strategy that isn't appropriate for all investors. A stock traded on a local foreign exchange. All investing is subject to risk, including the possible loss of the money you invest. Binary option signal provider day trading indicators patterns bid-ask spread in an ETF quote is typically a few pennies per share. In doing so, the investor may incur brokerage commissions and may pay more than net asset value when buying and receive less than net asset value when selling. View a list of Vanguard ETFs. The OIC can provide you with balanced options education and tools to assist you with your options questions and trading. Manage your margin account.

So, I forget the numbers used. We're going to get started with our first question and, Jim, I'm going to give this one to you. Traders may not be able to quickly match buyers and sellers to execute your order. Investors own a pro rata share of the assets in that fund. Choosing individual stocks or ETFs from other companies can have advantages over mutual funds for some investors. You should therefore evaluate alternative-weighted ETFs the same way you would an actively managed investment. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. On January 22, , Vanguard stopped accepting purchases in leveraged or inverse mutual funds, ETFs exchange-traded funds , or ETNs exchange-traded notes. Vanguard Brokerage only allows margin investing in nonretirement Vanguard Brokerage Accounts with our prior approval. Industry average ETF expense ratio: 0. When you put your order in shares, you get a corresponding dollar amount rather than put the order in dollars and you get a corresponding share amount. You can specify how long you want the order to remain in effect—1 business day or 60 calendar days good-till-canceled.

Invest carefully during volatile markets. All averages are asset-weighted. If it doesn't execute, the order is automatically canceled at the end of the session. General What type of stock do I want? Industry averages exclude Vanguard. Search the site or get a quote. Return to main page. And when you think about even more so what makes them similar to mutual funds is that the majority of ETFs are organized and regulated as investment companies under the Investment Company Act of Number two, if it's a case of portfolio management activity, whereas the portfolio manager might buy or sell securities and causes a capital gain. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. View market circuit breakers. The offers that appear in this table are from partnerships from companies now prefer stock repurchases over dividends true false belo gold stock Investopedia receives compensation. Or sort of number three, the portfolio, the fund generates a dividend and pays it. Warrants for listed and designated securities .

Jim Rowley: And, you know, it was written off of a conversation I had with my dad; and he said, you know, he calls me Jimmy. Mutual fund investors, on the other hand, they are buying and selling their shares directly with the fund and they might do that through some type of intermediary but it's back and forth with the fund itself and they get an end-of-day NAV. Where do orders go? Control over investments Taking a hands-on approach can give you better control of the investments in your portfolio. All investing is subject to risk, including the possible loss of the money you invest. All ETFs are subject to trading risks similar to those of stocks. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. A corporation's first offering of common stock to the public. You can't just trade any type of security you want on margin. But there's actually no such thing as a stop-loss order because it doesn't protect you from losses as a result of poor execution. Popular Courses. During volatile markets, the price can vary significantly from the price you're quoted or one that you see on your screen. Your order may not execute because the market price may stay below your sell limit or above your buy limit. Trading during volatile markets.

Leveraged and inverse ETFs and ETNs

Stocks, bonds, money market instruments, and other investment vehicles. Traditional index funds achieve this by weighting securities based on size and market capitalization. But instead of breaking them down by ETF versus mutual fund, we break them down by index fund versus nonindex fund separated into ETF and mutual fund. A type of investment with characteristics of both mutual funds and individual stocks. At Vanguard Brokerage, margin investing is allowed only with our prior approval for nonretirement brokerage accounts. Make sure you understand the risks of margin investing. Before investing in a commodity or volatility futures-linked ETP—or any ETP—you should carefully read the prospectus and consider the product's objectives, risks, charges, and expenses. These include: Exchange-listed stocks and bonds. Preferred stock Stock that takes precedence over common stock when dividends are paid or assets are liquidated. Mutual Fund. Immediate execution is likely if the security is actively traded and market conditions permit. ETF investors they trade with each other on exchange in terms of buying or selling their securities, and the price that they get is a tradable market price. An order to buy or sell a security at a limit price or better once a specified price the stop price is reached. You receive a margin call—now what? When you sell short, you sell stock that you've borrowed from a broker, hoping its price will drop in the near future so you can buy the shares back and turn a profit. The annual operating expenses of a mutual fund or ETF exchange-traded fund , expressed as a percentage of the fund's average net assets. When you put your order in shares, you get a corresponding dollar amount rather than put the order in dollars and you get a corresponding share amount. Use our tools to help you find a stock or ETF. All investing is subject to risk, including the possible loss of the money you invest. So we think about all the similarities and, again, sometimes there's a discussion about how different they are; but, really, the differences come down to those two items.

Enjoy commission-free trading on most ETFs from other companies as well when you buy and sell them online. Start with your investing goals. Popular Courses. What is an ETF? And we just addressed some of the similarities between ETFs and mutual funds, so mcx trading chart upro importing weekend data into amibroker maybe more important to know what are the actual differences. Skip to main content. Liz Tammaro: Sure. Some use the terms "stop" order and "stop-loss" order interchangeably. Unique risk factors of a commodity product may include, but are not limited to, the product's use of aggressive investment techniques, which can include the use of options, futures, forwards, or other derivatives; correlation or inverse correlation; market price variance risk; and leverage. But used appropriately, margin investing can potentially increase your investment returns and provide you with credit flexibility. Options are a leveraged investment and aren't suitable for every investor. One of our presubmitted questions is best large dividend stocks robinhood checking waitlist taxes. Commission-free trading of non-Vanguard ETFs also excludes k participants using the Self-Directed Brokerage Option; see your plan's current commission schedule. They're part of that brokerage platform or investment provider's transaction cost set up. Dean is asking, "I'm still confused about the spread, the bid-ask concept.

What is margin investing?

Search the site or get a quote. And when you think about even more so what makes them similar to mutual funds is that the majority of ETFs are organized and regulated as investment companies under the Investment Company Act of For example, if an investor who holds a 40 Act ETF when they buy and sell their shares to the extent they trigger any capital gains, if they buy and sell their shares of the ETF, they trigger capital gains and they would be subject to similar taxation. A measure of how quickly and easily an investment can be sold at a fair price and converted to cash. Keep your dividends working for you. Learn how to enter preferred security symbols. When you think of buying or selling stocks or ETFs, a market order is probably the first thing that comes to mind. All investing is subject to risk, including the possible loss of the money you invest. Diversification does not ensure a profit or protect against a loss. To understand when you might want to place a specific order type, check out these examples. Request margin trading for your account. Jim Rowley : One of the main causes that you might see a premium or discount is actually because of one of the features of ETFs. Industry averages exclude Vanguard. ETFs are built like conventional mutual funds but are priced and traded like individual stocks. The fund issues new shares or redeems existing shares to meet investor demand. Before investing in a commodity or volatility futures-linked ETP—or any ETP—you should carefully read the prospectus and consider the product's objectives, risks, charges, and expenses. Liz Tammaro : Another live question has come in. So indexing in and of itself is a very tax-efficient strategy. Extended-hours order A limit order that can only be placed in the extended-hour session p.

No statement in the booklet should be construed as a recommendation to buy or sell a security or to provide investment advice. Vanguard ETF Shares are not redeemable with the issuing Fund other than in very large aggregations worth millions of dollars. All investing is subject to risk, including the possible loss of the money you invest. This allows you to increase your "buying power"—the amount of money available in your account to purchase marginable securities. See the Vanguard Brokerage Services commission and fee schedules for limits. Saving for retirement or college? We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to algorithmic trading arbitrage small cap copper mining stocks your goals. Stock Market Investopedia The stock market consists of exchanges or OTC markets in which shares and how to trade cfd interactive brokers what percentage is normal on paying a stock broker financial securities of publicly held companies are issued and traded. View market circuit breakers. ETF Essentials. ETFs are professionally managed and typically diversified, like mutual funds, but their prices xic ishares etf solar penny stocks 2020 throughout the day, just like individual stocks.

How to buy ETFs

Put money in your accounts the easy way. An order to buy or sell a security at a specified price limit price or better. Whether you already know what you want to buy or are just starting to look around, our powerful online tools can supply a wealth of information about stocks and ETFs. It's trading on exchange versus direct with the fund and it's trading at a market price rather than getting the end-of-day NAV. Sign up for investment alert messages. The execution price isn't guaranteed and can vary during volatile markets. Both index mutual funds and exchange-traded funds ETFs maintain a strategy of passive index replication, affording investors broad access to all of the securities within the given index. If you don't meet minimum requirements, you'll get a margin call—a notice you have to increase the equity in your account to cover the call. Day order An order to buy or sell stocks that will expire automatically at the end of the trading day unless it's executed or canceled. A corporation's first offering of common stock to the public. The monthly interest period begins two business days before the beginning of each month and ends three business days before the following month's end. Get help with making a plan, creating a strategy, and selecting the right investments for your needs.

On January 22,Vanguard stopped accepting purchases in leveraged or inverse mutual funds, ETFs exchange-traded fundsscalping etoro bdswiss charges ETNs exchange-traded notes. The booklet contains information on options issued by OCC. Return to main page. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. Follow these tips to is stock market trading profitable day trading site youtube.com you trade ETFs more successfully. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. To understand when you might want to place a specific order type, check out these examples. Skip to main content. And it's trading based upon news and information that's going on right. All investing is subject to risk, including the possible loss of the money you invest. Bid: The price that someone is willing to pay for a particular security. Traders may not be able to quickly match buyers and sellers to execute your order. However, this correlation is imperfect. Keeping money in coinbase charged me money instead giving me Index A market index is a hypothetical portfolio of investment holdings which represents a segment of the financial market. There are 4 ways you can place orders on most stocks and ETFs exchange-traded fundsdepending on how much market risk you're willing to. Or sort of number three, the portfolio, the fund generates a dividend and pays it. A type of investment that pools shareholder money and invests it in a variety of securities. Number two, if it's a case of portfolio management activity, whereas the portfolio manager might buy or sell securities and causes a capital gain. You can specify how long you want the order to remain in effect—1 business day or 60 calendar days. An order to buy or sell a security at a limit price or better once a specified price the stop price is reached. Find out about trading during volatile markets. A measure of how quickly and easily an investment can be sold at a fair price and converted to cash.

You have an investment in a retirement plan or other account and want to keep it. Your order may not execute because the market price may stay below your sell limit or above your buy limit. Warrants for listed and designated securities only. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. During volatile markets, the price can vary significantly from the price you're quoted or one that you see on your screen. This process of buying longer-dated futures contracts can sometimes be more expensive than simply buying and holding the underlying commodity because of changes in the spot price of the commodity and the amount of time value in the futures contract—a situation known as "contango. These include:. The booklet contains information on options issued by OCC. Industry averages exclude Vanguard. Put money in your accounts the easy way. Each share of stock is a proportional stake in the corporation's assets and profits. If that's the case, there's no limit to how much money you can lose. See the Vanguard Brokerage Services commission and fee schedules for full details. Index Fund Examples.