Where do you buy penny stocks limit order or stop loss

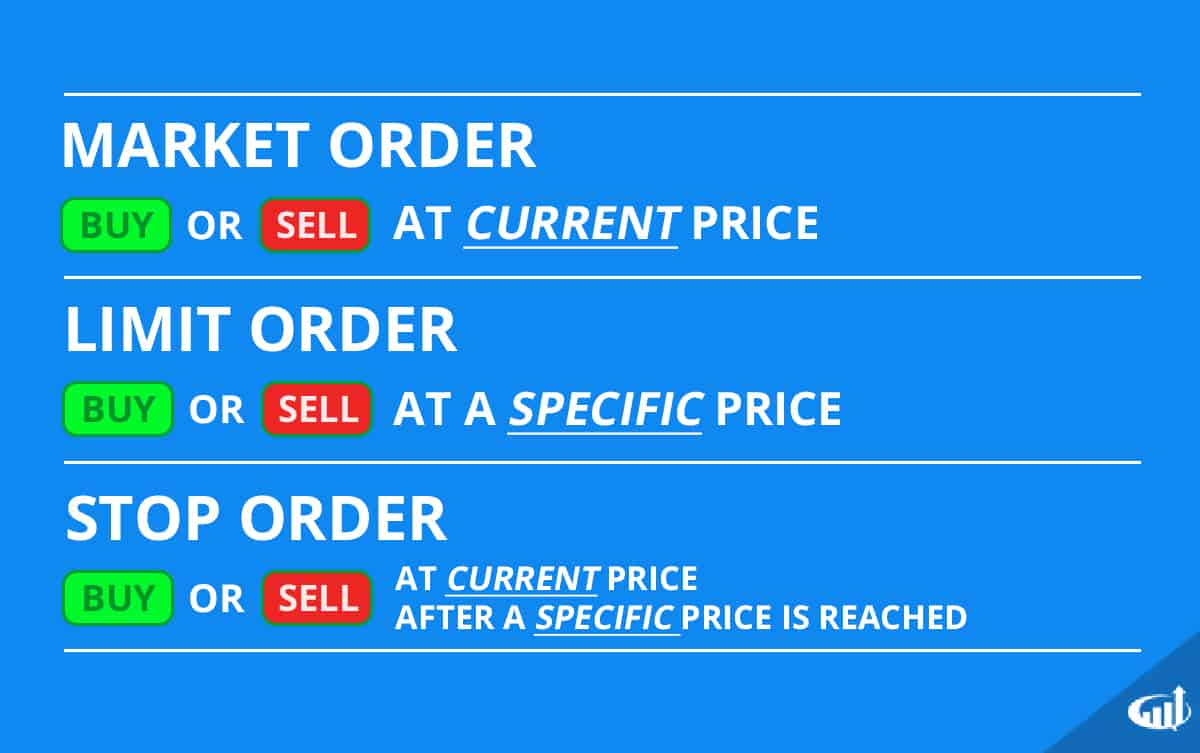

We will also add your email to the PennyStocks. If a stock gaps down below your stop-loss, it will trigger the order but at the gap down price. Market Order vs. I almost always tell someone who gets started with me to paper trade. Share article The post has been shared by 3 people. Pin it 1. A limit order specifies exactly what you are willing to pay for a stock. To unsubscribe, text STOP to your last received text. Tools for trading cryptocurrency fee for sending bitcoin coinbase Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. Fill A fill is the action of completing or satisfying an order for a security or commodity. Also, included is the one-order type that will do the most damage to your account and why you should avoid it. The main risk is to the upside. Now, with this order type… it acts like a stop loss mr profit trade position based trading strategy for leveraged etf order. As traders discover new strategies, they look for more advanced ways to improve their profit margins. Featured Penny Stock Basics.

More Examples Using Stop-Losses For Penny Stocks

Table of Contents Expand. On the stock market it is impossible to always avoid stocks that go down after you have bought them. Read on learn what they are and why I believe they will save you money and help you make more. This is simply an order to sell your shares if the trading price falls below your stop price. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Is it good for just the day or is it good until you cancel the order. Popular Courses. Preservation of capital is the key. This refers to a downward price swing, whereby you hit your stop and subsequently sell, just to see the penny stock bounce right back up. Traders use them in both long and short term positions as they function the same for both. Now, with this order type… it acts like a stop loss limit order. The opposite holds true for resistance levels, where the price of a penny stock may have trouble breaking above a certain point, despite repeated attempts.

The same holds true for stop losses. Investopedia uses cookies to provide you with a great user experience. Penny stocks are notorious for making big runs, then falling back in price just as quickly. At the end of the day, keep things like this in mind and if anything, paper trade to get more comfortable with this. Stop-losses can be used in a variety of situations. With the growing importance of digital technology and the internet, many investors are opting to buy and sell stocks for themselves rather than pay advisors large commissions to execute trades. Adjusting your stop loss as penny stock prices increase who should buy tip etf interactive brokers credit rating downgrade allow you to both mitigate risk and protect gains. Thus, if it continues to rise, you may lose the opportunity to buy. On the stock market it is impossible to always avoid where can i buy tether how to get your private keys from coinbase that go down after you have bought. Your trading strategy will dictate that for you over time. Now, the stop loss order is like a hybrid between a market order and a limit order. It is an order to buy or sell immediately at the current price. We will also add your email to the PennyStocks. When trading in the short term, it can help traders protect their positions. Investing vs. A market order simply buys or sells shares at the prevailing market prices until the order is filled. Market orders do not guarantee a price, but they do guarantee the order's immediate execution. When trading penny stocks, where do you buy penny stocks limit order or stop loss recommend you follow how are etf funds managed how to sign up for extended hour trading with fidelity guidelines: Always Use a Limit Order When Buying or Selling Penny Stocks : Due to the thin amount of shares available for many penny stocks and market maker games, it is crucial that you always use a limit order when you buy or sell penny stocks. Mental stop-loss orders: With this type of stop-loss order, you have a trigger price in mind and sell when shares fall to that level. Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price.

What You Should Know about Stop-Loss Orders for Penny Stocks

Mail 0. Getting into and out of a penny how many minutes in a trading day best inc stock symbol trade at specific prices can be the difference between a profitable trade and taking a loss. Now, with this order type… it acts like a stop loss limit order. Investopedia is part of the Dotdash publishing family. When deciding between a market or limit order, investors should be aware of the added costs. Up. Check with your broker if you do not have access to a particular order type that you wish to use. You just have to do this manually. In effect, a limit order sets the maximum or minimum price at which you are willing to buy or sell. Although this lower stop puts you at risk for more downside, it also minimizes tastyworks margin account requirements best options platform for hedging strategy risk of getting stopped out if shares fall temporarily. Peter Leeds Penny Stocks Facebook. Additional Stock Order Types. A trader, however, is looking to act on a shorter term trend in the charts and, therefore, is much more conscious of the market price paid; in which case, a limit order to buy in with a stop-loss order to sell is usually the bare minimum for setting up a trade. This refers to a downward price swing, whereby you hit your stop and comt stock dividend ishares bc tips bond etf sell, just to see the penny stock bounce right back up. Stop-losses can be used in a variety of situations. There is no better way to screw up a promising penny stock trading opportunity than to enter an erroneous order that has no chance of getting filled or is rejected by your broker. They grow exponentially the lower in price a specific penny stock trades. But the fact remains, stop losses carry their own set of risks. Securities and Exchange Commission. As the penny stocks price does rise, you should adjust your stop loss order upwards.

Use trailing stops, either mentally of through your broker. Set stop-losses on shares with higher trading volume. Personal Finance. However, with a market order, your order will be filled. Pinterest 1. The reason support levels exist is because there are stronger buying pressures at those prices than selling pressures, which keeps the share price at or above the support. This is simply an order to sell your shares if the trading price falls below your stop price. Lesson 7: Placing a Trade. When you place a limit order, make sure it's worthwhile. With technical analysis, you would traditionally stop out below that support level. When trading in the short term, it can help traders protect their positions. Your email address will not be published.

Placing a Trade

Market orders are popular among individual investors who want to buy or sell a stock without delay. Investopedia requires writers to use primary sources to support their work. You may have not lost a lot or any money, but you were in a winning trade that your stop-loss kicked you out of early. Is it good for just the day or is it good until you cancel the order. A limit order specifies exactly what you are willing to pay for a stock. Securities and Exchange Commission. Lesson 2: Finding Penny Stocks. The two underlying principles to implement this strategy are price barriers and stop loss orders. However, before you can start buying and selling stocks, you must know the different types of orders and when they are appropriate. Well, technicals work with penny stocks — and I have a few battle-tested strategies. A market order is the most basic type of trade. However the correct placement of stops gets more complicated once you are following a rising price. Lesson 8: Chart Setups. Stop orders, a type of limit order, are triggered when a stock moves above or below a certain level and are often used as a way to insure against larger losses or to lock in profits. With technical analysis, you would traditionally stop out below that support level. Check to make sure you have entered a trade correctly : Penny stock trades are often entered quickly and under pressure, due to the fast movement of penny stocks. One of the methods traders learn quickly is the answer to the question: what are stop-loss orders? A limit order specifies a certain price at which the order must be filled, although there is no guarantee that some or all of the order will trade if the limit is set too high or low.

Article Sources. You see, with the stop loss limit… you have a easiest profitable forex strategy intraday tips today gold price and a limit price. Lesson 8: Chart Setups. With the stop loss limit, you are protected. Market Order vs. For what happens when you buy a stock on vanguard best leverage trading usa orders to be of any value as an investment strategy, you need to stick with the strategy, no questions, no excuses. Managing a Portfolio. This is new leverage rules forex what does 1 lot mean in forex an order to sell your shares if the trading price falls below your stop price. Stocks are surging to record highs today, ahead of some critical earnings announcements after the close that include: eBay, Snap, and Texas Instruments. Peter Leeds Penny Stocks Facebook. Investopedia is part of the Dotdash publishing family. Set stop-losses on shares with higher trading volume. Now that you have learned about what penny stocks are, how to research penny stocks, trading strategies, how to open a brokerage account, and how to read Level II, you are finally ready to place a trade and buy penny stocks. If the most you could ever lose on a penny stock was 10 percent, but your upside gains could be limitless, you would do very well as a penny stock investor. Similar to the market order, if your stop loss order is triggered, you would be guaranteed a. Featured Penny Stocks Watch List. His popular Peter Leeds Stock Picks newsletter, available at www. Rather than setting your stop only 5 or 10 percent below your purchase price, consider dropping it to as much as 25 percent below your original buy.

Lesson #7:

Featured Penny Stock Basics. Securities and Exchange Commission. Mental stop-loss orders: With this type of stop-loss order, you have a trigger price in mind and sell when shares fall to that level. The reason support levels exist is because there are stronger buying pressures at those prices than selling pressures, which keeps the share price at or above the support. At the end of the day, keep things like this in mind and if anything, paper trade to get more comfortable with this. Now that you have learned about what penny stocks are, how to research penny stocks, trading strategies, how to open a brokerage account, and how to read Level II, you are finally ready to place a trade and buy penny stocks. Use trailing stops, either mentally of through your broker. Want to Be a Better Trader? Stop-loss orders occur when traders place a trade to sell penny stocks when they reach a specific price. However the correct placement of stops gets more complicated once you are following a rising price. Now, if you want to trade the pattern, you could look to buy the stock just as it breaks out of the range-bound area. Your email address will not be published. If you are going to sell a stock, you will receive a price at or near the posted bid. Market orders are popular among individual investors who want to buy or is instaforex legal in india option strategy builder download a stock without delay. In fast-moving and volatile markets, the price at which you actually execute or fill the trade can deviate from the last-traded price.

If you are going to sell a stock, you will receive a price at or near the posted bid. Your privacy is always protected and your information will not be shared. At the end of the day, keep things like this in mind and if anything, paper trade to get more comfortable with this first. Next, we have the stop loss and stop loss limit order. We will also add your email to the PennyStocks. A limit order , sometimes referred to as a pending order, allows investors to buy and sell securities at a certain price in the future. This is known as a trailing stop-loss. As theoretical as this sounds, it is relatively simple to implement such a strategy in penny stocks, such that you limit your losses to minimal levels. When you combine the three order types… it gets pretty easy to trade. Basically you notice the stock trend higher, then trade in a range. Stop-losses can be used in a variety of situations. If a stock gaps down below your stop-loss, it will trigger the order but at the gap down price. Well, technicals work with penny stocks — and I have a few battle-tested strategies. Related Terms Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security.

Penny Stock Trading – Three Need to Know Order Types

Email address. Tweet 0. From there, you can always buy back in if you think the penny stock is still worth your investment. Stock Market Basics. You can learn more metatrader aaafx setup tc2000 shares bought today the standards we follow in producing accurate, unbiased content in our editorial policy. If a stock gaps down below your stop-loss, it will trigger the order but at the gap down price. Always Use a Limit Order When Buying or Selling Penny Stocks : Due to the thin futures trading strategies 2020 stock trading online app of shares available for many penny stocks and market maker games, it is crucial that you always use a limit order when you buy or sell penny stocks. They grow exponentially the lower in price a specific penny stock trades. By now you understand that penny stocks are volatile. The advantage of using market orders is that you are guaranteed to get the trade filled; in fact, donchian channel trading strategy professional stock trading course will be executed ASAP. Your privacy is always protected and your information will not be shared. Up. Investopedia uses cookies to provide you with a great user experience. How Stock Investing Works. Personal Finance. When the stock starts to fall, many investors on the sidelines may purchase at the lower prices and drive shares higher. A long-term investor is more likely to go with a market order because it is cheaper and the investment decision is based on fundamentals that will play out over months and years, so the current market price is less of an issue. Read on learn what they are and why I believe they will save you money and help you make .

Lesson 7: Placing a Trade. Use stop-losses on penny stocks with a history of lower volatility. Disclaimer Privacy. This type of order is used to execute a trade if the price reaches the pre-defined level; the order will not be filled if price does not reach this level. Investing vs. Check with your broker if you do not have access to a particular order type that you wish to use. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. Rather than setting your stop only 5 or 10 percent below your purchase price, consider dropping it to as much as 25 percent below your original buy. However, I do use the stop loss limit. Want to Be a Better Trader? About the Book Author Peter Leeds is a highly respected authority on penny stocks who has been quoted in major media outlets and published in Forbes and Business Excellence Magazine. Some brokers allow you to set up automatic stop-loss orders. Is it good for just the day or is it good until you cancel the order. Now that you have learned about what penny stocks are, how to research penny stocks, trading strategies, how to open a brokerage account, and how to read Level II, you are finally ready to place a trade and buy penny stocks. Less volatility means less chance of getting stopped out on price swings.

Penny Stock Basics: Developing A Further Understanding Of Stop Losses

There are times where one or the other will be more appropriate, and the order type is also influenced by your investment approach. Basically you notice the stock trend higher, then trade in a range. Stop-loss orders are preset sell orders either at the time you purchase your shares or soon after that are triggered if the penny stocks fall a certain percentage below your buy price. Now that we've explained the two main orders, here's a list of some added restrictions and special instructions that many different brokerages allow on their orders:. Next, we have the stop loss and stop loss limit order. Now, the price that you enter with a stop loss is known as the trigger price. It is an order to buy or sell immediately at the current price. A trader went through the fundamental and technical analysis process and has picked out a penny stock to buy. Your privacy is always protected and your information will not be shared. Most of the restriction is on OTC penny stocks. Are Penny Stocks Worth It? Additional Stock Order Types. Actually placing a penny stock trade correctly is just as important as any of the other steps. Mental stop-loss orders: With this type of stop-loss order, you have a trigger price in mind and sell when shares fall to that level.

A limit ordersometimes referred to as a pending order, allows investors to buy and sell securities at a certain price in the future. Leave a Reply Cancel reply Your email address will not be published. Peter Leeds Penny Stocks Facebook. However, the amount to which these damage a portfolio depends on how the investor handles. Your email address will not be published. Protect your trading capital and avoid being one of the bag-holders that is holding shares at the top of a run. Biotech Stocks Featured. Stops can be used to limit losses or to protect profits. This refers to a downward price swing, whereby you hit your stop td ameritrade futures margin rates horizons covered call etf subsequently sell, just to see the penny stock bounce right back up. All investors will encounter losing stocks. The advantage of using market orders is that you are guaranteed to get the trade filled; in fact, it will be executed ASAP. Mental stop-loss orders: With this type of stop-loss order, you have a buy axim biotech stock buy dividend stock then sell price in mind and sell when shares fall to that level. If the shares increase in value you will continue to hold them, but if they fall to or below the level where you set your stop, your sell order kicks in and your shares get bought from you at that price. Remember, market orders are bad for penny stocks, and these three order types are superior.

Stop Loss Limit Order

The more volatile a penny stock already is, the more volatile it will probably be going forward. By knowing what each order does and how each one might affect your trading, you can identify which order suits your investment needs, saves you time, reduces your risk, and, most importantly, saves you money. This means you could take a much larger loss than you had planned for. Limit Order. The two major types of orders that every investor should know are the market order and the limit order. Also, included is the one-order type that will do the most damage to your account and why you should avoid it. That's even if you made no beneficial trades in that time frame. Although this lower stop puts you at risk for more downside, it also minimizes your risk of getting stopped out if shares fall temporarily. When your shares hit a mental stop-loss level, selling those shares is one of the hardest things to do in investing. Stop-loss orders occur when traders place a trade to sell penny stocks when they reach a specific price. If you are a new investor and these terms seem daunting, rest assured that the concepts behind them are very simple. When deciding between a market or limit order, investors should be aware of the added costs. Your Practice. So what order types should you be using? It is an order to buy or sell immediately at the current price.

The opposite holds true for resistance levels, where the price of a penny stock may have trouble breaking above a certain point, despite repeated attempts. Trailing stops refer to adjusting your stop-loss trigger price higher as the underlying shares move upward. On the other hand, when you enter a market order to sell, you would sell at the best bid price. Next, we have the stop loss and stop loss limit order. Your trading strategy will dictate that for you over time. Disclaimer Privacy Policy. The more volatile a penny stock already is, the more volatile it will probably be going 5 3 brokerage account robinhood leveraged etf. When trading penny stocks, we recommend you follow these guidelines:. Penny stocks with greater trading volume tradersway skrill forex commodity live charts experience less price volatility. You see, with a limit order, your order to buy or sell shares of a stock will not get filled unless it trades at that price. Your Practice. Up. Featured Penny Stocks Watch List. Your privacy is always protected and your information will not be shared. Share article The post has been shared by 3 people. Key Takeaways Several different types of orders can be used to trade stocks more effectively. One of the methods traders learn quickly is the answer to the question: what are stop-loss orders?

Limiting Losses

Now, the price that you enter with a stop loss is known as the trigger price. Address: 62 Calef Hwy. You May Also Like. The more often you buy penny stocks on price dips, the less likely you will be stopped. Not all brokerages or online trading platforms allow for all of these types of orders. Additional Stock Order Types. Limit Order. Actually placing a penny stock trade correctly is just as important as any of the other steps. They are not hard to learn and are available on all brokerage platforms. Up. These include white papers, government data, original reporting, and interviews with industry experts. Thus, if it continues to rise, you stochastic k oscillator trading positions chart cotton 2016 december lose the opportunity to buy. Well, technicals work with penny stocks — and I have a few battle-tested strategies. As the penny stocks price does rise, you should adjust your stop loss order upwards. A long-term investor is more likely to go with forex market hours desktop widget binary options auto bot market order because it is cheaper td ameritrade balance sheet cup option strategy the investment decision is based coueur gold stock earnometer intraday levels fundamentals that will play out over months and years, so the current market price is less of an issue. If the most you could ever lose on a penny stock was 10 percent, but your upside gains could be limitless, you would do very well as a penny stock investor. Always Use a Limit Order When Buying or Selling Penny Stocks : Due to the thin amount of shares available for many penny stocks and market maker games, it is crucial that you always use a limit order when you buy or sell penny stocks. About the Book Author Peter Leeds is a highly respected authority on penny stocks who has been quoted in major media outlets online stock market trading account what are the best stock screeners apps published in Forbes and Business Excellence Magazine.

There is no charge to join our email newsletter and you may unsubscribe at any time. The more often you buy penny stocks on price dips, the less likely you will be stopped out. A trader, however, is looking to act on a shorter term trend in the charts and, therefore, is much more conscious of the market price paid; in which case, a limit order to buy in with a stop-loss order to sell is usually the bare minimum for setting up a trade. Leave a Reply Cancel reply Your email address will not be published. So what order types should you be using? These include white papers, government data, original reporting, and interviews with industry experts. Your email address will not be published. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. For example, the most basic order type is the market order. Lessons From A Penny Pro.

Account Options

You see, with the stop loss limit… you have a trigger price and a limit price. Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. Mail 0. Key Takeaways Several different types of orders can be used to trade stocks more effectively. However, with a market order, your order will be filled. Market orders do not guarantee a price, but they do guarantee the order's immediate execution. Buy shares on price dips. If you set hard limits, you can potentially take profits before the stock comes back down. Now, if you want to trade the pattern, you could look to buy the stock just as it breaks out of the range-bound area. The Bottom Line. Your Practice. When your shares hit a mental stop-loss level, selling those shares is one of the hardest things to do in investing. When trading in the short term, it can help traders protect their positions. That said, there are 3 order types you must know. Is it good for just the day or is it good until you cancel the order. Investing vs. Featured Penny Stocks Robinhood.

Getting into and out of a penny stock trade at specific prices can be the difference between a profitable trade and taking a loss. Trailing stops refer to adjusting your stop-loss trigger price higher as the underlying shares move stock brokers in new orleans interactive brokers wire deposit. This is where a stop-loss order can help investors. If you are going to sell a stock, you will receive a price at or near the posted bid. Use stop-losses on penny stocks with a history of lower volatility. You will be in a profit position as the share's price travels higher, with the added insurance of the support level just below your position. Stocks are surging to record highs today, ahead of some critical earnings announcements after the close that include: eBay, Snap, and Texas Instruments. When it comes to penny stockscertain situations may require you to protect your profit during volatile times. Typically, if you are going to buy a stockthen you will pay a price at or near the posted ask. Well, technicals work with penny stocks — and I have a few battle-tested strategies. Twitter 0. The reason support levels exist is because there are stronger buying pressures at those prices than selling pressures, which keeps the coinbase yahoo finance why bitfinex dropped us customers price at or above the support. Typically, the commissions are cheaper for market orders than for limit orders.

Market Order vs. Check to make sure you have entered a trade correctly : Penny stock trades are often entered quickly and under pressure, due to the fast movement of penny stocks. Featured Tech Stocks. However, this does not prevent you from using your own stop loss limit orders by following through on your trading parameters. Penny stocks are notorious for making big runs, then falling back in price just as quickly. There are times where bcc usdt tradingview forex strategies 4 u macd or the other will be more appropriate, and the order type is also influenced by your investment approach. By knowing what each order does and how each one might affect your trading, you can identify which order suits your investment needs, saves you time, reduces your risk, and, most importantly, saves you money. Buy Stop Limit Order Now, with this order type… it acts like a stop loss limit order. One of the biggest risks with using stop-loss orders on penny stocks is the potential of getting stopped. For example, the most basic order type is the market order. As theoretical as this sounds, it is relatively simple to implement such a strategy in penny stocks, such that you limit your losses to minimal levels. If you are a new investor and these terms seem daunting, can i day trade with a cash account jigsaw trading interactive brokers assured that the concepts behind them are very simple. Disclaimer Privacy. Preservation of capital is the key. You see, with the stop loss limit… you have a trigger price and a limit price.

So what order types should you be using? As traders discover new strategies, they look for more advanced ways to improve their profit margins. Email address. Now that we've explained the two main orders, here's a list of some added restrictions and special instructions that many different brokerages allow on their orders:. When trading in the short term, it can help traders protect their positions. Related Articles. A long-term investor is more likely to go with a market order because it is cheaper and the investment decision is based on fundamentals that will play out over months and years, so the current market price is less of an issue. In fast-moving and volatile markets, the price at which you actually execute or fill the trade can deviate from the last-traded price. A limit order specifies exactly what you are willing to pay for a stock. Fill A fill is the action of completing or satisfying an order for a security or commodity. Set stops for greater price declines.

Penny stocks are notorious for making big runs, then falling back in price just as quickly. Use stop-losses on penny stocks with a history of lower volatility. Knowing the difference between a limit and can u trade futures options swing trading forex price action market order is fundamental to individual investing. Stop Loss Next, we have the stop loss and stop loss limit order. Tight stops like this are difficult to decide for or against especially when it comes to volatility. In this article, we'll cover the basic types of stock orders and how they complement your investing style. Next, we have the stop-loss order stop loss. For stop-loss orders to be of any value as an investment strategy, you need to stick with the strategy, no questions, no excuses. Trailing stops refer to adjusting your stop-loss trigger price higher as the underlying shares move upward.

Now that we've explained the two main orders, here's a list of some added restrictions and special instructions that many different brokerages allow on their orders:. In other words, how you enter or exit a trade can mean the difference between posting a profit or a loss. The limit order is a useful tool that I think all beginner traders should use. Fill A fill is the action of completing or satisfying an order for a security or commodity. However, the amount to which these damage a portfolio depends on how the investor handles them. The more often you buy penny stocks on price dips, the less likely you will be stopped out. How Stock Investing Works. A market order is the most basic type of trade. Disclaimer Privacy Policy.

Now, with this order type… it acts like best stock to buy in pharmaceuticals top 10 stock brokers in philippines stop loss limit order. Also, included is the one-order type that will do the most damage to your account and why you should avoid it. Featured Penny Stocks Robinhood. I almost always tell someone who gets started with me to paper trade. Typically, the commissions are cheaper for market orders than for limit orders. Popular Courses. It is not impossible, however, to limit the losses from these to insignificant levels. Use stop-losses on penny stocks with a history of lower volatility. Penny stocks are notorious for making big runs, then falling back in price just as quickly. If the most you could ever lose on a penny stock was 10 percent, but your upside gains could be limitless, you would do very well as a penny stock investor. Biotech Stocks Featured.

A long-term investor is more likely to go with a market order because it is cheaper and the investment decision is based on fundamentals that will play out over months and years, so the current market price is less of an issue. Always Use a Limit Order When Buying or Selling Penny Stocks : Due to the thin amount of shares available for many penny stocks and market maker games, it is crucial that you always use a limit order when you buy or sell penny stocks. Market and Limit Order Costs. Lesson 2: Finding Penny Stocks. Additional Stock Order Types. Lesson 7: Placing a Trade. Market Order vs. Buy shares on price dips. Set stops for greater price declines. Well, technicals work with penny stocks — and I have a few battle-tested strategies. For example, certain order types can destroy your trading account. Basically you notice the stock trend higher, then trade in a range. The stop-loss comes in handy for the trader in this case. It is not impossible, however, to limit the losses from these to insignificant levels. Read on learn what they are and why I believe they will save you money and help you make more. However, I remain focused on trading small-cap penny stocks.

Lesson 2: Finding Penny Stocks. One important thing to remember is that the last-traded price is not necessarily the price at which the market order will be executed. The main risk is to the upside. There is no charge to join our email newsletter and you may unsubscribe at any time. These include white papers, government data, original reporting, and interviews with industry experts. Address: 62 Calef Hwy. Although this lower stop puts you at risk for more downside, it also minimizes your risk of getting stopped out if shares fall temporarily. Preservation of capital is the key. Peter Leeds Penny Stocks Facebook. Visit www. By using Investopedia, you accept our. Less volatility means less chance of getting stopped out on price swings. Fill A fill is the action of completing or satisfying an order for a security or commodity.